Punjab

This is a collection of articles archived for the excellence of their content. |

State debt burden

Subodh Varma, Jan 28 2017: The Times of India

The ebb and flow of electoral tides has thrown together a bunch of five widely different states that together go for Assembly polls in the coming weeks. Yet here's a strange thing: all of them have a state debt problem, the most serious being that of Punjab.

The total debt of the Punjab state was a staggering Rs 1.25 lakh cr as estimated in their last year's budget. Every resident of this rich state has a debt of Rs 38,536 hanging over his or her head.

Punjab's interest payments are steadily rising, having zoomed up by 58% since 2011-12 to reach Rs 9,900 crore in 2015-16. Nearly one fifth of the total revenue (earnings) of the state government are now going towards repaying the debt. Although Goa, another poll bound state and Kerala have bigger debt overhangs per person, these two states have understandable problems.In Goa, the biggest source of income in recent years, mining, collapsed after massive violations of law were found. Kerala, with declining agriculture and low industrialisation too, faces chronic financial difficulties.

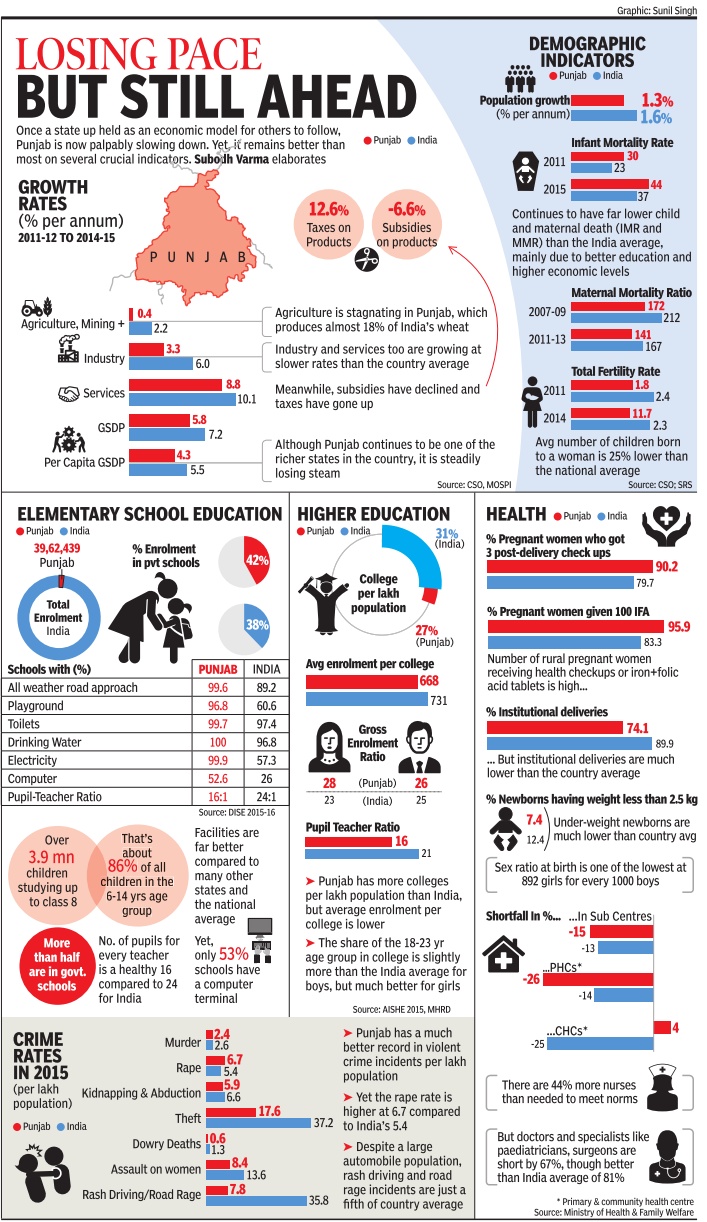

But what's happened to Punjab, the granary of India, once so advanced in both agriculture and industry? Its state government has been borrowing heavily from various sources to run itself. Data collated by the Reserve Bank shows that its annual debt is running at a 32.4% of the gross state domestic product, the value of the total output of the state in 2015. As per finance commission decisions in the past, a state with more than 20% debt to GSDP ratio should be considered `debt stressed'. This is the second highest in India, topped only by the chronically troubled West Bengal. Uttar Pradesh, another poll bound state has a debt to GSDP ratio not far behind Punjab's at 30.5%.

There is an unseemly scramble in the state for somehow raising cash. Re ports earlier this year said that the government mortgaged assets like jails and Gandhian institutions to raise cash. The government has also been borrowing from the Reserve Bank under a special provision called ways and means advances -but it has to pay an additional 2% penalty for it. Last year, 30 banks led by SBI stopped lending to the state government because foodgrain worth Rs 20,000 cr it bought using such loans had gone missing as per reports.

All this has dire consequences for the state's residents. Faced with a fiscal crisis, the state is putting the brakes on meaningful spending on key sectors. Agriculture is in crisis because of stagnating yields and declining returns to farmers.

Between 2011 and 2015, agricultural growth was a mere 0.4% per year. It needs a rejuvenation through new technology and new strategies. This means more investment from the state. But that is not forthcoming. Health and education are suffering similarly . Inflation-adjusted data for development expenditure shows a virtual standstill even as population grows and services stagnate.

The future is bleak because the Centre can't help much. Its hands are tied as regulations restrain it from offering grant in aid if the state is not a high revenue deficit one.

2013-15: Mortgaging properties to support subsidies, state schemes

The Times of India, Dec 09 2015

Rohan Dua

Indiana ZONES - Punjab goes bust. Mortgages jails, widows ashram, asylum land, residential complexes

The last place from where you expect a state government to raise funds is jails and a shelter for widows.But that is precisely what the Punjab government has done in the past two years to tide over its severe financial crisis.

The Gandhi Vanita Ashram for widows in Jalandhar and the state jails at Bathinda, Amritsar and Goindwal are among the dozen official properties that the state government has mortgaged to raise a massive loan of Rs 2,100 crore to fill up its depleted coffers.

The widows' home has heritage value, as Mahatma Gandhi once stayed here while on a visit to Punjab. It was built in 1947, after Independence, for the widows among Partition refugees.

Documents from Punjab's urban development department and chief minister's office reveal that the government mortgaged the properties between 2013 and 2015 to support its subsidies and state schemes. The Akali Dal-BJP government is facing a debt of Rs 1.25 lakh crore, and has found it tough to even pay salaries to its staff. All the mortgage deeds signed between the Punjab Urban Development Authority (PUDA) -chaired by chief minister Parkash Singh Badal -and five nationalised banks have been accessed by TOI.

From lands meant for multiplexes and old district courts, to jails and residential complexes -the government has mortgaged nearly every type of establishment.

Gandhi Vanita Ashram, which houses 120 widows and a small school that educates 250 girls, sits at the top of the list. As many as 67 families live at the ashram. The staff and women are yet to be rehabilitated to the new complex being built for them.

According to the deed signed on December 31, 2013, the ashram's entire property -including offices, the pavement and parking area -have been mortgaged for Rs 250 crore. “The old building is already in a dilapidated condition,“ said an inmate who works as a tailor, adding that she feels very uncertain about her future.

The documents also show that 3.73 acres reserved for a multiplex by Amritsar Improvement Trust has been mortgaged for a Rs 100-crore loan from Andhra Bank at an interest rate of 10.25% annually . The money is to be repaid before March 2018.

Another Rs 400 crore has been raised against 11.28 acres on which Amritsar's old mental hospital stands.

While the 350-bed hospital has already been shifted to a new site, the doctors insist that the government should have simply extended the building's area instead of raising loans against the unused land. One doctor told TOI that they desperately need more beds to manage the rush.

Deputy chief minister Sukhbir Badal, who holds the housing and urban develop ment portfolio, was not avail able for comment. PUDA offi cials meanwhile dub the mortgaging as routine. The burgeoning interest on the loans has not deterred them “It is an economic model by which we can get money and use it for the right purposes We are trying to find ways to settle the fund crunch. We are paying back interest and not stopping the instalments to banks,“ said Manvesh Sidhu chief administrator, PUDA.

Besides, three residential sites, each in Jagraon, Mansa and Patiala, with nearly 3,000 residential and 400 commer cial plots yet to be sold to pub lic, have been mortgaged for Rs 750 crore loan with Canara Bank. In Jalandhar, the gov ernment has also mortgaged two more state offices includ ing an old building that until few years ago housed the dep uty commissioner and senior superintendent of police.