Financial Secrecy and India

(→2018) |

|||

| Line 9: | Line 9: | ||

| − | =2018= | + | =The index= |

| + | ==2018== | ||

[https://timesofindia.indiatimes.com/business/india-business/switzerland-retains-top-spot-on-fin-secrecy-index/articleshow/62731286.cms January 1, 2018: ''The Times of India''] | [https://timesofindia.indiatimes.com/business/india-business/switzerland-retains-top-spot-on-fin-secrecy-index/articleshow/62731286.cms January 1, 2018: ''The Times of India''] | ||

| Line 35: | Line 36: | ||

As regards, Switzerland, TJN adds that the country has delayed implementation of automatic information exchange. | As regards, Switzerland, TJN adds that the country has delayed implementation of automatic information exchange. | ||

| − | + | [[Category:Economy-Industry-Resources|F FINANCIAL SECRECY INDEX AND INDIA | |

| + | FINANCIAL SECRECY INDEX AND INDIA]] | ||

| + | [[Category:India|F FINANCIAL SECRECY INDEX AND INDIA | ||

| + | FINANCIAL SECRECY INDEX AND INDIA]] | ||

=FDI and the Financial Secrecy Index= | =FDI and the Financial Secrecy Index= | ||

Revision as of 03:28, 18 May 2022

This is a collection of articles archived for the excellence of their content. |

Contents |

The index

2018

January 1, 2018: The Times of India

From: January 1, 2018: The Times of India

See graphic:

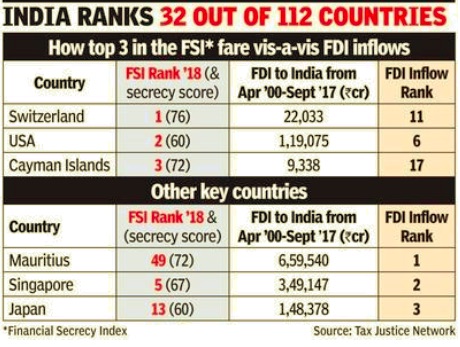

The Financial Secrecy Index rank in 2018 of the countries with the highest FDI investment in India

Switzerland retains top spot on fin secrecy index

Switzerland retained its top spot in the financial secrecy index (FSI) 2018, unveiled by the Tax Justice Network (TJN). It was followed by the US, Cayman Islands, Hong Kong and Singapore.

The US has over the past two surveys, which are carried out on a biennial basis, consistently ranked higher — indicating that it continues to remain a secrecy jurisdiction. In the FSI-2015, the US climbed to the third place from its sixth slot in the 2013 ranking. In FSI-2018, it has moved one rank higher to occupy the second slot.

According to TJN, an independent international thinktank, $21-32 trillion of private financial wealth is located, untaxed or lightly taxed in secrecy jurisdictions around the world. These countries use secrecy to attract illicit and illegitimate or abusive financial flows. Countries such as Switzerland, the US and Singapore that figure on the top 10 list of FSI-2018 (and are perceived as actively promoting secrecy in global finance), are also among the top 10 FDI investors to India (see table).

TJN's FSI ranking is based on a combination of a country's secrecy score and a scale-weightage based on the country's share in the global market for its offshore financial services. Thus, for instance, even though Mauritius (India's top FDI investor) has a secrecy score of 72 as it accounts for less than 1% of the global market for offshore financial services it is ranked lower at 49 as compared to Singapore. India's second largest FDI investor Singapore has a lower secrecy score of 67 points, but is ranked at fifth position in the secrecy index.

Among India's other top investors, Germany had the highest FSI ranking of 7. Japan, Netherlands, the UK and Cyprus were ranked at 13, 14 and 23 and 24 respectively. Among the notable FDI investors into India, countries such as Mauritius, Switzerland and Dubai have a secrecy score of more than 70. India had a lower secrecy score of 52 and was ranked 32, among the 112 countries. India's ranking would be of interest to countries where its outbound investments flow to.

According to the TJN, "The top two countries in this year's FSI, viz Switzerland and the US, are the two that have been most resistant to the key policy of automatic information exchange between tax authorities. The US refuses to take part altogether. Instead, it has set up its own parallel system (FATCA) which seeks information on US citizens abroad, but provides little, if any, data to foreign countries. The US has also failed to end anonymous companies and trusts that are aggressively marketed by some US states."

As regards, Switzerland, TJN adds that the country has delayed implementation of automatic information exchange.

FDI and the Financial Secrecy Index

2016

The Times of India, Nov 03 2015

Countries such as Switzerland, the US, Singapore and Germany that figure in the top 10 list of FSI-2015 (and are perceived as actively promoting secrecy in global finance) are also among the top 10 FDI investors to India; Graphic courtesy: The Times of India, November 3, 2015

Lubna Kably

Switzerland still top tax haven, US jumps to No. 3

Switzerland has retained its top spot in the financial secrecy index (FSI) 2015, unveiled by the Tax Justice Network (TJN) on Monday . Switzerland is followed by Hong Kong, the US, Singapore and the Cayman Islands. The biggest surprise is the US, which has climbed to third place from sixth place in FSI-2013.

Countries such as Switzerland, the US, Singapore and Germany that figure in the top 10 list of FSI-2015 (and are perceived as actively promoting secrecy in global finance) are also among the top 10 FDI investors to India. TJN's biennial FSI ranking is based on a combination of a country's secrecy score and a scale-weightage based on the country's share in the global market for its offshore financial services. Thus, for instance, even though Mauritius (India's top FDI investor) has a secrecy score of 72, it is ranked lower at 23 as it accounts for less than 1% of the global market for offshore financial services compared to Singapore. India's second largest FDI investor, Singapore, has a lower secrecy score of 69 points but is ranked at fourth position. Other top investors in India like the UK, Japan and the Netherlands have an FSI rank of 15, 12 and 41, respectively. Among the notable FDI investors in In dia, countries such as Mauritius, Switzerland and the UAE have a secrecy score of more than 70.

As regards the US, TJN's communication states, “US is more of a cause for concern than any other individual country , because of both the size of its offshore sector and also its rather recalcitrant attitude to international co-operation and reform. Though it has been a pioneer in defending itself from foreign secrecy jurisdictions, aggressively taking on the Swiss banking establishment and setting up its technically quite strong Foreign Account Tax Compliance Act (FATCA), it provides little information in return to other countries.“ According to tax experts, the FACTA agreement entered into with India provides for reciprocal exchange of information, but it's too early to comment on the information that will be shared by the US. Singapore and Germany , which also figure in the top 10 list of FSI-2015, are also among the top 10 investor countries for India. Germany's laxity in tackling illicit money and also in spearheading EU's resistance to public access of country-by-country reporting by multinational corporates has been pointed at.

See also

Financial Secrecy Index and India

Foreign currency inflows, outflows: India

Foreign Direct Investment (FDI): India

Foreign exchange reserves: India

Foreign Institutional Investment (FII): India

Foreign Portfolio Investors (FPI): India

Private equity investments in India, this page includes statistics that club PE/ VC capital together