Byju's

This is a collection of articles archived for the excellence of their content. |

Contents |

Byju Raveendran: A brief biography

As in 2019

From: Gadgetsnow

10 things to know about India's newest tech billionaire

It was revealed that when Byju Raveendran – the man behind popular education app Byjus – secured a funding of $150 million, he catapulted in the billionaire’s club. The 37-year-old teacher-turned-entrepreneur is India’s newest tech billionaire. Raveendran’s company Think and Learn also struck a deal with Disney to launch a standalone education app. Here are 10 things that you should know about India’s newest tech billionaire:

Byju Raveendran hails from the coastal village of Azhikode in Kerala.

He worked as an engineer with a UK-based shipping company before turning an entrepreneur

It was in 2006 when Raveendran started coaching students initially for Maths exams

He then helped friends and other students prepare for CAT exams

Raveendran himself achieved a score of 100 percentile in CAT

In 2011, he formed his company called Think and Learn

It was four years later when Byjus, the app was officially launched and within 3 months had seen 2 million downloads

Currently, there are over 35 million students who use Byjus and out of these about 2.5 million are paid subscribers

Byju's is valued at $5.7 billion and is a long-time member of India’s unicorn club (companies with valuation of $ 1 billion)

Byju’s bought the rights of the Indian cricket team’s jersey

Revenues

2019: Byju’s turns profitable, revenue jumps 174%

Education technology unicorn Byju’s reported an increase of 174% in revenues on a standalone basis to Rs 1,341 crore in the financial year ending March 31, 2019. The company also turned in a profit of a little over Rs 20 crore as compared to a loss of Rs 28.7 crore in the previous fiscal. But on a consolidated basis, the company reported a loss of Rs 8.8 crore as it spent on global expansion, including on acquisitions like USbased Osmo last year.

Byju’s is the world’s most valued education technology company at $5.7 billion and one of the biggest unicorns in India after Paytm, Oyo and Ola. The company counts Canadian pension firm CPPIB, Amsterdam-listed Prosus Ventures and PE major General Atlantic as investors.

Byju’s said it is targeting revenues of Rs 3,000 crore in FY20, doubling the top line. The company said it has 40 million registered users and 2.8 million paid subscribers.

Some of the major areas where Byju’s ramped up spending include advertising and marketing promotion, which increased by close to 150% to Rs 450 crore, and employee expenses which went up 157% to Rs 273 crore.

Byju’s expanded this year to focus on early learners from kindergarten to grade 3 by tying up with US-based media and entertainment conglomerate Walt Disney. This tie-up is aimed at expansion of the company into new English-speaking markets like the US, England and Australia.

The downfall begins

2023

Ayesha Singh, July 31, 2024: The Indian Express

Byju Raveendran is not a crook. He is not a fantastist either. He is a path-breaking pioneer in the growing world of ed-tech, who found an opportunity for growth during the pandemic. Once India's -- and the world's -- most valued startup at $22 billion, Raveendran is today facing the crisis of his lifetime. The gym rat who won the rat race in online education has seen his business nosedive, investors pulling out, directors leaving the board, layoffs, employees leaving citing a toxic workplace culture and investigation agencies raiding his Bengaluru office for violating foreign exchange rules; the government has launched a probe into his books.

Bollywood star Shah Rukh Khan, who was signed as brand ambassador for an annual fee of about Rs 4 crore, is unlikely to continue his association. Prosus NV, Byju’s biggest investor and shareholder, has cut its valuation to $5.1 billion. The ed-tech giant, whose stellar investors included General Atlantic, BlackRock and Sequoia Capital, is accused of defaulting on loans. Byju's own auditor, Deloitte Haskins and Sells Llp (DHS), resigned, saying the company delayed submission of its financial statements, which prevented them from assessing its financials to their satisfaction. Promoters had been selling their shares for millions of dollars since 2015, although a company spokesperson clarified that the money was reinvested in the company. Creditors have refused to restructure a billion-dollar loan; only CEO Raveendran, wife Divya Gokulnath and brother Riju Raveendran were left on the board.

Raveendran is fighting back with all he has to save the dream he turned into a billion-dollar reality. He quickly replaced Deloitte with BDO as its new auditor, to "uphold the highest standards of financial scrutiny and accountability". He promptly got on board former SBI chairman Rajnish Kumar and former CFO of Infosys TV Mohandas Pai as members of a newly constituted Advisory Council. The firm's new CFO Ajay Goel has promised shareholders the audit for FY2022 will be finished by the end of September and for FY2023 by the end of December. The results for 2020-2021 showed the company had lost Rs 4,588 crore, twice its revenue. Raveendran is in advanced talks with potential new shareholders to raise $1 billion, a part of which could go to pay the $1.2-billion term loan. In 2019, Raveendran paid $120 million in stock and cash to buy the US-based educational gaming company Osmo. Riju is a director of Think and Learn Private Limited, which owns Osmo. Glas Trust Company and investor Timothy R Pohl are suing Byju's Alpha, Tangible Play, Inc. and Riju after negotiations over repaying the $1.2 billion failed.

Byju's took on "a collective of lenders engaged primarily in opportunistic trades" and told the US court that it has met all its contractual payment obligations for a loan taken in 2021 and has not defaulted on a single payment. Raveendran told shareholders of his skin in the game, having personal investments in the company: $400 million in the parent company and $250 million to acquire Aakash Educational Services Limited, which helps students prepare for medical and engineering entrance exams, school/board exams, NTSE, Olympiads, etc. Raveendran pledged $250 million as secondary shares for the last funding round, which has been put back in the company at a valuation of $22 billion.

A close friend and colleague of his youth recalls Raveendran's penchant for problem-solving. He loved mathematics and unraveling complex equations. "He has the aptitude and confidence of a genius. No problem is too big for him," says the friend. Now he has the biggest problem of his life to solve. In the absence of checks and balances within the company, and what Gurugram-based public policy expert K Yatish Rajawat calls Byju's 'God Complex', where executive hubris creates a false belief in one's infallibility, the company is spinning out of control. "What starts as self-confidence turns into God Complex when priorities shift from product to the relentless pursuit of profits fuelled by venture capitalists’ (VC) demand for fast returns. The focus then shifts to merely a bull run for fund-raising," Rawat says.

Decoding the downfall

The Band-Aids haven't stopped Raveendran’s critics from baying for his blood. "Byju's serves as the classic case of a man biting off more than he could chew. It's a story of vicious greed and nauseous race to strike gold in the valuation race marred by savage competition that plagues the startup space today," says Mumbai-based Dr Aniruddha Malpani, an angel investor and a critic of Byju's business model.

The leadership crisis has plunged the company, which once climbed up the ladders of success with a spate of acquisitions, spin-outs and takeovers, into deep waters along with its stakeholders, employees, parents and the student community. The promoter shareholding in the company has dipped from 71.6 percent in 2015-16 to 21.2 percent in 2023. "The promoters seem to have lost faith in their product. This decision will have a deep impact on its stakeholder relationships and employee morale, but the worst part is the industry-wide implications of their actions, raising questions about the overall potential of the industry," says the CEO of a renowned Mumbai-headquartered ed-tech company. Once called a trailblazer of the entrepreneurial ecosystem, Byju's seems to have fallen victim to inorganic rise. "It's no more about the slow and steady inner growth, but a run-to-the-top with reckless mergers and acquisitions, getting on board attractive brand ambassadors (football star Lionel Messi in this case), and putting out flashy advertisements (Byju's was the main sponsor of the Indian cricket team and an official sponsor of 2022 FIFA World Cup). In this vein, the company fell short of upholding the ideals of corporate governance, exacerbating the situation by straying from taking accountability," says Malpani.

Conned customers' backlash

Just when Raveendran was fighting wildfire with its lenders over the repayment of $40 million interest on its $1.2 billion loan, the biggest blow was yet to come: a spate of horrific allegations against Byju's moral and ethical misconduct. One of them came from Geeta Undare, a part-time domestic help hailing from Mumbai's Chakala area, who hoped to give her 13-year-old daughter good education. Undare claimed she was gaslit by a Byju's salesperson to sign up her girl for personalised coaching.

"They asked my daughter a host of difficult questions to assess her knowledge and concluded by saying her abilities were 'not up to mark', and that she would need extra help to be brought up to speed. They also promised to help her with competitive examinations. I told them the course fee of Rs 33,000 exceeded my available finances, but the salesperson told me I would be responsible for my child's doomed future. I agreed to sign up on the condition that I could ask for a refund within the trial period if I wasn't satisfied with my decision. That was also the day I went into debt as nobody answered my calls when I contacted them 11 days later citing financial troubles. I regret my decision to this day," she says.

Even as vulnerable people like Undare often give in to the pressures of exploitative sales strategies, filmmaker Hansal Mehta condemned Byju's aggressive marketing publicly. "They came to my house during the pandemic, trying to sell programmes to my daughter that she did not need. They tried to convince her that she was poor academically to make an extra buck. I had to drive them out of my house," he had tweeted. When the chairman of the National Commission for the Protection of Child Rights, Priyank Kanoongo, accused Byju's of targeting first-generation learners and "buying phone numbers of children and their parents, rigorously following them and threatening them that their future will be ruined", it opened floodgates of extortionist charges.

Ranjana Sharma from Amritsar was one of the first people to speak out, accusing the Bengaluru-based firm of mentally harassing her over Rs 60,000 that the company owed her. "In addition to degrading and shaming us, they secretly enrolled me in a loan programme and registered two fictitious students under my name," she told the media.

Priyanka Dikshit from Indore filed a similar complaint, alleging that she paid Rs 1.8 lakh as fee for IAS coaching in 2021, but did not receive any. She took the matter to a consumer court in Madhya Pradesh, which ordered the company to return the fee and pay compensation. While Dikshit had the resources and the awareness regarding her legal rights, people like Undare caved into pressure. One infamous practice was to seduce middle-class parents with a third-party loan, which would be paid back in EMIs of a few thousand rupees. Repayment issues have made third-party lenders reluctant to fork out more. It's a three-year course, with the money coming in three tranches each year. Byju's doesn’t allow any outsider to monitor the success rate of its courses, which has cast doubts about transparency. This might explain why its auditor DHS has been squeamish about signing off on its financial results. The company reported operating revenues of Rs 2,280 crore in FY 2021 with a loss of Rs 4,588 crore, up from Rs 262 crore the previous financial year.

Tech isn't magic

Over-selling technology, rather than courses, has emerged as one of the firm's biggest mistakes.

"Byju's was selling hardware in the form of tablets that dispensed study material and bulldozed their way into making parents buy subscriptions by blackmailing them about their child's future. While technology can enhance learning, it cannot replace the need for personalised guidance and support," says Malpani.

The fact that collaboration lies at the intersection of education and technology was ignored by Raveendran.

"What Byju's did was to use technology as a replacement rather than a complementary learning tool. Hence, it may have missed out on the crucial role that peer-to-peer interaction plays; the right balance between online teaching and offline mentoring," says academic researcher Dr Usha Batra, director, Manav Rachna, CoE for Cyber Security, adding, "While selling these expensive courses to children, many of who belonged to lower-income groups, the company overlooked issues of digital disparity, affordability and literacy. As a result, many students dropped out despite paying the full fee."

Having said that, the way Raveendran harnessed the power of technology to make a difference in the K-12 segment of students is remarkable, Batra says. "He also emphasised the importance of self-learning rather than spoon-feeding, and his attempts at making students active learners, not passive, made them take agency of their academic life. His legacy of democratising education, the astute use of technology, and student-centric approach will outlive his missteps," the researcher adds.

Staff woes pile up

The story inside the company was no better. A lawyer for Byju's told Reuters that the company had a shortfall in payments to a national pension fund, which has now been addressed. Brutal trimming of staff has been underway for two months and more lay-offs are expected. The company staff criticised its unscrupulous work conditions, calling the environment “torturous".

"We were forced into working double shifts at times with hardly any breaks," says a former worker, who resigned last month owing to mental breakdown.

Coming to the aid of the embattled CEO though is a top business executive working in the primary education sector.

"Holding Raveendran, or any CEO for that matter, solely responsible for the downturn of a company is unfair. Building and running an organisation involves collective effort; therefore, all stakeholders need to take accountability. Unfortunately, none of them have been taken to task. Larger issues such as the fragmented and unorganised nature of the ed-tech sector, difficulties in securing funding that leads to risky behaviours such as financial and auditing irregularities, and the ruthless aspirations of funders that lead to such deviant behaviour is to be blamed," he says.

Part of the onus lies with the media for the creation of the Byju's beast. "It only covers successive rounds of funding a startup receives, and not its products, performance or balance sheets," says Rajawat.

Projecting Raveendran as the blue-eyed boy by highlighting his successes, while overlooking his missteps, "turned him into a hero who could do no wrong", says Malpani. Lack of labour rights and proper working conditions within the advancing ed-tech sector have opened a deep wound for people like Rajesh Kumar (name changed), a former employee of Byju's sales team, who was asked to leave with immediate effect without an explanation. The stress of unemployment for eight months left him sick and bitter. "I worked so hard -- sometimes 14 hours a day -- and it took them just one minute to kick me out," he says.

Even as the startup says it has hired more people, employee morale is at an all-time low. "Every person has a job portal open on their laptop at all times. Everyone wants to leave desperately before they are asked to pack up overnight," a senior manager at Byju's told Reuters.

Employee contracts are jargon-filled and unfairly constructed to serve only the interest of the employers, often unaligned with the labour law provisions. "Besides simplifying language in these contracts, it is HR's responsibility to explain employees' core rights and responsibilities. In addition, things such as key responsibility areas, working hours, compensation for overtime, rules related to leave, benefits and termination conditions should be explained before the joining of the employee. Lastly, employee unions need to take agency for equal representation of employees in contracts by rallying for their participation to avoid abuse at the hands of power and influence," says Kavita Sarin, who works for a recruitment consulting company in Delhi.

A success story unfolds

Raveendran, the son of physics and mathematics teachers from Azhikode village in the Kannur district of Kerala, was admired as an ambitious educator.

"As soon as he entered a room, the enthusiasm among students was palpable. Even though some of us questioned the effectiveness of his mass teaching methods, he won us over with his sheer intelligence," says a former student, who today is building an ed-tech firm of his own.

"He (Raveendran) hated the conventional classroom set-up, which he found dull and unimaginative. He promised to change that one day by inculcating a passion for learning," he adds. But the entrepreneur also harboured ruthless ambition.

"For a man who came from such humble beginnings, building an empire went to his head. He couldn’t take no for an answer. He had impossibly high standards and penalised those unable to meet his unrealistic targets," says the former student, who worked briefly with him.

Those close to Raveendran say he is a visionary who pushed the boundaries within the ed-tech space using technology, but they also admit to him being an eccentric who rose to the top quickly by raising millions in funding with which he introduced one product after another. This included Byju's learning app, which attracted more than two million students in just three months after the company secured $25 million in a Series B round led by Sequoia Capital in July 2015. It became a case study at Harvard Business School to illustrate how the company had used technology to impact learning outcomes.

When in March 2018, Byju's turned unicorn with a valuation of over $1 billion (per reports), all eyes turned to Raveendran and his story of how a self-taught tutor who went to a Malayalam-medium school emerged as the poster boy of the ed-tech sector. "Many started believing in his infallibility. I think Raveendran too, believed he was impervious to failure. I remember one of the board members saying he possessed the Midas Touch," says a former acquaintance.

Ed-tech myths busted

The Covid-19 pandemic reinforced Raveendran’s invincibility. Byju's ‘Live Classes’ on its app, which replicated a classroom environment, attracted many. Capitalising on the demand for virtual education, it became the biggest in the business, continuing its aggressive acquisition strategy, including big-ticket by-outs such as the $300-million WhiteHat Jr deal in 2020 and the $150 million Toppr deal in 2021 in addition to launching a fundraising spree, raising close to $4.2 billion, including heavyweights such as UBS and Abu Dhabi’s sovereign fund, during the pandemic. The fact that the company was backed by industry bigwigs such as Sequoia Capital India, Chan-Zuckerberg Initiative, Silver Lake, BlackRock, Qatar Investment Authority and others, made it seem failproof.

But no safety net is good enough to cover if the consequences of decisions implode. “As the pandemic receded and children returned to schools, Byju’s found itself on unstable ground. Contrary to investor expectations, the adaptation to online learning in India was not as enduring as initially assumed. The persistent cultural value of traditional classroom-based learning, combined with issues like the digital divide and limited access to high-speed internet in many parts of the country, may have led to a slower-than-expected adoption of online education. As a result, the anticipated sustained demand for ed-tech solutions failed to materialise,” says Mumbai-based Sonam Chandwani, managing partner, KS Legal & Associates.

Raveendran was heading for an unprecedented crisis in the face of red flags such as decreased demand for online learning, limitations of technological permeability and technical glitches in virtual education. In 2021, Byju’s posted a loss of $327 million. “Raveendran walked the road to his ruin. Surprisingly, even that didn’t deter investors as they kept pouring in funds, feeding the beast until it blew up in their face,” says Chandwani.

“What else did you expect?” asks Malpani. “When there is an over-dependence on VCs, which comprises pensioners’ wealth and sovereign wealth funds, financial instability is almost certain. In most cases, including Byju’s, there is a misalignment of intention. For a VC, the only draw is financial rewards, not necessarily the growth of the company,” says Malpani, adding, “The worst part is other large players in the business such as Vedantu and Unacademy are copy-pasting Byju’s template. Before you know it, you’ve created an ecosystem of defective leadership which operates without a moral compass.” The pressure exerted by VCs on startups to deliver quick returns (sometimes as high as 20 percent above the VC’s valuation) has created organisations with “monstrous ambition. With this spiralling greed, you’re reduced to a fund-raising company,” says Rajawat.

Perils of Poor Compliance

The optimism in the ed-tech space is waning. Byju’s downturn will be a reminder of the difference between “value and valuation”, “hype and efficacy” says Malpani. Hopefully, this will be a chance to obliterate the chicanery of excessive commercialisation of education driven by ruthless sales targets and profitability. Chandwani adds, “It’s not just one man’s fault; checks and balances are required at all levels of the pyramid starting from policymakers (the ed-tech space does not come under the ambit of any law or policy). The lack of regulations and jurisdiction pertaining to operational guidelines such as ethical practices, quality control, data security, accountability and evaluations pose a huge challenge for the sector,” she says, adding, “The existing framework doesn’t allow for the monitoring of compliance with the code of conduct and pedagogical standards.”

In the absence of such safeguards, argues Rajawat, novel challenges will keep emerging. The only way to save Byju’s, for the sake of students whose future is at stake, is a change of management as seen in the case of BharatPe and Satyam Computers. The biggest intervention required is in the board. “You need people who have run successful companies for decades like Arvind Thakur, Rajendra Pawar and Ganesh Natarajan, and not friends and family, which creates an accountability and transparency crisis,” says Rajawat. Amid increasing criticism of Bjyu’s is the exigency to hold the moneybags of the financing community accountable. Investing without carrying out due diligence contributes to horrific consequences. “Call it an oversight or stupidity, irresponsible investing practices have messed up the startup environment. A profit-first mindset rules the roost today,” says Malpani.

The angst and loss of confidence has put the spotlight on the muckety-muck of the accounting world—DHS—that resigned as Byju’s auditor. “Such large firms have major clout within the industry, which is why they could get away with murder, but holding them accountable is imperative. They need to be investigated for evading their fiduciary responsibility,” says Malpani, adding, “The decent thing for Raveendran to do now is to accept responsibility, instead of hiding in Dubai or laying off thousands of people.” As Byju’s management puts up a brave face in the wake of an unprecedented crisis, the question is whether the firm can be salvaged, or will the relentless undertow of spiralling events drag it into unconquerable tides.

Shorn in the USA: 2024

May 23, 2024: The Times of India

From: May 23, 2024: The Times of India

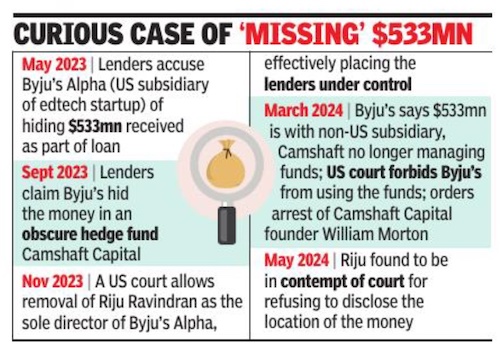

Mumbai : In a fresh setback for troubled edtech Byju’s, Riju Ravindran, the brother of the startup’s founder & CEO Byju Raveendran, has been found to be in contempt of a US court.

The development follows his defiance of a court order that directed him to disclose the location of $533 million that the company’s US subsidiary Byju’s Alpha received as part of its term loan proceeds.

Ravindran faces courtimposed financial penalties for his actions, the amount of which will be determined at a future hearing, the firm’s overseas lenders said in a statement.

“In making its ruling, the court found that Ravindran’s testimony lacks all credibility, and that he either knows where the money is being hidden and will not say, or he did not try to find out the location,” the lenders said, adding that they will continue to take all necessary legal actions to recover the “stolen funds”.

Ravindran, who was the director of Byju’s Alpha, a subsidiary Byju’s had set up in 2021 to receive the term loan proceeds was removed as the sole director of the US entity last year by the lenders with the unit being placed under the control of their representative, a move which was also approved by the court. Earlier this year, Byju’s had claimed that the disputed $533 million has been parked with a non-US subsidiary of the firm but did not disclose any additional details.

Byju’s did not comment on the development. Sources close to the company however, said that the contempt order holds no legal weight or practical implications for Byju’s or its stakeholders. Company insiders claim that the court has no jurisdiction over Ravindran, an Indian citizen.

YEAR-WISE DEVELOPMENTS

2021: acquires Epic, White-Hat

Shilpa Phadnis, July 22, 2021: The Times of India

Byju’s has acquired US digital reading platform Epic, focused on kids 12 and under, for $500 million. The acquisition will bolster Byju’s strategy to grow its footprint in the US. The development is part of the Bengaluru-based edtech player’s plan to invest $1 billion in North America.

Byju’s has made multiple big acquisitions in the past year, including those of White-Hat Jr for $300 million, and Aakash Educational Services for nearly $1 billion. It acquired US-based Osmo, a maker of educational games, for $120 million two years ago. Recently, Byju’s and Walt Disney launched a co-branded learning app targeted at kindergarten to class 3 students.

“Byju’s is redefining the way kids are learning to use tech as a strong enabler, both to create interactive formats that are engaging and, more importantly, to personalise books that are recommended to kids based on their reading proficiency,” Byju Raveendran, founder and CEO of Byju’s, said.

Byju’s has to date raised some $2.7 billion from investors, much of that in the past year, and the company was valued at $16.5 billion in the last round of funding.

Epic, Raveendran said, is the largest B2C edtech platform for this age group in the US. “Reading is a powerful format of learning. By creating a love of reading, you’re creating a love for learning,” he said. Epic’s global user base includes more than two million teachers and 50 million kids, a number that has doubled over the past year. The company works on a subscription model.

Epic co-founder & CEO Suren Markosian said that the platform is designed to personalise reading for kids, putting the right book in front of the right child. “Epic adjusts to their interest levels and the platform learns and grows with the child,” he said. The company has 150-odd employees. Markosian and co-founder Kevin Donahue will remain in their roles. Epic has raised $51 million in funding to date.

Byju’s has made many acquisitions in the past year, like WhiteHat Jr for $300mn and Aakash for $1bn. It bought Osmo, a US-based educational games, firm for $120mn two years ago

Byju’s acquires Great Learning, Toppr

July 27, 2021: The Times of India

Byju’s has bought Singapore-based Great Learning, which specialises in online higher and professional education, for $600 million, and Toppr, which provides online content for schools and competitive exams, for $150 million. The firm has done some 15 acquisitions to date, spending nearly $3 billion. Last week, it acquired US digital reading platform Epic, focused on kids aged 12 and under, for $500 million.