Coal: India

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

Contents |

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

COAL

The Ministry of Coal has the overall responsibility of determining policies and strategies in respect of exploration and development of coal and lignite reserves, sanctioning of important projects of high value and for deciding all related issues. These key functions are exercised through its public sector undertakings, namely, Coal India Limited (CIL) and Neyveli Lignite Corporation Limited (NLC) and Singareni Collieries Company Limited (SCCL), a joint sector undertaking of Government of Andhra Pradesh and Government of India with equity capital in the ratio of 51:49.

Coal and Lignite Reserves in India

The coal reserves of India up to the depth of 1200 meters have been estimated by the Geological Survey of India at 276.81 billion tonnes as an 1.4.2010. Coal deposits are chiefly located in Jharkhand, Odisha, Chhattisgarh, West Bengal, Madhya Pradesh, Andhra Pradesh and Maharashtra. The Lignite reserve in the country has been estimated at around 39.90 billion tonnes as on 31.3.2010. The major deposits of Lignite reserves are located in the state of Tamilnadu. Other States where lignite deposits have been located are Rajasthan, Gujarat, Kerala, Jammu & Kashmir and Union Territory of Puduchery.

Coal Conservation

Conservation of coal is an important area particularly when our coal reserves are finite. The aspect of conservation of coal is taken into account right from the planning state and maximum recovery is ensured during the implementation stage. Mines are designed to work the coal seams either through open cast or through underground methods depending on the technical feasibility and economic viability. Mechanised opencast (OC) mining is presently the commonly adapted technology for extraction of thick seams at shallow depth. This is also important from the conservation point of view since the percentage recovery by this technology is around 80% to 90%. Presently, this technology dominates and coal industry contributing more than 88% of country's coal production. Further, whenever it is feasible, the developed pillars of underground mines are being extracted through opencast operations.

In case of underground (UG) mining, the introduction of new technologies like the longwall method, shortwall method, blasting gallery technology and continuous miner technology have resulted in increased percentage of extraction. With the improvement in roof support technology with mechanized bolting with resin capsules, it has been possible to maintain wider gallery span and extract seams under bad roof conditions more efficiently resulting in improved conservation of coal. The Ministry of Coal (MoC) governs the Coal Mines (Conservation & Development) Act 1974 for conservation of coal and development of mine areas through Coal Controller Organisation. A stowing excise duty of Rs. 10/- per tonne is collected on coal production/despatch and coal companies are extended assistance for undertaking conservation measures.

SAFETY AND WELFARE

The problems of subsidence and fires are the result of unscientific mining carried out by the earstwhile mine owners over more than 200 years of operations in these coalfields of Jharia and Raniganj prior to nationalisation. The population living in the old mining areas has increased many times over the years, though these areas became unsafe for habitation. Inspite of the declaration of these areas unsafe by the local administration, the habitation increased unabated.

The problem of subsidence and fire are being addressed by the Government from time to time. In this regard a High Level Committee was set up in December, 1996 under the Chairmanship of the then Secretary, Ministry of Coal with representatives from other Departments, Coal Companies and the concerned State Governments to deal with the problem in a comprehensive manner. Based on the recommendations of the Committee, a Master Plan was prepared to deal with the problems of fire and subsidence and related rehabilitation covering the areas under Bharat Coking Coal Ltd. (BCCL) and Eastern Coalfields Ltd. (ECL) in 1999 for implementation of the same in a phased manner.

The Government has approved the Master Plan dealing with fire, subsidence and rehabilitation and diversion of surface infrastructure within the leasehold of Bharat Coking Coal Limited (BCCL) & Eastern Coalfields Limited (ECL) on 12th August 2009 at an estimated investment of Rs 9773.84 crore [7112.11 crores for Jharia Coal Field (JFC) and 2661.73 crores for Raniganj Coal Field (RCF]. This includes Rs 116.23 crores sanctioned earlier for various Environmental Measures & Subsidence Control (EMSC) schemes for implementation in ten years, time.

Coal India Limited

CIL the holding Company with headquarters in Kolkata. CIL is mainly responsible for laying down corporate objectives, approving and monitoring performance of subsidiary companies in the fields of long-term planning, conservation, research and development, production, sales, finances, recruitment, training, safety, industrial relations, wages, material for all operational, acquisition of land, execution of welfare programmes, maintenance of safety standards, improvement of industrial relation, etc.

Neyveli Lignite Corporation Limited

NLC was registered as a company on 14th November 1956. The Mining operations in Mine-I were formally inaugurated on 20th May 1957 by the then Prime Minister Pandit Jawahar Lal Nehru. Neyveli Lignite Corporation has been conferred with "Miniratna" status. NLC presently operates four open cast lignite mines, viz., Mine 1, Mine IA & Mine II in the State of Tamilnadu and Barsingsar Mine in the State of Rajasthan aggregating to a total capacity of 30.6. MTPA and three thermal power stations, viz., TPS-I & TPS-I Expansion and TPS-II with a capacity of 2490 MW all located in Tamil Nadu, and Barsingsar TPS in the State of Rajasthan (250 MW) and TPS-II Expansion at Neyveli (500 MW) are under implementation aggregating to a total of 3240 MW.

Coal for power plants

2009-18: new coal mines opened

Shrinking electricity demand-supply gap, 2009-18

From: Sanjay Dutta, 52 coal mines opened in 5 yrs to fuel power drive, January 23, 2019: The Times of India

86% Growth Over No. Of Mines Added From ’09 To ’14

The Narendra Modi government has opened 52 new coal mines since coming to power in May 2014 to fuel its flagship village and household electrification programmes without tripping the system, officials told TOI.

These 52 mines represent 86% growth over the number of mines added in the five-year period between 2009 and 2014, when most projects were stuck in red tape, especially pertaining to environment and forest clearances, before the NDA government took over.

The officials said structural reforms in the government’s functioning since 2014 made it possible to quickly open such a large number of coal mines, a cumbersome process involving approvals and permissions from various statutory authorities.

The new mines have added 164 MT (million tonne) to India’s annual coal production capacity, marking 113% increase over capacity added during the 2009-2014 period.

Since 57% of power is generated in India by burning coal, these mines allowed the government to rapidly move towards universal electricity access without creating shortages.

This is borne out by data in the Central Electricity Authority’s latest annual report, which shows demand-supply gap narrowing to 0.7% in 2018, down by 90% from 2009-10 level, and energy supply rising 120% over the 2004-2005 period. But for these new mines, this would not have been possible as the electrification drive has been pushing up demand for power by 5-6%.

On December 19, coal and railway minister Piyush Goyal told Parliament in a written reply that all-India coal production stood at 433.9 MT during the April-November period of 2018-19 financial year, indicating a growth rate of 9.8%. During the same period, state-run Coal India Ltd’s production stood at more than 358 MT, marking a growth rate of 8.8% over the previous corresponding period. In April, the government completed the task of hooking up all the 18,452 un-electrified inhabited villages to the national power grid under the Deen Dayal Upadhyaya Gram Jyoti Yojana.

It is now in the process of bringing power to all households without electricity by giving free connections under the Saubhagya scheme.

So far, 91.9% of the 2.48 crore households identified without power have been electrified.

Since 57% of power is generated in India by burning coal, these mines allowed the government to rapidly move towards universal electricity access without creating shortages

2011-2018

High coal supply helps power plants avoid summer outages, June 12, 2018: The Times of India

Coal rakes supplied per day to power sector, 2015-18

From: High coal supply helps power plants avoid summer outages, June 12, 2018: The Times of India

Aids Thermal Units Raise Output To 103% Of Their Target

Coal is once again helping avert electricity shortage by making it possible for thermal power stations to raise output to more than 103% of their scheduled production target with a view to bridging generation shortfall from hydro-electric plants.

Government data shows state-run Coal India Ltd, which is the lifeline for power plants, fed 82 million tonne of coal to power plants in the April-May period alone, marking a 15% increase in supplies over the previous corresponding period.

The increased fuel supply helped coal-fired power stations to operate beyond their targets for meeting supply gap left by hydel units, which saw generation dropping to 88% of estimates as reservoirs ran low.

The coal and railway ministries under Piyush Goyal’s watch have been preparing thermal plants for such an eventuality and ramping up fuel supply. This has resulted in thermal power generation rising 4.5% in 2017-18 from the previous fiscal, while hydro power generation has shown a drop of 20%.

The higher fuel supplies to power plants underline the substantial growth in coal production in the last four years. Total coal production increased to 676 mt (million tonne) in 2017-18 from 609 mt in 2014-15. CIL’s output went up from 494 mt to 567 mt. In the April-May period of the current fiscal, total coal production stood at 111 mt, with CIL’s output pegged at at 92 mt.

“What used to happen in 7-8 years (earlier) has happened in four years... This 105 mt (million tonne) increase in production in four years took almost seven years to achieve before 2013-14,” Goyal said on Monday.

Though coal despatch too has risen apace with rising coal production, several power plants are still complaining of running low on fuel.

2017: the new normal as uncertainty ends

Sanjay Dutta, Power plants draw down coal stocks by 50%, Feb 23, 2017: The Times of India

Power stations across the country have across the country have drawn down their coal stockpiles by half to reduce inventory costs as days of uncertainty over fuel supplies become a thing of the past.

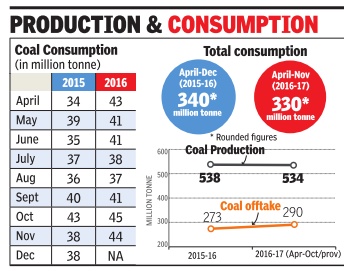

The move is a firm indication of a “new normal“ availability of adequate and assured fuel supplies as it comes at a time when coal consumption rose 9% on the back of a 6.5% rise in generation from coal-burning plants, reflected in rise in their capacity utilisation.

Government data shows power plants liquidating their stocks down to 20 million tonne as on January 1 from a stockpile of 39 million tonne as on April 1, 2016. Several plants showed a stock pile good enough to keep them spinning for 50-60 days at the beginning of 2016-17, while the average stock exceeded 25 days.

This is in marked con trast with the scenario prevalent well into 2014, when most of the country's power plants were doddering due to issues like continued coal shortage caused by low coal production and patchy evacuation plans.

“Coal stocks are prone to self-ignition and need constant watch to avoid accidents. The inventory and its safekeeping costs money .Since assured and adequate supply is the new normal, power plants prefer to regulate offtake from Coal India rather than maintaining surplus stocks,“ a top executive of a state-run generation utility told TOI. After assuming power, the Narendra Modi government initiated several measures simultaneously to raise output, improve despatch to power stations and build up stocks. As a result, coal stocks at pitheads and power plants rose to 96.5 million tonne as on April 1, 2016, the highest-ever build-up. This forced Coal India to pause operations for exposing coal seams to prevent building up of stocks further.

The total stockpile has now come down to 64.5 million tonne as on December 12, 2016, which is still more than the quantity needed for seamless supplies to the power plants and keep them spinning. This is borne out by the fact that there has been no report of plants shutting down due to coal shortage.

There are 110 power plants which are monitored for coal supply by the coal ministry as these plants have coal supply commitments through linkages or supply quotas from Coal India's mines. The plants are monitored based on the number of days of stock and distance from mines.

2018: record coal supply

Sanjay Dutta, Power plants light up on record coal supply, December 17, 2018: The Times of India

From: Sanjay Dutta, Power plants light up on record coal supply, December 17, 2018: The Times of India

Fuel Stock Rises To Average 10 Days In Spite Of Demand Spike During Festive Season

Record coal supply has helped power plants to replenish their dwindling stockpile even after pumping up generation, as electricity demand spiked 14% during the October festive season and continued to grow apace at 5.5% in November.

Government data showed coal supplies at a threemonth high in December, rising steadily since September when disruptions caused by rains had resulted in stockpiles at a large number of power plants diminishing to alarmingly low levels.

But improved coal supply since then has raised the average coal stock at power plants to more than 10 days in December. The number of ‘super critical’ power plants, where fuel stocks are down to four days or less of operations, has dropped to a monthly average of nine in the first 10 days of December from 14 in November and 18 in October.

Coal ministry officials said the alternatives were being examined to address pockets of problem, especially for plants located far from the coal mines.

“The coal and railway ministries followed a strategy to ramp up coal production and despatch not only to replenish fuel stock but also to build up inventory for festive season demand,” a coal ministry official told TOI.

Inter-ministerial panels tasked with the job are meeting more frequently than before, some almost daily.

2017 Oct-2019, Feb

Sanjay Dutta, ‘Zero blackout’ plan gets coal comfort, March 2, 2019: The Times of India

From: Sanjay Dutta, ‘Zero blackout’ plan gets coal comfort, March 2, 2019: The Times of India

Plants Have Stock To Meet Summer Demand

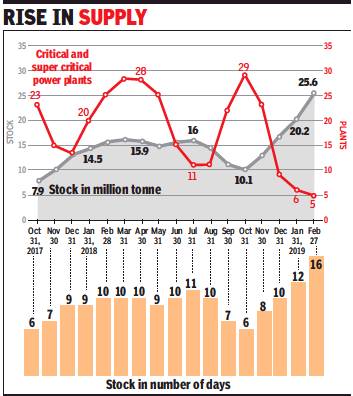

Coal inventory at power stations rose to 16 days operation and the number of plants with precarious inventory dropped 82% to just five on February 27 from 29 on October 31 last year, a move that will make ample power available to meet rising summer demand.

Top coal ministry sources told TOI on Friday state-run monopoly Coal India has indicated it will soon raise fuel stock at power stations to meet 20 days operation in preparation for summer spike in demand or meet unexpected shortfall in generation from hydel sources.

Rising stocks at power plants leave no excuse for discoms to resort to blackouts and avoid buying power when demand rises in summer. Under the ‘Power for All’ agreement with the Centre, states are to supply power 24X7 and the government is in the process of bringing in legal provision to penalise discoms for wilful blackouts to avoid buying power.

The coal and railway ministries scrambled additional fuel supplies since October 2018 when stocks were low because of rain-delayed replenishments but power plants had to increase consumption to meet festival demand. The two ministries ramped up fuel supplies with a view to fulfilling not only the immediate need but to build up inventory for summer demand.

Available data indicate fuel supply by state-run Coal India, the mainstay of coal-fired power plants, increasing by over 7% to more than 407 mt in the April-January period against the same period of 2017-18. Despatch of railway rakes to power stations too has risen by 13% to 252 in the same period.

The record coal supply has helped power plants to replenish dwindling stockpile even after pumping up generation as electricity demand spiked 14% during the October festive season and continues to grow apace at 5-6%.

Available government data shows aggregate coal stock at power plants rising to over 25 mt (million tonne) on February 27, indicating an increase of 66% from 15.7 mt on February 28, 2018. In spite of a healthy rise in power demand, the number of ‘critical’ and ‘super critical plants has fallen to 5, indicating a drop of over 80% from 25 in the same duration.

Mining

Allotment of coalfields to private parties

1992 guidelines

Ministry: Coal allocations breached 1992 guidelines

Dhananjay Mahapatra TNN

The Times of India 2013/09/24

The Coal Bearing Areas (Acquisition and Development) Act, 1957 has a notification in favour of [government-owned] Coal India Ltd subsidiaries

Coal India Ltd board’s guidelines laid down in August 1992 were:

• Blocks already identified and allotted should be a virgin block without basic facilities. Wherever CIL has already invested in the creation of infrastructure, new mine should be operated by CIL

• The blocks offered should be away from existing mines and operating coalfields of CIL

• Blocks already decided for development by CIL should not be offered for private mining

• Consumers or private sector should bear the full cost of exploration incurred by CIL, CIL and Central Mine Planning and Designing Institute Ltd (CMPDIL).

Commercializing coal blocks

[ From the archives of the Times of India]

Sanjay Dutta TNN

Pvt cos gained at cost of CIL

Private companies to whom the government allotted coal blocks without bidding may have made windfall gains at the cost of state-run major Coal India Ltd, a reading of the CAG draft report on the allocation of acreages suggests. The report observes that the proposal to take away blocks from CIL for allotment to commercial entities for captive mining was suggested by Tata Sons chairman Ratan Tata as the head of the government’s Investment Commission. Tata made the proposal in connection with initiatives in the power sector and it was agreed to by the Energy Co-ordination Committee (ECC) under the chairmanship of Prime Minister Manmohan Singh in February 2006. The report says that the ECC took the view that since Coal India till then had plans to mine only 150 acreages up to 2011-12, “some 79 blocks (out of 289 blocks reserved for it), which were explored in detail should be made available to NTPC and others for mining”. The ECC argued, the CAG draft report notes that such a move would be in the interest of increasing coal supplies. Thereafter, the coal secretary advised Coal India to retain only blocks which were projected to go into production up to 2011-12. Subsequently, the coal ministry “dereserved” 48 CIL blocks with over 9 bt (billion tonnes) of reserves in May 2006. Earlier, in January 2006, seven blocks of CIL had already been allotted — five to NTPC and two to the Sasan ultra-mega power project awarded to Reliance Power. These took away another 3.78 bt of reserves from Coal India, the report notes. However, the report notes, as of June 2011 no coal had been produced from an overwhelming majority of these blocks despite deadlines having passed. This was “contrary to the expectations of the Energy Coordination Committee” for earlier realization of production potential offered by these proven coal reserves. The CAG report notes that CIL was already working on an “emergency production plan” in the Tenth Plan (2002-07) “to meet the surge in demand of coal by advancing the production schedule in 12 existing mines/ ongoing projects and by taking up four new projects through outsourcing production of coal and removal of overburden (earth above layers of coal)”. Worried over its future production plans, CIL made repeated requests for additional blocks, which were “not acceded to/acted upon” by the coal ministry. It notes that CIL sought 138 blocks with reserves of over 57 bt in August 2008. In September 2011, the company tapered the demand to 116 blocks with reserves of 49 bt. Even after two years of CIL’s initial proposal, the ministry was yet to take a final decision, “This would adversely affect future production plan of CIL,” the CAG draft says. It also notes the government continued to give away explored mines despite objections from CIL and its subsidiaries. CIL PROPOSES, GOVT DISPOSES

November 2008 RAJHARA NORTH: Created 400 surplus employees for CIL

October 2009 MOIRA MODHUJORE NORTH: Block “inadvertently” included in dereservation list, Eastern Coalfield’s opposition rejected in Jan 2008

November 2011 BEHRABAND NORTH + VIJAY CENTRAL: De-reserved but not allotted. South Eastern Coalfields Ltd saw prospect of developing them as highly mechanised, high-capacity underground mines. Behraband North operated by SECL before de-reservation

Failure to block coal gate

[ From the archives of the Times of India]

Sanjay Dutta TNN

The government continued to give away coal blocks without bidding even after a meeting headed by Manmohan Singh (in his role as coal minister) on October 14, 2004 decided that all future allocation would be through the competitive route, says a draft CAG report. The government auditors’ report on performance of coal block allocations also says the Centre opted for the longer process of amending mining laws when it could have introduced competitive bidding through an administrative order under an existing law governing contracts. The report says that the October 2004 meeting with the PM as coal minister decided that applications for mines received after June 28, 2004 would be processed under the new competitive bidding regime. The government chose this as the cut-off date since the intention to introduce competitive bidding for coal blocks was first made public on this date at a ministry meeting with stakeholders, the auditor says. “However, the ministry of coal continued to follow the screening committee route for subsequent allotments till date with the approval of the Prime Minister’s Office,” says the CAG’s report. The draft report records how the government has failed to introduce the bidding process even after the necessary changes in the laws had been made. ‘Legal nod for bids came in 2006’ New Delhi: The law ministry had twice suggested ways to introduce auction for coal blocks while the coal ministry was tossing around the option of amending the Coal Mines (Nationalisation) Act of 1973 or the Mines and Minerals (Regulation and Development) Act of 1957, a CAG draft report says. As early as July 28, 2006, the CAG report notes, the department of legal affairs told the ministry the government could, if it wished, introduce competitive bidding by amending the “administrative instructions”. If the government chose to do so, the allotments could be done under the Indian Contract Act of 1872.

“In sum, there were a series of correspondences with the ministry of law and justice for drawing conclusion on the legal feasibility of the proposed amendments to the CMN Act/MMDR Act or through administrative order to introduce auctioning/competitive bidding process for allocation of coal blocks for captive mining. There was no legal impediment for introduction of transparent and objective process of competitive bidding for allocation of coal blocks for captive mining as per legal opinion of July 2006 of the ministry of law and justice and this could have been done through an administrative decision. However, the ministry of coal went ahead for allocation of coal blocks through the screening committee route and advertized in September 2006 for allocation of 38 coal blocks and continued with the process till 2009,” says the report. According to the lists of allotment in the CAG draft, 61 coal blocks were allotted to private companies in 2006. This is the highest number of allocations made between 2004 and 2009 in terms of how many blocks were given away in a year. However, in terms of reserves, 2009 stands out as the government gave away a reserve of 5,216 mt (million tonne) through 12 mines against 3,793 mt in 2006. Of this around 3,000 mt was given away to two private parties, a Tata group joint venture and a Jindal group unit, on a single day, February 27, 2009, barely a month before the Lok Sabha elections that year.

2013 methodology

Cabinet approves methodology for coal blocks auction

PTI [1]| Sep 24, 2013

Coal blocks will be put for auction after the environment ministry reviews them and bidders have to agree to a minimum work programme.

"CCEA has approved the methodology for auction by competitive bidding of the coal blocks. The methodology provides for auctioning the fully explored coal blocks and also provides for fast tracking the auction by exploration of regionally explored blocks," an official statement said.

The policy will ensure greater transparency and will pave the way for the government to auction explored blocks.

"The process of bidding of coal blocks will be started very soon. The government has fulfilled its commitment to bring transparency in the allocation of coal blocks," coal minister Sriprakash Jaiswal told . A source said six explored blocks will be auctioned first, with estimated reserves of over 2,000 million tonnes. The policy provides for production-linked payment on a rupee per tonne basis, plus a basic upfront payment of 10 per cent of the intrinsic value of the coal block.

The intrinsic value will be calculated on the basis of net present value (NPV) of the block arrived at through the discounted cash flow (DCF) method, the statement said. "To benchmark the selling price of coal, the international FoB (freight-on-board) price from the public indices like Argus/Platts will be used by adjusting it by 15 per cent to provide for inland transport cost which would give the mine mouth price," it said.

To avoid short-term volatility, the average sale price will be calculated by taking prices of the past five years. For the regulated power sector, a 90 per cent discount will be provided on the intrinsic value. This will help to rationalise power tariffs, the government said. To ensure firm commitment, there will be an agreement between the ministry and the bidder to perform minimum work programmes at all stages. There would be development stage obligations in terms of milestones to be achieved such as getting mining leases and obtaining environment/forest clearances, while the bidder will have to give performance guarantees. The policy also provides for relinquishment of a block without penalty if the bidder has carried out the minimum work programme stipulated in the agreement.

According to the statement, the ministry of environment and forests will review details of coal blocks and communicate its findings before the areas are put to auction. Final clearances will be subject to statutory approvals.

The government said exploration activities in identified blocks are at an advanced stage and are likely to be completed soon. They will be auctioned under the Competitive Bidding of the Coal Mines Rules, 2012, according to the statement.

2017: commercial mining by private companies resumes

Sanjay Dutta, Coal mining opened up after 44 yrs, Feb 3, 2017: The Times of India

Govt Identifies 4 Blocks For Commercial Ops

Forty-four years after nationalising coal mines, the government will allow commercial mining by private companies this year, a top official said on Thursday . “The coal ministry has identified four blocks that will be bid out for commercial mining without speci fying end-use for the mined coal,“ coal secretary Sushil Kumar told reporters in the presence of coal, power, renewables and mines minister Piyush Goyal. Kumar, however, declined to identify the mines or give other details such as reserves and auction methodology .

“The ministry will put out a consultation paper in public domain for feedback from stakeholder so on,“ he said.

The government had included provisions to allow commercial coal mining by private entities while amending the minerals and mining law in 2015 after the Supreme Court in 2014 struck down allotment of 214 blocks made since 1993. Since the amendments to the law, the Centre has been priming the market by allotting seven blocks to state government entities for commercial mining.

That decision to allot blocks for commercial mining by state entities--though limited to selling the commercially-mined coal to small, medium and cottage enterprises--marked the first bigticket reform in the sector after blocks were auctioned on a prompt from the Supreme Court.

Private entry will generate additional revenue for coal-bearing states from such mines “equal to the amount of royalty on the quantity of coal produced on a monthly basis“ during the lease periodlife of the mine as well as one-time upfront payment, which could be 10% or more of the intrinsic value of coal in the mine.Several Indian conglomerates such as Adani, Reliance ADAG, Jindal and GMR, as well as global majors, may be interested in bidding for blocks but the timing could prove to be an overhang. The country has turned surplus as demand has lagged rise in production and despatch.

Output

2004-19

From: Sanjay Dutta, Modi govt adds more to coal output in 5 yrs than UPA’s 10 yrs, April 2, 2019: The Times of India

The Narendra Modi government has raised India’s coal production by over 144 million tonne (mt) in the five years it has been in power, overshooting by 5% the 138mt added to the country’s output in the 10 years of UPA rule between 2004 and 2014.

Production by Coal India (CIL), the state-run miner accounting for nearly 90% of domestic supplies, stood at a little over 462mt when the Modi government took over in May 2014. Five years since then, production by the country’s largest coal miner stands at 607mt in 2018-19, coal ministry data shows.

In contrast, CIL’s production stood at 324mt in 2004-05 when the UPA-1 government came to power and rose to 404mt by 2008-09, indicating an addition of 80mt in the five-year period. In the subsequent five years, the UPA-2 government added 79mt to take the total production to 607mt.

Data shows coal offtake too largely keeping pace with production, indicating improved evacuation and transportation due to greater synergy between the coal and railway ministries. Quick decisions and clearances for mine expansions have also contributed to the sharp rise in production.

“There is a clear vision and direction from the leadership. The railway and coal ministries are working as a team with the power and other consumer ministries. Improved coordination with forest and environment ministry has ensured speedy clearances for mine expansion and evacuation projects,” a coal ministry official said.

But at the end, it is people who execute plans and can make or mar them. Here too, the ministry has taken care to motivate miners and executives by settling the wage issues and clearing gratuity payment, totalling several thousands of crores in employee welfare.

The result of this coordinated approach is showing on the ground as none of the coal-fired power stations monitored by the Central Electricity Authority (CEA) is starving for fuel, though several still show stocks of less than a week. But still, it is a far cry from 2014 when 66% of the units were doddering due to critical coal inventories.

Reforms

2017: results begin to show

Less Coal Burnt Now For Each Electricity Unit

Coal sector reforms initiated by the Narendra Modi government are beginning to pay . Initiatives to improve coal quality and efficiency in the supply chain have brought down the cost of power from coal-fired plants in spite of revisions in coal prices, central cess and railway freight in the last three years.

Decline in the cost of power has accrued mainly from power stations burning less coal to generate each unit of electricity on assured quality of domestic fuel.

There is also import substitution worth Rs 23,349 crore, which saves fuel costs. Since cost of coal makes up 54%-60% of the price charged by power producers and is passed on to consumers, coal consumption has a bearing on tariffs and environmental dividend in terms of emissions.

According to government data, power stations are now burning 8% less coal than they used to three years ago for each unit of electricity.State-run NTPC, which accounts for 17% of all generation capacity in the country and is the key supplier to states, reduced its coal consumption by 5.5% in 2016-17.

NTPC's coal cost stood at Rs 2 per unit in 2014-15 and should have risen by 33 paise due to revisions in coal price, government cess and railway freight. Remarkably though, it stood at Rs 1.94 per unit for 2016-17. In other words, even after paying 33 paise more since 2014-15, NTPC's power costs 6 paise less today .

For discoms then, this actually means a saving of 39 paise per unit, taking into account the impact of the revi sions, and translates into hundreds of crores of rupees.

Lower cost of power ultimately benefits consumers by way of lower tariff. That happens only in an ideal situation.In reality, discoms coping with sagging bottomlines and commercial losses may not be able to reduce monthly bills of consumers immediately . But they will find it hard to justify demand for tariff hike to state regulators. In the long run, however, cheaper power will result in lower traiffs once the discom reforms take root.

Shortage---and imports

2010-18

Sanjay Dutta, Coal import bill down ₹1L cr in 4yrs, September 11, 2018: The Times of India

From: Sanjay Dutta, Coal import bill down ₹1L cr in 4yrs, September 11, 2018: The Times of India

India has saved over Rs 1 lakh crore in coal import bill over the last four years as shipments brought in by the power sector — accounting for 76% of demand — came down steadily on the back of rising domestic production and improved quality control, says an internal assessment paper of the coal ministry.

The analysis, undertaken after several power stations recently ran low on coal stocks, assumes a CAGR (compounded annual growth rate) of 22.6% on the basis of average import growth rate between 2009-10 and 2014-15 to project a requirement of 380 MT (million tonne) shipments in 2017-18, valued at Rs 2.52 lakh crore. Against this projection, actual imports stood at 208 MT, valued at Rs 1.14 lakh crore, reflecting a huge saving of forex outgo.

The paper says imports by the power sector rose by nearly 10% annually between 2010-11 and 2014-15. But shipments shrank from 91.29 million tonne (MT) in 2014-15 to 56.41 MT in 2017-18, while power generation from coalfired stations grew at nearly 5% a year during this period.

“The rapidly growing trend of coal import between 2009-10 and 2014-15 was arrested by increased domestic production and thus the projected import of 380 MT was checked at around 200 MT without compromising the demand of a growing economy. This not only enhanced the country’s energy security, but also resulted into avoidance of extra expenditure in import bill,” says the analysis.

It argues that higher generation in spite of sliding imports became possible as coal production rose by 110 MT between 2014-15 and 2017-18 against 31 MT in the preceding four years. Simultaneously, quality control measures in the last four years reduced coal requirement for generating each unit of electricity to lower demand by 40-50 MT.

According to the analysis, the recent uptick in imports is driven by nearly 6% annual growth in coking coal shipments brought in by cement and steel industries. It says some coal imports are inevitable since India does not have adequate quantity of coking coal and there are several power stations built to run on high grade imported coal.

A top power ministry functionary admitted to supply issues in some patches, especially power stations being fed by Central Coalfields and Western Coalfields Ltd due to various limitations in transportation and rains.

2013

`Waive green nod to extract more coal from mines'

New Delhi Sanjay Dutta & Vishwa Mohan TNN

The Times of India Jun 20 2014

Coal imports India's coal shortage is estimated to hit 350MT in 2016-17.

India imported over 80 million tonnes (MT) of coal in the last fiscal. Nearly 50 MT of the imports went to meet the shortfall in supplies from state-run monopoly Coal India, which produced some 475MT against a target of 562MT. Power production has been hanging precariously for years as growth in fuel supplies failed to keep pace with rising demand and rapid expansion of coal-fired generation capacity . The UPA-2 (2009-14) government's dogmatic approach towards granting green nod for opening new mines only exacerbated the problem by setting the clock back by several years

During its last days, however, it tried to hasten coal production by devising the “automatic route“ with a nod for select mines to raise production without holding public hearings, a process that is often misused by vested interests to delay projects.

Theft of coal, 2012-May 15, State-wise figure

Graphic courtesy: The Times of India, August 12, 2015

See graphic:

Theft of coal, 2012-May 15: State-wise figure

Water from coal mines

2019: reaches 398 villages

Sanjay Dutta, Water from coal mines benefits 7 lakh people, April 2, 2019: The Times of India

From: Sanjay Dutta, Water from coal mines benefits 7 lakh people, April 2, 2019: The Times of India

Black Diamond Trove Turns Thirst Quencher Source In 498 Villages

Coal has always been identified as the primary source of energy in India, fuelling 55% of power generation. But thanks to a series of policy initiatives by the Narendra Modi government, the Black Diamond industry is now also quenching thirst of nearly seven lakh beneficiaries in 498 villages across six coal-bearing states.

According to coal ministry data, some 6,100 lakh cubic metre, or 16,700 litres per day, of water is pumped out annually from the mines of India’s biggest coal producer, Coal India.

Until a few years ago , coal mines utilised only a small portion of this water for sprinkling and coal washing etc. Some of the remaining water was stored in ponds created within mine areas and the rest was pumped out on to neighbouring land.

But things began to change since 2015-16 after coal minister Piyush Goyal asked miners to put mine water to good use. Packaged drinking water under the ‘Coal Neer’ brand was the first step. Since then, the initiative has grown into a civic service, with the ministry data showing CIL mines supplying some 484 lakh cubic metres of water for domestic use and 599 lakh cubic metres of water for irrigating over 2,060 hectares of land during 2017-18.

‘Coalgate’: wrong allocation of coal blocks

CBI court verdict: 2017

The three union coal ministry officials, held guilty in a coal block allocation case, made “dishonest misrepresentation“ of facts to the then Prime Minister Manmohan Singh while recommending the allocation of a coal block in Madhya Pradesh to Kamal Sponge Steel and Power Limited (KSSPL), a special CBI court observed.

The court found that the application of KSSPL was “clearly incomplete“ as it was not accompanied with all the requisite documents, thus liable to be rejected at the initial stage itself.

“The fact that the then PM of the country Manmohan Singh thought it appropriate to retain the charge of ministry of coal with himself only , clearly shows as to how important the work of said min istry was,“ noted special judge Bharat Parashar.

“While forwarding the file to PM as minister of coal for approval of the recommendation of the screening committee, it was nowhere mentioned by any of the MOC officers, much less by accused H C Gupta, that the applications have not been checked for their eligibility and completeness,“ the court said.

In such a scenario, the court said, there was no reason for the PM to presume that the guidelines issued have not been complied with.

A special court convicted former coal secretary H C Gupta then joint secretary K S Kropha and then director K C Samaria besides others in the case pertaining to alleged irregularities in allocation of Thesgora-B Rudrapuri coal block in Madhya Pradesh to KSSPL.

KSSPL and its former managing director P K Ahlu walia have also been convicted. The court will pronounce the order on quantum of sentence today (May 22).

The court observed that screening committee constituted by government of India was given the task of verifying the claims of various applicant companies before recommending their names for allotment of coal blocks. The court said the accused withheld the aspects of non-compliance with the guidelines from the Prime Minister, “knowing fully well“ that he would approve allocation on the basis of recommendation of screening committee only.

Mines, to boost tourism

In Kamshet or Panchgani, one can also descend into a coalmine 500 metres below the surface near Nagpur to experience the hardship of miners and learn about fantastic machines.

Two mines of Western Coalfields Limited--both active with their coal feeding power plants--about an hour's journey from Nagpur have been thrown open to the public by the state tourism authority , MTDC. The first is the open cast Gondegaon and the other is the underground Saoner. “We are already taking tourists there.

With growing popularity across the state, we expect a bigger crowd this season, which is between September and April,“ said director of tourism Satish Soni. The tours started after CM Fadnavis signed an MoU with WCL last month at Nagpur. Mine tourism started by the state government is the first such experiment in India.

According to tourism minister Jaykumar Rawal, there was a huge demand for it from the younger crowd, especially students. “Initially the response was average, but now it is picking up with the Nagpur MTDC witnessing growing online and offline bookings,“ he said.

The underground infotainment area at Saoner is as huge as around 5 sq km (see box). “Here, a unique man-riding system takes you down deep,“ said an MTDC official from Nagpur.Since, Gondegaon is an open cast mine, it can be seen from above.

“To operate this tour, there should be at least 10 passengers. If there are fewer than 10, they will be ac commodated in the next tour date as per their convenience. If a passenger is not willing, the booking amount will be refunded without any deduction,“ said a senior MTDC official. The tours can be booked on the MTDC website or offline.

The tour includes a trip to the mine, where visitors learn about the tough life of miners, the dangers they face and the huge machinery involved in mining.“Buses or private cars take the visitors 35 km from Nagpur to the Saoner mine. Prior to entering the mines, an undertaking will have to be given assuring the miners of no major health issues,“ said the official.

Visitors receive safety ge ar at the WCL guest house, and an eco-park nearby is open to them.

“A jungle safari on a toytrain which passes through stations-cum-mining galleries give a first-hand idea of underground mining technology ,“ he said. A visit to the famous Adasa Ganesh temple is also thrown in.It was an eye-opener for Satish Mohite, a tourist from Kolhapur. “Miners who extract the black gold and other minerals have to conduct blasts, divert water and ensure state-of-the-art security measures while doing all that.Managing quakes, blast effects, floods and other threats is part of the routine here,“ he said.

The protection force at the mines as well as special safety officers assigned by the director-general of mine safety double as guides and instructors who are meticulous about keeping the visitors safe. As of now, minors are not allowed.

India vis-à-vis the world

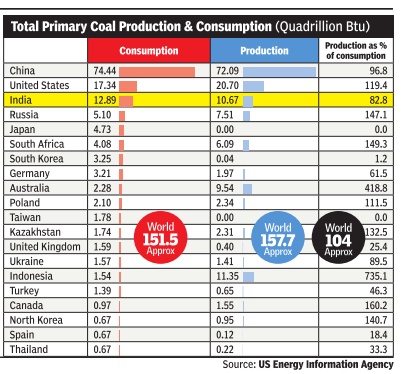

WHO'S GOT THE COAL?

The Times of India Sep 27 2014

India is the world's fourth largest producer of coal behind China, the US and Indonesia. China alone produces almost as much coal as the rest of the top 10 put together. Yet, both of these Asian giant nations are net importers of coal because they are among the largest consumers too, China the biggest and India the third biggest. Most other big producers are net exporters. At the other end of the spectrum, Japan and South Korea are among the biggest consumers of coal but are totally dependent on imports to meet their needs. The data here is in thermal units rather than tonnes since the same weight of coal can have varying energy value depending on its quality.