|

|

| Line 1: |

Line 1: |

| − | [[File: Governors of RBI since 1991.jpg|Governors of RBI since 1991; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=20_06_2016_017_024_002&type=P&artUrl=RAJANS-REPORT-CARD-IN-GOVERNORS-CLASS-20062016017024&eid=31808 ''The Times of India'']|frame|500px]]

| + | {| Class="wikitable" |

| − | | + | |

| − | {| class="wikitable" | + | |

| | |- | | |- |

| | |colspan="0"|<div style="font-size:100%"> | | |colspan="0"|<div style="font-size:100%"> |

| − | This is a collection of articles archived for the excellence of their content.<br/>You can help by converting these articles into an encyclopaedia-style entry,<br />deleting portions of the kind normally not used in encyclopaedia entries.<br/>Please also fill in missing details; put categories, headings and sub-headings;<br/>and combine this with other articles on exactly the same subject.<br/> | + | This is a collection of articles archived for the excellence of their content.<br/> |

| − | | + | </div> |

| − | Readers will be able to edit existing articles and post new articles directly <br/> on their online archival encyclopædia only after its formal launch.

| + | |

| − | | + | |

| − | See [[examples]] and a tutorial.</div>

| + | |

| | |} | | |} |

| − | [[Category:India|R]]

| |

| − | [[Category: Economy-Industry-Resources|R]]

| |

| − | [[Category:Government |R]]

| |

| − | [[Category:Name|Alphabet]]

| |

| | | | |

| − | =History= | + | [[Category:India |P ]] |

| − | [https://rbi.org.in/History/Brief_History.html rbi.org] | + | [[Category:Economy-Industry-Resources |P ]] |

| | + | = Employees' Provident Fund= |

| | + | ==A critique== |

| | + | ===As in 2020 === |

| | + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F01%2F28&entity=Ar00202&sk=C5B28F80&mode=text Rama Karmakar, January 28, 2021: ''The Times of India''] |

| | | | |

| | + | [[File: The EPF, As in 2020.jpg|The EPF, As in 2020 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F01%2F28&entity=Ar00202&sk=C5B28F80&mode=text Rama Karmakar, January 28, 2021: ''The Times of India'']|frame|500px]] |

| | | | |

| − | The Reserve Bank of India is the central bank of the country. Central banks are a relatively recent innovation and most central banks, as we know them today, were established around the early twentieth century.

| |

| | | | |

| − | The Reserve Bank of India was set up on the basis of the recommendations of the Hilton Young Commission. The Reserve Bank of India Act, 1934 (II of 1934) provides the statutory basis of the functioning of the Bank, which commenced operations on April 1, 1935.

| + | For a vast number of the salaried, the employee provident fund (EPF) is the only social security net they have. But the EPF rules are such that they tend to discriminate against the young and vulnerable — those who have not yet worked for five years without a break. It took a pandemic to expose how this hurts the private-sector salaried workers most when they have already been hit hard by job loss. |

| | | | |

| − | The Bank was constituted to:

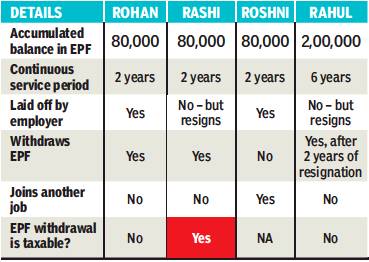

| + | ''' HOW EPF WITHDRAWALS ARE TAXED ''' |

| | | | |

| − | * Regulate the issue of banknotes

| + | Withdrawal of EPF accumulated balance is not taxable if: |

| | + | An employee participating in EPF has rendered continuous service for five or more years; |

| | | | |

| − | * Maintain reserves with a view to securing monetary stability and

| + | Or, if before 5 years, the employee’s service has been discontinued on grounds of ill-health, or by contraction or discontinuance of employer’s business or other causes beyond the control of the employee. |

| | | | |

| − | * To operate the credit and currency system of the country to its advantage.

| + | In other circumstances, the accumulated balance withdrawn within five years of continuous service is considered as taxable income. |

| | | | |

| − | The Bank began its operations by taking over from the Government the functions so far being performed by the Controller of Currency and from the Imperial Bank of India, the management of Government accounts and public debt. The existing currency offices at Calcutta, Bombay, Madras, Rangoon, Karachi, Lahore and Cawnpore (Kanpur) became branches of the Issue Department. Offices of the Banking Department were established in Calcutta, Bombay, Madras, Delhi and Rangoon.

| + | During the Covid-19 pandemic, many employees lost their jobs due to business uncertainties. The following illustration brings out the taxability of EPF withdrawal in different cases/ circumstances (all figures in Rs): As Rohan’s employment was terminated by his employer, the EPF balance withdrawn by him will be exempted from tax. As Rashi voluntarily resigned from employment after working for 2 years, her EPF balance withdrawn would be taxable. For withdrawals in excess of Rs 50,000, tax is usually deducted at source. Roshni, who did not withdraw the EPF amount, can map the accumulated balance to the new employer, in case she continues with EPF. Rahul rendered continuous service of more than five years, so his accumulated EPF would not be taxable. However, the interest that has accrued for the period of two years after cessation of employment would be taxable in his hands. |

| | | | |

| − | Burma (Myanmar) seceded from the Indian Union in 1937 but the Reserve Bank continued to act as the Central Bank for Burma till Japanese Occupation of Burma and later upto April, 1947. After the partition of India, the Reserve Bank served as the central bank of Pakistan upto June 1948 when the State Bank of Pakistan commenced operations. The Bank, which was originally set up as a shareholder's bank, was nationalised in 1949.

| + | ''' EPF ADVANCE DURING PANDEMIC ''' |

| | | | |

| − | An interesting feature of the Reserve Bank of India was that at its very inception, the Bank was seen as playing a special role in the context of development, especially Agriculture. When India commenced its plan endeavours, the development role of the Bank came into focus, especially in the sixties when the Reserve Bank, in many ways, pioneered the concept and practise of using finance to catalyse development. The Bank was also instrumental in institutional development and helped set up insitutions like the Deposit Insurance and Credit Guarantee Corporation of India, the Unit Trust of India, the Industrial Development Bank of India, the National Bank of Agriculture and Rural Development, the Discount and Finance House of India etc. to build the financial infrastructure of the country.

| + | The government has allowed members of the EPF scheme to claim ‘nonrefundable advance’ from their EPF account to the extent of the basic wages and dearness allowance for three months, or up to 75% of the amount outstanding in the EPF account, whichever is less. This has been a very effective scheme and a timely intervention to address liquidity issues faced by employees during the pandemic. The FAQs released by provident fund authorities have clarified that such withdrawals will not be taxable. However, the corresponding amendment in the Income Tax Act to ensure that the non-refundable advance received is not taxable is still awaited. |

| | | | |

| − | With liberalisation, the Bank's focus has shifted back to core central banking functions like Monetary Policy, Bank Supervision and Regulation, and Overseeing the Payments System and onto developing the financial markets.

| + | ''' EXEMPTION DESIRABLE FOR SOCIAL SECURITY WITHDRAWALS ''' |

| − |

| + | |

| | | | |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=A-bank-central-to-monetary-policy-22082016013031 ''The Times of India'']

| + | As compared to developed countries, India does not have a strong social security net to protect workers in the event of unemployment. Globally, many countries provide unemployment insurance to employees upon satisfaction of specified conditions. For instance, in the US, those who are unemployed due to no fault of their own are eligible to claim unemployment insurance. In Canada, employment insurance provides benefits to individuals who have lost their jobs and are available for work but cannot find a job. No such social security support is available in India. And, taxation of EPF withdrawals would leave a lower amount in the hands of employees in times of need. |

| | | | |

| − | '''Which was India's first central bank?'''

| + | For taxing EPF withdrawals, the limit of five years may be retained. However, exemption from tax may be considered if withdrawals are made before five years to meet certain contingencies/life goals such as purchase of residential house, marriage, education of children, medical expenses/ emergency, pandemics such as Covid-19 etc. |

| | | | |

| − | The first central bank was the Imperial Bank of India formed in 1921 by merging the Presidency banks. The bank was further enlarged by the merger of several banks owned by princely states like Jaipur, Mysore and Patiala. | + | The government is in the process of implementing the new Labour Codes, likely to be effective from April 1, 2021. One of the important aspects of the code is to provide ‘social security for all’. In keeping with this spirit, there is a need to amend the tax laws also, to no longer subject EPF withdrawals to tax. |

| | + | The writer is Tax Partner at EY India. Ankur Agrawal, senior tax professional with EY, also contributed to this article (Views expressed are personal) |

| | | | |

| − | The Imperial Bank of India was supposed to perform three functions -commercial banking, central banking and banker of the government. By 1930, there were 1,258 banking institutions in the country registered under the Companies Act. Of these, the Imperial Bank was the most dominant.The global economy was passing through the Great Depression and this resulted in the failure of many banks in India as well. Various committees set up to study the Indian banking system recommend ed the formation of a central bank which was free from commercial banking. In most modern economies, central banks were formed largely to tackle the failure of unorganised banking by enforcing regulatory safeguards.

| + | [[Category:Economy-Industry-Resources|P PROVIDENT FUND: INDIA |

| | + | PROVIDENT FUND: INDIA]] |

| | + | [[Category:India|P PROVIDENT FUND: INDIA |

| | + | PROVIDENT FUND: INDIA]] |

| | + | [[Category:Pages with broken file links|PROVIDENT FUND: INDIA |

| | + | PROVIDENT FUND: INDIA]] |

| | | | |

| − | '''When was the Reserve Bank of India formed?''' | + | == 2016/ SC: employees can raise contributions without cut-off date for eligibility == |

| | + | [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIM%2F2017%2F11%2F22&entity=Ar00324&sk=3FEF1339&mode=text Prabhakar Sinha, SC ruling enables massive rise in pvt sector pensions, November 22, 2017: ''The Times of India''] |

| | | | |

| − | The bank was formed in 1935 by the Reserve Bank of India Act, 1934. The objectives included being the banker of the government and other banks, to maintain the exchange ratio and to regulate issue of bank notes. The overall objective of the bank was to secure monetary stability. | + | [[File: The EPF scheme, the amendment of 1996 and the SC-mandated scheme.jpg|The EPF scheme, the amendment of 1996 and the SC-mandated scheme <br/> From: [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIM%2F2017%2F11%2F22&entity=Ar00324&sk=3FEF1339&mode=text Prabhakar Sinha, SC ruling enables massive rise in pvt sector pensions, November 22, 2017: ''The Times of India'']|frame|500px]] |

| | | | |

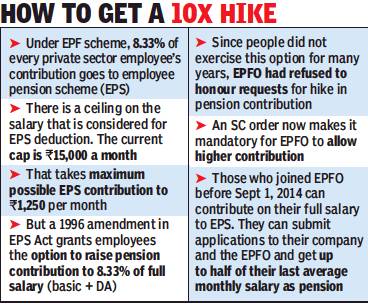

| − | '''What are its current roles?''' | + | '''See graphic:''' |

| | | | |

| − | The bank formulates, implements and monitors India's monetary policy. It monitors and regulates the financial system through prescribing broad parameters of banking operations to ensure public confidence in the system and protect depositors' interests.The bank also manages foreign trade and monitors foreign exchange reserves. It is the only authority that has the right to issue or destroy currency . | + | ''The EPF scheme, the amendment of 1996 and the SC-mandated scheme'' |

| | | | |

| − | '''How is the bank governed?'''

| |

| | | | |

| − | Like other central banks, the RBI too is an independent entity within the government.It is governed by a central board of directors appointed by the government according to the Reserve Bank of India Act. The board is appointed for four years with a governor and not more than four deputy governors as official directors. There are also 10 directors nominated by the government, two government officials and four directors -one each from local boards -who act as non-official directors.

| + | A Supreme Court order of October 2016 that directed the Employees’ Provident Fund Organisation (EPFO) to revise the pension of 12 petitioners under the employee pension scheme (EPS). |

| | | | |

| − | =Reserve Bank of India Act of 1934=

| + | The pension scheme, which is part of EPF, has over 5 crore members. Every employee in the organised sector contributes 12% of basic salary and dearness allowance to EPF. The employer makes a matching contribution. Of the employer’s contribution, 8.33% goes to the EPS. When people withdraw their EPF after a job switch or during unemployment, the EPS is not given out. It’s payable only after superannuation. |

| − | ==What is Section 7 of the Reserve Bank of India Act of 1934==

| + | |

| − | [[File: Sec 7 of the Reserve Bank of India Act of 1934.jpg|Sec 7 of the Reserve Bank of India Act of 1934 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F31&entity=Ar00501&sk=13998587&mode=text Mayur Shetty, Will govt invoke Sec 7 for 1st time if RBI logjam persists?, October 31, 2018: ''The Times of India'']|frame|500px]]

| + | |

| | | | |

| − | '''See graphic''':

| + | There is also a ceiling on EPS contributions. The current cap on salary (basic + DA) is Rs 15,000 per month so, the maximum one can contribute to the EPS is 8.33% of Rs 15,000, which is Rs 1,250 a month. |

| | | | |

| − | ''Sec 7 of the Reserve Bank of India Act of 1934''

| + | Between July 2001 and September 2014, the EPS salary cap was Rs 6,500 a month, which translated to a maximum contribution of Rs 541.4 a month. |

| | | | |

| | + | ''SC ruling to benefit 5 crore EPFO members'' |

| | | | |

| − | ==Sec 7 application considered in 2018, Oct==

| + | Prior to 2001, the ceiling was Rs 5,000 which yielded a maximum contribution of Rs 416.5. So how did 62-year-old Kohli get a pension of over Rs 30,000 a month with such a meagre contribution to the pension fund? |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F31&entity=Ar00501&sk=13998587&mode=text Mayur Shetty, Will govt invoke Sec 7 for 1st time if RBI logjam persists?, October 31, 2018: ''The Times of India'']

| + | |

| | | | |

| | + | It took a long struggle in which he cited an important amendment to the EPS. In March 1996, the EPS Act was amended to allow members to raise pension contribution to 8.33% of full salary (basic + DA) irrespective of what the salary is. This raised the pension multiple times. |

| | | | |

| − | ''Is Said To Have Referred To The Law Recently''

| + | However, for a decade hardly anybody opted for higher contribution. In 2005, following media reports, including in TOI, several private EPF fund trustees and employees approached EPFO with the demand to remove ceiling on their EPS contribution and raise it to their total salary. The EPFO rejected the demand claiming that response should have come within six months of the 1996 amendment. |

| | | | |

| − | No government has invoked Section 7 of the Reserve Bank of India Act of 1934 in the central bank’s 83-year history.

| + | Cases were filed against EPFO in various high courts. By 2016 all except one high court ruled against EPFO stating that the six-month deadline was arbitrary and the employees must be allowed to raise their pension contribution whenever they wish to. The case went to Supreme Court which, in two separate rulings in 2016, ruled in favour of the employees’ right to raise their contributions to their pension fund without imposing any cut-off date for eligibility. |

| | | | |

| − | It is seen as an instrument of last resort, a direct order from the government of the day to the central bank to carry out its wishes (see graphic, ‘In Public Interest’). | + | It took another year for the EPFO to implement the court order following a strong fight put up by petitioners like Kohli. Finally, from November 2017, Kohli started getting higher pension. |

| | | | |

| − | The Modi government, despite its growing frustration with the Urjit Patel-led RBI, has resisted suggestions that it invoke Section 7 to increase liquidity, ease pressure on banks and businesses, and boost economic growth. But there are indications that via recent communications, it has initiated a consultative process with the RBI in three areas of concern and while doing so, has mentioned Section 7 without actually invoking it.

| + | To raise his monthly pension from Rs 2,372 to Rs 30,592, Kohli had to pay Rs 15.37 lakh as the difference between EPS contribution he had made while in service and the contribution he would have made if he was allowed to raise it to his full salary. But he also got Rs 13.23 lakh as arrears for the higher pension that he was entitled to for four years spent in retirement before November 2017. So, by paying Rs 2.14 lakh |

| | | | |

| | + | additionally, Kohli was able to raise his lifelong pension by nearly 13 times. In case he passes away before his wife, she will get 50% of Kohli’s last drawn pension till she is alive. |

| | | | |

| − | '''Was fear of Section 7 behind RBI dy guv’s attack on govt?'''

| + | Are all 5 crore members of EPFO now eligible for higher pension if they opt to raise their EPS contribution? Yes, all those who joined EPFO before September 1, 2014 — the date on which the EPS imposed the Rs 15,000 salary cap — can contribute on their full salary to EPS. They can submit applications to their company and the EPFO and get up to half of their last average monthly salary as pension. Those who joined EPFO after September 1, 2014 and have a salary above Rs 15,000 are not eligible for pension while those starting with salaries lower than Rs 15,000 can contribute to EPS but the cap of Rs 15,000 will kick in when their salary rises. |

| | | | |

| − | The government is learned to have recently initiated a consultative process with the RBI in three areas of concern – power sector loans, ‘prompt corrective action’ (PCA), and special dispensation for micro-small and medium enterprises (MSMEs) – and while doing so, mentioned Section 7, without actually invoking it. The Section says, “The Central Government may from time to time give such directions to the Bank as it may, after consultation with the Governor of the Bank, consider necessary in the public interest.”

| + | EPFO is also discriminating against employees who are members of privately-managed EPF trusts (nearly 80 lakh), officially called Exempt Establishments and those who directly contribute to the government-run trust (4.25 crore) called Un-exempt Trusts. |

| | | | |

| − | The government’s move is significant as such a consultative process could potentially lead to the government issuing directions should the logjam persist. The issue of invoking Section 7 first came up during a hearing before the Allahabad high court in a case filed by the Independent Power Producers challenging the RBI’s February 12 circular which did away with all restructuring schemes for loans in default. After the counsel for RBI pointed out that legally the government could issue directions to the central bank, the court in its ruling in August said such a move could be considered. | + | Central provident fund commissioner V P Joy said, “EPS will not be able to give pension to those members whose contributions on higher salary have not been received by EPFO.” The EPFO is denying employees of exempt companies higher pension on the grounds that only 8.33% of up to Rs 15,000 and not their entire PF contribution goes to EPS. |

| | | | |

| − | Historically, whenever governors have spoken about the independence of the central bank, they have never failed to point out that Section 7 has never been used.

| + | However, two of the 12 petitioners who went to court were from the exempt category. So, a precedent has been set. It’s likely that members of private trusts or the trusts themselves will go to the court to settle the issue. The EPFO’s board of trustees is also likely to discuss the move to bar exempt EPF trusts. |

| | | | |

| − | A senior official in the government said there has so far been no move to invoke Section 7. Another person, when asked, said, “Communication between the government and the central bank is sacrosanct and cannot be disclosed.”

| + | ''Those who joined EPFO before September 1, 2014 can contribute on their full salary to EPS'' |

| | | | |

| − | There is some speculation that it was the government’s mention of section 7 that was the trigger for deputy governor Viral Acharya’s outburst against the government last Friday. While he did not make any reference to the Section, he did speak about how the government could undermine the independence of the central bank by ‘blocking or opposing rule-based central banking policies and favouring instead discretionary or joint decisionmaking with direct government interventions’.

| + | ==Amnesty scheme, 2017== |

| | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=India-Inc-can-enrol-employees-under-EPF-amnesty-03012017020057 Lubna Kably, India Inc can enrol employees under EPF amnesty scheme, Jan 3, 2017: The Times of India] |

| | | | |

| − | The government wants norms for non-performing assets in the power sector – which currently require companies to be referred to bankruptcy courts -- to be relaxed. Once admitted, the companies have to be either sold or liquidated.

| |

| | | | |

| − | Its concern about 'prompt corrective action' is that the classification of PCA has placed lending and expansion curbs on 11 public sector and one private bank, which it believes is choking fund flows to several sectors. The government has also been worried about the fate of MSMEs, and is keen that the definition of bad loans be softened.

| + | '''Cos Have To Pay Only Rs 1 Damages For Each Year Of Default''' |

| | | | |

| − | A broader concern is about the liquidity situation which has taken a turn for the worse after a series of defaults by IL&FS in September. The defaults have had a cascading impact — MFs that had invested in IL&FS debt were hit, corporates who had put shortterm funds in MFs turned cautious, and the funds themselves turned cautious about putting money in financial companies.

| + | Companies which have not enrolled their employees as members under the Employee Provident Fund (EPF) scheme will now get a chance to do so, against payment of a minimal damage fee of Re 1per year of default. |

| | | | |

| − | =Central board of directors=

| + | Additionally , if the employee wasn't enrolled earlier and hisher share of contribution was not deducted from salary , the employer company had to pay this sum also in addition to the past defaults of its own contribution. Now under the amnesty scheme, only the employer's contribution has to be deposited. |

| − | ==The Central Board==

| + | |

| − | The Reserve Bank's affairs are governed by a central board of directors. The board is appointed by the Government of India in keeping with the Reserve Bank of India Act.

| + | |

| | | | |

| − | • Appointed/nominated for a period of four years

| + | The objective of the amnesty is to ensure enrolment of employees and spread the benefit of the EPF scheme.Companies having 20 or more employees are required to mandatorily enrol those employees under the EPF scheme who have a salary of up to Rs 15,000 per month.The EPF scheme is optional for those drawing a higher salary . However, once an employee opts for the scheme, he or she cannot opt out. |

| | | | |

| − | Constitution:

| + | Both the employer and employee are required to contribute 12% per month towards EPF against the employee's basic salary plus dearness allowance. However, under the amnesty , interest at the rate of 12% on the amount due for delayed deposit of the contribution will be payable for the period of delay .This amnesty scheme, which comes into force from January 1, is open until March-end.“The main purpose of the amnesty is to expand coverage of the EPF scheme,“ said a government official. |

| | | | |

| − | o Official Directors

| + | Arrears in payment of EPF dues is rampant. More than a lakh employers had not deposited PF contributions and the arrears outstanding as of March 31, 2015 was nearly Rs 3,000 crore. “More damaging is that there is an equally large number of companies (especially micro, small & medium enterprises, or MSMs), say in the garment or auto ancillary sector, who do not enrol their employees at all,“ adds the government official. |

| | | | |

| − | ♣ Full-time : Governor and not more than four Deputy Governors

| + | Sonu Iyer, partner and leader people advisory services at EY India, explains, “Companies that had not enrolled employees under the EPF scheme for the period beginning April 1, 2009 to December 31, 2016 can take advantage of the amnesty scheme by making a declaration to the regional employee provident fund office.“ |

| | | | |

| − | o Non-Official Directors

| + | “The employer will be required to deposit the required sum, which denotes its share of contribution, employee's share of contribution only if deducted from employee's salary but not deposited, interest and a nominal damage charge within 15 days of making the declaration.The biggest largesse under the amnesty is that the company doesn't have to make good the share of the employee's contribution,“ adds Iyer. |

| | | | |

| − | ♣ Nominated by Government: ten Directors from various fields and two government Official

| + | After depositing the sums, adetailed return has to be filed with the Regional Provident Fund Commissioner. Employers are eligible to participate in the amnesty only if proceedings under section 7A (inquiries) have not already commenced against them. |

| | | | |

| − | ♣ Others: four Directors - one each from four local boards

| + | However, it is not clear whether the amnesty scheme will cover cases where employees had been enrolled in the EPF scheme but where there was a shortfall in depositing contributions. |

| | | | |

| − | Functions : General superintendence and direction of the Bank's affairs

| + | == EPFO to settle death claims within 7 days== |

| | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=EPFO-to-settle-death-claims-within-7-days-02112016009059 EPFO to settle death claims within 7 days, Nov 02 2016 : The Times of India] |

| | | | |

| − | ===The Board, as in 2018===

| |

| − | [[File: The RBI’s Central board of directors, as in 2018.jpg|The RBI’s Central board of directors, as in 2018. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F12%2F11&entity=Ar00314&sk=1E299772&mode=text Sidhartha, December 11, 2018: ''The Times of India'']|frame|500px]]

| |

| | | | |

| − | '''See graphic''': | + | Employees' Provident Fund Organisation (EPFO) issued guidelines in Nov 2019 to its field offices to settle death claims in seven days and retirement cases before a worker superannuates from the job, a move which comes days after PM Narendra Modi slammed the labour ministry for the provident fund manager's poor service. |

| | | | |

| − | ''The RBI’s Central board of directors, as in 2018'' | + | The central provident fund commissioner informed labour minister Bandaru Dattatreya that on the PM's directions, EPFO had issued guidelines to field offices to take “proactive action to settle death claims within seven days and reti rement cases on or before the day of retirement,“ the ministry said. |

| | | | |

| − | ==Local Boards== | + | ==EPFO coverage for Indians working abroad, 2017== |

| − | • One each for the four regions of the country in Mumbai, Calcutta, Chennai and New Delhi

| + | [https://timesofindia.indiatimes.com/india/no-technical-education-via-correspondence-courses-rules-supreme-court/articleshow/61479624.cms Amit Anand Choudhary, SC cancels engineering degrees given by deemed universities through correspondence course, Nov 3, 2017: The Times of India] |

| | | | |

| − | Membership:

| |

| | | | |

| − | • consist of five members each

| + | '''HIGHLIGHTS''' |

| | | | |

| − | • appointed by the Central Government

| + | The apex court restrained educational institutions from providing courses in subjects like engineering, in the distance education mode |

| | | | |

| − | • for a term of four years

| + | With its ruling, the SC affirmed the findings of the Punjab and Haryana high court on the issue |

| | | | |

| − | Functions : To advise the Central Board on local matters and to represent territorial and economic interests of local cooperative and indigenous banks; to perform such other functions as delegated by Central Board from time to time.

| + | Also with its ruling, the SC set aside a verdict by the Odisha high court, which allowed technical education by correspondence |

| | | | |

| − | ==Why RBI is not comfortable with active boards==

| |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F06&entity=Ar02101&sk=3514EE46&mode=text Mayur Shetty, Why RBI is not comfortable with a more active board, November 6, 2018: ''The Times of India'']

| |

| | | | |

| − | [[File: Industrialists on RBI Board.jpg|Industrialists on RBI Board <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F06&entity=Ar02101&sk=3514EE46&mode=text Mayur Shetty, Why RBI is not comfortable with a more active board, November 6, 2018: ''The Times of India'']|frame|500px]]

| + | Indians working abroad can now exempt themselves from their host country's social security scheme and get covered by retirement fund body EPFO, Central Provident Fund Commissioner (CPFC) V P Joy said. |

| | | | |

| − | ''Bizmen In Rule-Debating Role Raise Conflict Of Interest Issue'' | + | An online facility to avail the benefit has been made functional, he said at a national seminar on 'Fraud Risk Management-The New Initiatives' here. |

| | + | The scheme allows Indian employees the option of not being part of their host country's social security scheme and saves employers from double social security contributions. |

| | | | |

| − | An active board seeking a say in bank regulation has thrown up questions about conflict of interest, given the presence of industrialists on the board of the Reserve Bank of India (RBI).

| + | The Employees' Provident Fund Organisation, which manages the money in employees provident fund accounts, has entered into an agreement with 18 countries. |

| | + | "We have made the whole process employee friendly. Employees going abroad to work can get a certificate of coverage (CoC). They can apply for the CoC online and can get it too," he told. |

| | | | |

| − | Traditionally, the RBI board had a strong presence of eminent industrialists like Ratan Tata, N R Narayana Murthy and Azim Premji. It has also included chiefs of highly indebted groups like K P Singh of DLF and G M Rao of the GMR Group. However, there was never any conflict of interest as the minutiae of bank regulation or monetary policy never came up to the board. That’s because, until now, the RBI board only gave a broad direction that the central bank should take.

| + | Joy said there is a simple one-page application form available on the EPFO's website for the purpose. |

| | | | |

| − | But in the October 23 board meeting, some directors are understood to have turned vocal on a few RBI regulations. According to a senior former central banker, there would be conflict of interest if these businessmen had advance information of RBI’s regulations. He was reacting to reports that some directors wanted the RBI central board to play a more active role and deliberate on regulations. There is talk of the board wanting to push through five decisions, which includes issues such as regulatory forbearance and allowing weak banks to lend, in the forthcoming RBI board meet on November 19.

| + | "The scheme is of great help for Indian workers going overseas for a limited period of time. The biggest benefit they get from opting for the CoC is that their money is not blocked for a long time in the host country," he said, explaining the benefits of the scheme. |

| | | | |

| − | Sources close to the central bank also point out that, unlike boards constituted under The Companies Act, the RBI Act 1934 grants the governor with powers that are concurrent with the board. They refer to clause 3 of the hotly debated Section 7 of the RBI Act. While the first clause confers powers on the government to give directions to the RBI, the third part indicates that the governor shares power.

| + | India has operational social security agreements with Belgium, Germany, Switzerland, France, Denmark, Republic of Korea, Grand Duchy of Luxembourg, Netherlands, Hungary, Finland, Sweden, Czech Republic, Norway, Austria, Canada, Australia, Japan and Portugal. |

| | | | |

| − | This clause 3 states, “Save as otherwise provided in regulations made by the central board, the governor and in his absence the deputy governor nominated by him in this behalf, shall also have powers of general superintendence and direction of the affairs and the business of the bank, and may exercise all powers and do all acts and things which may be exercised or done by the bank.” A source said, “The choice of the words ‘shall also have powers’ indicates that these are concurrent with the board.”

| + | EPFO is one of the largest social security providers in the world, covering 9.26 lakh establishments with more than 4.5 crore members. It provides pension to 60.32 lakh pensioners every month. |

| | | | |

| − | According to sources, the powers of the governor are reiterated in the Reserve Bank of India, General Regulations, 1949, which also addresses the issue of conflict of interest between board decisions and individual interests of directors. “You can imagine what would happen if an issue like the February 12 circular on recognition of non-performing assets came up to a board that included owners of highly indebted companies,” a source said.

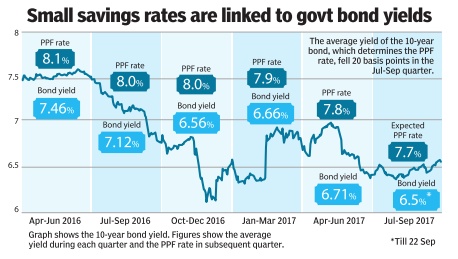

| + | ==Interest rates== |

| | + | ===Dec 2016: cut to 8.65%=== |

| | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=EPFO-cuts-interest-rate-to-865-20122016013009 ''The Times of India''], Dec 20 2016 |

| | | | |

| − | =How other central banks function=

| + | '''EPFO cuts interest rate to 8.65%''' |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F30&entity=Ar02204&sk=41DBD133&mode=text Source: Central bank websites, agencies, WSJ, How other central banks function, October 30, 2018: ''The Times of India''] | + | [[File: Employees Provident Fund, interest rates, 2010-16.jpg|Employees Provident Fund, interest rates, 2010-16; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=EPFO-cuts-interest-rate-to-865-20122016013009 ''The Times of India''], Dec 20 2016|frame|500px]] |

| | | | |

| − | [[File: The US government’s frictions with its central bank under President Trump.jpg|The US government’s frictions with its central bank under President Trump <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F30&entity=Ar02204&sk=41DBD133&mode=text Source: Central bank websites, agencies, WSJ, How other central banks function, October 30, 2018: ''The Times of India'']|frame|500px]]

| |

| | | | |

| | + | The Employees Provident Fund Organisation (EPFO) recommended a minor reduction in interest rate to 8.65% for the financial year 2016-17 compared to 8.8% in 2015-16 but it still remains the best investment bet given that there is no cap on how much you set aside and the entire corpus remains tax free. |

| | | | |

| − | '''The US Federal Reserve''': Like other central banks, the Fed is an independent government agency. It is accountable to the public and the US Congress. Members of the board of governors are appointed for staggered 14-year terms and the board chair is appointed for a four-year term. Elected officials and members of the administration are not allowed to serve on the board. The Fed does not receive funding through the congressional budgetary process. The financial statements of the Federal Reserve Banks and the board of governors are audited annually by an independent, outside auditor.

| + | The reduction in interest rate to a four-year low is in line with the falling regime although bank fixed deposit rates have seen a sharper decline due to demonetisation of Rs 500 and Rs 1,000 notes. State Bank of India, for instance, has lowered fixed deposit rates by 15 basis points (100 basis points equal one percentage point), while on deposits of over Rs 1 crore (known as bulk deposits) rates have been slashed by up to 190 basis points. In any case, with the RBI singalling a shift towards a low rate regime, the government was forced to pare returns on small savings schemes. |

| | | | |

| | + | Trade unions were demanding that EPFO central board headed by labour minister Bandaru Dattatreya retain the rates at least year's level, something that did not appear feasible given the retirement agency's projections. At 8.8%, EPFO would have faced a deficit of Rs 384 crore, while at 8.65% it will have a surplus of Rs 296 crore. |

| | | | |

| − | '''The Bank of England (BoE)''': The BoE is owned by the UK government. It has specific statutory responsibilities for setting policy rates, carried out within a framework set by government but free from day-to-day political influence. Parliament gives specific goals and responsibilities. The government sets the target — which is 2%. A panel meets to agree interest rate decisions eight times a year. There are other panels on other issues, which ensures that the financial system is working properly to serve UK households and businesses. The BoE is answerable to both parliament and the public.

| + | “The decision was arrived at after detailed consultations with all stakeholders. With consensus we have taken this decision,“ Dattatreya said in Bengaluru after the meeting.Interest income from PF investments for 2016-17 has been estimated mainly on the basis of interest income received or receivable in this financial year, including surplus of Rs 410 crore from previous year, an official said. |

| | | | |

| | + | “In 2015, the interest rate decided was at 8.8%. At that time, along with the income of EPFO, the surplus from the previous year was Rs 1,600 crore. This year, along with the income, the surplus available is Rs 410 crore,“ Central Provident Fund Commissioner V P Joy said. |

| | | | |

| − | '''European Central Bank (ECB)''': It manages the euro and implements monetary and economic policy for the EU. Probably the most independent of central banks, the ECB charter prevents it from backing any government. However, it is criticised as being non-independent because it is at the mercy of the governments of Europe’s creditor countries.

| + | The recommendation of the EPFO board needs to be ratified by the finance ministry , which notifies the rates. Last year, the finance ministry had suggested a reduction but was forced to go with the board's decision after public uproar. |

| | | | |

| | + | ===Erstwhile employees must pay tax on interest=== |

| | + | [https://timesofindia.indiatimes.com/business/india-business/quit-or-axed-as-employee-pay-tax-on-epf-interest/articleshow/61666067.cms November 16, 2017: ''The Times of India''] |

| | | | |

| − | '''Bank of Japan''': It has a legal mandate to maintain price stability. The government is not allowed to sack the central bank governor or members of the board but parliamentarians have the right to appoint them. Bank regulation is done by the Financial Services Agency.

| |

| − |

| |

| − |

| |

| − | '''People’s Bank of China''': The Chinese central bank is subservient to the communist party and its national objectives. It is responsible for mainlining growth, price stability, currency stability and health of financial sector.

| |

| − |

| |

| − |

| |

| − | '''Central Bank of Argentina''': RBI deputy governor Viral Acharya used the example of the constitutional crisis in Argentina. The Cristina Fernandez-led government in 2010 attempted to raid the central bank’s reserves, resulting in bond yields shooting up and foreign investors exiting.

| |

| − |

| |

| − |

| |

| − | '''Turkey Central Bank''': The sharp depreciation in emerging market currencies was seen to have been triggered by the fall in the Turkish lira. The collapse of the lira has been attributed to Turkish president Recep Tayyip Erdogan taking control of Central Bank of the Republic of Turkey and preventing it from raising rates.

| |

| − |

| |

| − | =The post of Governor=

| |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=No-age-cap-fixed-rules-for-RBI-top-20062016017020 ''The Times of India''], June 20, 2016

| |

| − |

| |

| − |

| |

| − | '''Who can be an RBI governor?'''

| |

| − |

| |

| − | Unlike the appointment of fo ur deputy governors, there are no fixed rules. But most RBI governors have been civil servants (11), followed by economists (five). There has also been one banker, an insurance company executive and one RBI employee who have gone on to be the governor.

| |

| − |

| |

| − | '''How are candidates selected?'''

| |

| − |

| |

| − | In the past, candidates were shortlisted by the government, and the Prime Minister appointed the governor in consultation with the finance mi nister. On some oc casions, some of the candidates we re called for an in LEARNING formal interaction WITH THE TIMES with the finance mi nister (D Subbarao was appointed through this route) although the final decision was taken by the PM. Now, the government has tasked a committee headed by the Cabinet secretary to shortlist candidates and the final decision will be taken by PM Narendra Modi.

| |

| − |

| |

| − | '''Is there an age cap or are some qualifications stipulated?'''

| |

| − |

| |

| − | No, there is neither an age restriction nor qualifications are specified in the law. Governments have opted for those with understanding of overall economy , the financial sector as well as those familiar with th functioning of the government

| |

| − |

| |

| − | '''What is the RBI governor' tenure?'''

| |

| − |

| |

| − | The RBI Act allows the government to specify the term but the ? tenure cannot exceed five years, with a possibility of reappointe ment. In recent years, only S Venkitaramanan, who spent two years as RBI governor, has had a shorter stint than Raghus ram Rajan.

| |

| − |

| |

| − | =Selection of Governor, Dy. Governor=

| |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=In-a-first-panel-to-list-RBI-guv-11062016001061 The Times of India], Jun 11 2016

| |

| − |

| |

| − | Rajeev Deshpande

| |

| − |

| |

| − | In a break from tradition, the government has tasked a selection committee headed by cabinet secretary P K Sinha with shortlisting candidates for Reserve Bank of India governor -a decision that was taken earlier by the Prime Minister in consultation with the finance minister.

| |

| − | In the past, chiefs of other regulatory bodies -including insurance, pension and Sebi -have been shortlisted by search committees. But this will be the first time the RBI governor will be appointed similar ly, signalling a major shift in government stance and ending the special treatment given to central bank chiefs. The decision to route the RBI governor's appointment through the financial sector regulatory appointment search committee (FSRASC) seems intended to cool speculation over Raghuram Rajan being considered for a second term.

| |

| − |

| |

| − | The FSRASC, set up in 2015, had interviewed candidates for Sebi chief. In February 2016, the government ignored its recommendation and reappointed U K Sinha for a year. A part from the cabinet secretary, the committe comprises additional principal secretary to PM P K Mishra, who is a permanent government nominee, and three outside experts -Rajiv Kumar of Centre for Policy Research, Manoj Panda of the Institute of Economic Growth and Bimal N Patel from Gujarat National Law University. A finance ministry representative will be a special invitee. The panel's recommendation will be sent to the appointments committee of cabinet headed by the PM, which will decide on the governor.

| |

| − |

| |

| − | Going by the current thinking in official circles, a second term for Rajan could well be on the cards despite occasional reports that put him at cross-purposes with the government over issues like rate cuts or `Make in India'. At the same time, the government does not seem keen to imbue the appointment with a greater profile of attention. The committee route would be in sync with PM Narendra Modi's remark that the appointment is an “administrative decision“ that will be taken closer to September when Rajan's term ends.

| |

| − |

| |

| − | The committee's recomendation for RBI deputy governor was a break from past practice as previously, the head of the regulatory body presided over the selection committee. This time around, the RBI governor was a member of the FSRASC.

| |

| − |

| |

| − | The process of making top-level appointments to regulatory bodies has been problematic, with the choices often being seen to be politically influenced. Even with the committee-bound process, the choice for sensitive posts will no doubt be vetted by the political authority. But the decision to make FSRASC the recommending body that could well put up a single name instead of a short list for a regulator is aimed at reducing discretion and putting all such bodies on a par.

| |

| − |

| |

| − | =Salary and perquisites of RBI governors=

| |

| − | ==2016: Urjit Patel’s package==

| |

| − | [http://timesofindia.indiatimes.com/business/india-business/RBI-governor-Urjit-Patel-gets-Rs-2-lakh-a-month-pay-no-support-staff-at-home/articleshow/55788608.cms December 4, 2016: The Times of India]

| |

| − |

| |

| − | ''' ''RBI governor Urjit Patel gets Rs 2 lakh a month pay, no support staff at home'' '''

| |

| | | | |

| | '''HIGHLIGHTS''' | | '''HIGHLIGHTS''' |

| | | | |

| − | RBI governor Urjit Patel gets a little over Rs 2 lakh as salary

| + | According to a notification issued, when an employee resigns from his job, his EPF account continues to be "operative" and earns an interest until he applies for withdrawal. |

| | | | |

| − | RBI governor Urjit Patel gets a little over Rs 2 lakh as salary and has not been provided with any support staff at his residence, the central bank has said.

| + | On the other hand, if an employee retires after 55 years of age, then post three years from the date of retirement, his EPF account is treated as "inoperative" and does not earn any interest. |

| | | | |

| − | Patel, who took over as RBI Governor in September+ , is presently in possession of the bank's flat (Deputy Governor's flat) in Mumbai, it said. "No support staff has been provided to the present Governor, Urjit Patel at his residence. Two cars and two drivers have been provided to the present Governor," RBI said in reply to an RTI query.

| + | Tax laws provide that interest credited to an employee provident fund (EPF) account after an individual ceases to be in employment+ is taxable in his hands in the year of credit. |

| | | | |

| − | The bank was asked to provide details of remuneration given to former RBI governor Raghuram Rajan+ and incumbent Patel.

| + | In its order, the Bengaluru bench of the Income-Tax Appellate Tribunal (ITAT) also upheld this I-T provision while adjudicating the matter of a retired employee+ . |

| − | For the month of October — the first full month Patel was in office as Governor — Patel got Rs 2.09 lakh as his salary, the same amount drawn by Rajan as his August's salary. Rajan demitted office on September 4, and was given Rs 27,933 as remuneration for four days.

| + | Post-employment, whether on account of termination, resignation or retirement, several employees continue to maintain their EPF accounts and earn interest on the same. Unfortunately, they are usually not aware of the tax implications on the interest accretion in the fund after termination of employment," says Amarpal Chadha, partner and India mobility leader at EY India. Investment consultants point out that even in the case heard by ITAT, the taxpayer had mistakenly thought that the interest which had accrued to his EPF account post his retirement was not taxable. |

| | | | |

| − | Rajan assumed the charge of RBI Governor from September 5, 2013 at a monthly salary of Rs 1.69 lakh. His salary was revised to Rs 1.78 lakh and Rs 1.87 lakh respectively during 2014 and March 2015. His salary was hiked to Rs 2.09 lakh from Rs 2.04 lakh in January 2016, the RTI reply said.

| + | This ITAT ruling is pertinent not only for retired employees, but also those who have quit employment for various reasons, say, to be an entrepreneur or a homemaker, and have continued to retain a balance in their EPF accounts. |

| | | | |

| − | Rajan was provided with three cars and four drivers. "One caretaker and nine maintenance attendants were posted as supporting staff in the bungalow provided by the bank to the former Governor Raghuram Rajan at Mumbai," RBI said.

| + | According to a notification issued last November, when an employee resigns from his job or his services are terminated, his EPF account continues to be "operative" and earns an interest until he applies for withdrawal of the accumulated balance or takes up another job and transfers the balance. On the other hand, interest accrual norms are different for a retired employee. If an employee retires after 55 years of age and does not apply for withdrawal from his EPF account or transfer of the balance, then post three years from the date of retirement, his EPF account is treated as "inoperative" and does not earn any interest. |

| | | | |

| − | The Centre has recently declined to share details on appointment of Patel and other candidates shortlisted for the top post in the central bank saying these are "cabinet papers" and cannot be made public. Patel was on August 20 named as RBI's Governor to succeed Rajan. | + | The applicable rate of interest is announced each year. For the recently concluded financial year 2016-17, the interest rate was 8.65% and rates for the current financial year are expected to be announced shortly. In the recent case, the man had retired from a prominent Bengaluru-headquartered software company after 26 years of service, on April 1, 2002, and the total amount in his EPF account then was Rs 37.93 lakh. |

| | + | Nine years later, on April 11, 2011, he withdrew the grown sum of Rs 82 lakh from his EPF account. This amount included interest of Rs 44.07 lakh that had accrued post his retirement till the date of withdrawal. |

| | | | |

| − | ==2017, pay hike: Rs 2.5 lakh/month==

| + | The retired employee did not offer this interest amount to tax, as he viewed it would be exempt under Section 10 (12) of the I-T Act. During assessment proceedings for financial year 2011-12, the I-T officer sought to levy tax on this amount and the litigation finally reached ITAT's doors. |

| − | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=RBI-governors-pay-hiked-to-Rs-25L-per-03042017008029 RBI governor's pay hiked to Rs 2.5L per mth, April 3, 2017: The Times of India]

| + | |

| | | | |

| | + | Based on a reading of Section 10(12) and also the definition of "accumulated balance", the ITAT held: "The exemption is limited to the accumulated balance due and payable to an employee up to the date of his retirement or end of his employment." |

| | | | |

| − | RBI governor Urjit Patel and his deputies have got a big pay hike with the government more than doubling their basic salary to Rs 2.5 lakh and Rs 2.25 lakh per month, respectively .

| + | ITAT pointed out that the term "accumulated balance due to an employee" is defined as the balance standing to his credit, or such portion of it as may be claimed by the concerned employee under the regulations of the fund "on the day he ceases to be an employee". |

| − | The “basic pay of the governor and deputy governors“ have been revised retrospectively with effect from January 1, 2016 and marks a huge jump from Rs 90,000 basic pay so far drawn by the Governor and Rs 80,000 for his deputies. Still, their salaries are much lower than the top executives of various banks regulated by the RBI.The RBI, however, did not disclose the new gross pay for Patel and his deputies following the revision in basic pay.

| + | |

| | | | |

| − | =Governors of the Reserve Bank of India=

| + | Thus, the ITAT agreed that the interest earned postretirement was taxable in the hands of the retired employee. However, it added that the aggregate interest of Rs 44.07 lakh should be taxable in the hands of the retired employee, in the respective financial years in which the interest income actually arose. |

| − | ==1935- 2013: complete list==

| + | |

| − | [http://epaper.timesofindia.com/Default/Scripting/ArticleWin.asp?From=Archive&Source=Page&Skin=TOINEW&BaseHref=CAP/2013/08/07&PageLabel=22&ForceGif=true&EntityId=Ar02206&ViewMode=HTML The Times of India] 2013/08/07

| + | |

| | | | |

| − | [[File: rbiGova.png||frame|left|500px]]

| + | Chadha says, "Under the tax laws, the accumulated balance, as it stands on the date of cessation of employment, is considered as an exempt income (subject to satisfaction of certain conditions). Any accreditation in the EPF account after cessation of employment would be taxable income. ITAT, in its recent decision, has also held likewise. Therefore, it is important for employees to consider this aspect while making a decision on retaining their EPF account once their employment ceases." |

| − | [[File: rbiGovb.png||frame|500px]]

| + | |

| − | <br/>

| + | |

| | | | |

| − | [[File: Governors of RBI since 1935.jpg|Governors of RBI since 1935; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=21_08_2016_017_017_001&type=P&artUrl=GOVERNORS-IN-LIBERALIZED-INDIA-21082016017017&eid=31808 ''The Times of India''], August 21, 2016|frame|500px]]

| + | ==Rules== |

| | + | ===PF a/c to be transferred automatically on change of employment=== |

| | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PF-acs-to-be-automatically-transferred-on-job-11082017009021 Mahendra Singh, PF a|cs to be automatically transferred on job switch, August 11, 2017: The Times of India] |

| | | | |

| − | [[File: Interest rates, inflation and GDP growth during the tenures of RBI Governors, 1990-April 2016.jpg| Interest rates, inflation and GDP growth during the tenures of RBI Governors, 1990-April 2016; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=16_04_2016_021_021_010&type=P&artUrl=Rate-cut-depends-on-raindrops-Rajan-16042016021021&eid=31808 ''The Times of India''], April 16, 2016|frame|500px]]

| |

| | | | |

| − | [[File: Rates during the regime of RBI governor Mr. Raghuram Rajan, September 2013-September 2016.jpg|Rates during the regime of RBI governor Mr. Raghuram Rajan, September 2013-September 2016; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=10_08_2016_027_050_009&type=P&artUrl=Rates-unchanged-but-Rajans-cash-promise-trims-yields-10082016027050&eid=31808 ''The Times of India''], August 10, 2016|frame|500px]]

| + | From next month, your PF account will be transferred automatically when you change your job, chief provident fund commissioner V P Joy has said. |

| | + | Joy, who is pushing a slew of initiatives in the Employees' Provident Fund Organisation (EPFO) to make it more worker-friendly , said premature closure of accounts was one of their main challenges, and they were trying to address it by improving services. |

| | | | |

| − | == Duvvuri Subbarao: 2008-2013==

| + | “Whenever there is change of job, a lot of accounts are closed; then they (the employees) restart their account later on,“ he added. |

| − | Subbarao, man who fell into cauldron of woes

| + | |

| − |

| + | |

| − | Surojit Gupta | TNN

| + | |

| | | | |

| − | [http://epaper.timesofindia.com/Default/Scripting/ArticleWin.asp?From=Archive&Source=Page&Skin=TOINEW&BaseHref=CAP/2013/08/07&PageLabel=22&EntityId=Ar02205&ViewMode=HTML The Times of India] 2013/08/07

| + | “Now we have made Aadhaar compulsory for enrolment. We don't want accounts to be closed. The PF account is the permanent account.The worker can retain the same account for social security,“ Joy added. |

| | | | |

| − | New Delhi: For Duvvuri Subbarao it was baptism by fire when he took over the reins of the Reserve Bank of India nearly five years ago.

| + | “We are trying to ensure transfer of money if one changes jobs, without any application, in three days. In future, if one has an Aadhaar ID and has verified the ID, then the account will be transferred without any application if the worker goes anywhere in the country. This system will be in place very soon,“ he added. |

| | | | |

| − | As soon as he stepped into the corner office at the central bank headquarters in Mumbai’s Mint Road, a tsunami struck the global financial system. The force of the 2008 global financial meltdown meant that RBI had to call on all its resources to shield the economy from being brutalized.

| + | The EPFO has also stepped up efforts to expand coverage, and initial results have been positive. “During the campaign from January to June, more than one crore workers were enrolled. Now, we are trying to retain them by improving services,“ Joy said. |

| | | | |

| − | Subbarao, a mild-mannered former civil servant, remained unfazed. With the government, he scripted a recovery process stabilizing the economy, helping it weather the storm better than some of its peers.

| + | Joy said PF money should be withdrawn only for major purposes like housing, education of children, or serious hospitalisation. “...Only then will people get social security. So, we are now starting a campaign...to educate people that money must be withdrawn only for essential purposes,“ Joy said. |

| | | | |

| − | But this was short-lived. The economy was buffeted by stubborn inflation, including double-digit food inflation, prompting the central bank to focus on taming prices. It raised rates furiously, almost 13 times, to throttle inflation.

| + | ===2017: GPF rules liberalised=== |

| | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GPF-rules-relaxed-for-govt-staffers-28032017010030 GPF rules relaxed for govt staffers, March 28, 2017: The Times of India] |

| | | | |

| − | Of late, frosty ties between RBI and the finance ministry have dominated discussions. Critics slammed the policy to tackle inflation while the government sometimes expressed disappointment. Finance minister P Chidambaram, who is careful with words, appeared disappointed as RBI left interest rates unchanged.

| |

| | | | |

| − | “Growth is as much a challenge as inflation. If the government has to walk alone to face the challenge of growth then we will walk alone,” Chidambaram said highlighting the need for an inflation-growth balance.

| + | In a major relief for government employees, the Centre recently relaxed and simplified the General Provident Fund Rules, particularly related to advances and withdrawals by the subscribers. |

| | | | |

| − | Adding to Subbarao’s problems, the fiscal situation deteriorated. Growth slowed. Scandals and policy missteps, such as retrospective taxes forced investors to the sidelines. Subbarao bravely continued calling for action on the fiscal front to enable him to slash interest rates. That didn’t happen until Chidambaram stepped in as finance minister in September. His reform initiatives helped restore the health of public finances. RBI obliged with a rate cut. But this came with a caveat on the ch a l l e n g e s on the prices front.

| + | As per relaxed norms, employees can withdraw up to 90% of their amount for housing needs and 75% for buying vehicles. The definition of education for the purpose of withdrawal of GP Fund has now been widened to include primary, secondary and higher education, covering all streams and institutions. |

| | | | |

| − | As things appeared to settle down, the crisis on the currency front emerged, prompting RBI to work towards taming the volatile forex market.

| + | The withdrawal limit has also been increased from three months' pay or half the amount at credit, to up to 12 months' pay or 34th of amount at credit, whichever is less. |

| | | | |

| − | Some economists said the RBI under Subbarao misjudged the signals. “You cannot separate two or three issues, one of which is that when it comes to inflation and growth, both monetary and fiscal policies matter. In my assessment, the country had the most unfortunate fiscal policies compounded by the most unfortunate monetary policy,” economist Surjit Bhalla said. “The RBI misjudged the economy, determinant of inflation, determination of growth and determinant of the exchange rate.”

| + | Also this is now admissible to a subscriber after completion of 15 years of service. |

| | | | |

| − | He said the RBI under Subbarao had misjudged food inflation and hiked rates. “What could’ve been a virtuous cycle has been turned into a vicious cycle,” Bhalla said. Not all would agree with such a harsh summation.

| + | ===2018: Those unemployed for 30 days can withdraw 75% === |

| | + | [https://timesofindia.indiatimes.com/business/india-business/epfo-member-can-withdraw-75-funds-after-30-days-of-job-loss/articleshow/64751097.cms EPFO members can withdraw 75% funds after 30 days of job loss, June 26, 2018: ''The Times of India''] |

| | | | |

| − | ==Raghuram Rajan==

| |

| − | [[Raghuram Rajan]]

| |

| | | | |

| − | ==Urjit Patel==

| + | '''HIGHLIGHTS''' |

| − | ===2016-18===

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F08%2F27&entity=Ar01714&sk=C1069BC6&mode=text Mayur Shetty, After 2 years as RBI governor, Patel nears bad debt endgame, August 27, 2018: ''The Times of India'']

| + | |

| | | | |

| − | [[File: The first two years of Urjit Patel’s innings as the Governor of the RBI- Economic indicators 2016-18.jpg|The first two years of Urjit Patel’s innings as the Governor of the RBI- Economic indicators 2016-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F08%2F27&entity=Ar01714&sk=C1069BC6&mode=text Mayur Shetty, After 2 years as RBI governor, Patel nears bad debt endgame, August 26, 2018: ''The Times of India'']|frame|500px]]

| + | EPFO members can also withdraw remaining 25 per cent of their funds after completion of two months of unemployment |

| | | | |

| − | When Urjit Patel was appointed the 24th governor of the Reserve Bank of India (RBI) in August 2016, TOI had cautioned those who saw him as a pro-administration governor, pointing out that he was an inflation hawk.

| + | At present, the members can withdraw the funds after two months of unemployment and settle the account in one go |

| | | | |

| − | As he completes two years in office next week (he took over from the previous RBI governor Raghuram Rajan on September 4, 2016), Patel has demonstrated that he is no pushover. Whether it is interest rates, non-performing assets (NPAs) or the issue of public sector bank regulation — Patel has not shied away from locking horns with the government.

| |

| | | | |

| − | While his first year as the head of the central bank was overshadowed by the events following demonetisation, Patel’s tenacity came to light during his second year. That was when the RBI asked lenders to take the who’s who of India Inc to court and sell their businesses under the newly-introduced Insolvency and Bankruptcy Code. These included corporate groups like Essar, Videocon and Bhushan Steel.

| + | Retirement fund body EPFO decided to give its members an option to withdraw 75 per cent of their funds after one month of unemployment and keep their PF account with the body. |

| | | | |

| − | Patel’s obduracy, insisting that lenders stick to the letter for classifying loans as bad, has frustrated senior bureaucrats and politicians. Government officials point out that even public sector companies fail to make timely payments. However, for those who have been paying attention to Patel, this tough stance should not come as a surprise.

| + | The members would also have an option to withdraw remaining 25 per cent of their funds and go for final settlement of account after completion of two months of unemployment under the new provision in the Employee Provident Fund Scheme 1952. |

| | | | |

| − | A year ago in a speech titled ‘Resolution of stressed assets: Towards the endgame’, Patel had highlighted the challenges ahead, “We all must realise that it will be a long haul before the intended objectives are fully achieved... but as long as the endgame is a desirable goal, these should be worth it for placing the private economy structurally on a path of sustained growth.”

| + | "We have decided to amend the scheme to allow members to take advance from its account on one month of unemployment. He can withdraw 75 per cent of its funds as an advance from its account after one month of unemployment and keep its account with the EPFO," Labour Minister Santosh Kumar Gangwar, who is also the Chairman of EPFO's Central Board of Trustees, told reporters after the trustees meet here. |

| | | | |

| − | When it comes to setting of interest rates, the central bank is perhaps more independent under Patel then it was ever before. This is because Patel’s regime in the RBI coincided with the constitution of the monetary policy committee (MPC), which had a mandated objective to keep inflation at around 4%. Incidentally, the MPC was constituted based on recommendations made by a committee headed by Patel as deputy governor.

| + | At present, in case of unemployment, a subscriber can withdraw his or her funds after two months of unemployment and settle the account in one go. |

| | | | |

| − | Patel’s second year saw increased friction with the finance ministry following the Punjab National Bank scam. Soon after news of the scam broke, FM Arun Jaitley lashed out at the central bank, stating that while politicians are accountable, regulators (meaning the RBI) are not.

| + | The minister was of the view that this new provision would give an option to members to keep their account with the EPFO, which he can use after regaining employment again. |

| | | | |

| − | Patel’s comeback was equally strong. In one of his rare speeches, the governor said, “Success has many fathers, failures none. Hence, there has been the usual blame game, passing the buck, and a tonne of honking.” He then listed seven legislative provisions that ensured the RBI did not have much of a say in public sector banks. The finance ministry’s pointed rebuttal brought to light the stress in the relationship.

| + | However, it was proposed that the members would be allowed to take 60 per cent of funds as an advance on unemployment for not less than 30 days. But, the CBT raised the limit to 75 per cent in the meeting held today. |

| | | | |

| − | Patel, whose signatures appear in more currency notes than any other RBI governor, is the most low-profile central banker with only eight public speeches in two years. The final year of his term, being an election year, will be even more crucial as it will also bring him into the stressed loan endgame that he speaks about.

| + | The minister further said, "We approved almost the entire agenda listed for the meeting of the CBT today. We have also given an extension of one year to ETF (exchange-traded funds) manufacturers SBI and UTI Mutual funds till July 1, 2019. We have also extended the term of fund managers till December 31, 2018." |

| | | | |

| | + | There was a proposal to give an extension of six more months to its five fund managers SBI, ICICI Securities Primary Dealership, Reliance Capital, HSBC AMC and UTI AMC for managing its corpus. |

| | | | |

| | + | The five fund managers were appointed for three years from April 1, 2015. They were given extension till June 30, 2018. The CBT has also approved the proposal to appoint a consultant for selection of portfolio managers. |

| | | | |

| − | [[Category:Economy-Industry-Resources|R

| + | The minister also said that the EPFO's ETF investment would soon cross Rs 1 lakh crore mark as it has already invested Rs 47,431.24 crore till May end this year earning a return of 16.07 per cent. |

| − | THE RESERVE BANK OF INDIA]]

| + | |

| − | [[Category:Government|RTHE RESERVE BANK OF INDIATHE RESERVE BANK OF INDIA

| + | |

| − | THE RESERVE BANK OF INDIA]]

| + | |

| − | [[Category:India|R

| + | |

| − | THE RESERVE BANK OF INDIA]]

| + | |

| − | [[Category:Name|ALPHABETTHE RESERVE BANK OF INDIATHE RESERVE BANK OF INDIA

| + | |

| − | THE RESERVE BANK OF INDIA]]

| + | |

| − | [[Category:Pages with broken file links|THE RESERVE BANK OF INDIA]]

| + | |

| | | | |

| − | =Balance sheet=

| + | The EPFO has also extended the tenure of its consultant CRISIL for evaluation of the performance of fund manager till December 31, 2018. |

| − | ==Where do RBI’s surplus funds come from?==

| + | |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F21&entity=Ar02914&sk=1554FE66&mode=text November 21, 2018: ''The Times of India'']

| + | |

| | | | |

| − | [[File: The RBI’s reserves, 2013-18.jpg|The RBI’s reserves, 2013-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F21&entity=Ar02914&sk=1554FE66&mode=text November 21, 2018: ''The Times of India'']|frame|500px]]

| + | On the widening of the range of the ETF investments by the EPFO, a CBT member said that the agenda was deferred and the board was unanimous that a call will be taken on the advice of new fund managers and consultants to be appointed shortly. |

| | | | |

| − | '''Where do RBI’s surplus funds come from?'''

| + | It was proposed to amend the investment pattern of the EPFO to enable the body to invest in equity index ETF beyond NIFTY 50 and Sensex ETF. |

| | | | |

| − | RBI’s board this week decided to set up an expert committee to examine its ‘Economic Capital Framework’. The committee is expected to break down RBI’s balance sheet to decide if its reserves are consistent with its needs.

| + | [[Category:Economy-Industry-Resources|P PROVIDENT FUND: INDIA |

| | + | PROVIDENT FUND: INDIA]] |

| | + | [[Category:India|P PROVIDENT FUND: INDIA |

| | + | PROVIDENT FUND: INDIA]] |

| | + | [[Category:Pages with broken file links|PROVIDENT FUND: INDIA]] |

| | | | |

| | + | =Employees’ Provident Fund Organisation EPFO= |

| | + | ==Interest rates== |

| | + | ===2012-20=== |

| | + | [[File: Interest rates given by the EPFO to its six crore subscribers, 2012-20.jpg| Interest rates given by the EPFO to its six crore subscribers, 2012-20 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F03%2F06&entity=Ar00527&sk=5ED2CDD0&mode=text EPFO snips interest rate by 0.15% to 7-year low of 8.5%, March 6, 2020: ''The Times of India'']|frame|500px]] |

| | | | |

| − | '''What is the size of the RBI’s balance sheet?'''

| |

| − |

| |

| − | In 2017-18, the size of RBI’s balance sheet was Rs 36.2 lakh crore. Its balance sheet, however, is unlike that of a company. The currency notes it prints make up more than half its liabilities. Another big share, 26%, represents its reserves. These are invested mainly in foreign and Indian government securities (essentially promisory notes bearing an interest rate against which these governments borrow) and gold. RBI holds a little over 566 tons of gold, which along with its forex assets make up almost 77% of its assets. Sometimes, the finance ministry and RBI disagree on what level of reserves RBI must hold to be consistent with its operations.

| |

| − |

| |

| − |

| |

| − | '''Where do the RBI’s reserves come from?'''

| |

| − |

| |

| − | Reserves with RBI are not all of the same kind. In the current debate there are two which are relevant: The Currency & Gold Revaluation Account (CGRA) makes up the biggest share — it was Rs 6.9 lakh crore in 2017-18. This represents the value of the gold and foreign currency that RBI holds on behalf of India. Simply put, variations in this represent the changing market value of these assets. Thus, the RBI notionally gains or loses on this count according to market movements. For example, last year the CGRA increased by 30.5% largely because of the depreciation of the rupee against the US dollar and due to an increase in the price of gold.

| |

| − |

| |

| − | The Contingency Fund (CF) is a specific provision meant for meeting unexpected contingencies that arise from RBI’s monetary policy and exchange rate operations. In both cases, RBI intervenes in the relevant markets to adjust liquidity or prevent large fluctuations in currency value. The CF in 2017-18 was Rs 2.32 lakh crore, or 6.4% of assets. The CGRA and CF put together constituted 26% of assets (and because in a balance sheet assets and liabilities must by definition match, also the same proportion of its liabilities).

| |

| − |

| |

| − |

| |

| − | '''What is the RBI’s surplus?'''

| |

| − |

| |

| − | This represents the amount RBI transfers to the government. There are two unique features about RBI’s financial statements. It is not required to pay income tax and has to transfer to the government the surplus left over after meeting its needs. RBI’s income comes mainly through interest on the securities it holds and in 2017-18 the largest component of expenditure was a provision of about Rs 14,200 crore it made to the contingency fund.

| |

| − |

| |

| − | Obviously, the larger the provision made to CF, the lower the surplus. Beginning 2013-14, RBI didn’t make a provision to CF for three successive years as a technical committee felt its “buffers” were more than enough. In the last two years, however, RBI has made provisions to CF. The adequacy of the current level of CF is one of the key issues likely to be debated extensively by the expert committee.

| |

| − |

| |

| − | ==2013-18: surplus transferred ==

| |

| − | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F20&entity=Ar02210&sk=E802297C&mode=text Pradeep Thakur, In last 5 yrs, RBI transferred 75% of its income as surplus, November 20, 2018: ''The Times of India'']

| |

| − |

| |

| − | [[File: RBI's Balance Sheet, 2013-18.jpg|RBI's Balance Sheet, 2013-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F20&entity=Ar02210&sk=E802297C&mode=text Pradeep Thakur, In last 5 yrs, RBI transferred 75% of its income as surplus, November 20, 2018: ''The Times of India'']|frame|500px]]

| |

| − |

| |

| − | The Reserve Bank of India (RBI) transferred around Rs 2.5 lakh crore to the government during the last five years, which was around 75% of the central bank’s income.

| |

| − |

| |