Financial Secrecy and India

(→See also) |

|||

| Line 35: | Line 35: | ||

As regards, Switzerland, TJN adds that the country has delayed implementation of automatic information exchange. | As regards, Switzerland, TJN adds that the country has delayed implementation of automatic information exchange. | ||

| − | =See also= | + | =See also= |

| + | [[Financial Secrecy Index and India]] | ||

| + | |||

| + | [[Foreign currency inflows, outflows: India]] | ||

| + | |||

[[Foreign Direct Investment (FDI): India]] | [[Foreign Direct Investment (FDI): India]] | ||

| + | |||

| + | [[Foreign exchange reserves: India]] | ||

| + | |||

| + | [[Foreign Institutional Investment (FII): India]] | ||

| + | |||

| + | [[Foreign Portfolio Investors (FPI): India]] | ||

| + | |||

| + | [[Private equity investments in India]], this page includes statistics that club '''PE/ VC capital''' together | ||

| + | |||

| + | [[Venture Capital Funding: India]] | ||

Revision as of 12:01, 17 March 2019

This is a collection of articles archived for the excellence of their content. |

2018

January 1, 2018: The Times of India

From: January 1, 2018: The Times of India

See graphic:

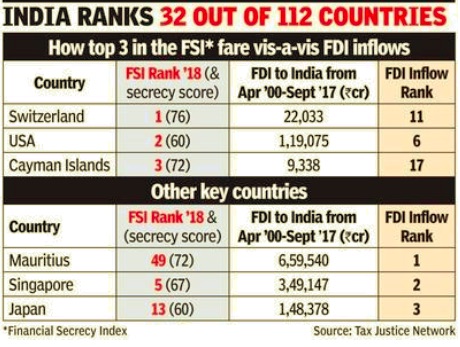

The Financial Secrecy Index rank in 2018 of the countries with the highest FDI investment in India

Switzerland retains top spot on fin secrecy index

Switzerland retained its top spot in the financial secrecy index (FSI) 2018, unveiled by the Tax Justice Network (TJN). It was followed by the US, Cayman Islands, Hong Kong and Singapore.

The US has over the past two surveys, which are carried out on a biennial basis, consistently ranked higher — indicating that it continues to remain a secrecy jurisdiction. In the FSI-2015, the US climbed to the third place from its sixth slot in the 2013 ranking. In FSI-2018, it has moved one rank higher to occupy the second slot.

According to TJN, an independent international thinktank, $21-32 trillion of private financial wealth is located, untaxed or lightly taxed in secrecy jurisdictions around the world. These countries use secrecy to attract illicit and illegitimate or abusive financial flows. Countries such as Switzerland, the US and Singapore that figure on the top 10 list of FSI-2018 (and are perceived as actively promoting secrecy in global finance), are also among the top 10 FDI investors to India (see table).

TJN's FSI ranking is based on a combination of a country's secrecy score and a scale-weightage based on the country's share in the global market for its offshore financial services. Thus, for instance, even though Mauritius (India's top FDI investor) has a secrecy score of 72 as it accounts for less than 1% of the global market for offshore financial services it is ranked lower at 49 as compared to Singapore. India's second largest FDI investor Singapore has a lower secrecy score of 67 points, but is ranked at fifth position in the secrecy index.

Among India's other top investors, Germany had the highest FSI ranking of 7. Japan, Netherlands, the UK and Cyprus were ranked at 13, 14 and 23 and 24 respectively. Among the notable FDI investors into India, countries such as Mauritius, Switzerland and Dubai have a secrecy score of more than 70. India had a lower secrecy score of 52 and was ranked 32, among the 112 countries. India's ranking would be of interest to countries where its outbound investments flow to.

According to the TJN, "The top two countries in this year's FSI, viz Switzerland and the US, are the two that have been most resistant to the key policy of automatic information exchange between tax authorities. The US refuses to take part altogether. Instead, it has set up its own parallel system (FATCA) which seeks information on US citizens abroad, but provides little, if any, data to foreign countries. The US has also failed to end anonymous companies and trusts that are aggressively marketed by some US states."

As regards, Switzerland, TJN adds that the country has delayed implementation of automatic information exchange.

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together