Brooms/ jhaadu: India

This is a collection of articles archived for the excellence of their content. |

The market

2019, 2020

Namrata Singh, January 20, 2021: The Times of India

From: Namrata Singh, January 20, 2021: The Times of India

The humble ‘jhaadu’ — an otherwise low-involvement category — is sweeping the market with innovation.

The tradition of buying a new jhaadu every Diwali has taken roots in several households. What’s brought the broom into the spotlight is a growing direct involvement of the consumer in this category since the pandemic.

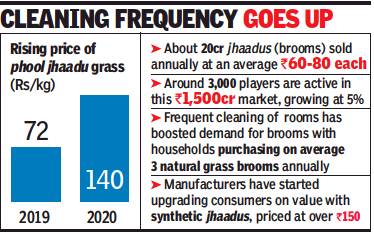

However, given that the lockdown coincided with the peak harvest season (January-March), the price of phool jhaadu grass (which is bundled together to make a jhaadu) doubled in auctions to Rs 140 per kg in 2020 (from about around Rs 72 in 2019), said industry sources (see graphic). The cultivation of phool jhaadu grass (tiger grass), mainly in the northeast, also supports livelihoods in the rural/tribal belts of the region. Nandakumar H N, CEO of Vibhava Industries, which makes the most jhaadu volumes by brand — ‘Monkey 555’ — said, “This year, the auction is expected to open at around Rs 100. It could subsequently stabilise at Rs 70-72.” Nandakumar produces over 1 lakh brooms every day.

What’s typical of a new broom is the ‘ bhusa’, or dust it sheds, for the first few days as flower pods dry and fall during the process of sweeping. The quicker a broom stops shedding dust, the premium is its value (over Rs 130 per unit). Jatin Gala, COO of Freudenberg Gala Household Product, said, “There are certain pain points associated with brooming, such as the dust it sheds in the initial days. This is what prompted us to do research and come out with a synthetic ‘no dust’ jhaadu, which will last a whole year and will be functional from day one.”

Synthetic brooms are priced upwards of Rs 150, which is more than double the price of a regular natural grass broom. This has upgraded consumers on value, making brooms a high-interaction category. “Traffic of our ‘no dust’ brooms on e-commerce sites is growing by the day. We have sold more than 3 crore of these brooms in the last seven years,” said Gala, who leads the market in value terms with a 19-20% share.

There are still new players entering the market. Aditya Pittie, MD & CEO of Pittie Group, which has come up with ‘Chakaachak’ brooms (including a synthetic variant), believes pricing is going to be the key to drive growth. Chakaachak has been priced 15% cheaper than national brands like Gala, making it a challenger. Pittie said the category has the potential for national consolidation.

The synthetic jhaadu segment has also attracted the attention of Chinese players. However, the ‘Monkey 555’ brand hasn’t entered the synthetic jhaadu segment. Nandakumar believes only natural grass jhaadus can remove the finest dust. “We are planning to come out with an eco-friendly ‘green’ broom that does not contain plastic. We are studying how to enhance the longevity of grass and would launch it this year,” said Nandakumar.

He said the price fluctuations of tiger grass would not be an impediment to continue in the natural segment. “We have built relationships with traders for over 25 years. We have often given them advances and have also nurtured them during crises, when prices were falling, by buying additional crop,” he added. As to whether synthetic jhaadus could overtake natural ones, Gala said, “One doesn’t know when the tipping point will come. It could be near.”