Flipkart

This is a collection of articles archived for the excellence of their content.

|

Contents |

Flipkart, a brief history

Timeline: 2007-2018

May 10, 2018: The Times of India

HIGHLIGHTS

In September 2007, Sachin Bansal and Binny Bansal start with an internet business named Flipkart.

Flipkart hires its very first full-time employee, Ambur Iyyappa

Sells as many as 1,00,000 books in a single day

In 2018, Flipkart became India's first billion-dollar e-commerce company and has 100 million registered users.

On May 9, 2018 US retailer Walmart Inc acquired a 77 percent stakes in Flipkart for nearly 16 billion dollars in its biggest acquisition till date. Sachin Bansal, who co-founded Flipkart with Binny Bansal in 2007, might leave the company after the deal. Sachin and Binny formerly worked for Amazon.com Inc and started off by selling books when they founded Flipkart. India's first billion-dollar e-commerce company, Flipkart, sells 8 million products across 80-plus categories. It has 100 million registered users.

Below-mentioned are the milestones achieved by the Indian e-commerce giant Flipkart:

2007 | Flipkart starts in a tiny Bengaluru apartment

On September 15, 2007, Sachin Bansal and Binny Bansal, who met at IIT Delhi in 2005, start with an internet business named Flipkart. It is an online bookstore that delivers all over India. In the initial weeks, the first customer from Mahbubnagar, places an order. Despite of a lot of drama, Sachin and Binny manage to pull off the delivery. After 20 shipments in that year, Flipkart is in business.

2008 | The big launch

• Flipkart sets up its first office opens in Bengaluru

• Over 3,400 shipments delivered

• 24×7 customer service launched

2009 | First employee and first funding

• Flipkart hires its very first full-time employee, Ambur Iyyappa

• In September, Accel Partners comes onboard as an investor by investing 1 million dollars

• Flipkart now has office in Delhi and Mumbai

• First book opens for pre-orders – Dan Brown’s The Lost Symbol

2010 | Cash-on-Delivery and Ekart wins the confidence of Indian consumers

• Aces the Cash-on-Delivery payment mode

• Launches logistics wing Ekart and fresher Vinoth Poovalingam heads it

• Comes up with 30-day return policy

• Takes over social book recommendation portal WeRead

• Ventures into categories, including Music, Movies, Games, Electronics and Mobiles

2011 | Broadening the delivery network

• Introduction of digital wallet

• Expands shopping categories to include Cameras, Computers, Laptops, Large Appliances, Health, Personal Care, Stationery

• Takes over Chakpak and Mime360

• Comes up with a 30-day replacement policy

• Delivery service reaches up to 600 Indian cities

2012 | Launches the Flipkart mobile app and brings shopping to every Indian’s fingertips

• Launches the mobile shopping app

• Takes over electronics e-tailer – Letsbuy

• Receives PCI DSS Certification, allowing customers access to ‘Saved Cards’ feature

• Launches Menswear, Fashion, Perfumes, Watches, Toys, Posters, Baby Care and a private label DigiFlip

• Launches Flyte MP3 for online music sales

2013 | Rise of the marketplace

• Comes up with Next Day Shipping Guarantee

• Raises 160 million dollars in funding

• Takes up marketplace model, opening up platform to sellers

• Sells as many as 1,00,000 books in a single day

• Launches PayZippy, an online payments solution for merchants and customers and also Women’s Lifestyle section

• Starts accepting international cards for transactions

• Recruits a record 118 candidates from IIT campuses

2014 | Myntra collaborates with Flipkart

• Becomes the first Indian internet retailer to register 1.9 billion dollars of gross merchandise value (GMV)

• Takes over fashion e-tailer Myntra and majority stakes in Jeeves and ngpay

• Launches Flipkart First and In-a-Day Guarantee concept

• Starts exclusive associations with Moto and Xiaomi

• Kicks off India’s largest online sale — Big Billion Day — in October

2015 | Adopts progressive maternity, paternity and other policies that make Flipkart a great place to work

• Starts with Home and Maternity categories

• Takes over AdIquity and AppIterate

• Launches Ad Platform and Strategic Brands Group

• Unveils the new logo of Flipkart

• Acquires payment services firm FX Mart

• Starts with Flipkart Lite

• Introduces progressive maternity and paternity policies for employees and introduces an adoption policy

2016 | Flipkart boasts of 100 million registered users

• Binny Bansal takes is the new CEO and Sachin Bansal becomes Executive Chairman

• Flipkart becomes the first Indian mobile app to cross 50 million users

• Has 100 million registered customers

• Launches No Cost EMI

• In April, Sachin Bansal and Binny Bansal named among the list of 100 most influential people by TIME magazine

• Acquires UPI-based payments startup PhonePe

• Acquires Jabong

• Sachin and Binny named “Asian of the Year” by Straits Times of Singapore as part of the ‘The Disruptors’ group

• Invests in Qikpod for locker deliveries

2017 | Flipkart celebrates 10 years with biggest-ever round of investments

• Kalyan Krishnamurthy becomes the CEO of Flipkart. Binny Bansal takes the position of the Group CEO

• PhonePe crosses 10 million downloads

• Flipkart raises 1.4 billion dollars from Tencent, eBay and Microsoft

• eBay India becomes part of the Flipkart Group

• Softbank Vision Fund which has invested in Flipkart will become one of the largest shareholders of the company

2007- April 2018, some brief highlights

May 9, 2018: The Times of India

HIGHLIGHTS

The journey of Flipkart started when two IIT-Delhi graduates left their jobs at Amazon to pursue entrepreneurial dreams

Flipkart was founded 11 years ago in 2007 by Sachin Bansal and Binny Bansal

India's largest e-commerce company Flipkart on Wednesday agreed to sell 77 per cent stake to US retail giant Walmart for $16 billion. Ahead of the official announcement, TOI had accurately reported the deal size. Walmart also plans to pump $2 billion (nearly Rs 13,000 crore) as fresh equity into Flipkart to strengthen its hold on the e-commerce firm.

Rival Amazon was reportedly interested in acquiring control of Flipkart but the Indian online retailer went for the deal offered by Walmart. Meanwhile, SoftBank CEO Masayoshi Son said that Walmart-Flipkart agreement was made.

The journey of Flipkart started when two IIT-Delhi graduates left their jobs at Amazon to pursue entrepreneurial dreams.

Here is a look back at the company's journey from a two-bedroom office to where it is now:

- Flipkart was founded 11 years ago in 2007 by Sachin Bansal and Binny Bansal. Although they share the same last name and come from Chandigarh, the two Bansals are not related. A batch apart in IIT-Delhi, they became friends while working together at Amazon.

- Flipkart was started from a two-bedroom apartment in Bengaluru's Koramangala area as an online bookstore. From those humble beginnings it would go on to become the country's largest e-commerce player.

- It opened its first office in Bengaluru in 2008 followed by offices in Delhi and Mumbai in 2009. Last month, Flipkart consolidated all its Bengaluru offices into one large campus sprawled across 8.3 lakh square feet.

- In 2011, Flipkart domiciled to Singapore, as it looked to woo foreign investors to fund rapid growth.

- Sachin was Flipkart CEO for nine years. In 2016, Binny Bansal took over as CEO as Sachin became executive chairman.

- In 2017, Kalyan Krishnamurthy, previously an executive in Flipkart investor Tiger Global, took over as Flipkart CEO. Binny Bansal became CEO of the whole group, which includes fashion portals Myntra-Jabong, payments unit PhonePe and logistics firm Ekart.

- Flipkart bought online apparel retailer Myntra in a deal pegged by sources at about $300 million in 2014, and another fashion retailer Jabong for $70 million in 2016.

- It bought payment startup PhonePe in 2016. In exchange for an equity stake in Flipkart, eBay agreed to make a $500 million cash investment in and sell its eBay.in business to Flipkart in 2017.

- Japan's SoftBank is currently the largest investor in Flipkart with a 23-24 per cent stake, along with early backer South African media and internet giant Naspers, which holds 13 per cent. Other investors include New York-based hedge fund Tiger Global, US private-equity firm Accel Partners, China's Tencent Holdings Ltd, eBay Inc and Microsoft Corp.

- In terms of financial statistics, Flipkart Group's consolidated loss attributable to owners of the company in fiscal 2017 widened to Rs 8,770 crore, from Rs 5,216 crore a year earlier. Consolidated revenue jumped 29 per cent to Rs 19,855 crore in fiscal 2017.

2008-14

Rags to riches: Flipkart’s journey from Rs 4,00,000 to $5-6 billion

The Times of India Business Insider | Jul 31, 2014

In the biggest fund-raising ever for an Indian e-commerce company, in 2014 Flipkart attracted a whopping $1 billion from its existing investors Tiger Global Management and Naspers.

As per industry experts, the Bangalore-based company is now valued at somewhere between $5 and $6 billion — double the estimated value of $2.5-3 billion in May this year.

Flipkart co-founders Sachin Bansal and Binny Bansal want to make Flipkart the country's first Internet company to be valued at $100 billion.

Flipkart has till now garnered almost $1.7 billion as it battles Amazon and Snapdeal for the top slot.

The rise: a timeline

The Times of India presents a timeline of Flipkart's funding — how within seven years a company that founders started off with just Rs 400,000 — is now worth thousands of crores.

October 14, 2008: Co-founders Sachin Bansal and Binny Bansal start Flipkart with a capital of Rs 400,000

July 15, 2010: Tiger Global joins with an investment of $10 million

June 16, 2011: The company announces new logo and gets another investment of $20 million by Tiger Global

August 24, 2012: Investment of $150 million by Tiger Global and Naspers group, crosses gross sales of Rs 100 crore

July 10, 2013: Attracts investment of $200 million from Tiger Global, Naspers, Accel Partners and Iconiq Capital, crosses single-day shipment of 1.3 lakh

October 9, 2013: Another investment of $160 million by Dragoneer Investment Group, Morgan Stanley Investment Management, Sofina, Vulcan Capital and Tiger Global

May 26, 2014: Flipkart acquires Myntra

July 29, 2014: Attracted a whopping $1 billion from Tiger Global Management and Naspers

Just a day after Flipkart announced raising $1 billion, e-commerce giant Amazon, too, announced that it will invest an additional $2 billion in India to expand its growth in the country.

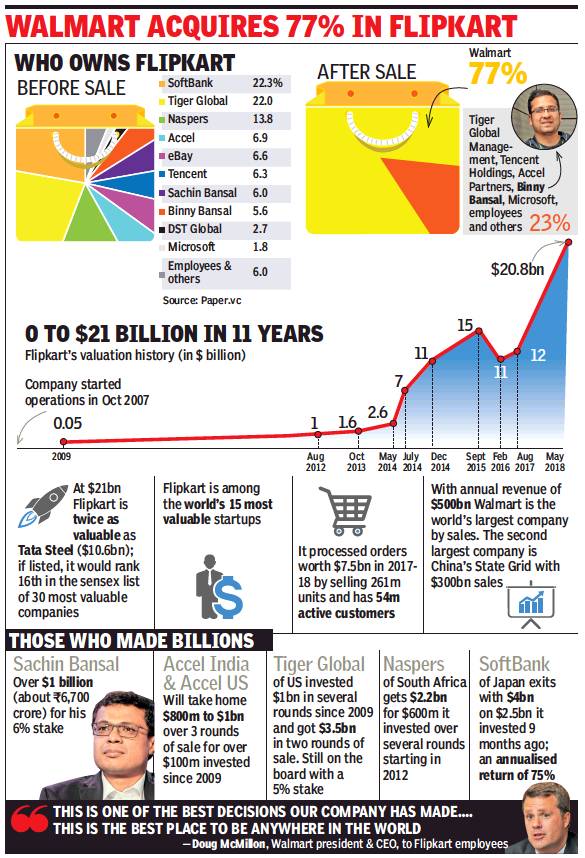

2018, May: Walmart picks up a 77% stake

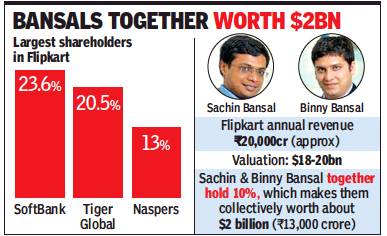

From: Samidha Sharma, World’s largest company buys India’s most valuable startup in biggest global e-comm deal, May 10, 2018: The Times of India

One Founder To Stay On As Group CEO, The Other To Cash Out For $1bn

American retail giant Walmart Inc is picking up a 77% stake in domestic online retailer Flipkart for $16 billion (Rs 1.12 lakh crore) in the largest e-commerce deal ever struck anywhere in the world. The deal values 11-year-old Flipkart at approximately $21 billion (Rs 1.47 lakh crore).

This catapults the poster boy of Indian e-tail to among the most valued internet startups in the world. It also brings to an end the independent run of Flipkart, founded by two twenty-something IITDelhi engineers, which spawned a brand new generation of internet entrepreneurs in the country. The stunning success of the unrelated Bansals — Sachin (now 36) and Binny (35) — made startups mainstream and helped the ecosystem attract an unprecedented inflow of capital from foreign investors.

The transaction, which was officially announced on Wednesday after months of extensive media coverage, has been in the works since 2016. It entails Walmart ploughing $2 billion into the company as primary capital.

The rest of the stake for Walmart will come from buying out existing investors like Japan’s SoftBank, Tiger Global (an investment fund based in New York) and South African media and internet group Naspers, among others, at a valuation of $19-20 billion, sources close to the matter said.

Online search engine major Google’s parent, Alphabet, is likely to pump another $1-2 billion, separately, later in the year, sources said.

TOI was the first to report on February 8 that Walmart was looking to get a majority shareholding in the Bengaluru web retailer at a $20 billion valuation.

The new structure would see Flipkart’s co-founder, chairman and longest serving CEO, Sachin Bansal, sell off his 6% stake and exit the company completely, as TOI first reported in its May 4 edition. Binny Bansal, Flipkart’s other co-founder, will stay on as the group CEO, and go on to take the executive chairman’s role at least for the next two years, as part of the terms of the deal. Kalyan Krishnamurthy, the present CEO of Flipkart, also continues in his role.

With SoftBank out, the Bentonville (Arkansas)-based retail behemoth will now become the single largest shareholder in Flipkart, as it prepares to extend its bitter US rivalry with Jeff Bezos’ Amazon to India.

Despite its massive shareholding, Walmart plans to keep Flipkart as a separate brand and have an independent operating structure, the press statement from the brick-and-mortar retailer said.

‘Sachin, Binny defined post-Ambani business era’

Samidha Sharma, ‘Sachin, Binny defined post-Ambani biz era’, May 10, 2018: The Times of India

They Will Further Spur Entrepreneurship, Become Full-Cycle Founder Role Models

Within a year of working at Amazon’s outpost in Bengaluru, Sachin Bansal and Binny Bansal — then in their mid 20s — had decided to step out and build a company that would take on the might of the Seattle-based internet giant on its own turf.

The Bansals, who first met at Amazon’s India development centre in 2006, along with another colleague, had prepared a paper plan to start an online comparison site. While the third co-founder never joined, the two IIT-Delhi graduates were resolute. They quit Amazon’s back-end office, which at the time was helmed by Amit Agarwal, the current India head of Amazon, to start their entrepreneurial journey. Sachin, Binny and Agarwal did not know back then they would square off in one of the most aggressive and fiercely-fought battles to win the Indian e-commerce market a few years later.

With Amazon’s entry into domestic online retail still six years away, Flipkart began life in October 2007 out of the tony Wilson Garden neighbourhood in Bengaluru as an e-bookstore. The initial code for the Flipkart website was written by these two young software engineers from Chandigarh, who were a batch apart at the IIT. Sachin was overseeing tech, product and marketing in the early days while Binny helmed the back-end, pricing of books and operations. One of the first few people who joined Flipkart says, “Sachin drove up the traffic on the site through great search engine optimisation in the first few years of launch, which started fetching ad monies in the range of Rs 10-12 lakh per month. This was enough to sustain the company.”

In June 2009, Flipkart registered itself as a private limited entity and lined up external funding of $1 million — spread over three instalments — from Accel Partners, Silicon Valley’s marquee venture capital fund and an investor in Facebook. It wasn’t long before Lee Fixel of Tiger Global, a New York-based investment fund, spotted Flipkart, and from there on the online bookseller was onits way to become a full-blown e-commerce platform, which went on to raise $6 billion in capital in the span of 11 years.

An early investor in the company says, “Sachin and Binny’s biggest contribution has been that they built the next-generation team behind their underlying tech platform, which enabled scale and ultimately the ability to compete with Amazon. Flipkart was the first internet startup that spawned product talent locally. It wouldn’t be a stretch to say they define the post-Ambani business era in India.”

Avnish Bajaj, MD at venture capital fund Matrix Partners, who co-founded Baazee-.com, an online auction site and sold it to eBay in 2004, says, “Sachin and Binny’s hard work has been rewarded. This will further spur entrepreneurial activity in India as they become full-cycle founder role models who have facilitated a huge exit at $20 billion.”

While people credit Sachin for being behind the launch of unique India solutions like cash-on-delivery, shoring up traffic to the site in the first couple of years, and being the face of Flipkart to external investors while fund-raising, Binny is seen by most as the one who brought his expertise to bear in verticals like operations, supply chain and logistics, which are the backbone of an online retail company.

Sachin, who ran Flipkart for nine years as its longestserving CEO, along with Binny and its early team, had aspirations of scale from the time they started, says another Flipkart old-timer. “What defined Flipkart and its founders was its staying power through the past decade amid many highs and lows. The golden period was till about 2014, after which Amazon doubled down on them and many naysayers wrote them off. But that changed in the past one year and now, with Walmart coming in, a lot of question marks on Flipkart have been set to rest.”

Many employees become dollar millionaires

May 10, 2018: The Times of India

Walmart’s buyout of Flipkart will make a host of former and current employees with shares in the latter rich, and quite a few will become dollar millionaires. Some 3,000 or more employees, current and former, are said to be holding shares. The company has a total strength of about 10,000.

At the employee town hall on Wednesday, there was a big cheer when Flipkart co-founder and group CEO Binny Bansal announced a 100% buyback of vested ESOPs (employee stock options. Sources told TOI that the buyback could be at around $150 (Rs 10,000) a share.

Among those turning dollar millionaires are said to be Sameer Nigam, CEO and founder of PhonePe, the payment arm of Flipkart, Amod Malviya, former chief technology officer, Sujeet Kumar, former president of operations, Vaibform Udaan. Nagori started healthcare platform Curefit, together with Myntra founder Mukesh Bansal.

Maheswari started Udhyam Learning Founhav Gupta, former business finance chief, Mekin Maheswari, former chief people officer, Ankit Nagori, former chief business officer, and Ananth Narayanan, CEO of Myntra and Jabong.

Malviya, Kumar and Gupta went on to found trading platdation, which works on developing entrepreneurial mindsets amongst youth from difficult backgrounds.

Flipkart was quite liberal in granting stock options to employees. But it would still not be able to rival Infosys, which is said to have created 20,000 rupee-millionaires and 500 dollar-millionaires in the 1990s and 2000s.

“Infosys grew organically, taking in less capital and creating sustainable cash flows. Flipkart has consumed huge amount of capital, which has gone into building the business and funding losses. But they need to be congratulated for creating value,” T V Mohandas Pai, former board member at Infosys, said.

Founders: Sachin Bansal & Binny Bansal

Their e-commerce enterprise, Flipkart, was valued at $7 billion in July 2014, after the company raised $1 billion from investors to bolster back-end operations, and according to reports, closer to $11 billion by november 2014.

Flipkart kicked up a storm in Indian retail after its big billion day sales on October 6 raked in Rs.600 crore on the back of hefty discounts.

They have grown their company aggressively, snapping up fashion retailer Myntra in May, and hiring an additional 12,000 personnel to beef up support and technology operations.

First book order

They had to buy leaving microsoft to change the world by john wood from a local bookstore before shipping it to their first customer.

The Bansals’ net worth

Bansals nearly as rich as Infy co-founders

The Times of India Jul 30 2014 Anshul Dhamija & Samidha Sharma Bangalore TNN

Flipkart Founders’ Combined Net Worth $1Bn

The Bansals of Flipkart—Sachin and Binny —now boast of a combined net worth in excess of $1 billion, inching closer to that of Bangalore’s iconic tech billionaires N R Narayana Murthy and Nandan Nilekani of Infosys.

The fresh $1-billion fund raise values the Bansals’ combined stake of approximately 15% at over Rs 6,000 crore. The four-member Murthy family has a net worth of around Rs 8,700 crore in India’s second largest IT services company, while the Nilekani family’s net worth stands at Rs 6,500 crore.

Consumer internet ventures have been getting fabulous valuations. The US and Chinese internet markets have fostered many billionaire entrepreneurs as their ventures went public. Facebook's Mark Zuckerberg has a net worth of $33 billion, while Alibaba's founder Jack Ma has a $12.5 billion net worth, up $8.9 billion year-todate, according to the Bloomberg Billionaires Index.

The Bansals, who are not related, have a higher net worth than Infosys' co-founder and outgoing CEO S D Shibulal, who along with his family holds shares worth Rs 4,300 crore in the company . Infosys' other co-founder Kris Gopalakrishnan's family has a net worth of around Rs 6,500 crore, as of Tuesday .

“On paper the Bansals personal wealth is a great story , but we will have to wait for a listing to see their actual net worth,“ said an investment banker who did not want to be named. Infosys is now into its fourth decade and has a market cap of about $30 billion.

Flipkart’s $7 billion valuation story has been scripted in just seven years, and the Bansals are now talking of creating a $100-billion e-commerce company.

From 2011 to 2014, Flipkart grew its sales from $10 million to an annualized $2 billion, an over 100 times growth in three years. There is a huge revolution in e-commerce in India, with the future of retailing coming from the internet, said the Bansals while announcing their latest fund raise. The Bansals believe that in the next 10 years, India would have several $100 billion companies in the internet space. “Flipkart is much bigger today than we or our investors had ever imagined,” Sachin Bansal said.

November 2017/ booked for "cheating"

HIGHLIGHTS

E-commerce major Flipkart founders Sachin Bansal and Binny Bansal and three employees have been booked for allegedly cheating a businessman.

The company cheated the man of Rs 9.96 crore by not clearing the dues.

E-commerce major Flipkart founders Sachin Bansal and Binny Bansal and three employees of the company have been booked for allegedly cheating a businessman of Rs 9.96 crore by not clearing the dues the company owed him towards 12,500 laptops he had supplied.

Sachin Bansal, Binny Bansal, sales director Hari, accounts managers Sumit Anand and Sharauque among other employees have been named in the FIR registered on the basis of a complaint lodged by Naveen Kumar, owner of Indiranagar-based C-Store Company.

In his complaint lodged on November 21, Naveen has said that he had entered into a contract with Flipkart to supply laptops and other electronic goods, and had supplied 14,000 laptops to the company between June 2015 and June 2016 for its Big Billion Day sale.

"Flipkart returned 1,482 units but did not pay for the remaining units. TDS and shipping charges for those units too were not paid. When asked to clear the dues, Flipkart falsely claimed it had returned 3,901 units. By not clearing the dues, they have cheated me to the tune of Rs 9,96,21,419," the FIR says.

A copy of the FIR is with the TOI. Indiranagar police have said that a case has been registered under IPC sections 34 (common intent), 406 (criminal breach of trust) and 420 (cheating), and a probe was on. Sachin Bansal and Binny Bansal are among those named in the FIR filed on the basis of a complaint lodged by Naveen Kumar, owner of Indiranagar-based C-Store Company.

ESOPs enrich employees

About 400 Flipkart employees with stock options become crorepatis in less than a decade

By Radhika P Nair, ET Bureau | 14 Aug, 2014 The Economic Times

BANGALORE: About 400 employees with stock options at online retailer Flipkart have hit the 'crorepati' jackpot because of the surging valuation of the online retailer.

The bonanza is reminiscent of the times when thousands of employees — among them office assistants, drivers and receptionists — at another Bangalore-based company Infosys hit Esop paydirt. "About 400 of the employees who own a stake have now become crorepatis," said a person who has direct knowledge of the employee stock option scheme at Flipkart, which received $1 billion (Rs 6,000 crore) in funding last month, valuing it at $7 billion.

About one-fourth of Flipkart's 7,000 full-time employees own a stake in the company.

At the senior-most level, nearly 20 employees who are at the grade of senior vice-president or above and joined over two years ago are now dollar millionaires, meaning their stock options are worth at least Rs 6 crore on paper. The firm's stock options get vested over four years. Flipkart declined to provide details for the report.

It is the online retail market leader's valuation jump that has led to this wealth creation.

In 2012, the company was valued at about $850 million when it raised about $150 million.

In two years, Flipkart's valuation has grown eight times. For the company's founders, Esops are a conscious attempt at creating wealth for their employees. "While we are competitive when it comes to salaries, Esops offer the opportunity for wealth and value creation," said Sachin Bansal, 32, Flipkart's co-founder and chief executive. "It's a long-term reward for those who believe in the future of Flipkart."

After the IT services industry, ecommerce is now the next big opportunity for employees to create wealth, said Anshuman Das, managing partner at Longhouse Consulting, a recruitment firm that works with startups. "The message going out to entrepreneurs is that wealth creation cannot be restricted to just the founders."

A number of junior employees at Flipkart too hold sizeable stake in the company. This has helped employees like 29-year-old Ambur Iyyappa, a senior manager of customer operations at Flipkart. "I was getting married in 2012 and the buyback allowed me to take care of my wedding expenses," said the graduate of Annamalai University.

Iyyappa, who sold only a part of his stake at the time of the buyback, declined to reveal how many shares he still holds.

He was the second non-founder employee to join Flipkart in 2008. It was only in 2009, the same year that the company raised its first round of funding of $1 million (over Rs 6 crore) from Accel Partners, that Flipkart started providing Esops.

Fashion e-tailer Myntra, which was acquired by Flipkart in May, allowed employees to sell shares at the time of the acquisition, according to a person with direct knowledge of the deal. The company declined to confirm this. Myntra provides Esops to all its core employees, numbering about 600, in functions such as technology and marketing across all levels.

For existing employees, Esops provide recognition.

Personnel issues

Binny Bansal resigns over 'misconduct'

Flipkart promoter quits after ‘personal misconduct’ probe, November 14, 2018: The Times of India

‘Uncorroborated’ Allegations Left Me Stunned: Binny

Six months after he led Flipkart, India’s most valuable start-up, into the biggest global acquisition deal in e-commerce with Walmart, the world’s largest company by revenue, Binny Bansal quit abruptly on Tuesday as chairman and group CEO following an “independent investigation into an allegation of serious personal misconduct”.

The 36-year-old Binny, who co-founded Flipkart with fellow IITian Sachin Bansal in 2007, has “strongly denied the allegation”. “Nevertheless, we had a responsibility to ensure the investigation was deliberate and thorough. While the investigation did not find evidence to corroborate the complainant’s assertions against Binny, it did reveal other lapses in judgment, particularly a lack of transparency, related to how Binny responded to the situation,” said a joint Flipkart-Walmart statement.

In a separate statement, Binny said the allegations were “uncorroborated after a thorough investigation completed by an independent law firm”, adding that they had left him “stunned”.

Acknowledging that “these have been challenging times for my family and me”, he said, “I am concerned that this may become a distraction for the company and the team, for which I am deeply sorry.”

As Flipkart’s largest individual shareholder with about 5.6%, he will continue to be on the board – but his exit from the day-to-day management of the group marks the end of the Era of the Bansals.

Ironically, it was Binny who went head-to-head with Flipkart’s other founder in pushing the deal with Walmart, leading to Sachin quitting the company lock, stock and barrel – his 6% stake leaving him about a billion dollars richer, but from almost all accounts, somewhat bitter. Sachin, who had been Flipkart’s chairman and longest-serving CEO, is thought to have favoured a deal with Amazon, the King Kong of e-comm, also the world’s second-most valuable company (after Apple).

According to a Reuters report, the investigation “stemmed from an allegation of sexual assault that dates back a few years”. It quotes a source saying, “In late July ... an allegation came to us,” adding that “the individual concerned was a former Flipkart associate who was not with the company at the time of making the allegation”.

While both Binny and Walmart are believed to have agreed to say nothing beyond their coordinated official statements, some old-timers at Flipkart feel the US giant, which now owns 77% in the Bengaluru-headquartered company, has used an “old case” to assume total control of their new acquisition. Others say that Walmart's problem was with “non-disclosure” of the alleged incident.

According to the joint statement, Kalyan Krishnamurthy will continue to be CEO of Flipkart, while Ananth Narayanan will still head Myntra and Jabong, reporting into Krishnamurthy. There is no word yet on who the new chairman will be.

Unanswered questions

Flipkart’s remaining co-founder, Binny Bansal, resigned from his post as the Group CEO; the parent company Walmart issued a cryptic statement, saying the decision was made after allegation of “serious personal misconduct” against Binny — he has denied the allegations, saying he was “stunned”. So, why did he quit, despite Walmart saying that the “investigation did not find evidence to corroborate the complainant’s assertions against Binny”?

What misconduct? A report by Reuters, quoting an unnamed source, says an allegation of a sexual assault by Binny surfaced in July — the complainant, a former Flipkart employee, alleged Binny sexually assaulted her some years back. While Binny has denied the allegation, Walmart cited the “lack of transparency” and “other lapses in judgement” on Binny’s part in its letter to the stock exchange.

Part of the plan? Walmart, which bought 77% stake in Flipkart in May earlier this year for $16 billion, had been contemplating replacing Binny for some months now as he was not involved in the day-to-day operations of the company, according to a report.

So, is he out? Not quite, as Binny, in his letter to Flipkart’s employees, has stated that he will continue to be a member of the company’s board and a significant equity shareholder, though he admitted to the investigation’s verdict about lapses in judgement and lack of transparency on his part.

What Binny's former colleagues said? Binny’s exit from the e-commerce company, just months after its sale to Walmart, has flummoxed his old colleagues. But many of them had predicted in private months ago that Walmart would move ahead without Flipkart founders in tow.

Binny decided to stay under the Walmart leadership even after his co-founder Sachin Bansal quit in disgust just before the $16-billion sale in May 2018. “Sachin was the more feisty among the two founders, while an amiable Binny was expected to ensure continuity. Now Binny’s exit under tightly-scripted secrecy clauses, even as he retains board seat and shares, strengthens belief that Walmart was interested in life beyond Bansals,” said a former Flipkart executive.

“One cannot help but feel that Binny was jettisoned for more than one reason,” said another former colleague when asked about allegations of personal misconduct against him. He said the Flipkart grapevine was buzzing about the new owner digging out an old, unproven allegation against Binny some three months ago.

Non-disclosure might have been Binny’s biggest undoing. It’s an issue that many global companies take very seriously. Sources close to Walmart said Binny did not make any disclosure about the allegation of personal misconduct against him to Walmart at the time of the latter’s acquisition of Flipkart earlier this year.

Walmart and Flipkart’s joint statement on the issue also hinted at this. They said that while the investigation did not find evidence to corroborate the complainant’s assertions against Binny, “it did reveal other lapses in judgment, particularly a lack of transparency, related to how Binny responded to the situation”.

Binny and woman had consensual affair: Probe

November 15, 2018: The Times of India

An independent probe into alleged "serious personal misconduct" by Flipkart co-founder Binny Bansal had concluded that Bansal and the woman had a consensual affair, Bloomberg reported, quoting two persons familiar with the matter. Bansal, 37, stepped down immediately following the probe, which he denies.

The accusation of sexual assault came in late July, according to a person with knowledge of the matter, who requested anonymity because the details aren’t public.

The person said the accuser was a former Flipkart employee, while a second person who knew of the situation said the woman never worked there.

“While the investigation did not find evidence to corroborate the complainant’s assertions against Binny, it did reveal other lapses in judgment, particularly a lack of transparency, related to how Binny responded to the situation,” Walmart said in a statement.

Walmart had completed its $16 billion purchase of a majority stake in the Indian company in August in a deal that lifted Bansal’s net worth to $1 billion.

2015: good times

23 employees get Rs 1 crore+ annually

The Times of India, Dec 8, 2015

Sagar Malviya & Sreeradha D Basu

23 Flipkart Internet employees draw more than Rs 1 crore salary annually

Flipkart Internet, the consumer-facing arm of the ecommerce giant, had over 23 employees who took home more than Rs 1 crore in annual salary last year — the same as consumer conglomerate ITC — highlighting how new-age firms are paying to attract talent, especially at the senior level.

Flipkart Internet's employee benefit expenses swelled threefold to Rs 476 crore, according to its filing with the Registrar of Companies.

Mekin Maheshwari, as chief people officer, drew Rs 18.73 crore in annual remuneration during 2014-15, according to the filing.

That's more than the salaries of top chief executives such as Hindustan Unilever's Sanjiv Mehta and ITC Chairman YC Deveshwar.

Maheshwari quit in September and now has an advisory role. The data is only for Flipkart Internet and excludes other group firms such as wholesaler Flipkart India and Flipkart Logistics.

Experts said the remuneration figures could rise if other group companies are included.

Flipkart did not respond to an email query. The high salaries indicate that ecommerce companies have a small pool of talent to draw from and need to pay well to attract and retain talent in a business that's considered riskier than established companies.

While ecommerce entities are increasingly edging out FMCG (fast-moving consumer goods) companies as the hottest career destination for engineering and B-school students, it's still a tough task for them to get the right talent on board, especially at the senior level. Experts said the nature of talent that these companies seek at a senior level is very scarce, especially in India, and they often have to look at places like Silicon Valley.

"They are getting in people from the Valley or people who have worked with organisations such as Google, Adobe, Intuit. For companies like Google, the practice of paying high salaries starts at the engineering college level where they are among the biggest paymasters," said Anuj Roy, partner, digital practice, at executive search firm Transearch.

"This phenomenon continues through the hierarchy, so while getting in people from companies such as these, there is a big premium to be paid."

NO MATCH FOR HUL

Still, Flipkart Internet isn't a match as yet for India's top consumer goods firm Hindustan Unilever, which has about 169 executives who drew eight-digit salaries. IT major Infosys had 123 such employees last year and Wipro had 70. However, this could change. Earlier this year, ET reported that ecommerce companies could roll out 500 jobs with salaries exceeding Rs 1 crore each this year, according to estimates by five search firms, including RGF Executive Search and Longhouse Consulting.

While traditional companies have reached a certain scale and operate in a mature market, online players are constantly trying to prove themselves in a hyper-competitive environment.

Life is hell for buyers who purchase defective items from Flipkart. I purchased 6 items and all are thrown in dustbin within a year. concern Customer

"Then there's the fact that people who do fit the requirements have the options to go to many other places which are equally keen to get the same kind of talent on board. The kind of salaries you pay depend largely on who you are competing with." Ecommerce as an industry hasn't stabilised in India and the risk factor associated with it merits a higher salary. According to headhunters, everybody at Flipkart at the level of vice-president, senior vice-president or CXO gets more than Rs 1-1.5 crore as the cash component alone. Senior directors of certain functions such as tech would also get this amount. The biggest packages would be heavily skewed towards people in product and tech.

2016: bad times

Targets missed, Bansal resigns as CEO/ Aug

Bansal also said that he stepped down as CEO as a result of the e-commerce major's weak performance under him

In a townhall meeting, Flipkart co-founders Sachin and Binny Bansal (not related) revealed that the company had missed growth targets, while addressing employee concerns over layoffs. They even admitted that rival Amazon has stolen their customers, but downplayed the role of the US company for Flipkart's stalled growth. The sluggish growth in the sector comes soon after the government's move to restrict discounts on e-commerce marketplaces as part of the new foreign direct investment (FDI) norms.

In March 2016 the government had revised its guidelines for FDI in e-commerce marketplaces, mandating that firms such as Flipkart and Amazon do not influence the price of products sold on their platforms. This move is now seen as directly impacting sales on such platforms as customers are unwilling to pay higher prices for products sold online.

In July 2016, the company laid-off close to 1,000 employees saying the move was part of its appraisal process, where employees who did not perform as required were asked to leave.

As Sachin Bansal revealed, this shape up or ship out philosophy wasn't just restricted to employees, but also to the top management including himself. Bansal, who stepped down as the chief executive of Flipkart in January this year, said that the move was "performance linked".

The frankness of the co-founder might be a rare occasion, where top executives at large companies admit to their failures, but it's also for the first time that Flipkart is admitting to missing performance targets. Binny Bansal, who took over as chief executive of Flipkart has been putting together an entirely new management team, after several top-level exits seemingly due to their inability to hit targets.

In the past eight months Flipkart has seen the exits of Mukesh Bansal - considered as the right hand man of Sachin and Binny Bansal; Ankit Nagori - a long-time Flipster and chief business officer; Punit Soni - Flipkart's million-dollar hire from Silicon Valley, who headed product and strategy and Manish Maheshwari - head of seller business.

While Flipkart's growth has stalled over the past few quarters, Amazon has maintained a brisk pace of growth. According to research firm Redseer Consulting, in the quarter that ended March 31, Amazon overtook Snapdeal to become India's second largest e-commerce marketplace and closed the gap with Flipkart. Armed with a $5 billion war chest to win the Indian market by beating Flipkart, the last thing the Indian company needed was tougher market conditions supplied to it by changing government policies.

Change in top management structure/ Aug

India's largest online marketplace Flipkart changed its top management structure again, putting two key business units under the control of Kalyan Krishnamurthy, a senior executive from Tiger Global, its largest investor.

The Bengaluru-based company has also expanded roles of two other executives, senior vice president Ravi Garikipati, who is now head of engineering and chief people officer Nitin Seth redesignated as chief administrative officer.

The top level changes mark the third major reorganisation in 2016 at Flipkart, India's most valued startup at $15 billion, which is battling Amazon to retain its market leadership.

Krishnamurthy, who joined as head of category design management, will now also lead the advertisement business, a key plank towards its aim of generating gross profit and reducing burn rate. Krishnamurthy will also be in control of managing "the demand side" of the commerce platform, which will mean heading both retail and marketplace business.

The move will also put both marketing, customer shopping experience and private label business under Krishnamurthy, with unit heads Samardeep Subandh, Surojit Chatterjee and Mausam Bhatt reporting to him.

Krishnamurthy, a senior operations executive with Tiger Global since 2011, had worked at Flipkart between 2013 and 2014 when he served as chief financial officer and head of category management. Krishnamurthy is also leading the charge for Big Billion Day, Flipkart's flagship sales event held in October.

Tiger Global is also the largest shareholder in Flipkart, after having invested about $1 billion across its various rounds of funding since 2010.

A Flipkart spokesperson said that Krishnamurthy does not work with Tiger Global anymore, and is now a company employee.

Saikiran Krishnamurthy, who is heading logistics unit Ekart, will be in charge of the supply side of the commerce business looking after sellers on the platform as well.

The appointments come as position for the leadership of commerce unit was left vacant after exit of Mukesh Bansal and chief business officer Ankit Nagori in March 2016.

"The move gives Flipkart CEO time to spend more time with other business units as he has been spending a lot of time with commerce platform. It will also simplify the reporting structure of the organisation, as now 8 people directly report to him against over 15 earlier," said a Flipkart spokesperson, confirming the reorganisation.

Current advertising unit head Ravi Garikipati has moved to lead the engineering team, after its head Peeyush Ranjan moved to US due to personal reasons. Ranjan is now heading the new Flipkart office in US, where he is also handling key relationships with players like Google.

Both engineering heads of consumer shopping experience Ashish Agarwal and supply chain Hari Vasudev will now report to Garipakiti.

Seth, currently heading human resources, will now be in charge of planning, strategy and business analytics as chief administrative officer.

2017

Acquires eBay's India business

Record $1.4bn Raise Takes Co Value To $11.6bn

India's largest e-commerce firm Flipkart said it has raised $1.4 billion led by China's internet giant Tencent, with participation from the online auction site eBay and Microsoft, valuing the Bengaluru-based company at $11.6 billion, post the invest ment. This marks the largest capital infusion for any privately-held Indian internet venture and surpasses the earlier high set by Flipkart itself when in July 2014 it picked up $1billion and set the stage for a funding boom in the local startup ecosystem.

The latest financing round for Flipkart comes amid talks of the e-tailer's likely acquisition of its domestic rival the SoftBank-backed Snapdeal, further consolidating the cash-guzzling e-commerce market, as reported by TOI in its March 28 edition.

Flipkart's much-anticipated fund-raise has been in the making for months even as it faced a series of valuation markdowns by its existing investors over the past year. The domestic e-commerce player was earlier valued at $15.2 billion when it last raised $700 million from existing investors in July 2015. TOI reported about Flipkart's latest fund raise in its March 16 edition. As part of this transac tion, eBay Inc has put $500 million in Flipkart and sold its India business to the Bengaluru firm. The online auction site will continue to be run as an independent entity , a statement from Flipkart said. Sources said eBay India may have been valued at about $200 million, however, the contours of the deal were not specified. Tencent and Microsoft have collectively pumped $900 million in Flipkart. “Once the Snapdeal acquisition comes through, SoftBank, the online retailer's largest shareholder may put $500 million in Flipkart as primary money besides buying secondary shares from Tiger Global,“ a source privy to the developments said. Tiger Global, a New York-based investment fund is the largest investor with about 30% stake in Flipkart.

Flipkart's humongous raise will give it firepower and bolster its position as it fights a fierce battle with the Seattle-based internet behemoth Amazon, which has allocated $5 billion for the India market and launched a wide set of offerings ranging from Prime subscription service to Prime Video even as it prepares to push the peddle on categories like food and grocery .

In a prepared statement, Flipkart founders, Sachin and Binny Bansal, who are unrelated, said, “This is a landmark deal for Flipkart and for India as it endorses our tech prowess, our innovative mindset and the potential we have to disrupt traditional markets. It is a resounding acknowledgement that the homegrown tech ecosystem is indeed thriving and succeeding in solving genuine problems in people's daily lives across all of India.“ The Bansals, co-founded Flipkart ten years ago, as an online bookstore and expanded to become a horizontal e-commerce player modelled on their exemployer the Jeff Bezos-led Amazon. They are not involved with the day-to-day operations at the company , presently .

Tencent, eBay Seen As Strategic Investors China's Tencent, which runs the hugely successful messenger service We Chat, is being positioned as a strategic investor along with eBay after years of getting on board financial backers in Flipkart.Tencent joins as a strategic investor, bringing experience in linking social networking and e-commerce. In leading this funding round, Tencent will lend significant expertise to Flipkart, a company statement said.

“This strategic partnership enables Tencent to participate in the exciting opportunities in e-commerce and payments in India. We look forward to helping Flipkart to deliver compelling experiences to users throughout India, and to contribute to the development of the internet ecosystem there,“ said Martin Lau, president of Tencent.Flipkart owns PhonePe, a UPI-based payments platform.

Post its acquisition, eBay India will be reporting to Flipkart's CEO Kalyan Krishnamurthy , an ex-eBay executive who was handed over the baton at the online retail firm in January this year. Krishnamurthy , who came from Tiger Global has been engineering a turnaround at Flipkart starting from its annual festive sale last year in October when it pipped Amazon in gross sales.

“The combination of eBay's position as a leading global e-commerce company and Flipkart's market stature will allow us to accelerate and maximize the opportunity for both companies in India,“ said Devin Wenig, president and CEO,eBay Inc. eBay has a small shareholding in Snapdeal, an investment that hasn't worked out while their own India operations never really took off.Coming in even at this valuation holds promise for eBay considering the potential of the Indian e-commerce market is still huge, said people tracking the space.

Binny Bansal, CEO of the Flipkart group, comprising Myntra, Jabong and PhonePe, said in an internal mail to the company employees that the valuation of the firm remains healthy and in dou ble digits and was reflective of the current business and the global economy . “While this funding provides the fuel, we need to reach that goal, we have to continue growing our business with careful considerations to costs,“ he cautioned Prior to this, Flipkart had raised $3.4 billion from investors such as Tiger Global, Naspers, GIC of Singapore, Qatar Investment Authority and Yuri Milner's DST across multiple financing rounds.

“This funding will give Flipkart some breathing space for sure. This round still has space for SoftBank to join in which will be a real shot in the arm for the e-tailer in terms of access to long term capital,“ an investor said.

“With a possible deal with SoftBank being in the works, it will likely be SoftBank and new Flipkart investors versus Amazon for now because Alibaba is still putting a lot of its focus in southeast Asian markets before going full throttle in India,“ said Satish Meena, analyst at Forrester.

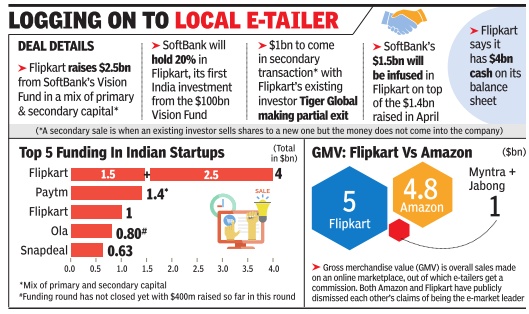

SoftBank gives record India loan of $2.5bn

See graphic: i) SoftBank’s 2017 loan of $2.5bn ii) Top 5 funding n Indian startups, till Aug 2017 iii) GMV of Flipkart vs Amazon, in Aug 2017

ii) Top 5 funding n Indian startups, till Aug 2017;

iii) GMV of Flipkart vs Amazon, in Aug 2017; The Times of India, SoftBank makes record India tech bet with $2.5bn in Flipkart, August 11, 2017

The Times of India, SoftBank makes record India tech bet with $2.5bn in Flipkart, August 11, 2017 Funding To Give Homegrown E-Tailer Ammo To Fight Amazon

In what is by far the largest investment ever for an Indian internet company , ecommerce major Flipkart has raised around $2.5 billion from the Japanese telecom and internet conglomerate SoftBank, giving the home-grown e-tailer the much-needed ammunition to fight Amazon for a bigger share of the online retail market. The fresh capital extends the size of Flipkart's financing round, which was announced in April this year, all the way to $4 billion.

While Flipkart and SoftBank did not disclose the exact amount being ploughed in by the Masayoshi Son-led group, sources said the number would total up to $2.5-2.6 billion, comprising a mix of primary and secondary capital. The fund-raise eclipses the highs set by Flipkart and Paytm when they both raised about $1.4 billion earlier this year. Pa ytm's $1.4-billion round had a sizeable $400-million secondary component, though this meant only about $1 billion went into the company .

This gives Flipkart a huge war chest along with the backing of the most sought after tech investor globally to fight the threat of Jeff Bezosled Amazon in its home market. The capital infusion is likely to further intensify Flipkart's battle with Amazon right before the start of the crucial festive season, opening up new battlegrounds for the two players.

For SoftBank's $100-billion technology-dedicated Vision Fund, which has been on a deal-making spree globally , backing Flipkart makes sense as the e-commerce player has been able to hold on against Amazon's onslaught locally .This is Vision Fund's first investment deal in India. Besides betting on Flipkart, SoftBank is also taking a wager on the broader India e-commerce, which is slated to grow with the advent of cheaper data charges unfurled by telecom operators like Reliance Jio.

The independent investment in Flipkart comes on the back of SoftBank's failed attempt to merge its portfolio company and online marketplace Snapdeal with the Bengaluru-based Flipkart over the past six months.With the proposed sale falling through, SoftBank was tipped to back Flipkart separately, which was reported by TOI in its July 28 edition.

Sources privy to the dealmaking said Flipkart would be valued at $14.2 billion after the investment. All told, the etailer has raised $6 billion (excluding secondaries) in capital since it began life as an online bookstore in 2007.

Flipkart said in a statement that the investment was part of its previously announced financing round when Tencent, eBay and Microsoft came on board. “This is a monumental deal for Flipkart and India. Very few economies globally attract such overwhelming interest from top-tier investors. It is recognition of India's unparalleled potential to become a leader in technology and e-commerce on a massive scale. We're excited to welcome the Vision Fund as a long-term partner,“ said Binny Bansal and Sachin Bansal, co-founders of Flipkart. SoftBank's Son said, “India is a land of vast opportunity . We want to support innovative companies that are clear winners in India because they are best positioned to leverage technology and help people lead better lives. As the pioneers in Indian e-commerce, Flipkart is doing that every day .“ Rajeev Misra, CEO of the Vision Fund, said this landmark transaction is a strong endorsement of India and its thriving economy .

With this massive capitalraise by Flipkart coming again, there is an expectation that it will rekindle the fund-raising momentum. “This is a vote of confidence that homegrown companies can take on their best global peers,“ said Avnish Bajaj, MD at venture capital firm Matrix Partners.

2018

Takeover by Walmart

From: Boby Kurian & Samidha Sharma, Flipkart co-founder likely to quit after Walmart takeover, May 4, 2018: The Times of India

‘Sachin May Exit, Binny Will Stay On’

The partnership of Flipkart co-founders Sachin Bansal and Binny Bansal is the stuff of modern Indian business legend. But it could be coming to an end.

Flipkart chairman Sachin Bansal is likely to quit the company board as Walmart, the world’s largest retail giant, nears a deal to pick up a majority stake in India’s most valued internet company, people familiar with the development said. Flipkart did not respond to queries by TOI .

Sachin, 36 and Binny, 35 are not related. A batch apart in IIT-Delhi, they became friends as colleagues in Amazon before starting Flipkart as an online bookstore in 2007 before going on to make it India’s preeminent e-commerce firm.

Sources said Walmart is keen on retaining only one of the two founders. “Sachin is most likely to leave and Binny will stay. Walmart has to make sure it buys off his shares, which is what is being worked out,” said a source.

‘SoftBank, Sachin were aligned for merger with Amazon’

The Bansals collectively own around 10% stake in the country’s largest online marketplace. Even as Sachin’s exit from Flipkart looks imminent, Walmart is holding on to Kalyan Krishnamurthy, the web retailer’s present chief executive, sources said.

“Binny and Krishnamurthy have backed the deal with Walmart and the two are seen leading the final negotiations, which will likely result in a share purchase agreement by Walmart by early next week,” another person close to the deal said.

Walmart is on course to announce a $8-10 billion deal to pick up a majority stake in Flipkart over the next few days. TOI first reported Walmart’s interest in getting a route to majority at Flipkart in its February 8 edition.

“Flipkart’s largest investor SoftBank and Bansal were aligned in pursuing a merger deal with Amazon, which didn’t get the backing of the majority shareholders,” said a person in the know.

The latest developments suggest that there has been a divide at the top of Flipkart with the two co-founders taking opposite sides in deciding the future of India’s most valued internet company. Sources said Sachin’s continuation would become untenable if the proposed deal with Walmart goes ahead. Walmart is seen keen on bringing Binny and Krishnamurthy (an ex-Tiger Global executive) on the board, besides having at least three of their own nominees. Krishnamurthy, who took over as CEO from Binny in January last year, is seen to have turned around the online commerce major after two sluggish years when it ceded market share to Amazon.

“There has been a shareholder realignment within Flipkart over the past few weeks, which may lead to Sachin’s exit,” said a source cited earlier in the report. Soft-Bank and Tiger Global are the two largest investors in Flipkart; Naspers, Accel Partners, DST Global are among the other key shareholders.

Flipkart buys back $350m to convert into private limited co.

Process Precursor to Walmart Sale, Values E-Tailer At $17.7Bn, May 4, 2018: The Times of India

Flipkart has executed a buyback of shares from a group of investors to convert the e-commerce company into a private limited firm under Singaporean laws. According to regulatory filings made by the e-commerce major in Singapore, and sourced through data platform Paper.vc, Flipkart has paid a set of investors — including T Rowe Price and Valic — about $350 million to purchase 18,95,574 preference shares. The transaction, which closed on April 27, pegs Flipkart’s valuation at around $17.7 billion.

In 2014, Flipkart had applied to Singapore’s registrar and regulator, where it is incorporated, for conversion into a public company as it was a mandatory procedure for entities with more than 50 shareholders. The process to get back its private company status is aimed at facilitating a proposed stake purchase by Walmart.

TOI reported in its May 3 edition that the world’s largest brick-and-mortar retailer was in the last stages of completing a deal which would entail acquiring more than 51% in the Indian web retailer, which started life in 2007.

Walmart is expected to invest $8-10 billion in Flipkart as its US rivalry with Amazon will travel to India.

TOI had reported in its February 8 edition, that Walmart is seeking a route to holding a majority stake at India’s largest web retailer, valuing it at $18-20 billion.

Flipkart declined to comment on the story.

The share buyback by Flipkart saw the exit of Accel Partner’s Shekhar Kirani in his personal capacity, SoftBank’s Deep Nishar, who was invested through a personal trust, venture capital fund IDG Ventures, which came on board after the acquisition of fashion etailer Myntra by Flipkart, and a number of other mutual funds and pension funds.

Flipkart’s largest backers like New York-based Tiger Global, Masayoshi Son’s SoftBank, Accel Partners, Microsoft, South African media and internet group Naspers, and Ebay stay on the shareholder list. These investors, including Soft-Bank, are expected to fully or partially sell their shares in Flipkart as Walmart would pump in the $8-10 billion in a mix of primary and secondary transaction.

TOI reported on May 3 that, while SoftBank wanted to bring in Amazon and merge Flipkart’s operations with the Jeff Bezos-led ecommerce behemoth, the proposal did not find much favour with other older investors in the company. These early investors in Flipkart were of the view that combining the Indian e-tailer with Amazon would face hurdles with the Competition Control of India.

India’s biggest M&A deal ran into a political headwind

Sidhartha, India’s biggest M&A deal runs into political headwind, May 10, 2018: The Times of India

From: Sidhartha, India’s biggest M&A deal runs into political headwind, May 10, 2018: The Times of India

Around a month ago, Walmart president and CEO Doug McMillon wanted to fly down to India to discuss the $16-billion Flipkart deal with key functionaries in the Narendra Modi government and explain how the acquisition of the e-tailer, which has expanded on the back of foreign capital, signals the global giant’s commitment to India.

On most occasions, ministers and top officials would be more than willing to not just discuss the deal but also pose for photographs with a Walmart CEO. But the Bentonville-based retail giant’s team that was chasing the appointments in the national Capital was surprised to find that there was little traction within the government, prompting McMillon to postpone his trip until the announcement.

But the announcement of the largest M&A deal in the country has not brought the 51-year-old Walmart CEO any closer to meetings with senior Modi government officials. NITI Aayog CEO Amitabh Kant on Wednesday made the government’s position clear saying the government is at an arm’s length in deals like these but will act as a facilitator for the e-commerce sector.

While the government, led by Modi, has been chasing investments to rev up the sluggish economy, the “lack of interest” in meeting McMillon is completely political. The traders’ lobby, a key vote bank for the BJP, is upset with the deal, with the Rastriya Swayamsevak Sangh-affiliate Swadeshi Jagran Manch (SJM) and other groups, such as the Confederation of All India Traders, launching a campaign to block the deal that will pit Walmart against Amazon in the Indian market.

“SJM, R-S-S and BJP have a consensus that FDI in multibrand retail will not only kill entrepreneurship, it is antifarmer and will kill job creation opportunities in the market. Hence, it is rightly kept out. But strangely, Walmart is using the e-commerce route to circumvent the rules to attack Indian market. It is to be noted that nowhere in the world, Walmart has a market place model,” SJM co-convener Ashwani Mahajan wrote in a letter to Modi on Wednesday, hours before the deal was announced.

And, with the Karnataka election campaign at its peak, the BJP will not be keen to annoy anyone, leave alone traders who haven’t forgotten the impact of demonetisation and the goods and services tax on their businesses.

Maintaining a distance with the visitors from Bentonville is seen as the best bet given that opponents can do little to block a clearance since Walmart only needs to inform the Reserve Bank of India about the transaction apart from obtaining approval from the Competition Commission of India, which vets deals above a certain threshold.

What led to Sachin Bansal's exit?

Samidha Sharma, What led to Sachin’s exit from Flipkart, May 29, 2018: The Times of India

How The Co-Founder Fell Out With Tiger’s Fixel, Who Was Once His Biggest Backer

Tiger Global’s Lee Fixel and Flipkart’s co-founder and CEO of nine years Sachin Bansal enjoyed a very special investor-founder relationship. Ever since the New York-based fund manager spotted the unrelated duo of Sachin and Binny Bansal in 2009 — two years after they founded an online bookstore in Bengaluru — it was a partnership that seemed poised to go down in the nascent history of India’s consumer internet industry.

We wrote in our May 10 edition — after Walmart bought a 77% stake in Flipkart, valuing it at $21billion — how Tiger and Fixel emerged as the online retailer’s champion investor, and its operator through its executive who’s currently the e-tailer’s CEO Kalyan Krishnamurthy, and the one who brokered the Walmart deal.

Relationship started to turn by 2015

This coincided with a rocky year at the e-retailer and also at the investment fund, which manages more than $25 billion

in assets. Under the CEO-ship of Sachin, Flipkart’s strategy of going mobile-app only, turning into a marketplace model instead of being inventory-led, and letting product take precedence over business grossly misfired. The first signs of a chasm started to develop between the two from here on.

A person close to the Flipkart story says, “The irony of the situation is that when Sachin decided to leave and sell his entire shareholding to Walmart because he was not able to get a larger role and special rights for founders and minority shareholders, it was Fixel who led the camp that pushed for his ouster. From being biggest supporter, he had by now turned totally against Sachin.”

So what changed?

Tiger under the cosh to deliver on Flipkart

Founded by Chase Coleman in 2001, Tiger started off primarily as a Wall Street hedge fund, but went on to build an impressive private market portfolio of hot internet and tech companies across the US, China and India. The fund established a beachhead here in 2007, when it bet on Just Dial and MakeMyTrip.

Its India operations, started by Feroz Dewan, were taken into top gear by Fixel. The 38-year-old became an India bull after seeing the China ecommerce market play out. Just the time he took a wager on Flipkart, Tiger had bet on JD.com, which IPOed at a $25-billion valuation in 2014. Having invested $2 billion in India, with half of that capital ploughed into Flipkart, Tiger was the web retailer’s largest and most influential shareholder till SoftBank came in last year, and took majority ownership by partly buying the fund’s shares.

Across 2014-15, Fixel began backing startups in series-A rounds at dizzying valuations. While the euphoria lasted for a couple of years, Fixel’s position at Tiger started to look shaky after the funding boom came to an end in mid-2015.

“Dewan was not in line with Fixel’s big bets in India, especially the outsize capital that had gone into Flipkart. This was the time Tiger had led consecutive financing rounds in the online retailer and had marked up its valuation to $15 billion,” says a person in the know. Things came to a head between Dewan and Fixel in 2015, as Tiger went through an internal churn. In May that year, Dewan left the fund, where he was managing $6 billion of the public market portfolio. Scott Shleifer took over from him. Fixel was made the sole head of the firm’s private equity portfolio.

In mid-2016, Shleifer came down to India and met with the top management at Flipkart, a person who was present at the meeting recalls. “Shleifer’s meeting seemed interrogative. Till now, no one other than Fixel had interfaced with Flipkart’s management, so it signalled a big change,” the person says.

Did Tiger become a seller in India?

An investor, who did not want to be named, says, “Fixel has very strong opinions on certain issues. And if the founder has strong opinions, too, which are on the opposite end, then they clash.” This is what played out between the Flipkart investor and the company’s co-founder and its longest serving CEO.

Sachin’s strained equation with Fixel’s aide Krishnamurthy, who made a return to Flipkart after two years in 2016, added to his deteriorating relationship with his biggest backer. People briefed on the developments say Tiger was under pressure to show returns from its huge India bet. The fund stopped making new investments by the end of 2015. Fixel’s visits to India became infrequent, and in 2016 he became disengaged with his portfolio companies, and Tiger actively started scouting for strategic investors for Flipkart.

Flipkart board rallied against Sachin

Another person familiar with the goings-on says, “After the missteps of 2015, Flipkart’s board gave a chance to Binny to helm the company. But another year down, Tiger wanted to pass on the baton to a strategic. Fixel and Sachin Bansal went to eBay, PayPal, Microsoft, and Tencent, discussing a potential investment.” In March 2016, they both first engaged with Walmart.

While Sachin continued in a non-operating role, he tried to claw back in 2017, after Krishnamurthy took over as CEO, by introducing a line of private label under ‘Billion’ and launching an artificial intelligence unit. By then, Flipkart had gone back to its successful formula of racking up mobile phone sales and driving up gross merchandise value (GMV) growth, as it fought an aggressive Amazon. And it fared well under the new leadership of Krishnamurthy, who was shaping a turnaround at Flipkart.

People in the know say Sachin was of the view that the e-tailer had stopped investing for the long term and was focusing on simply shoring up growth through sale events. “Even as he tried to make a return, the talks with Walmart started to get serious in 2017. Now, Sachin wanted Walmart to agree to give him a larger role, as the new investor and acquirer, but Fixel was vehemently opposed to the idea and the entire board rallied behind him along with Binny. Walmart went with the board, which led to Sachin quitting and selling his stake fully,” says a person privy to the talks. Sachin was asking for preferential ‘founder rights’, a little too late in the day, in order to win back from Tiger control of the company he co-founded. Other founders sensed it early on, like Ola’s Bhavish Aggarwal, who blocked a secondary deal when Tiger Global was selling its shares to SoftBank, as we first reported in our April 25 edition. Thanks to the favourable rights due to the changes made in the article of association, Aggarwal could scupper the transaction.

Cut to April 2018: The Walmart deal was almost sealed, despite Amazon making an offer of $22.5 billion, which was supported by SoftBank and Sachin. The rest of the shareholders were skittish about an Amazon and Flipkart alliance. “Besides the competition control lens, it would have taken much longer to close a deal with Amazon. Also, the demands laid out by Sachin were likely to delay the transaction or may be even jeopardise the sale. Seeing this, Fixel got Binny on board, and convinced him to steer the deal in the last few weeks,” says another person privy to the matter.

Fixel remains on the Flipkart board with a 4-5% stake, and Binny stays on as the group CEO in addition to taking on Sachin’s executive chairman title. A Tiger spokesperson said, “Neither Fixel nor Tiger Global will have any comments on leadership changes at Flipkart and/or Lee’s personal relationship with Sachin or Binny Bansal.”

Sachin also did not respond to an emailed query.

The real reason for Sachin's exit

Flipkart Group chief executive Binny Bansal said cofounder Sachin Bansal and he wanted to do “different things” and that it was a good time for the latter to exit since a major investor had come in.

He was speaking on the topic of Sachin Bansal’s exit for the first time since the $16-billion deal by Walmart to acquire the company.

The deal, announced in May, saw the shock exit of Sachin Bansal who, along with Binny Bansal, started Flipkart in 2007 from an apartment in Bengaluru. Sachin Bansal is expected to make at least $1 billion after selling his 5.5% stake.

Sachin Bansal was the group chairman of Flipkart after he stepped down as the company’s CEO in 2016 and was deeply involved in the negotiations with Walmart.

“Sachin played a very crucial role in building the company. He was the CEO for most of the time of the company, and his vision steered us to where we are,” Binny Bansal said during a fireside chat with Subrata Mitra, partner at venture capital firm Accel, at an event on Saturday.

“Going forward, there are different things (Sachin Bansal) wants to do and I want to do, so that’s the decision we took. I think it was a good time because a major investor had come in,” he said.

In a Facebook post announcing his exit from Flipkart in May, Sachin Bansal had said he would take time off for some “personal projects” and “catch up on gaming” and brush up his “coding skills”.

ET had reported at the time of the deal that Sachin Bansal had been very disappointed by events that had left him on the sidelines. The report also said Walmart did not see a role for two cofounders on the board and wanted to retain the successful partnership of Flipkart CEO Kalyan Krishnamurthy and group CEO Binny Bansal.

“Every person has to decide for oneself what they want to do,” Mitra told ET on the sidelines of Saturday’s event organised by startup funding platform LetsVenture.

“Even on the investor side, some are there (in Flipkart) and some are not. We each had to make up our minds,” he said.

Accel was one of Flipkart’s earliest backers, having put in more than $100 million in the ecommerce giant. It is expected to pocket $800 million-$1 billion in returns by selling its shares in Flipkart as part of the company’s acquisition by Walmart.

Accel’s exit from Flipkart was the biggest for the fund in India and also ranked very high globally, Mitra told ET.

At the fireside chat, Mitra defined Binny Bansal as the “backend guy” and Sachin Bansal as the “vision” of Flipkart.

Binny Bansal talked of how the duo developed their roles after launching the company. They initially wanted to start a shopping comparison engine but eventually decided to start a shopping website because of a dearth of good online retail platforms at the time in India.

“In the beginning, we hadn’t defined our roles. He was better at doing things like designing the website and (search engine optimisation), while I couldn’t get my head around it,” Bansal said.

“On the other hand, I was more intuitive in meeting vendors and building the catalogue. These gradually became the roles. Sachin would think of how to grow the business and how to get customers, while I would think of how this could work at 10x the scale,” he said.

The Walmart-Flipkart deal is expected to close later this year, with the companies awaiting a green light from the Competition Commission of India.

Asked by ET about protests by trade associations against the deal, Binny Bansal deflected the question, saying it fell under “Walmart’s domain”.

He also highlighted during the event that financial services would be a major part of the company’s strategy going forward, and that Flipkart’s financial-technology platform PhonePe was growing at 30-40% a month. “The next 30 years are going to be very exciting. There are many opportunities for us in the core business.

There are other opportunities as well, such as in financial services,” Binny Bansal said. “PhonePe is growing at 30-40% month-on-month, like Flipkart did in its early days. The future of financial services is digital and we see ourselves having a critical role in it.”

ET reported last week that financial products would contribute 15-20% of Flipkart’s growth in the next few years.