Cyrus Mistry

This is a collection of articles archived for the excellence of their content. |

Early life

[ From the archives of the Times of India]

Cyrus P Mistry is a ‘Bombay boy’. He’s the younger son of construction baron Pallonji Mistry, whose net worth is about Rs 38,000 crore ($7.6 bn) and who is the largest single stakeholder in Tata Sons. Cyrus is married to constitutional lawyer Iqbal Chagla’s daughter Rohiqa. Cyrus’ interests include golf, ‘easy listening’ music.

Graduated in civil engineering from Imperial College, London in 1990 and acquired an MSc in management from the London Business School in 1997

t He will be the sixth and youngest chairman of the Tata Group, and only the second non-Tata after Sir Nowroji Saklatvala to head the group

Building On Family Biz t He joined the board of Shapoorji Pallonji & Co. in 1991 and was appointed managing director of the Shapoorji Pallonji Group in 1994.

He has been on the board of Tata Sons since August 2006 and I have been impressed with the quality and calibre of his participation, his astute observations and his humility. He is intelligent and qualified to take on the responsibility being offered and I will be committed to working with him over the next year to give him the exposure, the involvement and the operating experience to equip him to undertake the full responsibility of the group on my retirement.

A profile

Keeping Tata OK

Because he brought in a whiff of change in the 146-yearold Tata Group, forming a Group Executive Council full of young faces, including Madhu Kannan, previously Bombay Stock Exchange's youngest MD & CEO, and Nirmalya Kumar, a former professor with the London Business School.

Because he followed a more pragmatic approach in his first year in office, doing deals worth only $385 million to focus on consolidation rather than expansion. because he kept Tata Motors running in top gear despite the sudden death of its MD, Karl Slym, in 2014 by forming a Corporate Steering Committee, with himself at the helm, to oversee strategy and key operations.

Brand firstbb

Mistry comes to office in different cars, sometimes even in a Tata Indigo Manza.

Home is...

A sea-facing mansion in Walkeshwar, a 20-minute drive from his Bombay House office at Flora Fountain.

Bookworm An avid reader, he is often seen devouring books on management strategy.

Vision 2025

Under Mistry, the Tata Group was supposed to invest $35 billion in the next three years. His grand plan, shared in an internal group conference in 2014, is to make the company among the top 25 in the world over the next decade.

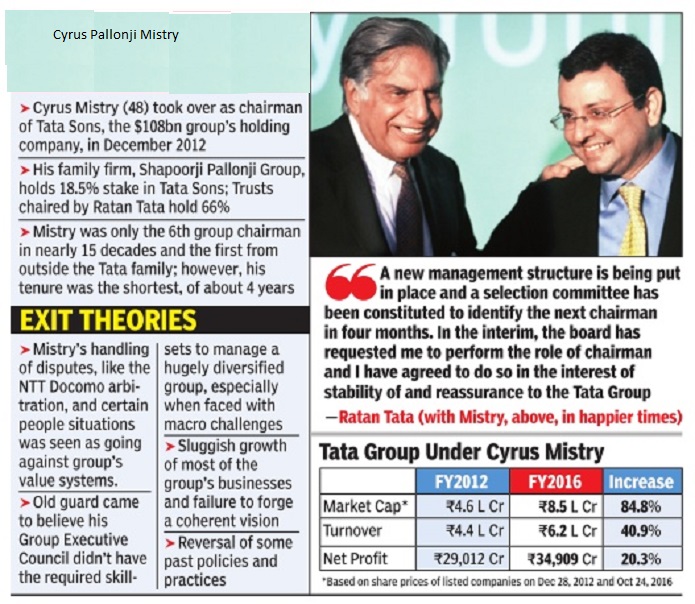

Cyrus Mistry as Tata chief, 2012-16

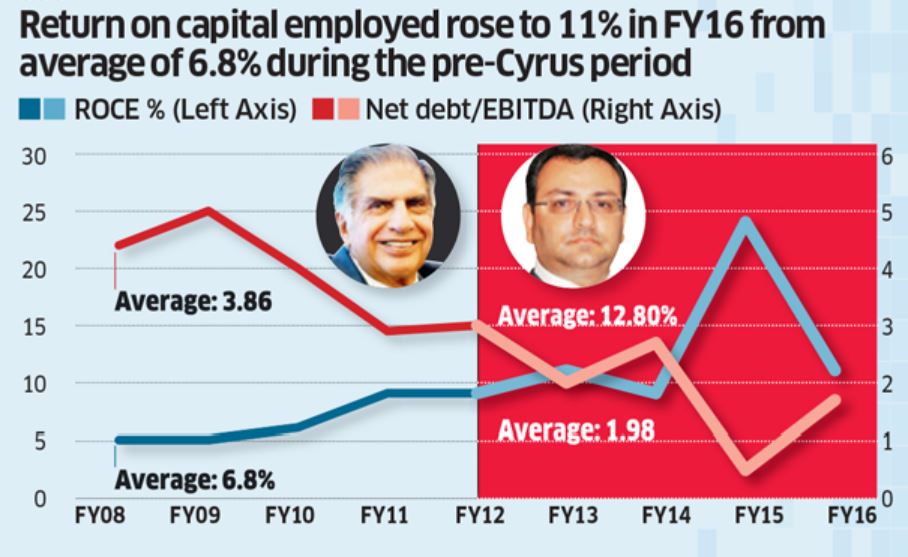

See graphic 'Cyrus Mistry, 2012-16'

The Times of India

Tata Group performance under Mistry, 2012-16

See three graphics

How Tata Sons fared during Mistry’s tenure, TNN, 4 Nov 2016, The Times of India |

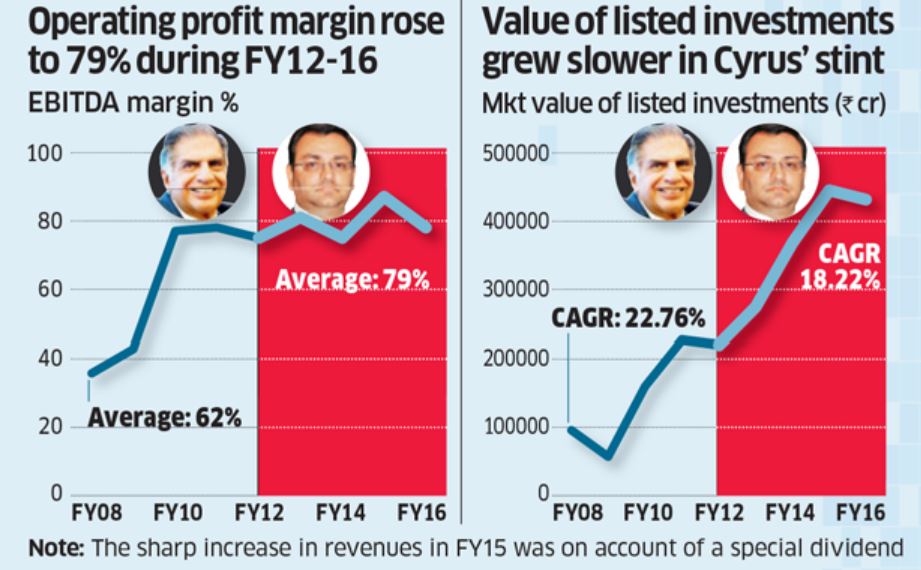

Tata Sons, the group's holding company, nearly doubled its revenues, operating profits and return on capital employed during the period it was helmed by Cyrus Mistry, who was sacked as the conglomerate’s chairman in a surprise move late last month. How did Mistry manage that? With sharpened focus on treasury operations and sustained reduction in finance costs.

The Times of India

The Times of India

i) operating profit margin,

ii) value of listed investments

The Times of India

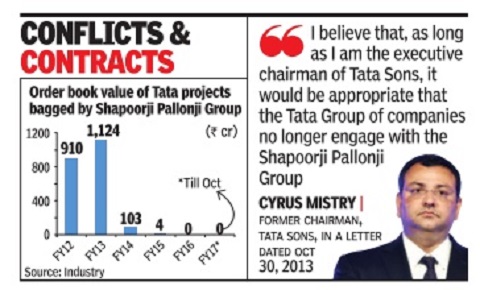

Mistry, Tata chief, discriminated against own companies

As Tata Chief, Mistry Asked Group Cos Not To Award Contracts To Family Biz

The iconic Taj Mahal hotel in Mumbai, Tata Motors' Nano plant in Sanand, Gujarat, and TCS' campus in Hinjewadi, Pune have one factor in common: They were all built by the Shapoorji Pallonjis. But that was before the scion of the Shapoorji Pallonji Group, Cyrus Mistry , became chairman of Tata Sons in December 2012. Since then, business from the Tata Group has dwindled.

Orders bagged by Shapoorji Pallonji Group from the Tatas plummeted from Rs 1,124 crore in 2012-13 to nil in 2015-16, following a directive from Mistry after he became chairman of Tata Sons, the holding company for the Tata Group. Within a year of taking charge, he barred Tata Group companies from awarding new contracts to the Shapoorji Pallonji firms, saying it would be “appropriate“ to “no longer engage“ with the latter as long as he was heading the Tata Group.

The move was intended at avoiding any conflict of interest, but led to significant loss of business for the Shapoorji Pallonji Group, whose chairman emeritus is Cyrus Mistry's fat her Pallonji Mistry .

The issue came back into focus over the last fortnight following allegations in the media that one of the reasons for Mistry's ouster from Tata Sons was that he was favouring Shapoorji Pallonjis during his tenure as Tata Sons chief.

Mistry's October 30, 2013 letter to Tata CEOs says: “The Tata Group has always prided itself on acting ahead of laws and re gulations to adhere to the highest standards of corporate governance in our country for over a century . In furtherance to the same philosophy and to avoid any perception of a potential conflict of interest, I believe that, as long as I am the executive chairman of Tata Sons, it would be appropriate that the Tata Group of companies no longer engage with the Shapoorji Pallonji Group of companies for any engineering and construction contracts.“

“Current contracts under the execution by the Shapoorji Pallonji Group of companies can, however, continue till completion,“ said Mistry's letter. It also requested Anil Sardana, CEO of Tata Power, R Mukundan, CEO of Tata Chemicals, T V Narendran, CEO of Tata Steel, among others, to place the matter “at the next board meeting after which you may suitably implement the recommendation“.

Cyrus Mistry’s big decision

- Mistry worked with his family enterprise Shapoorji Pallonji group, a real estate and construction giant.

- The most important decision Mistry took was to sell the beleaguered steel business in the UK

- This was a tough decision for Mistry considering that the acquisition of Corus in 2007, led by Ratan Tata himself.

MUMBAI: The kind of changes Cyrus Mistry brought about while at the helm of the Tata Group reflected that he was in a hurry to bring in a transformation. After all, Mistry was handed over a legacy he did not help create, unlike several other Tata Group chiefs who worked and rose through the ranks of the group companies.

Ratan Tata, whom Cyrus had replaced four years ago, had started his career in the Tatas at Nelco, which made a mark with its Nelco Blue Diamond colour TVs. JRD Tata, Ratan Tata's predecessor, has been a Tata lifer. In contrast, Mistry worked with his family enterprise Shapoorji Pallonji (SP) group, a real estate and construction giant. With nearly 18.5% holding, the SP group is the single largest shareholder in Tata Sons, the main promoter of most of the Tata Group companies. In November 2011, he was picked as Ratan Tata's successor to lead the $100-billion-plus group.

In his less than four-year tenure, perhaps the most important decision Mistry took was to sell the beleaguered steel business in the UK, which was turning out to be a drain on Tata Steel's balance sheet. This was a tough decision for Mistry considering that the acquisition of Corus in 2007, led by Ratan Tata himself, was considered to be an audacious move by an Indian entity. This, along with the group acquisition of the iconic auto brand Jaguar Land Rover, bolstered the Tatas' image globally. Recently, the group also decided to exit the urea business — another legacy of the past — to Yara Group of Norway.

Apart from undoing some of the legacies of the group, Mistry took the conglomerate into the new age e-commerce business with Tata CLiQ. As he prepared the blueprint for the group's new business strategy, Mistry also looked to expand the defence business. Early this year, the group sold 74% in data centre unit of Tata Communications to Temasek Holdings-owned Singapore Technologies Telemedia for $500 million. And in September this year, Mistry made it clear that the group won't shy away from paring more assets if needed. He was clearly looking to cut down on debt, which had ballooned to $24.5 billion.

During Mistry's term, high-value legal cases also rose sharply. The Tatas are fighting DoCoMo of Japan, its telecom partner, in a $1.7-billion lawsuit which has also impacted the Tata name badly. TCS, a group company, is also facing a $940 million lawsuit in the US.

During the months leading to his exit+ , Mistry was slowly coming into his own and steadily changing the way the group conducts its business. Mistry recently said group companies "need to earn the right to grow", hinting that performance of each of the group company would determine its place in the portfolio.

Mistry's ouster as Tata chairman, and after

Why Mistry was 'abruptly' sacked as Tata chairman

- The old guard, known for honouring commitments, was unhappy with the way dispute with DoCoMo was handled

- Some observers believe the trusts weren’t fully in sync with the functioning of the Group Executive Council set up by Mistry.

- Mistry had a different management perspective and perhaps needed time to evolve

MUMBAI: Seasoned Bombay House watchers offer illuminating pictures of how the Tatas handled the Corus acquisition (under Ratan Tata) in contrast to the messy divorce from DoCoMo (under Cyrus Mistry) to underscore the change in management styles+ and perhaps explain Mistry's abrupt dismissal.

A top investment banker recalled that Credit Suisse had offered Tatas a financing package that helped it aggressively outbid its Brazilian rival for Corus Steel in the UK. Once the deal was done, two other MNC banks approached the company's top brass with a more comfortable funding plan involving cost savings of about $400 million. As Tata Steel weighed in favour of the new funding option, Credit Suisse fetched up with a letter from the Tatas showing its commitment to $120 million in fees whether or not the financing was availed from it.

Bombay House top brass was left fuming that a bank had the temerity to place a demand on them. But when the matter was taken up to the then group chairman Ratan Tata, his decision was simple: There was a commitment made to Credit Suisse which must be honoured. Having paid the European bank, Tata Steel went ahead with the cheaper financing option.

Almost a decade later, Tata is telling DoCoMo, the Japanese partner in the troubled telecom business, that it would honour a put option to buy out at a pre-determined price but with a caveat. It would have to comply with Indian regulations. It's a small tweak to the much storied magnanimity and commitment of the Tatas. DoCoMo has already won the arbitration and blamed Tata's adamant stance for not resolving the dispute. (RBI had rejected Tata's proposal to pay a price which is higher than the 'fair value' to buy out its Japanese partner's stake after the finance ministry told the central bank to 'stick to the rules', leaving the issue to be resolved through arbitration).

"For a nuanced Tata watcher, this was a big change. In the past, Tatas would have told a battery of lawyers that there's a commitment and they must find a way around the problem," says the person quoted above. "The philosophy out there was that we would be fine in the long run," he adds, while explaining how this has served the group well over time. "What is the Tata Group? A string of under performing companies, if you exclude TCS and JLR, but strutting around because of the value system it firmly holds," says a person who has worked with the Bombay House extensively.

Was Tata Changing?

Also, there were indications that the group was getting preoccupied with decimal points, with a newfound eagerness to gather the last rupee. This was a mindset shift which roiled the Japanese ally and stymied other divestment plans aimed at de-leveraging the group's nearly $25-billion debt, says the banker mentioned earlier. It also surprised some insiders, including the Trusts that control Tata Sons, the holding company of the diversified salt-to-software behemoth. The Trusts started taking a keen interest in Mistry's new book-keeping ways.

Not just that. The handling of a harassment case at a group company, involving a senior functionary, led to considerable consternation among old-timers who were left fretting at the ways Tata was changing. The complainant had approached the chairman before quitting the job in disquiet. "The message from the top to a distraught employee didn't befit the group or the post," says the second person, cited earlier, with access to the group.

With the Tata Trusts turning their attention to the recent developments, strategic decisions across group companies were being elevated to the Tata Sons board. This reduced the space to maneuver for Mistry.

Some observers believe the trusts weren't fully in sync with the functioning of the Group Executive Council set up by Mistry, which worked closely with the boards, CEOs and senior management of Tata companies. There was strong criticism of GEC members Madhu Kannan, Nirmalya Kumar, and N S Rajan who now face an uncertain future. The Trusts, which have majority voting rights in Tata Sons' board, had started assessing the changed management style and its impact on the group which is facing sluggish growth.

5th Year That Wasn't

These developments came to the forefront even as Mistry entered his fifth year as chairman and was due for, most thought, a routine renewal.

Mistry, who spearheaded Shapoorji Pallonji Group before taking over the mantle at the Tata Group, was perceived to be attempting to secure his position by building strong ties with the country's political establishment. Some of his GEC appointees reportedly advised Mistry that as Tata chairman he had an opportunity to play a bigger role with the establishment at a time when the credibility of most business houses stood diminished.

Top Comment

Tatas are so attached to their values that they cannot see it getting compromised at whatever the cost. If they were driven by profit alone they would have conquered the world by now.Chirag Chaudhary

Mistry had a different management perspective and perhaps needed time to evolve. His backers saw in him a chairman who struggled with a difficult global economy and some unwieldy acquisitions he inherited.

Mistry, only the second group chairman not to have a Tata surname, was initially part of selection committee searching for Ratan Tata's successor. He so impressed fellow committee members during deliberations — detailing what a future Tata chairman should be like — that they actually gave him the job. In the end, it didn't quite work out. "Ratan Tata is a big picture man, a visionary. Mistry brims with energy and is very hands-on (for a Tata chairman). The change was very 'in- your-face' for the old-guard," one of the senior-most CEOs at the group said. He had to go.

Not abrupt, the ouster had been building up

Boby Kurian and team, Seems sudden, but was building up, Oct 25 2016 : The Times of India

Replacement To Be Named In 4 Months

For the past few months, TOI's national corporate editor, Boby Kurian, had been working on a story that all was not well within the House of Tata. He had heard reports of rising tension between Cyrus Mistry -who took over as chairman of India's largest conglomerate in December 2012 from Ratan Tata -and the `old guard'. There were many theories -ranging from unhappiness over the group's performance, to the handling of certain situations and companies -none of which could be confirmed.At the core, though, there appeared to be a clash of cultu res and management styles; there was concern over the erosion of long-held “values“ and the reversal of some policies and practices.

But the stunning suddenness with which the Tatas on Monday evening announced the replacement of Mistry , aged 48, and the temporary return of his 78-year-old predecessor to the helm has left India Inc in a state of shock.

What makes the sacking as extraordinary as it is dramatic is the fact that Mistry is not just another executive; he is son of construction tycoon Pallonji Mistry , the single lar gest individual shareholder in Tata Sons--the group's holding company--with a stake of 18.5%. But 66% is controlled by the Tata Trusts, whose life-long chairman is Ratan Tata (rest 15.5% of Tata Sons is held by group firms). Some years ago, the Articles of Association of Tata Sons were changed to give the trusts sweeping powers in the selection and removal of a chairman.

Conversations with people within or close to the group indicate that the decision was not as abrupt as it appears to be. Said one of them, “It seems to have happened in a hurry , but it was building up.“

The recent induction of industrialist Venu Srinivasan and Bain Capital managing director Amit Chandra to the board -apparently without even consulting Mistry -is now being seen as a precursor to the surgical strike against him.

Given the financial and family backing that Cyrus enjoys, any legal challenge he mounts against his dismissal could lead to uncertainty both within and outside the group, at a time when a number of its companies aren't doing very well.

A marathon meeting of the Tata Sons board was follo wed by a terse press release to announce that Mistry was being “replaced“ by Ratan Tata as “interim chairman“ and a five-member committee had been constituted to choose a successor within four months. It is said to have taken even top group executives who were physically present in Bombay House, the headquarters of the Tatas, by surprise; one CEO apparently called another and said, “Switch on your TV .“

Of the nine-member board, six are believed to have voted against Mistry while two abstained (Mistry didn't have a vote on this). Speculation is rife as to the identities of the two who abstained from voting.

In the hours that followed, the five-member Group Ex ecutive Council that Mistry had set up in 2103 was disbanded amid reports that three of them might be asked to leave the group. Tellingly , an interview Mistry had given to Tata Review, an in-house magazine, could no longer be found on the official website.

According to a business TV channel, the Tata Sons board had sought the legal opinion of P Chidambaram, R V Raveendran and Mohan Parasaran, who have served as Union finance minister, Supreme Court judge and solicitor general respectively. At least one part of that information turned out to be inaccurate; TOI has learnt that Parasaran will actually be representing Mistry in court.As for Chidambaram, he told TOI when asked for confirmation, “That's a question no one can ask any lawyer.“

The Tata Sons press release said the committee to choose a new chairman would comprise Tata, TVS chairman Venu Srinivasan, Bain Capital managing director Amit Chandra, former ambassador to the US and Russia Ronen Sen, and UK-based manufacturing guru Lord Kumar Bhattacharya, all of whom are on the board of Tata Sons. The committee had been “mandated to complete the selection process in four months,“ it added.

Sale of assets, falling revenue worried Tata Trusts

Sale of assets, falling revenue worried Tata Trusts, old timers, Oct 26 2016 : The Times of India

The Tata Trusts were concerned over the falling revenues of the group since Cyrus Mistry took over the reins of the company and there was a growing divergence over values and ethics, people close to the Tata Group have revealed in interviews to a television channel.

A day after the dramatic removal of Mistry , at least three people close to the Tata Group have spoken about the possible reasons for the dismissal of the former Tata Sons chairman.

“Since Cyrus took over, there's no formal link between trusts and Tata Group. The trusts are dependent for philanthropic activities on dividends on shares we hold. The performance of Tata Sons was becoming more and more dependent on just 2 cos -TCS & JLR,“ V R Mehta, trustee at the Sir Dorabji Tata Trust, was quoted as saying by NDTV .

“The trusts were concerned about falling revenue (since Mistry took over) -funds for charitable work were drying up. There's been divergence since Mistry took over on values and ethics. The trusts' concerns were a major factor in Cyrus' removal. Probably , no choices were left,“ Mehta was quoted as saying.

Noted lawyer Harish Salve, who is a legal expert for the salt-to-software group, told NDTV that the “group felt its formidable international reputation was being compromised“. “I'm sure all the people concerned here know they are not fighting for a piece of land or property ,“ Salve was quoted as saying by the TV channel.

He also said Mistry's move to sell group assets to pare debt was also a factor which had worried Tata Group old timers. “Tata has a reputation for weathering storms,“ Salve was quoted as saying by NDTV . He said Tata's approach had been not to “ditch assets in difficult times....try to fix it before you dismantle“.

Salve told the channel that the move to sell Tata Steel's assets in UK was seen as reversing the acquisitions undertaken by Ratan Tata because when the group acquired those assets, “it was not just buying a business, it was buying into an institution“.

The eminent lawyer said the decision to dismiss Mistry may not have been sudden and admitted that it had created some “bad blood“. “When it comes to governance of an institution, sometimes things don't go right, there is hurt, there is disappointment, sometimes there is also a sense of humiliation,“ Salve was quoted as saying by NDTV .

Another eminent lawyer, Mohan Parasaran, who has advised the Tata Group on the Mistry issue, said Ratan Tata had met Mistry before the board meeting on Monday and had asked him to quit. “I was approached a month back and gave an opinion to them on this issue. I said the board was competent to appoint chairman following their articles of association. They will need to appoint a selection committee. But there's no need of a selection committee for the removal. For that, a majority of directors is needed,“ Parasaran was quoted as saying.

“I was told that Ratan Tata and a board member came all the way from the US (Harvard Business School dean Nitin Nohria) to meet Cyrus to persuade him to step down. Mistry had his own views and refused -he is entitled to his views.“

Reeba Zachariah & Partha Sinha, Hidden agenda in `other items'?, Oct 26 2016 : The Times of India

Usually board members are informed in advance about the agenda for a meeting so that they have enough time to prepare for discussions that would come up during those meetings.Normally those meetings are predictable too.

However, the Tata Sons board meeting on October 24 deviated from the usual routine.Before the board of directors gathered, the entire agenda for the meeting was shared with all of them but for one item, which was not shared with Cyrus Mistry , the chairman of the board. This one entry , listed among `other items' was the crucial proposal that con cerned Mistry's tenure as chief of Tata Sons. This `item' was, for some reason, buried among several other items.What's even more curious is that this particular `other item' was missing from the no te that was sent to Mistry.

So, in effect, eight of the nine-member Tata Sons board knew that they would discuss cutting short Mistry's tenure as chairman at one of India's richest privately-held companies. Mistry , who was till then the chairman of the board, had no idea about it. This also raises the question of who moved this particular `other item' at the board meet that ran for several hours.

However, Mistry was aware by then that a faction of the board was keen to see him step down. Ratan Tata and Nitin Nohria, dean of the Harvard Business School, had met him and “tried to persuade him“ to step down, according to one of the group's legal advisors Mohan Parasaran. Mistry rejec ted the suggestion.

At the meeting that followed, six of the eight members excluding Mistry voted in favour of his removal while two abstained. According to a lawyer, if there is a controversial item in the board agenda, the person against whom the particular item has been moved will not participate in the vote. That, probably, explains why Mistry didn't vote during the October 24 meeting.“Good governance requires that you don't participate in the voting if the matter is related to you,“ the lawyer said.

A spokesperson for Tata Trusts, the largest shareholder of Tata Sons, said all the processes were followed during the crucial Monday board meeting.

Cyrus Mistry’s point of view

The Times of India

The Times of India

The Times of India

The Times of India

The Times of India

'Nano has consistently lost money... has not been shut for emotional reasons alone': Cyrus Mistry in his letter to Tata Sons

The Times of India Reproduces Sacked Tata Sons Chairman Cyrus Mistry's Email To Board Directors Of Holding Co And Tata Trustees

DIRECTORS OF TATA SONS LTD

I was shocked beyond words at the happenings at the board meeting of October 24, 2016.

Apart from the invalidity and illegality of the business that was conducted, I have to say that the board of directors has not covered itself with glory. To "replace" your chairman without so much as a word of explanation and without affording him an opportunity of defending himself in a summary manner must be unique in the annals of corporate history .The suddenness of the action, and the lack of explanation has led to all manner of speculation and has done my reputation and the reputation of the Tata Group immeasurable harm. At the outset, I have to say that I have great respect for the Tata Group and the thousands of employees who are working hard despite the challenges. I am writing this letter to the board to emphasise the total lack of corporate governance and to point out the failure on the part of the directors to discharge the fiduciary duty owed to stakeholders of Tata Sons and of the group of companies. All of this does not augur well for the future of the group.All that is said here is well known to many among you, but I would like to put in one place my journey as chairman of Tata Sons.It is important to emphasise the enormity of what has transpired in the group and what corrective action is to be taken. Each of you is already in receipt of and familiar with the Strategy 2025 document that I presented to you, and in which I had articulated our growth strategy for the future.

In 2011, after some exploration by a search committee, I was approached by both Ratan Tata and Lord Bhattacharyya individually to be a candidate for the position.I politely declined. I had myself built a business which I would continue to run. However, as the search process progressed and the committee was unable to find a suitable candidate, I was asked to reconsider. After consulting my family and in the broader interests of the Tata Group, I took courage to overcome my initial reluctance and agreed to consider the position.

Prior to my appointment, I was assured that I would be given a free hand. The previous chairman was to step back and be available for advice and guidance as and when needed. After my appointment, the Articles of Association were modified, changing the rules of engagement between the Trusts, the board of Tata Sons, the chairman, and the operating companies. Inappropriate interpretation indeed followed, and as elaborated below, it severely constrained the ability of the group to engineer the necessary turnaround.

I am not sure if the individual board members and the trustees truly appreciated the extent of the problems I had inherited. I cannot blame them, for I myself, as a nonexecutive director, did not have a clear grasp of the gravity of the issues involved. Without meaning to air a laundry list, let me outline some of the major challenges faced at the time of my entry .

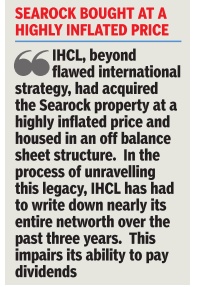

As is public knowledge, the foreign acquisition strategy , with the exceptions of JLR and Tetley , had left a large debt overhang.The European steel business faced potential impairments in the excess of $10 billion, only some of which has been taken as of date. Many foreign properties of IHCL and holdings in Orient Hotels have been sold at a loss.The onerous terms of the lease for Pierre in New York are such that it would make it a challenge to exit. Tata Chemicals still needs tough decisions about its UK and Kenya operations.

IHCL, beyond flawed international strategy , had acquired the Searock property at a highly inflated price and housed in an off balance sheet structure. In the process of unravelling this legacy , IHCL has had to write down nearly its entire networth over the past three years. This impairs its ability to pay dividends.

Tata Capital had a book that required significant clean up on account of bad loans to the infrastructure sector. The loan to Siva was under the strong advice of Executive Trustee Venkatraman (sic) which had since turned into a non-performing asset. All of this resulted in Tata Capital to recognise an abnormal rise of NPAs. Of all the companies in the portfolio, the telecom business has been continuously haemorrhaging. If we were to exit this business via fire sale or shut down, the cost would be $4-5 billion. This is in addition to any payout to DoCoMo of at least a billion-plus dollars. The original structure of the DoCoMo transaction raises several questions about its appropriateness from a commercial or prudential perspective within the then prevailing Indian legal framework. In light of all this, our strategy over the past three years has been to increase the EBITDA from Rs 400 crore to Rs 2,500 crore, in the hope of being a potential player in consolidation of the industry .

Tata Power aggressively bid for the Mundra project based on low-priced Indonesian coal. As regulations changed, the losses in 2013-14 alone amounted to Rs 1,500 crore. Given that Mundra constitutes Rs 18,000 crore of capital employed (40% of the overall company's capital employed), this substantially depresses the return on capital for Tata Power as well as carries the risk of considerable future impairment.

An even more challenging situation arose in Tata Motors, both on the commercial and passenger vehicles. Before 2013, in order to shore up sales and market share, Tata Motors Finance extended credit with lax risk assessment.As a result, the NPAs mounted to being in excess of Rs 4,000 crore.Historically , the company had employed aggressive accounting to capitalize substantial proportion of the product development expenses, creating a future liability. Beyond this, the Nano product development concept called for a car below Rs 1 lakh, but the costs were always above this.This product has consistently lost money, peaking at Rs 1,000 crore.As there is no line of sight to profitability for the Nano, any turnaround strategy for the company requires to shut it down. Emotional reasons alone have kept us away from this crucial decision.Another challenge in shutting down Nano is that it would stop the supply of the Nano gliders to an entity that makes electric cars and in which Mr Tata has a stake.

On the performance of the portfolio, as you are aware from my presentations to you in the recent past, if we look at the aggregate data between 2011 and 2015 and limit the analysis largely to the legacy hotspots (IHCL, Tata Motors PV , Tata Steel Europe, Tata Power Mundra, and Teleservices), it will show that the capital employed in those companies has risen from Rs 132,000 crore to Rs 196,000 crore (due to operational losses, interest and capex).This figure is close to the networth of the group which is at Rs 174,000 crore. A realistic assessment of the fair value of these businesses could potentially result in a write down over time of about Rs 118,000 crore.

In the face of the above challenges, I had to take many tough decisions with sensitive care to the group's reputation as well as containing panic amidst internal and external stakeholders.Despite bad press, impairments were taken to clean the books but substantial exposure remains. Dividends were reduced, e.g. Tata Motors and IHCL, to conserve cash needed for investments in the teeth of shareholder fury .Apart from hotels, the group made several exits in the fertilizer business, UK steel operations, and of course in small companies such as the logistics company , DIESL. I had to ease out hangerson who are prone to flaunt their proximity to power. On the more positive side, Kalinganagar, the largest domestic capital investment of the group was completed overcoming significant obstacles that had left the project in doubt previously .

Early in my tenure, our foray into the aviation sector began when Mr Tata ushered me into his office and handed me a report on AirAsia by Bain & Co. He had concluded negotiations to partner with AirAsia and wanted the proposal tabled at the forthcoming Tata Sons board meeting. My pushback was hard but futile.However, I was able to extract a promise of no debt to be raised at the level of the JV as well as limiting Tata Sons investment to 30% of the $30 million equity . A few months later, I was surprised to be confronted with a similar situation requiring me to execute a fait accompli JV with Singapore Airlines. Without the benefit of time and experience to fully evaluate the proposal, I had to accept that Tata Sons would take a 51% stake in a $100 million joint venture. The passion for the airlines sector has led Mr Tata to continue his involvement with the strategy of the two airlines. It is on his advice that the Tata Sons board has increased the capital infusion in the sector at multiple levels of the initial commitment.

Board members and trustees are also aware that in the case of AirAsia, ethical concerns have been raised with respect to certain transactions as well as the overall prevailing culture within the organization. A recent forensic investigation revealed fraudulent transactions of Rs 22 crore involving non-existent parties in India and Singapore. Executive Trustee, Mr Venkatraman (sic), who is on the board of Air Asia and also a shareholder in the company , considered these transactions as non-material and did not encourage further study . It was only at the insistence of the independ ent directors, one of whom immediately submitted his resignation, that the board decided to belatedly file a first information report.

Despite all of the above, during my term, the operat ing cash flows of the group have grown at 31% compounded per annum. The Tata Group valuation from 2013 to 2016 increased by 14.9% per annum in rupee terms as against the BSE Sensex annual increase of 10.4% over the same period. That Tata Sons networth has increased from approximately Rs 26,000 crore to Rs 42,000 crore, after considering the impairments. This has significantly strengthened our balance sheet, enhancing our ability to absorb further shocks from restructuring in the companies.

To come back to the amendments in the Articles of Association, as feared, the inappropriate implementation created a flux in the decision-making process. I have often presented to the trustees, before and after Tata Sons board meetings. This created alternative power centres without any accountability or formal responsibility, invalidating the very governance role of the Tata Sons board and the chairman, resulting in dysfunctional governance. The trust nominated directors, who I would assume would use their own independent judgment and discharge their fiduciary duties, were reduced to mere postmen. As an example, once, the trust directors (Nitin Nohria and Vijay Singh) had to leave a Tata Sons board meeting in progress for almost an hour, keeping the rest of the board waiting, in order to obtain instructions from Mr Tata. Such a work pattern has also created the added risk of contravening insider trading regulations and exposed the Trust, apart from exposing the trustees to potential tax liabilities.These circumstances forced me to circulate a note on corporate governance in order to clarify the distinct roles of Tata Trusts, Tata Sons board, and the boards of the operating companies.

I cannot believe that I was removed on grounds of non-performance. As you are aware, the Nomination and Remuneration Committee comprising Vijay Singh, Farida Khambata and Ronen Sen, independent directors (two of whom have voted for my removal now), had only recently lauded and commended my performance.

In keeping with Tata Group values, to engage employees and have a favourable impact on the communities we operate in, we launched a volunteering programme, challenging group employees to volunteer a million hours in 2015 and the result was volunteering of 1.2 million hours, making it one of the top ten global volunteering programmes.

I hope you do realize the predicament that I found myself in. Being pushed into the position of a "lame duck" chairman, my desire was to create an institutional framework for effective future governance of the group. I believe I had to be true to myself and the best interests of the organization. While I would be lying if I said I am not disappointed, I have a sense of pride and dignity intact in the efforts I have taken to professionalise and institutionalise, regardless of the outcome of effect, I now witness.

Since the developments at the board meeting were purported to have been initiated at the instance of the Trusts, I am copying the Trustees.

Sincerely, Cyrus (Cyrus P Mistry) C.C. Trustees of Tata Trusts

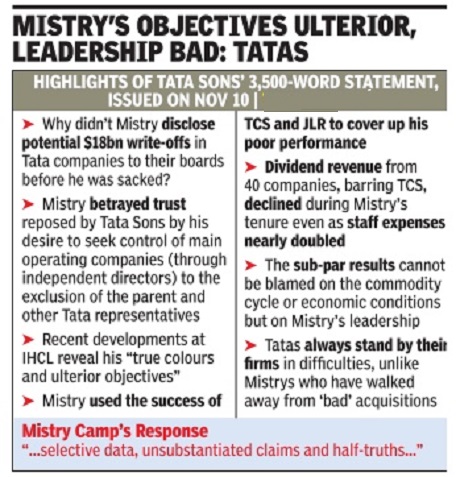

The Tatas’ rebuttal

Here is a statement issued by Tata Sons on the allegations made by Cyrus Mistry, who was sacked as the group's chairman days ago:

"It is a matter of deep regret that a communication marked confidential to Tata Sons board members has been made public in an unseemly and undignified manner. The correspondence makes unsubstantiated claims and malicious allegations, casting aspersions on the Tata group, the Tata Sons board and several Tata companies and some respected individuals. These will be responded to in an appropriate manner.

Mr. Cyrus Mistry, the former Chairman of Tata Sons, has been on the Board of the Company since 2006. He was appointed Deputy Chairman in November, 2011, and formally appointed Chairman of Tata Sons on December 28, 2012. He would be fully familiar with the culture, ethos, governance structure, financial and operational imperatives of the Tata Group as well as various group companies. As the Executive Chairman, he was fully empowered to lead the group and its companies. It is unfortunate that it is only on his removal that allegations and misrepresentation of facts are being made about business decisions that the former Chairman was party to for over a decade in different capacities. The record, as and when made public, will prove things to the contrary.

Efforts are now being made to level accusations against individuals and company boards for ignoring corporate governance norms that were supposedly upheld by the former Chairman while in office. The Tata Sons board gives its Chairman complete autonomy to manage opportunities and challenges. However, the tenure of the former Chairman was marked by repeated departures from the culture and ethos of the group.

The Board of Directors of Tata Sons is composed of several eminent personalities from all walks of life. This is not a group of people who one would expect to act without exercising proper judgement in the best interests of the entities they sit on the boards of. It is unfortunate that Mr. Mistry had overwhelmingly lost the confidence of the Members of the Board of Directors for a combination of several factors. The Directors of the Tata Sons board had repeatedly raised queries and concerns on certain business issues, and Trustees of the Tata Trusts were increasingly getting concerned with the growing trust deficit with Mr. Mistry, but these were not being addressed. The Tata Sons board, in its collective wisdom, took the decision to replace its Chairman in the manner undertaken.

The strength of the Group is not just confined to its value system and ethics in the Board room but to a very large extent by the adherence to the values by its 600,000 plus employees whose spirit and cooperation has built the Group to where it is today. It is unforgivable that Mr. Mistry has attempted to besmirch the image of the Group in the eyes of the employees.

It will be beneath the dignity of Tata Sons to engage in a public spat with regard to the several unfounded allegations appearing in his leaked confidential statement. These allegations are not based on facts or the true state of affairs. It is convenient to put selective information in the public domain to defend one's point of view. There is a multitude of records to show that the allegations made by Mr. Cyrus Mistry are unwarranted and these records will be duly disclosed before appropriate forums, if and when necessary, sufficiently justifying the decision made by responsible Boards of Directors, of Tata Sons and its Group companies.

The Interim Chairman in his first interaction with senior leaders has stressed to them the need to continue on focusing on building great businesses while emphasising on delivering strong shareholder returns. Board members of Tata Sons have in the past stressed on the need to be more decisively focused on bringing down debt, sharpening focus on both the portfolio and capital efficiency.

The Tata Group is proud of its rich legacy of contributing to the growth of the nation. During a long history, it has faced many challenges and the employees of this group have worked hard to create great companies, and deliver shareholder value. The Tata way is to not run away from problems, or constantly complain about them, but firmly deal with them and build a better tomorrow."

Tata, Mistry met PM

Tata, Mistry met PM after boardroom upheaval, Oct 30 2016 : The Times of India

Ratan Tata, interim chairman of Tata Sons, as well as Cyrus Mistry who was sacked as the firm's chairman, met PM Narendra Modi to brief him of the upheaval in the $100 billion saltto-software conglomerate.

Sources in the government said that Mistry , who was dismissed as chairman of Tata Sons by its board earlier this week, met Modi on Thursday and is understood to have explained his view of the events. TOI had reported in its October 26 edition about Mistry seeking an audience with the PM.

Ratan Tata flew in to Delhi and, over 20 minutes, briefed the PM about the changes, sources said. Sources also said that Tata had called finance minister Arun Jaitley on the day the Tata Sons board sacked Cyrus and had explained to him the circumstances which forced them to take the decision.

In an unprecedented move, Ratan Tata had written to the PM shortly after Mistry was removed to inform him about the decision.

All 6 independent directors of Taj Group back Mistry

Tell Bourses He Has Their Full Confidence

In what is being viewed as a setback for Ratan Tata and the board of Tata Sons, which sacked Cyrus Mistry last week, all six inde pendent directors of Tata Group's Indian Hotels Company publicly reposed faith in Mistry's leadership on Friday ahead of a board meet.

Nadir Godrej, Deepak Parekh, Keki Dadiseth, Ireena Vittal, Gautam Banerjee and Vibha Paul Rishi met at the group's headquarters, Bombay House, and were unanimous in their praise for Mistry's strategic direction and le adership. What surprised observers was the stand taken by Dadiseth, a trustee of the Sir Ratan Tata Trust.

The board of IHCL, known as the Taj Group, has 10 members, including Mistry and his brother, Shapoor. The six directors are the first to endorse Mistry since he was axed as Tata Sons chairman.

What surprised Tata observers was the stand taken by Keki Dadiseth, a trustee of the Sir Ratan Tata Trust (SRTT) which is headed by Ratan Tata. SRTT is one of the two principal Tata Trusts which control 66% in Tata Sons; it is also a shareholder in IHCL.

In a statement to stock exchanges, IHCL's independent directors said that taking into account board assessments and performance evaluations carried out over the years, “the independent directors unanimously expressed their full confidence in the chairman, Cyrus Mistry“.

Current laws require that every year all independent directors should hold at least one separate meeting to review performance of non-independent directors and the chairperson. In two recent instances at Tata Global Beverages and Jaguar Land Rover when Mistry chaired board meetings, it involved rou tine business unlike at IHCL where audited results were being declared.

Re-affirmation of faith in Mistry's abilities by IHCL's independent directors is completely at odds with the stand taken by the majority of the Tata Sons board. After removing Mistry last month, Tata Sons had attributed a trust deficit in Mistry as the reason for his removal.

Two of the six independent directors of IHCL told TOI that they supported Mistry because they felt he was leading the company well. “Honestly , he's done a great job as chairman of IHCL,“ said one of the two.On Friday , IHCL's board, which met to consider its July-September results, reported a consolidated net loss of Rs 27 crore, substantially lower than the Rs 152crore loss it had reported a year earlier.

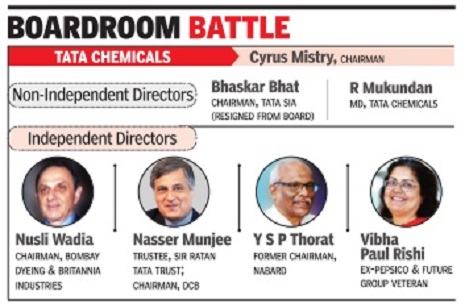

Tata's friend Nusli backs Mistry

Backs Cyrus At Tata Chem | Is Also On Tata Steel, TaMo Boards

Nusli Wadia, who was godson of J R D Tata and was for years considered a close friend of Ratan Tata, came out on the other side on Thursday when he led the independent directors of Tata Chemicals in unanimously supporting Cyrus Mistry's chairmanship of the prominent Tata Group company -the second such endorsement that Mistry has received in a week after Indian Hotels Company .

The board of Tata Sons, which is the largest promotershareholder in Tata Chemicals, sacked Mistry as chairman of the holding company on October 24, triggering a raging corporate war between Mistry and Ratan Tata, who has returned to Tata Sons as interim chairman.

TOI had front-paged a report on November 7 saying all eyes were on which way Wadia would go in the Tata-Mistry war and hinted that Wadia's loyalties might have shifted. Wadia, who is chairman of Bombay Dyeing and Britannia Industries, has been an independent director of Tata Chemicals for decades and was considered a staunch supporter of the Tatas. Also significant is the fact that Nasser Munjee, who is one of the other independent directors of Tata Chemicals, is a trustee of Sir Ratan Tata Trust, where Ratan Tata is the chairman.SRTT, together with the Sir Dorabji Tata Trust, controls about 66% of Tata Sons -and it was said at the time of Mistry's ouster that the Tata Trusts had lost trust in him. Munjee is the second trustee of SRTT to support Mistry . Last week, Keki Dadiseth, a former chairman of Hindustan Unilever, publicly backed Mistry at IHCL.

Wadia -a veteran of several bitter corporate wars -along with Munjee and two other independent directors met for four hours to review and discuss Mistry's leadership abilities and his performance ahead of Tata Chemicals' board meeting. They concluded that over the last four years, Mistry had executed all strategic decisions and conducted operations of the company as per the directions of its board.

Besides Tata Chemicals, Wadia is an independent director of Tata Motors and Tata Steel; Munjee is also on the board of the automobile company . The board of Tata Steel is meeting on Friday to consider the financial results of the metal giant while the board of Tata Motors is meeting on November 14.

“We again reviewed Mistry's performance. And there haven't been any new, diffe rent facts that have emerged from the last evaluation,“ an independent director of Tata Chemicals told TOI, describing the process as “torturous“ given circumstances at the House of Tata. Besides Wadia and Munjee, who is chairman of DCB Bank, the other two directors are YSP Thorat, former Nabard chairman, and Vibha Paul Rishi, a former marketing head of PepsiCo.

Rishi was also one of the six independent directors of IHCL had unanimously backed Mistry's chairmanship of the hotels company that's better known as the Taj Group.

Current rules require that at least once a year, all the independent directors of a company should meet separately and review the performance of all non-independent directors, including the chairman.

Late on 10 Nov 2016, Bhaskar Bhat, a representative of Tata Group, resigned from the board of Tata Chemicals.

, Independent directors of Tata Motors back Cyrus

Close on the heels of being endorsed by the independent directors of Indian Hotels (IHCL) and Tata Chemicals, ousted Tata Sons chairman Cyrus Mistry in Nov 2016 scored what is being seen as a significant moral victory when he received the backing of the independent directors of yet another major Tata group company , Tata Motors.

In fiscal 2016, the auto major contributed 40% to the conglomerate's $103 billion turnover and was once considered close to Mistry's predecessor and interim replacement Ratan Tata's heart.

After a board meeting that lasted nearly five hours, the Tata Motors company secretary , H K Sethna, issued a statement to stock exchanges, saying, “The independent directors have confirmed that all decisions taken by the board with regard to the strategy , operations and business of the company have been unanimous and executed by the chairman and the management accordingly .“

People close to the new dispensation at Bombay House argued that the Tata Motors statement was more “guarded and veiled“ in that it did not mention Mistry by name, instead referring to him as “chairman“. But the Mistry camp was quick to counter, saying that the Tata Chemicals letter of November10 hadn't named Mist November10 hadn't named Mistry either, and that “chairman means Mistry“. They pointed out that the wording of all the three statements issued by IHCL, Tata Chemicals and Tata Motors were very similar in expressing their “confidence“ in the respective managements, except that the one on behalf of the independent directors of the hotels company had gone a step further and “praised“ Mistry by name.

With Mistry at the helm, during the July-September quarter of fiscal 2017, Tata Motors' consolidated net profit was Rs 848 crore, against a net loss of Rs 1,740 crore during the same period in the previous fiscal.The company also recorded a 7% jump in revenues to Rs 67,000 crore in the second quarter from Rs 62,647 crore a year earlier.

The independent directors of Tata Motors are Nusli Wadia, chairman of Bombay Dyeing and Britannia Industries; Subodh Bhargava, chairman emeritus of Eicher; Nasser Munjee, chairman of DCB; RA Mashelkar, former director general of Council of Scientific and Industrial Research; V K Jairath, exprincipal secretary of Maharashtra; and Falguni Nayar, former MD of Kotak Investment Bank. Rules require independent directors to meet separately at least once a year to assess the performance of the non-independent directors including the chairman of the company .

Till 14 Nov 2016, the independent directors of just one major Tata company--Tata Steel--hadn't come out with any statement supporting Mistry because of a 3-3 deadlock among them.

Tata Sons rebut Cyrus Mistry's allegations

The Times of India Reproduces Excerpts From Tata Sons' Statement Rebutting Ousted Chairman Cyrus Mistry's Allegations

W e understand and appreciate that a period of change like this can lead to a sense of uncertainty and would like to put forward some facts so that the decision is seen in the desired perspective.

1. Tata Sons Related Matters

The directors of Tata Sons are primarily concerned with the results of Tata Sons and their duty to all its shareholders, particularly, the Tata Trusts, who hold 66% of the equity capital.

2. Selection Of Chairman

It is also relevant to refer to the basis of selection of Mr Mistry as chairman in 2011 by the selection committee as provided under the company's Articles. Without going into the details, the committee's original objective was to look for a person with the experience of running large (and preferably diverse) businesses with considerable international exposure and other criteria. During the meetings, Mr Mistry made many relevant comments and submitted a detailed note in October 2010 setting out his views on how a large and complex group like Tatas should be managed and gave a comprehensive management structure with details of the composition and objectives of each component of the structure. This fitted with the views of the committee and having failed to find an alternative candidate, the committee decided to recommend Mr Mistry partly because of his recorded views and plans and also his association with the group.

After four years, it is unfortunate that hardly any of his major views on the management structure (which had impressed the committee favourably) have been implemented. In fact, even the then existing structure of the group which had sto

3. Mistry's Role In The Past Four Years

Unlike in the past, Mr Mistry constantly used the strong public relations network of Tata to emphasize the supposedly good work being done by and under the new leadership and particularly and repeatedly highlighting the major problem areas in the group inherited by him (commonly referred to by him as `legacy' issues and `hot spots') from the previous chairman, to account for any perceived lack of his performance.

The articles and interviews are littered with text-bookish directives and objectives, eg `growth with profits', `target to be among the top 25 groups in the world' by market capitalization, `cater to the lives of many millions' and other such nice-sounding phrases with no indications on how these ambitious targets are to be achieved. Is all this relevant when there are so many major problems which need urgent attention and action? Would it not be more appreciated if the reports talked specifically on these problem issues and their solutions rather than continuously harping on the past versus the present?

Nobody will deny that there were some problem companies but surely Mr Mistry was fully aware of them since he was associated with the parent company , Tata Sons, as a director on the board for many years prior to his appointment as executive vice-chairman in 2011 and then as executive chairman in 2012.He voluntarily took this position, knowing the composition of the Tata Group and its many strong companies as well as the weaker and problem companies -which he presumably took on as a challenge for `turning around' those difficult situations.

Yet, after four years of full-time involvement and executive authority , we continue to be told how these `legacy' problem areas are a major drag on Mr Mistry's otherwise good performance. How many more years would we be told this same story?

The three major problem companies are Tata Steel Europe, Tata Teleservices Docomo and the Indian operations of Tata Motors. The fact is that even after four years, there is no noticeable improvement in the operations of these companies and in fact they have got worse as shown by continuing huge losses, increasing high debt levels and declining share in their respective markets. There are a few other companies which are also having different problems -and are these also to be excused as `legacy' issues?

Even with no turnaround in these major problem areas, the only action taken was to write-off huge amounts against these companies -which is no solution because the problem companies continue to exist with their continuing losses and high debt and only the shareholders suffer from these write-offs.

The media is fed with the total group figures over the past four years as evidence of the progress but it is not highlighted that these aggregate figures which show a good picture are largely (if not only) due to the excellent performance on all parameters of just two companies, namely , TCS and Jaguar Land Rover (JLR), which is a wholly owned UK subsidiary of Tata Motors. There is no complaint about these good legacies. These two jewels in the Tata crown were also inherited by the new chairman from the previous chairman, Mr R N Tata, who was also responsible for the acquisition of JLR by Tata Motors in 2008-09 and personally worked with the then management of Tata Motors to turn JLR around. These two companies probably account for around 50% of the total turnover and probably over 90% of the total profits of the whole group and have been performing successfully continuously over the past many years, for which Mr Mistry cannot take credit.

It is evident that the group under Mr Mistry's leadership was intolerant to critical reports about the actions taken under his aegis. Over the past four years, only a very few such partially negative reports have appeared in some parts of the media -the most recent one being by the highly respected `Economist' magazine of the UK, which was really a well-balanced and critical review of the Tata group's performance in recent years and which was reproduced by another respected Indian daily . Even this report was vociferously refuted in the strongest terms by the PR machinery of Tatas as being biased and incorrect. In short, those who analyse the overall position of the group in an unbiased and professional way which may differ from the version put out by Bombay House (the Tata headquarters) are uniformly wrong, even if they only seek to present an overall balanced picture which may (and rightly should) include the negative aspects. This attitude does not befit an old and venerable house like Tatas known for their fair play and transparency .

Insiders in Bombay House who have been with the group for many years silently and helplessly watched the conscious departure from old, proven and successful structures within the group and the induction of very senior executives from outside the group with little or no experience of running large companies and being paid amounts reportedly running to several crores for purely functional positions at the very top. Some changes always accompany a change at the top and some may even be considered necessary but the ultimate test is whether these changes have shown improvement and success -which is not visible even af ter four long years.

The stellar performance of TCS and JLR have more than compensated for the drop in returns in the other ope rating companies under Mr Mistry's tenure. Some strategic initiatives have been articulated repeatedly but the implementation is too slow to show re sults. Such of these initiatives which are good and worthwhile need to be pursued more vigorously by the com panies concerned. od the test of a long period of nearly 100 years by the visionary founders and generations of Tatas seem to have been consciously dismantled so that now the operating companies are drifting farther away from the promoter company and their major shareholder (except for periodic presentations) through systematically reducing the effective control and influence of the promoter. Tata Sons has historically exercised control over its group companies through its shareholding and commonality of senior directors (apart from the chairman) which had acted as a binding force in the group for many years and which has enhanced the credibility and creditworthiness of the group companies. We now have an unacceptable new structure where the chairman alone is the only common director across several companies and this situation could not be allowed to go on.

4. Group Indebtedness And Return On Investments

Group indebtedness has increased by Rs 69,877 crore to Rs 225,740 crore over the last four years. Despite huge investments by companies, the returns are not visible in increased profits, though, in all fairness, some major growth projects like the new steel plant at Kalinganagar will show results only in coming years.

5. Market Share Drop In Tata Motors

There has been a perilous drop in market share in both passenger cars and commercial vehicle areas over the past three years. In passenger cars, in the year ended March 2013, the market share was 13% which now stands at 5%. It will be difficult, if not impossible, to retrieve the market share losses. However, even more concerning is the market share in commercial vehicles, which in March 2013 stood at 60% and now stands at 40+% -the lowest in the company's history as the market leader in commercial vehicles.

The two passenger car launches of good products like Bolt and Zest introduced as turnaround products for the company have both been lacklustre in market acceptance -achieving current sales levels more or less equal to those of the Indica and Indigo which are around 15-year-old vehicles. The third launch of Tiago has been well received in the market but its sustained steady state volumes are yet to be determined.

These details are masked by the performance and profitability of JLR as most references to Tata Motors are in consolidated form.

6. Group Write-offs Write-downs Provisions Asset Sale

During the past three years, the group has written down, written off or made provisions for impairment worth thousands of crores. Tata Steel alone has written off a large part of its investment in its UKEuropean assets. It is interesting to note that the new buyers of some of the steel assets for £1 in the UK have claimed a dramatic turnaround in the very first year of their takeover. In our view, these sub-par results cannot be blamed on the commodity cycle or economic conditions -but on his leadership.

Mr Mistry repeatedly talks of `bad' acquisitions, but he forgets that his own firm had acquired South India Viscose and Special Steels many years ago from which they walked away , while Tatas always stand by their companies in difficulties.

7. Handling Of Critical Issues

Critical reports have been received of the handling of the Tata Steel Europe problems in the UK and the negotiations with Docomo of Japan in the respective countries.

8. Other Issues

a) The accusation of interference by the Trusts is not only wrong in reality but has been twisted to mislead people. The continuous decline in the income of Tata Sons from its large portfolio of investments other than TCS during the last four years of Mr Mistry's regime (as elaborated above), reflected the corresponding decline in the many operating companies in which Tata Sons holds a significant shareholding. It also reflects a disturbing over-dependence on one single company , ie TCS, over a long period of four years. This was not only disturbing but needed corrective action in the management of Tata Sons. In fact, many practical suggestions made to Mr Mistry for the benefit of Tata Sons vis-à-vis some of its major investments have often been ignored.

b) Mr Mistry conveniently forgets that he was appointed as the chairman of the Tata operating companies by virtue of and following his position as the chairman of Tata Sons. Therefore, it was fair expectation of Tata Sons that Mr Mistry would gracefully resign from the boards of other Tata companies on being replaced from the position of the chairman of Tata Sons. This expectation was in line with convention, past practice as well as the Tata governance guidelines that were approved and adopted by Tata Sons under the aegis of Mr Mistry . However, his departure from these requirements and conduct since his replacement as chairman of Tata Sons demonstrates his absolute disregard of long-standing Tata traditions, values and ethos.

c) The recent development in the Indian Hotels Co (IHCL) now seems to reveal the true colours of Mr Mistry and his ulterior objective. Having been replaced as the chairman of Tata Sons, where the majority of the board and the major shareholders had expressed lack of confidence, Mr Mistry is trying to gain control of IHCL with the support of the independent directors of the board. He has cleverly ensu red over these years that he would be the only Tata Sons representative on the board of IHCL in order to frustrate Tata Sons' ability to exercise influence and control on IHCL. In hindsight, the trust reposed by Tata Sons in Mr Mistry by appointing him as the chairman four years ago has been betrayed by his desire to seek to control main operating companies of the Tata Group to the exclusion of Tata Sons and other Tata representatives. Indeed, this strategy of being the only Tata Sons' representative on the boards of the operating Tata companies, seems to have been a clever strategy planned and systematically achieved over the last four years. It is unfortunate that Tata Sons, acting in good faith, did not anticipate such devious moves by Mr Mistry and thereby did not inform the other directors of the operating companies about its dissatisfaction with Mr Mistry at the level of Tata Sons. However, we will now do whatever is required to deal with this situation.

In our capacity as the main promoter of the major listed Tata companies and as the largest shareholding group, we have to express our very serious concern on the personal email dated October 25, 2016, from Mr Mistry , addressed to the directors of Tata Sons and purportedly to the trustees of the Tata Trusts, and which simultaneously appeared in full in various newspapers.

Here, we are only referring to the shocking statement of five or six major Tata companies having to take `potential write-downs of $ 18 billion' in future in their assetsinvestments and the following points queries need to be raised:

a) Has Mr Mistry , the chairman, informed the boards of these companies at any time in the past specifically of the above mentioned potential write-downs? If so, when was this done and why was it not made public as this is clearly a major item of information -apart from disclosing only the write-offs required to be made to date.Surely , he could not have `discovered' such a large potential liability only a day or two after he was replaced as the chairman of Tata Sons.

Therefore, he must have been aware of this potential large provision much earlier but did not disclose it. It presumably relates to possible future provisions to be made (with no firm basis) but only his own expectation, ie a forward-looking statement which is normally not permissible due to its uncertainty . It also suggests that he had no intention of or given up any attempt to revive the value of these companies. It is unfortunate that the BSE NSE have asked the companies to explain this statement and not Mr Mistry as the author of this statement.

b) On the same point, it has been widely reported that this statement of potential write-downs of this magnitude has been largely responsible for the loss in the total market value of these five or six companies of an amount of over Rs 25,000 crore and all the shareholders would naturally be unhappy at this loss in their own value for no fault of theirs, but mainly due to this shocking and sudden statement on the part of the chairman of these companies, which may or may not have been shared with the board and certainly not publicly disclosed earlier. Here again, it is unfortunate that the shareholders and regulatory authorities would put the onus on the companies and not Mr Mistry as the author of the statement for being responsible for this large loss in market value.

Ratan Tata wanted to sell TCS to IBM in '90s

`Ratan Tata wanted to sell TCS to IBM in '90s', TIMES NEWS NETWORK Nov 23, 2016

Training his guns on Ratan Tata's business judgment, Cyrus Mistry , in his letter, has claimed that Tata had proposed the sale of TCS to global IT major IBM when J R D Tata was alive.

Established in the mid-1960s, TCS was a division of Tata Sons till 2003.

Mistry said midway through the TCS journey , when F C Kohli, the founding CEO of TCS, was recovering from a cardiac condition, Ratan Tata, who then headed the Tata-IBM India joint venture, had approached JRD with a proposal from IBM to buy out TCS. Mistry said JRD refused to discuss the deal because Kohli was still in hospital. On his return, Kohli assured JRD that TCS had a bright future and that the group should not sell it, Mistry claimed.

JRD turned down Ratan Tata's offer, demonstrating true vision, said Mistry's letter. But it was also a near-death experience for TCS at the hands of Ratan Tata, the letter added.

JRD had stepped down as chairman of Tata Sons and some of the leading group companies in 1991, and was replaced by Ratan Tata.

Cyrus quits all Tata boards except holding companies

Cyrus Mistry abruptly announced his decision on Dec 19, 2016 to step down from the boards of all the listed Tata Group companies. But, he told TOI he would continue the fight to improve governance at India's largest conglomerate “till his last breath“. The battle between Ratan Tata and Mistry thus shifted from boardrooms and shareholder meetings to the courtroom.

Mistry's decision to step down came just 16 hours before the start of the Indian Hotels EGM called by Tata Sons to remove him from its board. The e-voting for a resolution to remove Mistry had closed on Monday evening. Indian Hotels is likely to go ahead with the EGM on Tuesday but when the resolution comes up for discussion, it will be dropped.

“Having deeply reflected on where we are in this movement for cleaning up governance and regaining lost ethical ground, I think it is time to shift gears, up the momentum, and be more incisive in securing the best interests of the Tata Group,“ said Mistry .“Towards this end, the objective of effective reform and the best interests of employees, public shareholders and other stakeholders of the Tata Group (the very people I sought to protect as chairman) would be better served by my moving away from the forum of EGMs. It is with this thought in mind that I have decided to shift this campaign to a larger platform and also one where the rule of law and equity is upheld.“

While quitting the boards of listed Tata Group companies, Cyrus Mistry has not quit the board of Tata Sons, the group's holding company in which his family holds 18.5%.

Mistry's legal recourse is likely to focus on the relationship between Tata Sons and its principal shareholders, the Tata Trusts, which were instrumental in replacing Mistry as the company's chairman. Mistry said that the trustees of Tata Trusts, Ratan Tata and Noshir Soonawala, who had retired from Tata Sons, refused to give up participation in key decisions involving Tata Sons and the operating Tata companies, including those listed in India and abroad.

Mistry said he has no plans to step down from the Tata Sons board, but if the shareholders of the holding company want, they can vote him out.

Mistry's decision to step down from the listed compa nies came after he attended a routine, three-hour-long board meeting of Tata Sons at Bombay House.

Feb 2017: voted out as director Tata Sons, exit complete

Cyrus Mistry, the ousted chairman of Tata Sons, was removed as a director of the company by a majority vote of shareholders, thus stripping him of the only position he had held on to in the group after his resignation from the boards of various group entities.

The extraordinary general meeting (EGM) of Tata Sons held at the company headquarters had but one agenda: Mistry's removal as director. Tata trusts and group companies which hold the controlling stake as well as sections of the Tata clan voted in favour of the resolution. However, a few members of the family abstained. Mistry himself stayed away but, through a proxy , voted against the resolution.

Ratan Tata's brother Jimmy Tata, Piloo Minocher Tata (wife of a grandnephew of group founder Jamsetji Tata) and her children--Jimmy M Tata and Vera Farhad Choksey--were among those who abstained. Noel Tata (stepbrother of Ratan and Jimmy Tata and brother-in-law of Cyrus Mistry) and his mother Simone Tata backed the resolution which was moved by four Tata Sons shareholders: JRD Tata Trust, Tata Education Trust, Tata Social Welfare Trust and R D Tata Trust.

The MK Tata Trust (Piloo Tata is a trustee here), Maharaja Virendra Singh Chauhan, Tata Industries, Tata International and Tata Investment Corporation were the other shareholders who abstained.

Maharaja Virendra Singh Chauhan owned one share of Tata Sons but after he passed away , the ownership of this share along with some of his other assets are currently under dispute. The three Tata companies mentioned above could not vote as the law does not permit subsidiaries to participate in any resolution concerning their parent. In short, about 2.6% (10,367 shares) of total voting rights was not enfranchised.

Mistry and his family hold 18.4% (74,352 shares) in Tata Sons. With Mistry voted out, it brings to an end his family's decades-old representation on the board.

Mistry became a director of Tata Sons in 2006 after his father retired from the company . Though the family does not have a right to a board seat, it was given a non-executive directorship to acknowledge its sizeable stake in the Tata Sons. Sources close to Mistry said that the family has no plans to sell their shares despite the latest development.Firms that represent Mistry had sought to stall the EGM by filing a petition before the quasi-judicial National Company Law Tribunal citing oppression of minority shareholder rights. After dismissal of the petition, an appeal was made before an appellate bench, which refused to stall the meeting. However, the case continues at the tribunal where it will come up for hearing later this month.

Noel Tata and Simone Tata did not attend Monday's meeting but voted through proxies. Noel was seen as a contender for chairman's post at Tata Sons after the board ousted Mistry . In the im mediate aftermath of Mistry's controversial ouster, Noel made his presence felt at the shareholder meetings called to remove Mistry or Nusli Wadia from boards of listed companies. Wadia was an independent director in three Tata firms and was removed for his stand on the issue of Mistry's removal. Buzz is that Noel may now be inducted on the board of Tata Sons.

Currently , there are 11 directors on the board of Tata Sons. With Ratan Tata stepping down on February 20, there is room to induct one more individual on the board.

Tata Sons is 66% owned by a clutch of charitable trusts chaired by Ratan Tata. Besides Tata Trusts, Tata Group companies including Tata Chemicals, Tata Steel, Indian Hotels, Tata Power, Tata Global Beverages and Tata Motors hold stake in Tata Sons.All these entities backed the resolution to remove Mistry .

“The shareholders of Tata Sons at the EGM held, passed with the requisite majority, a resolution to remove Cyrus Mistry as a director of Tata Sons,“ the company said in a statement.

2017/ Tribunal dismisses Mistry plea against Tatas

Tribunal nixes Mistry plea against Tatas, April 18, 2017: The Times of India

The National Company Law Tribunal on Monday dismissed a company petition filed against Tata Sons by shareholders linked to ousted chairman Cyrus Mistry as they did not have the required stake, reports Swati Deshpande. The plea had alleged acts of oppression of the minority and mismanagement of the company's affairs. The precedent setting order is a significant win for Tata Sons, which hopes it buries the controversy over Mistry's exit once and for all.

2021/ Making Cyrus chairman Tatas’ wrong decision of lifetime: SC

Dhananjay Mahapatra, March 27, 2021: The Times of India

The Supreme Court upheld Cyrus P Mistry’s removal from the post of executive chairman of Tata Sons and rejected the Shapoorji Pallonji Group’s accusations against Ratan Tata, including Tata Sons board’s allegedly oppressive practices against minority shareholders.

The court dismissed SP Group’s last-minute plea for evaluation of its shares for an honourable exit from Tata Sons through payment of fair compensation. The bench said, “At this stage, and in this court, we cannot adjudicate on fair compensation. We will leave it to the parties to take the Article 75 route or any other legally available route.”

SC: Incomprehensible NCLAT directed Mistry’s reinstatement

A bench of Chief Justice S A Bobde and Justices A S Bopanna and V Ramasubramanian in a 282-page judgment shredded SP Group and Mistry’s arguments against Tata Sons and wondered how the National Company Law Appellate Tribunal (NCLAT) could have deviated from the law to order Mistry’s reinstatement even after expiry of his tenure as executive chairman and direct conversion of Tata Sons into a public company. The court said, “In fact, it may be conceded today by Tata Sons that one important decision that the board took on March 16, 2012 (appointment of Mistry as executive deputy chairman) certainly turned out to be the wrong decision of a lifetime.”

Writing the judgment for the bench, CJI Bobde laid the blame squarely at the doors of Mistry and SP Group for starting the fight with Tata Group and Ratan Tata. “It is an irony that the very same person who represents shareholders owning just 18.37% of the total paid-up share capital and yet identified as the successor to the empire, has chosen to accuse the very same board of conduct oppressive and unfairly prejudicial to the interests of the minorities,” the bench said. The SC blamed Mistry for bringing misfortune on himself by attempting to set the house on fire, the safekeeping of which was entrusted to him. “In any event, the removal of a person from the post of executive chairman cannot be termed as oppressive or prejudicial,” the SC said.