Demonetisation of high value currency- 2016: India

This is a collection of articles archived for the excellence of their content. |

Related pages on Indpaedia

Demonetisation of high value currency- 2016: India

Demonetisation of high value currency- 1946, 1978: India

2016: The demonetisation of Rs. 500 and Rs 1000 notes

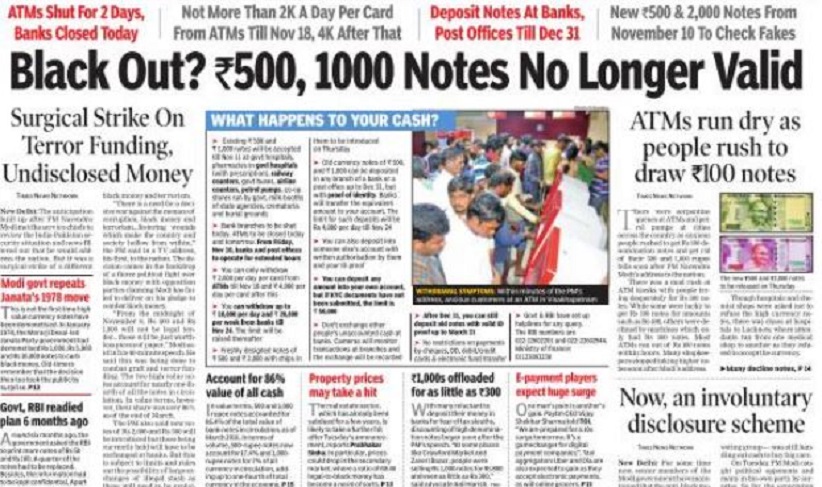

Black Out? Rs 500, 1000 Notes No Longer Valid, Nov 09 2016 : The Times of India

i) thwart Pakistan’s attempts to subvert the Indian rupee (by printing counterfeit Indian currency of high denominations like Rs. 500 and Rs.1,000), and

ii)render useless the illegal cash that political parties had collected and stowed away.

The Times of India

The Times of India

The anticipation built up after PM Narendra Modi met the service chiefs to review the India-Pakistan security situation and news filtered out that he would address the nation. But it was a surgical strike of a different kind, with Modi delivering a stunning surprise by scrapping Rs 1,000 and Rs 500 notes and calling for a “decisive war“ against corruption, black money and terrorism.

“There is a need for a decisive war against the menace of corruption, black money and terrorism...festering wounds which make the country and society hollow from within,“ the PM said in a TV address, his first, to the nation. The decision comes in the backdrop of a fierce political fight over black money with opposition parties claiming Modi has failed to deliver on his pledge to combat black money .

“From the midnight of November 8, Rs 500 and Rs 1,000 will not be legal tender...these will be just worthless pieces of paper,“ Modi said in his 40-minute speech. He said this was being done to combat graft and terror funding. The two high-value notes account for nearly one-fourth of all the notes in circulation. In value terms, however, their share was over 86% as of the end of March.

The PM also said new notes of Rs 2,000 and Rs 500 will be introduced but those being currently held will have to be exchanged at banks. But this is subject to limits and rules out the possibility of large exchanges of illegal stash as these will need to be explained and accounted for. Pitching the decision as a much needed antidote to stamp out the menace of corruption and terror funding, the PM said “Black money and corruption are the biggest obstacles in eradicating poverty...Have you ever thought how these terrorists get their money? Enemies from across the border have run their operations using fake currency notes.“

Describing illegal finan cial activities as the “biggest blot“, Modi said that despite several steps taken by his government over the last twoand-a-half years, India's global ranking on corruption had moved only to 76th position from 100th earlier.

According to the finance ministry , the total number of bank notes in circulation rose by 40% between 2011 and 2016, while the increase in number of notes of Rs 500 denomination was 76% and for Rs 1,000 denomination was 109%.

The World Bank in July 2010 estimated the size of In dia's shadow economy at 20.7% of GDP in 1999, rising to 23.2% in 2007. “A parallel shadow economy corrodes and eats into the vitals of the country's economy ,“ a finance ministry statement said. BLACK OUT? P 2, 13, 14, 15, 25, 29 & 30 It (a parallel shadow econo my) generates inflation, which adversely affects the poor and the middle classes more than others. It deprives government of its legitimate revenues which could have been otherwise used for welfare and development activities,“ a finance ministry statement said.

The move could have political ramifications in the forthcoming state elections as it impacts the capacity of parties to spend unaccounted cash for campaigning and various political payments. ATM withdrawals will be restricted to Rs 2,000 per day and withdrawals from bank accounts will be limited to Rs 10,000 a day and Rs 20,000 a week. Banks will remain closed on Wednesday and ATMs will also not function for the next two days, Modi said.

Apart from depositing money in bank accounts, Rs 500 and Rs 1,000 notes can also be changed for lower denomination currency notes at designated banks and post offices on production of valid government identity cards like PAN, Aadhaar and election card from November 10 to November 24 with a daily limit of Rs 4,000.

The demonetised currency notes will remain valid for transactions like booking of air tickets, railway and government bus journeys and hospitals till midnight of November 11 and 12. The RBI and the finance ministry have set up helplines to answer questions.

The background

The Hindu, November 9, 2016

RBI board had approved production of Rs. 2,000 denomination notes long ago, say officials

The government’s move to scrap nearly 23.2 billion high-value currency notes of Rs. 500 and Rs. 1,000, was in the pipeline for several months but was kept tightly under wraps, with just a handful of officials in the know.

The Reserve Bank of India’s central board had approved the production of the Rs. 2,000 notes several months ago and even began production of the new Rs. 500 and Rs. 2,000 notes, which are to be issued from November 10 a few months ago.

System ready

“The timing [of the announcement by the Prime Minister] was appropriately chosen as we should be ready with adequate number of notes to replace the existing ones. We had ramped up production in the past few months of the new notes, and hence, it was decided to do it now as we can provide more of them in the weeks and days to come,” said RBI governor Urjit Patel at a briefing.

Security concerns

The case for introducing new notes followed prolonged deliberations within the top echelons of government, based on inputs from security agencies and the central bank.

“There’s been no breach of security features of our notes. But for ordinary citizens, it is often difficult to tell a genuine note from a fake. There’s now a confluence of thought between the government and the Reserve Bank of India. Multiple objectives can be met so this led us to withdraw the legal tender character of Rs. 500 and Rs. 1,000 notes,” Mr Patel pointed out.

Mr. Das said the bold and decisive step to fight black money and the use of fake currency notes to finance terrorism was backed by analysis of India’s currency trends.

‘Disproportionate rise’

“Statistics show that high denomination currency in circulation has risen sharply between 2011 and 2015. When all currency notes grew 40 per cent, Rs. 500 notes in circulation rose by 76 per cent and Rs. 1000 notes went up by 109 per cent. But during this period, the economy expanded by 30 per cent so the circulation of such notes had gone up disproportionately,” he said.

“The long shadow of the ghost economy has to go for the real economy to grow. This will add to our economy’s strength,” Mr. Das stressed.

The origin of the idea

HIGHLIGHTS

Pune-based think-tank Arthakranti's founder-member Anil Bokil says that to realise all benefits of note ban, we need a ‘Taxless, Less Cash Economy’

Anil Bokil, the founder-member of Pune-based think tank ArthaKranti Pratishthan, is the man credited with germinating the idea of demonetisation in PM Modi's head back in July 2013 when he was the Gujarat chief minister. On the eve of the first anniversary of the surprise move to outlaw high denomination currency notes from the system, Bokil opens up to timesofindia.com on a range of issues ranging from why 'demonetisation' is not the correct term, to his views on GST and how he would have carried out demonetisation differently.

Q1. There are reports that you have been pitching for demonetisation for more than 15 years. Did you suggest this idea to previous governments as well? What did you find in Narendra Modi that made you think that he is the person who can implement a step like this?

We have been presenting and demanding implementation of the ArthaKranti Proposal for more than 17 years now. We have presented it to all the major political parties. For us, implementation of the proposal has been the only goal. To every leadership, we presented it with this same aim - that - the proposal would be taken up for implementation. So, we presented the proposal to PM Modi also with the same aim. This was in July 2013 when he was Gujarat CM.

Speaking about the word 'demonetisation', there are two components of money - narrow money and broad money. Of these, narrow money also called transaction money consists of two components - currency money and bank/credit money. Since the so called 'demonetisation' exercise pertained only to the currency money, the word 'demonetisation' is inappropriate. Instead, the word 'note ban' correctly describes the exercise.

In our opinion, apart from Modiji's determination, the clear mandate to this government has a vital role in taking of a radical decision like demonetisation.

Having said that, withdrawal of High Denomination Currency Notes (HDCN) is only one of the five points of the ArthaKranti Proposal.

The Five Point ArthaKranti Proposal

Withdrawal of existing taxation system completely (except Customs/Import Duties)

- All central, state and local government taxes - direct as well as indirect

Every transaction routed through a bank will attract a certain deduction in appropriate percentage (say 2 per cent) as a Bank Transaction Tax (BTT) - A single point tax deducted at source

- This deduction is to be effected on receiving/credit account only

- This deducted amount will be credited to different government levels like Central, State and Local (as say, 0.7 per cent, 0.6 per cent and 0.35 per cent respectively)

- Transacting bank will also have a share (say 0.35 per cent) in the deducted amount as the bank has a key role to perform

Cash transactions will not attract any tax

Withdrawal of high denomination currency (say above Rs. 50)

Government should make legal provisions to restrict cash transactions up to a certain limit (say Rs 2,000). This means, cash transactions above this limit will not enjoy any legal protection.

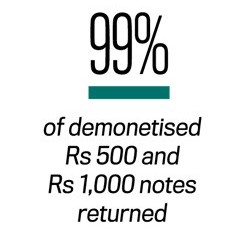

Q2. There is an opinion that the coming back of 99.5 per cent of the demonetised notes to the banking system accounts for the failure of the move. Do you agree?

What else could happen? The demonetised notes could either come back to the banking system or become invalid after the deadline. As such, what happened is not a great surprise. The less discussed but important things are: In what volume the fake currency notes either came to light or became invalid and why was the withdrawal of HDCNs so critically important.

With nearly 30 per cent of our population below poverty line, High Denomination (Rs 500 and Rs 1,000) Currency Notes (HDCNs) accounted for about 85 per cent of total currency money by value. This made cash transactions very easy, thus boosting corruption, black money generation, parallel economy and all sorts of anti-social, anti-national activities. The HDCNs were also a rational reason for large proportion of devastating fake currency notes in circulation. The adulterated and huge proportion of cash in HDCNs, meant banks were always short of primary deposits, leading to hard and costly capital supply to the national economy. This affected one and all from farmers to businessmen.

Due to all pervasive parallel economy, democratic governing systems simply failed to control and deliver. Thus, demonetisation was a much needed step which the government took. The cash gathered in HDCNs over the years came back to banks, that is, in the national formal traceable economy. Banks now have more primary deposits at their disposal and can be converted into derivative deposits for lending purpose. Apart from this, banking/card/mobile transactions are on the rise. These are positive signs for the economy and the country as a whole.

Yet, it is far from being over. Given our per capita income and our poverty line numbers, even 500 rupee notes are required to be withdrawn. We perceive 'note ban' is just a start of a structural change. It is an ongoing process. One needs to wait for some more time to assess the complete outcome of the note ban.

Q3. Do you subscribe to the government's version that demonetisation has led to widening of tax base and has brought hoarded cash into the formal economy?

Since the hoarded cash is brought back into the formal economy, widening of tax base a natural outcome. There are many more noteworthy things. Per RBI data published on 15 September 2017: Re-distribution of currency: 2,000 rupee notes account for nearly 50 per cent of total currency money by value; 500 rupee notes account for nearly 22 per cent of total currency money as against 47 per cent a year ago

500 and 1,000 rupee notes together made it nearly 85 per cent of total currency money by value a year ago while now, 500 and 2,000 rupee notes together make nearly 72 per cent of total currency money by value

Total volume of currency stands at nearly Rs 13.3 lakh crore as on 31 March 2017 compared to nearly 16.6 Lakh Crore Rupees as on 31 March 2016, that is, nearly Rs 3 lakh crore less New 200 rupee notes are being printed

Bank money/demand deposits have increased to nearly Rs 14 lakh crore leading to increased bank money to currency money ratio from 0.6 to nearly 1

Q4. Given the fact that litigation processes in India take time to materialise, how early do you feel that hoarders of black money will get prosecuted and the 'long term benefits' of demonetisation will come to fruition?

Of the two pillars, 'law' and 'order', ArthaKranti believes in and works on the 'order' part. It is under 'law' that the litigation and punishment fall. Our thinktank works only on the 'systemic' correction. We do not believe in and work on the punishment models. As such, we always put forth the ills of cash and how HDCNs promoted it. And therefore the dire need to withdraw the HDCNs.

As regards realising the long term benefits of demonetization, it will take a while. But, even 500 and 200 rupee notes are required to be withdrawn along with 2,000 rupee notes in a phased, calculated manner. This will mean more of banking and less of cash; easier and cheaper credit/capital. At the same time, taxation needs to be much simplified. To realise all the benefits, we propose a 'Taxless, Less Cash Economy'!

Q5. What about the claims that there are other ways than hoarding cash, like investing in gold and real estate, to bypass demonetisation?

In our view, it was a must to check the hyper volatility and non traceability of money which was in the form of cash, as it was the prime factor promoting the all pervasive corruption. Also one of the main objectives of note ban was to bring back hoarded cash into the formal economy and make it a less of cash economy to also address the challenges posed by fake currency to the economy as well as security.

Q6. As you mentioned, one of Arthakranti's proposals is withdrawal of the existing taxation system. Is the current structure of GST in sync with this proposal?

In our view, GST may be better than earlier indirect taxation systems. However, Bank Transaction Tax (BTT) is the best form of taxation as it is auto-compliant, and without any discrimination and political influence. We demand that the complete existing taxation system is replaced by a single, effective Tax- the BTT. This is a win-win-win solution for the government, the taxpayer and the banks. The government gets revenue as much as needed, the taxpayer gets credit in return thanks to entry in banking and the banks get a share in each transaction thus freeing them of so far costly primary deposits which also meant costly lending.

What we have proposed is an exchange, it is not a compliance. For an exchange, there is a natural gravity unlike natural resistance to compliance of tax procedures. Everything invested in compliance is a pure cost-addition and this is on top of taxes paid. We are for simplifying the taxation system which works for everyone.

Q7. The bit of chaos that ensued post the surprise move...how do you feel about that. Is there any way that could have been avoided?

The nature of such radical decision was certainly going to be a cause for some inconvenience and trouble for the society in general. It did lead to difficulties for the common man, but, it is a matter of great appreciation that people went through all the difficulties with commendable patience considering that the step being taken is required for the common good. That is why we are ok with the courageous decision taken.

Q8. Lastly, would you have implemented demonetisation in a different way? If yes, then how?

Our suggestion to the government was to withdraw HCDNs in phased manner and simultaneously withdrawing taxes along with the introduction of Bank Transaction Tax.

ArthaKranti Proposal Transition Plan is outlined below:

As a part of transition, a clean Amnesty scheme to be announced in which all demonetised currency money to be deposited in individuals' accounts

These deposits beyond a certain limit, to be converted in government Security Bonds of designed maturity periods

These deposits will attract a one-time tax at progressive rate

Phase 1: First Six Months:

Withdrawal of Central government Taxes like Personal Income Tax, Central Excise, Service Tax etc.

Withdrawal of 1000 rupee notes may be with introduction of 200 rupee notes 500 rupee notes to be supplied in calculated additional numbers

In lieu of the withdrawn taxes, a Fractional Bank Transaction Tax, say 0.55 per cent to come into effect. (Breakup: 0.5 per cent to Central government account and 0.05 per cent to the Banking System for setting up required Tax Collection Mechanism).

Phase 2: Next Six Months:

Monitoring revenue generated through Bank Transaction Tax

Negotiating with / Counseling State governments to withdraw All State and Local government Taxes assuring nearly 25 per cent rise in their current tax revenues via their share in the Bank

Transaction Tax, based on actual Bank Transaction Tax figures

Fixing the Bank Transaction Tax Percentage to generate required Revenues for Central, State and Local governments in lieu of withdrawn taxes

Withdrawal of 500 rupee notes

100 rupee notes and if required 200 rupee notes to be supplied in calculated additional numbers

Phase 3: Next 6 Months:

Complete transition is put in place and monitored meticulously

Withdrawal of 200 and 100 rupee notes

50 rupee and lower value notes to be supplied in calculated additional numbers

2016: Preparations began in Jan, decision on May 27

RBI, govt were in touch over note ban since Jan 2016, Jan 19, 2017: The Times of India

Demonetisation Decision Taken Around May 27

The Reserve Bank of India and the government were in regular touch over the demonetisation of Rs 500 and Rs 1,000 notes and printing of a new series of no tes since January 2016, the central bank and senior officials told a parliamentary committee.

In his comments before the standing committee on finance, RBI governor Urjit Patel said consultations were held but no minutes were maintained to ensure that secrecy was not compromised. The actual decision was taken around May 27, 2016.

Finance ministry officials and Patel said discussions on demonetisation were held, countering suggestions that the RBI recommended demonetisation after being prodded by the government just ahead of the November 8 announcement by the PM. RBI governor Urjit Patel also informed the parlia mentary committee that of the Rs 15.44 lakh crore that was demonetised, Rs 9.2 lakh crore had been replaced by way of new currency notes.

BJP member Nishikant Dubey is understood to have suggested that the RBI could produce travel details of its officials and other records to confirm that the discussions with the government did indeed take place. Patel said he was not in a position to respond to questions whether deposits below a threshold would not be investigated. He was asked about the central bank's autonomy as well in the context of the demonetisation decision.

Patel's comments on interactions with the government elaborated on the background note that the central bank had provided the committee. “It occurred to the government and the RBI that the introduction of new series of notes could provide a very rare and profound opportunity to tackle all three problems of counterfeiting, terrorist financing and black money by demonetising bank notes of Rs 500 and Rs 1,000 or by withdrawing legal tender status of such notes,“ the bank said. The large number of questions posed by members, said sources, made it difficult for officials and the governor to respond in length. Some members felt unhappy that Patel could not provide clear-cut answers on how much scrapped currency was deposited with banks by the December 30 deadline. Patel said he could not offer clarity as “physical counting“ of the currency was still in progress. Similarly, on the issue of when normal banking would be re stored, Patel said he hoped this would be soon and that ATMs were nearly back to their previous status.

Congress's Jyotiraditya Scindia, BSP's Satish Misra and TMC's Saugata Roy asked several questions.

Six months’ preparation

RBI got 6 months to prepare for this, Nov 09 2016 : The Times of India

Around six months ago [around May 2016], the government asked the RBI to prepare for its latest assault on black money , and told the currency manager to print more Rs 50 and Rs 100 notes, with PM Modi having decided to phase out the current lot of Rs 500 and Rs 1,000 notes earlier this year.

After all the task was hu mongous: replacing 23 billion notes.Besides, the information had to be kept confidential at all costs.

In any case, apart from the PM, only finance minister Arun Jaitley knew, and two senior officers each in the finance ministry and the RBI were in the loop.

The six months were used not just to print enough Rs 50 and Rs 100 currency notes, but also to plan the operations meticulously . This meant that, on Tuesday 8 Nov 2016, the Reserve Bank of India initiated the first “public“ move when its board met around 6pm and recommended the withdrawal of Rs 500 and Rs 1,000 notes. Soon, the government, which was ready with the notification, moved the Cabinet, which met at 6.30pm on Tuesday . The decision was taken and the PM went on air to announce the first demonetisation in 38 years.

The government's calculation was simple. It sees major gains accruing to the economy , beginning with an immediate halt to black money transac tions -at least in the near run. This is ex pected to force peo ple to use only legal channels, which will result in higher tax es in the govern ment's kitty .

While those showing “agricultu ral income“ can still use a possible loop transact in cash, the hole to transact in cash, the window is seen to be limited and the government expects bulk of the funds to flow into the banking system. This itself is going to provide more boost for lending, which has remained subdued, a senior government official said. “We have hastened the printing of these notes,“ RBI governor Urjit Patel said.

Designs approved on May 19, 2016

New note designs got RBI nod in May, 2016: Jan 25, 2017: The Times of India

The design of new banknotes of Rs 500 and Rs 2,000 denominations was approved at the May 19, 2016 meeting of the Central Board of RBI, an RTI query has revealed.

In his application, city-based activist Jeetendra Ghadge had sought the exact date of the approval of the design of new bills. “The new design of the bank notes was approved by the central board of RBI in its meeting held on May 19, 2016,“ the central public information officer of RBI stated in the response.

As per the Reserve Bank of India Act, 1934, general superintendence and direction of the Bank's affairs are taken care of by the central board of directors, a body headed by the governor of the RBI. Raghuram Rajan was governor of the apex bank during September 2013-September 2016.

RBI cited section 8(1)(a) of RTI Act to refuse information to Ghadge, who had sought to know exact date of the first meeting held at the apex bank with the agenda to print new currency notes of Rs 500 and Rs 2,000 denominations, and the exact date for the order allowing their printing. Ghadge, on Tuesday , said the RBI and its Governor need to come clean on the entire process of demonetisation “so that responsibility could be fixed and the common people's trust is maintained.“ Demonetisation of old Rs 500 and Rs 1,000 bills was announced by PM Narendra Modi on November 8 last year.

Rs 2000 notes' value with the RBI on November 8, 2016: Rs 4.98 lakh

The Times of India, Dec 20 2016

RBI had just Rs 5L cr in new notes on Nov 8

An RTI query has revealed that the Reserve Bank of India (RBI) only had around Rs 4.95 lakh crore in the new Rs 2,000 notes when the demonetisation decision was announced. An estimated Rs 15.44 lakh crore was in circulation in the old Rs 500 and Rs 1,000 notes on November 8. According to RTI activist Anil Galgali, the RBI's Rs 2,000 notes accounted for less than one-fourth of the value of its own stock of the old notes. On that day , the RBI had Rs 20.51lakh crore in the old Rs 500 and Rs 1,000 notes.

“As per the RTI reply by RBI PIO Suman Rai, it is clear that the government was well aware of the gamble it was taking on a decision that had the potential to wreak havoc on the lives of 125 crore Indians,“ Galgali said.

How currency ban was kept a secret

Ban on currency: How it was kept a secret TNN | Nov 10, 2016 The Times of India

- The ministers who attended the Cabinet meeting on Tuesday had to stay back till PM's address to the nation was over

- This was to ensure that there was no premature leak of the plan to scrap Rs 500 and Rs 1,000 notes

- Members of the Reserve Bank of India board too left only after Modi's speech

NEW DELHI: The ministers who attended the Cabinet meeting on Tuesday evening had to stay back till PM Narendra Modi's televised address to the nation was over, in order to ensure that there was no premature leak, even by a few minutes, of the plan to scrap Rs 500 and Rs 1,000 notes.

The demonetisation plan+ , the best kept secret in the power corridors of the national capital, was a tightly policed affair with only a handful of top officials privy to the move. Apart from ministers at the Cabinet meeting who had to remain in quarantine for a while, members of the Reserve Bank of India (RBI) board too left only after Modi's speech.

Sources said the official agenda for the Cabinet meeting on Tuesday was a deceptive string of MoUs between India and Japan, and even ministers were not aware about the proposal to ban high value currency notes.

"We just got some indication 10 minutes before the meeting started. It was a bold step by government. All ministers remained in the meeting hall from 6.45pm to 9pm until the PM's address to the nation ended," a minister said.

The Cabinet meeting ended around 7.30pm and the PM went to meet the President to inform him about the decision. "All ministers remained in the meeting hall.The PM held another meeting with three senior ministers later, which went on till late night," a source said.

It's worth mentioning that only a few weeks ago, the cabinet secretariat had issued a circular, to personal staff of all ministers, advising ministers not to carry mobile phones to the Cabinet meeting+ . "So, there was no scope of the information going out," said a source.

The government had also planned the timing of the Cabinet meeting. It was moved to the late evening slot and the RBI board also met around the same time. Sources said this was done to ensure that the news did not leak out.

Bankers Got Just A Few Hours To Mount Operation

10 Days On, They Reveal How Secret It All Was

Prime Minister Narendra Modi maintained such a deep level of secrecy in executing the decision to demonetise two high-value denominiations, that even the top bankers of the country had no idea about the move till he went on air at 8pm on November 8 to announce the decision to the world.

In the first week of November, RBI officials informed the chairpersons and MDs of all the top banks in India about a meeting at the central bank's headquarters in south Mumbai scheduled for 7pm on November 8. Uncharacteristically , the RBI didn't specify any particular agenda for the meeting, two bankers said. Usually , the central bank gives some notice to bankers when they are called for a meeting since it wants them to come prepared. On the day of the meeting, convened on the 15th floor of the RBI's Mint Street headquarters, all the top bankers of India, each with more than three decades of experience in the sector, were in attendance. The meeting started with RBI officials mainly discussing the situation pertaining to non-performing assets in the banking sector, a hot topic for the sector until that day.They discussed some other issues as well. Just before 8pm, RBI officials switched on the TVs in the room. They said that the PM would be on air soon, and they would continue the discussion after his speech, the bankers told TOI.

Until the time the PM had announced that India was scrapping Rs 500 and Rs 1,000 notes in less than four hours, none of the top bankers had any clue that the next few days would be their careers' most challenging.

“Basically it was as much of a surprise to us as to anybody else,“ said SBI chairperson Arundhati Bhattacharya. After the PM ended his speech, the bankers wanted to leave immediately and start work.

“The mood (with everyone present) was just to get out of the place and get things in place. We had to get out quickly to tell our people to switch off the ATMs by midnight; about the evacuation the next day, which was a huge exercise, then to take care of the recalibration; in the branches, what would be the instructions because there was to be exchanges, Rs 10,000 withdrawals etc,“ the SBI chief added.

However, the RBI deputy governors listed out what was expected of them and the bankers scrambled to meet their teams. The SBI chairperson, along with others, left the meeting between 9.30pm and 9.45pm.

By the time she reached her home at Malabar Hills around 10pm, she had called some of the top SBI officials to her bungalow. Soon enough, the meeting started and went on until the early hours. The next three days proved to be a tough challenge for the banking veterans, but they say that things have since started to fall in place.

RBI, Nov. 8, 2019: DeMo won’t curb black money

Some directors on the RBI board were not fully convinced with a majority of reasons cited by the government for demonetisation, but supported the move — which had been under discussion with the Centre for six months — in “larger public interest”, as it provided an opportunity to promote financial inclusion and digital payments.

The government had said demonetisation would help curb black money and steep rise in Rs 500 and Rs 1,000 notes; check the circulation of fake currency; and promote epayments and financial inclusion. But according to minutes of the RBI board meet at 5.30pm on November 8, 2016, three hours before the PM announced demonetisation, “directors made the following significant observations”:

• “Most of the black money is held not in cash but in the form of real sector assets such as gold or real estate and this move would not have a material impact on the assets.”

Some RBI directors had countered the government’s argument on the growth in high denomination notes being much faster than the pace of economic expansion, arguing that “adjusted for inflation, the difference may not be so stark”.

• “While any incidence of counterfeiting is a concern, Rs 400 crore as a percentage of the total quantum of currency in circulation is not very significant.”

• On the plus side, it said, “Proposed step presents a big opportunity to take the process of financial inclusion and incentivising the use of electronic modes of payment forward...”

RBI directors warned of short-term hit to GDP

Some RBI directors had also cautioned against “short-term negative effect on the GDP” for 2016-17, although they termed it a “commendable measure”.

Despite these reservations the board approved demonetisation, which was proposed by an RBI deputy governor and supported by a note from the finance ministry, which provided a draft scheme for withdrawal of existing Rs 500 and Rs 1,000 bank notes. The board was reassured by the fact that all the issues raised by the directors were under discussion between the central government and the RBI for six months. The Centre had also assured RBI that it would take measures to contain the use of cash and promote financial inclusion and electronic modes of payment.

A few hours after the RBI board gave the go-ahead, PM Modi went on national TV to announce the withdrawal of the old Rs 500 and Rs 1,000 notes. The deliberations in the meeting on November 8 are a revelation as it shows that RBI did not see demonetisation as a solution to black money and counterfeit notes being used for terror financing and anti-national activity. The government had argued that during 2011-12 to 2015-16, the economy had expanded by 30%, while the pace of rise in Rs 500 notes was 76% and that of Rs 1000 notes was 109%. In counter, RBI said, “The growth rate of economy mentioned is the real rate, while growth in currency is nominal… Hence, the argument does not adequately support the recommendation.”

It now appears that the government decision to allow medical stores to accept demonetised currency was at the behest of RBI. Those part of the board meeting included then governor Urjit Patel and his two deputies R Gandhi and SS Mundra. The other directors were Anjuly Chib Duggal, (then financial services secretary), Shaktikanta Das (then economic affairs secretary and independent directors Nachiket Mor, Bharat N Doshi, and Sudhir Mankad with RBI chief general manager SK Maheswari in attendance.

Cost to RBI

The Hindu, November 9, 2016

New notes to cost RBI more than Rs. 12,000 crore

Sharad Raghavan

By removing the Rs. 1,000 note, the government is doing away with the cheapest note to print in relation to the face value of the note.

Replacing all the Rs. 500 and Rs. 1,000 denomination notes with other denominations, as ordered by the government, could cost the Reserve Bank of India at least Rs. 12,000 crore, based on the number of notes in circulation and the cost incurred in printing them.

Data from a Right to Information answer by the RBI in 2012 shows that it costs Rs. 2.50 to print each Rs. 500 denomination note, and Rs. 3.17 to print a Rs. 1,000 note.

That means that it cost the central bank Rs. 3,917 crore to print the 1,567 crore Rs. 500 notes in circulation, and Rs. 2,000 crore to print the 632 crore Rs. 1,000 notes in circulation currently.

Assuming that the new Rs. 500 notes cost the same to print, then that is an additional Rs. 3,917 crore spent in simply maintaining the same number of notes in circulation.

The new Rs. 2,000 notes are likely to cost about the same or a little more than the Rs. 1,000 notes, which means an additional cost of Rs. 2,000 crore to print them.

In total, removing the old notes and replacing them with the new Rs. 500 and Rs. 2,000 notes will cost the central bank a total of at least Rs. 12,000 crore. This figure is likely to go up since additional security measures, which the new notes are set to have, will only add to the cost of printing.

By removing the Rs. 1,000 note, the government is doing away with the cheapest note to print in relation to the face value of the note.

Highest cost

The Rs. 3.17 it costs to print a Rs. 1,000 note is the highest in absolute terms across denominations, but it is the lowest when compared to the face value of the note.

For example, a Rs. 10 note costs only Rs. 0.48 to print, but that works out to 9.6 per cent of the face value of the note. Printing a Rs. 10 note costs 10 per cent of what that note is worth. This, for a Rs. 1,000 note, is 0.3 per cent.

Nashik mint goes into printing overdrive

The Currency Note Press (CNP), Nashik, has dis patched 74 million pieces of currency notes of Rs 500, Rs 100 and Rs 20 denominations to Reserve Bank of India (RBI) in just two days, on Monday and Tuesday .

Of the 74 million notes, 13 million are of Rs 500 denomi nation, 31million of Rs 100, and the remaining 30 million are of Rs 20 denomination, sources from the CNP told TOI. The CNP had sent five million pie ces of new currency notes of Rs 500 to RBI on Friday too.

The CNP, which is one of the nine units of the Security Printing and Minting Corpo ration of India Ltd (SPMCIL), is printing cur rency notes of all denomina tions, except the new Rs 2,000 note. “We despatched 37 mil lion currency notes on Mon day and the same quantity on Tuesday ,“ an official said “We are taking efforts to print maximum number of notes of Rs 500, Rs 100 and Rs 20. On an average, 16 million notes are being printed daily .“

The government scrapped the currency notes of Rs 500 and Rs 1,000 with effect from Tuesday midnight. Although the Rs 2,000 currency notes have come into circulation, the new Rs 500 notes are expected in the market shortly . The RBI is printing Rs 2,000 and Rs 500 notes at its two printing units in Mysore in Karnataka and Salboni in West Bengal, while SPMCIL is printing Rs 500 notes at its presses in Nashik and Dewas in Madhya Pradesh.

Economists’ view

Nobel laureate Thaler lauded move; critiqued implementation

HIGHLIGHTS

Nobel-winning economist Richard Thaler said demonetisation was a "good" concept but its implementation was "deeply flawed"

He critiqued that the move to introduce Rs 2,000 notes was "puzzling" and undercut the purpose of the note ban

Thaler had won the Nobel Prize in Economic Sciences in 2017

US economist and Nobel laureate Richard Thaler thinks that the Indian government's decision to demonetize high value currency notes was a "good" concept but its implementation was "deeply flawed."

Thaler further says that the move to introduce Rs 2,000 notes during the remonetisation exercise was "puzzling" and undercut the purpose of the note ban, considering that it aimed to crack down on the parallel economy and transform India into a less-cash society.

All this emerged after Swaraj Kumar, a student of the Chicago University professor, approached him for his views on demonetisation.

Kumar posted the email conversation with Thaler on his Twitter account. Here's what the economist had to say: "The concept was good as a move to a cashless society to impede corruption but the rollout was deeply flawed and the introduction of the Rs 2000 note makes the motivation for the entire exercise puzzling."

Kumar's tweet was later retweeted by Thaler's handle.

But when he got to know that the government planned to introduce Rs 2,000 notes, he registered his surprise and skepticism in the following two-word tweet.

Legal view

HC: Ban came with enough relaxations

HC: Ban on notes came with enough relaxations, Nov 29 2016 : The Times of India

The Delhi high court on Monday appeared to have agreed with the Centre that relaxation has been provided to citizens to help them deal with the shift to new currency as per the demonetisation policy .

“Relaxation has been given wherever it is necessary ,“ a bench of Chief Justice G Rohini and Justice Sangita Dhingra Sehgal said. The court was hearing a PIL seeking relaxation of the Rs 2.5 lakh withdrawal limit for marriages. The petition also sought a direction for allowing old notes of Rs 1,000 and Rs 500 for paying fines and court fees till December 31. HC is likely to deliver the verdict on Tuesday .

Appearing for the Centre, additional solicitor general Sanjay Jain and standing counsel Gaurang Kanth said fear of misuse has made government impose conditions. “For weddings, if there are no conditions, then anybody can get a marriage card printed and go to the bank,“ Jain said, urging the court to dismiss the plea.

Petitioner Birender Sangwan alleged that the guidelines that seeks detailed list of people to whom the cash is proposed to be paid for marriage and declaration from them that they do not have a bank account were “arbitrary“ and made it impossible for a family to withdraw cash at the time of need.

“Liberty must be given for marriages so one can pay as per the customs. How can somebody give such an undertaking? As per the guidelines, even the priest who performs marriages has to give an undertaking of not having an account. The parents of the bride and groom should be allowed to withdraw without such arbitrary conditions,“ Sangwan said.

Supreme Court’s judgement

Dhananjay Mahapatra, January 3, 2023: The Times of India

From: Dhananjay Mahapatra, January 3, 2023: The Times of India

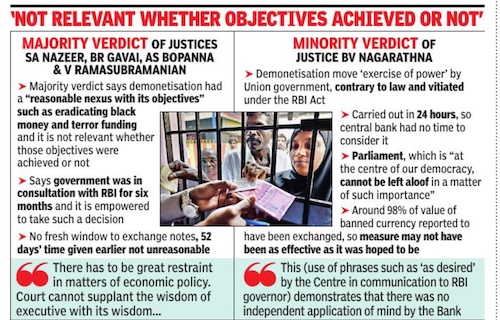

New Delhi : A five-judge Constitution bench of the Supreme Court, by a 4-1 majority, validated the controversial November 8, 2016 decision of the Union government to demonetise currency notes of Rs 500 and Rs 1,000 denomination and rejected lock, stock and barrel the challenge by 58 petitionsto the demonetisation decision-making process, saying it was “flawless”.

The majority judgment, authored by Justice BR Gavai on behalf of himself and Justices SA Nazeer, AS Bopanna and V Ramasubramanian, said the hardships faced by citizens following demonetisation six years ago cannot be a ground to reverse the decision.

On creating a fresh window for return of demonetised currency, the majority verdict said it did not have the expertise to “frame such a scheme”.

Ploughing a lone furrow,Justice BV Nagarathna said though the objective of demonetisation was noble and aimed to achieve economic health and stability by targetingfake currencies, terror funding and black money, the process adopted by the Union government was illegal. She quashed both the 2016 ordinanceas well as Parliament-enacted Specified Bank Notes (Cessation of Liabilities) Act, 2017.

NEPAL and BHUTAN: the pain

I

Nepal Rashtra Bank and the Royal Monetary Authority of Bhutan are in touch with the RBI regarding facilitation of collection and deposit of old Rs500 and Rs1,000 notes Nepal and Bhutan, two major recipients of Indian developmental aid, have taken up with New Delhi the issue of demonetisation of high-value currency bills and the impact it could have on financial assistance to them.

As per the 2016-17 budget, India has earmarked Rs5,490 crore for Bhutan and Rs300 crore for Nepal.

II

Below are excerpts from Jeremy Luedi, Senior Analyst, Global Risk Insights, Under the Radar: Nepal in turmoil after India’s rupee demonetization, November 25, 2016. The full article and graphs can be accessed at this link.

Under the Radar: Nepal in turmoil after India’s rupee demonetization

Hundreds of thousand of Nepalese citizens work in India as migrant workers, with Nepal receiving $640 million in remittances from its citizens in India in 2016. Much of these remittances, which amount to 2.6% of GDP, are sent home using the now defunct banknotes.

Pandey, who attempted to deposit $440 worth of rupees, only to be refused, is now unable to repay a $275 loan used to rebuild the family home after the 2015 earthquake. He is in a situation shared by hundreds of thousands of others now unable to deposit their Indian earnings in Nepalese banks, as said banks no longer recognized the defunct bills. Alongside migrant workers, Nepalese students seeking admission to Indian institutions, those seeking medical treatment, pilgrims, and those visiting family in India are also affected. Moreover, thousands of veteran Gurkhas drawing pensions in Indian rupees have seen their payments undermined.

Unlike Indians, Nepalese citizens are not able to exchange or deposit their notes by the December 30th deadline set by New Delhi’s transition plan. The Federation of Nepalese Chambers of Commerce and Industry estimates that some ten billion rupees ($146 million) in defunct notes is held by the informal sector and private individuals – a major loss of savings in a country with a nominal per capita GDP of only $837.

To make matters worse Nepal has banned the use of the new replacement bills until India issues a FEMA notification, as per the Foreign Exchange Management Act. While this is standard procedure, the move only puts Nepal further at the mercy of New Delhi’s schedule, as well as exacerbates the troubling plight of ordinary Nepalese caught in the middle. This is not the first time consumers and investors have faced difficulties regarding the rupee in Nepal, as prior to 2015 India’s 500 and 1,000 rupee notes were banned, a ban only removed after a visit by PM Modi in the same year.

During Nepal’s previous ban India set up a task force to ease currency exchanges with Katmandu after which the now defunct 500 and 1,000 rupee bills were finally accepted.

Another concern for both Nepal and Bhutan is how banknote demonetization will impact foreign aid from India, as New Delhi allocated 54.9 billion rupees ($798 million) to Bhutan and 300 million rupees ($4.36 million) to Nepal in 2016.

Demonetization threatens unrest, tourism in Nepal

The losses incurred by ordinary Nepalese from India’s demonetization will have serious knock-on effects, especially in a country with severe existing food shortage problems and a lack of other basic services.

Any instability could seriously damage Nepal’s efforts at economic growth. The country’s tourism sector is particularly at risk as the industry is highly exposed and responsive to political risk. Tourism constitutes Nepal’s largest source of foreign exchange, and if this source diminishes, then it (coupled with stymied remittance rates) will contribute to a major reduction in desperately needed foreign reserves.

Laundering money

Methods used

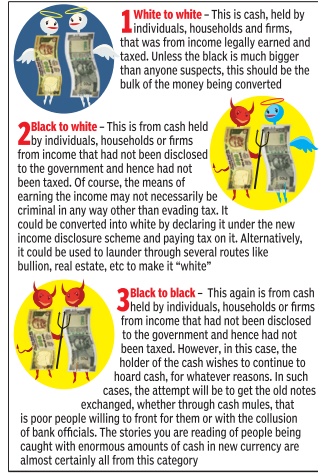

Please see graphic

1. Fall back on friends:

The easiest and most pervasive is the use of personal network. Asking the person who can legitimately exchange.

2. NBFCS can play facilitator:

Here, a person tells a willing non-banking financial company (NBFC) that he is ready to hand over cash in exchange for an interest-free loan of an amount that is say, 20% lower than the cash being paid. The loan is transferred into the person's account, providing legitimate cash. The loan is interest-free for 3 years, within which time a paper trail would be created to show than it has been repaid. The 20% is the cut the NBFC takes for putting through this fraudulent transaction.

3. Forex route:

Governments, after all, can not demonetise other currencies. Hence, people are rushing to the grey market for dollars, euros and pounds. Once again, they are ready to pay a sizeable exchange premium. The dollar has been driven up to around Rs 120 in these deals, sources say.

4. Realty to the rescue:

The real estate sector is assumed to be badly hit by demonetisation. And, sources in the trade say the unsold inventory is being bought by those seeking quick conversion of cash at rates prevailing months ago. As is common in realty, these deals are often settled at 70-30 or 60-40 ratios of white and black payments. It is clear how this helps the buyer, but what does the builder get out of it? Where is his conversion charge? Partly, he gains from getting rid of unsold inventory. And partly from sticking to old rates at a time when prices have fallen.

5. Pumping out the cash:

Through transporters: According to an industry source, permission to use old notes at petrol pumps has been used to hilt for this operation. Figures being thrown run into tens of thousands of crores, but even if these are an exaggeration, this is certainly a major conduit for cash.

6. The gold route:

Those with large stashes of demonetised cash hand in old Rs 500 and Rs 1000 notes and get gold in exchange. Of course, gold in these transactions is priced much higher than the official rate of Rs 30,000 or so. And in some cases, it is close to Rs 50,000 per 10gm, sources say. The premium is the charge for legitimising the cash stash.

Some other indigenous tricks:

1. NGOs: Donations have spiked

2. Sales of medicines, as chemists were accepting old notes

3. AC-I ticket sales, up by 1000% with buyers planning to cancel them later

4. Advance salary with pay hike

5. Temple donations

6. Jan Dhan accounts: People "rented" JDY accounts to deposit black money to be withdrawn later.

Cash sent repeatedly from unscheduled airfield, on chartered aircraft to the NE

Income tax and intelligence officials in the national capital suspect that the Rs 3.5crore in scrapped currency notes seized from a chartered flight in Nagaland could be part of a big money laundering racket, with the masterminds exploiting tax exemptions for tribals in the northeast and non-existent security at smaller airports.

A probe by the I-T department revealed that some businessmen, including the Gurgaon-based owner of a printing and packaging firm, allegedly roped in Anato Zhimomi, who claimed the seized money after produc ing an I-T exemption certificate, and took advantage of the absence of security at a small airfield in Hisar to haul at least Rs 11 crore in outlawed denominations of 500 and 1,000 to Dimapur by a chartered plane.

The money thus ferried was deposited into the account of Anato, the son-in-law of three-time Nagaland CM Neiphiu Rio, the sole representative in the Lok Sabha from the state who backs the BJP-led NDA at the Centre.Anato's father Khekiho Zhimomi served as a member of the Rajya Sabha from the Naga People's Front party.

Anato, who has been arrested, was supposed to transfer the money back into the account of the business men through RTGS [Real-time gross settlement systems].

Sources in the I-T department said Anato had “confessed“ to have ferried cash thrice from Hisar to Dimapur by the same plane on November 12, 14 and 21. Anil Sood is the Gurgaon-based owner of a printing and packaging firm, in whose bank account Anato had been making transfers through RTGS after cash was deposited in his Dimapur account. The proprietor of the airline is also under the scanner, with the I-T department seeking to verify Anato's claim that the last cash shipment belonged to the former.

Besides highlighting the desperation of those with stashes of scrapped notes, the incident has rung alarm bells among authorities over the absence of security at the airfield belonging to Hisar Flying Club -something which the group capitalised on. Inquiries suggest that those involved in shipping cash faced no questions as they loaded their cargo onto the aircraft chartered from Air Car Airlines. “Today, this is a case of money laundering. Tomorrow, any terrorist can similarly fly from an unscheduled airfield to land at a scheduled commercial airport to wreak havoc,“ said an official source.

Large cash enters inactive Jan Dhan accounts

A large amount of cash has suddenly started flowing into previously inactive Jan Dhan accounts in the aftermath of the demonetisation of Rs 500 and Rs 1,000 notes.

The Jan Dhan Yojana was launched in August 2014 with an aim to bring the poor into the fold of banking facilities, and empower them financially by encouraging savings, and easing loan delivery and direct cash transfer.

Accounts opened at the time but not used so far have overnight turned flush with funds. Many such accounts, which held only Re 1or Rs 2 till November 8, now have up to Rs 49,000, the upper limit for deposits that can be done without PAN cards.

A few bank officials told TOI on the condition of anonymity that many accountholders were possibly being exploited by middlemen or the rich to lend their accounts to park cash.

Ajay Agnihotri, manager of State Bank of India's Fatehabad Road branch in Agra, said, “There are around 15,000 Jan Dhan accounts at our branch, and 30% of the account-holders have deposited amounts of up to Rs 49,000 since Thursday (when banks reopened in the wake of the demonetisation announcement). We are quite sure that this percentage will go up in the coming days.“

Another bank official added, “In certain cases, we are quite sure that it is not their money . Gullible persons and those working on a contractual basis in factories are being used by their employers as well as middlemen. However, people should know that the government is tracking all the records and transactions.“

TOI was able to track a few account-holders used for this purpose. One of the victims, who had deposited Rs 49,000, said he was promised Rs 500 in return. He would have to return the rest of the money in some days.

“I was told that if I deposit this amount, my reputation in the bank will go up. The middleman also said he would help me financially in the future,“ he added.

Shell companies send money to multiple bank accounts

Taxmen unearth mega fund routing after demonetisation, Oct 07 2017: The Times of India

Shell Cos Used Web Of ACs For Illegal Cash Deals

In a major breakthrough, tax authorities have uncovered details of several shell companies routing massive sums of money through a web of bank accounts during the demonetisation period. Nearly Rs 4,600 crore has been detected so far, and this, officials believe, is only the tip of the iceberg. They have collected information on only 5,820 of over 2 lakh companies whose names were struck off by the ministry of corporate affairs last month, and their directors and bank accounts put under the scanner. The 5,820 companies had 13,140 accounts in nine banks.

Sources told TOI these companies had deposits worth Rs 4,574 crore on November 8 last year, the day demonetisation was announced, in the accounts investigated.Nearly 99% (Rs 4,552 crore) was withdrawn by the time their names were struck off.Initial information available with IDBI Bank showed 3,300 firms whose names were struck off had 3,634 accounts with this bank alone that saw deposits of Rs 3,792 crore and withdrawals of Rs 3,794 crore.

The discovery is expected to strengthen the government's argument that the tax department's post-demoneti sation operations will actually help unearth black money , and blunt criticism that the exercise was a failure. Tax authorities are of the view that the RBI and the Registrar of Companies need to conduct a detailed probe into these companies.

The tax department has identified at least nine firms that had over 100 accounts each. Gold Sukh Trade India, with 2,134, and Aswin Vanaspathi India, with 915, top the list, followed by Anujay Exim (313) and Radha Krishna Payal Bhandar (298).

According to data provided by the Bank of Baroda, some of the companies had negligible balance when demonetisation was announced but saw large deposits over the next few weeks. MAATara Ispat Pvt Ltd, for instance, had 45 accounts with a balance of Rs 6,781 on November 8 but deposited and withdrew over Rs 6 crore till its name was struck off.

Radha Krishna Payal Bhandar had Rs 1.9 crore across its bank accounts on the eve of demonetisation.But over the next few weeks, Rs 12.6 crore was deposited, and Rs 12.53 crore withdrawn.

At Canara Bank, Subhash Pipes deposited Rs 13.91 crore and withdrew the entire amount. Similarly , Technext Vyapaar deposited and withdrew Rs 9.9 crore. The bank told tax authorities there were 429 firms with zero balance on November 8 that subsequently saw deposits of over Rs 11crore and withdrawals of a similar amount, leaving a cumulative balance of Rs 42,000.

Post demonetisation, November 2016: 35,000 shell firms deposited/withdrew Rs 17,ooo cr

The government's crackdown on “shell companies“ has shown that around 35,000 of the 2.24 lakh companies, whose names have been struck off, deposited over Rs 17,000 crore post-demonetisation, which was later withdrawn, raising suspicion of wrongdoing.

In one case, a company with a negative opening balance on November 8, 2016, when Prime Minister Narendra Modi announced that Rs 500 and Rs 1,000 notes were being junked, deposited and withdrew Rs 2,484 crore post-demonetisation. In a statement, the finance ministry said a company had as many as 2,134 accounts and data for such entities had been shared with enforcement authorities, including the Central Board of Direct Taxes, Financial Intelligence Unit (FIU), department of financial services and the Reserve Bank of India for further action. Companies have also been identified for inquiry inspectioninvestigation under the Companies Act, 2013 and necessary action is underway, the release said.

The government has so far de-registered over 2 lakh companies that were inactive for two years or more and did not file the statutory reports, while also disqualifying over 3 lakh directors. “Preliminary enquiry has shown that over 3,000 disqualified directors are directors in more than 20 companies each, which is beyond the limit prescribed under the law,“ the government said.

Separately , banks have been asked to freeze the accounts of these companies and share da ta with the government. So far, 56 banks have shared information involving 58,000 companies with more information expected to come in the coming months. Data released on Sunday was a continuation of the trend witnessed earlier.

The multi-pronged approach is being driven by a special task force (STF) set up by the PMO, which is co-chaired by revenue secretary Hasmukh Adhia and corporate affairs secretary I Srinivas.While several corrective measures to tighten regulations have been initiated, the government is also initiating criminal investigation under new provisions of the Companies Act.

“Under Section 447 of the Act, which defines fraud, stringent punishment, including imprisonment up to 10 years, is stipulated. Further, reference has been made to the ministry of finance to include it as a Scheduled Offence under the Prevention of Money Laundering Act,“ the government said.Action against professionals who assisted these companies is also being pursued.

Gold worth Rs 2,700cr bought in Hyderabad

The Times of India, Dec 18 2016

Gold worth Rs 2,700cr bought in Hyd with banned notes from Nov 8-30

SagarKumar Mutha

Investigations by the Enforcement Directorate (ED) have revealed that gold biscuits worth Rs 2,700 crore were bought with demonetised currency in November in Hyderabad alone. People who purchased the biscuits went underground thereafter. ED sources told TOI that going by details of air cargo, more than 8,000kg of gold was imported into Hyderabad between November 8 and 30.“That all this was sold can be ascertained from the fact that there was fresh import of 1,500kg of gold between December 1and 10. There is a sudden spurt in the bullion market and those with high stash of the banned currency are buying gold from bullion traders and jewellers in Hyderabad,“ the sources said.

Rs 9,000cr put in dist co-op banks in 5 days

The Times of India, Dec 18 2016

UNDER LENS - Rs 9k cr deposited in dist co-op banks in 5 days after cash ban

Freny Fernandes & Shrutika Sukhi

Entities Cater Primarily To Poor Farmers

Either the rural economy is extremely robust, or farming possibly the most lucrative of occupations. Deposits totalling over Rs 9,000 crore were made in select district central cooperative banks (DCCBs) across 17 states between November 10 and 14. The five-day window began a day after the government's demonetisation decision kicked in on November 9.

Perennially saddled with accumulated losses and large non-performing assets, DCCBs suddenly mopped up over 147 crore of the demonetised Rs 500 and Rs 1,000 notes in the period.

Old notes selling at a premium in Kolkata market, Rohit Khanna | TNN | Dec 27, 2016

Old notes of Rs 500 and Rs 1000 will fetch you Rs 550 and Rs 1,100 here

Shell companies need to shore up 'cash in hand' in their balance sheets before the third quarter ends on December 31

These old notes can be deposited in banks only till December 30

After PM Modi announced demonetisation on November 8, the business community in Calcutta adopted every possible means to either exchange the notes or get some deposited in banks. With the third quarter coming to an end, they have little cash left to show as 'cash in hand'. Income tax officials have come across a number of companies which have shown a large amount 'cash in hand' in the balance sheet when the physical cash was much less.

If these companies have shown 'cash in hand' over a long period, then a large part of the amount is expected to be in the form of old Rs 500 or Rs 1,000 notes. But, as per RBI guidelines, these notes can be deposited in banks only till December 30 this year. This has led to the sudden surge in demand for the scrapped currency. "There is such a possibility but I can't say if anyone has utilised the scope to fudge the balance sheet," said Anirban Datta, chairman of Institute of Chartered Accountants of India (eastern region).

At a time when people across the country are queuing up outside banks to get rid of old Rs 500 and Rs 1000 notes, the scrapped currencies are selling at a premium in the serpentine bylanes of trading hub Burrabazar. Old notes of Rs 500 and Rs 1000 will fetch you Rs 550 and Rs 1,100 here.

On 26 Dec 2016 The Times of India spotted men sitting with wads of new currency notes in the shops dotting the trading hub. They were there a month ago too, but then they were handing out anything between Rs 800 and Rs 850 in exchange for a note of Rs 1000 in old denomination. The sudden reverse exchange may stump commoners but those in the know say it has been triggered by shell companies who need to shore up 'cash in hand' in their balance sheets that show huge paper transactions. The city's accountancy fraternity sees this as a bid to justify the paper transactions before the third quarter ends on December 31.

In the balance sheet, 'cash in hand' is the amount held by a company in the form of notes or coins. In layman's term, 'cash in hand' is the money that is kept to pay small amounts but is not deposited in the bank. However, it does not mean the money lies in physical form in a chest or a drawer.

The six most common methods used

See graphic.

The Times of India

Karnataka laundered other states’ money

BV Shivashankar, Dec 29 2016: The Times of India

Investigation into the seizures in Karnataka has revealed that the state could be a prominent part of well-oiled operations, with 70% of all cash seized belonging to currency chests from other states.

A source said the serial numbers on the notes indicate that most of the seized money -Karnataka recorded the highest number of seizures -came from currency chests in Chennai, Hyderabad, Vijayawada, Ahmedabad and Surat, among other cities. “Going by the serial numbers of notes seized, only a few were allocated to banks in Karnataka,“ he added.

Of over Rs 3,500 crore seized as of December 25 across the country , Rs 100 crore was in Rs 2,000 notes.The income tax department has referred over 55 cases to the Enforcement Directorate, out which 26 are from Karnataka. The currency notes seized indicated the rackets spread to TN, Andhra, Gujarat and Goa. For instance, of the Rs 29 lakh seized from the Bengaluru home of P Vivek, the son of sacked TN chief secretary Ram Mohan Rao, Rs 23 lakh was in new notes issued to a currency chest in Chennai. Tirumala Tirupati Devasthanams trust member J Shekhar Reddy and D K Badrinath, brother of former Chittoor MP Adikeshavulu Naidu, were allegedly linked to a money laundering racket in Bengaluru. Most of the notes they dealt with were from Andhra and TN.

Even in the case of Bheema Nayak, who allegedly helped mining baron G Janardhana Reddy with currency conversion, Rs 100 crore is said to have been routed to Bengaluru from Andhra.

Not linked to this was a racket operated from Goa.Many casino owners were involved, and the Rs 5.7 crore seized from the residence of JD(S) politician K C Veerendra, also a casino owner, is linked to it.

Corrupt bank employees were acted against

156 PSB officials suspended for note ban irregularities Feb 04 2017 : The Times of India

Many bank employees were found involved in `irregular exchange of transaction' of specified bank note (SBN) during the phase of demonetisation.

As many as 156 senior officials of various state-owned banks were suspended and 41 transferred after they were found involved in irregularities related to demonetisation, Parliament was informed in Feb 2017.

Banks also reported having filed 26 cases with police and the Central Bureau of Investigation (CBI) wherever criminal cases were involved.

In respect of private banks the Reserve Bank of India (RBI) informed that 11 employees have been placed under suspension The RBI has further informed that banks have initiated internal investigation and complaints have been filed with police/ CBI.“

Misuse Of Windows Offered By Govt

17% of cash seized in raids during demonetisation were in new notes

TIMES NEWS NETWORK Indicates Misuse Of Windows Offered By Govt As much as Rs 110 crore of the Rs 610 crore of unaccounted money seized in raids during demonetisation was in new Rs 2,000 and Rs 500 notes, indicating misuse of windows offered by the government to change old currency. The new currency seized by police and income tax officials was partly generated through rou tes such as petrol pumps, railway and airline ticketing and toll plazas where denotified notes were accepted and also the handiwork of a section of crooked bank officials who exchanged notes illegally . The figures are part of the arguments made by the Centre in the Supreme Court in explaining its reluctance in offering a fresh window for exchange of old notes. The exemptions offered, it has said, have been abused and so might any new windows. The SC has suggested that a genuine case where a person for circumstances out of his control was unable to change old currency should be given an opportunity to argue his case. The view in the Centre is even a deserving case can be exploited to change illegal money.

The Centre has argued that the experience of demonetisation did not support the case for a fresh window and also said that ordinance issued to shut down all ex change or deposit of notes after December, 2016 was legally valid. It has said the language of the earlier notification did not mean the government was bound to provide a window beyond the end of the year.

The seizure of as much as Rs 110 crore of new notes in demonetisation between November 9, 2016 to December 30, 2016 was a good indicator of how the exchange mechanisms were manipulated. The exchange or use of notes was different from the facility to deposit old notes in bank accounts. The 1,100 raids during demonetisation yielded Rs 5,400 crore of undisclosed income and 400 cases are being investigated by the CBI and Enforcement Directorate.

Trash cash sent to temples

Siddhivinayak hundi swells

Siddhivinayak hundi swells with donation in trash cash, Nov 18 2016 : The Times of India

Temple donation boxes across the country are over flowing with cash, a bulk of it in old 500 and 1,000 rupee notes, prompting their managements to speed up counting of currency and ensure timely deposits in bank accounts.

Mumbai's Siddhivinayak has received twice the usual amount in anonymous donations in the week since the demonetisation of the old Rs500 and Rs1,000 currency notes. Its hundi was opened on Wednesday to reveal cash donations of Rs 60 lakh, much of it in highdenomination notes.The average weekly tally is Rs 35-40 lakh.

The Maharashtra government has requested Siddhivinayak and other prominent shrines in the state to deposit cash offerings in banks on a daily rather than weekly basis so that the flow of new currency can be augmented.

Narendra Rane, chairman of Siddhivinayak temple trust, said, “We have received 90 bank notes of Rs2,000 denomination also. It shows devotees who have spent long hours in queues at banks and ATMs want to offer the first note to Lord Ganesha. As for the outgoing currency , there are 1,060 notes of Rs 1,000 which total Rs 10.60 lakh. There is a flood of of Rs500 notes, which comes to approximately Rs 17 lakh. The rest is small currency .“

Tirumala Tirupati Devastanams

Hundi collection at the Tirumala Tirupati Devastanams (TTD), considered the richest temple trust in India, stands at a little over Rs 20 crore since the announcement of demonetisation. “For the last few days we are receiving hundi income in the range of Rs 2 crore to Rs 2. 5 crore daily ,“ said Chandrasekhar Pillai, deputy executive officer, TTD.

Mathura and Vrindavan

Anuja Jaiswal, UP DONATIONS - Govt eyes shrines for change, Nov 18 2016 : The Times of India

Desperate for cash in small denominations, temples in Mathura and Vrindavan, which get close to Rs 6 crore each month in donations, have been asked by the district administration to take each day's earnings to banks and deposit them.

There are over 7,000 temples in the two districts and all of them will be expected to open their donation boxes at the end of the day for various banks to collect them.

All temples in India have been instructed to deposit their donations in their respective bank accounts.

The move is also being viewed as a step by the administration to check people from doing away with money in the form of now-banned Rs 500 and Rs 1,000 notes. Officials TOI spoke to on Thursday said religious places should not turn into “exchange centres“ for people to get their ill-gotten wealth converted into legitimate cash.

Temples get I-T notices

Arshad Afzaal Khan, It's Temple Run Across India In Hard Times, Nov 18 2016 : The Times of India

Ayodhya religious bodies get I-T notice in black cash fight

The income tax department has issued notices to all religious trusts and major temples in Ayodhya asking them to present their balance sheets as on November 8, when the demonetisation order was implemented. The I-T department swung into action after reports that there was a beeline for all religious trusts for turning black money into white after the demonetisation announcement.

The I-T department has also issued notices to religious trusts being run by scions of erstwhile estates, said sources.

I-T commissioner Vijay Kumar said, “We have served notices to all religious trusts. Ac tion would be taken against trusts whose accounts would have anomalies.“

THE IMPACT OF THE DEMONETISATION OF 2016 ON...

The remaining part of this page deals exclusively with THE IMPACT OF THE DEMONETISATION OF 2016

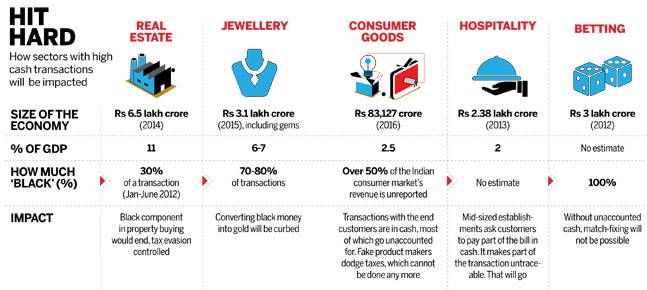

See graphic:

Split of the money in circulation by value in FY 2016

From: M.G.Arun and Shweta Punj , Down and Ouch “India Today” 24/11/2016

The immediate impact

The first few days’ impact

The demonetisation of Re.500 and Re.1,000 notes was announced on Tuesday 8 Nov. 2016. It impact began to be felt the next day itself. The following items from

From: M.G.Arun and Shweta Punj , Down and Ouch “India Today” 24/11/2016

The Times of India of 12, 14, 15 Nov 2016 chronicle the immediate, three-day impact of the action taken by the government.

ADVANCE PAYMENTS First, many employers have begun to pay their staff in advance -in some instances, salaries for the next one year -in cash. The tendency to pay employees in advance has been noticed in many private educational institutions, which mostly pay their staff in cash, said a source.These staffers will deposit this advance salary in their bank accounts.

Second, some traders are depositing their cash as business revenue to be shown as sales done before November 8 (the day of the ban) but payment received thereafter. Others, particularly wholesale traders, are reporting cash-in-hand in their ledgers to legitimise unaccounted for cash, and having it deposited at a later date. (Day 3)

BANKS SBI gets one month's deposits in one day

Demonetisation: Banks Get Rs 60K Cr In 2 Days

Banks have received nearly Rs 60,000 crore in deposits following the withdrawal of Rs 500 and Rs 1,000 currency notes. SBI alone has raised about Rs 39,677 crore in deposits following the withdrawal of high denomination notes. Bankers expect the surge in deposits to bring down interest rates.

“We have received deposits of Rs 11,000 crore in savings accounts in one day .Normally , it takes a month to mobilise Rs 8,000 crore of savings deposits,“ said SBI chairman Arundhati Bhattacharya, while announcing the results on Friday afternoon.

At the end of the day , the bank said that the collections on Friday amounted to Rs 17,527 crore on the back of Rs 22,150 crore on Thursday . For exchange, the country's largest bank received Rs 723 crore worth of notes on Thursday and another Rs 943 crore on Friday .

According to Bhattacharya, demonetisation tends to have a deflationary impact.Also, the surge in low-cost deposits will bring down the bank's cost of funds.

Taken together, both measures would help bring down interest rates. Before demonetisation, the public held around Rs 14 lakh crore in Rs 500 and Rs 1,000 currency notes. These notes have to be exchanged or deposited in banks and post offices. (Day 3)

5th day: The total cash deposited in banks since the announcement of the withdrawal of the old Rs 500 and Rs 1,000 notes has crossed Rs 1.5 lakh crore, according to estimates received from different banks. SBI received total cash deposits of Rs 75,945 crore and exchanged currency worth Rs 3,753 crore.Against this, there had been withdrawals of Rs 7,705 crore in currency notes of Rs 100 and Rs 2,000 till the 5th day .

CARS Delhi has seen about 70% dip in registration of new vehicles in the past three days. On average, 1,500 vehicles are registered every day in the city. This number has come down drastically since November 8.

Sources said dealers, who also register vehicles in Delhi, had reported a similar drop in the number of registrations. “Some registrations are taking place but the number is minuscule. Registrations have almost stopped in the 13 RTOs in the city ,“ added the official. (Day 3)

JAN DHAN Dead since birth, Jan Dhan a|cs now flush with cash

A large amount of cash has suddenly started flowing into previously inactive Jan Dhan accounts.

The Jan Dhan Yojana was launched in August 2014 with an aim to bring the poor into the fold of banking facilities, and empower them financially by encouraging savings, and easing loan delivery and direct cash transfer.

Accounts opened at the time but not used so far have overnight turned flush with funds. Many such accounts, which held only Re 1or Rs 2 till November 8, now have up to Rs 49,000, the upper limit for deposits that can be done without PAN cards.

A few bank officials told TOI on the condition of anonymity that many accountholders were possibly being exploited by middlemen or the rich to lend their accounts to park cash.

Ajay Agnihotri, manager of State Bank of India's Fatehabad Road branch in Agra, said, “There are around 15,000 Jan Dhan accounts at our branch, and 30% of the account-holders have deposited amounts of up to Rs 49,000 since Thursday (when banks reopened in the wake of the demonetisation announcement). We are quite sure that this percentage will go up in the coming days.“

Another bank official added, “In certain cases, we are quite sure that it is not their money . Gullible persons and those working on a contractual basis in factories are being used by their employers as well as middlemen. However, people should know that the government is tracking all the records and transactions.“

TOI was able to track a few account-holders used for this purpose. One of the victims, who had deposited Rs 49,000, said he was promised Rs 500 in return. He would have to return the rest of the money in some days.

“I was told that if I deposit this amount, my reputation in the bank will go up. The middleman also said he would help me financially in the future,“ he added. (Day 3)

Day 18 Govt: Jan Dhan deposits now Rs 64,252 crore, Nov 26 2016 : The Times of India

Deposits in Jan Dhan accounts [by Day 18] totalled Rs 64,252.15 crore with Uttar Pradesh leading the list with Rs 10,671 crore in these accounts, the government said on Friday . Since the government scrapped high value notes on November 8, nearly 7 lakh new Jan Dhan accounts were opened and the total addition to deposits has been Rs 18,615.55 crore.

Minister of state for finance Santosh Gangwar told the Lok Sabha in a written reply that the number of Jan Dhan accounts totalled 25.58 crore. According to data available on the PMJDY website, there were 25.51 crore accounts as on November 9 with an amount of Rs 45,636.61crore. “Out of 25.58 crore accounts, 5.89 crore accounts (23.02%) are zero balance accounts. PMJDY (Pradhan Mantri Jan Dhan Yojana) scheme allows all account holders the benefits of zero balance accounts,“ Gangwar said citing data up to November 16.

In terms of number of accounts, Bihar followed Uttar Pradesh with 2.62 crore accounts totalling Rs 4,913 crore. West Bengal has 2.44 crore accounts with Rs 7,826 crore and Rajasthan had 1.89 crore accounts with 5,346 crore. Gangwar said all state-run banks have denied giving any instructions to deposit Rs 1 to 2 in the zero balance accounts. Reports had indicated some banks were depositing the token amount to cut their number of zero banalance Jan Dhan accounts.

There has been a surge in deposits in Jan Dhan accounts and the government has said that it is keeping a close watch on any spurt. The limit for deposits have been set at [Rs?] 50,000 in these accounts.

JEWELLERY MEERUT/DELHI/DEHRADUN: With the rumour mill going on overdrive after demonetisation of Rs 500 and Rs 1,000 currency notes on the 1st night, hoarders rushed to jewellery showrooms to convert cash into precious metals. Across Delhi, Mumbai, UP and Uttarakhand, some jewellery shops were seen doing business till late in the night. There was a small queue outside one such shop in Delhi's Green Park Extension at 11.50pm, with no sign of it shutting anytime soon. (Sandeep Rai & Shivani Azad | Did jewellers sell gold to hoarders at Rs 50k/10gm?, TNN | The Times of India Nov 10, 2016)