Auditors, Chartered Accountants :India

This is a collection of articles archived for the excellence of their content. |

Contents |

Auditor exits (auditors leaving mid-term)

2012-18

From: Partha Sinha & Lubna Kably, ‘Auditor exits from cos good in long term’, June 8, 2018: The Times of India

Stocks Take A Hit But Quitting Seen As Cleansing Exercise, To Boost Governance

Auditors halting assessment of listed companies could bring short-term pain for shareholders in the form of a sharp fall in stock prices. But decisions like these are good for the long-term health of the overall market, as such steps could eventually lead to better corporate governance standards among listed companies.

According to advisers for good corporate governance processes, lawyers and auditors, for too long, companies manipulated books and got away with the same. But stricter rules and regulatory oversights, combined with better disclosure standards and shareholders’ apathy towards these stocks, are forcing such companies to come clean.

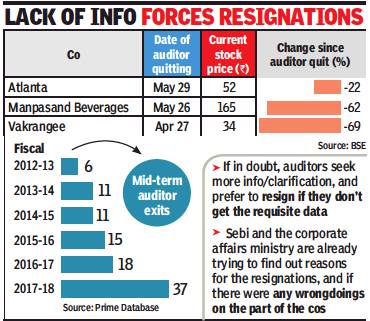

So far, 37 auditors have quit the assessing books of companies for fiscal 2017-18. Of these, 15 resigned from the process in May and seven in April this year, data from Prime Database showed. Stock prices of some of the companies that have seen auditor exits — like Atlanta, Manpasand Beverages and Vakrangee — have crashed up to 69% since the news about auditor resignations were made public, BSE data showed. Sebi and the ministry of corporate affairs are already on the trail to find out the reasons for the resignations and if there were any wrongdoings on the part of the companies.

According to Kalpana Unadkat, partner at Khaitan & Co, penal consequences for auditor negligence are now tougher under Companies Act, 2013. The Act provides for a strict set of duties and responsibilities for auditors, such as duty to report fraud. It also prescribes severe penal consequences in case of non-compliances. “The law requires auditors to pay damages to shareholders and statutory bodies for loss arising out of incorrect or misleading statements in their audit report. We have seen that Indian courts have allowed Sebi to take action against auditors if there is any adverse impact on the securities market or for protection of the interest of the investors,” Unadkat said.

Although auditors were required to be careful at all times, of late, due to enforcement actions, “auditors in general are more guarded”, Unadkat said. “If in doubt, they are seeking more information/clarification, and prefer to resign, if they don’t get the requisite information. They are responsible to stakeholders and they should give relevant reasons for their resignation,” Unadkat added.

For example, in its letter about quitting from Vakrangee, a partner for its auditor Price Waterhouse noted that it had asked for information about bullion and jewellery businesses. The replies it got were either inadequate or they did not answered the queries. After back and forth between the auditors, the company’s audit committee members and its MD, Price Waterhouse, finally quit on April 27.

According to J N Gupta, founder of corporate governance research firm Stakeholders Empowerment Services, there are at least four reasons why auditors are quitting midway into their job. For one, there is increased focus on transparency in the corporate sector, which went up further after Prime Minister Narendra Modi spoke last July at an ICAI event and questioned their integrity. Second, Sebi — following recommendations of the Kotak committee on corporate governance — has made it mandatory for auditors to detail reasons for their resignation. Another reason is that the Insolvency and Bankruptcy Code (IBC) allows for a forensic audit of a company’s books, which can subsequently nail auditors if they are found to have erred during the audit process. And last, Sebi’s decision to penalise Price Waterhouse for its role in Satyam scam.

Disciplining CAs, auditing firms

ICAI questions legality of National Financial Reporting Authority

October 30, 2018: The Times of India

From: October 30, 2018: The Times of India

The Institute of Chartered Accountants of India (ICAI) has said that the National Financial Reporting Authority (NFRA) to discipline CAs and firms auditing listed and large companies may not be in line with the current regulations and suggested that the task should be left to the self-regulating body.

The statement came months after the government set up NFRA, citing ICAI’s poor track record at disciplining errant auditors. While the new agency has been set up five years after it was provided for in the Companies Act, a CA recently petitioned against the move in the Delhi high court, which has made ICAI a party.

Gupta said legal opinion from advocate Mukul Rohatgi suggested that the establishment of NFRA is not constitutionally valid and it encroaches upon the powers of ICAI. The former attorney general has said the CA Act does have precedence over provisions of the Companies Act, 2013.

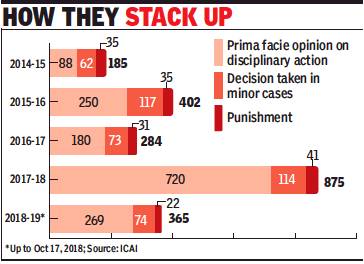

ICAI, which had so far refrained from sharing data on disciplinary actions, released numbers on Monday to suggest that the pace had picked up in 2017-18 (see graphic) and it would have been maintained but the government’s decision to appoint Rangachari Sridharan — its nominee on the disciplinary committee as the first NFRA chief — has slowed down the run rate.

It has flagged the concern to the ministry of corporate affairs and suggested that in at least 35 cases, the final outcome of the disciplinary proceedings will have to be started afresh and will delay the entire process.

While around 1,300 cases were currently pending disciplinary action, including 135 complaints filed by government agencies, Gupta said the speed has picked up in recent years. “We have been fastest in taking action, acknowledging what’s happening and most of the times, acting suo motu,” he said, adding that cases, that were pending for nearly 15 years, have also been decided. The government is, however, not fully satisfied with the agency’s response and is cut up with it for trying to scuttle the establishment of NFRA.

Gender ratio

2019-23

March 20, 2024: The Times of India

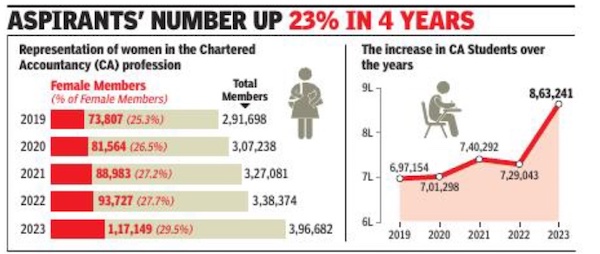

Not only topping different levels of Chartered accountant exams, female aspirants comprise a record 48% of the qualifiers or pass-outs. In the overall pool, women CAs have a 30% share, making a big jump from just 8% in 2000. In the student base of 8.63 lakh too, 43% are females, reports Manash Gohain.

Now there are more women toppers — four out ofsix in the final and intermediate exams in 2020 and alltoppers in both old and newcourse exams in 2021. Notably, 75 women aspirantshave topped CA exams atdifferent levels in thelast decade.

Details

Manash Gohain, March 20, 2024: The Times of India

From: Manash Gohain, March 20, 2024: The Times of India

New Delhi: Not only topping different levels of Chartered Accountancy exams, female aspirants now comprise a record 48% of the qualifiers or pass-outs. In the overall pool, women CAs now have a 30% share, making a massive jump from just 8% in 2000. In the student base of 8.63 lakh too, 43% are females.

Outsourcing of accounting & auditing to India bringing in new opportunities and average annual salary of Rs 12.5 lakh for a fresher, as well as the flexibility of pursuing the course and affordable cost of study, are big attractions. Significantly, now there are more women toppers — four of six in the final and intermediate exams in 2020 and all toppers in both old & new course exams in 2021. Women candidates repeated their 2021 feat in next two years too. Notably, 75 women aspirants have topped CA exams at different levels in the last decade.

In 2021, Institute of Chartered Accountants of India introduced a new course in sync with the National Education Policy, 2020. ICAI president Ranjeet Kumar Agarwal told TOI, “Participation of women in this profession in accountancy, tax and finance is increasing phenomenally.”

“Chartered accountancy and financial sectors are poised for better growth in India than in countries with an aging population. India has emerged as the hub with most countries outsourcing their accounting work to us. If a burger is sold in US or UK, accounting is done in Gurgaon or Kolkata. And the attractive salary package — the average package here is Rs 12.5 lakh the moment you pass. Our highest package in the last campus placement was Rs 28 lakh and international package was Rs 49 lakh,” he added.

In 2019, of the 2.91 lakh CAs, 73,807 were women, which rose to 1.2 lakh (out of 3.9 lakh) in 2023. It was 70,047 in 2018 and 64,685 in 2017. A bigger marker is that increasing number of women are taking one of the toughest professional programmes in India. In 2023, of the total 8.63 lakh aspirants 43% were females, against 30% in 2019.

“Growing opportunities in accounting and auditing and return on investment of a five-year course costing Rs 75,000 is seen as biggest draw,” Agarwal said. “Young population in India is technologically-empowered, and that’s why you can see that 47% of global digital transactions are happening in India, providing ample professional growth opportunities here,” he said.

Multinational auditors

SC suggests curb on their illegal operations

The Supreme Court took serious note of alleged illegal operations of multi-national accounting firms (MAFs) in India in collaboration with Indian charted accountancy firms (ICAFs) and asked the Centre on Friday to examine steps to rein them in.

“The Union of India may constitute a three-member committee of experts to look into the question whether, and to what extent, the statutory framework to enforce the letter and spirit of Sections 25 and 29 of Chartered Accountants Act and the statutory code of conduct for CAs requires revisit so as to appropriately discipline and regulate MAFs,” a bench of Justices Adarsh Kumar Goel and Uday Umesh Lalit ordered.

Petitioner S Kumar and NGO Centre for Public Interest Litigation had alleged that MAFs, operating illegally in India in contravention of the CA Act and providing accounting, auditing, book keeping and taxation services, were found indulging in falsification of accounts leading to major scams like the one involving Satyam Computers.

The NGO, while seconding Kumar’s allegations, had alleged: “PricewaterhouseCoopers Private Ltd and their network audit firms operating in India... have indulged in violation of FDI policy, RBI Act and FEMA, which requires investigation.”

Taking note of the facts, the bench said: “The ED may complete the pending investigation within three months. In the present context... it may prima facie appear there is violation of statutory provisions and policy framework.”

The bench tasked the three-member expert committee, to be constituted within two months, to consider steps for effective enforcement of provisions of the FDI policy and FEMA regulations. “It may identify the remedial measures which may then be considered by appropriate authorities. Report of the committee may be submitted within three months of it being constituted. The Union government may take further action after due consideration of such report,” the bench said.