IL&FS

(→‘LIC stalling Piramal deal led to crisis’) |

|||

| Line 120: | Line 120: | ||

IL&FS sources said that the group’s bailout of Satyam’s real estate entities, which includes Hill Country Properties, had resulted in substantial funds being locked in. Since the property under development was saddled with litigation, the outgo was much higher with Rs 2,300 crore still invested. One of the biggest challenges for the new board would be to bring in a management capable of getting its arms around the group with 169 subsidiaries and associate companies. The new board would also have to find people to run its subsidiary IL&FS Financial Services, where the CEO and five board members resigned last week. | IL&FS sources said that the group’s bailout of Satyam’s real estate entities, which includes Hill Country Properties, had resulted in substantial funds being locked in. Since the property under development was saddled with litigation, the outgo was much higher with Rs 2,300 crore still invested. One of the biggest challenges for the new board would be to bring in a management capable of getting its arms around the group with 169 subsidiaries and associate companies. The new board would also have to find people to run its subsidiary IL&FS Financial Services, where the CEO and five board members resigned last week. | ||

| + | |||

| + | ==2018, Sept: Govt takes charge of IL&FS== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F02&entity=Ar00515&sk=3CFDF266&mode=text Govt takes charge of IL&FS, names board of 6 to run co, October 2, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: The IL&FS descent, a brief history.jpg|The IL&FS descent, a brief history <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F02&entity=Ar00515&sk=3CFDF266&mode=text Govt takes charge of IL&FS, names board of 6 to run co, October 2, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: The IL&FS crisis of 2018- July to September.jpg|The IL&FS crisis of 2018- July to September <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F02&entity=Ar00515&sk=3CFDF266&mode=text Govt takes charge of IL&FS, names board of 6 to run co, October 2, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''Some Ousted Directors May Be Barred From Leaving India'' | ||

| + | |||

| + | In a Satyam-like rescue act for Infrastructure Leasing & Financial Services (IL&FS), the government on Monday successfully moved the National Company Law Tribunal to supersede the company’s board and change its management. | ||

| + | |||

| + | The government has alerted immigration authorities against possible escape of some directors on the superseded board. The Centre may approach the courts to order impounding of passports of some of the former directors. | ||

| + | |||

| + | Based on a government petition, NCLT approved a sixmember board to manage the affairs of the company. The tribunal directed the new board to meet before October 8 and submit a roadmap for resolution by the next hearing on October 31. The board is likely to elect Uday Kotak as chairman with sources indicating that he would be able to use his network to work out a financial resolution plan . | ||

| + | |||

| + | |||

| + | '''IL&FS suffered due to mismanagement: Govt''' | ||

| + | |||

| + | The government alleged that the debt-laden financial services company had suffered due to “misgovernance and mismanagement”. | ||

| + | |||

| + | The company has debt of around Rs 90,000 crore with assets of close to Rs1.15 lakh crore and was seen to be posing a risk to the system. Besides, the government argued that the IL&FS auditor had brought to the notice of the board certain concerns related to the management’s fund raising plans as well as the “extremely precarious financial position”. Further, there were doubts about the “correctness of the financial statement” given the rise in value of intangible assets, prompting “red signals” from department of economic affairs. | ||

| + | |||

| + | Ruling in favour of the government, Justice M K Shrawat and Justice Ravi Duraiswamy said that this was a fit case to invoke jurisdiction prescribed under the Companies Act 2013 and to declare that the conduct of IL&FS management was prejudicial to public interest. | ||

| + | |||

| + | The government action comes a little over two months after IL&FS founder-CEO Ravi Parthasarthy stepped down as chairman after leading the company for three decades on health grounds. Since his stepping down, the company’s rating has slipped from ‘AAA’ to ‘default’. | ||

| + | |||

| + | While the market was worried about the future of IL&FS and its 169 group companies, the government decided to step in after a go-ahead from the Prime Minister’s Office. | ||

Revision as of 23:19, 7 October 2018

This is a collection of articles archived for the excellence of their content. |

Contents |

October 2018

From: Sidhartha, October 2, 2018: The Times of India

See graphic:

IL&FS shareholding (%), as in October 2018

Crisis

India’s Near-Lehman Moment

Mythili Bhusnurmath, September 25, 2018: The Times of India

The crisis at IL&FS must be used to address fault lines in the financial sector

The coincidence is uncanny. Almost to the day 10 years ago, when trouble surfaced at iconic US investment bank Lehman Bros, leading to its bankruptcy on September 15, 2008, India had its own near-Lehman moment. One of our largest infrastructure finance companies, Infrastructure Leasing and Financial Services (IL&FS), a “systemically important core investment company” registered with the Reserve Bank of India (RBI), began to implode. At first slowly and now, more rapidly!

Starting with a default on its Rs 1,000 crore bond repayment to Sidbi (Small Industries Development Bank of India), IL&FS and its non-banking finance subsidiaries have begun to renege on one repayment after another. By Friday last, fears that mounting troubles in the IL&FS group might be symptomatic of larger problems in the non-banking finance company (NBFC) space and, in turn, pose a serious threat to financial stability saw markets plunge more than 1,100 points intra-day.

The unstated fear was that thanks to its inter-linkages with the financial system IL&FS, like Lehman before it, may drag the entire financial system and the larger macro-economy down with it.

For now the storm seems to have abated. Latest reports speak of Orix Corporation, the diversified Japanese financial services company and one of the largest shareholders in IL&FS, being willing to up its stake; of government and RBI pitching in to help with speedy sale of IL&FS assets. But these are only band-aid solutions that cannot, and will not, last. We need to look deeper and address the cause, rather than the symptom, of the disease.

“Never waste a crisis,” said Rahm Emanuel, former US President Barack Obama’s Chief of Staff. Sound advice! The crisis at IL&FS has exposed a number of fault lines. To begin with, the ills of the financial sector go much beyond the much-maligned public sector banks. It is the familiar story of failure on multiple fronts: the regulator Reserve Bank of India (RBI), credit rating agencies who downgraded IL&FS much too late, auditors, and most importantly, the board of IL&FS.

Take these one by one. IL&FS is a ‘Core Investment Company’, a holding company, whose operations are restricted to investments in group companies. It is registered with RBI as ‘systemically important’, that is its financial health has ramifications for the financial system and the economy. Given that one of the biggest learnings of the 2008 crisis is of the dangers posed by shadow banks like IL&FS, one would have expected RBI to keep a close eye on IL&FS, particularly in view of its excessive leverage. But, sadly, it failed to do so!

If RBI bears the main responsibility for the unfolding events at IL&FS, it is not the only one. Rating agencies have, again, been caught sleeping on the watch. Ratings have been rapidly downgraded; in many cases after the event.

The problem goes deeper. Rating agencies are technically under the Securities and Exchange Board of India (Sebi); but are not subject to close regulatory oversight. Worse, under the current rating model, fees are paid by the rated entities. There is, thus, a huge incentive to give generous ratings for fear of losing business. Until we address this basic flaw in the rating model, ratings must be taken for what they are worth: very little!

Company auditors are no less culpable. The annual accounts of IL&FS and its close to 200 subsidiaries were audited by some of the biggest names in the profession. Yet none thought it fit to red flag the growing dependence on short term debt and the excessively high leverage.

The biggest opprobrium must, however, be reserved for the board of IL&FS. As with Satyam Computers and more recently ICICI Bank, IL&FS had a star-studded board. Yet Ravi Parthasarathy, CEO from 1989 till July 2018, seems to have run the company like his fiefdom. Not only were no questions asked, so it would seem, he was handsomely rewarded for presiding over the virtual destruction of IL&FS. According to the latest annual report, his last annual pay was close to Rs 25 crore – 141 times the median salary of the IL&FS employee.

Each of these entities, RBI, rating agencies, auditors and the board, must share the blame and take corrective measures. But there is a larger factor at play that must be factored in while considering any kind of rescue package: the inherent flaw in the extant model of infrastructure financing. This makes any short-term solution akin to kicking the can down the road. Infra projects have long gestation periods. They require long term funding that neither banks nor NBFCs can provide.

Moreover, issues related to land acquisition, environmental clearance, policy flip-flop, political interference and rapidly changing external dynamics make infrastructure financing particularly risky. Cost and time overruns are inevitable. Unless we address these we will not be able to ring-fence either banks or NBFCs from the risk associated with financing infrastructure. Look no further than to the erstwhile IDBI, ICICI and IDFC that were initially set up as term-lending institutions and then had to be converted into banks to save them from going down under.

It is imperative that before we consider any solution, especially bailout with taxpayer money, RBI must make an informed assessment of IL&FS’s interconnectedness (and, hence, risk of systemic failure). Remember, any solution will prove short lived unless we address fault lines all around, including underlying risks in infra financing.

₹91000 crore debt: a ticking bomb?

From: Abhik Deb, IL&FS: Rs 91,000 crore debt that might well be a ticking bomb, September 25, 2018: The Times of India

From: Abhik Deb, IL&FS: Rs 91,000 crore debt that might well be a ticking bomb, September 25, 2018: The Times of India

From: Abhik Deb, IL&FS: Rs 91,000 crore debt that might well be a ticking bomb, September 25, 2018: The Times of India

Infrastructure Leasing & Financial Services Limited (IL&FS), the infrastructure lending conglomerate which was instrumental in inception of public private partnerships in India, has sent tremors down the country's financial markets -- and the rot might well spread.

WHAT HAS GONE WRONG

To put things succinctly, the IL&FS group is faced with a debt of Rs 91,000 crore in its books and is saddled with a severe liquidity crunch. Of the Rs 91,000 crore, IL&FS alone has a debt of nearly Rs 35,000 crore while IL&FS Financial Services owes Rs 17,000 crore. Together these two sit as standard asset for most of the lenders, according to a Nomura India report.

The lack of liquidity means that the financier which has to its name marquee projects like the country's longest tunnel -- Chenani-Nashri tunnel-- has repeatedly missed debt repayments in the past few months.

On Monday, for the third time this month, it defaulted on interest payments on commercial papers. Earlier this month, it came to light that IL&FS group defaulted on a short-term loan of Rs 1,000 crore from Small Industries Development Bank of India (Sidbi), while a subsidiary has also defaulted Rs 500 crore dues to the development finance institution. IL&FS has not been able to pay Rs 490 crore so far this year and is due to pay an additional Rs 220 crore by October end. In the next six months, it needs to pay as much as Rs 3,600 crore.

To make things worse, news agency Bloomberg on Monday reported quoting sources Sidbi has filed an insolvency application against IL&FS at the National Company Law Tribunal (NCLT).

THE LARGER PICTURE

IL&FS, a financier categorised by Reserve Bank of India (RBI) as 'systematically important', having a debt of Rs 91,000 crore spells trouble in itself.

The complexity of the rot however lies in the fact that IL&FS is majorly exposed to state-owned entities and thus puts public money at risk. The shareholding pattern of the conglomerate shows that Life Insurance Corporation of India (LIC) is the biggest shareholder, with State Bank of India (SBI) and Central Bank of India also having stakes.

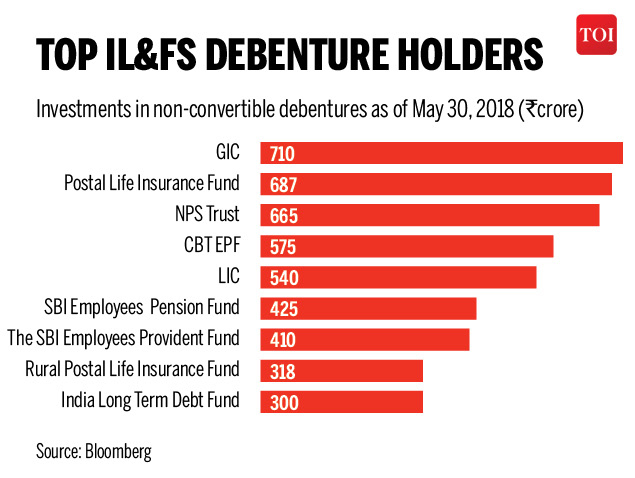

More signs of danger lie in the quality of borrowings of IL&FS. According to company filings, almost 60 per cent of IL&FS's borrowings (as of May 2018), lie in non-convertible debentures. For the uninitiated, debenture is a type of debt instrument that is not secured by physical assets or collateral. The absence of collateral in debentures is based on the belief that the bond issuer is unlikely to default on the repayment -- exactly where IL&FS has betrayed the markets.

As far as loss to individual investors are concerned, the risk does not end here. A major chunk of the debentures mentioned above are subscribed by insurance companies, pension funds and provident funds -- savings that the huge middle class of the country banks upon.

The beleaguered shadow bank has caused jitters in the equity markets too. Coupled with other global and domestic cues, the IL&FS fiasco has resulted in a rout in the banking and financial stocks in the last one month, precisely since IL&FS missed the first repayment in August-end. The Nifty Financial Services sub-index has lost 10.97 per cent, while the Nifty Bank sub-index has slipped 12.18 per cent during the period.

“There are liquidity concerns ... financial stocks led the rally and now they are dragging the markets and it has a domino effect on sectors such as real estate and autos,” told AK Prabhakar, head of research at IDBI Capital to news agency Reuters.

IS A RECOVERY IN SIGHT?

In the wake of the crisis, the strongest support till now has come from the LIC. On Tuesday, Reuters quoted the state-owned insurer's chairman V K Sharma as saying that LIC will not let IL&FS collapse adding they have kept all options, including increasing LIC's stake in IL&FS open.

RBI and Sebi on Sunday promised 'appropriate action' to prevent market disruption while SBI has assured continued support to non-banking finance companies (NBFCs).

This week could prove to be a crucial one for IL&FS with the RBI slated to meet the stakeholders on September 28 ahead of the annual general meeting (AGM) of the financier, which is expected to take up a capital infusion plan. Earlier this month, news agency PTI reported LIC is believed to have agreed to subscribe to the forthcoming rights issue and extend some immediate working capital loan.

Bloomberg quoted an internal memo of the company to report IL&FS is seeking to sell 25 assets worth Rs 30,000 crore, adding that 14 of the 25 assets have garnered investor interests.

However, with a number of long and short-term borrowings downgraded to 'default' or 'junk' by rating agencies, it might be difficult for IL&FS to roll over the debt.

‘LIC stalling Piramal deal led to crisis’

From: Mayur Shetty, LIC stalling Piramal deal led to crisis, say IL&FS insiders, October 2, 2018: The Times of India

Infra Financier Wanted To Value Stake At ₹750/Share In ’15

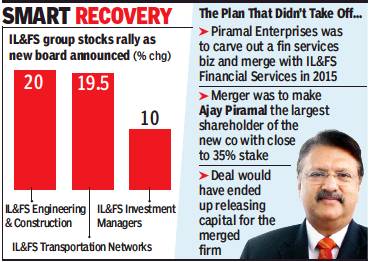

Key officials in IL&FS see the Life Insurance Corporation’s stalling of a deal with Piramal Group in 2015 as the trigger behind the present capital crunch. The beleaguered infrastructure financier had been seeking capital for over three years and one route was bringing in Piramal Group chairman Ajay Piramal as a shareholder.

While the board has decided not to oppose the government move to take over, some members want to place on record their reading of what is the root cause behind the current crisis. According to sources, while scouting for capital three years ago, IL&FS was keen to get on board Piramal, who was looking to grow his financial services business. In 2015, a deal was almost finalised where the industrialist would pick up stake in the group at Rs 750 per share. However, it did not go through as LIC — which is the main the shareholder with a 25.34% stake — had stuck to a valuation of Rs 1,150.

At that point, LIC’s current chairman V K Sharma was the corporation’s nominee director on the board. Neither did LIC agree to the price, nor did it bring in capital through a rights issue at a much lower price. “Now, three years later, the corporation is not bringing in funds at a price of even Rs 150, although the shares have been valued by an independent valuer at Rs 350,” sources said.

LIC had earlier shied away from increasing its shareholding on the grounds that insurance regulation prevents it from taking a strategic stake.

Although it had recently made public statements that it would support IL&FS, the conditionalities placed for investing in the rights issue made it impossible to comply with them in a month.

In the board superseded on Monday, LIC had two nominee directors — its MD Hemant Bhargava and another nominee Praveen Kumar Molri. The board chairman S B Mathur is also a former LIC chairman and was brought in to replace Bhargava, who stepped down to avoid conflict of interest as he is also on the investment committee of LIC.

IL&FS sources said that the group’s bailout of Satyam’s real estate entities, which includes Hill Country Properties, had resulted in substantial funds being locked in. Since the property under development was saddled with litigation, the outgo was much higher with Rs 2,300 crore still invested. One of the biggest challenges for the new board would be to bring in a management capable of getting its arms around the group with 169 subsidiaries and associate companies. The new board would also have to find people to run its subsidiary IL&FS Financial Services, where the CEO and five board members resigned last week.

2018, Sept: Govt takes charge of IL&FS

Govt takes charge of IL&FS, names board of 6 to run co, October 2, 2018: The Times of India

From: Govt takes charge of IL&FS, names board of 6 to run co, October 2, 2018: The Times of India

From: Govt takes charge of IL&FS, names board of 6 to run co, October 2, 2018: The Times of India

Some Ousted Directors May Be Barred From Leaving India

In a Satyam-like rescue act for Infrastructure Leasing & Financial Services (IL&FS), the government on Monday successfully moved the National Company Law Tribunal to supersede the company’s board and change its management.

The government has alerted immigration authorities against possible escape of some directors on the superseded board. The Centre may approach the courts to order impounding of passports of some of the former directors.

Based on a government petition, NCLT approved a sixmember board to manage the affairs of the company. The tribunal directed the new board to meet before October 8 and submit a roadmap for resolution by the next hearing on October 31. The board is likely to elect Uday Kotak as chairman with sources indicating that he would be able to use his network to work out a financial resolution plan .

IL&FS suffered due to mismanagement: Govt

The government alleged that the debt-laden financial services company had suffered due to “misgovernance and mismanagement”.

The company has debt of around Rs 90,000 crore with assets of close to Rs1.15 lakh crore and was seen to be posing a risk to the system. Besides, the government argued that the IL&FS auditor had brought to the notice of the board certain concerns related to the management’s fund raising plans as well as the “extremely precarious financial position”. Further, there were doubts about the “correctness of the financial statement” given the rise in value of intangible assets, prompting “red signals” from department of economic affairs.

Ruling in favour of the government, Justice M K Shrawat and Justice Ravi Duraiswamy said that this was a fit case to invoke jurisdiction prescribed under the Companies Act 2013 and to declare that the conduct of IL&FS management was prejudicial to public interest.

The government action comes a little over two months after IL&FS founder-CEO Ravi Parthasarthy stepped down as chairman after leading the company for three decades on health grounds. Since his stepping down, the company’s rating has slipped from ‘AAA’ to ‘default’.

While the market was worried about the future of IL&FS and its 169 group companies, the government decided to step in after a go-ahead from the Prime Minister’s Office.