Alcohol industry, business: India

A note on spellings: Whisky (without an E) Is the spelling used for Scotch and spirit produced in regions that have followed the Scottish way of whisky production, including India. Indpaedia would like to follow this rule but cannot impose it on the sources of our articles, which incorrectly spell it the American way.

This is a collection of articles archived for the excellence of their content. |

Contents |

IMFL: A history

Jabir , Imperial pints “India Today” 5/6/2017

The British empire may have forced us to pay for our own oppression but it had its compensations. So as the sun flares over another Indian summer, let's raise our chilled glasses to the imperialists who begat Indian beer. The pioneer, apparently, was one Henry Bohle who set up businesses in Meerut and Mussourie in 1825. The latter thrived for some years in the hands of the Mackinnon family, seeding a ferment of hill station breweries that stretched from Murree to Shimla, Kasauli and Ranikhet and on to Darjeeling. Edward Dyer, in particular, bought up or established a chain of breweries in the Himalayas and is credited with launching Asia's first beer brand, 'Lion', which was produced in both Murree and Kasauli. Dyer would sire (and later disown) the notorious Reginald Dyer of Jallianwala Bagh-but that's another story. By the 1880s, another experienced brewer, H.G. Meakin, had set up an extensive empire, buying some of Dyer's factories as well as establishing new ones as far afield as Dalhousie, Kirkee and Nuwara Eliya in Sri Lanka. The two firms would ultimately merge as Dyer and Meakin in the 1930s.

By 1889, the 25-odd breweries in British India were producing some 5,165,138 gallons a year, (roughly a thousand times less than passes through our national gullets today). And judging by some of the vintage beer labels (yes, it's a thing) treasured by collectors today, there was a lot more variety back then. The Dyer Meakin breweries, for example, offered a range of light and dark ales, a stout, and several 'sparkling beers'. Today, the concern known as Mohan Meakin is sustained by the popularity of its house rum, while johnny-come-lately United Breweries (estd. 1857) dominates India's beer market with bland lagers and knuckleheaded strong beers. Did the British take all the tasty beer with them when they left? Well, the glass may be half empty but look at it this way: they gave us beer, we gave them Vijay Mallya.

Exports

In 2018

From: Oct 10, 2019: The Times of India

See graphic:

India’s Alcohol Exports, presumably as in 2018

Imports

Scotch whiskey

2022

Agencies , Feb 13, 2023: The Times of India

LONDON: India has overtaken France to become the UK's largest market of Scotch whisky in terms of volume with a 60% hike in imports in 2022 over the previous year, according to figures from Scotland's leading industry body.

The Scotch Whisky Association (SWA) said that India imported 219 million 70cl bottles of Scotch compared to France's 205 million last year representing growth of the Indian Scotch market of more than 200% in the past decade.

In terms of value, the US continued to hold on to its topmost position as the largest market at 1.1 billion pounds. The total export value of Scotch whisky - one of the UK's biggest exporters - was up 37% by value to 6.2 billion pounds.

As one of the key sectors of focus for the UK in the free trade agreement (FTA) talks with India, now in their seventh round of negotiations, SWA pointed out that the hike in volume still makes up only a fraction of the Indian whisky market due to high tariffs.

"Despite double-digit growth, Scotch whisky still just comprises 2% of the Indian whisky market," the association said.

"SWA analysis shows that a UK-India FTA deal which eases the 150% tariff burden on Scotch whisky in India could boost market access for Scotland's whisky companies, allowing for an additional 1-billion pound of growth over five years," it noted.

The value of the Indian market for Scotch exports comes in at fifth worth 282 million pounds, up 93% in 2021 and behind France, Singapore and Taiwan. The 2022 trend also saw the Asia-Pacific region overtake the EU as the industry's largest regional market, with double-digit post-pandemic growth also seen in Taiwan, Singapore and China besides India. "In a year of economic headwinds and supply chain disruption, the industry continued to be an anchor of growth," said SWA chief Mark Kent.

2023

January 8, 2024: The Times of India

From: January 8, 2024: The Times of India

New Delhi : Move over Glenlivet, Macallan, Lagavulin and Talisker — it’s now time for homegrown single malts, whose sales have for the first time overtaken those produced by the global giants.

Early estimates prepared by industry body Confederation of Indian Alcoholic Beverage Companies (CIABC) show that Indian single malts have cornered a share of around 53% of total sales in 2023. Of the total sales of around 6,75,000 cases (of nine litres each) of single malts in India last year, around 3,45,000 cases were retailed by Indian-origin makers, while the remaining 3,30,000 were by Scottish and others.

“In our estimate, the local brands grew by around 23% in 2023, while the imported ones grew at a more conservative 11%. This is a milestone,” Vinod Giri, director-general of CIABC, told TOI.

The numbers are seen as a milestone for homegrown players. “It’s not everyday that such a feat is achieved. From being mocked around till just adecade-and-a-half back, Indian whisky makers have co- me a long way as they are now second to none in terms of quality and refinement,” says Thrivikram Nikam, joint MD of Amrut Distilleries.

The craze for ‘Made in India’ brands has prompted Diageo and Pernod Ricard, which source their single malts mainly from Scotland, to join the party launching local brands. Diageo had introduced the Godawan in 2022, while Pernod recently launched its first Indian single malt Longitude 77.

“India is a fast-growing market and very diverse, and the younger audience is experimenting and gravitating towards niche products. Consumers want newer stuff, and there is lot of value in newness,” says Kartik Mohindra, chief marketing officer at Pernod India.

Paul P John, chairman of John Distilleries that makes its single malts in Goa, says the foreign brands are “panicking now” as Indian companies grow bigger. “They were caught napping and are now trying to catch up. Unfortunately, they are taking short cuts, and are producing stuff here that they don’t understand. India has arrived.”

Indian single malt makers dismiss the “arrogance of Scotch puritans” who swear by ‘Scottish weather, Scottish water, and Scottish barley’ to root for the “irreplaceable quality” of the European brands. Prem Diwan, chairman and MD of Devans Modern Breweries, which distils its whiskies in Jammu, says, “The quality of Indian single malts is absolutely fantastic, which is one of the main reasons fuelling their demand. While Scottish makers are very traditional in their processes, Indian makers love to experiment.

Pernod’s Mohindra says there is enough demand for all the players to keep growing.

Malpractices of the industry

Cartelisation: 2021

Sep 25, 2021: The Times of India

Competition Commission of India (CCI) imposed penalties totalling over Rs 873 crore on United Breweries (UB), Carlsberg India, All India Brewers’ Association (AIBA) and 11 individuals for cartelisation in the sale and supply of beer.

In its 231-page order, which comes nearly four years after ordering a detailed probe, CCI has also directed the companies, association and individuals to “cease and desist” from anti-competitive practices in the future.

The final order has been passed against UB, SABMiller India, now renamed as Anheuser Busch InBev India (AB InBev), and Carlsberg India, among other entities. The regulator did not impose any fine on Ab InBev, while lesser penalties have been slapped on others. UBL and Carlsberg India, which are major players in the beer market, said they were reviewing the order.

An official release said the companies and other entities have been found to be “indulging in cartelisation in the sale and supply of beer in various states and UTs in India, including through the platform of AIBA”. As AIBA was found to be actively involved in facilitating such cartelisation, CCI has also held it to be contravening the competition law. The fines on UBL and Carlsberg India are nearly Rs 752 crore and Rs 121 crore, respectively. A fine of over Rs 6.2 lakh has been imposed on AIBA and various individuals have also been fined by the regulator.

As per the release, October 10, 2018, was the date on which the director general (DG) conducted search and seizure operations at the premises of the beer companies. Based on evidences of regular communications between the parties collected by the DG during search and seizure, and disclosures made in the lesser penalty applications, CCI found that the three companies engaged in price coordination, which is in violation of competition norms, the release said. PTI

Sales

India

2016> 19

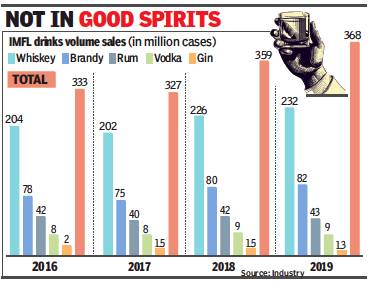

Avik Das, January 25, 2020: The Times of India

From: Avik Das, January 25, 2020: The Times of India

BENGALURU: Volume growth in India’s spirits industry was just 3% last year, compared to 10% in the year before, impacted negatively by the national elections and sagging consumer demand.

Data sourced from the industry show that domestic brands — or Indianmade foreign liquor (IMFL), which make up the bulk of the sales — reported a volume of 368 million cases (of 9 litres each) for the calendar year, up marginally from 358 million cases in 2018.

Whiskey, brandy and rum, the top three segments, grew at 2.6%, 2.5% and 2.4% respectively. December provided some impetus to the sales as people consumed more due to the winter. “Like all other sectors, the economic slowdown has impacted this as well,” said Allied Blenders Distillers (ABD) executive vice-chairman and CEO Deepak Roy.

India remains a whiskey drinking country and consumers prefer drinks made here because of relatively low price tags. Companies, however, are slowly selling more premium drinks aided by a new class of drinkers with more disposable income. Imported spirits account for 2% of the overall consumption.

Drinks makers warned early last year that the national elections in May would impact sales due to an increase in number of dry days and customs officials opting for election duties. The brakes on growth come on the heels of a relatively good 2018.

The year before that was disastrous — pummeled by demonetisation and the ban on sale of liquor around highways ordered by the Supreme Court. “India is a volatile environment. We used to say it’s two steps forward and one step back,” Carlsberg CEO Cees ‘t Hart said in November.

“In addition to the difficult economic environment, the cost of extra neutral alcohol (ENA) has shot up by almost 60% in the last 18 months, leading to under supply in the popular and lower segments,” he added. ENA is the primary raw material for alcoholic beverages.

Delhi

2019- 22

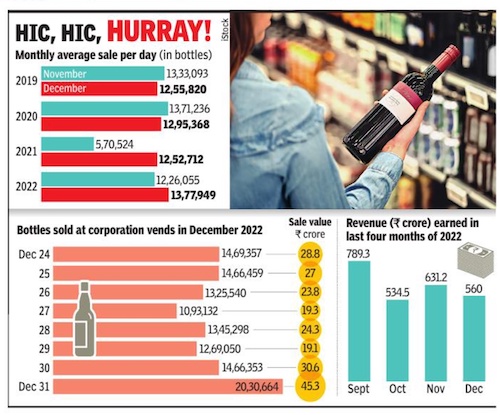

Bottles sold at corporate vends in December 2022;

Revenue earned in last four months of 2022

From: Atul Mathur, January 3, 2023: The Times of India

See graphic:

Monthly average sales per day 2019-22;

Bottles sold at corporate vends in December 2022;

Revenue earned in last four months of 2022

The spirits market in India

2019 – 22: product-wise

Sidhartha, July 24, 2023: The Times of India

From: Sidhartha, July 24, 2023: The Times of India

New Delhi : Despite the rise of wine and gin consumption in recent years, the liquor market in India is dominated by whiskey — and that too by the under Rs 750 a bottle segment.

Latest data available with global agency IWSR shows that nearly two-thirds of the spirits sales in India is accounted for by whiskey. Within that, 85% of the market is controlled by 10 homegrown brands at the lower end of the price spectrum. The share of imported whiskey is estimated at 3.3% of the pie and is projected to rise to 3.7% of the whiskey market in 2027. The numbers suggest that even with a projected 3.8% growth over the next five years, Indian-made whiskey will control over 96% of the market.

The latest numbers indicate that the business is back on track, having overcome the Covid-19 shock, with Vodka making a strong comeback with a 34% jump in sales, driven by flavours (see graphic).

India is the world’s fifth largest market for alcoholic beverages with overall size pegged at around $53 billion, and the consumption at home is expected to drive volumes over the next five years. Ready-to-drink beverages have emerged as the fastest growing segment, clocking near 40% surge last year, and expected to expand at double-digit rates even over the next five years. Wine — where nearly a fifth is made up through imports — will be the next fastest (6.6% projection), followed by spirits (3.7%) and beer (2.7%), according to IWSR.

While there are no estimates available, imported wine from countries such as Australia and the European Union may have a bigger share of the pie due to the free trade agreements. In whiskey — where the UK is seeking tariff cuts — the domestic industry will be the key driver. This is despite some of the imported whiskeys seeing a rapid rise, although it has come over a small base.

“There is a growing trend of new whiskeys being explored by Indian consumers. While scotch leads, the new players on the table are Irish, US, Japanese and Canadian whiskies. And of course, Indian Single Malts too,” said Nita Kapoor, CEO, International Spirits & Wines Association of India.

Whiskey 2020 – 22

Sidhartha, August 22, 2023: The Times of India

From: Sidhartha, August 22, 2023: The Times of India

New Delhi : The sales of Indian single malts have caught up with their rivals from Scotland due to growing appetite of consumers to take homegrown brands, which do not come cheap.

In 2022, the sales of Indian malts shot up 2.4 times to 2,81,000 cases, while Scotch (single malt) sales rose 35% to 2,96,000 cases, according to industry data accessed by TOI. A year ago, Indian brands accounted for around a third of the market, compared with 15% five years before that, TOIhad reported in March 2022.

Two Amrut offerings are on top of the heap, and bigger than Glenlivet, followed by Paul John (see graphic). Singleton sales have shot up in recent years and were estimated at 22,000 cases in 2022, while 10-year Talisker sold around 14,000 cases. Among the Indian malts, Solan Gold sold 20,000 cases, while Rampur was at around 10,000 cases. “Indian players are now making exceptionally good single malt whiskies, which are comparable to all others. Within Indian itself, we are able to produce good stan dards and are reasonably priced. We are trying to cater to demand globally. Things might change (for us) going forward due to free trade agreements,” said Rakshit Neelkant, managing director of Amrut.

“As of now there are about eight-nine distilleries with their own single malt whisky brands. This number is growing which brings one to the matter of ensuring quality and consistency, a must for a global brand. CIABC is working with the domestic industry and government agencies to evolve product and process stan dards that ensure product quality uniformly and consistently for Indian malt whiskies,” said Vinod Giri, director general of lobby group Confederation of Indian Alcoholic Beverage Companies (CIABC).

With income levels on the rise, Indians are now willing to spend more on alcohol, which has resulted in the demand for malt whiskies rising, although they still make up a very small share of the pie. The overall whisky market in India is pegged at 242 million cases, which is around two-thirds of the overall spirits market.

Whisky

The pricing of whisky

2019 – 22

From: Sidhartha, July 31, 2023: The Times of India

The share of Scotch Whisky in the ₹ 750 plus per bottle category, 2019 – 22