Anil Ambani

This is a collection of articles archived for the excellence of their content.

|

Contents |

As an industrialist

The marathon-runner CEO is considered to be close to PM Narendra Modi, and was the only industrialist to figure in the list of nine personalities Modi nominated for the Clean India campaign in October.

Some of his businesses crossed important milestones in 2014. Reliance Infrastructure's Mumbai Metro became operational, creating a world record with 30 million passengers in just over 100 days. His communications firm raised a billion dollars via qualified institutional placement QIP), India's largest-ever QIP in the private sector.

Reliance Media Works partnered with Prime Focus to create the world's largest media services company that handled blockbusters Gravity in 2013 and Transformers 4 in 2014.

Early bird

He starts giving to-do instructions to executives as early as 5.30 a.m. when he wakes up. Works till 7.30 p.m, has an early dinner and is in bed by 10 p.m. Conducts review meetings on Sundays.

Inverted Diet

He has fruits for breakfast, a frugal soup and vegetable sandwich for lunch, but has a heavy dinner.

Marriage with Tina Munim

When Tina Munim turned down Anil Ambani

One of the most popular couples of the country, Anil and Tina Ambani are a perfect example of 'love conquers all'. Though in an interview with Simi Garewal, Anil Ambani revealed that it was never love at first sight for him, his friends and Tina love to disagree over this. Anil spotted Tina for the first time unofficially at a wedding. As per Anil the thing that caught his attention was Tina's black saree as she was the only person in the entire wedding ceremony who wore something black. The second time they met was when Anil Ambani was in Philadelphia. Anil was introduced to Tina and he instantly asked her out. But Tina coming from the place where everyone runs after beautiful actresses turned him down.

In 1986, Tina was again introduced to Anil Ambani by her nephew. In the interview Tina said that she was not too keen on meeting guys at that stage in her life. This was the reason she kept postponing or cancelling their dates. But when they finally met Tina was struck by his simplicity and genuinity. Tina thought he was very different from the lot. And she instantly felt the connection as they were also born and brought up the same way.

On the other hand, Anil who was already struck by her beauty found her very down to earth and beautiful from within. Anil had known many people from the industry and he had certain notions about how Tina would be. But he said she was not like any of them. Anil stressed on the fact that he was really attracted to her only after they'd met a couple of times.

Tina and Anil dated for a couple of months after this. During this period Tina was also in the process of giving up Bollywood and was mostly busy with completing shoots. When Anil's family got to know of Tina, they weren't really excited about the match. They had certain notions about people from the film industry thus the thought of bringing someone from the fraternity into their lives and home did not go down too well with them.

It was family pressure that influenced Anil and Tina to stop seeing each other. Anil tried explaining things to Tina agreed to his decision without questioning him. But at the end she was just a girl who was heart broken. After this incident Anil and Tina did not speak to each other for 3-4 years.

During this period of 3-4 years, Tina left Bollywood and went to America. She continued studying interior designing and putting everything else behind her. And time just flew by. In the meanwhile Anil was showered with marriage prospects from good families but he kept turning them down. Anil said in the interview, "It was a lot of pain, a feeling of great loss." But during this period, neither Tina nor Anil went out with anyone else.

In that period of 3-4 years where they never interacted, there was only one time when Anil called her up. In 1989 when Anil heard that there was a major earthquake in Los Angeles, he got Tina's number and called her up. Anil asked Tina if she was alright and she being surprised and overwhelmed said 'yes'. But before she could continue the interaction or ask him something else Anil disconnected the call.

During this period, Anil kept refusing all the marriage proposals and kept trying to persuade his parents that Tina was the girl he should be with. After much persuasion when his family finally agreed, he called up Tina again and asked 'when are you coming back'. Tina replied that she would be back in a couple of weeks but later she just brushed it off. Though Tina still had strong feelings for him, she knew there was no future and thus just brushed off this conversation.

Tina who after leaving Bollywood had absolutely no friends in the industry kept postponing her plans of coming back to India. Weeks passed by and one day Anil called up Tina Munim again. He said, "you ahve been telling me you'll come back I want to know when will you come back?" Tina says, "This was the moment I realised I had to go back now. I could not have missed this."

After she came back, he told her his plans and Tina met his family. Anil also went to Khar to meet Tina's family and informed them about his plans. After everything materialised, Tina and Anil tied the knot in a spectacular ceremony six weeks later.

Anmol Ambani

2016: Additional director of Reliance Capital

The Times of India, Aug 24 2016

Anil Ambani's son Anmol inducted into RCap board

Anmol Ambani, the 24-year-old eldest son of Reliance Group chairman Anil Dhirubhai Ambani, is joining Reli ance Capital as additional director following a board meet. The appointment marks continua tion of the third generation of the Ambani family in the divided Reliance business empire.

Earlier, Mukesh Ambani's children Akash and Isha took up positions in the telecom and retail businesses. Anmol, who joined Reliance Capital in 2014, is expected to join the management as an executive director after shareholders' approval.In the last two years, he has been actively involved in internal business reviews across subsidiaries of Reliance Capital. He has also been part of the negotiations with Nippon Life for increasing stake in Reliance Life Insurance and Reliance Capital Asset Management.

The induction follows the recommendation by the nomination and compensation committee of the board of Reliance Capital, comprising mostly independent directors. “The last two years have given me great learnings about the financial services business. I look forward to using this experience for scaling up our businesses and contributing towards their growth and progress,“ said Anmol.

Ericsson

2018, May: ‘Settlement outside of bankruptcy court with Ericsson unlikely’

Investments in the Indian capital market through participatory notes climbed to Rs 84,647 crore till August-end, making it the first rise in such fund infusion in 10 months.

Participatory notes (P-notes) are issued by registered foreign portfolio investors (FPIs) to overseas players who wish to be part of the Indian stock market without registering themselves directly. They, however, need to go through due diligence.

According to the Securities Exchange Board of India (SEBI) data, total value of P-note investments in the Indian market - equity, debt, and derivatives - rose to Rs 84,647 crore till August-end from Rs 80,341 crore clocked by the end of July.

Prior to this, an increase in investment was seen in October 2017, when the cumulative value of such fund infusion rose to Rs 1,31,006 crore from Rs 1,22,684 crore in September-end.

Of the total investments made last month, P-note holdings in equities were at Rs 66,233 crore and the remaining in debt and derivatives markets.

Besides, the quantum of FPI investments via P-notes rose to 2.5 percent during the period under review from 2.4 percent in the preceding month.

Before the rise, P-note investments were on a decline since, June last year and hit an over eight-year low in September. However, these investments rose slightly in October but fell again in November and the trend continued till July this year.

In July this year, the investment had touched the lowest level since April 2009 when the cumulative value of such investments stood at Rs 72,314 crore.

The decline in investment could be attributed to several measures taken by the market watchdog to stop the misuse of the controversy-ridden participatory notes.

In July 2017, SEBI had notified stricter norms stipulating a fee of $1,000 on each instrument to check any misuse for channelising black money. It had also prohibited FPIs from issuing such notes where the underlying asset is a derivative, except those which are used for hedging purposes.

Last month, market regulator SEBI issued revised KYC norms for FPIs, wherein resident, as well as, non-resident Indians have been permitted to hold non-controlling stake in such entities.

These norms have been put in place weeks after a panel suggested various changes to the guidelines proposed earlier, amid concerns in certain quarters that overseas funds might face difficulties in ensuring compliance.

Non-resident Indians (NRIs), overseas citizens of India (OCIs) and resident Indians (RIs) have been permitted to hold non-controlling stake in FPIs. There would also be no restriction on them to manage the non-investing FPIs SEBI-registered offshore funds as well as registered investment managers.

2018, Oct: Ericsson files contempt of court petition against Anil

Kiran Rathee, October 2, 2018: Business Standard

SC will hear the plea of RCom on October 4 whereas a date is not finalised for Ericsson

Swedish telecom gear maker Ericsson has filed a petition in the Supreme Court for contempt of court against Anil Ambani, chairman of Reliance Communications after the firm failed to pay about Rs 5.50 billion to Ericsson to settle the dispute over dues.

RCom had to pay the amount to Ericsson by September 30 but the company approached SC seeking a 60-day extension. As Ericsson did not agree to the extension, it has now filed a contempt of court petition.

SC will hear the plea of RCom on October 4 whereas a date is not finalised for Ericsson. However, sources say Ericsson's petition can also be taken up on October 4.

Meanwhile, the National Company Law Appellate Tribunal will hear the matter on October 3. The tribunal has asked the two parties to settle the disputes.

Queries sent to the companies remained unanswered.

In order to pare debt, RCom has already sold its tower and fibre business to Reliance Jio. However, selling of spectrum to Jio has not received a clearance from Department of Telecommunications yet. RCom has contested the department's Rs 20 bn (approx) demand for spectrum charges for clearing the deal.

Manipal Technologies

Rs 2.74 crore case in NCLAT/ 2018

On December 28, on the date of the deadline for conversion of debt to equity, Anil Ambani's Reliance Communications (RCom) signed a definitive agreement with big brother Mukesh Ambani's Reliance Jio and bought itself some time from lenders.

On December 28, just on the deadline of conversion from debt to equity by the Banks under the Reserve Bank of India Strategic Debt Restructuring (SDR) regulations Anil Ambani’s Reliance Communications (RCom) signed a definitive agreement with big brother Mukesh Ambani’s Reliance Jio and bought itself some time from lenders. Nearly 10 days later, its Chinese lender, which had moved the insolvency court for a debt of Rs 9,000 crore, withdrew the case. However, RCom’s legal trouble is far from over.

A petition was filed by a Karnataka-based company, Manipal Technologies for a due of about Rs 2.74 crore from the troubled RCom. Agencies on Thursday reported that the dispute between the two companies is not over and the National Company Law Appellate Tribunal (NCLAT) will hear the case on January 25.

Manipal Technologies supplied fingerprint scanners to RCom in 2016. However, the money was not paid as RCom claimed that the invoices were raised in the name of HP financial services and not RCom. Earlier, it had approached the National Company Law Tribunal, which had rejected Manipal’s plea, accepting RCom’s argument that dues were not against the firm. Following this, Manipal Technologies moved the NCLAT.

RCom has a total debt of Rs 45,000 crore, including Rs 20,000 crore in the form of foreign loans and bonds. After failing to seal two deals with Aircel and Brookfield, Anil Ambani finally turned to his big brother for the deal. “The transaction has happened after a transparent and due process of bidding for RCom’s assets” and “was duly monitored by an oversight committee in which Reliance Jio emerged as the highest bidder for some of the assets…” RCom clarified. According to a Times of India report, Anil Ambani took the decision after Kokilaben Ambani, his mother, caught him in a pensive mood and told him “to ensure no lender loses a single rupee.” Anil Ambani then took the decision to exit the bleeding wireless telecom business.

RCom signed a deal with elder brother Mukesh Ambani’s Reliance Jio to sell four wireless infrastructure assets for Rs 23,000 crore on December 28, the birth anniversary of the late Dhirubhai Ambani. In his latest meeting with lenders, Anil Ambani said, “I owe this money to you morally, rather than legally.” RCom, in the process, has also shut its 2G and DTH services.

However, the legal trouble for RCom does not end with Manipal Technologies’ plea. The insolvency plea filed by Ericsson against RCom for unpaid dues of nearly Rs 1, 150 crore also stands.

RCom

2019: The fall

The collapse of Reliance Communications (RCom) marks a complete fall in flamboyant Anil Ambani’s fortune as the ‘prized family jewel’ — that he inherited as part of a family settlement with elder brother Mukesh — comes to haunt him nearly 15 years after the Ambanis’ mega expansion into the telecom business.

While Anil always viewed the telecom business as the next frontier for growth, after losing the lucrative oil and gas operations in the family settlement, heavy investments and stiff competition made it an uphill task for him to realise his dreams. And with debts mounting by the day — it is estimated at nearly Rs 47,000 crore now — the final death knell was sounded when Mukesh made a re-entry into the telecom arena (in September 2016) with free services under the Reliance Jio banner.

The debt proved too daunting even for the ambitious Anil, once touted as the financial wizard of the combined Reliance Group. In between the family handover and the collapse, there were many failed deals that led to the unprecedented fall in Anil’s fortune. As he began aggressive expansion of the business after getting RCom in 2005 and listing it on the bourses in 2006, the challenging nature of the telecom sector and its need for heavy investments started hitting home.

The market was shifting from 2G voice, and then to data and internet-heavy 3G and 4G, requiring heavy investments in telecom equipment and also in spectrum purchases. In between all this, Anil also had to fight off the so-called GSM lobby that comprised the combined might of Airtel, Vodafone and Idea Cellular. The pressures of a high-pitched battle and aggressive investments started showing on the company, which eventually spun off into a debt pile-up from which he could never manage to recover.

Failed deals were surely a part of the saga, which included the collapsed Rs 50,000-crore telecom infra deal with GTL Infra in 2010. Undeterred at that time, Anil continued to make investments in 3G, under-sea cable and network expansion.

But with his services never really making a cut with the high-paying mobile users, Anil was never really seen as a strong challenger by his competitors. The saga of failed deals continued and the most notable was the collapse of the merger deal with Aircel in 2017, just when RCom (like other telecom operators) was coming to terms with the highly-aggressive re-entry of Mukesh into the business.

The collapse of the Aircel deal, that RCom blamed on “inordinate delays” caused by “legal and regulatory uncertainties and various interventions by vested interests”, also led to the failure of a nearcompleted tower sale deal with Canadian infra company Brookfield. With no Aircel deal, Brookfield found it wiser to back off, giving a death blow to RCom. Soon after, RCom announced closure of 2G and 3G mobile business, shaving off over 75% of an estimated 80 million customers.

As it shifted focus on the enterprise business, the debt resolution process became harder as lenders started approaching court for recovery. The most notable of these included Sweden’s Ericsson, which accused Anil and RCom of deliberate and wilful default in payment of Rs 550 crore, which it had scaled down from the original Rs 1,600 crore.

The courtroom battle and the failure to realise a deal with Mukesh saw the company’s stocks being hammered. It closed the day at Rs 5.62, a far cry from the high of Rs 821 reached on January 9, 2008.

YEAR-WISE DEVELOPMENTS

2019

From: Partha Sinha, Anil Ambani cos allege illegal pledged share sale, February 9, 2019: The Times of India

Accuse Edelweiss, L&T Arms Of Wrongly Offloading Stocks, Fin Cos Deny Charges

A war of words has broken out in India Inc involving three leading business groups with allegations of “breach of trust” and veiled legal threats.

Anil Ambani’s Reliance conglomerate on Friday accused financial arms of Edelweiss and L&T of illegally selling promoters’ shares in four of its group companies in the open market, causing a steep fall in their value.

Edelweiss and L&T Finance denied any illegality and said all rules were followed while selling these shares. The four Anil group companies whose shares plunged by over 50% this week, causing a market capitalisation loss of about Rs 13,000 crore, are Reliance Communications, R-Power, R-Infrastructure and RCapital.

Reliance Group, meanwhile, removed Edelweiss as one of the lead merchant bankers to manage the IPO of Reliance General Insurance following selling of pledged shares. Sources said Edelweiss had walked out of the IPO deal since it did not “find any value in it”. Reliance General Insurance has filed an offer document with Sebi.

Reliance Power said L&T Finance and certain entities of Edelweiss Group, among others, sold pledged shares of group companies in the open market for about Rs 400 crore. “The illegal, motivated and wholly unjustified action by the two groups has precipitated a fall of Rs 13,000 crore, an unprecedented nearly 55%, in market capitalisation of Reliance Group over four days, causing substantial losses to 72 lakh institutional and retail shareholders, and harming the interests of all stakeholders,” R-Power said in a statement. The company alleged that the way these shares were sold could be termed as “price manipulation, insider trading, front-running and market abuse”, and were in violation of various regulatory provisions.

The shares sold were once pledged by Ambani and his associates to borrow money from arms of Edelweiss and L&T, among others. According to Edelweiss, since the stock prices of these shares had fallen sharply in the last few months, the total value of promoters’ shares — which were pledged with these entities to avail of the loan — was less than the loan amount.

In its statement, Edelweiss refuted Reliance Group’s allegations, calling it “entirely unfounded, baseless and false”. It said that despite their best efforts and opportunities given to the Ambani-controlled group for a remedy, “not only did Reliance Group fail to address any of the concerns raised by Edelweiss Group, but also continued to breach contractual obligations”. Throughout the process, Edelweiss had acted in a lawful and responsible manner, it said.

L&T Finance too refuted the allegations made by Reliance Group, relating to sale of pledged shares of that group. The financier had given loans against pledge of shares to Reliance Group companies and under loan and pledge agreements, “the borrower did not cure various events of defaults, including providing margin for shortfall in the stipulated security cover”.

“Despite various notices in the past few months, events of defaults continued. Consequently, L&T Finance enforced its rights of invocation and sold pledged shares to the extent of its outstanding dues by following the due process of contract and law,” the company said.

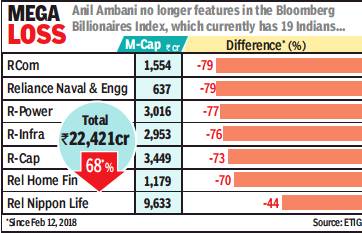

Anil group loses 68% value in a year

February 13, 2019: The Times of India

From: February 13, 2019: The Times of India

The market value of Anil Ambani group companies have fallen by nearly 68% in the last 12 months. In absolute terms, the group has lost Rs 47,300 crore in valuation. In 2018, Anil ranked 28 on the Forbes Indian billionaire list with a net worth of $2.4 billion — a gap of nearly $45 billion with his elder brother and country’s richest man, Mukesh Ambani.

A 65% erosion in value of holdings would mean that the junior Ambani has dropped off the billionaire list. His net worth would have also come down because his shares pledged with the finance arms of L&T and Edelweiss were sold by them following a default, which led to a sharp drop in the value of group companies.

The decline in fortunes accelerated in February when RCom said that it failed to come up with a resolution plan and had no choice but file for bankruptcy.

See also

The Ambanis <> Anil Ambani <> Mukesh Ambani