Cell/ Mobile phones: India

(→2018/ villages (not) having mobile network coverage, state-wise) |

(→2019: ownership trends; 2015-19: technology used) |

||

| (22 intermediate revisions by 2 users not shown) | |||

| Line 8: | Line 8: | ||

See [[examples]] and a tutorial.</div> | See [[examples]] and a tutorial.</div> | ||

|} | |} | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

Cell phones: India | Cell phones: India | ||

| − | =App(lication)s/ Apps= | + | =History in India = |

| + | ==1994-2020 == | ||

| + | [[File: A History of Cell- mobile- phones in India, 1994-2020..jpg|A History of Cell-/ mobile- phones in India, 1994-2020. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F08%2F02&entity=Ar01309&sk=5285F1F8&mode=image August 2, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' A History of Cell-/ mobile- phones in India, 1994-2020. '' | ||

| + | |||

| + | = App(lication)s/ Apps: by genre/ category= | ||

| + | ==Dating apps== | ||

| + | ===2020? India and the world === | ||

| + | [[File: Usage of Dating apps in India and the world, presumably in 2020.jpg|Usage of Dating apps in India and the world, presumably in 2020 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F02%2F15&entity=Ar01909&sk=086C332C&mode=image February 15, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Usage of Dating apps in India and the world, presumably in 2020 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | |||

| + | =App(lication)s/ Apps: usage of= | ||

==App usage by Indians: 2016,17== | ==App usage by Indians: 2016,17== | ||

| Line 138: | Line 166: | ||

''In Jan-Feb 2018, India overtook the US as the country with the highest number of paid or promoted app(lication) downloads'' | ''In Jan-Feb 2018, India overtook the US as the country with the highest number of paid or promoted app(lication) downloads'' | ||

| + | |||

| + | ==2019, 20: USAGE OF Chinese Apps== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F02%2F16&entity=Ar02115&sk=818CCE13&mode=text Sindhu Hariharan, February 16, 2021: ''The Times of India''] | ||

| + | |||

| + | [[File: HQ of top 200 apps in India (by installs), 2019-20.jpg|HQ of top 200 apps in India (by installs), 2019-20 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F02%2F16&entity=Ar02115&sk=818CCE13&mode=text Sindhu Hariharan, February 16, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | Geopolitical tensions between India and China and the rise of local developers have resulted in Indian apps holding a larger chunk of the overall market at the cost of Chinese options. | ||

| + | |||

| + | The share of installs of Chinese apps slipped to 29% in 2020 from 38% in 2019, a report by analytics firm Apps-Flyer said. Indian apps leveraged this opportunity by dominating the install volume with 39% share in 2020. | ||

| + | |||

| + | China’s loss was also captured by apps from Israel, the US, Russia, and Germany. These countries made further inroads too into India’s rapidly growing app market, the report noted. | ||

| + | |||

| + | “With app marketers increasingly expanding their remit to cover tier-2 and tier-3 regions, the demand from semi-urban areas is firing up India’s app consumption. In this highly diverse and fragmented marketplace, personalised content is critical to engage and retain customers,” Sanjay Trisal, country manager, AppsFlyer India, said. | ||

| + | |||

| + | States with semi-urban areas emerged as the sweet spot for mobile usage, the study showed. Around 85% of app installs came from tier-2 and tire-3 cities. With people spending more time at home, dependency on apps increased on the one hand. But, on the other, it also meant that users had more time to declutter their phones and remove unwanted apps. | ||

| + | |||

| + | In an indication of cut-throat competition across verticals, retention rate (number of users using the app after a certain number of days) dipped and day-1 uninstall rates (number of times users uninstalled the app on the day of install itself) increased. | ||

| + | |||

| + | For an average app, overall retention rate across verticals fell this year by around 12% as marketing budgets were slashed due to the pandemic, the report said. While on day one, the retention rate of apps was at 22.3% this dipped to1.7% by day 30, the study showed. | ||

| + | |||

| + | Indian app users continued to prefer apps that take up less space on phones, consume less data, and are more seamless to use in spotty connectivity. | ||

| + | |||

| + | Overall, day-1 uninstall rates stood at 27% (marginally up from 26% last year). This was higher for gaming, food and finance apps at 32%, 32% and 30%, respectively. | ||

| + | While most players in India’s nascent app economy prioritise new user acquisition over retention, without a retention strategy, companies are essentially spending resources with no benefit, analysts said. | ||

| + | |||

| + | AppsFlyer’s study analysed 7.3 billion installs recorded in India between January 1 and November 30, 2020 covering 4,519 apps across verticals. | ||

| + | |||

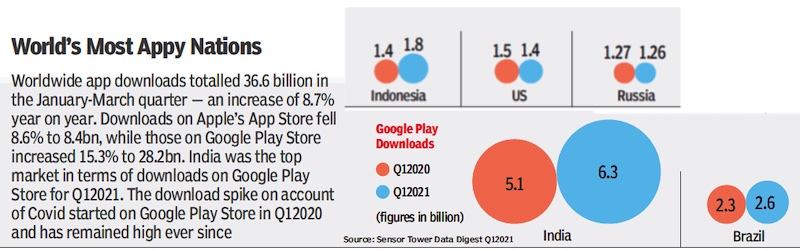

| + | == India’s rank in the world: 2020, 21 May == | ||

| + | [[File: The usage of apps, India’s rank in the world- 2020, 21 May.jpg| The usage of apps, India’s rank in the world: 2020, 21 May <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/06/19&entity=Ar02506&sk=9E4FE158&mode=image June 19, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' The usage of apps, India’s rank in the world: 2020, 21 May '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

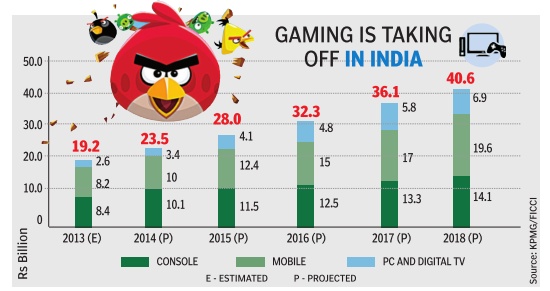

=Cell phone gaming= | =Cell phone gaming= | ||

| Line 178: | Line 251: | ||

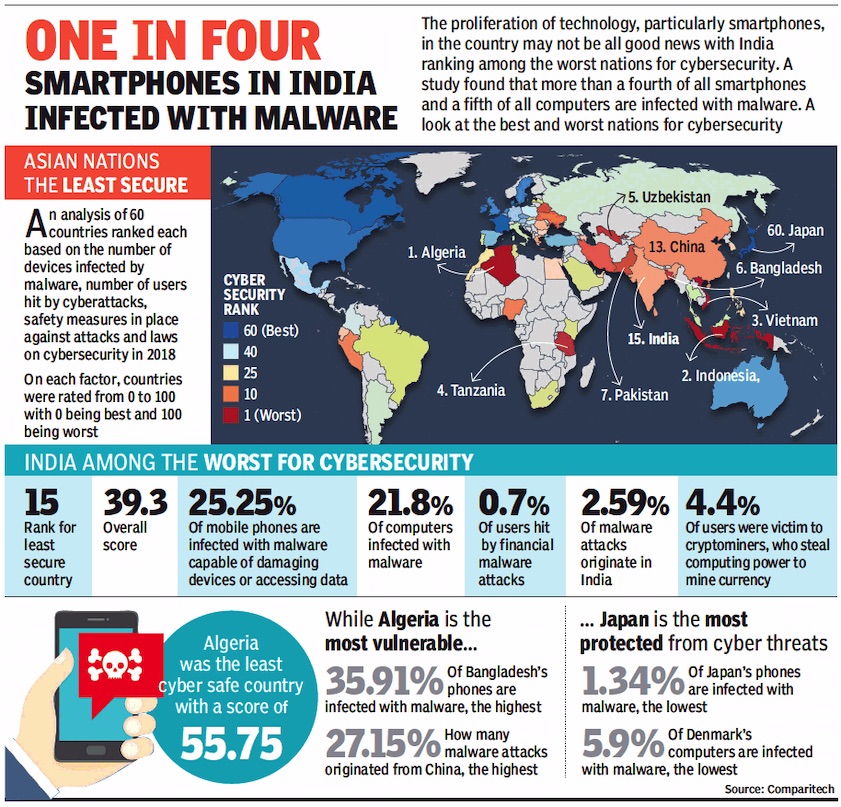

''Malware in smartphones in Bangladesh, China, India, Pakistan and other Afro-Asian countries, presumably as in 2018.'' | ''Malware in smartphones in Bangladesh, China, India, Pakistan and other Afro-Asian countries, presumably as in 2018.'' | ||

| + | |||

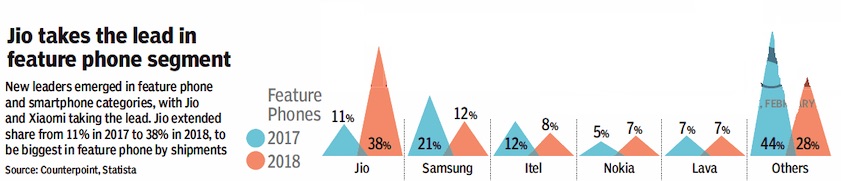

| + | =Feature- and smart- phones= | ||

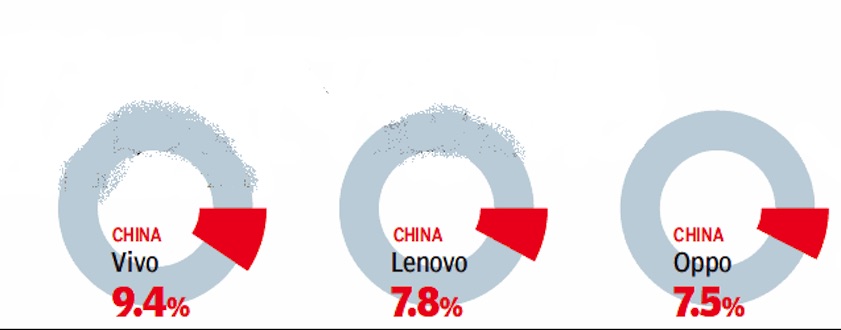

| + | ==Sales: 2017, 2018== | ||

| + | [[File: Feature- phone sales in India- 2017, 2018.jpg|Feature- phone sales in India- 2017, 2018 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F18&entity=Ar01909&sk=13609B96&mode=image February 18, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: Smart- phone sales in India- 2017, 2018.jpg|Smart- phone sales in India- 2017, 2018 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F18&entity=Ar01909&sk=13609B96&mode=image February 18, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | ''Feature- phone sales in India- 2017, 2018'' | ||

| + | |||

| + | ''Smart- phone sales in India- 2017, 2018'' | ||

| + | |||

| + | = India vis-à-vis the world= | ||

| + | ==2019: ownership trends; 2015-19: technology used== | ||

| + | [[File: Cell Mobile phones used in India vis-à-vis other countries, 2019- ownership trends; 2015-19, technology used.jpg|Cell Mobile phones used in India vis-à-vis other countries <br/> 2019: ownership trends; 2015-19: technology used <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2019/12/04&entity=Ar00202&sk=FAA55699&mode=image Dec 4, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Cell Mobile phones used in India vis-à-vis other countries <br/> 2019: ownership trends; 2015-19: technology used '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

= Payments (through mobiles)/ Mobile payments= | = Payments (through mobiles)/ Mobile payments= | ||

| Line 188: | Line 292: | ||

=Smart-/ cell- phones: production in India= | =Smart-/ cell- phones: production in India= | ||

| − | ==Ringing Bells== | + | ==1995-2018: 9,000-fold growth== |

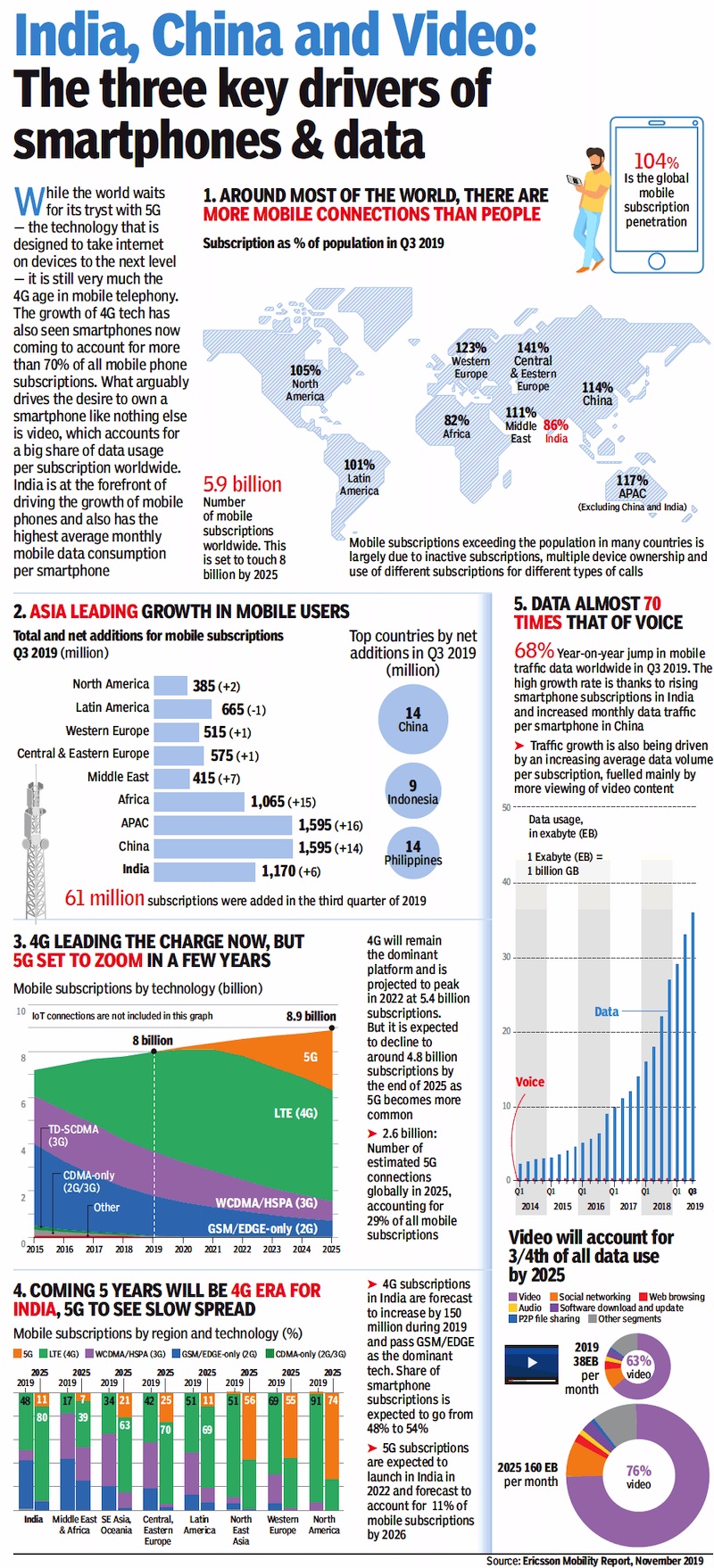

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F06%2F20&entity=Ar01909&sk=E49100E8&mode=text Between 1995 and now, 9,000-fold growth in mobile phone connections, June 20, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Cell phone subscriptions per 100 persons, 1995-2018.jpg|Cell phone subscriptions per 100 persons, 1995-2018 <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F06%2F20&entity=Ar01909&sk=E49100E8&mode=text Between 1995 and now, 9,000-fold growth in mobile phone connections, June 20, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Cell phone subscriptions per 100 persons, 1995-2018 '' | ||

| + | |||

| + | |||

| + | The private sector wasn’t allowed in telecom until 1991, and then only for value-added services like mobile calling and paging. In 1994, private companies were allowed to invest in telecom, starting a revolution that has made India the world’s second-biggest wireless market after China. Where only 1 in 10,000 Indians had a mobile phone in 1995, now 8,900 of every 10,000 have them. | ||

| + | |||

| + | |||

| + | ==Ringing Bells failed to ring== | ||

[http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Until-Ringing-Bells-Goel-had-small-grocery-shop-19022016013020 ''The Times of India''], Feb 19 2016 | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Until-Ringing-Bells-Goel-had-small-grocery-shop-19022016013020 ''The Times of India''], Feb 19 2016 | ||

| Line 205: | Line 323: | ||

This surely is a dampener after the excitement created around the Rs 251smartphone, unveiled by a Noida-based company -Ringing Bells. The company's website only way to book the phone could not f take orders on Thursday. According to those who logged on to the , website, bookings could not be made, even though some had logged in very early in the day. Earlier, Ringing Bells had said that people can make a booking for the phone from its website from 6 am onwards. However, the company in a written message on the website said that an overwhelming response to the offer had over-loaded the servers that , now needed to be upgraded. “... we are very grateful for your enormous response and your kind patronage and would submit that as of now we (have) received approximately six lakh hits per second. As a result of your kind overwhelming response, servers are over loaded. We humbly submit that we are therefore taking a pause and upgrading the service and will revert within or before 24 hours,“ the company said. | This surely is a dampener after the excitement created around the Rs 251smartphone, unveiled by a Noida-based company -Ringing Bells. The company's website only way to book the phone could not f take orders on Thursday. According to those who logged on to the , website, bookings could not be made, even though some had logged in very early in the day. Earlier, Ringing Bells had said that people can make a booking for the phone from its website from 6 am onwards. However, the company in a written message on the website said that an overwhelming response to the offer had over-loaded the servers that , now needed to be upgraded. “... we are very grateful for your enormous response and your kind patronage and would submit that as of now we (have) received approximately six lakh hits per second. As a result of your kind overwhelming response, servers are over loaded. We humbly submit that we are therefore taking a pause and upgrading the service and will revert within or before 24 hours,“ the company said. | ||

| + | ===2021: Goel arrested for dry fruits=== | ||

| + | Noida: Rs 251 smartphone man Mohit Goel now accused of dry fruits fraud, arrested | ||

| + | |||

| + | Jan 12, 2021 Source: TOI.in The Times of India | ||

| + | |||

| + | His idea of a smartphone for Rs 251 vanished without a trace but not Mohit Goel. The Noida-based entrepreneur, who had started the company Ringing Bells and named the phone it planned to launch ‘Freedom 251’, has been popping up on the police radar since. This time, Goel stands accused of cheating scores of dry fruit traders in what police say is a Rs 200-crore fraud. Goel, who was running a company called Dubai Dry fruits and Spices Hub with five others, was arrested near Meghdootam Park in Sector 51. Among police’s immediate recoveries were an Audi, 60 kg dry fruits and documents. | ||

| + | The company operated out of Corenthum, the premier office complex in Sector 62, and paid a rent of Rs 3 lakh per month. Among their employees were three foreigners, who handled the front office as receptionists, police said. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIA]] | ||

==2014-17== | ==2014-17== | ||

| Line 306: | Line 441: | ||

“The sales channels have changed, there isn’t anyone now who can spend like Oppo and Vivo did, going into the deepest pockets and giving shopkeepers rentals to put up their glow signs. Now, even Oppo and Vivo have curtailed spends,” IDC’s Singh cautioned. | “The sales channels have changed, there isn’t anyone now who can spend like Oppo and Vivo did, going into the deepest pockets and giving shopkeepers rentals to put up their glow signs. Now, even Oppo and Vivo have curtailed spends,” IDC’s Singh cautioned. | ||

| + | |||

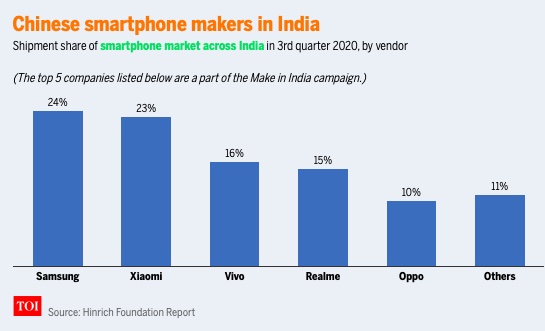

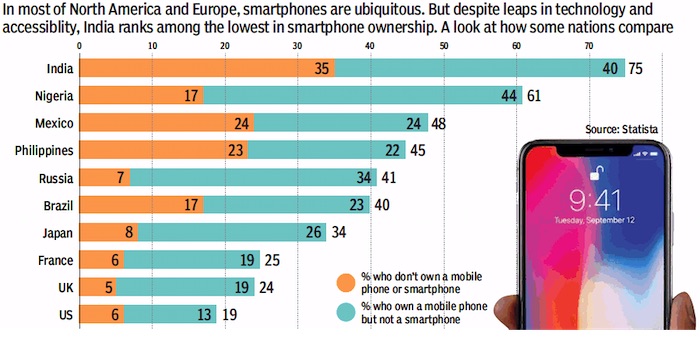

| + | ==2020== | ||

| + | [[File: Chinese smartphone makers in India, 2020.jpg|Chinese smartphone makers in India, 2020 <br/> From: [https://timesofindia.indiatimes.com/business/india-business/how-india-can-become-a-major-tech-hub/articleshow/81764046.cms March 30, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''' Chinese smartphone makers in India, 2020 ''' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

=Smart-phone usage in India= | =Smart-phone usage in India= | ||

| Line 343: | Line 497: | ||

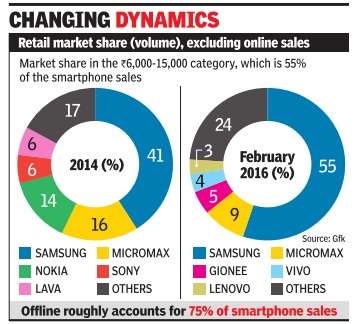

[[File: Top brands share , India Today , June 20,2016 .jpg| Top brands share , India Today , June 20,2016 |frame|500px]] | [[File: Top brands share , India Today , June 20,2016 .jpg| Top brands share , India Today , June 20,2016 |frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''Top brands share , India Today , June 20,2016'' | ||

| + | |||

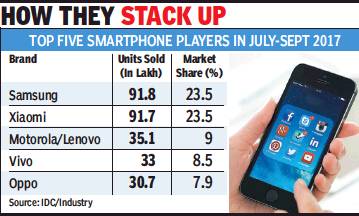

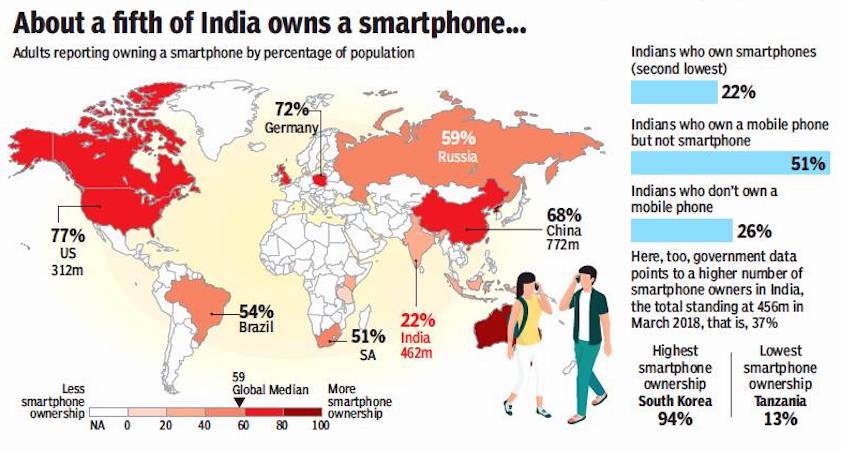

| + | ==2015-18: market-share of Chinese, India brands== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F11&entity=Ar01707&sk=7F321988&mode=text Pankaj Doval, Chinese phones mute Indian brands, February 11, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: 2015-18- the market-share of Chinese and India brands Cell, Mobile phones.jpg|2015-18: the market-share of Chinese and India brands Cell/Mobile phones. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F02%2F11&entity=Ar01707&sk=7F321988&mode=text Pankaj Doval, Chinese phones mute Indian brands, February 11, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Once popular across smartphone users, homegrown Indian companies have lost out in the race to Chinese brands, which today account for six out of every 10 devices sold in the country. Indian brands such as Micromax, Karbonn, Lava and Intex — which used to lord over the burgeoning smartphone market till just four years ago — are just a pale shadow of their dominant self, finishing 2018 with a single-digit share against 43% recorded in 2015. | ||

| + | |||

| + | Chinese brands such as Xiaomi, OnePlus have been witnessing massive growth as they introduced new models, packed them with latest features, and backed it up with aggressive pricing. Having harnessed the online sales channels through an intelligent ‘flash sales’ mode to create a buzz around their highly affordable devices, the companies have now started to target the offline — or brick-and-mortar — market through ‘Made in India’ devices, even unsettling Korean behemoth Samsung from the top position in the process. | ||

| + | |||

| + | The exception to this sorry state of affairs of Indian brands has been Reliance Jio, but only in features phones, which are mostly bundled with its mobile telecom services. Jio dominates feature phones market with a share of nearly 40%. Second-ranked Samsung is estimated to have a share of 12%. | ||

| + | |||

| + | So, what led to this fall of Indian brands? “The Chinese brands had been very aggressive from the very beginning. They were very strong when the transition from 3G to 4G devices was happening,” says Tarun Pathak, associate director at Counterpoint Research. “Indian brands — such as Micromax — were busy clearing large pile-up of 3G inventory, which was clearly outdated.” | ||

| + | |||

| + | Also, Indian brands failed to read larger consumer trends. As Chinese companies expanded their portfolio and brought in new features, Indian companies were slow to react, lagging in introducing features such as 4G, dual camera, finger-print sensor, or glass-back. For example, Counterpoint estimates that glass-back — which gives a premium feel to devices — is already on 26% of smartphones, and is expected to have a 60% share by end-2020. | ||

| + | |||

| + | The Chinese companies’ decision to initially target the online model really worked in terms of keeping costs under check and reaching buyers faster. Also, their focus on highpitched marketing and advertising campaigns — even an expensive cricket sponsorship — helped them gain visibility very fast. “Indian companies were not in touch with reality, and had lost focus,” says Mohan Shukla, a telecom industry veteran and CEO of consulting firm FinXPros. | ||

| + | |||

| + | According to Ashok Gupta, whose company Optiemus had an Indian phone brand Zen, the Chinese have “literally killed” local brands. “Our homegrown industry stands nowhere… Selling smartphones means suffering losses,” says Gupta. “Earlier it was entry time for people in smartphone, now it’s time to exit. I am not pessimistic, but if I face certain death, then I will save myself,” says Gupta, whose company now does contract-manufacturing for other brands, apart from making Blackberry phones. | ||

| + | |||

| + | It is time to have “champion Indian brands” to counter the trend, says Pankaj Mohindroo, chairman of India Cellular and Electronics Association. “We have sought a special dispensation from the government for creating global Indian companies. It is the need of the hour. Fighting Chinese brands is like fighting a nation.” | ||

==2016, a slide in sale== | ==2016, a slide in sale== | ||

| Line 442: | Line 621: | ||

==2018/ villages (not) having mobile network coverage, state-wise== | ==2018/ villages (not) having mobile network coverage, state-wise== | ||

| − | [[File: Villages without mobile network coverage; Villages without mobile network coverage as a % of total, presumably in 2018.jpg|Villages without mobile network coverage; <br/> Villages without mobile network coverage as a % of total, state-wise <br/> presumably in 2018 <br/> Source: Lok Sabha Question Hour; <br/> From: [https://epaper.thehindu.com/Home/ShareImage?Pictureid=GJK4CNBQU.1&fbclid=IwAR17_1xb5utfqfCwAcHgV0acbqiNJgp8s0IIolN_NjR-POFOu0Q2DmE0MHw July 19, | + | [[File: Villages without mobile network coverage; Villages without mobile network coverage as a % of total, presumably in 2018.jpg|Villages without mobile network coverage; <br/> Villages without mobile network coverage as a % of total, state-wise <br/> presumably in 2018 <br/> Source: Lok Sabha Question Hour; <br/> From: [https://epaper.thehindu.com/Home/ShareImage?Pictureid=GJK4CNBQU.1&fbclid=IwAR17_1xb5utfqfCwAcHgV0acbqiNJgp8s0IIolN_NjR-POFOu0Q2DmE0MHw July 19, 2018: ''The Hindu'']|frame|500px]] |

| Line 455: | Line 634: | ||

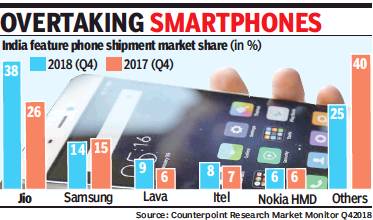

''Smartphone ownership in India and other countries, presumably as in 2018'' | ''Smartphone ownership in India and other countries, presumably as in 2018'' | ||

| + | |||

| + | ==2019, 2020== | ||

| + | [[File: 2019, 2020- THE biggest selling smartphones in India.jpg|2019, 2020: THE biggest selling smartphones in India <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F01%2F29&entity=Ar02302&sk=6D25F00E&mode=image January 29, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' 2019, 2020: THE biggest selling smartphones in India '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | |||

| + | ==40-45% of online smartphone sales are by resellers: Study== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F04%2F16&entity=Ar02003&sk=4500D1A9&mode=text Sindhu Hariharan, April 16, 2019: ''The Times of India''] | ||

| + | |||

| + | |||

| + | Smartphone purchases have long been considered a driver of online shopping among Indian end users, but that may not be entirely true. While industry estimates show that almost 40% of the smartphone sales happen online, a new study by tech consulting firm techARC noted nearly half (40-45%) of this is in the nature of “reseller fraudulent” sale. | ||

| + | |||

| + | This refers to small and medium-size sellers (or called resellers in this report) purchasing smartphones in bulk from online portals and selling them in the offline market, and techARC says this is hurting the entire smartphones e-commerce segment. | ||

| + | |||

| + | “With this volume of reseller fraud prevalent, the pure online sales contribution declines to 21-24% of the total smartphone sales,” the report said. techARC’s finding is based on interaction with retailers, distributors, logistics companies and others part of the value chain. | ||

| + | |||

| + | “Reseller fraud is modernday malpractices adopted by few, making the entire digital commerce of smartphones appear shoddy and shabby,” Faisal Kawoosa, founder and chief analyst, techARC said. | ||

| + | |||

| + | E-commerce portals have technological controls restricting the number of units a user can buy, but retailers find a way around it using various techniques, he said. | ||

| + | |||

| + | “The flash sales of smartphones by e-retailers is a key area, where we see resellers buying at a discount and selling to end consumers -who cannot buy or miss purchasing the models online- at full retail price,” Kawoosa explained. E-commerce portals like Amazon, Flipkart and others offer special discounts on smartphones to attract end-users and create an online buying culture, however under the reseller scenario, the benefit is taken up by other sellers. | ||

| + | |||

| + | The strategic importance of the online channel for sale of smartphones is also overstated, and this impacts the business plan of smartphone brands and other channel partners, the study notes. | ||

| + | |||

| + | “While brands should come heavily on resellers who are caught in such unethical trade practices, the digital commerce platforms need to reinforce business processes to arrest reseller fraud,” Kawoosa said. | ||

| + | |||

| + | The draft e-commerce policy released recently includes provisions to crackdown on piracy, sale of counterfeit products and sale of prohibited items among other things but does not address the loophole of reselling. Other industry watchers TOI spoke to said they too have come across instances of retailers buying online in bulk and selling in the offline market. E-commerce portals did not respond to TOI’s queries on existing controls to curb this practice. | ||

| + | |||

| + | The draft e-commerce policy released recently includes provisions to crackdown on piracy, sale of counterfeit products and sale of prohibited items among other things but does not address the loophole of reselling | ||

| + | |||

| + | ==2018-19: Indians upgrade smartphones == | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F10&entity=Ar02519&sk=98A3D81C&mode=text Sindhu Hariharan, August 10, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: 2018-19, Indians upgraded their smartphones.jpg| 2018-19: Indians upgraded their smartphones <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F10&entity=Ar02519&sk=98A3D81C&mode=text Sindhu Hariharan, August 10, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Indians upgrade smartphones quickly | ||

| + | |||

| + | Chennai: | ||

| + | |||

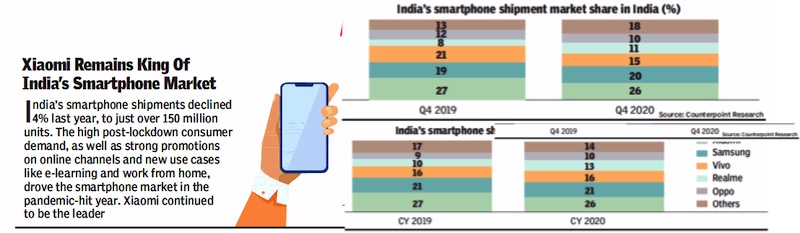

| + | India is set to lose its image as a ‘budget smartphone market’ as consumer aspirations push up demand for higher priced models. The share of smartphone shipments from the largest category (by volume) — the Rs 10,000-15,000 range — has reduced from 32% in June 2018 quarter to 30% in March 2019 quarter, and further to 27% in the latest quarter April-June quarter, data shared by Counterpoint Research showed. | ||

| + | |||

| + | Analysts attributed the shift to consumers willing to loosen their purse strings and move to the next bracket — Rs 15,000-20,000 range of smartphones. This category has doubled its share in the June quarter to almost 16% of shipments from 8% in the same quarter in the previous year. | ||

| + | |||

| + | Smartphones in the Rs 10,000-15,000 category include offerings from Xiaomi, Oppo and a few Samsung models. The Rs 15,000-20,000 range is dominated by Samsung, Vivo and Xiaomi’s recent highend offering Redmi K20. Overall, smartphone shipments in India grew in lower singledigits to 37 million units in the June quarter. | ||

| + | |||

| + | As Indian consumers mature and look toward multiple phones or higher models, the premium segment is also emerging as another beneficiary. Shipments in the premium segment (greater than Rs 30,000) grew almost 33% annually in the June quarter. | ||

| + | |||

| + | “The growth in the segment was mainly driven by flagship launches from One-Plus in terms of OnePlus 7 series, price cuts from Apple for its iPhone XR, and aggressive promotions from Samsung for Galaxy S10 series,” Counterpoint Research analyst Anshika Jain said. On a market share basis, the share of premium segment was at 4% in the June quarter, growing from 3% in the year-ago period. | ||

| + | “We are especially excited about growing the premium segment that is under-penetrated for several years with less than 5% share of the total smartphone segment,” OnePlus India general manager Vikas Agarwal said. | ||

| + | |||

| + | Further, users of premium smartphones also seem to be in a hurry to upgrade their devices. In a recent user survey by Counterpoint, a large majority (81%) of users said they replace their high-end smartphones before they are two years old. The survey said Samsung users replace their smartphones slightly faster than average, while OnePlus users hold on to their devices for a bit longer. “Almost six out of 10 Samsung users are interested in replacing their smartphone within the next year. About four out of every 10 users of OnePlus plan to buy a new smartphone in the next year,” the survey of around 800 respondents said. | ||

| + | |||

| + | Research firm Canalys noted that the bulk of growth in the Indian smartphone market is now coming from users who are upgrading their devices to a $200-300 (Rs 15,000-20,000) smartphone. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

=Spam= | =Spam= | ||

| Line 566: | Line 822: | ||

PUBG throws 100 players onto an island with scattered resources. Once the game starts, they need to find weapons to defend themselves with as the safe areas of the island begin to shrink. The last player or team surviving at the end of the round is the winner. | PUBG throws 100 players onto an island with scattered resources. Once the game starts, they need to find weapons to defend themselves with as the safe areas of the island begin to shrink. The last player or team surviving at the end of the round is the winner. | ||

| + | |||

| + | |||

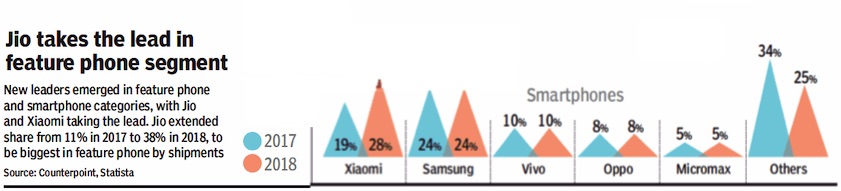

| + | ===2018: entertainment, sports, lifestyle=== | ||

| + | [https://timesofindia.indiatimes.com/business/entertainment-most-consumed-content-by-mobile-users/articleshow/70155465.cms July 10, 2019: ''The Times of India''] | ||

| + | |||

| + | Entertainment accounted for over a quarter of the content consumed by mobile users. It is followed by sports and lifestyle. Social media which saw its penetration rose to 17% in 2018 from 11% in 2015 accounts for just 10% of consumption . | ||

| + | |||

| + | |||

| + | [[File: Category-wise consumption of mobile content, January- September 2018.jpg|Category-wise consumption of mobile content, January- September 2018 <br/> From: [https://timesofindia.indiatimes.com/business/entertainment-most-consumed-content-by-mobile-users/articleshow/70155465.cms July 10, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Category-wise consumption of mobile content, January- September 2018 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

=See also= | =See also= | ||

| Line 578: | Line 856: | ||

[[Telecommunications 2: Indian government data ]] | [[Telecommunications 2: Indian government data ]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|C | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|C | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|C | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABET | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:India|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Law and Constitution|CCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Name|ALPHABETCELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

| + | [[Category:Pages with broken file links|CELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIACELL/ MOBILE PHONES: INDIA | ||

| + | CELL/ MOBILE PHONES: INDIA]] | ||

Revision as of 20:56, 16 July 2021

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Cell phones: India

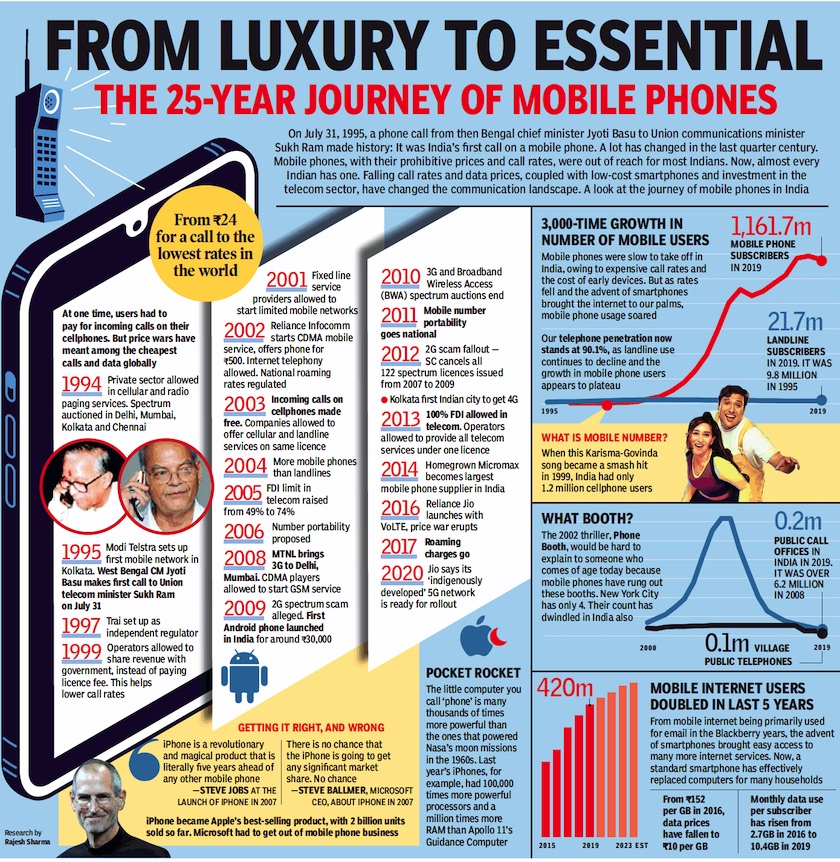

History in India

1994-2020

From: August 2, 2020: The Times of India

See graphic:

A History of Cell-/ mobile- phones in India, 1994-2020.

App(lication)s/ Apps: by genre/ category

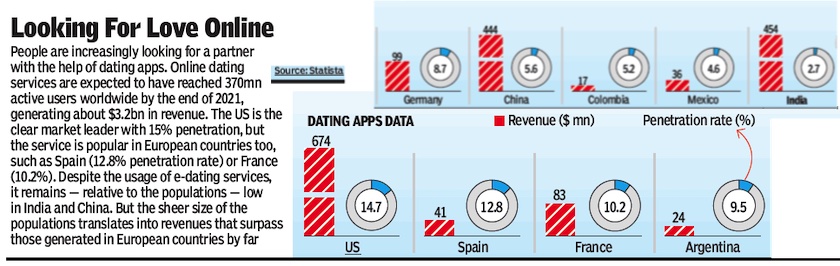

Dating apps

2020? India and the world

From: February 15, 2021: The Times of India

See graphic:

Usage of Dating apps in India and the world, presumably in 2020

App(lication)s/ Apps: usage of

App usage by Indians: 2016,17

Ranjani Ayyar, Indians spend 2.5 hrs|day on apps , May 13, 2017: The Times of India

Indians spent 2.5 hours a day on apps in the first three months of 2017, higher than the 2 hours they spent during the same period in 2016. India also ranked ahead of the US, UK, Germany and France where users spent 1.5 -2 hours per day on apps.

Areport by data analytics company App Annie reveals that time spent in apps globally increased to nearly one trillion hours in 2016 with an average usage of 9 apps per day . Brazil, China and India led with over 10 apps used every day . During the first three months of 2017, the average Indian smartphone user had almost 80 apps in stalled on hisher phone and used over 40 apps in a month.

“Consumers have spoken. By and large, they prefer to manage their lives through apps. For many industries, apps are increasingly becoming a must-have,“ the report said.

An interesting observation is that over 80% of time spent in apps was spent outside of the top app. “While this represents a considerable amount of user time, it is far less than some might as sume. There is plenty of user time to go around that is not dominated by major apps such as FB, WhatsApp,“ the report said. 2016 saw the advent of chatbots with players in several sectors including education, fin tech, insurance and health dabbling with bots. While industry insiders touted bots to be the next stage of transformation, it is yet to gain traction in India.“They are still limited to niche use in urban India and are still meant only for the tech savvy consumer conversant in English,“ said Anand Rajkumar, head of marketing, Hasura, a startup that offers an app development platform.

“On the other hand, apps are becoming more mainstream. As telecom and 4G penetration increases, and smartphones become cheaper, a new section of the population is getting connected to the internet. And as several essential functions such as operating a bank account (or even paytm) are much better done through an app, their introduction to the internet necessarily involve apps,“ he said. Experts say apps will continue to grab the larger share of user's time while bots will be useful only for specific processes.

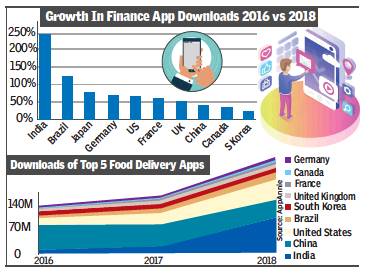

2016>2018

Digbijay Mishra, India sees fastest app download growth, January 18, 2019: The Times of India

From: Digbijay Mishra, India sees fastest app download growth, January 18, 2019: The Times of India

Food Delivery, Finance Lead Surge In 2016-18

India’s mobile internet economy is on fire. The country saw the fastest growth in app downloads among major countries between 2016 and 2018, led by a surge in downloads in food delivery and finance. It also saw the fastest growth by far in the hours spent on video streaming apps.

The latest annual data from App Annie, an independent agency that collates data on apps, shows downloads in India (across Android and iOS) growing by 165% in this period. In China, which accounts for almost 50% of all the downloads in the world, it grew by 70%. Indonesia followed at 55%.

In food delivery, India saw a dramatic 900% increase in downloads, way more than any other country. The global average increase was 115%. While UberEats and Zomato were the two top apps globally, in India, Swiggy is likely to have led the increase. Swiggy and Zomato emerged as unicorns last year, with valuations above $1 billion.

India also saw an explosion of sessions growth in food and drink apps in 2018, up 120% from 2016, the report said. Sessions are the number of times an app is opened. This metric is high for several countries, but India’s growth in 2018 took its overall sessions way ahead of the No. 2, the US (the statistic excludes China).

Downloads of finance apps grew more than 200% in India, where countries like US and Germany did just over 50%. Indonesia and Brazil also saw high growth rates. Indians are also checking their bank accounts and doing transactions more frequently on the mobile, from about three times a week in 2016, to over four times a week last year. In Australia, users check their banking apps almost 10 times a week, and in the UK, about seven times a week.

“Growth in sessions of top fintech apps indicate the stickiness of these services and their ability to become weekly — even daily — habits that slot into existing preferences like checking the stock markets and shopping,” the report said.

In online shopping, India had the highest number of sessions — akin to foot traffic — among Android markets, way ahead of the US and South Korea. But China has about seven times as many sessions as India. This could narrow, with two of the largest retailers in the world — Walmart (through Flipkart) and Amazon — now fighting for a significant slice of the India retail market. App Annie said the sessions metric is crucial since the time spent in shopping apps correlates strongly with ecommerce sales. Globally, mobile is expected to see almost 75% of total e-commerce transactions by 2021.

Hours spent on the top five video streaming apps in India soared by 185%. South Korea grew by 155% and Brazil by 130%. Indians spent over 45 billion hours on video streaming apps. Among Android markets, Brazil followed at about 22 billion. Out of every one hour spent consuming media in 2019, ten minutes will be video streaming via mobile, the study predicts. “This is an indication of consumption habits shifting from desktop and television to mobile,” it said.

2017: App usage by Indians

Shalina Pillai, India widens lead in app downloads, October 28, 2017: The Times of India

From: Shalina Pillai, India widens lead in app downloads, October 28, 2017: The Times of India

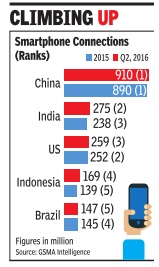

Most of the growth in global mobile app downloads in the third quarter of 2017 was accounted for by India, says app analytics firm App Annie. The report did not disclose India-specific figures, but it said that the country surpassed the rest of the markets in absolute download growth by a wide margin.The number of downloads in India in Q3 (July-September) was twice as high as that in Q3 2016, the report said.

Download numbers have risen sharply since the launch of Reliance Jio in September last year, which brought down mobile internet access costs dramatically . Global mobile app downloads -in Apple Store and Google Play Store -grew 8% to 26 billion in Q3, compared to a year ago. Google Play Store alone accounted for 18 billion downloads. These numbers include only new downloads and does not count reinstalls and app updates.

India became the largest app downloader from Google Play Store in full-year 2016, accounting for over 6 billion downloads, or more than 10% of the total downloads.

The US was No. 2 at just about 6 billion. India was No. 3 in 2015, but the Jio phenomenon pushed it to the top the following year.

Currently , Brazil is the No.2 downloader from Google Play Store, and the US is No. 3.

“Continuing a long-standing trend, download growth on Google Play was fuelled by emerging markets. The ongoing influx of first-time smartphone owners in these countries has been a significant driver of this growth.Given that these markets still have a relatively low level of smartphone penetration, we expect these trends to continue for the foreseeable future,“ the App Annie report further said.

Video streaming apps drove growth in both stores. Hotstar is one of the top video streaming apps for India. The other top apps in the Google Play Store currently are WhatsApp, FB Messenger, ShareIt, and Truecaller.

The total time spent in apps worldwide among Android phone users grew 40% year-over-year, coming close to 325 billion hours in Q3 2017.According to an earlier report, the most active users in India spent over 4 hours per day on mobile apps.

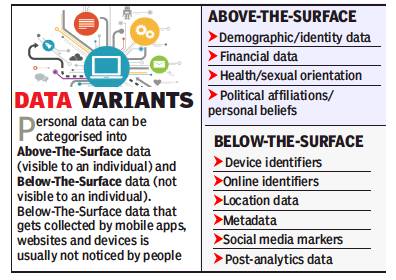

Most Indian apps fail on privacy

Digbijay Mishra, Most desi apps fail on privacy front, December 21, 2017: The Times of India

As more smartphone users install apps, privacy concerns are rising around the data being shared while installing these applications. Almost 70% of Indian apps do not take explicit user consent during installation and ask for 3.5 times more permissions than their US counterparts. This was revealed by a study of 100 Indian apps by Arrka Consulting — a data advisory and consulting firm — shared with TOI.

These 100 apps had over 1 million downloads and were spread across various sectors for fair representation — communication, e-wallets, shopping, education, jobs, dating, travel, finance, game, and food & drinks, among others.

Mobile apps often ask for access to your phone camera, microphone, location and call log, among other such things, the study pointed out. In fact, 77% of apps were non-committal when asked what happens to a user’s personal data once the apps are deleted. As many as 68% of Indian apps do not let users have a choice to opt out from giving personal information. Essentially what this means is that, after allowing certain sensitive permissions if a user wants to go back and block them, these applications won’t allow for it.

For instance, the study said one of the popular weather apps, AccuWeather, was sending location data without users’ go ahead. To be sure, there are standard permissions needed by apps before they run on your mobile phones, which are like setting up time zones. But the sensitive ones are like access to the camera (through which the app can create photos and videos), access to microphone, read external & internal storage, SMS and location.

According to the study, this lets apps build a profile of users and can track them. Such apps usually share the data with third-party advertisers and analytics providers. Here, too, Indian apps have a higher percentage of instances of sharing data with thirdparty outlets compared to the US. Almost 94% of such Indian apps share the user data with at least one of the third party outlets.

“There are two sides to the whole issue. First being collection of data and then storage of it. Legislation has to be brought in and then it will create awareness among every stakeholder. The companies need to realise they have to give the choice to the user, and then a user can say whether he/she is willing to share very sensitive data. Bringing legislation can be a good start to address these concerns,” said Arrka Consulting CEO Shivangi Nadkarni.

On an average, Indian apps take about almost eight such sensitive permissions before they run on the phone.

Indian apps top in accessing data/ 2018

Digbijay Mishra, Indian apps top in accessing your data, December 6, 2018: The Times of India

From: Digbijay Mishra, Indian apps top in accessing your data, December 6, 2018: The Times of India

Take Up To 45% More Permissions Than Globally Info Ends Up With Google, FB

Some top Indian Android apps across categories seek as much as 45% higher permissions from users compared to their global counterparts. Access to SMSes, microphone and contact book were some permissions taken by a significantly higher number of Indian apps compared to global peers. According to an annual study by enterprise cyber security and data privacy platform Arrka Consulting, about a third of the permissions sought weren’t required for core functionality of those apps. Interestingly, most data that these apps and websites share with third-parties end up going to two of the largest global tech firms — Google and Facebook.

The key privacy metrics were assessed on 100 Indian apps with each having at least a million downloads across Google Play, Apple’s App Store and websites. About 50 global Android apps were assessed on privacy and technical parameters to draw a parallel to Indian ones and their permission settings. In some categories such as travel, shopping and e-wallets, homegrown apps end up taking 1.5-2 times higher permissions than global peers. Essentially, these permissions help build user profiles that third-party vendors can then use for targeted selling. On an average, Indian apps take about eight permissions when a user installs a certain app.

When an app seeks more permissions, it collects additional information about a user that’s seen as an invasion of privacy, especially when the user has unknowingly granted access to certain apps. Global tech firms like Facebook have come under scrutiny for mishandling customer data. Most recently, Google said it’s bringing in new controls that allow users the rights to share data while installing third-party apps from Google Play.

It said 99% of apps send data to one or more third-parties for advertising, analytics, etc. “On an average, an app/website sends data to more than five third-parties and many had the same parent organisation. Google was observed in 30-58% instances and was clearly the leader, while Facebook was second,” the report said.

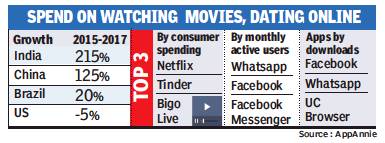

2017: India ranks 2nd in app downloads

Digbijay Mishra, India ranks 2nd in app downloads, January 19, 2018: The Times of India

From: Digbijay Mishra, India ranks 2nd in app downloads, January 19, 2018: The Times of India

See graphic:

Consumer spending on waching movies, dating online, India, China, Brazil and the USA- 2015-17

India has clocked the second-largest number of mobile app downloads, overtaking the US and trailing only China, according to a report from App Annie — a third-party agency which collates data on apps.

This data is inclusive of Apple’s iOS Store, Google Play and third-party Android stores. App usage grew rapidly in India, driven by the introduction of subsidised, unlimited 4G access by Reliance Jio in September 2016, the report noted. India saw a growth of about 215% while US saw a degrowth of 5% during 2017.

India, which is seen as an emerging market in the app economy, came on top of the list for highest monthly average number of apps used and installed. On an average, Indians use more than 40 apps in a month, while having a total base of close to 80 apps. On this parameter, China and Brazil are behind India.

Incidentally, the report threw light on consumer spending behaviour of Indians with regards to mobile apps. Despite the popular perception that Indians shy away from paying for in-app purchases, dating app Tinder and over-the-top (OTT) entertainment platform Netflix topped the chart as far as spends on apps go.

Chinese video app Bigo Live and Google Drive are the other top apps where Indians have spent significantly in 2017, the data in the report pointed out. Star Indiaowned Hotstar is another OTT player in the top 10 apps here with high consumer spends. The report did not specify the amount consumers spent on these apps throughout last year.

The data indicates an interesting trend where Indians are starting to pay for various apps. The more mature a market is, the higher chances of monetisation, the report added. For example, China is much ahead of India in terms of monetisation like the US, the UK and Japan, among others.

Tinder, which launched in 2012, started its India office — the first outside the US — in 2016. In India, with the rise of smartphone usage and cheaper data, multiple startups have ventured into online dating. Some of the other prominent names in this space include TrulyMadly, Floh and Woo. Netflix competes with the likes of Hotstar and Amazon Prime Video. Gaming, which sees a higher number of paying users traditionally than other segments, saw Teen Patti emerging as the top gaming app in India in terms of consumer spending.

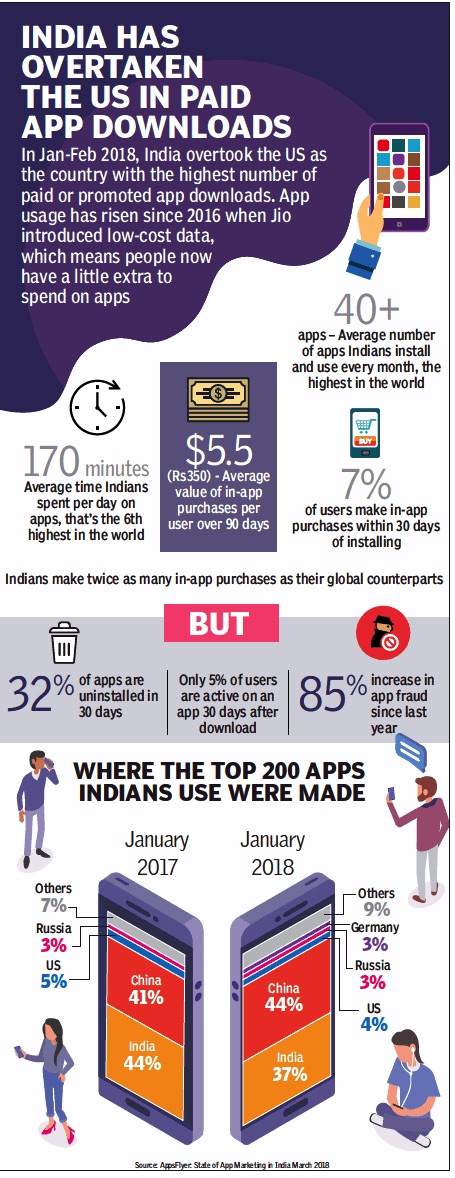

2018: India overtakes USA, ranks no.1

From: April 8, 2018: The Times of India

See graphic:

In Jan-Feb 2018, India overtook the US as the country with the highest number of paid or promoted app(lication) downloads

2019, 20: USAGE OF Chinese Apps

Sindhu Hariharan, February 16, 2021: The Times of India

From: Sindhu Hariharan, February 16, 2021: The Times of India

Geopolitical tensions between India and China and the rise of local developers have resulted in Indian apps holding a larger chunk of the overall market at the cost of Chinese options.

The share of installs of Chinese apps slipped to 29% in 2020 from 38% in 2019, a report by analytics firm Apps-Flyer said. Indian apps leveraged this opportunity by dominating the install volume with 39% share in 2020.

China’s loss was also captured by apps from Israel, the US, Russia, and Germany. These countries made further inroads too into India’s rapidly growing app market, the report noted.

“With app marketers increasingly expanding their remit to cover tier-2 and tier-3 regions, the demand from semi-urban areas is firing up India’s app consumption. In this highly diverse and fragmented marketplace, personalised content is critical to engage and retain customers,” Sanjay Trisal, country manager, AppsFlyer India, said.

States with semi-urban areas emerged as the sweet spot for mobile usage, the study showed. Around 85% of app installs came from tier-2 and tire-3 cities. With people spending more time at home, dependency on apps increased on the one hand. But, on the other, it also meant that users had more time to declutter their phones and remove unwanted apps.

In an indication of cut-throat competition across verticals, retention rate (number of users using the app after a certain number of days) dipped and day-1 uninstall rates (number of times users uninstalled the app on the day of install itself) increased.

For an average app, overall retention rate across verticals fell this year by around 12% as marketing budgets were slashed due to the pandemic, the report said. While on day one, the retention rate of apps was at 22.3% this dipped to1.7% by day 30, the study showed.

Indian app users continued to prefer apps that take up less space on phones, consume less data, and are more seamless to use in spotty connectivity.

Overall, day-1 uninstall rates stood at 27% (marginally up from 26% last year). This was higher for gaming, food and finance apps at 32%, 32% and 30%, respectively. While most players in India’s nascent app economy prioritise new user acquisition over retention, without a retention strategy, companies are essentially spending resources with no benefit, analysts said.

AppsFlyer’s study analysed 7.3 billion installs recorded in India between January 1 and November 30, 2020 covering 4,519 apps across verticals.

India’s rank in the world: 2020, 21 May

From: June 19, 2021: The Times of India

See graphic:

The usage of apps, India’s rank in the world: 2020, 21 May

Cell phone gaming

Apr 24 2015

Narayanan Krishnaswami

A new generation of entrepreneurs who have grown up playing Super Mario Brothers and God of War are making the most of low-entry barriers to create startups focusing on mobile games. They are making a mark in the international market even as they cater to India's growing smartphone user base

Last week, Udupi-based Robosoft raised Rs 74 crore from Ascent Capital and Kalaari. Part aof that money will be invested in develop ing new games, as well as acceler ating the growth of Star Chef, the flagship title of Robosoft subsidiary and mobile game-maker 99games. Star Chef is a restaurant-themed building game. Released in August last year for the iOS, the game has seen more than 1.2 million downloads, with an average rating of 4.7 out of 5 across more than 35,000 reviews, says Anila Andrade, a producer at 99games.“Nearly 4.5% of our users are paying users -with one user having spent as much as $4,800 so far,“ she says.

“Monetization rates in the mobile gaming industry average 1-2 %,“ says Amit Khanduja, EVP of Reliance Gaming. In that context, Andrade's pride is justified. But low monetization levels are not deterring entrepreneurs, or investments in mobile gaming. Earlier this year, Moonfrog Labs raised $15 million as Series A funding from Tiger Global and Sequoia Capital. Before that, Sequoia had invested in Delhi-based Octro. Both Moonfrog and Octro make mobile versions of Teen Patti, our own variant of poker. And just over a year ago, GSN Games, the US social casino games maker, bought Bengaluru-based Bash Gaming for around $165 million.

NEW GAMES, NEW FACES

The new generation of India's entrepreneurs are people who grew up playing games -whether it was on old Nintendo Game and Watch devices, mobile-sized devices with controls on either side, with titles like Octopus and Parachute, or on later consoles like the PlayStation. For them, games are a labour of love, and they have the confidence of youth. It's not surprising that the mobile game development industry is taking off in India, in a way that PC game development or console game development never did. The entry barriers are much lower, for one. The Unity 5 game engine, one of the most popular development platforms for games, is available for free.

The game makers include the usual suspects, engineering students with a desire to do their own thing, but there are others as well. Raoul Nanavathi is a 27-year-old graduate of economics and political science who runs Mumbai-based BYOF Studios. He worked for WOI, a company that specialized in making in-flight games for airline companies, before striking out on his own. BYOF's Discover-O, a deceptively simple game that involves colour matching, made it to the top five games of Pocket Gamer Connects, the mobile games conference held in Bengaluru last week.

Nalin Savara is a garrulous 30-something whose conversation swings easily from Jung and Freud to the use of stereotypes in story telling. Savara quit his job at Escosoft, started a gaming company called Darksun Tech, and is now working on BlokStok, a fighting game where recognizably Indian characters battle it out in front of recognizably Indian backgrounds.

Himanshu Manwani quit his job and moved in with his parents in Bhopal. The 25-year-old wanted to make a game that would recapture the experience of playing Super Mario Brothers or Super Meat Boy. Manwani built Super Nano Jumpers solo. Design, art, coding, testing -the works. It was a difficult time for Manwani. Despite his parents' support, there were always people who felt that he should be working, and not pursuing a fool's dream. All that changed last week, when Super Nano Jumpers won the first prize -Rs 10 lakh -at the Big Indie Pitch, the culmination of Reliance Gaming's Game Hacks held around the country over the course of last year. Now, Manwani has used his prize money to get himself an iPhone and will be hiring people to help him with his next project.

Mobile gaming is a cut-throat business. Games make up 21.45% of 1.4 million plus apps on Apple Store, by far the largest chunk. The next highest category , business apps, make up just 10%. And a good mobile game has to hold the downloader's interest if it is to survive. You could call it the “seven second churn“. If the game doesn't hook the user in its first seven seconds, it's unlikely that it will be a success.And if the interval between the first and second time the user plays a mobile game is greater than seven days, that user is probably lost.“There are three simple things about making a great mobile game,“ says Manish Agarwal, CEO of Reliance Gaming. “The game should be easy to pick up -the gameplay must be easily mastered. It should give the impression of being easy . It should not be easy. Simple rules, but very difficult to implement“.

“What Indian developers lack is confidence,“ says Chris James, MD of Steel Media, the organization that runs PocketGamer, the influential mobile app site. “That's probably because they lack history (in making games)“. But that doesn't mean that the games are bad, though.James says that the quality of mobile games he'd seen made by Indian gamemakers is “very high, as high as (those) made in London or elsewhere“. The Guardian newspaper's games editor, Keith Stuart, who was in Bengaluru for Pocket Gamer Connects, said his preconceptions about Indian mobile game developers were “not so much challenged as kicked in the face“.

BIGGER THAN E-COMMERCE

Nitish Mittersain is CEO of Mumbai-based Nazara Technologies, one of India's oldest gaming companies. They've been around since 2000, but he believes the next few years are going to be crucial. “The number of smartphone users in India is going to go up from 130 million to anywhere between 300 million and 500 million. The market for mobile gaming will take off in India over the next three to five years,“ he says. “As games get better, we will see more and more Indians willing to spend money on things like in-game purchases“. Nazara is also partnering with small companies, co-developing games with them. “We see a lot of young people developing games, we can provide money and mentorship and help them reach a larger market,“ he says. That's a tack that Reliance is taking as well. “We will co-develop games with promising developers, those with good ideas and the passion that's needed to deliver a great game,“ says Reliance's Agarwal. “Remember Flipkart a few years ago? This is going to be bigger than e-commerce“.

Cyber-security

2018: Malware in South Asia

From: February 9, 2019: The Times of India

See graphic:

Malware in smartphones in Bangladesh, China, India, Pakistan and other Afro-Asian countries, presumably as in 2018.

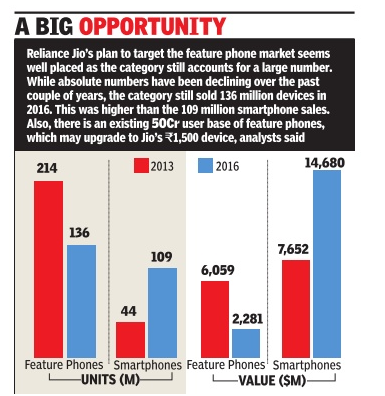

Feature- and smart- phones

Sales: 2017, 2018

From: February 18, 2019: The Times of India

From: February 18, 2019: The Times of India

See graphics:

Feature- phone sales in India- 2017, 2018

Smart- phone sales in India- 2017, 2018

India vis-à-vis the world

2019: ownership trends; 2015-19: technology used

2019: ownership trends; 2015-19: technology used

From: Dec 4, 2019: The Times of India

See graphic:

Cell Mobile phones used in India vis-à-vis other countries

2019: ownership trends; 2015-19: technology used

Payments (through mobiles)/ Mobile payments

2016-18

From: October 21, 2018: The Times of India

See graphic:

Mobile transactions/ payments in India, China and the USA: 2016-18

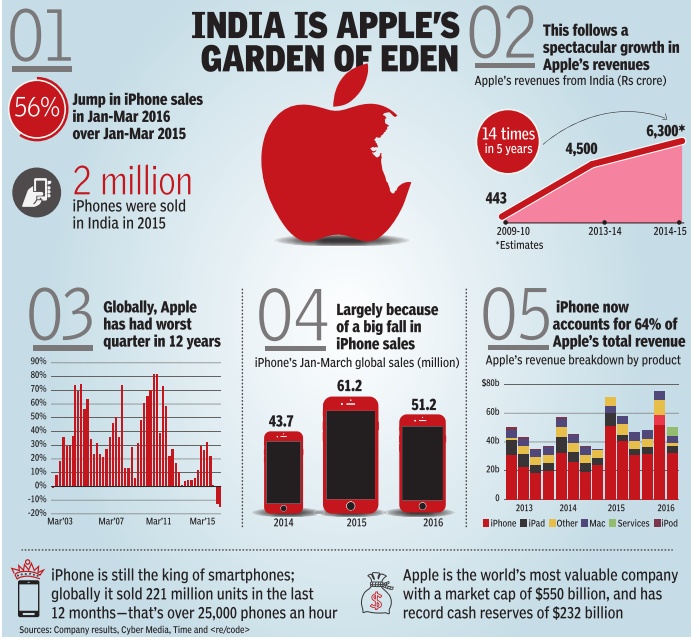

Smart-/ cell- phones: production in India

1995-2018: 9,000-fold growth

From: Between 1995 and now, 9,000-fold growth in mobile phone connections, June 20, 2019: The Times of India

See graphic:

Cell phone subscriptions per 100 persons, 1995-2018

The private sector wasn’t allowed in telecom until 1991, and then only for value-added services like mobile calling and paging. In 1994, private companies were allowed to invest in telecom, starting a revolution that has made India the world’s second-biggest wireless market after China. Where only 1 in 10,000 Indians had a mobile phone in 1995, now 8,900 of every 10,000 have them.

Ringing Bells failed to ring

The Times of India, Feb 19 2016

Pankul Sharma

Until Ringing Bells, Goel had small grocery shop

The whole country is today talking about Ringing Bells, Mohit Goel's Rs 251 smart phone His father Rajesh Goel, though, sitting in his smalgrocery shop that proclaims its name to be `Ram ji' on a grey board doesn't know what the fuss is all about. He says he always knew his son would do some thing big. Even in Garhipukhta asmall town in Shamli district o Uttar Pradesh, not many knew about the Goels or their shop. It's a different story today. They are suddenly all that everyone here is discussing. Goel Sr, who is now also one o the directors of the company the directors of the company said, “ After completing his schooling, Mohit went to Noida and competed his graduation from Amity University . The last time that he was home to meet us he had expressed his desire to open a company and I loaned him some money to start what he wanted to. Then he started a mo bile phone company and told us about his venture. Little did we know what it meant then. It's re ally big, is it? We also attended the event where Freedom 251mo bile was launched in New Delhi.“

Mohit, who is the managing director of Ringing Bells, has lived with his father at Garhipuk hta most of his life, often helping around in the grocery shop. On Thursday , Ringing Bells launched Freedom 251, the mobile phone, in a glitzy event in New Delhi that was attended by several dignitaries, including senior BJP's Murli Manohar Joshi.A few residents from Shamli were also invited to the launch.

After completing his schooling from Saint RC Convent School, Mohit earned his engineering degree from Amity University. He recently married Dhaarna, a Noida resident, who is now CEO of Ringing Bells.

6 lakh hits per second lead to co's website crash

This surely is a dampener after the excitement created around the Rs 251smartphone, unveiled by a Noida-based company -Ringing Bells. The company's website only way to book the phone could not f take orders on Thursday. According to those who logged on to the , website, bookings could not be made, even though some had logged in very early in the day. Earlier, Ringing Bells had said that people can make a booking for the phone from its website from 6 am onwards. However, the company in a written message on the website said that an overwhelming response to the offer had over-loaded the servers that , now needed to be upgraded. “... we are very grateful for your enormous response and your kind patronage and would submit that as of now we (have) received approximately six lakh hits per second. As a result of your kind overwhelming response, servers are over loaded. We humbly submit that we are therefore taking a pause and upgrading the service and will revert within or before 24 hours,“ the company said.

2021: Goel arrested for dry fruits

Noida: Rs 251 smartphone man Mohit Goel now accused of dry fruits fraud, arrested

Jan 12, 2021 Source: TOI.in The Times of India

His idea of a smartphone for Rs 251 vanished without a trace but not Mohit Goel. The Noida-based entrepreneur, who had started the company Ringing Bells and named the phone it planned to launch ‘Freedom 251’, has been popping up on the police radar since. This time, Goel stands accused of cheating scores of dry fruit traders in what police say is a Rs 200-crore fraud. Goel, who was running a company called Dubai Dry fruits and Spices Hub with five others, was arrested near Meghdootam Park in Sector 51. Among police’s immediate recoveries were an Audi, 60 kg dry fruits and documents. The company operated out of Corenthum, the premier office complex in Sector 62, and paid a rent of Rs 3 lakh per month. Among their employees were three foreigners, who handled the front office as receptionists, police said.

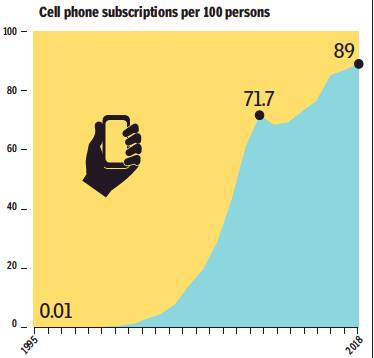

2014-17

From: August 9, 2018: The Times of India

See graphic :

Smartphone manufacturers in India, 2014-17

NOIDA is the hub: 2016

Pankaj Doval, Aug 26 2016, The Times of India

If you unclip the back of your new Samsung smartphone, or one from a homegrown brand like Karbonn, Lava or Intex, you might find a `Made in India' sticker there. And chances are that the device has been assembled in the Noida-Greater Noida region at Delhi's doorstep.

Ever since the Centre introduced a 10.5% duty differential between imported devices and those made locally in last year's Budget, the region has become India's biggest smartphone hub, with a capacity to make more than 140 million devices per annum -40% more than a year's demand.

Not that Qualcomm and MediaTek are stamping out processors here -all the critical components still come from China and Taiwan -but it is a significant start for the industry . Sources said the local industry does about 5-8% of value addition at present, and this can be scaled up to around 35% within five years.

The flurry of investments to the region was perhaps prompted by the presence of Korean giants Samsung and LG. Samsung, which started local manufacturing a decade ago and reportedly has the highest installed capacity of 40 million devices per annum -the company did not confirm it -seeded a significant number of smartphone com ponent suppliers in the area.The company produces mobile phones from completelyknocked-down (CKD) kits.

“All our mobile phones, from feature phones to the Galaxy S7 that we sell in India, are manufactured at our Noida factory , and we will continue to explore future investment opportunities,“ a spokesperson for Samsung said.

Now Indian brands like Lava, Intex and Karbonn, besides Taiwanese contract manufacturer Wistron, have also set up shop. In partnership with home-grown telecom retailer and manufacturer Optiemus, Wistron makes phones for LG, China's OnePlus and Oppo, and Taiwan's HTC. Another Chinese vendor, Water World Technology , has partnered local company UTL Group, which is one of the backers of Karbonn Mobiles. Each factory creates 3,000-4,000 direct jobs, employing mostly high-school or ITI graduates.

Proximity to Delhi, where most home-grown phone brands are headquartered, has certainly helped the region bloom despite UP's iffy image as a business destination. “The promoters wanted operations in a region that remains within their reach and under their control,“ said Narendra Bansal, chairman of Intex Technologies, a major Indian phone brand.

“Noida's proximity to the capital, its growing infrastructure, and development as a large residential hub close to the capital's business districts also helped,“ the Samsung spokesperson said.

Intex, which has three factories in Noida with an annual installed capacity of 30 million phones (feature and smart), is now setting up a 20-acre base at Kasna in Greater Noida for a larger integrated facility that will also house key suppliers. “There are huge advantages here in terms of the cost and availability of labour. The power supply is largely uninterrupted and the productivity levels are even better than China's in many cases,“ said Sunil Vachani of Dixon Technologies whose company makes Karbonn and Panasonic devices in a joint venture. But is it easy to do business in UP? “The benefits may be less than in states like Andhra Pradesh, which offer incentives. However, operating in the south is difficult for a north-Indian brand. Moreover, the UP administration is supportive,“ Vachani added.

Lava managing director Hari Om Rai said availability of land in the Noida-Greater Noida industrial area has also been an important enabler. “There may be a few instances of difficulty in getting approvals, but the broader policies are clear,“ said Rai whose company has an annual installed capacity of nearly 36 million devices. “We have not faced interventions by the government.“

Now, even Chinese vendors and suppliers are gravitating to the region, drawn by its large production capacities. The manufacturing processes are still low-end, with a lot of assembly done manually , but efforts to increase local engagement and add sophisticated processes, such as the assembly of printed circuit boards (PCB), are on.

Analysts said PCB assembly will enhance the quality of local manufacturing. Also, there are efforts to develop R&D and design capabilities within the country , instead of relying on partners in China and Taiwan. “It will take at least 5-7 years to develop a high valueadd manufacturing set-up here,“ said Pardeep Jain, MD of Karbonn Mobiles.

IT minister Ravi Shankar Prasad said more initiatives are planned to boost the manufacturing of electronics.“Electronics manufacturing is a focus of the government as part of the `Make in India' initiative. The current investments have resulted in as many as 40,000 direct jobs and over 1.2 lakh indirect employment. We estimate that mobile phone production will reach a level of around 500 million devices by 201920.“

For now, uncertainty over the fate of the 10.5% duty differential in a GST regime is worrying investors, even though they have welcomed the simpler tax structure a GST will bring. “It will be near-suicidal to make fresh investments until GST is described,“ Jain said. “We do not want to gamble in such an uncertain scenario,“ Vachani added.

Minister Prasad said concerns around GST would be addressed.“Please remember, GST is for India.Surely , in the whole fiscal architecture we will ensure that Indian manufacturing interests are saved.“

Asked if the duty differential between local manufacturing and imports will be maintained, he said, “Obviously , why not... the interest of India's manufacturers will be kept in mind.“

2016-17/ production worth more than 1 lakh crore

Pankaj Doval, India-made phones hit Rs 1L cr in FY17, Feb 11 2017: The Times of India

Mobile phones worth nearly Rs 1 lakh crore are expected to be produced locally by the end of this financial year (2016-17), more than five times compared to two years back, as companies churn out around 200 million devices in one of the world's fastest-growing market.

The growth in output is a heartening development for the government, which has been pushing manufacture of electronics in the country , led by a lower duty regime for devices produced in-house.

“India will be producing mobile phones worth Rs 97,000 crore this fiscal, a quantum jump when compared to the Rs 18,900 crore achieved in 2014 15,“ IT minister Ravi Shankar Prasad told TOI here.

Prasad said that nearly 40 new factories have come up in the country during this period, and these have been joi ned by nearly three-dozen top ancillary makers. “If you look at the output, India is expected to locally-produce nearly 200 million devices this fiscal against 60 million units two years back.“

Local production enjoys around 12% incentive compared to imported products, and this has been a major incentive for companies to look inwards. A large number of companies have started manufacturingsourcing locally over the past two years and these include some of the top Chinese names such as Huawei, LenovoMotorola, Xiaomi and Gionee. Homegrown brands such as Intex, Lava, Karbonn and Micromax have also been boosting local output.

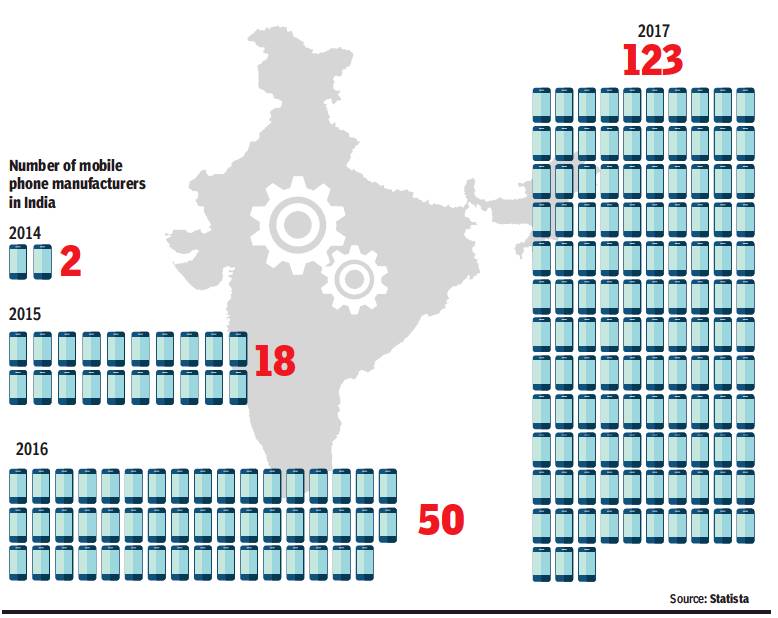

July-September 2017, production of mobile phones

Pankaj Doval, Xiaomi is 2nd biggest mobile co in India, November 15, 2017: The Times of India

From: Pankaj Doval, Xiaomi is 2nd biggest mobile co in India, November 15, 2017: The Times of India

Pips Lenovo-Motorola, Just Behind Samsung

Chinese phone major Xiaomi grew strongly in the third quarter (July-September) of 2017 and emerged as the second-biggest smartphone company in India, a shade lower than Samsung that still managed a slender edge. Xiaomi toppled Lenovo-Motorola, which has dropped to third position.

Micromax, which was in third position in July-September 2016, has slipped out of top five positions.

According to numbers released by IDC, Samsung’s sales in July-September 2017 stood at 91.8 lakh units against 91.7 lakh units sold by Xiaomi in the same period. The companies had a market share of 23.5% each. Lenovo-Motorola sold 35.1lakh units and had a market share of 9%.

Cumulatively, 39 million smartphones were sold in the period, showing a year-on-year growth of 21%, which was led by robust demand ahead of the festive period (Navratra and Diwali) and high-decibel offers by online players.

“E-tailers’ several rounds of online festival sales in August and September led to robust growth in the smartphone category. Thirteen million smartphones were billed to etailers with 35% annual growth and 73% growth from the previous quarter,” IDC said. The top five brands, which also included Vivo and Oppo of China, accounted for 72% share of the smartphone market compared to nearly 50% a year ago.

Pre-festive offers and discounts thrown in by the online sellers gave a big push to demand. “E-tailers have popularised many trends in the smartphone market, like making devices more affordable through easy financing options, attractive exchange offers,” said Jaipal Singh, senior analyst at IDC India.

Xiaomi was one of the strongest gainers with around threefold rise in numbers. “There was strong traction for products and we have been boosting capacity and retail presence to build further momentum,” Manu Jain, MD of Xiaomi’s local operations, said.

2018, Jan- April: 10 smartphone companies quit

Gulveen Aulakh, April 30, 2018: The Times of India

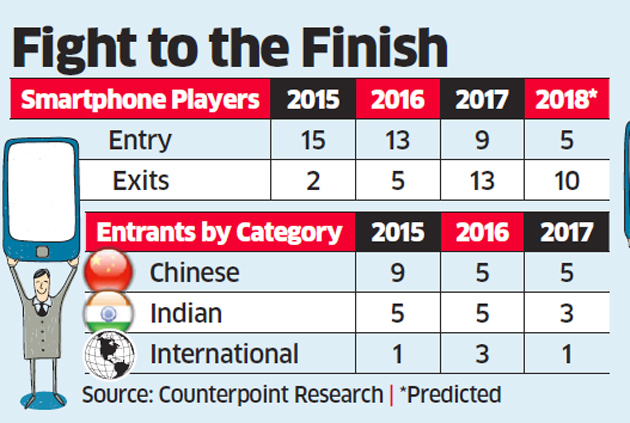

Entrance by category, country-wise- 2015-17

From: Gulveen Aulakh, April 30, 2018: The Times of India

The shakeout in India’s smartphone market mirroring the telecom industry saw number of new entrants nearly halved between 2015 and 2017 while exits grew six-fold as the capital intensive business weeded out weak players unable to sustain and expand as competition capped prices.

The top five smartphone brands — Xiaomi, Samsung, Oppo, Vivo and Huawei — currently control over 72% of the market against 63% in 2015, albeit with a different brand combination. The top 15 have cornered over 90%, of the market according to Counterpoint Research and experts believe exits and consolidation will gather pace this year. Singapore-based research firm Canalys data showed that the top five — Xiaomi, Samsung, Oppo, Vivo and Lenovo — had about 77% of the smartphone market in the March quarter and Micromax, Intex and Lava, the three Indian players in the list in 2015, fell off. “The fast changing dynamics and fierce competition in the India smartphone market will lead towards consolidation in the market,” said Shobhit Shrivastava, research analyst at Hong Kong based Counterpoint Research.