Expenditure Department: India

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

Contents

|

The source of this article

INDIA 2012

A REFERENCE ANNUAL

Compiled by

RESEARCH, REFERENCE AND TRAINING DIVISION

PUBLICATIONS DIVISION

MINISTRY OF INFORMATION AND BROADCASTING

GOVERNMENT OF INDIA

Expenditure Department:India

The Department of Expenditure has taken a number of measures to improve the systems and procedures of public financial management, thereby promoting the cause of good governance. The Prime Minister's Thrust Areas included five planks of institutional reforms, viz., decentralization, simplification, transparency, accountability and e-governance. The Department of Expenditure and Planning Commission had jointly prepared the first ever outcome Budget for the year 2005- 06. Thereafter, a series of guidelines were issued to all ministries/departments on preparation of Outcome Budget and Performance Budget by individual ministries.

In a further refinement of the process, fresh guidelines were issued for integration of Outcome Budget and Performance Budget documents into single document. Outcome Budget has become an integral part of the budgeting process since 2005- 06. Latest guidelines issued in January, 2010 emphasized that the projected physical output should be disaggregated by sex, wherever possible and appropriate to where delivery is to individuals, indicators of performance relating to individuals should also be sex disaggregated.

STAFF INSPECTION UNIT

The Staff Inspection Unit (SIU) was set up in 1964 with the objective of securing economy in the staffing of Government Organisations consistent with administrative efficiency and evolving performance standards and work norms. In the changed scenario and keeping in view the Government emphasis on better governance and improved delivery of services, the role of SIU has been re-defined. The SIU has now been positioned to act as catalyst in assisting the Ministries and autonomous organisations in improving their organizational effectiveness, through improved organizational structure/processes, optimum utilization of resources and focusing on monitorable, measurable outcome and specific deliverables.

Chief Adviser (Cost)

Office of Chief Adviser Cost (CAC) is one of the divisions functioning in the Department of Expenditure, Ministry of Finance. The office is responsible for advising the Ministries and Government Undertakings on cost accounts matters and to undertake cost investigation work on their behalf. It is a professional agency staffed by Cost/Chartered Accountants.

The office of Chief Adviser Cost is dealing with matters relating to costing and pricing, industry level studies for determining fair prices, studies on user charges, central excise abatement matters, cost-benefit analysis of projects, studies on cost reduction, cost efficiency. Appraisal of capital intensive projects, profitability analysis and application of modern management tools evolving cost and commercial financial accounting for Ministries/Departments of Government of India.

It was set up as an independent agency of the Central Government to verify the cost of production and to determine the fair selling price for Government Departments including Defence purchases in respect of the cases referred to it. The role of the Office was further enlarged and extended to fixing prices for a number of products covered under the Essential Commodities Act, such as, Petroleum, Steel, Coal, Cement, etc. under the Administered Price Mechanism (APM). Since cost/ pricing work in the Ministries increased significantly, various other Ministries/ Departments started to have their in-house expertise by seeking posting of services of officers for work requiring expertise in cost/commercial accounts matters. In the post-liberalization era, the office is receiving and conducting studies in synchronization with liberalization policy of the Government in addition to the traditional areas of cost-price studies.

Chief Adviser Cost Office is also the cadre controlling office for "Indian Cost Accounts Service" (ICoAS) up to Adviser (Cost) level and looks after training requirements of the officers for continuous up-gradation of their knowledge in addition to rendering professional guidance to the ICoAS officers working in different participating organizations.

The major areas of professional functions of the office of the Chief Adviser Cost are as under: -

(i) Assisting all Central Government Ministries/Departments/ Organizations/ in solving complex Price/Cost related issues, in fixing fair prices for various services/products and rendering advice to various Ministries/Departments in cost matters.

(ii) Examination/Verification of claims between Government Departments/ Public Sector undertakings and suppliers, arising out of purchase contracts.

(iii) Determining prices of products and services supplied to Government, in order to enable Government Departments to negotiate the prices with the supplying organizations.

(iv) Unit specific as well as industry level studies for determining cost/fair prices and making recommendations for fair prices/rates for products and user charges for services, revision of these charges and also to determine reasonableness of prices charged, duty structure, etc.

(v) Valuation of assets and liabilities of business taken over and shares of public sector undertakings.

(vi) Functioning as Chairman/Members of Committee constituted by Government/different Departments related to Cost/financial and Pricing matters.

(vii) Cost and performance audit of industrial undertaking.

(viii) Concurrent Internal audit of escalations claims of urea manufacturing units, determined by Fertiliser Industry Coordination Committee.

(ix) Subsidy determination and verification of claims.

(x) Cost Accounting System for departmental undertakings/autonomous bodies.

(xi) Time and Cost Overruns of major projects. Efficiency and Competitiveness studies.

(xii) Arbitrator in resolving pricing disputes.

(xiii) Advise on matters relating to determination of abatement rate for purposes of Central Excise.

Till March 2010, total 8164 number of studies/reports were completed by the office of Chief Adviser Cost and out of these 79 reports were completed during the year 2009-10. The studies completed during the year varied widely in nature.

During the year, the office of Chief Adviser Cost provided its services to various ministries like Petroleum and Natural Gas, Chemicals and Fertilizers, Agriculture, Commerce, Textiles, Defence, Home, Railways, Health and Family Welfare Ministry of Urban Development and Corporate Affairs etc.

Some of the major studies undertaken were Study of Under-recovery of Oil Marketing Companies on petroleum products, Concurrent cost audit of escalation claims of Urea Fertilizer units, Reimbursement of loss under Price Support Scheme and Market Intervention Scheme, Fixation of final prices of Traction and Electronics Equipment supplied by BHEL to Railway factories, Common hourly rate and overhead percentages for Government of India Printing Presses, Ascertainment of cost of Multipurpose National Identify Card (MNIC), cost of production of bogies used for manufacturing of Railway Wagons for supply to the Indian Railways etc. Through these studies, savings of several hundred crores of rupees have been achieved.

The officers are functioning as Chairman/Members of Committee constituted by Government/different Departments related to Cost/Financial and Pricing matters like National Pharmaceuticals Pricing Authority, Fertilizer Industry Coordination Committee, Department of Fertilizers and various Inter-ministerial committees constituted by different departments.

Central Assistance to States

Central Assistance to States for their Annual Plans including Normal Central Assistance that is not tied to specific projects are released. Further, Additional Central Assistance is provided for specific schemes/project such as Externally Aided Projects, Jawaharlal Nehru National Urban Renewal Mission , Accelerated Irrigation Benefit Programmes, Accelerated Power Development and Reforms Programme, National Social Assistance Programme (including Annapurna), Backward Region Grant Fund, Nutrition Programme for Adolescent Girls (NPAG), National E-Governance Action Plan, Tsunami Rehabilitation Programme, Long Term reconstruction of assets damaged during 2005-06 floods and ACA for other specific schemes/projects of the States.

Special Plan Assistance is also provided to States.Special Central Assistance for Hill Areas/Western Ghats Development Programmes and Special Central Assistance for the Border Areas Development Programme. Central Plan

In respect of development schemes and projects, the focus has been on improving the quality of development expenditure through better project formulation, emphasis on outputs, deliverables, impact assessment, projectisation (Mission approach) and convergence.

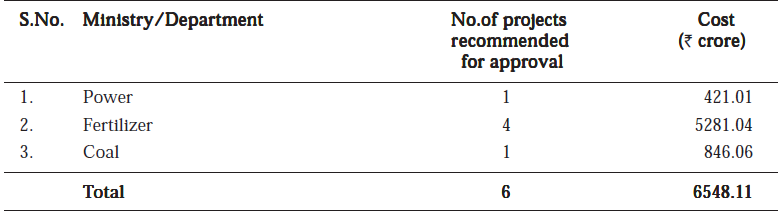

During the period from 1st January to 31st December 2009, 51 meetings of the Expenditure Finance Committee (EFC) chaired by Secretary (Expenditure) considered 93 Plan Investment Proposals/Schemes of various Ministries/ Departments costing Rs121227.42 crore. Also, 7 meetings of Public Investment Board (PIB) were held and 13 projects with a capital outlay of Rs 7087.10 crore were considered and out of this 6 cases were recommended by the competent authority as per the following details :-

Financial restructuring of Central PSUs on the recommendations of Bureau

for Restructuring of Public Sector Enterprises (BRPSE) are also done. Modalities

for financial assistance to CPSEs, quantification of IandEBR generation for

preparation of budget, finalizing modernization of Plants and Equipments to ensure

more efficiency in production are worked out.

At micro level, issues relating to food, fertilizers and petroleum subsidies. including their quantification and extension of assistance to the Stake holders are dealt with. Concerned Department/Ministry, are actively consulted in shaping up future subsidy policy of the Government to ensure effective targeting coupled with minimum burden on the Government.

During 2009-10, an amount of Rs 65736.50 crore was released for assistance to various schemes and budget provision of Rs 70156.25 crore were made for the year 2010-11.

FINANCE COMMISSION DIVISION

Finance Commission Division undertakes processing of and follow up action on the various recommendations and suggestions of Finance Commission’s including issue of Presidential/Executive Orders and sanctions. Under Article 280 of the constitution, a Finance Commission is to be constituted every fifth year or at such earlier time bt the President on specified aspects of Centre-State Fiscal relations.

The recommendations of the Commission together with an Explanatory Memorandum as to the action taken thereon, are laid before each House of Parliament.

The award period of the 12th Finance Commission (FC-XII) ended on 31.03.2010 and the award period of the 13th Finance Commission (FC-XIII), 2010- 15, commenced on 01.04.2010. The FC-XIII was appointed by President on 13th November 2007 under the Chairmanship of Dr. Vijay Kelkar. It submitted its report on December. 30,2009. The FC-XIII report covering the five year period commencing 1st April 2010 together with the Explanatory Memorandum as to the action taken on the recommendations of the Finance Commission was laid on the Table of both the Houses of the Parliament on 25.2.2010.

The Twelfth Finance Commission

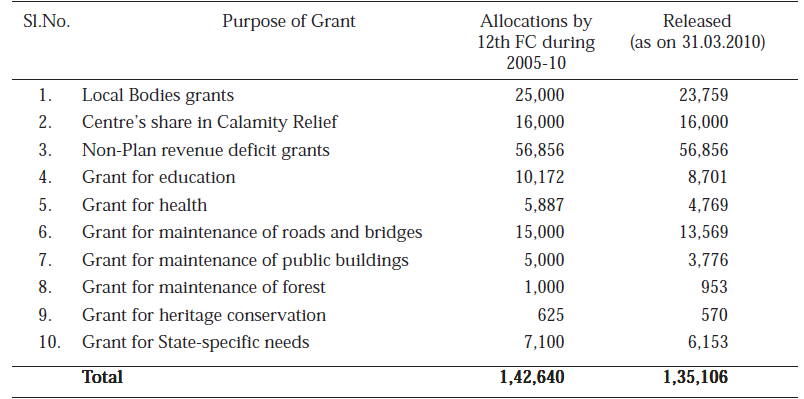

Grants-in-aid : The 12th FC in its report for the period 2005-10 had recommended a total transfer of Rs 7,55,752 crore (share in central taxes and duties of Rs 6, 13, 112 crore and grants-in-aid of Rs 1,42,640 crore ) to States. The grants-in-aid recommended by 12th FC under various sectors and amounts released are as under:

(Rs in crore) Sl.No. Purpose of Grant Allocations by Released 12th FC during (as on 31.03.2010) 2005-10

1. Local Bodies grants 25,000 23,759

2. Centre’s share in Calamity Relief 16,000 16,000

3. Non-Plan revenue deficit grants 56,856 56,856

4. Grant for education 10,172 8,701

5. Grant for health 5,887 4,769

6. Grant for maintenance of roads and bridges 15,000 13,569

7. Grant for maintenance of public buildings 5,000 3,776

8. Grant for maintenance of forest 1,000 953

9. Grant for heritage conservation 625 570

10. Grant for State-specific needs 7,100 6,153

Total 1,42,640 1,35,106

Debt Consolidation and Relief Facility (2005-10)

Debt Consolidation and Relief Facility (DCRF), formulated as per recommendations of Twelfth Finance Commission, had two components - consolidation of central loans (from Ministry of Finance); and debt waiver. FC-XII had recommended that the Central loans to States contracted till March 31, 2004 and outstanding on March 31, 2005 (estimated by FC-XII at Rs 128,795 crore) may be consolidated and rescheduled for a fresh term of 20 years (resulting in repayment in 20 equal installments), and an interest rate of 7.5 per cent per annum be charged on them.

The year 2009-10 was the last year of the award period of the 12th Finance Commission. So far, 26 out of 28 States (except West Bengal and Sikkim) have enacted FRBM Acts. Central loans (from Ministry of Finance) of 26 States have been consolidated to the extent of Rs. 113601.14 crore. Details of Debt relief and interest relief provided under Debt Consolidation and Relief Facility (DCRF) to the 26 States during 2005-10 are as under :

The Thirteenth Finance Commission

Main recommendations of the FC-XIII relate to the sharing of net proceeds of Union taxes between Centre and States, grants-in-aid of revenue of States under Article 275, Goods and Services Tax (GST), financing of relief expenditure and roadmap for fiscal consolidation.

Salient recommendations of the Thirteenth Finance Commission (FC-XIII)

(i) Sharing of Union Taxes : The Commission has recommended that the share of States in the net proceeds of Union taxes may be fixed at 32 per cent. It has also recommended on the inter-se distribution of the States' share amongst the States. The total transfers to the States on the revenue account be subjected to an indicative ceiling of 39.5 per cent of the gross revenues receipts of the Centre.

(ii) Grants-in-Aid of Revenues of States under Article 275 of the constitution

l Non Plan Revenue Deficit Grant: FC-XIII has assessed the revenues and expenditure of the States for the period 2010-15 and has projected the deficit for each State after taking into account the amount of share in Central taxes for that State. It has recommended a grant of Rs 51800 crore to meet this deficit for eight States. FC-XIII has also recommended a performance incentive grant of Rs 1500 crore for three special category States of Assam, Sikkim and Uttarakhand that have graduated out of non Plan Revenue Deficit.

l Grant for Elementary Education : After accessing the requirement of providing elementary eduction for each State based on the Sarva Shiksha Abhiyan norms and recommended to provide a grant of Rs 24068 crore equivalent to 15 per cent of the assessed requirement.

l Environment Related Grants : FC-XIII has recommended three grants under this category of Rs 5000 crore each aggregating Rs 15000 or as under:

a) forest grant

b) promotion for renewable energy

c) water sector

l Grants for Improving Outcomes : FC-XIII has recommended six grants under this category aggregating to Rs 14446 crore as under:

a) an incentive grant for reduction in infant mortality - Rs 5000 crore,

b) improved delivery of justice for Lok Adalats and Legal Aid, Alternate

Dispute Resolution Centres, Heritage Court Buildings, State Judicial

Academy and training of judicial officers and public prosecutor - Rs 5000 crore,

c) grant for Unique Identification (UID) programme - Rs 2989. 10 crore,

d) District Innovation Funds - Rs 616 crore,

e) improving statistical systems at district and State levels - Rs 616 crore,

f) setting up database of employees and pensioners - Rs 225 crore.

l Grants for maintenance of Roads and Bridges : FC-XIII has assessed the requirement of ordinary repairs of roads in a State and has recommended grant of Rs 19,930 crore equivalents to 90 per cent of the assessed requirement for PMGSY roads and 50 per cent of the assessed requirement for other roads, for four years of the award period starting 2011-12.

l State Specific grants: FC-XIII has recommended grants aggregating to Rs 27945 crore for various state specific needs of the States subject to States meeting conditions stipulated by FC-XIII.

The Government has accepted the above recommendations.

(iii) Goods and Services Tax: FC-XIII has recommended a model GST structure that includes features such as single rate, zero rating of exports, inclusion of various indirect taxes at the Central and State level in GST ambit, major rationalisation of the exemption structure, etc. The Commission has recommended a grant of Rs 50,000 crore for implementation of GST as per the recommended model. This grant is to be disbursed initially in the form of compensation for loss due to implementation of GST and residual amount to be distributed amongst States in the terminal year of the awarded period as per the devolution formula. It has also recommended administrative structure for implementation and monitoring of this grant. The Government has accepted these recommendations in principle.

(iv) Local Bodies

l FC-XIII has recommended a basic grant and a performance grant for local bodies quantified, based on a percentage of the divisible pool of the preceding year. Basic grant amounts to 1.5 per cent of the size of divisible pool in the preceding year. Performance grant for 2011-12 is 0.5 per cent of the divisible pool of the preceding year and for subsequent years in the award period, 1 per cent of the divisible pool of the preceding year.

l FC-XIII has also recommended a separate special area basic grant of Rs 20 per capita, carved out of the total basic grant, for every year in the award period for Schedule V and Schedule VI areas and areas excluded from Part IX and IXA of the Constitution. For these areas, it has recommended a special area performance grant of Rs 10 per capita for 2011-12 and Rs 20 per capita for subsequent years of the award period.

l The performance grants are to be released if the States meet conditions specified by FC-XIII.

l FC-XIII has estimated total grant recommended for the local bodies aggregates to Rs 87519 crore over the award period. The Commission has also recommended distribution of the grants between urban and rural areas and the inter-se distribution between States.

(v) Disaster Relief

l FC-XIII has recommended merger of the National Calamity Contingency Fund (NCCF) into National Disaster Response Fund (NDRF) and merger of Calamity Relief Fund (CRF) into State Diaster Response Fund (SDRF) with effect from 1 April 2010 and transfer of the balances in the existing funds into the new funds. NDRF and SDRF are under the Disaster management Act, 2005.

l It has 75 per cent of the SDRF requirement for general category states and 90 per cent for special category states that Centre will provide through a grant to the States. FC-XIII has also recommended a grant of Rs 525 crore for capacity building. Overall, to meet the Central share of SDRF and for capacity building, the Commission has recommended a grant of Rs 26373 crore. It has mandated all states to follow the required accounting practices to properly account for relief expenditure. The Government has accepted recommendations on local bodies and disaster relief.

(vi) Fiscal Roadmap

l FC-XIII has specified a combined debt target of 68 per cent of gross domestic Product (GDP) to be met by 2014-15.

l It has worked out a roadmap for Fiscal Deficit (FD) and Revenue Deficit (RD) for the award period. For Centre, it has recommended RD to be eliminated and FD to be brought down to 3 per cent of GDP by 2013-14. For States, the Commission has worked out fiscal roadmap for each State depending on its current deficit and debt levels. The States are required to eliminate RD and achieve FD of 3 per cent of their respective Gross State Domestic Product (GSDP) during the Commission's award period in stages, in a manner that all the States would eliminate RD and achieve FD of 3 per cent of GSDP latest by 2014-15.

l The borrowing limits of the States should be fixed by the Centre in line with these targets. The Government has accepted these recommendations in principle.

(vii) Debt Relief to States

l FC-XIII has recommended that the interest rates on loans from National Small Savings Fund (NSSF) to States contracted till the end of 2006-07 and outstanding as at the end of 2009-10 be reset at interest rate of 9 per cent. This is estimated to provide relief of Rs 13517 crore during the award period and Rs 28360 crore over the entire period, till the maturity of the last loan. Government has accepted it in principle.

l FC-XIII has recommended write-off of Central loans advanced to States by central ministries other than Ministry of Finance under Centrally Sponsored Schemes/Central Plan Schemes outstanding as at the end of 2009-10.

l The Commission has also recommended extension of the debt consolidation facility recommended by the FC-XIII to States that have not yet availed this benefit. The loans contracted by these states till 31st March 2004 and outstanding as at the end of the year preceding the year in which FRBM Act is put in place, shall be consolidated as per the same terms and conditions as recommended by FC-XII.

l All the above mentioned debt relief is available to States only if they amend/ legislate FRBM Acts in accordance with the recommendations of the Commission. The Commission has also recommended that the States will be eligible for the state specific grants only if they comply with this condition.

l Government has accepted recommandations relating to write-off of the Central loans to States, extension of the debt consolidation schemes recommended by the Twelfth Finance Commission to States that did not avail the benefit till now, and the conditions laid down by the Commission for availing these benefits.

CONTROLLER GENERAL OF ACCOUNTS

According to Article 150 of the Constitution of India, the accounts of the Union and the States shall be kept in such form as the President may on the advice of Comptroller and Auditor General of India prescribe. This function of the President has been allocated to Controller General of Accounts in terms of Article 77 (3) of Constitution of India. The Controller General of Accounts (CGA) is the principle advisor to the Government of India on accounting matter and is responsible for establishing and maintaining a sound and efficient accounting and financial reporting system.

Principles and Form of Accounts: The CGA prescribes general principles and form of accounts of government relating to Union as well as State governments and frames rules and manuals relating thereto. In exercise of this power, CGA is entrusted with the responsibility of framing and administering Government Accounting Rules, Central Government Accounts (Receipts and Payments) Rules, Central Treasury Rules, Accounting Rules for Treasuries, Account Code for State Accountant Generals, Account Code – Vol III, List of Major and Minor Heads of Account, Civil Accounts Manual, Suspense Manual, Drawing and Disbursing Officers Manual and Inspection Code.

Budgetary Control, Payments, Receipts Collection and Accounting : The CGA, through Chief Controller/Controller of Accounts and their Pay and Accounts Offices, carries out the budget control, payments, receipts collection and accounting functions of the Union. The CGA also prescribes the banking arrangement for government transactions and closely monitors movement of cash through a network of over 20,000 bank branches, authorised to handle government transactions, into and out of the government cash balance with Reserve Bank of India.

Financial Reporting : The CGA provides regular feedback to the Finance Minister and other line Ministries on the status of Government finances. He submits a critical fiscal analysis to the Finance Minister every month and releases data on Central Government Operations on the Internet in compliance with the Special Data Dissemination Standards (SDDS) of IMF.

Technical Advice on Accounting Matters : The CGA provides advice to all Ministries/ Departments and State Governments on various accounting matters. The advice rendered by the CGA covers aspects related to maintenance of accounts, accounting procedures for new schemes/programmes or activities, collection of receipts and its crediting into Government account, release of payment and it’s accounting, creation and operation of funds within Government accounts, banking arrangements of making payments and collecting receipts, etc.

Disbursement of pension: The CGA is responsible for disbursement and accounting of pension payments to Government employees retiring from all civil ministries. The functions are discharged through Central Pension Accounting Office (CPAO), which was created with the primary objective of simplifying the procedure of pension disbursement and accounting and providing better quality service to the pensioners. The CPAO is the central budgeting and accounting unit for the civil pensions. It functions as a single point interface between the Government, the banks and pensioners. With the introduction of modern technology, CPAO is able to serve over 6,00,000 pensioners spread all over the country through the network of bank branches specially authorised for pension disbursement.

Quality Assurance Wing: Consequent upon the decision to introduce Sevottam in Civil Accounts Organisation at the earliest, the Inspection Wing of the office of CGA, whose main duty was to conduct regulatory/compliance inspections of Pr. Accounts Offices and Pay and Accounts Offices, was renamed as 'Quality Assurance Wing' w.e.f. 16th April, 2010. The revised roles and responsibilities of the Quality Assurance Wing is to improve the quality in functioning of the departmentalized accounting units and to guide the Internal Audit Wings of the line Ministries in conducting 'Quality Audits' of the Pay and Accounts Offices and Drawing and Disbursing Offices.

The Quality Assurance wing has, keeping in line with its new roles and responsibilities, developed a checklist of control points for conducting Internal Audit of PAOs of the line Ministries. A similar checklist for internal audit of DDOs is being finalized. The Quality Assurance Wing is also geared to assist the Steering Group set up by the Controller General of Accounts for implementing Sevottam in the Civil Accounts Organisation.

Capital Restructuring and Disinvestment of PSUs: With the setting up of Board of Reconstruction of Public Sector Enterprises, the Capital Restructuring Cell in the Office of Controller General of Accounts has been offering its comments on the proposals for consideration of the Board as well as on proposals for restructuring received from administrative Ministries.

Core Accounting Solution : The office of CGA has taken initiative to achieve Core Accounting Solutions in phases. This program aims at a seamless electronic data transfer related to payment and receipt information, accounting information and reconciliation information in a secure environment. This will establish a centralized database to enable the organization to act as a single window for accessing all information related to accounts and other MIS data for decision making. By using Information Technology for compressing the timelines for submission of audited accounts and ensuring real time reporting of revenue/expenditure data, financial management in Government is expected to improve significantly.

Human Resource Development: The CGA manages the cadre of the Indian Civil Accounts Service (ICAS) and the entire accounts personnel deployed in civil ministries and is responsible for the entire gamut of personnel management including their recruitment, transfers, promotions, training, and capacity building both within the country as well as abroad, and periodical review of cadre strength and distribution.

Training: Founded in 1992, the Institute of Government Accounts and Finance (INGAF) is defined by its excellence as the training arm of the Controller General of Accounts (CGA) specializing in professional training in modern, technology enabled government accounting and financial systems. Its changing mandate over the years reflects the growing role of INGAF in an era of super-specialization that calls for professional skills being continuously and consistently upgraded. It curriculum has been diversified to fast-track the changing environment of public expenditure management and, to focus on cutting edge capacity building in a gamut of areas related to financial management, information technology, fiscal and budgetary reforms, internal audit and leadership and change management.

Parliamentary Financial Control: Monitoring Cell in office of CGA is entrusted with monitoring the progress of submission by Ministries of remedial/corrective Action Plan taken, keeping in mind the recommendations of Public Accounts Committee (PAC), as contained in their reports from time to time. It is further entrusted with the task of coordination, collection and monitoring the submission of Action Taken Notes on various Paras contained in CandAGs Report (Civil).

Besides, it is also responsible for coordination, collection and timely submission to the Public Accounts Committee of explanatory Notes by Ministries/Departments on "excess expenditure" and "savings" of Rs 100 crores and above, appearing in the annual appropriations accounts. In addition, the Monitoring Cell monitors the reciept of Utilization certificates from Grantee Institutions by various Ministries/ departments of Government of India.

Central Plan Schemes Monitoring System : CPSMS is a central sector plan scheme being implemented by the Office of Controller General of Accounts. The scheme aims at establishing a suitable on-line management information system and decision support system for plan schemes of civil ministries of government of India. The system is envisaged to track the fund disbursement from about 1000 Central Plan and Centrally Sponsored Schemes and ultimately report utilization under these schemes at different levels of implementation on a real time basis.

CPSMS is a web-enabled application and all Civil Ministries/Departments have to register the detail of agencies on this portal for releasing grants/funds. Thereafter, sanction IDs are generated for releasing the payments. The system has helped in creating a comprehensive and permanent master data bank of all the agencies receiving grants and detail of releases made from the Government of India. The system can generate Ministry-wise, Scheme-wise, State-wise, Agency-wise releases made under Plan schemes. The website address is www.cga.nic.in.

NATIONAL INSTITUTE OF FINANCIAL MANAGEMENT

In 1994, the Government of India established the National Institute of Financial Management (NIFM) as an autonomous organization under the Ministry of Finance to train directly recruited probationers belonging to various group 'A' Accounting Services.

The Union Finance Minister, the Minister of State in the Ministry of Finance, the Secretay to the Government of India, Department of Expenditure and the heads of various accounting services, are ex-officio members of the Registered Society for providing broad policy guidelines. Currently the Institute runs three long-term programmes - Professional Training Course of 44 weeks for newly recruited probationers of Accounting Services; a one year Diploma Course in Govt. Accounts and Internal Audit and a two-year Post-Graduate Diploma in Business Management (Financial Management) programme for officers of Central Government, the State Government, Public Sector Undertakings and other Organizations under Government. In addition, NIFM also conducts short term programmes for Central Government, State Governments, PSUs, Autonomous Bodies and Officers from different foreign countries also participate in the programmes. NIFM also provides consultancy services to various departments and organizations of the Govt. of India, State Government, PSUs, Autonomous Body, Universities and foreign countries.