Sports goods, sportswear: India

This is a collection of articles archived for the excellence of their content. |

Contents |

2014: Adidas was top sports goods maker

The Times of India, Oct 07 2015

John Sarkar German sportswear maker Adidas has emerged as the top sport goods maker and one of the largest international brands in the country by revenue, surpassing direct rivals such as Puma and Nike. Earlier this year, German sporting lifestyle brand Puma had reported Rs 766 crore as domestic revenues for the calendar year 2014, which made it the top international brand in the country by revenue. This signals a shift in consumer preference towards a sporting goods as Indians are looking to adopt a healthy lifestyle in line with their global counterparts. Adidas Group India, the local arm of German MNC Adidas AG, has notched up total revenues of around Rs 805 crore, for the year ended March 2015. While Puma, part of the French luxury goods conglomerate Kering, follows calendar year for reporting business numbers, most other brands, including the ones that retail pure lifestyle products, follow the April-March financial year format. In FY14, Adidas had reported (Rs 737 crore), Nike (Rs 624 crore), Benetton (Rs 594 crore), Levi's (Rs 599 crore) and Zara (Rs 580 crore) as revenues. Reebok, owned by Adidas, has raked in revenues of around Rs 330 crore with losses of Rs 57 crore for the year ended March 2015.When asked about current figures, a Nike India spokesperson said, “Our company policies do not allow us to share financial data at a country level.“ Adidas Group India MD, Dave Thomas could not be reached for comment.

“The potential of the active lifestyle market reflects the young demographic of the country with very special needs. Take the growing trend of buying affordable SUVs, crossovers and going for adventure vacations. As a brand, Puma has been very aggressive over the last three years, and to be honest, the big daddies of the sportswear world, Nike and Adidas, ignored them in the beginning. Puma disregarded all conventions in terms of branding and reached out smaller cities apart from the big ones and this resulted in good sales. Only recently, Adidas has been quick to respond and give them some solid competition in terms of expanding reach and opting for innovative marketing and retail practices. With housing complexes in major cities boasting in-house fitness centres, this segment will grow very rapidly in the coming years,“ said Arvind Singhal, founder of retail consultancy, Technopak.

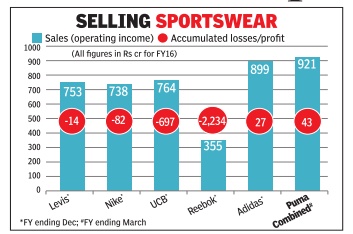

2016, sales and accumulated losses and profits

From Digbijay Mishra & John Sarkar, Puma sees India in top 5 in 3 yrs, Sep 8, 2017: The Times of India

Digbijay Mishra & John Sarkar, Puma sees India in top 5 in 3 yrs, Sep 8, 2017: The Times of India

German sports lifestyle brand Puma will count India among its top five markets within three years even as some of the international peers struggle with their domestic operations here. In his first interview to Indian media, Puma CEO Bjorn Gulden said the `athleisure' trend of combining sportswear with street style was working well in Asia's thirdlargest economy .

“In 2016, India was the eight-largest market for Puma. We expect India to be among the top five by 2020,“ Gulden said without getting into specific details. Puma India reported a $145-million (Rs 921-crore) revenue last calendar, becoming the largest sports lifestyle brand in the country . Puma's strong India show could push it ahead of markets like Germany and France to climb into the top-five markets. US, China, Japan and Korea are among the brand's big markets by sales.

Puma has been scripting a global turnaround over the past few years with the help of powerhouse celebrities, who've endorsed the brand at a time when sneaker culture has become mainstream.

Gulden said the brand would push this so-called athleisure trend to `generation hustle' in India too, taking a cue from the success the concept has received internationally .“We are primarily a sports company and continue to invest in sports innovation and technology . But today , 80% of sports shoes are used for everyday use, so stylish and welllooking products are a must,“ he said.

2014-16 (figures), 2017 (estimates)

From: John Sarkar, Sportswear sales rise up to 100% in Dec 2016, January 8, 2018: The Times of India

John Sarkar, Sportswear sales rise up to 100% in Dec 2016, January 8, 2018: The Times of India

Demand for athletic gear in India has always surged during December due to millions of people making a New Year resolution to head to the gym. But this time, sportswear firms saw up to 100% growth in sales in December, thanks to early end-ofseason sale across the country.

“We did twice of what we usually do in other months,” said Rajat Khurana, MD of Japanese footwear maker Asics India. “While New Year resolutions have always helped us get good results in December, we could rake in better numbers in 2017 due to end-of-season sale and marathons.” End-of-season sale for the last quarter of the calendar year traditionally used to take place in January but in 2017, it was brought forward to December.

Similarly, Puma India MD Abhishek Ganguly said December was a high-traction month for the German sportswear firm. “Sports and fitness are clearly getting more prioritised and are topping New Year resolutions,” he said. “We have seen a substantial uplift in consumer demand during December this year. Across channels, our sales is 30% more than the average monthly sales for the year.”

Categories such as running, training and fitness usually do well for sportswear companies during the end of the year, while at other times, companies bank on athleisure (active wear that people can wear outside a gym) for a bulk of their volumes.

Several industry experts that TOI spoke to said e-commerce companies are disrupting traditional shopping patterns in the country due which end-of-season sales, even for sportswear makers, are being rescheduled.