Income Tax India: Expert advice

(→Tax saving instruments) |

(→I) |

||

| Line 290: | Line 290: | ||

=Tax saving instruments= | =Tax saving instruments= | ||

| − | == | + | ==Tips== |

[http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=The-seven-ways-you-can-escape-tax-legally-22062015018027 ''The Times of India''], Jun 22 2015 | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=The-seven-ways-you-can-escape-tax-legally-22062015018027 ''The Times of India''], Jun 22 2015 | ||

Revision as of 22:38, 16 July 2018

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

The basics

Filed your I-T return on time? Here's why you can still get a notice

By Sanket Dhanorkar, ET Bureau | 11 Aug, 2014 The Economic Times

Introduction

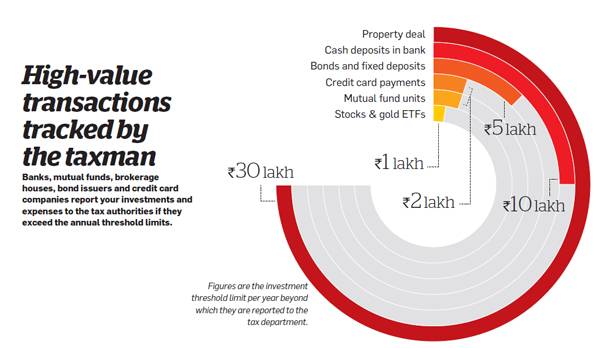

Are you among the more than two crore taxpayers who filed their returns before 31 July? These taxpayers can rest easy because they filed by the due date. However, the dread of the taxman does not end here. It is common for taxpayers to make errors or deliberately conceal income in their returns, which could lead to notices from the tax department. Nudged by the government to enhance revenue collections, the tax authorities are on an overdrive to catch tax evaders. Not only are financial transactions being tracked, but loopholes that allowed tax evasion are also being plugged.

In October 2013, the Central Board of Direct Taxes issued a new rule for claiming HRA exemption. Salaried taxpayers claiming HRA exemption were asked to report their landlord's PAN if the total rent in a year exceeded Rs 1 lakh. Earlier, if the total rent paid was less than Rs 15,000 a month, there was no need to submit the landlord's PAN details.

What is a tax scrutiny?

Scrutiny essentially means evaluating the income tax return for its authenticity. Typically, if a return is picked up for scrutiny, a notice will be served within a period of one year from the month in which the return was filed.

WHAT THE TAXMAN WILL CHECK:

> Bank statements, credit card statements

> Form 16

> Details of your family members who live with you

> Withdrawals and expenses, including those through credit cards

> Any interest-free loans you might have given

Interest income

The declaration of interest income is the most common mistake that taxpayers make.

The interest earned on bank fixed deposits, recurring deposits and infrastructure bonds is fully taxable but many taxpayers skip mentioning it in their tax return. Some think that the newly introduced exemption for bank interest makes this income tax-free. But the exemption under Section 80TTA is only for the interest on your savings bank balance. Interest from other sources, including 5-year tax saving bank fixed deposits, is fully taxable.

The other big fallacy is the TDS. Banks deduct 10 per cent TDS if the interest exceeds Rs 10,000 in a year. If the income is below Rs 10,000 and TDS has not been deducted, you have to add the interest to your total taxable income and accordingly pay tax. Even if TDS has been deducted, it does not mean that your tax liability is taken care of. If you are in the 20-30 per cent tax bracket, you are required to pay more tax on the income.

Don't think you can get away by concealing this income. "Failure to report this is tantamount to concealment of income. The tax authorities can easily detect it as the bank has already deducted the TDS and reported the same along with your PAN details," says Kirit Sanghvi, senior partner, K S Sanghvi & Co.

Also, in case of recurring deposits, no TDS is deducted, irrespective of the quantum of the interest, but the interest income is still fully taxable. Similarly, the interest earned on NSCs and infrastructure bonds is taxable ..

Some taxpayers feel safe from the prying eyes of the taxman if they put money in coperative banks. Till now, interest from fixed deposits in cooperative banks was exempt from TDS. However, there is a rude shock waiting for such taxpayers this year. The Karnataka Income Tax Tribunal recently ruled that if the interest exceeded Rs 10,000 in a year, it must be subjected to TDS. Following this, several cooperative banks have received notices from the Income Tax Department asking them to deduct tax for the year 2013-14.

That's not the only count on which taxpayers go wrong on interest. Even the interest from tax-free instruments, such as the PPF and tax-free bonds, has to be reported in your return. However, this is not a serious transgression and the taxman won't come after you with hammer and tongs if you skipped mentioning this income.

Clubbing income of minor child, spouse

Your earning is not the only income you need to declare in your tax return. If you invested in the name of your minor child or gave money to your spouse for investing, the income from such investments will also be treated as your income. Any income of a minor child (below 18 years) is clubbed with the income of the parent who earns more. There is a tiny deduction of Rs 1,500 per child for up to two children in a year.

Similarly, if you have invested in your spouse's name, the income will be treated as your income and taxed at the applicable rate. If you bought a house in your wife's name and rented it out, the rent will be treated as your income, not hers. Even if the house is transferred to the wife as the gift, this principle would apply. "The entire income would have to be included in the tax working of the original holder of the asset," says Kuldip Kumar, executive director, PwC.

In rare cases, where the spouse is given a remuneration for working in the taxpayer's business, the money given to the spouse will not get clubbed. For instance, if your chartered accountant wife maintains the accounts of your business and you pay her a remuneration which she invests, the income will not be clubbed. But she should have the required qualifications to do the work she is being paid for. "The onus is squarely on the taxpayer. You should be able to prove that your spouse is hired in a professional capacity, not otherwise," says Sandeep Shanbhag, director, Wonderland Consultants.

Not filing tax return

This is another common mistake. Many taxpayers believe that since their salary is subject to TDS, they don't have to file returns. That's not true. If your income exceeds Rs 2 lakh, you have to file your return. Even if the tax liability is reduced to zero after deduction under Section 80C, the return has to be filed. The government has identified the category of non-filers as a key one for tapping unpaid taxes. Last year, the Income Tax Department sent 12 lakh notices for non-filing of taxes.

Non-filers are not the only ones who may get such a notice. Many taxpayers file their returns online but don't complete the process. "A lot of them forget to send the physical copy of the ITR V to the tax department," says Sudhir Kaushik, co-founder and CFO, Taxspanner.com. A taxpayer must submit the ITR V to the Centralised Processing Centre in Bangalore within 120 days of uploading his return. "Until you submit the IT return to the authorities physically and get the acknowledgment of receipt, the return you filed will be treated as invalid," says Kaushik.

Not spending enough

The taxman also gets suspicious if you are investing too much or withdrawing too little. A Mumbai-based individual was asked to explain how she was sustaining herself because her entire salary was flowing into investments.She was using the cash allowances received from her employer for her day-to-day needs and investing the entire salary that came by cheque.

"The tax officer will estimate the household expenditure you are likely to incur based on your earning capacity, family size, lifestyle and number of earning members. If your bank statement does not show commensurate withdrawals for expenses, the question will arise how you are surviving on so little," says Manish Shah, partner, S K Parekh & Company. If you are using cash for purchases and not withdrawing from your bank account, the , the taxman will assume that you have undeclared sources of income.

The taxman can question not only your income but also the expenses claimed. If allowances are being used for day-to-day expenses, it means the taxpayer submitted bogus receipts to claim those allowances. "If you stay in your parents' house and claim HRA exemption for the rent paid to them, your bank statement should be able to validate the payment of rent," says Kumar.

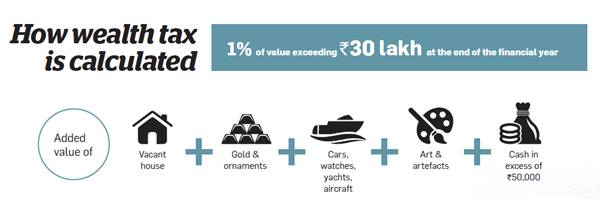

Not filing wealth tax return

See also Wealth tax: India

Apart from income tax, you may also be liable to pay wealth tax. Most people are blissfully unaware that if they own certain assets, including jewellery, gold or silver bullion, vacant house, non-agricultural land, costly watches, luxury cars and paintings, they have to shell out wealth tax. If the aggregate value of these assets exceeds Rs 30 lakh, they have to pay 1 per cent of the amount by which it exceeds Rs 30 lakh. This also includes .. cash worth over Rs 50,000.

A taxpayer must file his wealth tax return for the same. "One house is exempt from wealth tax. Also, if you have rented out your second home for more than 300 days in the year, it will also be exempt," says Kumar. Also, if the property is used to conduct business, then it is not included for computation of wealth tax. Any loan outstanding against the house will also be subtracted from the market value of the house. However, the valuation of these items is a tedious process. "Only government approved valuers can be approached in this regard," says Kaushik. Perhaps that is why the tax authorities have gone relatively soft on implementing wealth tax provisions so far.

Wealth tax is minuscule in the total revenue collection — it accounts for less than 0.25 per cent of the total direct taxes collected. in the total revenue collection — it accounts for less than 0.25 per cent of the total direct taxes collected. This doesn't mean the taxman will not go after you for not paying it. There is a stiff penalty for evading wealth tax. Incorrect declaration of wealth can invite a fine of up to 500 per cent of the evaded tax. One can also be jailed for up to seven years if the tax due is over Rs 1 lakh.

Reversal of Section 80C benefit

For salaried employees in the in the organised sector, the Employee Provident Fund (EPF) is a great way to save for retirement, but for some, it can also be the reason for a tax notice. Many people withdraw their Provident Fund when they change jobs. The monthly contribution to the EPF is eligible for deduction under Section 80C. If the balance is withdrawn within five years of joining the organisation, the entire deduction claimed in previous years will be reversed. "The amount claimed as deduction will have to be added back to your income for the year in which withdrawal takes place," says Shah. Similarly, if you junk a life insurance policy within two years of buying, the tax benefits claimed under Section 80C will be reversed.

The same holds true if you sell a house within five years. If you availed of tax benefits on the loan, all the deductions claimed in the previous years, including on principal repayment and payment of stamp duty along with registration fees, will be added to the taxable income of the year in which you sell the house.

Since the onus of reversing the benefit and paying the tax for the previous years is on the taxpayer, many people will conveniently skip mentioning it in their tax return. "These issues are not likely to be picked up by the taxman in isolation," says Sanghavi. "But in case your return is picked up for scrutiny, the investigating officer may come across these facts," he adds.

Items received as gifts

Diamonds are a girl's best friend, but if you gift a solitaire diamond ring worth Rs 1 lakh to your friend, she might end up paying a huge tax on it. Gifts from unrelated people are taxable if the aggregate value exceeds Rs 50,000 in a year. "Even gifts received collectively, such as on a birthday or anniversary, but whose combined value exceeds Rs 50,000, will invite tax," says Kumar. The gifts received from blood relatives or on specific ocassions like marriage or under inheritance or by will are not taxable.

The specific assets for which gift tax is applicable include cash, immovable property such as land and buildings, and movable property including financial assets (shares, fixed deposits), jewellery and bullion, art and antiques (paintings, sculptures). Since such instances of gifting occur regularly in our lives, it is a must that one is aware of the tax implications of such activities. "Even when you are the one who is gifting money, you may come under the scanner if the recipient of the gift happens to come under scrutiny," cautions Sanghvi.

How to deal with a tax notice

Here is a checklist of things to do when you get a notice.

> Preserve envelope

The envelope has the Speed Post number, which shows when the notice was posted and served.

>Check PAN details

Maybe the notice was meant for someone with same name. Check your PAN details.

>Make copies of notice

You can't afford to lose the notice, so make photocopies or scan and store it on your computer.

> Check validity

A notice under Section 143(3) for scrutiny assessment has to be served within six months of the end of the financial year in which the return was filed. If served later, it will be deemed invalid. However, a notice served under Section 148 can reopen a case even up to six years if the assessing officer (AO) suspects evasion. If the sum is less than Rs 1 lakh, only 4-year-old returns can be reopened.

> Check sender's details

A notice must have the name, designation, sign, stamp and official address of the sender.

>Organise documents

Some returns are picked up for scrutiny at random. Don't panic, but compile all documents.

> Seek professional help

If it is just a simple demand notice for excess tax, an individual can handle ithimself. If the matter is a little complicated, it is best to take a professional's help. You may be required to appear before the AO to explain any discrepancy in the return or make a clarification. A professional can help you organise your response so that you can provide cogent and specific clarifications.

Economic Times adds: Our intention is not to alarm our readers. If you have missed some income in your tax return or made a mistake in calculating your tax liability, we suggest you file a suggest you file a revised return. You might have to shell out a small amount in tax, but you will be able to sleep easy. You can revise your return as many times as you want. However, a revised return can be filed only if you filed the original return before the 31 July deadline. Now, here's one more reason to file your tax return on time.

Filing tax returns

New rules of filing tax returns (2013)

The tax authorities have introduced several new guidelines for filing returns this year. Find out how these changes are likely to impact you

The Times of India 2013/07/15

First they made it compulsory for businesses to e-file their tax returns. Then they made it mandatory for taxpayers with incomes of over 10 lakh to take the online route. This year, the income tax authorities have cast a wider net and made e-filing compulsory if your taxable income is above 5 lakh a year.

The lowered threshold represents one of the key changes in the tax filing rules this year. Some of these are mere tweaks, such as mentioning your bank’s IFSC number, instead of the MICR code, in the return. However, some of these variations are tectonic, such as the mandatory e-filing for incomes above 5 lakh a year. In the following pages, ET Wealth explains the new rules and how they will affect the way you file your tax return this year.

E-filing tax returns

E-filing of tax returns has grown tenfold since its introduction in 2006. Less than 8% of the 3.37 crore taxpayers efiled their returns in 2007-8. Last year, 45% of the 5 crore taxpayers took the online route. That’s a big jump and the figure is expected to go up significantly this year.

The change has spawned a massive opportunity for tax e-filing portals. These websites charge individual taxpayers between 200 and 4,000 for uploading their tax returns. You can also do it for free on the official website of the Income Tax Department. However, private tax filing portals hand-hold the taxpayer through the process. They guide you while filling the form and even correct you if you make a mistake.

Filing tax returns online is easy. The average taxpayer won’t take more than 30-40 minutes to enter all the details and upload the return. However, the average taxpayer also harbours several misconceptions about e-filing. Mumbai-based Harshad Doshi has fallen in and out of love with online filing during the past three-four years. Doshi started e-filing in 2008, but when he got a scrutiny notice in 2010, he was advised by a relative to desist from the online route. The next year, he reverted to physical returns, but still got a notice. This year, Doshi has no choice but to e-file his returns because his annual income is above 5 lakh. “I have realised that one can get a tax notice, irrespective of whether one files his return online or offline,” he says wryly.

He’s right. Tax returns are picked up for scrutiny through a computerassisted selection procedure that has no human intervention. If the computer detects certain discrepancies in the return, it raises the red flag and the individual gets a notice. In fact, there is a greater probability that a return filed offline will get picked up for scrutiny. The information in your physical return is ultimately fed to the computer by operators. A typing error at this stage can introduce a discrepancy in the return, leading to a notice being sent to you.

This problem can be avoided when you file online because the chances of going wrong are lesser. The e-filing portals further reduce the risk of errors by calculating the tax as you fill in the form. Some e-filing companies, such as Taxspanner, even verify your return for a small fee. If you are ready to shell out 200, the portal will check if you have entered correct information and alert you when you are going wrong. Tax professionals go through your return form, tallying the numbers and cross-checking the information before it is uploaded.

Choose the right form

The online filing data reveals that more than 32% of the 2 crore individual taxpayers used the basic ITR 1, also known as Sahaj, to file their returns last year. Only 11% used the more complicated ITR 2. These statistics indicate that a lot of taxpayers who should have used ITR 2 filed their returns using the simpler Sahaj form. The income level does not matter; what is important is the source of income. For instance, if one had made capital gains or earned rent from more than one house, he should have used ITR 2.

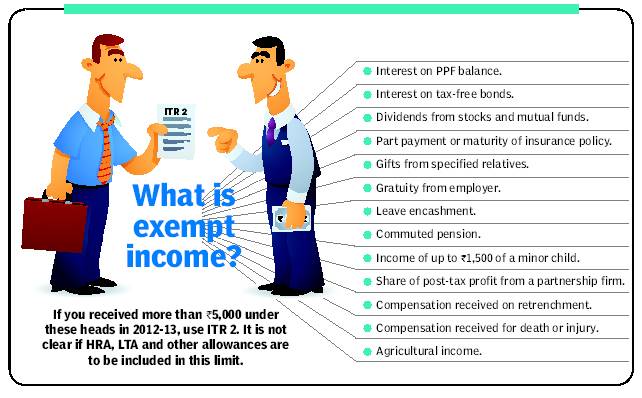

Whether the popularity of ITR 1 was out of ignorance or a deliberate attempt to conceal income is not clear. However, the government has now changed the rules to capture a better picture of the income of taxpayers. If you received more than 5,000 tax-exempt income during 2012-13, you will have to use the ITR 2 for filing your return this year. Exempt income includes tax-free sources of income, such as the interest on PPF, tax-free bonds and dividends (see table). Also, a taxpayer is is not supposed to use ITR 1 if he has foreign assets or has claimed tax relief under any double taxation avoidance treaty.

Experts are divided over the interpretation of exempt income in this regard. “This change will have a big impact on the salaried taxpayers because HRA, LTA or conveyance allowance are commonly availed of by most of them,” warns Kuldip Kumar, executive director of PriceWaterhouse Coopers. This effectively means that a vast majority of salaried taxpayers will have to use ITR 2 this year. Even if they don’t claim HRA exemption, they get LTA, or at least 800 conveyance allowance per month, which is tax free.

However, other experts believe that the 5,000 limit for exempt income does not include HRA, LTA and other allowances that a taxpayer receives from an employer as part of the salary package. More clarity is needed on this aspect.

The stress on disclosure demonstrates the tax department’s resolve to plug the leakages in tax collection. The direct tax collection of 5.58 lakh crore in 2012-13 fell short of the revised target by 7,000 crore. Addressing a meeting of tax officials in May, Finance Minister P Chidambaram exhorted them to “target non-filers and stop-filers to widen the tax base”. Almost 12.5 lakh such “non-compliant” taxpayers have been identified by the Central Board of Direct Taxes, and almost 2 lakh notices are already on their way. The taxpayers who have not filed or s t o p p e d f i l i n g would do well to take heed of the warning. If you have not filed your return for last year as well, you can do so now. A return filed after the due date is a delayed return. If you file your delayed return before you get a notice, you have a better chance of getting away lightly. The taxman will not take you to task for not filing your returns, just give you a mild rap for waking up late.

Automatic choice for e-filers

For some online tax filers, choosing the right form is not an issue. “A taxpayer has to just enter what he has earned under different heads of income and the portal automatically chooses the applicable form,” says Sudhir Kaushik, co-founder and CFO of Taxspanner.com. For instance, if the person has only income from salary and no exempt income, his return will be filed using ITR 1, but if he made some capital gains, has rental income from more than one house or his exempt income exceeds 5,000, ITR 2 will have to be used.

However, taxpayers who upload their returns through the official Income Tax Department website will have to be more careful about the form they use. Delhi-based Kuldip Kaushik used the ITR 1 last year, but since he had dividend income of over 5,000 for the year 2012-13, he will have to use ITR 2 this year.

If a taxpayer uses the wrong form and the mistake is discovered by the tax authorities, the return may be rejected. Every year, thousands of defective returns are sent back to taxpayers. A defective return is not an earth shattering matter. If you get a notice, you will have to file a revised return within 15 days. If you meet the deadline, the return is treated as valid. Get delayed and your return will become invalid and you will have to file afresh.

“If you discover on your own that you have made a mistake in the return or used the incorrect form, you can file a revised return to rectify the mistake,” says Vineet Agrawal, director KPMG. Your new return will overule the previous one if the assessment has not been completed.

Check your TDS details

Before you sit down to file your returns this year, spend a few minutes to check whether the tax you paid for last year has been correctly credited to your name. The Form 26AS has details of the tax deducted on behalf of the taxpayer and can be easily checked online. Noida-based Brijendra Singh wishes he had done so last year. The former army officer got a tax notice because of a clerical error by his bank. The TDS paid on his income from fixed deposits was credited to another PAN by mistake. Though he was eventually given credit for his TDS, Singh is not taking any chances this year. He has diligently matched all his TDS details with his Form 26AS online.

Checking your tax credit details online is child’s play if you have a Net banking account with any of the 35 banks that offer this facility. Otherwise you can go to the official website of the Income Tax Department and click on ‘View Your Tax Credit’. First-time users will have to register but it takes less than five minutes before you can log on and view your details. “It is necessary that taxpayers check their TDS when they file their returns,” says Kuldip Kumar of PwC.

Forms 15G and 15H: Do not misuse to avoid TDS

The Times of India, Apr 27 2015

Chandralekha Mukerji

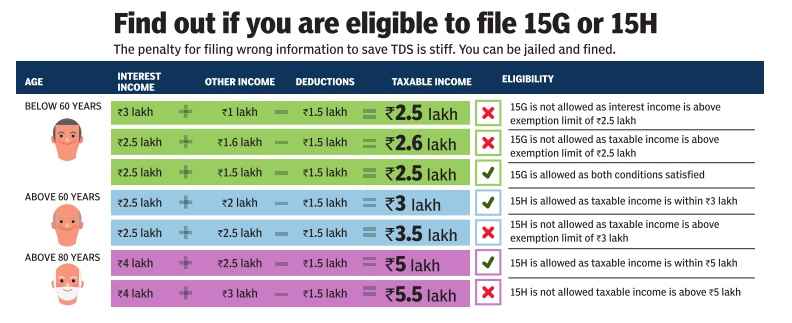

Imprisonment and fines await those who wrongly file the two forms to avoid tax on interest income

Getting a tax refund can be cumber some as delays by the Income Tax Department are common. It makes sense to plan taxes at the beginning of the year, to avoid overpayment and the refund process. Submitting investment declaration with the employer on time and filling form 15G15H will save one half the hassles. However, one cannot randomly submit forms 15G and 15H. If one’s interest income exceeds `10,000 a year, the bank will deduct 10% tax at source.If one does not furnish PAN details, the TDS rate will be higher at 20%. However, one can submit a Form 15G and 15H to avoid TDS on interest income. While Form 15G is for Indian residents below 60 years of age, HUFs and trusts, Form 15H is for those above 60.

The repercussions of wrong filing is stiff.A false or wrong declaration in Form 15G attracts penalty under Section 277 of the Income Tax Act. “Prosecution includes imprisonment ranging from three months to two years, and a fine. The term can be extended to seven years and fine, where tax sought to be evaded exceeds `25 lakh,“ says Sudhir Kaushik, CA and CFO, Taxspanner.Keep in mind the following points.

Eligibility

The basic conditions for filing 15G are--the final tax on estimated total income computed as per the Income Tax Act should be nil; and, the aggregate of the interest (excluding interest earned on securities) received during the financial year should not exceed the basic exemption slab of `2.5 lakh. If these criteria are met, one can submit Form 15G and the entire interest income would be credited without any tax cut.

One needs to meet both criteria. Even if the interest income is less than the basic exemption allowed during that financial year, but one’s total tax liability is not nil, one will not be eligible for filing Form 15G. The reverse is also true. Say your income is `4 lakh, of which `3 lakh is earned as interest from the bank. You might invest `1.5 lakh in PPF and be out of the tax net, but you are not eligible for Form 15G as though your tax liability is zero, the interest income is high er than the basic exemption of `2 lakh. The refund route is one’s only recourse. Form 15H can be only filed by individuals above 60. This form imposes only the first condition--the final tax on the investor's estimated total income should be nil. So, if one is above 60, his/her taxable income for the financial year can be up to `3 lakh for him/her to be eligible for 15H. For super senior citizens above 80 years, this limit is `5 lakh.

Forms seek more information

If salaried people are feeling jittery about using the more detailed ITR 2, imagine what partners in firms and businessmen are going though. In an attempt to dig deeper for undisclosed income, the government has made it mandatory for partners, professionals and businessmen with an income of over 25 lakh to furnish details of their assets and liabilities. There is a new ‘Schedule AL’ in the ITR 3 and ITR 4. If the taxpayer’s income exceeds 25 lakh during the year, he will have to declare his assets and liabilities.

Don’t forget the ITR V

The most important form in the whole process is the ITR V. This is the acknowledgement of your return. If you file offline, this form has to be submitted along with the ITR. If you file online without digital signature, this form has to be sent to the CPC in Bangalore by snail mail within 120 days of uploading the return. This also means that for a vast majority of efiling taxpayers, the process is not fully online. The CBDT is considering a proposal that will do away with the physical posting of the ITR V. However, till then you will have to send it by ordinary post.

Others feel that the cost of digital signature should be brought down and its usage expanded to cover other areas as well. “If e-filing has been made mandatory, the government should also make the use of digital signatures mandatory,” says Delhibased chartered accountant Minal Agrawal Jain.

Choosing an e-filing portal

Charges should not be the only reason for choosing a portal. Here are some other factors that you should consider.

Is it comprehensive?

The more details sought, the better it is. If the return uses only Form 16, you might lose out on deductions you were eligible for, but didn’t claim.

Assistance in filing

For a small charge some portals guide you in the process to ensure there are no mistakes. Others pick up documents from your office or residence.

Follow-up services

Does the portal help even after the uploading? Some alert you if you forget the ITR V. Others send it to the CPC in Bangalore on your behalf.

Privacy policy

The data in your tax return form is priceless for financial services companies. If it goes out, you will be inundated with calls and spam mail.

Income tax rules: 6 common violations

The Times of India, June 6, 2016

CHANDRALEKHA MUKERJI Tax authorities can send you a notice if you commit any of these six common mistakes

There are many reasons why small taxpayers can get into trouble with tax authorities. “My mother is a senior citizen and has paid all her taxes. But she still got a notice for not filing her return for 2014-15,“ says Mumbai-based marketing manager Arun Kapoor. Delhibased finance professional Varun Sahay received a notice for not deducting TDS when he bought a flat last year. “I had no idea that I was supposed to deduct 1% of the house's value and deposit the amount with the government on behalf of the seller,“ he says.

In recent months, the tax department has stepped up efforts to ensure tax compliance. New rules have been introduced to plug leaks and officials are cracking down on evasion. Tax records are being scanned and notices being sent to individuals if the computer-aided selection system notices a discrepancy .

We look at six mistakes that can fetch you a tax notice. Some mistakes are just calculation errors. But others are serious transgressions that can invite penalties of up to 300% of unpaid tax. We tell you where you are going wrong and the correct position on the matter. We also offer tips to help you avoid falling foul of the tax rules.

1 NOT REPORTING INTEREST INCOME

INTEREST income from fixed deposits, recurring deposits, tax saving bank deposits and infrastructure bonds is fully taxable. Yet, 59% of respondents to a recent online survey believed that interest income of up to `10,000 a year is tax free. The tax exemption of `10,000 a year under Sec 80 TTA applies only to interest earned on bank savings account balance.

Another 6% of respondents thought no tax is payable if the bank deducts TDS. TDS is only 10% of the income. If the taxpayer falls in a higher tax slab, the liability is higher. Interest income is often unreported in tax returns. Till two years ago, TDS kicked in when the interest from deposits made in one bank branch exceeded `10,000 in a financial year. Investors used to split deposits across branches to avoid TDS. Now TDS applies if the combined income from deposits in all branches of a bank exceeds the threshold. What's more, TDS also applies to recurring deposits now.

SMART TIP

Calculate how much interest you will get on your FDs, RDs and other fixed income investments and add that to your income.

2 IGNORING INCOME OF PREVIOUS JOB

EVERY TIME you switch jobs, you are in danger of falling foul of tax laws. This is because the new employer doesn't take into account the income earned from the previous job and offers tax exemption and deduction to the employee all over again. Instead of `2.5 lakh basic exemption and `1.5 lakh deduction under Section 80C, you get `5 lakh basic exemption and `3 lakh deduction. However, this discrepancy will be discovered when you file your return. This would translate to a large tax payment at the time of filing returns because the duplicate benefits would be rolled back.

3 NOT FILING TAX RETURNS

A LOT OF TAXPAYERS have received notices for not filing their tax returns.Anybody with an income above the basic exemption is liable to file his tax return.The basic exemption is `2.5 lakh per year for people below 60, `3 lakh for senior citizens above 60 and `5 lakh for very senior citizens above 80. The rest of us, including NRIs, have to comply .

Keep in mind that this is the gross income before any deductions and tax breaks. If your annual income is `4.2 lakh and you invest `1.5 lakh under Sec 80C, your tax will come down to zero. But you are still liable to file your tax return.Similarly , even if all your taxes are paid, you still need to file the return.

For a lot of people, confusion stems from a rule introduced four years ago, where salaried individuals with an income of up to `5 lakh a year were exempted from filing returns. However, that rule has long been withdrawn.

Not filing returns is not a serious of fence if all taxes are paid. You will get a notice asking you to do the needful.Tax laws allow a taxpayer to file delayed returns even after the due date.

4 MISUSING FORMS 15G, 15H TO AVOID TDS

MANY INVESTORS try to avoid TDS by splitting investments across different banks. Many others submit Form 15G or 15H so that their bank does not deduct TDS. These forms are declarations that the individual's income for the year is below the taxable limit and therefore no TDS should be deducted from the interest. Misuse of these forms is a serious offence. A false declaration can attract a jail term.

You need to meet two conditions to file form 15G. One, your taxable income for the year should not exceed `2.5 lakh.Two, the total interest received during the financial year should not exceed `2.5 lakh. Form 15H, for senior taxpayers above 60, imposes only the first condition. The final tax on total annual income should be nil. Senior citizens whose taxable income is below the `3 lakh limit are eligible to file Form 15H.For those above 80, this limit is `5 lakh.

SMART TIP

File Form 15G if you fulfill both conditions. TDS is an interim tax and you can claim a refund.

5 NOT DEDUCTING TDS WHEN BUYING PROPERTY

THE GOVERNMENT has extended the scope of TDS to property transactions as well. If you buy a house worth more than `50 lakh, you have to deduct 1% TDS from the payment to the seller. In case the seller is an NRI, the TDS will be 30%. This amount should be deposited with the government on behalf of the seller using Form 26QB. Sahay had no idea of this rule when he bought a property last year. He now has to respond to a tax notice, and could be slapped with a penalty of `1 lakh.

The rule is applicable even if you pay in instalments. In such cases, the TDS needs to be deducted from each payment and the money deposited with the government within seven days.

While TDS deduction happens automatically when you buy a new property from a builder, in case of transactions between individuals, it is often ignored. Many are not sure how to calculate the tax. TDS has to be calculated on the total sale price and not just the amount exceeding `50 lakh. The total sale price is the amount payable and as registered in the sale agreement.It does not include stamp duty and brokerage.

Also, only the sale price has to be taken into consideration, not the circle rate of the property .

6 NOT REPORTING FOREIGN ASSETS

TAXPAYERS CANNOT afford to be unsure about their foreign income and assets. Mis-reporting overseas assets will not be taken lightly by the government. You could be prosecuted under the Black Money Act and the penalty can be as high as `10 lakh for even small errors. Taxpayers who have worked abroad often go wrong when reporting foreign assets. Same goes for employee stock options which are often acquired at no cost and sold out, but get missed when you take an account of assets.

Not just salary and perks, freelancers who receive money from foreign clients need to report this income under the foreign assets schedule. This should also include gifts, which are deemed to be income. Also, all foreign bank accounts--whether operational or not--need to be reported. You even have to report bank accounts where you are merely a signing authority .

Five tax filing mistakes

Five tax filing mistakes to avoid

Here’s how to ensure you don’t commit errors and receive a tax notice

The Times of India 2013/07/15

1 Availing of deduction twice

This is a common error that many salaried taxpayers commit. If you had switched jobs during the previous financial year, you might have got the Form 16 from both employers. While the first company may have deducted the tax correctly, the second might have deducted very little. It would have considered only the income for the rest of the year and given you the basic exemption of 2 lakh, as also the deduction under Section 80C. However, these must have already been factored in by the previous company. “You might have to pay additional tax in such a situation,” says Sudhir Kaushik, co-founder of tax filing portal, Taxspanner.com. Don’t think you can escape by ignoring the previous income in your tax return. The computerised scrutiny will immediately detect the discrepancy. There will also be a mismatch in your TDS details because the previous employer would have deposited the TDS on your behalf, along with your PAN and other details. 2

Not mentioning exempt income

Dividends are tax-free. So are longterm capital gains from stocks and equity funds, as well as the interest on your PPF investments and taxfree bonds. There is also no tax to be paid on agricultural income and gifts from specified relatives. Even though these are tax-free, all exempt incomes must be mentioned in the tax return. Ignore this at your peril. The new rules for tax filing announced this year state that if the total exempt income during the year exceeded 5,000, you will have to use ITR 2 to file your return.

3 Not including interest

2012’s budget had introduced a new Section 80TTA, which gives a deduction of up to 10,000 on interest earned on your balance in the savings bank account. Many taxpayers think this deduction also includes the interest earned on bank deposits. The interest earned on fixed deposits and recurring deposits is fully taxable at the normal rate. You have to mention it under the head ‘Income from other sources’ in your tax return. Tax is payable even if the TDS has been deducted. TDS is only 10% (20% if you haven’t submitted your PAN details), and if you are in the 20-30% bracket, you need to pay additional tax. The interest on NSCs is also taxable.

4 Not checking TDS details

Before you file your returns, check whether the tax you had paid for last year has been correctly credited to your name. The Form 26AS has details of the tax deducted on behalf of the taxpayer and can be easily checked online. It is easier if you have a Net banking account with any of the 35 banks that offer this facility. Otherwise, you can go to the official website of the Income Tax Department and click on ‘View your tax credit’. First-time users will have to register, but it takes less than 5 minutes to log on and view your details.

5 Not mailing ITR V in time

The ITR V is the acknowledgment of your tax return. It is to be submitted along with your return if you file offline. If you have e-filed your return without a digital signature, you need to take a print of the ITR V, sign it and send it to the CPC in Bangalore by ordinary mail. This should be done within 120 days of uploading your return. The filing process is complete only after the ITR V is received at the CPC. You can check the status of your ITR V on the official website of the Income Tax Department. If it has not been recieved within 7-10 days of mailing, call up the Ayakar Sampark Kendra or send another copy.

Tax saving instruments

Tips

The Times of India, Jun 22 2015

Chandralekha Mukerji

Ways to escape tax legally

The government is keen on making benami property laws even more stringent. So, all those asset owners who fail to produce legal proof of source of earning that allows him or her to own the asset, risk it being termed benami. Here, the term property will mean not just real estate but any kind of movable or immovable, tangible or intangible assets, including jewellery, cash and investments.

The new law is likely to state that property acquired in the name of any person (other than spouse and unmarried daughter)--brother, sister, father, mother, son-risks being confiscated and could lead to jail time. All `gifts' given to relatives to escape tax could be probed even more closely . However, no one is stopping you from saving taxes using legitimate ways. Here are seven ways to escape tax legally when investing in the name of family members.

Invest gifted money in tax-free instrument

Exhausted your 80C limit? Transfer some money to your non-working spouse or minor child and invest that sum in a tax-free instrument such as PPF or ELSS funds, tax free bonds and Ulips. The gift tax rules won't apply to these relations, including any of your or your spouse's lineal ascendants or de scendants. Therefore, you can transfer any amount you want. Since you are investing in a tax-free instrument, even the clubbing of income clause won't affect your tax liability.

Minor child

Deduction available in case of minor child

You can claim a deduction of up to `1,500 per child for two children in case of investments made in the name of minors. This means you can invest, say, `15,000 (or `30,000, for two kids) in a one-year FD scheme which gives a return of 10% and be exempt from tax.

Long-term gains

There is no tax on long-term gains –

Not interested in locking your money in long term investments or fixed assets? Invest the l gift money in stocks and equity mutual funds e and hold for more than a year. There is no capital gains tax on equity assets held for g more than 12 months. In case of gold and property and debt-oriented mutual funds, the holding period is 3 years.

The clubbing is only at the first level

If earnings are reinvested, it will be treated as your relative's income. This means the second year onwards, you'll have no further tax liability on that money. You can use this strategy even if your spouse is earning, but falls in a lower tax bracket.

Adult children

Adult children are big tax savers

The clubbing rule does not apply once your child turns 18. Since the person is treated as a separate individual for all tax purposes, you can transfer money and enjoy another `2.5 lakh exemption along with all the other deductions and benefits that other taxpayer enjoys. You can start investing if the child is turning 18 before 31 March of that financial year and benefit for the entire year.

Clubbing not applicable in case of parents

You can also invest in your parent's name and the best part is the clubbing rules won't be applicable here. Also, there is no gift tax on the money you give to your parents. So, make use of their a basic tax exemption limit-`2.5 lakh for up to 60 years, `3 lakh for those above 60 and `5 lakh if they are above 80. In case they are exceeding the exemption limit, help them save taxes.

There are huge tax benefits if you live with your parents and the house is registered in their name. You can pay rent to them and claim HRA benefits. Your parents on the other hand can claim 30% of the annual rent as deduction for maintenance expenses.They will be taxed for only the income above their basic tax exemption limit, which is `2.5 lakh (`3 lakh in case they are above 60 and up to `5 lakh if above 80 years). You get a bigger benefit if the house is co-owned by your parents. They can split the earning from rent and show separate tax liability.This money can be invested in options such as the Senior Citizens Saving Scheme, fiveyear bank deposits or tax saving equity MFs.You can consider buying health insurance for up to `25,000 (`30,000 if they are above 60 years) and claim deductions under 80D.

'Loans'

Show the monetary transaction as a loan

The clubbing provision is applicable on earnings from gifted money . However, if you show the transaction as a loan where your relative pays you a nominal interest, income from the investment will not be taxable.

Choosing the best suited instrument

The Times of India Jan 11 2016

BABAR ZAIDI

Choose the tax-saving instrument that best suits your needs and financial goals Do-it-yourself tax planning can be rewarding and challenging.

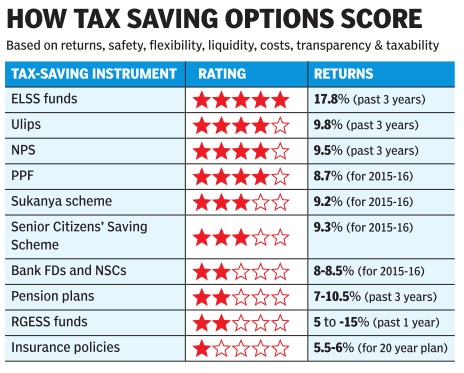

Rewarding, because you can choose the tax-saving instru ment that best suits your needs. Challenging, because if you make the wrong choice, you are stuck with an unsuitable investment for at least 3-5 years. This is where our annual ranking of best tax-saving options can prove helpful. It assesses all the investment options on seven key parameters--returns, safety, flexibility, liquidity, costs, transparency and taxability of income. Each parameter is given equal weightage and a composite score is worked out for the various tax-saving options.

While the ranking is based on a robust methodology, your choice should also take into account your requirements and financial goals. We consider the pros and cons of each option and tell you which instrument is best suited for taxpayers in different situations and lifestages. We hope it will help you make an informed choice. Happy investing!

ELSS FUNDS

ELSS funds top our ranking because of their tremendous potential, high liquidity and transparency . The ELSS category has given average returns of 17.8% in the past 3 years. The 3-year lock-in period is the shortest for any Section 80C option.If you have already fulfilled KYC requirements, you can invest online. Even if you are a new investor, fund houses facilitate the investment by picking up documents from your house and guiding you through the KYC screening. ELSS funds are equity schemes and carry the same market risk as any other diversified fund.Last year was not good for equities, and even top-rated ELSS funds lost money.However, the funds are miles ahead of PPF in 3and 5-year returns.

The SIP route is the best way to contain the risk of investing in equity funds.However, with just three months left for the financial year to end, at best, a taxpayer will manage 2-3 SIPs before 31 March. Since valuations are not stretched right now, one can put in a bigger amount.

SMART TIP

Opt for the direct plan. Returns are higher because charges are lower.

ULIP

The new online Ulips are ultra cheap, with some of them costing even less than direct mutual funds. They also offer greater flexibility. Unlike ELSS funds, where the investment cannot be touched for three years, Ulip investors can switch their corpus from equity to debt, and vice versa. What's more, there is no tax implication of gains made from switching because insurance plans enjoy exemption under Section 10 (10d). Even so, only savvy investors who know how to use the switching facility should get in.

SMART TIP

Opt for liquid or debt funds of the Ulip and gradually shift the money to the equity fund.

NPS

The last Budget made the NPS attractive as a tax-saving tool by offering an additional tax deduction of `50,000. Also, pension fund managers have been allowed to invest in a larger basket of stocks.Concerns remain about the cap on equity exposure. Besides, the taxability of the NPS on maturity is a sore point. At least 40% of the corpus must be put in an annuity . Right now, the income from annuities is taxed at the normal rate.

SMART TIP

Opt for the auto choice where the equity exposure is linked to age and comes down as you grow older.

PPF AND VPF

It's been almost four years since the PPF rate was linked to the benchmark bond yield. But bond yields have stayed buoyant and the PPF rate has not fallen. However, the government has indicated that it will review the interest rates on small savings schemes, including PPF and NSCs. If this is a worry, opt for the Vol untary Provident Fund. It offers that same interest rate and tax benefits as the EPF. There is no limit to how much you can invest in the VPF. The contribu tion gets deducted from the salary itself so the investor does not even feel it go.

SMART TIP

Allocate 25% of your pay hike to VPF . You won't notice the deduction.

SUKANYA SAMRIDDHI SCHEME

This scheme for the girl child is a great way to save tax. It is open only to girls below 10. If you have a daughter that old, the Sukanya Samriddhi Scheme is a better option than bank deposits, child plans and even the PPF account. Ac counts can be opened in any post office or designated branches of PSU banks with a minimum `1,000. The maximum investment in a financial year is `1.5 lakh and deposits can be made for 14 years. The account matures when the girl turns 21, though up to 50% of the corpus can be withdrawn after she turns 18.

SMART TIP

Instead of PPF, put money in the Sukanya scheme and earn 50 bps more.

SENIOR CITIZENS' SCHEME

This is the best tax-saving instrument for retirees. At 9.3%, it offers the highest interest rate among all Post Office schemes. The tenure is 5 years, extendable by 3 years. Interest is paid quarterly on fixed dates. However, there is a `15 lakh overall investment limit.

SMART TIP

If you want ot invest more than `15 lakh, gift the amount to your spouse and invest in her name.

BANK FDS AND NSCs

Though bank FDs and NSCs offer assured returns, the interest earned on the deposits is fully taxable. They are best suited to taxpayers in the 10% bracket or senior citizens who have exhausted the `15 lakh limit in the Senior Citizens' Saving Scheme.

SMART TIP

Invest in FDs and NSCs if you don't have time to assess the other options and the deadline is near.

PENSION PLANS

Pension plans from insurance companies still have high charges which makes them poor investments. They also force the investor to put a larger portion (66%) of the corpus in an annuity . The prevailing annuity rates are not very attractive. Pension plans launched by mutual funds have lower charges, but are MFs disguised as pension plans. Moreover, they are debtoriented plans so they are not eligible for tax benefits that equity plans enjoy.

SMART TIP

Invest in plans from mutual funds.They offer greater flexibility than those from life insurers.

INSURANCE POLICIES

Traditional life insurance policies remain the worst way to save tax. Still, millions of taxpayers buy these policies every year, lured by the “triple benefits“ of life insurance cover, longterm savings and tax benefits. Actually, these policies give very little cover.A premium of `20,000 a year will get you a cover of roughly `2 lakh. The returns are very poor, barely 6% if you opt for a 20-year plan. And the tax-free income is a sham. Going by the indexation rule, if the returns are below the inflation rate, the income should anyway be tax free. The problem is that once you sign up for these policies, they become millstones around your neck.

SMART TIP

If you can't afford to pay the pre mium, turn your insurance plan into a paid-up policy.

2016: Tax saving investing

The Times of India, Mar 22, 2016

With just about a week left be fore the financial year ends, there are many taxpayers who have not yet made the requisite investments or bought financial products which can save them some extra money from their annual tax outgo. Ideally, the plan to save taxes should start at the start of the financial year, that is in April, but not everyone sticks to that regime. In turn the procrastination leads some people to either rush to invest in products which may not be suitable for their long term financial goals or worse, not save enough tax even when they are eligible for the same.

Pitfalls of last minute investing to save taxes

In addition to settling for wrong investments, going for last-minute tax saving investments could also lead to other problems. Some of these hurried investments could also turn costly in the long run, financial planners and advisors say. For example, if someone buys an insurance product with a high premium outgo that is not in line with the risk profile of the buyer, heshe may either be forced to continue to pay the same high pre miums for several years or surrender the policy which could lead to some loss to himher. These last-minute tax saving investing may also stretch the family's monthly budgets during the month when such investments are done. In turn this could result into some un w a r ranted cuts in other areas for the whole family .

Options left to save taxes

Individual taxpayers have a limit of investing Rs 1.5 lakh under Section 80C of the Income Tax Act to save on taxes. For most salaried taxpayer, a part of this limit is exhausted through their contributions towards Employee Provident Fund (EPF). For taxpayers who have bought a house on a loan and paying the EMI, the principal amount in the EMI is also included within the section 80C limit. Within these categories, the late comers can't do much at this mo ment.

According to Ramesh Chand Maloo of Maloo Finance & In vestment Services, for last moment tax planning equity linked savings schemes (ELSS) floated by mutual fund houses, Public provident fund (PPF), 5 year tax saving fixed de posits, National Pension Scheme and unit linked insurance plans (ULIPs) by life insurance could be considered. "If y o u want to connect it (tax saving) with your long term financial goals, then you can save through retirement funds.However, the best option is ELSS for three years as it has growth potential in the current market scenario," Maloo, who runs his financial advisory business from Jaipur, said. "Outside of the section 80C limits, the other tax saving options are NPS and mediclaim policies which could also be used," he said. Among the tax saving options still available, a taxpayer could invest ` 1.5 lakh in one shot in an ELSS or in a PPF account. While in ELSS there is a lock-in of three years, one can withdraw funds from PPF after five years, but not the full amount. An investor can also invest through NPS, where heshe could choose between three types of schemes, categorised as high risk, medium risk and low-risk. With the Budget this year making 40% of the total amount withdrawn tax free, NPS will get an extra edge from fiscal 2017.

Lesser known deductions

The Times of India, Jul 27 2015

Preeti Kulkarni

Here are a few little known deductions, from specified illnesses to donations, that taxpayers tend to miss out on Most taxpayers are familiar with the tax deductions under Sec tion 80C and 80D. But there are several other deductions that a taxpayer can avail.

Home loan processing fee and other charges

Home loan customers are aware of the tax benefits on the loan interest and principal repayment. But even the processing fees qualifies for deduction under Section 24. “The processing fees and other charges are considered as interest and can be claimed as a deduction,“ says Vaibhav Sankla, Director, H&R Block. This includes the prepayment charges.

Interest on personal loan for down payment

Section 24 also includes the interest paid on any loan taken for the purchase, renovation or reconstruction of a house. “The tax laws do not specify that only interest on a `housing loan' would be eligible for deduction,“ says Sankla. Even loans taken from friends or family members are eligible for deduction under Section 24. But the taxman may want to see a loan agreement and the interest earned by the lender will be taxed as his income.

Tax deduction for disabilities

If a taxpayer suffers from 40% disability (certified by a government hospital), he can claim deduction of `50,000 under Sec 80U. For a disabled dependent, he can claim a deduction of `50,000 under Sec 80DD. In both cases, if the disability is severe, the deduction is `1 lakh. This is a flat deduction and does not depend on actual amount spent. The disabled person should be dependent on the taxpayer for maintenance, and should not have claimed deduction for disability separately.

Clubbing income of disabled child

If you invest in the name of your spouse or minor child, the income from the investment will be clubbed with your income under Sec 64 and taxed accordingly. However, if the child is disabled, the income from investments made in his name will not be clubbed with the income of parents.

Deduction for specified illnesses

A deduction of up to `40,000 can be claimed if a taxpayer suffers from any ailment specified under Sec 80DDB or has a dependent who is a patient. For senior citizens, the deduction is higher at `60,000. The diseases include certain neurological ailments, cancers, AIDS and haematological disorders. However, if the amount is reimbursed by the employer or insurance, the taxpayer is not eligible for deduction. If he gets partial reimbursement, the balance can be claimed as deduction.

Interest from savings accounts

The interest is fully taxable but there is a small window of exemption. Up to `10,000 interest earned on savings banks account is exempt under Sec 80TTA. Also, up to `3,500 interest from a post office savings account is exempt from tax under Sec 10(15)(i). If you hold a joint account, the exemption is higher at `7,000.

House rent exemption without HRA

Many pay house rent but cannot avail exemp tion because there is no HRA component in their salary. Under Sec 80GG, you can claim a deduction for the rent even if you don't get HRA. However, the taxpayer should not be drawing any housing benefit. Nor should he or spouse or child be owning a house in the city where he stays. The exemption is limited to the least of the following: rent paid less 10% of total income; or `2,000 a month; or 25% of total income.

Adjusting losses against gains

If you lost money in stocks or on other investments during the previous financial year, you can adjust some losses against capital gains from the sale of stocks, property, gold or debt funds. Short-term capital losses can be set off against both short-term capital gains as well as taxable long-term capital gains. However, long term capital losses can only be set off against taxable long-term capital gains.Long-term losses from stocks and equity funds cannot be adjusted against any gain.

Section 80G donations

Donations under Sec 80G are generally not included in Forms 16. You will have to claim this deduction at the time of filing your return. Depending on the organisation or fund you have contributed to, you can claim a deduction of 50-100% of the donated amount.But the deduction cannot be more than 10% of your gross total income.

6 important deductions

Adhil Shetty, Income Tax filing: 6 deductions you must be aware of, July 3, 2018: The Times of India

HIGHLIGHTS

From insurance policies, medical expenses, house loans to donations, you can claim tax benefits through these avenues

Tax deduction benefits can cut down your tax liability to great extent, provided you plan it in advance

Tax filing is mandatory for all the individuals whose gross income is above Rs. 2.5 lakh in a financial year. The Income Tax Department allows deductions under various sections to reduce your tax liability to a great extent. This implies that some of your investments and insurance policies get you deductions and exemptions under different sections.

From insurance policies, medical expenses, house loans to donations, you can claim tax benefits on all these avenues. So, it is important to understand important deduction benefit allowed under the income tax law to significantly reduce your tax liability.

Deduction U/s 80 (C)

Under Sec 80 (C) of Income Tax Act 1961 you are allowed to claim a deduction up to Rs. 1.5 lakh against eligible tax saving instruments. Deduction under 80 (C) covers investments and instruments such as PPF, tax saver FD, NSC, Equity linked savings scheme (ELSS), SCSS, NPS (Up to Rs. 1.5 lakh), term insurance, ULIPs, traditional life insurance policies, etc.

Apart from investments, you can also claim tax deduction benefit against expenses such as payment for tuition fees, home loan principal repayment, statutory expenses such as stamp duty and registration fee for buying a house etc.

Remember, the maximum limit for claiming the benefit U/s 80 (C) is Rs. 1.5 lakh including all the expenses incurred and investments made during the relevant year.

Deduction U/s 80 (D)

This section allows you to avail deduction benefits on premium payment made for Health Insurance policy. Under section 80 (D), you can claim a maximum deduction of Rs. 25,000 if your age is below 60 years, for senior citizens the deduction limit is Rs. 30,000 for Assessment Year 2018-19. Preventive health check-up cost up to Rs. 5,000 can also be claimed as deduction U/s 80 (D). You can claim deduction for premium paid for self, dependent children and spouse. The premium paid for parents can also be claimed as deduction. So, you can claim a deduction of up to Rs. 30,000 for self (If your age is over 60 years) and an additional Rs. 30,000 for your senior citizen parents i.e. a total of Rs. 60,000 as deduction benefit for filing returns for FY 2017-18. This year budget has increased this deduction to Rs 50,000 for senior citizen parents for filing returns in FY 2018-19. Therefore, if you and your parents are senior citizens, then the deduction claim would be Rs. 50,000 each, taking the total deduction to Rs. 1 lakh.

Deduction U/s 24 (B)

Under this section, you can claim tax deductions towards interest paid on home loan. The limit is Rs. 200,000 per year.

Deduction U/s 80 (G)

Under this section, you can claim tax deductions in case you donate money towards social causes or charitable purposes. The deductions can only be claimed if they are made to qualified charitable institutions, relief funds, etc. Deduction benefit may vary from 50% to 100% of the donation amount, as per prescribed rules U/s 80 (G). Donation above Rs. 2000 must be given in the non - cash mode to qualify for deduction U/s 80 (G).

Deduction U/s 80 (E)

This section allows you to avail tax benefits for Education Loan taken from approved banks or financial institutions. You get tax deductions benefits against interest paid on the education loan. There is no upper limit for claiming the deduction under 80 (E).

Deduction U/s 80 CCD (1B)

On investing money U/s 80 (C) you get the tax benefit up to Rs. 1.5 lakh. In addition to this, you can claim deduction up to Rs. 50,000 by investing in the National Pension Scheme. The pension income that you’ll receive on maturity would be subject to tax at the applicable slab rate. On death of the investor, the amount received by the nominee is exempt from the tax.

Apart from the above-mentioned tax deductions you can also claim the deduction benefit such as Rs. 75,000 under Sec 80 (U) by person suffering from specified disability, Sec 80(GGB) for donations to qualified political parties, Sec 80 (TTB) by senior citizens for interest on deposits, under Sec 80 (TTA) for interest earned up to Rs. 10,000 in savings account. There are many more deductions available which you can claim based on your eligibility.

Tax deduction benefits can cut down your tax liability to great extent, provided you plan it in advance.

Little-known deductions for freelancers and entrepreneurs

The Times of India, Aug 31 2015

Chandralekha Mukerji

Freelancers and entrepreneurs can reduce their tax outgo by claiming these not-so-well-known deductions

For the salaried class, it is easy to file eturns. There is Form 16 to turn to. There are also defined and well known heads under which salaried employees can claim deductions.However, for freelance professionals and consultants, it's a different story . To claim certain deductions, besides having to keep records of various financial transactions, they have to ensure that some little-known conditions are also met. “Quite often, they tend to miss out on claiming genuine expenses because of lack of awareness,“ says Varun Advani, COO, makemyreturns.com.Clearly, information is key to keeping the money in one's own pocket. Here's how freelancers and new entrepreneurs can ensure they do not miss out on deductions they are eligible for.

Operational expenses

A freelancer can claim expenses directly related to his or her business. This includes rent, repairs, office supplies, telephone bills, Internet bills, travel expenses--domestic and foreign--meals, entertainment and hospitality-related expenses connected with the business. These have to be business-related expenses and not personal. If you are using a mobile phone or Internet connection for personal and business purposes, only a portion of the bill can be claimed as deduction. “One can see the trend for a couple of months and then define the percentage of the bill which can be allocated to professional expenses,“ says Archit Gupta, Founder and CEO, ClearTax.in.

Similarly , in case you are living in a rented apartment and are using a room to carry out business-related activities, you can show a proportional amount as business rental.“Even if the house belongs to your parents, you can pay them rent and show it as a business expense,“ says Sudhir Kaushik, CA and CFO, Taxspanner .com.

Compliance Tip:

When paying in cash, make sure the amount does not exceeds `20,000 per day. As per Section 40 A (3), payments above `20,000, to qualify for deductions, have to be made using an accountpayee cheque.

Depreciating assets

On capital expenses, you are allowed to charge a small depreciation every year. Capital expenditures include furniture and gadgets used to set up your office, property bought to run business, etc, where benefits from such assets are expected to last more than a year. The depreciation percentage and methods are laid out in the I-T Act for different type of assets, ranging from 5% to 100%. In case you own the property and only a portion is being used as your office, you can still show depreciation on a percentage of property value. “If you have taken a home loan on this property, make sure you do not claim the amount twice. Deduct the business expense from your interest and principal repayment claims before you show it under the capital asset depreciation column,“ says Kaushik.

Compliance Tip:

The percentage you can charge as depreciation varies hugely, even within a category. For instance, for a building mainly used for residential purposes, you can charge 5-10% depreciation. However , if you have built wooden structures in the office, those can be depreciated at 100% in the first year itself. Then there are different rates for intangible assets such as patents and copyrights. It is important to recognise the block of assets correctly. If in doubt, it is best to take professional help.

Professional fees

Freelancers often consult other professionals and pay them a fee. If documented, such payments can be claimed as deductions, as they qualify as business expense. However, do not try to fool the taxman. A lot of new entrepreneurs tend to employee their relatives at key positions at higher salaries. “To check these cases of tax-avoidance, the I-T department says that any payment made over and above the market rate for hiring such a resource, won't be eligible for deduction,“ says Advani.Entrepreneurs often take services from professionals outside India. Some of them work as consultants, while others are on pay-rolls.“Either the money is being paid as a fee or as salary , such an expense will be allowed for deductions only when TDS has been deducted and paid to the I-T department before filing taxes,“ says Advani.

Compliance Tip:

If you are a professional with a turnover of more than `25 lakh and are liable to get your books of accounts audited, payments such as interest, commission, royalty, etc. won't be allowed for deductions, if you have not deducted the tax at source and submitted it before filing the return.

2017-18: Lesser known deductions

How to make your salary tax efficient, January 16, 2018: The Times of India

Often the most seemingly fat salaries get reduced significantly only to the disappointment of the earner due to lack of tax management.

And giving away hard-earned money can make anyone flinch. You could get the better of it and keep your money from slipping away by structuring the salary in a tax efficient manner.

While the end of each financial year sees employees trying to put things together to minimise tax incidence, they often don't look beyond Section 80C. Let's look at some ways to cut back on the tax amount you need to shell out every year.

Uniform Allowance: Section 10 (14) (i) of the Income Tax Act ensures tax exemption on allowance given out for uniform if the job profile requires wearing of dedicated uniform. This includes all purchases made against the uniform allowance. However, to make claim for such deductions, you need to submit to your employer genuine bills for all purchases made during a financial year.

Education Loan: The interest paid towards education loan is tax free and the Income Tax Department has not set any embargo on the amount.

Donations: Donations made to charitable institutions or trusts that are duly registered are not taxable under Section 80G. However, it is important to retain the stamped receipt of the donation to claim tax exemption.

Medical Allowance: Healthcare costs keep going up every year. And you could relive yourself from the burden of such expenses to a certain extent by claiming tax exemption against the medical allowance offered by your employer. You could produce bills for all medical expenses incurred for self, spouse, children, parents and dependent siblings during the financial year to avail tax benefits.

Retirement Benefits/Contributions: Contributions toward retirement are not just lucrative for future days but also an avenue for tax exemption. People are often reluctant towards making such contributions, as higher retirement contribution would mean lower take-home salary. The Income Tax Department offers exemptions and deductions for such contributions in a move to encourage more people to put money into such plans.

Restructuring Your Salary: The size of the basic pay in a salary is what attracts attention of employees the most. However, this is the component that is fully taxable. If your employer is open to restructuring the salary in a more tax-efficient manner, you must try and include allowances and perquisites to minimise the tax burden.

House Rent Allowance (HRA): HRA is a vital component of your salary structure. Any employee staying in a rented accommodation is eligible to get HRA under the provisions of the Income Tax Act.

Leave Travel Allowance (LTA): Under Section 10(5) of the Income Tax Act, the leave travel allowance provided by the employer to the employees is tax free. This allowance is paid out as part of the employee's salary towards meeting his/her travel expenses with family. LTA can be claimed for any two trips made in four calendar years. You can claim LTA by submitting proof of travel to your employer.

Section 80C: Besides these avenues, anyone who falls within the taxable limits of the Income Tax Department can enjoy tax exemption on investments covered under Section 80C. Some of these deductions include life insurance premiums, national savings certificate, five-year-long fixed deposits with banks or post office, principal amount repaid on home loan, tuition fees paid for the education of children of up to two children etc.

While you explore these tax deduction options, make sure you keep your bills and receipts in place to make the most of it.

Employers and employment: changing of losing a job

Changing employment

LUBNA KABLY, TAX TIPS FOR JOB CHANGES, Sep 19 2016 : The Times of India

Here's how to deal with various taxation issues that may arise when you switch jobs

Vandana R sailed through three tough rounds of interviews to land the exciting job of pro ject lead, big data analytics.

The sprawling campus of the MNC (let's call it Company B), which she will join next week, looks inviting. Her salary has been doubled and she has been given a managerial role with more responsibilities. There is a hitch though.For jumping ship early, she will have to return her `5 lakh sign-up bonus to her former employer (Company A). Amidst all the excitement, taxes are the last thing on Vandana's mind. But there are complex tax issues facing her, and others in similar situations.

Salary received from two employers in same financial year

Vandana joined Company B on 1 September, in the middle of financial year 201617. At Company A, she earned `65,000 a month. A hike to `1.30 lakh a month puts her in the highest tax bracket of 30.90%.

Company A would have calculated the tax to be deducted at source (TDS) based on her entire taxable income for 2016-17.It would have taken into account her proposed investments under Section 80C.After arriving at the tax liability for the year, it would have determined the TDS to be deducted each month. Company B, on the other hand, would typically take cognisance of Vandana's income from her joining date (for the seven month period from 1 September 2016 to 31 March 2017). It could also consider the deduction under Section 80C, which the previous employer has already factored in.

If Company B does not consider her past records, the TDS deducted by her new employer will be much lower than what her tax liability ought to be, taking into consideration her entire taxable income for the year. Vandana will have to bear the additional tax liability (as TDS is lower than her liability) plus penal interest (see chart).

To avoid TDS shortfall

To avoid any shortfall in her tax obligations, (for which she will have to pay penal interest), Vandana ought to inform Company B of her previous income and exemptions considered by Company A, plus the tax already deducted at source.

Vandana should ideally furnish Form 12B to Company B, which would contain details of previous salary, taxable perquisites, Section 80C deduction considered and the tax already deducted.

“Form 12B is not mandatory, but it is a better option. The other alternative is for the employee to calculate her final tax liability and meet the gap in shortfall of TDS by paying advance taxes,“ says Gautam Nayak, Tax Partner at chartered accountancy firm CNK Associates.

Adds Amarpal S. Chadha, Partner, People Advisory Service at EY, “If the employee does not disclose salary received from the former employer to new employer, any shortfall in TDS will need to be paid by the employee from his own pocket with interest, if applicable.“

Advance tax & penal interest

If Company B is not given the requisite details, advance taxes can be paid by Vandana to meet the TDS shortfall. Advance tax is payable in four instalments.Up to 15% of the estimated tax must be paid by 15 June, up to 45% by 15 September, up to 75% by 15 December and up to 100% by 15 March. If not, a 1% interest per month is charged on the shortfall, under Section 234C of the Income Tax (I-T) Act, until the next instalment, which falls due after three months.

Vandana's tax liability, after all the TDS cuts is `72,530. As the first instalment of advance tax is due on 15 September, she could pay `32,640 (45%) by this date. Else she has to pay interest at 1% for three months, until 15 December.The interest works out to `980. If the advance tax continue to remain unpaid, the interest component keeps cascading. Further, she is liable to pay interest of `326 in any case on the shortfall of `10,880 in respect of the first instalment of 15%, which was due on 15 June, even though she changed jobs after that.

Irrespective of whether advance tax has been paid or not, if the total advance tax paid (including TDS) is less than 90% of the tax liability at the end of the financial year (March 2017), then the interest under Section 234B is payable. This is calculated at the rate of 1% a month and is payable on the shortfall from 1 April 2017 till the month in which she files returns and makes the payment. “Non-payment of advance tax attracts interest of 1% a month, which is not deductible for tax purposes. The effective rate of interest is therefore higher, depending on the slab you are in. It is advisable to discharge your advance tax liability in time,“ adds Nayak.

Repayment of sign-up bonus

Vandana was selected during a campus placement. Company A paid her a handsome sign-up bonus of `5 lakh on the understanding that she would work for the company for three years. As she is quitting within two years, she has to return that amount. Though Company B is compensating her, the amount received from Company B will be considered her salary income and tax will be deducted at source.

Now since the `5 lakh was part of Vandana's taxable income during the year in which she received it and she is now being forced to repay it, will she be able to deduct it from her income for 2016-17? “The Income Tax Act doesn't explicitly provide for deduction from income on repayment of sign-up bonus to previous employer,“ says Chadha.The Income Tax Appellate Tribunal in a recent order also held likewise.

Salary in lieu of notice period

Employment contracts typically provide for payment of salary in lieu of the notice period, payable by the company if services are being terminated, or by the resigning employee.

As Company B requires Vandana to join by 1 September, she will not be able to serve the entire two month notice period and will have to cough a month's salary as payment in lieu of notice period from her own pocket.

She will not be allowed any deduction from her taxable income for such repayment. If she is compensated by an equivalent amount by her new employer, it will be part of her salary vis-à-vis the new employer, who will deduct TDS.

If you have worked for 5 years