Income Tax India: Statistics

(→Return form) |

(→Complaints for prosecution) |

||

| Line 341: | Line 341: | ||

"The income tax department is committed to carry forward the drive against tax evasion and action against tax evaders will continue in all earnest in the remaining part of the current financial year," the ministry said. | "The income tax department is committed to carry forward the drive against tax evasion and action against tax evaders will continue in all earnest in the remaining part of the current financial year," the ministry said. | ||

| + | |||

| + | =Disputes related to Income Tax= | ||

| + | ==Some borderline cases== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F06%2F21&entity=Ar01710&sk=376EF962&mode=text June 21, 2020: ''The Times of India''] | ||

| + | |||

| + | ''' PARATHA TO PAPAD: THE WEIRD WORLD OF TAX DISPUTES ''' | ||

| + | |||

| + | India discovered GST is the stuff frozen parotas are made of, even as patrons of aloo, mooli and gobhi paratha steered clear of the debate, saying they were fresh off the tawa, so please. From calling out wafers pretending to be biscuits and actors pretending to be farmers, tax disputes have often required ‘high-definition’ rulings | ||

| + | |||

| + | ''' Fryums vs papad ''' | ||

| + | |||

| + | Fryums which aspired for the same tax status as papad as they required frying were slotted to stay a ‘namkeen’ and pay GST at 18%. This even though in a Rajasthan sales tax case, the Supreme Court held that ‘gol papad’ – little discs made of maida, salt and starch – are legit papad, since size or shape is no matter for a papad | ||

| + | |||

| + | ''' Barfi vs chocolate ''' | ||

| + | |||

| + | Chocolate barfi had an existential crisis amid threats that it would be taxed as ‘chocolate’. However, the GST council clarified that the brown variant would remain part of the barfi khandaan. KitKat too escaped a heavier tax burden when it was classified as a biscuit and not chocolate | ||

| + | |||

| + | ''' Actor vs cricketer ''' | ||

| + | |||

| + | The income-tax authorities were stumped when in 2011, Sachin Tendulkar claimed that he had claimed exemptions for appearing in ads as he was an “actor” rather than a cricketer. They ruled in his favour. That’s what you call a masterstroke | ||

| + | |||

| + | ''' Coconut oil vs hair oil ''' | ||

| + | |||

| + | From papad to oil, Parachute doesn’t fancy calling its plain coconut oil ‘hair oil’ since that would invite the excise levy for cosmetic products. The little sachet, it argued in vain, was for those who use cooking oil ‘for small purposes’ – such as frying papad? | ||

| + | |||

| + | ''' Game vs puzzle ''' | ||

| + | |||

| + | And if you thought the issue of tax and nomenclature is all fun and games, well, some of it is. About 10 years ago, a weighty Supreme Court bench looked into the weighty matter of whether Scrabble is a game or puzzle. Many long words later (nobody got points), the bench ruled that it is not a puzzle and, therefore, liable to excise duties. The logic: a crossword is a puzzle because it has clues unlike Scrabble which is more about chance and skill | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|I | ||

| + | INCOME TAX INDIA: STATISTICS]] | ||

| + | [[Category:India|I | ||

| + | INCOME TAX INDIA: STATISTICS]] | ||

=Exchange of tax information= | =Exchange of tax information= | ||

Revision as of 10:30, 6 October 2020

This is a collection of articles archived for the excellence of their content. |

Arrears

See graphic:

Income tax rates in India, 2000-2016

2015: 17 people owe Rs 2.14 lakh crore

The Times of India, Aug 01 2015

Just 17 people owe massive Rs 2.14 lakh cr in tax arrears

Just 17 individuals have a whopping Rs 2.14 lakh crore as outstanding tax arrears, with each of them owing more than Rs 1,000 crore. This is more than double the amount of total tax dues worth Rs 90,568 crore outstanding against 35 companies in this category (with outstanding tax arrears of over Rs 1,000 crore each), the Parliament has been informed.

Together, these individuals and companies account for more than one-third of the overall direct tax arrears (including the demand not fallen due), which stood at Rs 8,27,680 crore as on April 1, 2015.

At the same time, the number of taxpayers owing over Rs 10 crore to the government rose by about 69% to 4,692 in three years to March, 2015.

These details have been disclosed in written replies to the Rajya Sabha by minister of state for finance Jayant Sinha, who also said that a large proportion of the large-size outstanding tax arrears may not be collectible due to various reasons. Sinha said action for recovery is being taken.

Black Money Compliance Scheme

Valuer's report will not be questioned

The Times of India, Aug 19 2016

The valuation report from a registered valuer will not be questioned by the income tax department for disclosures made under the domestic black money compliance scheme, the CBDT clarified.

“The valuer is expected to furnish a true and correct valuation report in accordance with the accepted principles of valuation. In case of any misrepresentation, appropriate action as per law shall be taken against the registered valuer,“ said the fifth set of FAQs.

CBDT had received representations from stakeholders to provide an option to value the immovable property on the basis of the registered value.“After due consideration of the representations, the rules have been amended to provide that where acquisition of an immovable property is evidenced by a registered deed, an option shall be available with the declarant to declare the fair market value of such property by applying the cost inflation index to stamp duty value of property ,“ FAQs said.

City-, region-wise trends

2012-17, Income Tax in the states; persons in the tax bracket

December 21, 2017: The Times of India

See graphics:

Top ten states by Income tax collection, 2016-17; Top 5 states by growth in Income tax collections (2010-11 to 2016-17)

Ten types of Income tax assesses, individuals and companies, 2012-13 to 2016-17; Persons in the tax bracket, 2015-16

From: December 21, 2017: The Times of India

From: December 21, 2017: The Times of India

HIGHLIGHTS

Only 3% Indians (4.1 crore) filed income tax returns in 2014-15.

Only 1.6% actually paid income tax.

Nearly 50% of tax assessees who filed a return declared zero taxable income.

Reports released by the income tax department show 4.1 crore Indians filed income tax returns in 2014-15. But two crore tax filers declared zero taxable income. Another two crore Indians paid average annual income tax of Rs 42,456. Only one crore taxpayers paid income tax of more than Rs 1 lakh.

2016-17: cities where evaders live

From The Times of India, October 12, 2017

See graphics:

The cities in which high- worth tax evaders lived in India in 2016-17

Why income tax payers in India are a small and shrinking section, some facts, 2017

2017-18: Mumbai 1, Delhi grew fastest

From: Sidhartha, Nat’l capital jumps closer to biz capital in I-T collections, November 16, 2018: The Times of India

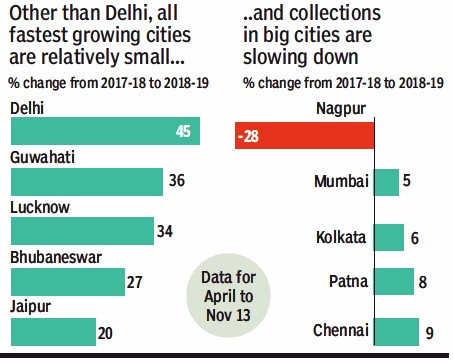

Delhi Records 45% Growth So Far This Year

The changing economic landscape of India is showing up in the region-wise break-up of income tax collections. Mumbai, the business capital of the country, still contributes the largest, 29%, of total income tax revenues, but its share has been falling. Delhi, the second-largest contributor to the tax kitty, saw collections rising 45% from April to November 13 this year over the same period in 2017.

Collections in Mumbai rose only 5%. Slower growth in Mumbai is attributed to hefty refunds. The massive growth in Delhi has helped the region increase its share in total collections to 16.5%, a jump of over five percentage points compared to a year ago.

The region’s growth was much higher than even smaller centres like Chennai and Kolkata which recorded single-digit growth rates during these seven and a half months. “The department has been proactive in paying refunds across the country. But the number should be seen in the context of refunds paid out in Mumbai, which have been quite high,” said an official, without revealing any details.

Another official said that refund claims in Delhi were not high, which were reflected in the gross collection numbers, but these were not immediately available.

The high refunds may also be a pointer to the tax authorities getting large taxpayers in Mumbai to pay higher amounts last March to meet the annual target.

Collection of tax

About Taxmen

India Today.in , Why it’s tough taxing with love “India Today” 23/6/2016

See graphic

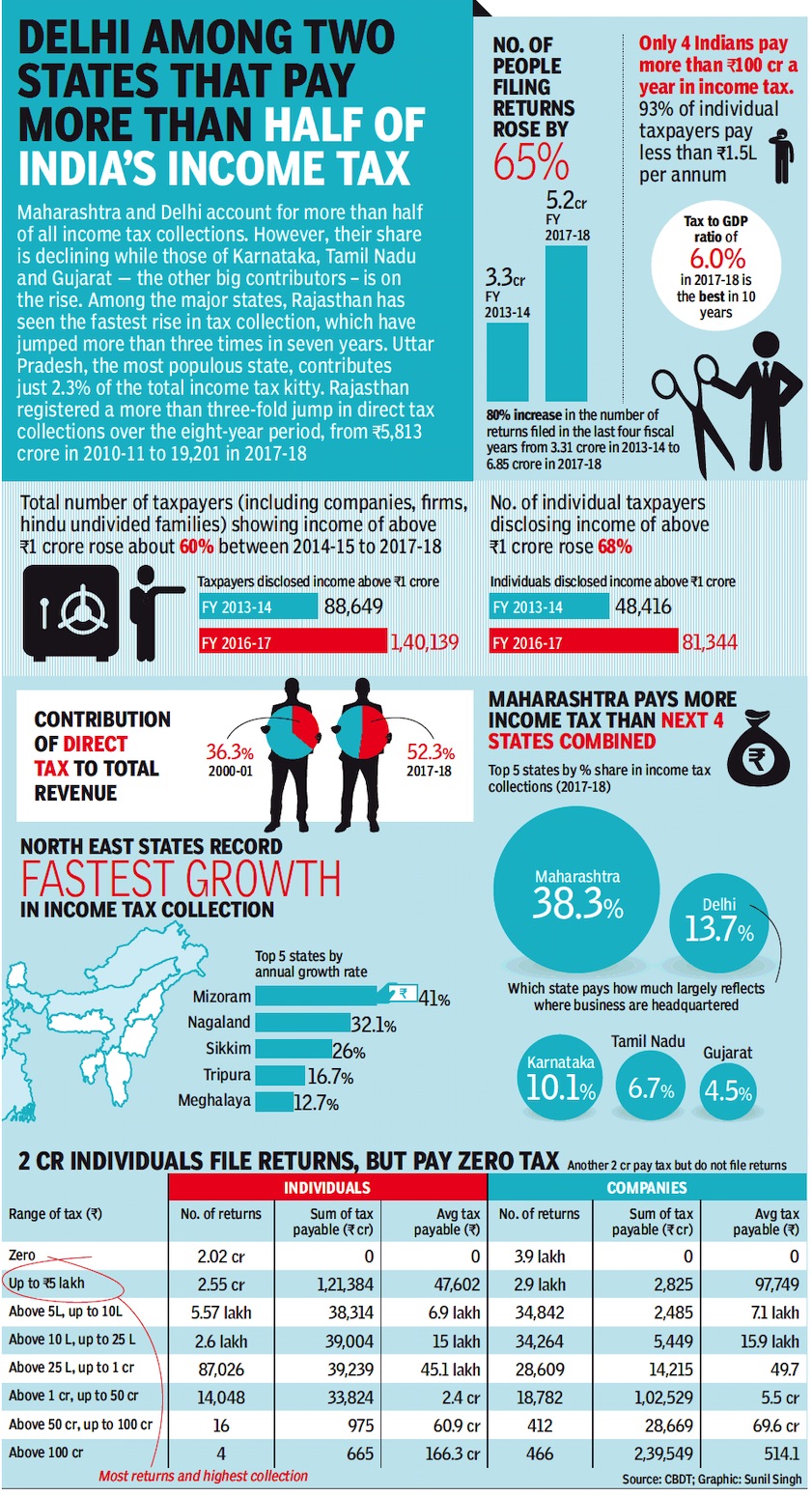

Statistics (2000-18: contribution of ITax, 2017-18: top states)

2017-18: The states that pay the most taxes

From: October 23, 2018: The Times of India

See graphic:

2000-18: contribution of direct taxes to total revenues

2017-18: The states that pay the most taxes

2011: 2.77% Indians pay I Tax

Only 2.77% Indians pay income tax

The Times of India, Sep 1, 2011

Just 2.77% of India’s 1.21 billion people pay personal income tax, official data has revealed. “The number of effective tax payers as on March 31, 2011 was 3,35,79,831 (33.57 million),” minister of state for finance S S Palanimanickam said in a reply to a question in the Rajya Sabha on Tuesday.

This is just 2.77 % of over 121 crore or 1.21 billion population of the country. The amount of direct tax collection rose to Rs 446,070 crore in 2010-11 from Rs 378,063 crore the previous year, the minister said. IANS

2011-12, individuals in tax bracket

The Times of India, Aug 20 2016

1.3L disclosed zero income in 2011-12

Over 35,600 individuals filed returns showing annual income of over Rs 1 crore with at least 1.3 lakh disclosing zero income during financial year 2011-12, data released by the government showed. Those reporting zero income in their returns were those who accounted for tax breaks against investments such as provident fund and public provident fund as well as home loans, which helped reduce the total income to under Rs 1.8 lakh, which was threshold for the levy of tax in the lowest bracket.

Another 36 lakh tax payers, or 12.5% of the 2.89 crore individuals who filed returns disclosed income of up to Rs 1.5 lakh, while over 37% were in the Rs 1.5-2 lakh range.

But the number which is under watch is those in the higher brackets as only 14 lakh or less than 5% of the entire taxpayer base was in the top bracket of 30%. But this segment paid nearly 75% of the total income tax. The government has initiated a number of steps to track those failing to disclose income.

2012-13, individuals in Income Tax bracket

The Times of India, Aug 19 2016

Only 14L fell in 30% tax bracket in 2012-13

Only 14 lakh individuals out of 2.89 crore assessees declared an annual income of over Rs 10 lakh, attracting the highest tax bracket of 30%, in assessment year 2012-13. As per the Income Tax Return Statistics for Assessment Year 2012-13, 14 lakh people or just 4.6% of the total assessees paid taxes in the highest 30% tax bracket. These 14 lakh people accounted for 75% of the total personal income tax collection. “The data reveals very clearly that there is a need for widening and deepening of the tax net now,“ revenue secretary Hasmukh Adhia said.

The analysis revealed that of 2.89 crore taxpayers who filed returns, 1.63 crore (56.4%) did not pay taxes and 0.84 crore assessees (29.3%) were in the 10% tax bracket. These two segments constitute more than 85.5% of the individual tax base.

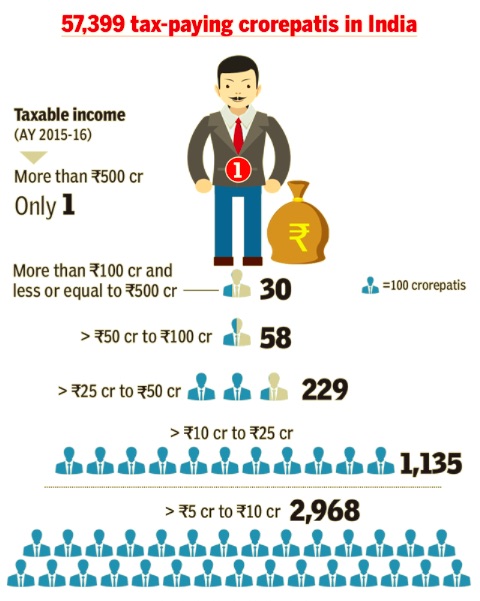

2012-16: crorepatis (₹10m.) increase by 54%

India sees a 54% rise in tax-paying crorepatis, January 2, 2018: The Times of India

From: India sees a 54% rise in tax-paying crorepatis, January 2, 2018: The Times of India

How is the super-rich population growing in India? A look at the individual income tax returns reveals that there has been a steady increase in the number of individuals whose taxable income show earnings over Rs 1 crore. In the assessment year 2012-13, there were 37,248 such individuals.This went up to 57,399 in 2015-16.

2013-17: Doctors, CAs, nursing homes less likely to pay IT than salaried

Number of taxpayers up, but salaried still bear the brunt, October 23, 2018: The Times of India

From: Number of taxpayers up, but salaried still bear the brunt, October 23, 2018: The Times of India

68% Rise In Crorepatis Over Four Years

At last count, there were around 8.6 lakh doctors in India, of which less than half paid income tax. In the case of chartered accountants, who advise individuals and companies on tax matters, one in three paid income tax.

While there are nursing homes every few km, only 13,000 paid taxes. In fact, their number is less than the number of fashion designers (14,500) paying income tax.

Data released by the I-T department on Monday showed that efforts to widen the tax base resulted in an 80% jump in number of returns filed to 6.9 crore in the last four years. But the salaried, whose taxes are deducted, continued to bear the brunt of the tax burden.

The I-T department claimed a 68% rise in individuals with annual income of over Rs 1 crore, though the previous figure was not readily available.

No. of salaried taxpayers rising at faster pace than non-salaried

At Rs 5.2 lakh a year, the average annual income of the non-salaried is around 75% of salaried taxpayers, which adds up to Rs 6.8 lakh. The number of salaried taxpayers is rising at a faster pace than the non-salaried, although the count surprisingly is the same — 2.3 crore. On the positive side, over the last four years, there has been an increase of 27% in the income declared by the non-salaried, against a 19% increase in case of salaried.

On the flip side, compared to 2015-16, there was a marginal decrease in the number of fashion designers and nursing homes that filed returns in 2016-17. While the tax department has been expressing concern over the low number of non-salaried taxpayers, as also the income disclosed, it has now taken up deepening the tax base as a key focus area. “We are looking at multiple sources of data. We are doing data analysis continuously,” Central Board of Direct Taxes (CBDT) chairman Sushil Chandra said.

Last year, the tax department scanned all property transactions of over Rs 1 crore and sent out an advisory to pay advance tax in March itself. Similarly, the department has been scanning data related to bank deposits, where 10% tax is deducted at source (TDS), and matching it with the returns, where disclosures related to interest income are often low or completely absent. In all these cases, the government has been sending reminders and has managed to recover taxes, Chandra said.

In fact, CBDT has asked its officers to look at data on overseas deposits, real estate and other assets that is now available through information flowing from other countries.

Besides, there has been targeted action against some segments, such as fashion designers, including some high profile ones, some of whom are being probed for under-reporting sales.

But there are areas where the tax department can do little. For instance, when it comes to high-end vehicles, the government conceded that a large number of them are owned by companies instead of individuals.

2015-16: 1.7% Indians paid income tax

December 25, 2017: The Times of India

HIGHLIGHTS

In the previous AY 2014-15, 1.91 crores, out of 3.65 crores who filed returns, had paid income tax.

The data, released last week, indicates just over 3 per cent of the 120 crore population filed returns.

Of the 4.07 crore tax returns field in AY 2015-16, close to 82 lakh showed zero or income less than Rs 2.5 lakh.

Just over 2 crore Indians, or 1.7 per cent of the total population, paid income tax in the assessment year (AY) 2015-16, according to data released by the I-T department.

The number of income-tax return filers increased to 4.07 crore in the assessment year 2015-16 (FY 2014-2015) from 3.65 crores in the previous year but only 2.06 crore actually paid tax as the others claimed income below taxable limits.

In the previous AY 2014-15, 1.91 crores, out of 3.65 crores who filed returns, had paid income tax. But the total income tax paid by individuals declined to Rs 1.88 lakh crore in AY 2015-16 from Rs 1.91 lakh crore in AY 2014-15.

The data, released last week, indicates just over 3 per cent of the 120 crore population filed returns. Of these, 2.01 crore paid nil income tax, 9,690 paid tax of over Rs 1 crore. Only one individual paid over Rs 100 crore in taxes (Rs 238 crore to be precise).

Maximum among of 19,931 crore was collected from 2.80 crore tax filers who paid between Rs 5.5 lakh to Rs 9.5 lakh in taxes. As many as 1.84 crore returns were filed for payment of income tax of less than Rs 1.5 lakh or an average of Rs 24,000. Of the 4.07 crore tax returns field in AY 2015-16, close to 82 lakh showed zero or income less than Rs 2.5 lakh.

Currently, no income tax is for income up to Rs 2.5 lakh.

In AY 2014-15, 3.65 crore filed tax returns with 1.37 crore showing zero or less than Rs 2.5 lakh income. The combined income of all individual tax filers rose to Rs 21.27 lakh crore in AY 2015-16 from Rs 18.41 lakh crore in the previous year.

A maximum number of 1.33 crore individuals were in Rs 2.5 lakh to Rs 3.5 lakh income group in AY 2015-16. In all, 4.35 crore income tax returns, including those by individuals, were filed in AY 2015-16. Total income declared was Rs 33.62 lakh crore.

In the previous year, 3.91 crore returns were filed with Rs 26.93 crore declared income. Companies filed 7.19 lakh returns with gross income of Rs 10.71 lakh crore.

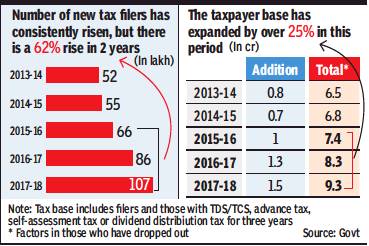

2016 vs. ’17, ’18: taxes rise 62% ; taxpayers by 25%

i)Income Tax receipts;

ii) The number of taxpayers

From: Sidhartha, Govt mops up ₹1.5L cr addl tax, to chase 65L non-filers, April 30, 2018: The Times of India

The government’s drive towards higher compliance has already helped it garner an additional Rs 1.5 lakh crore in direct taxes during 2017-18 and get a record number of new filers. But it is not done yet, with the tax department chasing 65 lakh people who it suspects did not file returns last year as it hopes to expand the taxpayer base to over 9.3 crore.

The base includes those who file returns in addition to those with TDS, tax collected at source, advance tax, self-assessment tax and dividend distribution tax during the last three financial years. The efforts, including text messages and email campaigns, have helped the Centre expand the taxpayer base with I-T expecting an addition of over 1.5 crore new entities during 2017-18.

Over 1cr filed returns for first time

I-T authorties expect to expand the tax base, net of exits by over 12%. Officials told TOI that a large part of this increase will be on account of just over 1 crore individuals who filed their returns for the first time in 2017-18, which the government believes is partly driven by the demonetisation drive in 2016 that prompted people to disclose higher income. On last count, the government had mopped up over Rs 10 lakh crore as direct taxes, compared to a shade under Rs 8.5 lakh crore in 2016-17.

But there are many, who despite several reminders, have not filed their returns and are on the radar as part of the work programme for the current financial year, said an official. An analysis by the department has shown that of the nearly 6.8 crore returns filed in 2017-18, nearly a fifth was related to previous years — as was the situation earlier too.

Separately, officials said, the text messages and emails were targeted at close to 1.75 crore “potential assessees” of which 1.07 crore have voluntarily filed returns so far. Going by this measure too, the numbers add up.

Some of the “potential assessees” will be targeted through the non-filers management system (NMS) that the tax department has deployed successfully over the last few years. One of the focus areas will be on those who had deposited Rs 10 lakh or more in demonetised Rs-500 and Rs-1,000 notes but did not care to file their returns. Of the over three lakh people in this category, over two lakh have filed returns and paid close to Rs 6,500 crore in self-assessment tax.

NMS depends on several data sources with special focus on those who indulge in high-value transactions but do not file returns or do not disclose their income fully. Often, the spending pattern of this segment does not tally with the income disclosed in their tax returns.

Voters amongst Income Tax payers, 2017

See graphic

Number of taxpayers per 100 voters, India and the world, February 2017

2017-18: Direct tax collection increases 19%

January 17, 2018: The Times of India

Direct tax collection jumps 19% to Rs 6.89 lakh crore this fiscal

Direct tax collections during the first nine-and-a-half months of the current fiscal have risen by 18.7 per cent to Rs 6.89 lakh crore, the tax department said. The collections till January 15, 2018 represent over 70 per cent of the Rs 9.8 lakh crore revenue target from direct taxes, the Central Board of Direct Taxes (CBDT) said in a statement.

"The provisional figures of direct tax collections up to January 15, 2018, show that net collections are at Rs 6.89 lakh crore which is 18.7 per cent higher than the net collections for the corresponding period last year," it said.

Gross collections (before adjusting for refunds) have increased by 13.5 per cent to Rs 8.11 lakh crore during April, 2017 to January 15, 2018.

Refunds amounting to Rs 1.22 lakh crore have been issued during this period.

Stating that there has been "consistent and significant" improvement in the position of direct tax collections during the current fiscal, the CBDT said the growth rate of total gross collections has improved from 10 per cent in Q1, to 10.3 per cent in Q2, to 12.6 per cent in Q3 and to 13.5 per cent as on January 15, 2018.

Similarly, the growth rate of total net direct tax collections has climbed up from 14.8 per cent in Q1, to 15.8 per cent in Q2, to 18.2 per cent in Q3 and to 18.7 per cent as on January 15, 2018.

The growth in corporate tax collections has risen from 4.8 per cent in first quarter of current fiscal to 10.1 per cent in Q3 and 11.4 per cent as on January 15, 2018.

Similarly, the growth rate of net corporate tax collections increased from 10.8 per cent in Q2 to 17.4 per cent in Q3 and to 18.2 per cent as on January 15, 2018.

2017, April-Dec: Rs 26,500 crore paid by those who don’t pay full taxes

From: Govt mops up ₹26,500 crore from those who didn’t file tax returns, February 10, 2018: The Times of India

The government’s drive, through a non-filer monitoring system, to target those who indulge in highvalue transactions but don’t pay enough taxes has forced the filing of at least 1.7 crore extra returns and helped the Centre mop up close to Rs 26,500 crore till December.

In a written reply, finance minister Arun Jaitley told Parliament on Friday that for the past few years, the tax department has been identifying non-filers by tracking in-house information and tallying it with data on high-value transactions received from external agencies along with TDS and tax collected at source (TCS).

“The mechanism for collection and verification of financial information has been broadened to include data in respect of various types of high-value transactions from banks and FIs and high-value expenditure from commercial establishments in the form of Statement of Financial Transaction (SFT),” the FM said, adding that the scope of TDS and TCS was also expanded.

He said quoting the Permanent Account Number was now mandatory for transactions of over Rs 2 lakh. This was yielding enormous data, which was being mined by I-T.

As a result, last year, 35 lakh non-filers were identified who the tax department believe had a tax liability. Though the number is down from 67 lakh a year ago, many who had large cash deposits may have filed returns.

‘Aim to get 1.25cr new return filers’

The move is part of an exercise aimed at deepening the income tax system with the FM saying this year, the target was to get 1.25 crore new return filers.

He said that after identifying the non-filers, the government was using rule-based algorithms to classify cases into various categories and monitoring them. Text messages and emails were sent to the targeted groups to file returns and a compliance management cell had been set up to track responses. This was followed by notices. The system is now proposed to be made more stringent through a new mechanism — Project Insight — to target people and seek voluntary compliance.

2018: Indians are earning more, paying more taxes

June 30, 2018: The Times of India

HIGHLIGHTS

Indians have deposited 44 per cent higher advance personal income tax in the first quarter of 2018-19 compared to same period last year

According to government data, Indians have deposited 44 per cent higher advance personal income tax in the first quarter of 2018-19 (April-June) than they did in the same period last year.

In the corporate tax front too, companies have paid 17 per cent higher advance tax this quarter than last year.

What has cheered the government is the over 40 per cent growth for the second year in a row on the personal tax front, while there are signs that the corporate sector is performing better with the growth rate more than doubling from 8 per cent in June 2017, despite the weak show put up by banks.

What does the increase signify?

Increase in collection of personal income tax indicates more people are in the tax net than earlier. Finance minister Arun Jaitley seconded this view in a blog post published on Friday. "Increase in the amount of collections in category of personal income tax is also due to more people coming within the tax net," he wrote.

On the other hand, increase in corporate tax payment means India Inc is seeing increase in sales and expects profits to improve in the days to come.

It also means that Indians are spending more and consuming more goods and services than earlier.

The government however has to give tax refunds to those who have paid excess tax in the previous years which will moderate the hike in advance tax payment to some extent.

“After repayment of refunds due to some excess tax paid in earlier years, which are usually paid back in the first quarter, the net amount would be somewhat lesser. But if the same trend continues in the next three quarters, one expects a significant increase in the direct tax collection this year,” Jaitley further wrote in the blog.

The government has budgeted for a 14 per cent increase in direct tax collections, estimated at Rs 11.5 lakh crore, with personal income tax budgeted to rise 20 per cent — twice the estimated rate of growth for corporation tax.

Complaints for prosecution

2017: Income Tax prosecution cases treble in 2017+ conviction up four times

HIGHLIGHTS

Prosecution complaints filed by the I-T department shot up nearly three times to 2,225 during April-November 2017

48 people were convicted of various offences during the first eight months of the financial year, a four-fold jump from last year

NEW DELHI: Prosecution complaints filed by the income tax department shot up nearly three times to 2,225 during April-November 2017, compared to 784 cases a year ago, the government said on Friday.

The tax authorities decided to push for the prosecution of offenders as they did not want to be seen as being soft on violations of the Income Tax (I-T) Act, given the Modi government's focus on reducing black money. In addition, there has been an 83 per cent rise in cases where compounding has taken place, with the number reaching 1,052. Compounding of offences is done when the defaulter admits to their offence and pays the compounding fee as per stipulated conditions.

In a statement, the finance ministry said 48 people were convicted of various offences during the first eight months of the financial year, compared to 13 during April-November 2016, a jump of nearly four times. The numbers come a day after the government said it had stepped up its crackdown on benami property and are seen as a response to criticism that demonetisation and other black money actions failed to produce the desired results.

"Prosecutions have been initiated for various offences, including wilful attempt to evade tax or payment of any tax; wilful failure in filing returns of income; and false statement in verification and failure to deposit the tax deducted/collected at source, or inordinate delay in doing so," the finance ministry said.

Among the cases where the judiciary has ruled in favour of the I-T department include one where a Dehradun court convicted a defaulter for holding an undisclosed account in a foreign bank and sentenced him to two years of imprisonment for wilful attempt to evade tax and two years for false statement in verification, along with a monetary penalty for each default.

In Bengaluru, the managing director of an infrastructure company was found guilty of not depositing tax deductions of over Rs 60 lakh and sentenced to rigorous imprisonment of three months along with a fine. Similarly, a Mohali resident was held guilty of non-deposit of TDS within the prescribed time and sentenced to a year's jail along with fine.

"The income tax department is committed to carry forward the drive against tax evasion and action against tax evaders will continue in all earnest in the remaining part of the current financial year," the ministry said.

Some borderline cases

June 21, 2020: The Times of India

PARATHA TO PAPAD: THE WEIRD WORLD OF TAX DISPUTES

India discovered GST is the stuff frozen parotas are made of, even as patrons of aloo, mooli and gobhi paratha steered clear of the debate, saying they were fresh off the tawa, so please. From calling out wafers pretending to be biscuits and actors pretending to be farmers, tax disputes have often required ‘high-definition’ rulings

Fryums vs papad

Fryums which aspired for the same tax status as papad as they required frying were slotted to stay a ‘namkeen’ and pay GST at 18%. This even though in a Rajasthan sales tax case, the Supreme Court held that ‘gol papad’ – little discs made of maida, salt and starch – are legit papad, since size or shape is no matter for a papad

Barfi vs chocolate

Chocolate barfi had an existential crisis amid threats that it would be taxed as ‘chocolate’. However, the GST council clarified that the brown variant would remain part of the barfi khandaan. KitKat too escaped a heavier tax burden when it was classified as a biscuit and not chocolate

Actor vs cricketer

The income-tax authorities were stumped when in 2011, Sachin Tendulkar claimed that he had claimed exemptions for appearing in ads as he was an “actor” rather than a cricketer. They ruled in his favour. That’s what you call a masterstroke

Coconut oil vs hair oil

From papad to oil, Parachute doesn’t fancy calling its plain coconut oil ‘hair oil’ since that would invite the excise levy for cosmetic products. The little sachet, it argued in vain, was for those who use cooking oil ‘for small purposes’ – such as frying papad?

Game vs puzzle

And if you thought the issue of tax and nomenclature is all fun and games, well, some of it is. About 10 years ago, a weighty Supreme Court bench looked into the weighty matter of whether Scrabble is a game or puzzle. Many long words later (nobody got points), the bench ruled that it is not a puzzle and, therefore, liable to excise duties. The logic: a crossword is a puzzle because it has clues unlike Scrabble which is more about chance and skill

Exchange of tax information

2013-16: India’s compliance rating slips

India slips in OECD ratings on exchange of tax info, November 22, 2017: The Times of India

From: India slips in OECD ratings on exchange of tax info, November 22, 2017: The Times of India

Peer Review Seeks More Clarity In Requests For Data

India has slipped from a rating of ‘compliant’ to an overall rating of ‘largely compliant’ as regards its meeting international standards for exchange of tax information, according to a peer review. A set of peer review reports covering six countries, including India, were released recently by the Organisation for Economic Co-operation and Development (OECD).

A pertinent suggestion for India, is to “ensure the quality of the exchange of information (EoI) requests sent to tax authorities of other countries and an efficient communication with its EoI partners, in all cases”. A peer review of a country is periodically conducted by officials representing other countries to check the implementation of the OECD-stipulated standards of transparency and exchange of information, which helps combat offshore tax evasion.

EoI requests made by India’s tax authorities to its counterparts worldwide have resulted in India detecting over Rs 1,900 crore in undisclosed bank accounts and 171 prosecutions in 123 cases. This covers cases where details of hundreds of offshore accounts were disclosed by the International Consortium of Investigative Journalists (ICIJ) in April 2013, and details of alleged unaccounted HSBC bank accounts in Switzerland which were uncovered via another leak in February 2015, cites the peer review report.

The current peer review covers the period July 1, 2013 to June 30, 2016. The report notes that the earlier review (report released in 2013) did not take into account the quality of information exchange requests sent by India to other countries or its communication with foreign tax authorities. The earlier report also did not factor the availability of information in India relating to beneficial ownership. Both these new parameters, on which India was judged as ‘largely compliant’, also pulled down its overall rating.

While India has legal and regulatory norms in place for disclosure of beneficial ownership in e-tax returns and under anti-money laundering regulations, the peer review group has suggested that India’s tax authorities monitor the quality of information collected via income tax (I-T) returns. As regards EoI requests, the report calls for greater clarity of such requests made by India’s tax authorities. They should also demonstrate the relevance of their requests and improve communications with the tax authorities in other countries, notably where bulk requests or complex requests are concerned, adds the report.

India extensively relies on the EoI mechanism. During the peer review period, it received 298 requests largely from tax officials in Belgium, Norway, US, Singapore and Indonesia. On the other hand, 3,787 requests were sent by India’s tax authorities to officials, mainly in British Virgin Islands (BVI), France, Singapore, Mauritius and UAE.

A retired government official said, “In the initial period covered by the review, Indian tax authorities lacked adequate expertise and experience in framing EoI requests. It was only in May 2015 that the CBDT issued a revised comprehensive manual on exchange of information, as ‘fishing expeditions’ — cases where information was sought without any concrete basis — had given India a bad name.” The peer review report concedes that since 2015, India has shown improvements in the quality of its requests and is also implementing an action plan.

Exemptions claimed

Tax exemption limits over the years/ 1949, 2015

See graphic:

Income tax exemption limits:1949-2015

Tax exemption limits over the years/ 1949, 2017

See graphics:

Payment of income tax, 1949-2017, some salient changes

Tax-free income levels in 1949 and 2017

From: January 15, 2018: The Times of India

Exemptions on agricultural income: 2013-14

In 2013-14, ten top bodies claimed Rs 628cr tax breaks Oct 03 2016 : The Times of India

The Times of India

The comptroller and auditor general has initiated an audit of entities claiming tax exemption on agricultural income amid suggestions from some political parties and income tax authorities that a blanket exemp tion be done away with and tax be levied after a threshold.

The auditor has written to the finance ministry seeking details of entities which have declared agricultural income and the amount of tax exemption granted to them. Recently, tax authorities had raised concerns about possible misuse of the exemption availab le to agricultural income, although the government has clearly said that there was no move to impose tax.

Finance ministry data showed that nearly four lakh people declaring farm income had been granted exemption during 2013-14. Total agricultural in come exempted from tax in 2013-14 was Rs 9,338 crore.

The details were as per the list of those who had filed their returns till November 2014.

During 2013-14, the top 10 entities had claimed tax exemption of Rs 628 crore on their agricultural income and the list included multinational seed distribution companies. In fact, those declaring over Rs 1 crore agricultural income had come under the lens recently .

Evasion of taxes; evaders

2013-18

From: Sidhartha, Govt goes after tax evaders, sees threefold jump in prosecution, April 30, 2018: The Times of India

Tax defaulters cannot hope to get away lightly any longer. The income tax (I-T) department had initiated prosecution in close to 7,700 cases during the financial year 2017-18, an over threefold jump compared with the previous year.

Similarly, there was a near fourfold rise in the prosecution cases filed in court, which totalled over 4,500 in FY18 compared with 1,252 in the previous year, data accessed by TOI showed.

The efforts have resulted in conviction of 75 tax evaders during the last financial year, compared to 16 in the previous year.

In the past, the government was lenient in chasing those who did not pay taxes although a tax demand had been raised. Or in several cases, individuals who had to file returns got away without actually doing so.

“If you want voluntary compliance in 99% of the cases, then you have to target those who are not following the law. In other countries, you cannot get away after committing serious tax offences,” a senior tax official told TOI. Sources said that in a number of cases, people were not even afraid of searches and used them to clear their liability. Further, there were several instances where tax was deducted at source (TDS) but the amount was not deducted. “This is a serious offence and we are taking it very seriously,” another official said.

As a result, the government is now focusing on cases where there is “wilful attempt” to evade taxes or penalty with even late returns and false statements under the scanner.

Prosecution was a key agenda point in last year’s action plan, along with compounding in case of less serious offences and the department is expected to retain the focus during the current financial year as well.

2018: The top defaulters

Sidhartha, Rajeev Deshpande, January 23, 2019: The Times of India

From: Sidhartha, Rajeev Deshpande, January 23, 2019: The Times of India

The government has cracked the whip on several large companies, which had either failed to deposit tax deducted at source (TDS) + with the income tax (I-T) department or delayed the payment, with claims against top 10 such entities adding up to nearly Rs 350 crore. I-T authorities have gone ahead and launched prosecution action, while some of the companies have come forward to settle the cases. Under the law, individuals as well as companies have to deduct tax for several payments — ranging from salaries to rent and payments to contractors above a specified threshold.

The payments also have to be made during a stipulated period, failing which a company is liable to be prosecuted as the government sees this as a major violation. While a large number of cases relate to 2016-17, 2017-18 as well as the current financial year, action has been taken in cases where default dates back to 2012-13 as well, sources told TOI.

On top of the pile is Crest Logistics and Engineers, with delayed payments and defaults adding up to Rs 110 crore. Construction company HCC was also on the list, where tax authorities stepped in to recover dues of around Rs 65 crore, while Hubtown (that was earlier Ackruti City), had delayed payments of Rs 50 crore. Tax officials said apart from default by a company, the violation impacted employees and other entities who were unable to file returns due to someone else’s fault.

“The department’s action is not against any honest taxpayer but only relates to large violators. When action is taken against large taxpayers, they along with consultants raise a bogey of tax terrorism,” said a senior source. “HCC is fully tax-compliant. In the past two financial years, delays were caused due to a substantial lock-up of funds due from various government agencies. HCC is pro-actively engaged with tax authorities to resolve any outstanding issues concerning the same, including receipt of any notices,” the company said in response to a questionnaire from TOI. Three Essar Group companies also faced action, which have now sought compounding of cases along with Lodha Developers.

“Essar Group companies are by and large up to date in payment of all statutory dues. Some group companies may have had to delay some payments due to factors and business cycles beyond their control. The delays, if any, towards TDS are being addressed in discussions with the tax department and the respective companies are entering into compounding arrangements with the relevant tax departments, for an early and satisfactory closure,” an Essar spokesperson said.

A spokesperson for Eros International said, “Eros International has complied (with) its TDS obligation for the financial year 2016-17 and 2017-18 and there has been no action on the company.” Some of the companies — Lodha Developers, 3i Infotech, Bombay Rayon and E land Apparel — did not respond to questionnaires e-mailed on Tuesday evening. Three companies could not be reached for a comment. Sources in some of the companies approached for comment said they had cleared the dues.

Raids/ ‘surveys’

2017-19: Raids on politicians

I-T heat faced more by oppn than by BJP members, April 11, 2019: The Times of India

With income tax searches on close aides of Madhya Pradesh CM Kamal Nath over the past few days leading to allegations of political bias, a perusal of most “politically sensitive” operations in the last one year shows that more leaders of opposition parties have faced action.

Among the cases involving the ruling party at the Centre, Rs 1.8 crore was seized from a BJP candidate’s son in Arunachal Pradesh. The state police filed an FIR on the Election Commission’s directive. Usually, in such cases, seizure details are immediately shared with the tax department for further investigation. However, nothing is known yet on the action taken by the tax officials.

Former Karnataka CM B S Yeddyurappa was questioned by I-T investigation on November 25, 2017, in the context of Congress leader D K Shivakumar having produced some loose sheets alleging the senior BJP leader paid massive sums to his party’s central leadership in unaccounted cash.

Shivakumar himself was earlier searched and questioned by I-T officials in October 2017 for alleged tax evasion. The I-T department conducted searches at 64 locations on properties linked to Shivakumar, who was then energy minister of Karnataka and overseeing the stay of 44 Congress MLAs from Gujarat at a resort near Bengaluru for fear of being poached by BJP. I-T officials had then claimed that Rs 10 crore in unaccounted cash was recovered during the raids.

There have been other cases of involvement of BJP leaders. In 2015, the Enforcement Directorate, while probing a money laundering case against former IPL chairman Lalit Modi, found that a firm owned by then Rajasthan CM Vasundhara Raje’s son, Dushyant Singh, a BJP MP from Jhalawar-Baran, had received Rs 11.63 crore from an entity belonging to the former IPL commissioner.

In January, I-T officials raided premises of BJP leader Anil Goyal in Uttarakhand. In the last one year, the tax department has made a series of searches that have involved leaders of SP, BSP, RJD, TDP, JD(S), DMK and Congress. The department has said it is acting on information recieved and not on the basis of a select list of targets.

On Tuesday, I-T officials searched a cost accountant in Vijayawada and Rs 45 lakh in unaccounted cash was recovered. The accused said he was providing services to TDP MP Galla Jayadaev for election purposes. On April 3, I-T officials searched the premises of Congress leader M S Atmananda on suspicion of having unaccounted cash. This came a week after action against JD(S) leaders in Mandya, including residences of Karnataka irrigation minister C S Puttaraju.

On March 12, I-T officials searched premises of former UP-cadre IAS officer Netram, former principal secretary to ex-UP CM Mayawati. The tax department, which later attached properties worth Rs 225 crore of Netram and his associated entities, claimed it had diaries that had details of transactions and political links. Similar searches were conducted on people close to SP chief Akhilesh Yadav in a mining lease case.

In October 2018, the department had attached more than 17 properties worth over Rs 128 crore of family members of former Bihar CM Lalu Prasad. In 2017, AAP came under scrutiny after the I-T department served notice for undisclosed donations of Rs 13 crore in its books of accounts.

Return form

Online returns

2016: 2.2 crore filed

The Times of India, Aug 09 2016

The income tax (I-T) department has issued refunds to 55 lakh assessees for Rs 14,300 crore till last week, in the first four months of the current financial year. This includes refunds of around Rs 3,000 crore for assessment year 201617, the last date of filing of returns for which was August 5. This is the first time that the government has refunded such a large tax surplus even before the date for filing returns had expired. A new benchmark has also been set with 2.27 crore people filing online returns this year, compared to 71 lakh in 2015-16. The total returns filed were a little more than two crore till the extended date of September 7 last year. A finance ministry statement said the growth in e-returns this year has been over 9.8%. Faster refunds have been possible as a large number of taxpayers have used the everification facility this time. The e-verification of re turns has been used by over 75 lakh taxpayers till August 5 as compared to 33 lakh last year till September 7.

This time, Aadhaar-based everification was used by 17.68 lakh taxpayers during the current year as against 10.41 lakh during the same period in 201516. At least 3.32 lakh digitally signed their returns. “Over 35% of taxpayers have already completed the entire process of return submission electronically,“ the ministry said.

The department has been encouraging taxpayers to use e-verification process as an easy alternative to sending their return forms to the I-T's central processing centre in Bengaluru for verification.

2018: What is different?

April 6, 2018: The Times of India

HIGHLIGHTS

The new ITR form mandates salaried class assessees to provide their salary breakup and businessmen their GST number and turnover

All the seven ITRs are to be filed electronically except for some category of taxpayers

The last date for filing the ITR is July 31

The new Income Tax Return (ITR) forms for the assessment year 2018-19 were notified on Thursday by the Central Board of Direct Taxes (CBDT) that mandated salaried class assessees to provide their salary breakup and businessmen their GST number and turnover.

The policy-making body of the tax department said some fields have been "rationalised" in the latest forms and that there is no change in the manner of filing the ITRs as compared to last year.

All the seven ITRs are to be filed electronically except for some category of taxpayers, the CBDT said in a statement.

The most basic -- ITR-1 or Sahaj -- is to be filled by the salaried class of taxpayers, which was used by 3 crore taxpayers during the last financial year.

The form this time seeks an assessees salary details in separate fields and in a breakup format such as allowances that are not exempt, value of perquisites, profit in lieu of salary and deductions claimed under section 16.

These details are provided in the Form 16 of a salaried employee and a senior tax official said that these are now meant to be mentioned in the ITR for clarity of deductions.

The CBDT said the ITR-1 can be filed by an individual who "is resident other than not ordinarily resident and having income of up to Rs 50 lakh and who is receiving income from salary, one house property or other interest income".

"Further, the parts relating to salary and house property have been rationalised and furnishing of basic details of salary (as available in Form 16) and income from house property have been mandated," CBDT spokesperson Surabhi Ahluwalia said.

The ITR-2 has "also been rationalised" for individuals and HUFs (Hindu Undivided Families) having income under any head other than business or profession.

"The individuals and HUFs having income under the head business or profession shall file either ITR-3 or ITR-4 in presumptive income cases," the statement said.

Under the ITR-4, assessees who have presumptive income from business and profession will have to furnish their GST registration number and its turnover.

In case of non-resident taxpayers, the requirement of furnishing details of "any one" foreign bank account has been continued like the last time for the purpose of credit of refund, it said.

Further, the statement said, the requirement of furnishing details of cash deposit made during a specified period (in the wake of the note ban of 2016) as provided in ITR form for the Assessment Year 2017-18 has been "done away with" this time.

Space has also been provided in forms to either mention the 12-digit Aadhaar number or the 28-digit enrolment Aadhaar ID, as was the case in last years' forms.

The CBDT said that individual taxpayers of 80 years or more at any time during the previous year or an individual or HUF whose income does not exceed Rs 5 lakh and who has not claimed any refund, can file ITR in the paper form, using the ITR-1 or ITR-4.

The new ITRs have been uploaded on the official website of the department--www.incometaxindia.gov.in.

The last date for filing the ITR is July 31.

Refunds

2008-17: Interest on delayed refunds cost ₹58,000 cr

From: Interest on delayed I-T refunds cost CBDT ₹58,000 cr in 9 years, December 20, 2017: The Times of India

See graphic:

Interest paid on late refunds of income tax, 2008-17

The Central Board of Direct Tax has incurred an expenditure of over Rs 58,500 crore in the last nine years only on interest paid to individuals and corporates for delayed refunds of excess income tax paid to the department.

The comptroller and auditor general, in its report tabled in Parliament on Tuesday, has criticised the CBDT and the revenue department in the finance ministry for not making budgetary provisions for the interest to be paid on delayed refunds and incurring such expenditure without the approval of Parliament.

“As in the past, no budget provision for interest on refunds was made in the budget estimates for the financial year 2016-17 and expenditure on interest on refunds amounting to Rs 2,598 crore was incurred by the department in contravention of provisions of the Constitution and in disregard of the recommendations of the public accounts committee,” CAG observed.

It said an expenditure of Rs 58,537 crore on interest payments had been incurred over a period of last nine years without obtaining approval of the Parliament through necessary appropriation.

The CBDT, however, informed the CAG that on the basis of opinion of the attorney general “holding the current practice of treating interest on refund as reduction of revenue and with the approval of the ministry of finance, recommendations of the PAC were not accepted”.

The CBDT classifies interest on refunds of excess tax as reduction in revenue. However, successive CAG’s audit reports have commented on this incorrect practice and observed that the department has failed to take any corrective action.

The CAG pointed out: “Article 114(3) of the Constitution stipulates that no money shall be withdrawn from the Consolidated Fund of India except under appropriation made by law. Payment of interest on refunds of excess tax is a charge on the Consolidated Fund and is, therefore, payable only after having been authorised under due appropriation made by law.”

Women’s income

Urban women

The Times of India, July 26, 2011

Samidha Sharma & Namrata Singh

Urban women’s average income doubles in 10yrs

Mumbai: Reinforcing the growing financial independence of women in India, a survey says the income level of urban Indian women has doubled in the last decade. This increase has also led to the average urban household income doubling, according to a study by market research firm IMRB. The urban Indian woman, who earned Rs 4,492 per month in 2001, took home Rs 9,457 as of 2010. The rise in income is directly reflected in the average monthly household income of urban India going up from Rs 8,242 to Rs 16,509 in 2010, says the survey. While this seems impressive, urban incomes seem to have gone up significantly less than those of the average Indian. According to official data, India’s per capita income rose from Rs 16,688 in 2000-01 to Rs 54,835 in 2010-11, a rise of 228%. The IMRB figures suggest urban incomes in the same period rose by 100% and incomes of urban women by 111%.

“We have aligned our strategy, communication and products to women. And with the growing aspirations and financial independence of women not only in urban India but in tier II and tier III cities, women are at the core of our business. The woman today is buying for herself and for her family,” said Kishore Biyani, founder, Future Group.

2001-10

Urban women’s avg income rose from 4,492/month in 2001 to 9,457 in 2010

Avg monthly household income of urban India rose from 8,242 to 16,509

No. of women doing household work dropped from 91% to 71%, says survey Women sourcing household work

As the income level of urban Indian women is rising fast, retail giant Future Group, which runs stores like Pantaloon and Big Bazaar, has seen the contribution of womenswear to overall sales more than double from 22% when it started operations to 55% at present.

What is significant in the survey is that with the woman’s personal income doubling, she is increasingly outsourcing household work. From 91% women saying they did household work themselves, the number has dropped to 71% in 2010, according to the survey. “With the average income of women and of urban households increasing over the years the propensity to spend has also gone up significantly. Although, there is a strong sense of deriving value for money out of all purchases made, the thought of putting all of the household income into savings is slowly diminishing,” said Ashish Karnad, group business director, IMRB International.

Brand experts say the changes over the last decade where more of the buying power is moving into the hands of woman has led to her influence in purchases even in categories predominantly of male consumption. “There remain very few areas of consumption in which the female does not increasingly participate today. Most household purchase decisions are either joint or exclusively female,” Tanya Dubash, ED, Godrej Industries.

See also

Income Tax India: Expert advice

Income Tax India: Statistics: this page includes historical details of income tax rates and tax exemption limits over the years; how many Indians pay I Tax; how the income of women has risen over the years; the extent of tax arrears...