Pensions and retirement: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Government pensions

National pension scheme vis-à-vis Old Pension Scheme

As in 2023

Sep 19, 2023: The Times of India

From: Sep 19, 2023: The Times of India

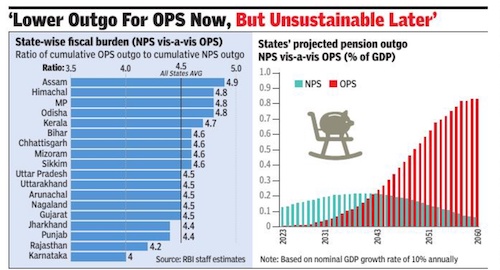

Mumbai : Cautioning against a return to the Old Pension Scheme (OPS), a study published by RBI has estimated the cumulative fiscal burden of implementing it at 4.5 times the outgo toward the existing National Pension System (NPS) and warned against the adverse impact on government finances.

“Short-run reduction in states’ pension outgo which may be driving decisions to restore OPS would be eclipsed by the huge rise in unfunded pension liabilities in the long-run. States’ reverting to OPS would be a major step backwards and can increase their fiscal stress to unsustainable levels in the medium to long-term,” the study by RBI staff said.

The report comes at a time when five states — Rajasthan, Chhattisgarh, Jharkhand, Punjab and Himachal Pradesh — have announced their decisions to revert to OPS for government staff. The rush to reverse the pension mechanism has prompted the Centre to set up a committee headed by finance secretary T V Somanathan, which is looking at ways to ensure that NPS remains attractive for government employees without saddling the exchequer with an unfunded liability.

According to the report, for Rajasthan, the outgo for OPS would be 4.2 times the new scheme, whereas for Chhattisgarh and Jharkhand, it would be 4.6x and 4.4x, respectively. In the case of Punjab and Himachal Pradesh, it will be 4.4x and 4.8x, respectively.

“Any reversion to OPS by states would be fiscally unsustainable, though it may result in an immediate fall in their pension outgo. At a time when most countries are moving from ‘defined benefit’ to ‘defi- ned contribution’ plans, reverting to OPS from NPS by states will be a major step backwards — undermining the benefits of past fiscal reforms and compromising the interest of future generations,” the report published in RBI’s Bulletin said.

The study’s findings are in line with earlier reports that said the pension burden of the states may be 4-5 times higher in OPS than in NPS. “Under different alternative scenarios, it was found that the OPS burden remains above three times the NPS burden even after varying the salary growth rate and discount rate assumptions by about 2%,” the report said.

State governments can make announcements as OPS is ‘a defined benefit’, and the extent of pension is known to the employee in advance.

The NPS is a ‘defined contribution’ where the government pays a fixed amount with every salary into the fund. Upon retirement, the employee uses the corpus to purchase annuities which provide a fixed income. The return provided by the annuities, however, depends on interest rates and life expectancy at the time of the employee’s retirement.

Unified Pension Scheme (UPS) vis-à-vis OPS, NPS

As in 2024 Aug

Harikishan Sharma, Aug 26, 2024: The Indian Express

Over the last few years, the political opposition has tapped into the unhappiness of government employees about the National Pension Scheme (NPS), which is popularly known as the new pension scheme. The Congress governments in Himachal Pradesh in 2023, and Rajasthan and Chhattisgarh in 2022, as well as the AAP government in Punjab (in 2022) have reverted to the Old Pension Scheme (OPS).

Assured family pension: Upon a retiree’s death, their immediate family would be eligible for 60% of the pension last drawn by the retiree.

Inflation indexation: Dearness relief will be available on these three kinds of pensions, which will be calculated based on the All India Consumer Price Index for Industrial Workers, as is the case with serving employees.

Lumpsum payment at superannuation: This will be in addition to gratuity, and will be calculated as 1/10th of the monthly emolument (pay plus dearness allowance) on the date of superannuation for every six months of service completed.

What was the NPS, and why was it introduced?

The NPS replaced the OPS on January 1, 2004 as part of the Centre’s effort to reform India’s pension policies. Those joining government service after this date were put under the NPS.

Under the OPS, pension to government employees both at the Centre and the states was fixed at 50% of the last drawn basic pay, like it is in the proposed UPS. In addition, there was Dearness Relief — calculated as a percentage of the basic salary — to adjust for the increase in the cost of living.

The NPS was introduced by the Atal Bihari Vajpayee government because of a fundamental problem with the OPS — that it was unfunded, i.e., there was no corpus specifically for pension. Over time, this led to the government’s pension liability to balloon to fiscally unhealthy, if not unsustainable, levels. With better healthcare facilities leading to longer average lifespans, the OPS could not have continued in the long run.

Data show that over the last three decades, the pension liabilities of the Centre and states have jumped manifold. In 1990-91, the Centre’s pension bill was Rs 3,272 crore, and that of all states put together was Rs 3,131 crore. By 2020-21, the Centre’s pensions bill had jumped 58 times to Rs 1,90,886 crore; for states, it had shot up 125 times to Rs 3,86,001 crore.

How does NPS work, and what was the basis for the opposition to it?

The NPS was different from OPS in two fundamental ways. First, it did away with an assured pension. Second, it would be funded by the employee himself/ herself, along with a matching contribution by the government. The defined contribution comprised 10 per cent of the basic pay and dearness allowance by the employee and the government’s contribution of 14 per cent (now proposed to be increased to 18.5 per cent). Individuals under NPS can choose from a range of schemes from low risk to high risk, and pension fund managers promoted by public sector banks and financial institutions, as well as private companies.

Schemes under the NPS are offered by nine pension fund managers — sponsored by SBI, LIC, UTI, HDFC, ICICI, Kotak Mahindra, Aditya Birla, Tata, and Max. The risk profiles of the schemes vary from ‘low’ to ‘very high’.

For government employees, the NPS not only gave lower assured returns, it also implied employee contributions — which was not the case with the OPS. This was what drove the opposition to the NPS.

In the wake of persistent demands for a return to OPS, Prime Minister Narendra Modi constituted a committee under the chairmanship of then Finance Secretary (and now Cabinet Secretary) T V Somanathan in 2023. This committee held more than 100 meetings with different organisations and states. The recommendations of this committee have now resulted in the announcement of the UPS.

Who can avail of the UPS?

The UPS will be applicable to all those who have retired under the NPS from 2004 onwards, Somanathan said on Saturday. “In their case (NPS retirees), they will get arrears adjusted with whatever they have already drawn under the NPS,” he said.

“I think in over 99 per cent of cases it will be better to go into the UPS [rather than the NPS]… to the best of my knowledge, almost nobody will want to remain in the NPS, but if there is somebody we are leaving options with them,” he said.

Simply put, employees can still opt to remain under the NPS, but it is unlikely to be beneficial to them. However, an employee can only opt for once. once opted, the option can not be changed.

Currently, the new scheme is for central government employees, but states can adopt it as well, Somanathan said.

What about the fiscal concerns that had led the government to move away from the OPS two decades ago?

Somanathan said that the expenditure on arrears will be Rs 800 crore in the first year of implementation, and would cost the exchequer roughly Rs 6,250 crore.

The UPS is more fiscally prudent, Somanathan said. “One, it remains in the same architecture of a contributory funded scheme. That is the critical difference. The OPS is an unfunded non-contributory scheme. This (the UPS) is a funded contributory scheme,” he said.

“The only difference in the changes that are made today is to give an assurance and not leave things to vagaries of market forces. The structure of UPS has the best elements of both [OPS and NPS],” Somanathan said.

National Pension System (NPS)

Transfer from provident, superannuation funds

`Fund transferred from PF to NPS not taxable', March 8, 2017: The Times of India

PFRDA Now Unveils Rules On Transfers

The pension regulator unveiled rules for transfer from recognised provident and superannuation funds to the National Pension System (NPS).

In the 2016-17 budget, the government had announced that subscribers from provident and superannuation funds would be able to transfer their corpus from these funds to NPS without any tax complications.

The Pension Fund and Regulatory Development Authority said any subscriber interested in such a transfer should have an active NPS Tier I account which can be opened either through the employer (where NPS is implemented) or through the points-of-presence (POPs) or online through eNPS on the NPS Trust website.

The regulator also made it clear that as per the provisions of the Income Tax Act, 1961, the amount transferred from recognised provident or superannuation fund to NPS was not treated as income for the current year and hence not taxable.

“Further, the transferred recognised provident fund superannuation fund will not be treated as contribution of the current year by employeeemployer and accordingly the subscriber would not make income tax claim of contribution for this transferred amount,“ the regulator said in a statement.

The subscriber presently under government, private sector employment should approach the recognised provident or superannuation fund trust through the current employer requesting transfer to the NPS account.

“The recognised provident fundsuperannuation fund trust may initiate transfer of the fund as per the provisions of the trust deed read with the provisions of the Income Tax Act,“ the pension regulator said.

In case of a government or private sector employee, the employee should request the recognised provident or superannuation fund to issue a letter to his present employer mentioning that the amount was being transferred from the recognised fund to the NPS Tier I account of the employee. This should be recorded by the present employer or POP as the case may be, while uploading the amount.

The return on NPS for central government employees for one year works out to 15.9% while for five years it stands at 11%.

2017: Age limit relaxed

Age limit relaxed for National Pension System, Nov 1, 2017: The Times of India

HIGHLIGHTS

Subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years

The choice of pension fund and investment option to remain same for subscribers

At a time when bank fixed deposits rates are falling, the government on Wednesday increased the age limit for joining the National Pension System (NPS). This small savings scheme is open for Indian citizens as well as for the non-resident Indians (NRIs).

The maximum age of joining the savings scheme under NPS-Private Sector (All Citizen and Corporate Model) is now increased to 65 years from the existing 60, a release from the Ministry of Finance stated. Any subscriber "between the age of 60-65 years can also join NPS and continue up to the age of 70 years," it added.

"With this increase of joining age, subscribers who are willing to join NPS at later stage of life will be able to avail the benefits of the scheme," it further said.

The choice of pension fund and investment option to remain same for subscribers joining after or before the age of 60 years.

To opt out from the scheme, the subscribers joining NPS after the age of 60 years will have an option of normal exit after completion of 3 years. In this case, they are required to utilise at least 40 per cent of the corpus for purchase of annuity and the remaining amount can be withdrawn in lump-sum.

Pension fund regulator PFRDA said that the subscribers of NPS increased by 27 per cent to 1.78 crore at September-end.

25% withdrawal from after 3 years

Allirajan M, Pension plan withdrawal norms eased, January 17, 2018: The Times of India

Coimbatore: The Pension Fund Regulatory Development Authority (PFRDA) has relaxed the norms for partial withdrawal under the National Pension Scheme (NPS). NPS subscribers who have contributed for three years can now withdraw up to 25% of the corpus subject to conditions. Earlier, NPS subscribers were allowed to make a withdrawal from the corpus only after 10 years.

“A subscriber, on the date of submission of the withdrawal form, shall be permitted to withdraw not exceeding 25% of the contributions made by such subscriber to his/her individual pension account,” PFRDA said in its latest circular.

Such withdrawals, however, will be allowed only for “higher education of his/ her child including legally adopted child, marriage of his/her child including a legally adopted child”. Withdrawals can also be made for the purchase or construction of a residential house or flat in his or her own name or in a joint name with his or her legally wedded spouse.

“In case, the subscriber already owns either individually or in the joint name a residential house or flat, other than ancestral property, no withdrawal under these regulations shall be permitted,” PFRDA stated.

NPS subscribers can withdraw money for treatment of specified illnesses for himself, legally wedded spouse, including a legally adopted child and dependent parents. Subscribers can withdraw money for hospitalisation and treatment for cancer, end stage renal failure, primary pulmonary arterial hypertension, multiple sclerosis, major organ transplant, coronary artery bypass graft, aorta graft surgery, heart valve surgery, stroke, myocardial infraction, coma, total blindness, paralysis, accident of serious/life threatening nature and any other illness of a life threatening nature stipulated in the circulars, guidelines or notifications issued by PFRDA from time to time.

Subscribers are allowed to withdraw only a maximum of three times during the entire tenure of subscription under NPS.

New tax regime hits pvt sector addition to NPS/ statistics 2023-24

Sidhartha, April 5, 2024: The Times of India

From: Sidhartha, April 5, 2024: The Times of India

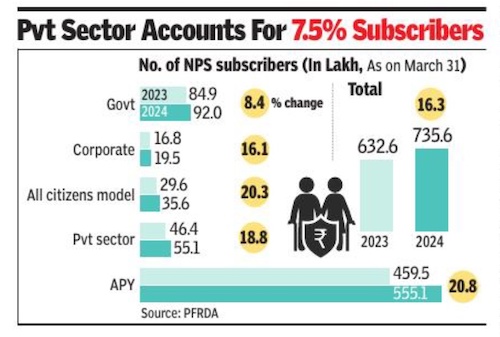

New Delhi: The pension scheme for the corporate and individuals, regulated by Pension Fund Regulatory and Development Authority (PFRDA), may have been hit by the new tax regime, which offers lower tax rates but no exemptions, such as, those for investment.

Latest data released by PFRDA on Thursday estimated that the growth in overall subscriber base, comprising govt, private sector and Atal Pension Yojana, slowed to 16.3% during the last financial year, with the total number pegged at over 7.3 crore. Within National Pension System (NPS), with under 36 lakh subscribers, the share of private sector contributors, comprising the corporate scheme (where the employer and employee contribute) and individual pension accounts, was estimated at 7.5%.

In terms of growth, in the last financial year, for the corporate scheme the pace moderated to 16.1%, the slowest since 2020-21 when Covid-19 took a toll on the economy. The all-citizens model (largely individuals) saw a sharper moderatation in pace of growth to 20.3% in FY24, compared to 29% in FY23 and over 30% in previous four.

Officials and experts blamed it on the new tax regime, a feedback shared by several companies, which were giving the corporate scheme to their employees. Under the new tax regime, which is the default option, there is a tax benefit for employer’s share of contribution to NPS even in the case of private sector employers, but the employee’s share will not get the benefit.

PF and Employees Pension Scheme, which is part of it, being default option across companies is seen as the other stumbling block for the pension system regulated by PFRDA, that is seen to be much more cost effective and has a track record of offering goods returns. “Whenever an employee joins a company, PF papers along with gratuity and other statutory compliances are given to him or her, without even making them aware of other options,” an industry source said.

What is also adding to disinterest even among govt employees and private sector is absence of tax benefit on the additional contribution being made by the employer. When NPS started, the employee and the employer, which is the central and the state govts, were contributing 10% each to the pension corpus. Subsequently, to sweeten the deal, the states and the central govt increased their contribution to 14% of the employee’s salary. But the tax benefit was not extended. At March-end 2024, assets under management under NPS, rose over 30% to 11.7 lakh crore, with govt employees accounting for over three-fourths share, while private sector’s share rose to 19.3%.

India vis-a-vis other countries

Global Pension Index 2015

The Times of India, Dec 13 2015

No country to retire

The Indian retirement system was ranked last worldwide, while Denmark topped the list of countries in the Melbourne Mercer Global Pension Index 2015. The MMGPI's seventh edition measured 25 retirement income systems against more than 40 indicators, under the sub-indices of adequacy, sustainability and integrity. In the process, it covered nearly 60% of the global population

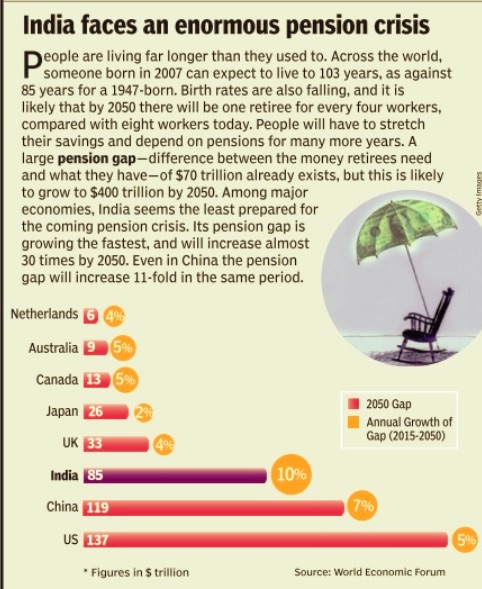

Pension gap

2015: India and the world

See graphic:

Pension gap, India and the world

2025

Oct 17, 2025: The Times of India

New Delhi : India’s pension system fared poorly in the Global Pension index 2025 even as Netherlands, Iceland, Denmark and Israel emerged as the top performers, and Singapore became the first Asian country to break into the top league.

“As in previous editions, this year’s index reveals wide disparities, index grades, and scores range from D grade and 43.8 in India to Agrade and 85.4 in Netherlands, highlighting the diversity in how nations approach retirement,” read Mercer CFA Institute Global Pension index. The systems are assessed across three pillars — adequacy, sustainability & integrity. TNN

2018: Indians who plan for retirement

From: Only a third of Indians put money into retirement account every month, November 26, 2018: The Times of India

See graphic:

2018: Indians who plan for their retirement, and those who don’t

Planning for life after work is crucial, but many are not making adequate monthly investments. Only a third (33%) of those surveyed among a working age group are contributing to a retirement kitty. Not surprisingly, one out of every two worries about running out of money during retired life.

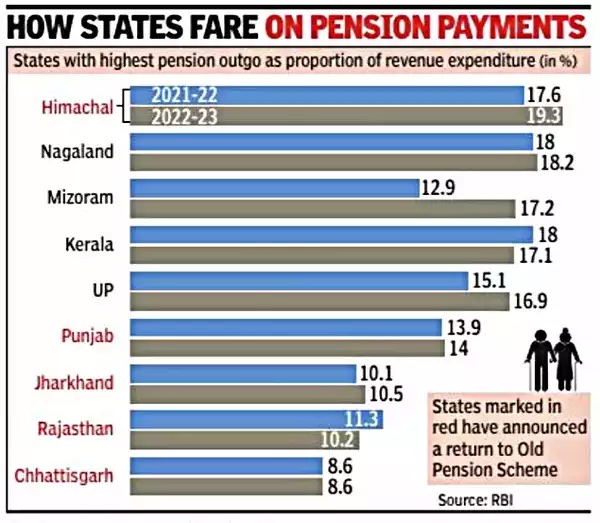

Pension outgo as proportion of revenues

1980-2022

From: January 1, 2025: The Times of India

See graphic:

The government’s pension outgo as a proportion of revenues (in %), 1980- 22

2021- 22

From: TNN , January 17, 2023: The Times of India

See graphic:

States with highest pension outgo as proportion of revenue expenditure (in %), 2021- 22

Private sector pensions

SC upholds removal of Rs 15,000 cap/ 2019

Prabhakar Sinha, April 2, 2019: The Times of India

From: Prabhakar Sinha, April 2, 2019: The Times of India

From: Prabhakar Sinha, April 2, 2019: The Times of India

But PF Corpus Will Be Reduced As A Result

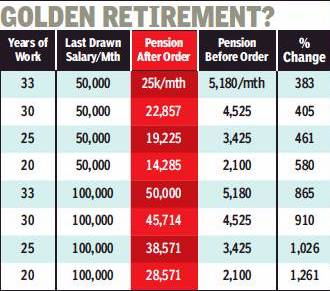

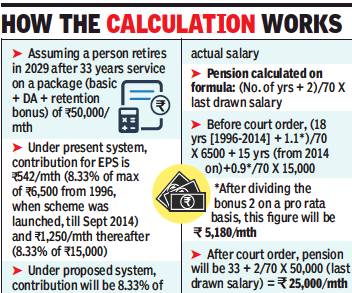

The Supreme Court paved the way for higher pension to all private sector employees by dismissing a special leave petition filed by the Employees Provident Fund Organisation (EPFO) against a Kerala high court judgment.

The high court had asked EPFO to give pension to all retiring employees on the basis of their full salary, rather than capping the figure on which contribution is calculated at a maximum of Rs 15,000 per month.

“We find no merit in the special leave petition. The same is, accordingly, dismissed,” the SC ruled.

The only catch is that while pension will increase, the provident fund corpus will be reduced as the extra contribution will now go to EPS rather than PF. However, the amount reduced is unlikely to be significant as the commutation of the part of increased pension will be sufficient to fill the gap.

The Centre had introduced the Employees Pension Scheme (EPS) in 1995, under which an employer was supposed to contribute 8.33% of the employee’s salary in a pension scheme. However, the contribution was capped at 8.33% of Rs 6,500 (or Rs 541 per month). In March 1996, the government amended the act and allowed the contribution to be a percentage of the actual salary, provided the employee and employer had no objection.

On September 1, 2014, the EPFO amended the act to increase the contribution to 8.33% of a maximum of Rs 15,000 (or Rs 1,250). The amendment also stipulated that in case of those who availed of the benefit of pension on full salary, their pensionable salary would be calculated as the average of the last five years’ monthly salary, and not of the last one year of average salary, as per earlier norms. This reduced the pension of many employees.

SC extends pension order to exempt firms

Subsequently, the Kerala high court set aside the September 1, 2014 amendment and also reinstated the old system of calculating the pensionable salary as the average of the last one year’s monthly salary.

In October 2016, the Supreme Court directed the EPFO to accept the requests of employees to contribute to the pension scheme on the basis of full salary, with back date, and give pension on full salary.

A number of retired employees benefitted from the scheme, including Parveen Kohli, a private sector employee who got his pension revised from Rs 2,372 per month to Rs 30,592 per month. Kohli now works to get pension enhanced for other retired employees. However, even after the SC judgment, EPFO refused to accept contributions of employees of exempt companies, whose EPFs are managed by trusts, even when they were ready to contribute the due amount. Provident funds of most of the large PSUs like navratnas including ONGC, Indian Oil and others and large private sector companies are managed by trusts as per norms suggested by EPFO.

A number of high courts like Kerala, Rajasthan, Andhra Pradesh and Madras, among others, ruled in favour of employees and asked EPFO to allow them to contribute. Monday’s decision of Supreme Court is expected to settle the issue once and for all. Employees who have begun working after September 1, 2014, will also be able to avail the benefit of pension on full salary.

Retirement age

In India and the world, 2017?

This graphic is factually incorrect insofar as the age of retirement for employees of the Government India, male as well as female, has been 60 since 1998. Several state governments adopted this age, though after 1998.

In this graphic only Brazil and China are somewhat comparable to India. OECD countries (which include Japan) have falling birth rates (which India does not) and rising life expectancy, which forced them to raise the age of retirement.

From: April 25, 2018: The Times of India

See graphic:

The age of retirement in Brazil, China, India and some western countries, presumably as in 2017 .

This graphic is factually incorrect insofar as the age of retirement for employees of the Government India, male as well as female, has been 60 since 1998. Several state governments adopted this age, though after 1998.

In this graphic only Brazil and China are somewhat comparable to India. OECD countries (which include Japan) have falling birth rates (which India does not) and rising life expectancy, which forced them to raise the age of retirement.

Retirement. savings for

India vis-à-vis the world

The Aegon Retirement Readiness Index 2017: Indians best

Indians best at retirement plans: Survey, January 22, 2018: The Times of India

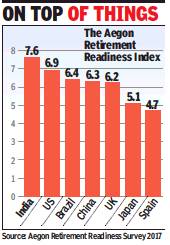

See graphic:

The Aegon Retirement Readiness Index, 2017

From: Indians best at retirement plans: Survey, January 22, 2018: The Times of India

43% Expect Own Savings To Generate Most Income

Indian workers are more confident of managing retirement in 2017 as compared to three years earlier. However, they are much more worried about health in retirement compared to their global peers.

According to Aegon Retirement Readiness Survey 2017, Indians continue to be the best placed in superannuation preparedness among respondents from 15 countries. The Aegon Retirement Readiness Index (ARRI) measures the preparedness and aspirations for retirement based on six parameters — personal responsibility, awareness, financial understanding, superannuation planning, financial preparedness and income replacement.

Aegon has said that the survey is not indicative of the general population and is conducted among middle and high income-earning organised workers in cities.

India, with an ARRI score of 7.6, ranks higher than all 15 major economies. India is followed by the US (6.9), Brazil (6.4), China (6.3) and the UK (6.2). Spain and Japan rank the lowest with index scores of 4.7 and 5.1respectively.

According to the survey report, in 2014, 37% of Indian workers were confident that they would achieve a comfortable retirement. This has risen by over half to 57% in 2017.

Interestingly, Indians have considerably different expectations to the global average as to how their retirement will be funded. Around 43% of those surveyed expect the greatest portion of their retirement income to be funded by their own savings and investments. Globally, only 30% of retirees expect to self-fund their retirement and expect contributions from their employers and government to keep them going.

While 60% of Indian workers are habitual savers, around 25% keep aside some money for retirement from their occasional surpluses. Only 16% of Indian workers said that they do not save at all. This is a much smaller ratio compared to 37% of workers not saving globally.

The median age at which Indian workers expect to retire is 60 years. Those in fair or good health expect to spend a further 15 years living in retirement, while those in excellent health have considerably higher expectations of living 20 years.

See also

Pensions and retirement: India Provident Fund: India