Labour: India, Provident Fund: India

(→Literacy/ educational levels of workers, non-workers) |

(→A critique) |

||

| Line 6: | Line 6: | ||

|} | |} | ||

| − | [[Category:India | | + | [[Category:India |P ]] |

| − | [[Category:Economy-Industry-Resources | | + | [[Category:Economy-Industry-Resources |P ]] |

| − | + | = Employees' Provident Fund= | |

| − | [ | + | ==A critique== |

| + | ===As in 2020 === | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F01%2F28&entity=Ar00202&sk=C5B28F80&mode=text Rama Karmakar, January 28, 2021: ''The Times of India''] | ||

| + | [[File: The EPF, As in 2020.jpg|The EPF, As in 2020 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F01%2F28&entity=Ar00202&sk=C5B28F80&mode=text Rama Karmakar, January 28, 2021: ''The Times of India'']|frame|500px]] | ||

| − | |||

| − | |||

| − | |||

| + | For a vast number of the salaried, the employee provident fund (EPF) is the only social security net they have. But the EPF rules are such that they tend to discriminate against the young and vulnerable — those who have not yet worked for five years without a break. It took a pandemic to expose how this hurts the private-sector salaried workers most when they have already been hit hard by job loss. | ||

| − | + | ''' HOW EPF WITHDRAWALS ARE TAXED ''' | |

| − | + | Withdrawal of EPF accumulated balance is not taxable if: | |

| + | An employee participating in EPF has rendered continuous service for five or more years; | ||

| − | + | Or, if before 5 years, the employee’s service has been discontinued on grounds of ill-health, or by contraction or discontinuance of employer’s business or other causes beyond the control of the employee. | |

| − | + | In other circumstances, the accumulated balance withdrawn within five years of continuous service is considered as taxable income. | |

| − | + | ||

| − | + | ||

| − | + | ||

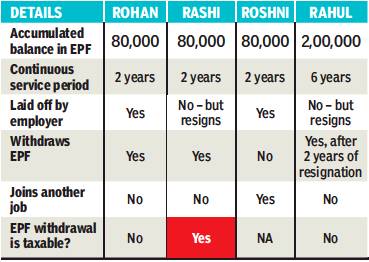

| − | + | During the Covid-19 pandemic, many employees lost their jobs due to business uncertainties. The following illustration brings out the taxability of EPF withdrawal in different cases/ circumstances (all figures in Rs): As Rohan’s employment was terminated by his employer, the EPF balance withdrawn by him will be exempted from tax. As Rashi voluntarily resigned from employment after working for 2 years, her EPF balance withdrawn would be taxable. For withdrawals in excess of Rs 50,000, tax is usually deducted at source. Roshni, who did not withdraw the EPF amount, can map the accumulated balance to the new employer, in case she continues with EPF. Rahul rendered continuous service of more than five years, so his accumulated EPF would not be taxable. However, the interest that has accrued for the period of two years after cessation of employment would be taxable in his hands. | |

| − | + | ''' EPF ADVANCE DURING PANDEMIC ''' | |

| − | + | The government has allowed members of the EPF scheme to claim ‘nonrefundable advance’ from their EPF account to the extent of the basic wages and dearness allowance for three months, or up to 75% of the amount outstanding in the EPF account, whichever is less. This has been a very effective scheme and a timely intervention to address liquidity issues faced by employees during the pandemic. The FAQs released by provident fund authorities have clarified that such withdrawals will not be taxable. However, the corresponding amendment in the Income Tax Act to ensure that the non-refundable advance received is not taxable is still awaited. | |

| − | + | ''' EXEMPTION DESIRABLE FOR SOCIAL SECURITY WITHDRAWALS ''' | |

| − | + | As compared to developed countries, India does not have a strong social security net to protect workers in the event of unemployment. Globally, many countries provide unemployment insurance to employees upon satisfaction of specified conditions. For instance, in the US, those who are unemployed due to no fault of their own are eligible to claim unemployment insurance. In Canada, employment insurance provides benefits to individuals who have lost their jobs and are available for work but cannot find a job. No such social security support is available in India. And, taxation of EPF withdrawals would leave a lower amount in the hands of employees in times of need. | |

| − | + | For taxing EPF withdrawals, the limit of five years may be retained. However, exemption from tax may be considered if withdrawals are made before five years to meet certain contingencies/life goals such as purchase of residential house, marriage, education of children, medical expenses/ emergency, pandemics such as Covid-19 etc. | |

| − | + | The government is in the process of implementing the new Labour Codes, likely to be effective from April 1, 2021. One of the important aspects of the code is to provide ‘social security for all’. In keeping with this spirit, there is a need to amend the tax laws also, to no longer subject EPF withdrawals to tax. | |

| + | The writer is Tax Partner at EY India. Ankur Agrawal, senior tax professional with EY, also contributed to this article (Views expressed are personal) | ||

| − | + | [[Category:Economy-Industry-Resources|P PROVIDENT FUND: INDIA | |

| + | PROVIDENT FUND: INDIA]] | ||

| + | [[Category:India|P PROVIDENT FUND: INDIA | ||

| + | PROVIDENT FUND: INDIA]] | ||

| + | [[Category:Pages with broken file links|PROVIDENT FUND: INDIA | ||

| + | PROVIDENT FUND: INDIA]] | ||

| − | + | == 2016/ SC: employees can raise contributions without cut-off date for eligibility == | |

| + | [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIM%2F2017%2F11%2F22&entity=Ar00324&sk=3FEF1339&mode=text Prabhakar Sinha, SC ruling enables massive rise in pvt sector pensions, November 22, 2017: ''The Times of India''] | ||

| − | + | [[File: The EPF scheme, the amendment of 1996 and the SC-mandated scheme.jpg|The EPF scheme, the amendment of 1996 and the SC-mandated scheme <br/> From: [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIM%2F2017%2F11%2F22&entity=Ar00324&sk=3FEF1339&mode=text Prabhakar Sinha, SC ruling enables massive rise in pvt sector pensions, November 22, 2017: ''The Times of India'']|frame|500px]] | |

| − | + | '''See graphic:''' | |

| − | + | ''The EPF scheme, the amendment of 1996 and the SC-mandated scheme'' | |

| − | + | ||

| − | |||

| − | + | A Supreme Court order of October 2016 that directed the Employees’ Provident Fund Organisation (EPFO) to revise the pension of 12 petitioners under the employee pension scheme (EPS). | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | The pension scheme, which is part of EPF, has over 5 crore members. Every employee in the organised sector contributes 12% of basic salary and dearness allowance to EPF. The employer makes a matching contribution. Of the employer’s contribution, 8.33% goes to the EPS. When people withdraw their EPF after a job switch or during unemployment, the EPS is not given out. It’s payable only after superannuation. | |

| − | + | There is also a ceiling on EPS contributions. The current cap on salary (basic + DA) is Rs 15,000 per month so, the maximum one can contribute to the EPS is 8.33% of Rs 15,000, which is Rs 1,250 a month. | |

| − | + | Between July 2001 and September 2014, the EPS salary cap was Rs 6,500 a month, which translated to a maximum contribution of Rs 541.4 a month. | |

| − | + | ''SC ruling to benefit 5 crore EPFO members'' | |

| − | + | Prior to 2001, the ceiling was Rs 5,000 which yielded a maximum contribution of Rs 416.5. So how did 62-year-old Kohli get a pension of over Rs 30,000 a month with such a meagre contribution to the pension fund? | |

| − | + | ||

| − | + | ||

| − | It | + | It took a long struggle in which he cited an important amendment to the EPS. In March 1996, the EPS Act was amended to allow members to raise pension contribution to 8.33% of full salary (basic + DA) irrespective of what the salary is. This raised the pension multiple times. |

| − | + | However, for a decade hardly anybody opted for higher contribution. In 2005, following media reports, including in TOI, several private EPF fund trustees and employees approached EPFO with the demand to remove ceiling on their EPS contribution and raise it to their total salary. The EPFO rejected the demand claiming that response should have come within six months of the 1996 amendment. | |

| − | + | Cases were filed against EPFO in various high courts. By 2016 all except one high court ruled against EPFO stating that the six-month deadline was arbitrary and the employees must be allowed to raise their pension contribution whenever they wish to. The case went to Supreme Court which, in two separate rulings in 2016, ruled in favour of the employees’ right to raise their contributions to their pension fund without imposing any cut-off date for eligibility. | |

| − | + | ||

| − | + | It took another year for the EPFO to implement the court order following a strong fight put up by petitioners like Kohli. Finally, from November 2017, Kohli started getting higher pension. | |

| − | + | ||

| − | + | ||

| − | + | To raise his monthly pension from Rs 2,372 to Rs 30,592, Kohli had to pay Rs 15.37 lakh as the difference between EPS contribution he had made while in service and the contribution he would have made if he was allowed to raise it to his full salary. But he also got Rs 13.23 lakh as arrears for the higher pension that he was entitled to for four years spent in retirement before November 2017. So, by paying Rs 2.14 lakh | |

| − | + | ||

| − | + | ||

| − | + | additionally, Kohli was able to raise his lifelong pension by nearly 13 times. In case he passes away before his wife, she will get 50% of Kohli’s last drawn pension till she is alive. | |

| − | + | ||

| − | + | ||

| − | + | Are all 5 crore members of EPFO now eligible for higher pension if they opt to raise their EPS contribution? Yes, all those who joined EPFO before September 1, 2014 — the date on which the EPS imposed the Rs 15,000 salary cap — can contribute on their full salary to EPS. They can submit applications to their company and the EPFO and get up to half of their last average monthly salary as pension. Those who joined EPFO after September 1, 2014 and have a salary above Rs 15,000 are not eligible for pension while those starting with salaries lower than Rs 15,000 can contribute to EPS but the cap of Rs 15,000 will kick in when their salary rises. | |

| − | + | EPFO is also discriminating against employees who are members of privately-managed EPF trusts (nearly 80 lakh), officially called Exempt Establishments and those who directly contribute to the government-run trust (4.25 crore) called Un-exempt Trusts. | |

| − | + | ||

| − | + | ||

| − | + | Central provident fund commissioner V P Joy said, “EPS will not be able to give pension to those members whose contributions on higher salary have not been received by EPFO.” The EPFO is denying employees of exempt companies higher pension on the grounds that only 8.33% of up to Rs 15,000 and not their entire PF contribution goes to EPS. | |

| − | + | ||

| − | + | However, two of the 12 petitioners who went to court were from the exempt category. So, a precedent has been set. It’s likely that members of private trusts or the trusts themselves will go to the court to settle the issue. The EPFO’s board of trustees is also likely to discuss the move to bar exempt EPF trusts. | |

| − | + | ||

| − | + | ''Those who joined EPFO before September 1, 2014 can contribute on their full salary to EPS'' | |

| − | + | ==Amnesty scheme, 2017== | |

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=India-Inc-can-enrol-employees-under-EPF-amnesty-03012017020057 Lubna Kably, India Inc can enrol employees under EPF amnesty scheme, Jan 3, 2017: The Times of India] | ||

| − | |||

| − | + | '''Cos Have To Pay Only Rs 1 Damages For Each Year Of Default''' | |

| − | + | Companies which have not enrolled their employees as members under the Employee Provident Fund (EPF) scheme will now get a chance to do so, against payment of a minimal damage fee of Re 1per year of default. | |

| − | + | Additionally , if the employee wasn't enrolled earlier and hisher share of contribution was not deducted from salary , the employer company had to pay this sum also in addition to the past defaults of its own contribution. Now under the amnesty scheme, only the employer's contribution has to be deposited. | |

| − | + | The objective of the amnesty is to ensure enrolment of employees and spread the benefit of the EPF scheme.Companies having 20 or more employees are required to mandatorily enrol those employees under the EPF scheme who have a salary of up to Rs 15,000 per month.The EPF scheme is optional for those drawing a higher salary . However, once an employee opts for the scheme, he or she cannot opt out. | |

| − | + | Both the employer and employee are required to contribute 12% per month towards EPF against the employee's basic salary plus dearness allowance. However, under the amnesty , interest at the rate of 12% on the amount due for delayed deposit of the contribution will be payable for the period of delay .This amnesty scheme, which comes into force from January 1, is open until March-end.“The main purpose of the amnesty is to expand coverage of the EPF scheme,“ said a government official. | |

| − | + | Arrears in payment of EPF dues is rampant. More than a lakh employers had not deposited PF contributions and the arrears outstanding as of March 31, 2015 was nearly Rs 3,000 crore. “More damaging is that there is an equally large number of companies (especially micro, small & medium enterprises, or MSMs), say in the garment or auto ancillary sector, who do not enrol their employees at all,“ adds the government official. | |

| − | + | ||

| − | + | Sonu Iyer, partner and leader people advisory services at EY India, explains, “Companies that had not enrolled employees under the EPF scheme for the period beginning April 1, 2009 to December 31, 2016 can take advantage of the amnesty scheme by making a declaration to the regional employee provident fund office.“ | |

| − | ''' | + | “The employer will be required to deposit the required sum, which denotes its share of contribution, employee's share of contribution only if deducted from employee's salary but not deposited, interest and a nominal damage charge within 15 days of making the declaration.The biggest largesse under the amnesty is that the company doesn't have to make good the share of the employee's contribution,“ adds Iyer. |

| − | + | After depositing the sums, adetailed return has to be filed with the Regional Provident Fund Commissioner. Employers are eligible to participate in the amnesty only if proceedings under section 7A (inquiries) have not already commenced against them. | |

| − | + | However, it is not clear whether the amnesty scheme will cover cases where employees had been enrolled in the EPF scheme but where there was a shortfall in depositing contributions. | |

| − | + | ||

| + | == EPFO to settle death claims within 7 days== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=EPFO-to-settle-death-claims-within-7-days-02112016009059 EPFO to settle death claims within 7 days, Nov 02 2016 : The Times of India] | ||

| − | |||

| − | + | Employees' Provident Fund Organisation (EPFO) issued guidelines in Nov 2019 to its field offices to settle death claims in seven days and retirement cases before a worker superannuates from the job, a move which comes days after PM Narendra Modi slammed the labour ministry for the provident fund manager's poor service. | |

| − | + | The central provident fund commissioner informed labour minister Bandaru Dattatreya that on the PM's directions, EPFO had issued guidelines to field offices to take “proactive action to settle death claims within seven days and reti rement cases on or before the day of retirement,“ the ministry said. | |

| − | + | ==EPFO coverage for Indians working abroad, 2017== | |

| + | [https://timesofindia.indiatimes.com/india/no-technical-education-via-correspondence-courses-rules-supreme-court/articleshow/61479624.cms Amit Anand Choudhary, SC cancels engineering degrees given by deemed universities through correspondence course, Nov 3, 2017: The Times of India] | ||

| − | |||

| − | + | '''HIGHLIGHTS''' | |

| − | + | The apex court restrained educational institutions from providing courses in subjects like engineering, in the distance education mode | |

| − | + | With its ruling, the SC affirmed the findings of the Punjab and Haryana high court on the issue | |

| − | + | Also with its ruling, the SC set aside a verdict by the Odisha high court, which allowed technical education by correspondence | |

| − | |||

| − | |||

| − | |||

| − | ' | + | Indians working abroad can now exempt themselves from their host country's social security scheme and get covered by retirement fund body EPFO, Central Provident Fund Commissioner (CPFC) V P Joy said. |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | An online facility to avail the benefit has been made functional, he said at a national seminar on 'Fraud Risk Management-The New Initiatives' here. | |

| + | The scheme allows Indian employees the option of not being part of their host country's social security scheme and saves employers from double social security contributions. | ||

| − | + | The Employees' Provident Fund Organisation, which manages the money in employees provident fund accounts, has entered into an agreement with 18 countries. | |

| + | "We have made the whole process employee friendly. Employees going abroad to work can get a certificate of coverage (CoC). They can apply for the CoC online and can get it too," he told. | ||

| − | + | Joy said there is a simple one-page application form available on the EPFO's website for the purpose. | |

| − | + | "The scheme is of great help for Indian workers going overseas for a limited period of time. The biggest benefit they get from opting for the CoC is that their money is not blocked for a long time in the host country," he said, explaining the benefits of the scheme. | |

| − | + | India has operational social security agreements with Belgium, Germany, Switzerland, France, Denmark, Republic of Korea, Grand Duchy of Luxembourg, Netherlands, Hungary, Finland, Sweden, Czech Republic, Norway, Austria, Canada, Australia, Japan and Portugal. | |

| − | + | EPFO is one of the largest social security providers in the world, covering 9.26 lakh establishments with more than 4.5 crore members. It provides pension to 60.32 lakh pensioners every month. | |

| − | = | + | ==Interest rates== |

| − | == | + | ===Dec 2016: cut to 8.65%=== |

| − | [ | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=EPFO-cuts-interest-rate-to-865-20122016013009 ''The Times of India''], Dec 20 2016 |

| − | [[File: | + | '''EPFO cuts interest rate to 8.65%''' |

| + | [[File: Employees Provident Fund, interest rates, 2010-16.jpg|Employees Provident Fund, interest rates, 2010-16; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=EPFO-cuts-interest-rate-to-865-20122016013009 ''The Times of India''], Dec 20 2016|frame|500px]] | ||

| − | |||

| − | + | The Employees Provident Fund Organisation (EPFO) recommended a minor reduction in interest rate to 8.65% for the financial year 2016-17 compared to 8.8% in 2015-16 but it still remains the best investment bet given that there is no cap on how much you set aside and the entire corpus remains tax free. | |

| − | + | The reduction in interest rate to a four-year low is in line with the falling regime although bank fixed deposit rates have seen a sharper decline due to demonetisation of Rs 500 and Rs 1,000 notes. State Bank of India, for instance, has lowered fixed deposit rates by 15 basis points (100 basis points equal one percentage point), while on deposits of over Rs 1 crore (known as bulk deposits) rates have been slashed by up to 190 basis points. In any case, with the RBI singalling a shift towards a low rate regime, the government was forced to pare returns on small savings schemes. | |

| − | + | Trade unions were demanding that EPFO central board headed by labour minister Bandaru Dattatreya retain the rates at least year's level, something that did not appear feasible given the retirement agency's projections. At 8.8%, EPFO would have faced a deficit of Rs 384 crore, while at 8.65% it will have a surplus of Rs 296 crore. | |

| − | + | “The decision was arrived at after detailed consultations with all stakeholders. With consensus we have taken this decision,“ Dattatreya said in Bengaluru after the meeting.Interest income from PF investments for 2016-17 has been estimated mainly on the basis of interest income received or receivable in this financial year, including surplus of Rs 410 crore from previous year, an official said. | |

| − | + | “In 2015, the interest rate decided was at 8.8%. At that time, along with the income of EPFO, the surplus from the previous year was Rs 1,600 crore. This year, along with the income, the surplus available is Rs 410 crore,“ Central Provident Fund Commissioner V P Joy said. | |

| − | + | The recommendation of the EPFO board needs to be ratified by the finance ministry , which notifies the rates. Last year, the finance ministry had suggested a reduction but was forced to go with the board's decision after public uproar. | |

| − | + | ===Erstwhile employees must pay tax on interest=== | |

| + | [https://timesofindia.indiatimes.com/business/india-business/quit-or-axed-as-employee-pay-tax-on-epf-interest/articleshow/61666067.cms November 16, 2017: ''The Times of India''] | ||

| − | |||

| − | + | '''HIGHLIGHTS''' | |

| − | + | According to a notification issued, when an employee resigns from his job, his EPF account continues to be "operative" and earns an interest until he applies for withdrawal. | |

| − | + | On the other hand, if an employee retires after 55 years of age, then post three years from the date of retirement, his EPF account is treated as "inoperative" and does not earn any interest. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | Tax laws provide that interest credited to an employee provident fund (EPF) account after an individual ceases to be in employment+ is taxable in his hands in the year of credit. | |

| − | + | ||

| − | + | ||

| − | + | In its order, the Bengaluru bench of the Income-Tax Appellate Tribunal (ITAT) also upheld this I-T provision while adjudicating the matter of a retired employee+ . | |

| − | + | Post-employment, whether on account of termination, resignation or retirement, several employees continue to maintain their EPF accounts and earn interest on the same. Unfortunately, they are usually not aware of the tax implications on the interest accretion in the fund after termination of employment," says Amarpal Chadha, partner and India mobility leader at EY India. Investment consultants point out that even in the case heard by ITAT, the taxpayer had mistakenly thought that the interest which had accrued to his EPF account post his retirement was not taxable. | |

| − | + | ||

| − | The | + | This ITAT ruling is pertinent not only for retired employees, but also those who have quit employment for various reasons, say, to be an entrepreneur or a homemaker, and have continued to retain a balance in their EPF accounts. |

| + | |||

| + | According to a notification issued last November, when an employee resigns from his job or his services are terminated, his EPF account continues to be "operative" and earns an interest until he applies for withdrawal of the accumulated balance or takes up another job and transfers the balance. On the other hand, interest accrual norms are different for a retired employee. If an employee retires after 55 years of age and does not apply for withdrawal from his EPF account or transfer of the balance, then post three years from the date of retirement, his EPF account is treated as "inoperative" and does not earn any interest. | ||

| + | |||

| + | The applicable rate of interest is announced each year. For the recently concluded financial year 2016-17, the interest rate was 8.65% and rates for the current financial year are expected to be announced shortly. In the recent case, the man had retired from a prominent Bengaluru-headquartered software company after 26 years of service, on April 1, 2002, and the total amount in his EPF account then was Rs 37.93 lakh. | ||

| + | Nine years later, on April 11, 2011, he withdrew the grown sum of Rs 82 lakh from his EPF account. This amount included interest of Rs 44.07 lakh that had accrued post his retirement till the date of withdrawal. | ||

| + | |||

| + | The retired employee did not offer this interest amount to tax, as he viewed it would be exempt under Section 10 (12) of the I-T Act. During assessment proceedings for financial year 2011-12, the I-T officer sought to levy tax on this amount and the litigation finally reached ITAT's doors. | ||

| + | |||

| + | Based on a reading of Section 10(12) and also the definition of "accumulated balance", the ITAT held: "The exemption is limited to the accumulated balance due and payable to an employee up to the date of his retirement or end of his employment." | ||

| + | |||

| + | ITAT pointed out that the term "accumulated balance due to an employee" is defined as the balance standing to his credit, or such portion of it as may be claimed by the concerned employee under the regulations of the fund "on the day he ceases to be an employee". | ||

| + | |||

| + | Thus, the ITAT agreed that the interest earned postretirement was taxable in the hands of the retired employee. However, it added that the aggregate interest of Rs 44.07 lakh should be taxable in the hands of the retired employee, in the respective financial years in which the interest income actually arose. | ||

| + | |||

| + | Chadha says, "Under the tax laws, the accumulated balance, as it stands on the date of cessation of employment, is considered as an exempt income (subject to satisfaction of certain conditions). Any accreditation in the EPF account after cessation of employment would be taxable income. ITAT, in its recent decision, has also held likewise. Therefore, it is important for employees to consider this aspect while making a decision on retaining their EPF account once their employment ceases." | ||

| + | |||

| + | ==Rules== | ||

| + | ===PF a/c to be transferred automatically on change of employment=== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PF-acs-to-be-automatically-transferred-on-job-11082017009021 Mahendra Singh, PF a|cs to be automatically transferred on job switch, August 11, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | From next month, your PF account will be transferred automatically when you change your job, chief provident fund commissioner V P Joy has said. | ||

| + | Joy, who is pushing a slew of initiatives in the Employees' Provident Fund Organisation (EPFO) to make it more worker-friendly , said premature closure of accounts was one of their main challenges, and they were trying to address it by improving services. | ||

| + | |||

| + | “Whenever there is change of job, a lot of accounts are closed; then they (the employees) restart their account later on,“ he added. | ||

| + | |||

| + | “Now we have made Aadhaar compulsory for enrolment. We don't want accounts to be closed. The PF account is the permanent account.The worker can retain the same account for social security,“ Joy added. | ||

| + | |||

| + | “We are trying to ensure transfer of money if one changes jobs, without any application, in three days. In future, if one has an Aadhaar ID and has verified the ID, then the account will be transferred without any application if the worker goes anywhere in the country. This system will be in place very soon,“ he added. | ||

| + | |||

| + | The EPFO has also stepped up efforts to expand coverage, and initial results have been positive. “During the campaign from January to June, more than one crore workers were enrolled. Now, we are trying to retain them by improving services,“ Joy said. | ||

| + | |||

| + | Joy said PF money should be withdrawn only for major purposes like housing, education of children, or serious hospitalisation. “...Only then will people get social security. So, we are now starting a campaign...to educate people that money must be withdrawn only for essential purposes,“ Joy said. | ||

| + | |||

| + | ===2017: GPF rules liberalised=== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GPF-rules-relaxed-for-govt-staffers-28032017010030 GPF rules relaxed for govt staffers, March 28, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | In a major relief for government employees, the Centre recently relaxed and simplified the General Provident Fund Rules, particularly related to advances and withdrawals by the subscribers. | ||

| + | |||

| + | As per relaxed norms, employees can withdraw up to 90% of their amount for housing needs and 75% for buying vehicles. The definition of education for the purpose of withdrawal of GP Fund has now been widened to include primary, secondary and higher education, covering all streams and institutions. | ||

| + | |||

| + | The withdrawal limit has also been increased from three months' pay or half the amount at credit, to up to 12 months' pay or 34th of amount at credit, whichever is less. | ||

| + | |||

| + | Also this is now admissible to a subscriber after completion of 15 years of service. | ||

| + | |||

| + | ===2018: Those unemployed for 30 days can withdraw 75% === | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/epfo-member-can-withdraw-75-funds-after-30-days-of-job-loss/articleshow/64751097.cms EPFO members can withdraw 75% funds after 30 days of job loss, June 26, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | '''HIGHLIGHTS''' | ||

| + | |||

| + | EPFO members can also withdraw remaining 25 per cent of their funds after completion of two months of unemployment | ||

| + | |||

| + | At present, the members can withdraw the funds after two months of unemployment and settle the account in one go | ||

| + | |||

| + | |||

| + | Retirement fund body EPFO decided to give its members an option to withdraw 75 per cent of their funds after one month of unemployment and keep their PF account with the body. | ||

| + | |||

| + | The members would also have an option to withdraw remaining 25 per cent of their funds and go for final settlement of account after completion of two months of unemployment under the new provision in the Employee Provident Fund Scheme 1952. | ||

| + | |||

| + | "We have decided to amend the scheme to allow members to take advance from its account on one month of unemployment. He can withdraw 75 per cent of its funds as an advance from its account after one month of unemployment and keep its account with the EPFO," Labour Minister Santosh Kumar Gangwar, who is also the Chairman of EPFO's Central Board of Trustees, told reporters after the trustees meet here. | ||

| + | |||

| + | At present, in case of unemployment, a subscriber can withdraw his or her funds after two months of unemployment and settle the account in one go. | ||

| + | |||

| + | The minister was of the view that this new provision would give an option to members to keep their account with the EPFO, which he can use after regaining employment again. | ||

| + | |||

| + | However, it was proposed that the members would be allowed to take 60 per cent of funds as an advance on unemployment for not less than 30 days. But, the CBT raised the limit to 75 per cent in the meeting held today. | ||

| + | |||

| + | The minister further said, "We approved almost the entire agenda listed for the meeting of the CBT today. We have also given an extension of one year to ETF (exchange-traded funds) manufacturers SBI and UTI Mutual funds till July 1, 2019. We have also extended the term of fund managers till December 31, 2018." | ||

| + | |||

| + | There was a proposal to give an extension of six more months to its five fund managers SBI, ICICI Securities Primary Dealership, Reliance Capital, HSBC AMC and UTI AMC for managing its corpus. | ||

| + | |||

| + | The five fund managers were appointed for three years from April 1, 2015. They were given extension till June 30, 2018. The CBT has also approved the proposal to appoint a consultant for selection of portfolio managers. | ||

| + | |||

| + | The minister also said that the EPFO's ETF investment would soon cross Rs 1 lakh crore mark as it has already invested Rs 47,431.24 crore till May end this year earning a return of 16.07 per cent. | ||

| + | |||

| + | The EPFO has also extended the tenure of its consultant CRISIL for evaluation of the performance of fund manager till December 31, 2018. | ||

| + | |||

| + | On the widening of the range of the ETF investments by the EPFO, a CBT member said that the agenda was deferred and the board was unanimous that a call will be taken on the advice of new fund managers and consultants to be appointed shortly. | ||

| + | |||

| + | It was proposed to amend the investment pattern of the EPFO to enable the body to invest in equity index ETF beyond NIFTY 50 and Sensex ETF. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|P PROVIDENT FUND: INDIA | ||

| + | PROVIDENT FUND: INDIA]] | ||

| + | [[Category:India|P PROVIDENT FUND: INDIA | ||

| + | PROVIDENT FUND: INDIA]] | ||

| + | [[Category:Pages with broken file links|PROVIDENT FUND: INDIA]] | ||

| + | |||

| + | =Employees’ Provident Fund Organisation EPFO= | ||

| + | ==Interest rates== | ||

| + | ===2012-20=== | ||

| + | [[File: Interest rates given by the EPFO to its six crore subscribers, 2012-20.jpg| Interest rates given by the EPFO to its six crore subscribers, 2012-20 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F03%2F06&entity=Ar00527&sk=5ED2CDD0&mode=text EPFO snips interest rate by 0.15% to 7-year low of 8.5%, March 6, 2020: ''The Times of India'']|frame|500px]] | ||

| − | |||

| − | |||

| − | |||

'''See graphic''': | '''See graphic''': | ||

| − | + | '' Interest rates given by the EPFO to its six crore subscribers, 2012-20 '' | |

| + | |||

| + | [[Category:Economy-Industry-Resources|P | ||

| + | PROVIDENT FUND: INDIA]] | ||

| + | [[Category:India|P | ||

| + | PROVIDENT FUND: INDIA]] | ||

| + | |||

| + | =Private EPF trusts= | ||

| + | ==They cannot declare interest lower than EPFO's== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Pvt-EPF-trusts-cant-declare-interest-lower-than-10102017014026 Lubna Kably, Pvt EPF trusts can't declare interest lower than EPFO's, October 10, 2017: The Times of India] | ||

| − | |||

| − | |||

| + | '''Companies To Be Periodically Ranked On Six Parameters''' | ||

| + | Nearly 1,500 private employee provident fund trusts set up by companies for administration of their employee provident funds (EPFs) will have to ensure that the rate of interest declared by them is at par or higher than that declared by the Employee Provident Fund Office (EPFO). | ||

| − | + | Further, there will be periodic evaluation and monthly ranking of companies which have set up such trusts to ensure better compliance.Employees will also have to be promptly intimated within two days when their EPF account is credited. | |

| − | + | The ministry of labour noticed that a few private EPF trusts were not able to declare the rate of interest at par with EPFO. Hence, a recent circular emphasises that any deficit in interest declared by the board of trustees is to be made good by the employer to bring it up to the statutory limit. | |

| + | “About 1,500 companies have been granted exemption (ie: permission) to maintain their own EPF trusts. While declaration of the minimum interest prescribed by the EPFO and meeting of any deficit by the employer company , are conditions prescribed for running a private EPF trust, some were not following it.The recent circular on interest rate and prompt communication to employees aims to ensure parity for employees covered by such private trusts,“ said an official. | ||

| − | + | Sonu Iyer, leader and partner, People Advisory Services at EY India, illustrates: “For the financial year 2016-17, the interest rate announced by the EPFO was 8.65%. Irrespective of the earnings actually made by the private trusts, they are required to provide this minimum interest rate to their employees. These trusts have also been advised, via the circular, to constitute investment committees to ensure optimal financial management of the trust's funds.“ | |

| − | + | “Stringent action, such as cancellation of the permission given to the private EPF trust, will be taken for repeated defaults, especially for delays in remittance of money collected from employees or for reduced interest rates,“ say government sources. | |

| − | + | Companies with private EPF trusts will be evaluated periodically on six parame ters (100 points for each), such as: full and timely monthly remittances of EPF accumulations to the private trust; transfer of funds for example on exit of employees; efficacy of making investments, the rate of return and settlement of claims and audit of the private trust's accounts. | |

| − | + | ||

| − | + | All companies having 20 or more employees have to provide a social security net via provident fund. If a company has not opted for its own private provident fund trust, the employees are covered by the fund administered by the EPFO, which currently oversees nearly 15 crore employee accounts. | |

| − | + | EPFO communicates remittances made to an employee's account through UMANG mobile app e-passbook. | |

| − | + | The EPFO website has already put up the ranking of 1,552 companies for July , with 50 firms getting a perfect score of 600. Notable names include Steel Authority of India, West Bengal Power Development Corporation, Gujarat State Fertilizers, Godrej Consumer Products, Nestle India, and Mother Diary . | |

| − | + | =Public Provident Fund (PPF)= | |

| + | ==10- year bond determines PPF rates== | ||

| + | [[File: 2016-17- the yield of the 10- year bond that determines PPF rates.jpg|2016-17: the yield of the 10- year bond that determines PPF rates <br/> From [http://epaperbeta.timesofindia.com/Gallery.aspx?id=25_09_2017_024_019_005&type=P&artUrl=Politics-may-prevent-a-steep-cut-in-the-25092017024019&eid=31808 The Times of India], September 25, 2017 |frame|500px]] | ||

| − | + | See graphic, '' 2016-17- the yield of the 10- year bond that determines PPF rates '' | |

| − | + | ==Premature closure for studies, medical expenses== | |

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Premature-PPF-closure-okayed-for-studies-med-expenses-22062016008071 ''The Times of India''], Jun 22 2016 | ||

| − | + | '''Premature PPF closure okayed for studies, med expenses''' | |

| − | + | Subscribers of the Public Provident Fund (PPF) can now close their accounts before maturity , but after it completes five years, for reasons such as higher education or expenditure towards a medical emergency . | |

| + | “A subscriber shall be allowed premature closure of his account, or account of a minor of whom he is the guardian, on the ground that the amount is required for treatment of serious ailments or life-threatening diseases of the account-holder, spouse or dependent children, on production of supporting documents from the competent medical authority ,“ the finance ministry said in a notification.. | ||

| − | + | Similarly , the closure of account to seek funds for higher education will require the submission of documents and fee bills confirming the account-holder's admission in a recognised institution in India or abroad. | |

| − | == | + | ==Rules and procedures for holders== |

| − | [https:// | + | ===PPF account to be closed if holder becomes NRI=== |

| + | [https://timesofindia.indiatimes.com/business/india-business/ppf-account-to-be-closed-if-holder-becomes-nri/articleshow/61330739.cms October 30, 2017: The Times of India] | ||

| − | |||

| − | + | '''HIGHLIGHTS''' | |

| − | + | Government has notified that PPF accounts would be closed prior to maturity in case of holders changing their personal status to become NRIs | |

| − | + | NRIs are not allowed in instruments like the National Savings Certificates, Public Provident Fund, Monthly Income Schemes and other time deposits offered by the post office | |

| − | + | Amending rules on post office savings schemes like the National Savings Certificates (NSC) and Public Provident Fund (PPF), the government has notified that such accounts would be closed prior to maturity in case of holders changing their personal status to become non-resident Indians (NRIs). | |

| − | + | The amended rules were notified in the official gazette earlier this month. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | The amendment to the PPF Scheme, 1968, says: "If a resident who opened an account under this scheme, subsequently becomes a non-resident during the currency of the maturity period, the account shall be deemed to be closed with effect from the day he becomes non-resident". | |

| − | + | The interest payable would be up to the date of the account closure, it said. | |

| − | + | A separate notification on NSCs said in case of a similar change of status of the certificate holder before the maturity period, "the certificate will be encashed, or deemed to be encashed on the day he becomes non-resident" and interest will be paid accordingly. | |

| − | + | NRIs are not allowed in instruments like the National Savings Certificates, Public Provident Fund, Monthly Income Schemes and other time deposits offered by the post office. | |

| − | + | In September 2017, the government had retained the interest rate on Public Provident Fund for October-December unchanged at 7.8%, in line with the rates for small savings schemes. | |

| − | [ | + | ==Withdrawals== |

| + | ===For housing, health=== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PF-withdrawal-allowed-for-housing-health-19042016009014 ''The Times of India''], Apr 19 2016 | ||

| − | + | ''' PF withdrawal allowed for housing, health ''' | |

| − | + | The labour ministry eased the planned restriction on withdrawal of contribution to the employees' provident fund. It said withdrawal can be allowed for housing, major medical treatment for self and family members, medical, dental and engineering educa tion of children, and for their marriage. | |

| − | + | The relaxation has also been extended to members who have joined an establishment belonging to or under the central or state government, and become a member of contributory provident fund or old age pension. | |

| − | + | These norms will come into effect from August. | |

| − | [[ | + | The amendments were made after labour minister Bandaru Dattatreya received representations from trade unions. A government release said the ministry had decided to pay the full accumulations to the credit of a member, including interest up to the date of payment, if he or she fulfils any of the above-mentioned conditions. In February , the ministry had said PF subscribers would not be able to withdraw their provident fund after attaining the age of 54 years, and will have to wait till they are 58 years old. |

| + | =See also= | ||

| + | [[Pensions and retirement: India]] | ||

| + | [[Provident Fund: India]] | ||

Revision as of 08:08, 28 January 2021

This is a collection of articles archived for the excellence of their content. |

Contents

|

Employees' Provident Fund

A critique

As in 2020

Rama Karmakar, January 28, 2021: The Times of India

From: Rama Karmakar, January 28, 2021: The Times of India

For a vast number of the salaried, the employee provident fund (EPF) is the only social security net they have. But the EPF rules are such that they tend to discriminate against the young and vulnerable — those who have not yet worked for five years without a break. It took a pandemic to expose how this hurts the private-sector salaried workers most when they have already been hit hard by job loss.

HOW EPF WITHDRAWALS ARE TAXED

Withdrawal of EPF accumulated balance is not taxable if: An employee participating in EPF has rendered continuous service for five or more years;

Or, if before 5 years, the employee’s service has been discontinued on grounds of ill-health, or by contraction or discontinuance of employer’s business or other causes beyond the control of the employee.

In other circumstances, the accumulated balance withdrawn within five years of continuous service is considered as taxable income.

During the Covid-19 pandemic, many employees lost their jobs due to business uncertainties. The following illustration brings out the taxability of EPF withdrawal in different cases/ circumstances (all figures in Rs): As Rohan’s employment was terminated by his employer, the EPF balance withdrawn by him will be exempted from tax. As Rashi voluntarily resigned from employment after working for 2 years, her EPF balance withdrawn would be taxable. For withdrawals in excess of Rs 50,000, tax is usually deducted at source. Roshni, who did not withdraw the EPF amount, can map the accumulated balance to the new employer, in case she continues with EPF. Rahul rendered continuous service of more than five years, so his accumulated EPF would not be taxable. However, the interest that has accrued for the period of two years after cessation of employment would be taxable in his hands.

EPF ADVANCE DURING PANDEMIC

The government has allowed members of the EPF scheme to claim ‘nonrefundable advance’ from their EPF account to the extent of the basic wages and dearness allowance for three months, or up to 75% of the amount outstanding in the EPF account, whichever is less. This has been a very effective scheme and a timely intervention to address liquidity issues faced by employees during the pandemic. The FAQs released by provident fund authorities have clarified that such withdrawals will not be taxable. However, the corresponding amendment in the Income Tax Act to ensure that the non-refundable advance received is not taxable is still awaited.

EXEMPTION DESIRABLE FOR SOCIAL SECURITY WITHDRAWALS

As compared to developed countries, India does not have a strong social security net to protect workers in the event of unemployment. Globally, many countries provide unemployment insurance to employees upon satisfaction of specified conditions. For instance, in the US, those who are unemployed due to no fault of their own are eligible to claim unemployment insurance. In Canada, employment insurance provides benefits to individuals who have lost their jobs and are available for work but cannot find a job. No such social security support is available in India. And, taxation of EPF withdrawals would leave a lower amount in the hands of employees in times of need.

For taxing EPF withdrawals, the limit of five years may be retained. However, exemption from tax may be considered if withdrawals are made before five years to meet certain contingencies/life goals such as purchase of residential house, marriage, education of children, medical expenses/ emergency, pandemics such as Covid-19 etc.

The government is in the process of implementing the new Labour Codes, likely to be effective from April 1, 2021. One of the important aspects of the code is to provide ‘social security for all’. In keeping with this spirit, there is a need to amend the tax laws also, to no longer subject EPF withdrawals to tax. The writer is Tax Partner at EY India. Ankur Agrawal, senior tax professional with EY, also contributed to this article (Views expressed are personal)

2016/ SC: employees can raise contributions without cut-off date for eligibility

From: Prabhakar Sinha, SC ruling enables massive rise in pvt sector pensions, November 22, 2017: The Times of India

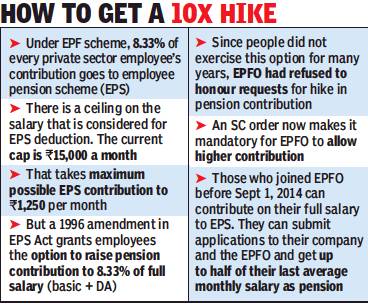

See graphic:

The EPF scheme, the amendment of 1996 and the SC-mandated scheme

A Supreme Court order of October 2016 that directed the Employees’ Provident Fund Organisation (EPFO) to revise the pension of 12 petitioners under the employee pension scheme (EPS).

The pension scheme, which is part of EPF, has over 5 crore members. Every employee in the organised sector contributes 12% of basic salary and dearness allowance to EPF. The employer makes a matching contribution. Of the employer’s contribution, 8.33% goes to the EPS. When people withdraw their EPF after a job switch or during unemployment, the EPS is not given out. It’s payable only after superannuation.

There is also a ceiling on EPS contributions. The current cap on salary (basic + DA) is Rs 15,000 per month so, the maximum one can contribute to the EPS is 8.33% of Rs 15,000, which is Rs 1,250 a month.

Between July 2001 and September 2014, the EPS salary cap was Rs 6,500 a month, which translated to a maximum contribution of Rs 541.4 a month.

SC ruling to benefit 5 crore EPFO members

Prior to 2001, the ceiling was Rs 5,000 which yielded a maximum contribution of Rs 416.5. So how did 62-year-old Kohli get a pension of over Rs 30,000 a month with such a meagre contribution to the pension fund?

It took a long struggle in which he cited an important amendment to the EPS. In March 1996, the EPS Act was amended to allow members to raise pension contribution to 8.33% of full salary (basic + DA) irrespective of what the salary is. This raised the pension multiple times.

However, for a decade hardly anybody opted for higher contribution. In 2005, following media reports, including in TOI, several private EPF fund trustees and employees approached EPFO with the demand to remove ceiling on their EPS contribution and raise it to their total salary. The EPFO rejected the demand claiming that response should have come within six months of the 1996 amendment.

Cases were filed against EPFO in various high courts. By 2016 all except one high court ruled against EPFO stating that the six-month deadline was arbitrary and the employees must be allowed to raise their pension contribution whenever they wish to. The case went to Supreme Court which, in two separate rulings in 2016, ruled in favour of the employees’ right to raise their contributions to their pension fund without imposing any cut-off date for eligibility.

It took another year for the EPFO to implement the court order following a strong fight put up by petitioners like Kohli. Finally, from November 2017, Kohli started getting higher pension.

To raise his monthly pension from Rs 2,372 to Rs 30,592, Kohli had to pay Rs 15.37 lakh as the difference between EPS contribution he had made while in service and the contribution he would have made if he was allowed to raise it to his full salary. But he also got Rs 13.23 lakh as arrears for the higher pension that he was entitled to for four years spent in retirement before November 2017. So, by paying Rs 2.14 lakh

additionally, Kohli was able to raise his lifelong pension by nearly 13 times. In case he passes away before his wife, she will get 50% of Kohli’s last drawn pension till she is alive.

Are all 5 crore members of EPFO now eligible for higher pension if they opt to raise their EPS contribution? Yes, all those who joined EPFO before September 1, 2014 — the date on which the EPS imposed the Rs 15,000 salary cap — can contribute on their full salary to EPS. They can submit applications to their company and the EPFO and get up to half of their last average monthly salary as pension. Those who joined EPFO after September 1, 2014 and have a salary above Rs 15,000 are not eligible for pension while those starting with salaries lower than Rs 15,000 can contribute to EPS but the cap of Rs 15,000 will kick in when their salary rises.

EPFO is also discriminating against employees who are members of privately-managed EPF trusts (nearly 80 lakh), officially called Exempt Establishments and those who directly contribute to the government-run trust (4.25 crore) called Un-exempt Trusts.

Central provident fund commissioner V P Joy said, “EPS will not be able to give pension to those members whose contributions on higher salary have not been received by EPFO.” The EPFO is denying employees of exempt companies higher pension on the grounds that only 8.33% of up to Rs 15,000 and not their entire PF contribution goes to EPS.

However, two of the 12 petitioners who went to court were from the exempt category. So, a precedent has been set. It’s likely that members of private trusts or the trusts themselves will go to the court to settle the issue. The EPFO’s board of trustees is also likely to discuss the move to bar exempt EPF trusts.

Those who joined EPFO before September 1, 2014 can contribute on their full salary to EPS

Amnesty scheme, 2017

Lubna Kably, India Inc can enrol employees under EPF amnesty scheme, Jan 3, 2017: The Times of India

Cos Have To Pay Only Rs 1 Damages For Each Year Of Default

Companies which have not enrolled their employees as members under the Employee Provident Fund (EPF) scheme will now get a chance to do so, against payment of a minimal damage fee of Re 1per year of default.

Additionally , if the employee wasn't enrolled earlier and hisher share of contribution was not deducted from salary , the employer company had to pay this sum also in addition to the past defaults of its own contribution. Now under the amnesty scheme, only the employer's contribution has to be deposited.

The objective of the amnesty is to ensure enrolment of employees and spread the benefit of the EPF scheme.Companies having 20 or more employees are required to mandatorily enrol those employees under the EPF scheme who have a salary of up to Rs 15,000 per month.The EPF scheme is optional for those drawing a higher salary . However, once an employee opts for the scheme, he or she cannot opt out.

Both the employer and employee are required to contribute 12% per month towards EPF against the employee's basic salary plus dearness allowance. However, under the amnesty , interest at the rate of 12% on the amount due for delayed deposit of the contribution will be payable for the period of delay .This amnesty scheme, which comes into force from January 1, is open until March-end.“The main purpose of the amnesty is to expand coverage of the EPF scheme,“ said a government official.

Arrears in payment of EPF dues is rampant. More than a lakh employers had not deposited PF contributions and the arrears outstanding as of March 31, 2015 was nearly Rs 3,000 crore. “More damaging is that there is an equally large number of companies (especially micro, small & medium enterprises, or MSMs), say in the garment or auto ancillary sector, who do not enrol their employees at all,“ adds the government official.

Sonu Iyer, partner and leader people advisory services at EY India, explains, “Companies that had not enrolled employees under the EPF scheme for the period beginning April 1, 2009 to December 31, 2016 can take advantage of the amnesty scheme by making a declaration to the regional employee provident fund office.“

“The employer will be required to deposit the required sum, which denotes its share of contribution, employee's share of contribution only if deducted from employee's salary but not deposited, interest and a nominal damage charge within 15 days of making the declaration.The biggest largesse under the amnesty is that the company doesn't have to make good the share of the employee's contribution,“ adds Iyer.

After depositing the sums, adetailed return has to be filed with the Regional Provident Fund Commissioner. Employers are eligible to participate in the amnesty only if proceedings under section 7A (inquiries) have not already commenced against them.

However, it is not clear whether the amnesty scheme will cover cases where employees had been enrolled in the EPF scheme but where there was a shortfall in depositing contributions.

EPFO to settle death claims within 7 days

EPFO to settle death claims within 7 days, Nov 02 2016 : The Times of India

Employees' Provident Fund Organisation (EPFO) issued guidelines in Nov 2019 to its field offices to settle death claims in seven days and retirement cases before a worker superannuates from the job, a move which comes days after PM Narendra Modi slammed the labour ministry for the provident fund manager's poor service.

The central provident fund commissioner informed labour minister Bandaru Dattatreya that on the PM's directions, EPFO had issued guidelines to field offices to take “proactive action to settle death claims within seven days and reti rement cases on or before the day of retirement,“ the ministry said.

EPFO coverage for Indians working abroad, 2017

HIGHLIGHTS

The apex court restrained educational institutions from providing courses in subjects like engineering, in the distance education mode

With its ruling, the SC affirmed the findings of the Punjab and Haryana high court on the issue

Also with its ruling, the SC set aside a verdict by the Odisha high court, which allowed technical education by correspondence

Indians working abroad can now exempt themselves from their host country's social security scheme and get covered by retirement fund body EPFO, Central Provident Fund Commissioner (CPFC) V P Joy said.

An online facility to avail the benefit has been made functional, he said at a national seminar on 'Fraud Risk Management-The New Initiatives' here. The scheme allows Indian employees the option of not being part of their host country's social security scheme and saves employers from double social security contributions.

The Employees' Provident Fund Organisation, which manages the money in employees provident fund accounts, has entered into an agreement with 18 countries. "We have made the whole process employee friendly. Employees going abroad to work can get a certificate of coverage (CoC). They can apply for the CoC online and can get it too," he told.

Joy said there is a simple one-page application form available on the EPFO's website for the purpose.

"The scheme is of great help for Indian workers going overseas for a limited period of time. The biggest benefit they get from opting for the CoC is that their money is not blocked for a long time in the host country," he said, explaining the benefits of the scheme.

India has operational social security agreements with Belgium, Germany, Switzerland, France, Denmark, Republic of Korea, Grand Duchy of Luxembourg, Netherlands, Hungary, Finland, Sweden, Czech Republic, Norway, Austria, Canada, Australia, Japan and Portugal.

EPFO is one of the largest social security providers in the world, covering 9.26 lakh establishments with more than 4.5 crore members. It provides pension to 60.32 lakh pensioners every month.

Interest rates

Dec 2016: cut to 8.65%

The Times of India, Dec 20 2016

EPFO cuts interest rate to 8.65%

The Employees Provident Fund Organisation (EPFO) recommended a minor reduction in interest rate to 8.65% for the financial year 2016-17 compared to 8.8% in 2015-16 but it still remains the best investment bet given that there is no cap on how much you set aside and the entire corpus remains tax free.

The reduction in interest rate to a four-year low is in line with the falling regime although bank fixed deposit rates have seen a sharper decline due to demonetisation of Rs 500 and Rs 1,000 notes. State Bank of India, for instance, has lowered fixed deposit rates by 15 basis points (100 basis points equal one percentage point), while on deposits of over Rs 1 crore (known as bulk deposits) rates have been slashed by up to 190 basis points. In any case, with the RBI singalling a shift towards a low rate regime, the government was forced to pare returns on small savings schemes.

Trade unions were demanding that EPFO central board headed by labour minister Bandaru Dattatreya retain the rates at least year's level, something that did not appear feasible given the retirement agency's projections. At 8.8%, EPFO would have faced a deficit of Rs 384 crore, while at 8.65% it will have a surplus of Rs 296 crore.

“The decision was arrived at after detailed consultations with all stakeholders. With consensus we have taken this decision,“ Dattatreya said in Bengaluru after the meeting.Interest income from PF investments for 2016-17 has been estimated mainly on the basis of interest income received or receivable in this financial year, including surplus of Rs 410 crore from previous year, an official said.

“In 2015, the interest rate decided was at 8.8%. At that time, along with the income of EPFO, the surplus from the previous year was Rs 1,600 crore. This year, along with the income, the surplus available is Rs 410 crore,“ Central Provident Fund Commissioner V P Joy said.

The recommendation of the EPFO board needs to be ratified by the finance ministry , which notifies the rates. Last year, the finance ministry had suggested a reduction but was forced to go with the board's decision after public uproar.

Erstwhile employees must pay tax on interest

November 16, 2017: The Times of India

HIGHLIGHTS

According to a notification issued, when an employee resigns from his job, his EPF account continues to be "operative" and earns an interest until he applies for withdrawal.

On the other hand, if an employee retires after 55 years of age, then post three years from the date of retirement, his EPF account is treated as "inoperative" and does not earn any interest.

Tax laws provide that interest credited to an employee provident fund (EPF) account after an individual ceases to be in employment+ is taxable in his hands in the year of credit.

In its order, the Bengaluru bench of the Income-Tax Appellate Tribunal (ITAT) also upheld this I-T provision while adjudicating the matter of a retired employee+ . Post-employment, whether on account of termination, resignation or retirement, several employees continue to maintain their EPF accounts and earn interest on the same. Unfortunately, they are usually not aware of the tax implications on the interest accretion in the fund after termination of employment," says Amarpal Chadha, partner and India mobility leader at EY India. Investment consultants point out that even in the case heard by ITAT, the taxpayer had mistakenly thought that the interest which had accrued to his EPF account post his retirement was not taxable.

This ITAT ruling is pertinent not only for retired employees, but also those who have quit employment for various reasons, say, to be an entrepreneur or a homemaker, and have continued to retain a balance in their EPF accounts.

According to a notification issued last November, when an employee resigns from his job or his services are terminated, his EPF account continues to be "operative" and earns an interest until he applies for withdrawal of the accumulated balance or takes up another job and transfers the balance. On the other hand, interest accrual norms are different for a retired employee. If an employee retires after 55 years of age and does not apply for withdrawal from his EPF account or transfer of the balance, then post three years from the date of retirement, his EPF account is treated as "inoperative" and does not earn any interest.

The applicable rate of interest is announced each year. For the recently concluded financial year 2016-17, the interest rate was 8.65% and rates for the current financial year are expected to be announced shortly. In the recent case, the man had retired from a prominent Bengaluru-headquartered software company after 26 years of service, on April 1, 2002, and the total amount in his EPF account then was Rs 37.93 lakh. Nine years later, on April 11, 2011, he withdrew the grown sum of Rs 82 lakh from his EPF account. This amount included interest of Rs 44.07 lakh that had accrued post his retirement till the date of withdrawal.

The retired employee did not offer this interest amount to tax, as he viewed it would be exempt under Section 10 (12) of the I-T Act. During assessment proceedings for financial year 2011-12, the I-T officer sought to levy tax on this amount and the litigation finally reached ITAT's doors.

Based on a reading of Section 10(12) and also the definition of "accumulated balance", the ITAT held: "The exemption is limited to the accumulated balance due and payable to an employee up to the date of his retirement or end of his employment."

ITAT pointed out that the term "accumulated balance due to an employee" is defined as the balance standing to his credit, or such portion of it as may be claimed by the concerned employee under the regulations of the fund "on the day he ceases to be an employee".

Thus, the ITAT agreed that the interest earned postretirement was taxable in the hands of the retired employee. However, it added that the aggregate interest of Rs 44.07 lakh should be taxable in the hands of the retired employee, in the respective financial years in which the interest income actually arose.

Chadha says, "Under the tax laws, the accumulated balance, as it stands on the date of cessation of employment, is considered as an exempt income (subject to satisfaction of certain conditions). Any accreditation in the EPF account after cessation of employment would be taxable income. ITAT, in its recent decision, has also held likewise. Therefore, it is important for employees to consider this aspect while making a decision on retaining their EPF account once their employment ceases."

Rules

PF a/c to be transferred automatically on change of employment

From next month, your PF account will be transferred automatically when you change your job, chief provident fund commissioner V P Joy has said.

Joy, who is pushing a slew of initiatives in the Employees' Provident Fund Organisation (EPFO) to make it more worker-friendly , said premature closure of accounts was one of their main challenges, and they were trying to address it by improving services.

“Whenever there is change of job, a lot of accounts are closed; then they (the employees) restart their account later on,“ he added.

“Now we have made Aadhaar compulsory for enrolment. We don't want accounts to be closed. The PF account is the permanent account.The worker can retain the same account for social security,“ Joy added.

“We are trying to ensure transfer of money if one changes jobs, without any application, in three days. In future, if one has an Aadhaar ID and has verified the ID, then the account will be transferred without any application if the worker goes anywhere in the country. This system will be in place very soon,“ he added.

The EPFO has also stepped up efforts to expand coverage, and initial results have been positive. “During the campaign from January to June, more than one crore workers were enrolled. Now, we are trying to retain them by improving services,“ Joy said.

Joy said PF money should be withdrawn only for major purposes like housing, education of children, or serious hospitalisation. “...Only then will people get social security. So, we are now starting a campaign...to educate people that money must be withdrawn only for essential purposes,“ Joy said.

2017: GPF rules liberalised

GPF rules relaxed for govt staffers, March 28, 2017: The Times of India

In a major relief for government employees, the Centre recently relaxed and simplified the General Provident Fund Rules, particularly related to advances and withdrawals by the subscribers.

As per relaxed norms, employees can withdraw up to 90% of their amount for housing needs and 75% for buying vehicles. The definition of education for the purpose of withdrawal of GP Fund has now been widened to include primary, secondary and higher education, covering all streams and institutions.

The withdrawal limit has also been increased from three months' pay or half the amount at credit, to up to 12 months' pay or 34th of amount at credit, whichever is less.

Also this is now admissible to a subscriber after completion of 15 years of service.

2018: Those unemployed for 30 days can withdraw 75%

EPFO members can withdraw 75% funds after 30 days of job loss, June 26, 2018: The Times of India

HIGHLIGHTS

EPFO members can also withdraw remaining 25 per cent of their funds after completion of two months of unemployment

At present, the members can withdraw the funds after two months of unemployment and settle the account in one go

Retirement fund body EPFO decided to give its members an option to withdraw 75 per cent of their funds after one month of unemployment and keep their PF account with the body.

The members would also have an option to withdraw remaining 25 per cent of their funds and go for final settlement of account after completion of two months of unemployment under the new provision in the Employee Provident Fund Scheme 1952.

"We have decided to amend the scheme to allow members to take advance from its account on one month of unemployment. He can withdraw 75 per cent of its funds as an advance from its account after one month of unemployment and keep its account with the EPFO," Labour Minister Santosh Kumar Gangwar, who is also the Chairman of EPFO's Central Board of Trustees, told reporters after the trustees meet here.

At present, in case of unemployment, a subscriber can withdraw his or her funds after two months of unemployment and settle the account in one go.

The minister was of the view that this new provision would give an option to members to keep their account with the EPFO, which he can use after regaining employment again.

However, it was proposed that the members would be allowed to take 60 per cent of funds as an advance on unemployment for not less than 30 days. But, the CBT raised the limit to 75 per cent in the meeting held today.

The minister further said, "We approved almost the entire agenda listed for the meeting of the CBT today. We have also given an extension of one year to ETF (exchange-traded funds) manufacturers SBI and UTI Mutual funds till July 1, 2019. We have also extended the term of fund managers till December 31, 2018."

There was a proposal to give an extension of six more months to its five fund managers SBI, ICICI Securities Primary Dealership, Reliance Capital, HSBC AMC and UTI AMC for managing its corpus.

The five fund managers were appointed for three years from April 1, 2015. They were given extension till June 30, 2018. The CBT has also approved the proposal to appoint a consultant for selection of portfolio managers.

The minister also said that the EPFO's ETF investment would soon cross Rs 1 lakh crore mark as it has already invested Rs 47,431.24 crore till May end this year earning a return of 16.07 per cent.

The EPFO has also extended the tenure of its consultant CRISIL for evaluation of the performance of fund manager till December 31, 2018.

On the widening of the range of the ETF investments by the EPFO, a CBT member said that the agenda was deferred and the board was unanimous that a call will be taken on the advice of new fund managers and consultants to be appointed shortly.

It was proposed to amend the investment pattern of the EPFO to enable the body to invest in equity index ETF beyond NIFTY 50 and Sensex ETF.

Employees’ Provident Fund Organisation EPFO

Interest rates

2012-20

From: EPFO snips interest rate by 0.15% to 7-year low of 8.5%, March 6, 2020: The Times of India

See graphic:

Interest rates given by the EPFO to its six crore subscribers, 2012-20

Private EPF trusts

They cannot declare interest lower than EPFO's

Companies To Be Periodically Ranked On Six Parameters

Nearly 1,500 private employee provident fund trusts set up by companies for administration of their employee provident funds (EPFs) will have to ensure that the rate of interest declared by them is at par or higher than that declared by the Employee Provident Fund Office (EPFO).

Further, there will be periodic evaluation and monthly ranking of companies which have set up such trusts to ensure better compliance.Employees will also have to be promptly intimated within two days when their EPF account is credited.

The ministry of labour noticed that a few private EPF trusts were not able to declare the rate of interest at par with EPFO. Hence, a recent circular emphasises that any deficit in interest declared by the board of trustees is to be made good by the employer to bring it up to the statutory limit.

“About 1,500 companies have been granted exemption (ie: permission) to maintain their own EPF trusts. While declaration of the minimum interest prescribed by the EPFO and meeting of any deficit by the employer company , are conditions prescribed for running a private EPF trust, some were not following it.The recent circular on interest rate and prompt communication to employees aims to ensure parity for employees covered by such private trusts,“ said an official.

Sonu Iyer, leader and partner, People Advisory Services at EY India, illustrates: “For the financial year 2016-17, the interest rate announced by the EPFO was 8.65%. Irrespective of the earnings actually made by the private trusts, they are required to provide this minimum interest rate to their employees. These trusts have also been advised, via the circular, to constitute investment committees to ensure optimal financial management of the trust's funds.“

“Stringent action, such as cancellation of the permission given to the private EPF trust, will be taken for repeated defaults, especially for delays in remittance of money collected from employees or for reduced interest rates,“ say government sources.

Companies with private EPF trusts will be evaluated periodically on six parame ters (100 points for each), such as: full and timely monthly remittances of EPF accumulations to the private trust; transfer of funds for example on exit of employees; efficacy of making investments, the rate of return and settlement of claims and audit of the private trust's accounts.

All companies having 20 or more employees have to provide a social security net via provident fund. If a company has not opted for its own private provident fund trust, the employees are covered by the fund administered by the EPFO, which currently oversees nearly 15 crore employee accounts.

EPFO communicates remittances made to an employee's account through UMANG mobile app e-passbook.

The EPFO website has already put up the ranking of 1,552 companies for July , with 50 firms getting a perfect score of 600. Notable names include Steel Authority of India, West Bengal Power Development Corporation, Gujarat State Fertilizers, Godrej Consumer Products, Nestle India, and Mother Diary .

Public Provident Fund (PPF)

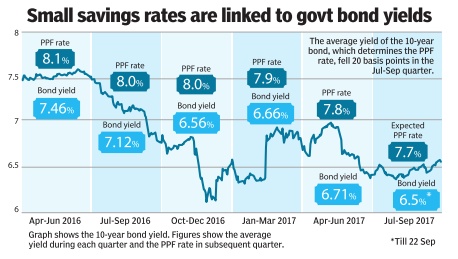

10- year bond determines PPF rates

From The Times of India, September 25, 2017

See graphic, 2016-17- the yield of the 10- year bond that determines PPF rates

Premature closure for studies, medical expenses

The Times of India, Jun 22 2016

Premature PPF closure okayed for studies, med expenses

Subscribers of the Public Provident Fund (PPF) can now close their accounts before maturity , but after it completes five years, for reasons such as higher education or expenditure towards a medical emergency . “A subscriber shall be allowed premature closure of his account, or account of a minor of whom he is the guardian, on the ground that the amount is required for treatment of serious ailments or life-threatening diseases of the account-holder, spouse or dependent children, on production of supporting documents from the competent medical authority ,“ the finance ministry said in a notification..

Similarly , the closure of account to seek funds for higher education will require the submission of documents and fee bills confirming the account-holder's admission in a recognised institution in India or abroad.

Rules and procedures for holders

PPF account to be closed if holder becomes NRI

October 30, 2017: The Times of India

HIGHLIGHTS

Government has notified that PPF accounts would be closed prior to maturity in case of holders changing their personal status to become NRIs

NRIs are not allowed in instruments like the National Savings Certificates, Public Provident Fund, Monthly Income Schemes and other time deposits offered by the post office

Amending rules on post office savings schemes like the National Savings Certificates (NSC) and Public Provident Fund (PPF), the government has notified that such accounts would be closed prior to maturity in case of holders changing their personal status to become non-resident Indians (NRIs).

The amended rules were notified in the official gazette earlier this month.