Indian money in HSBC, Switzerland

(→The Indian Express' exclusive report) |

(→Diamonds are for Swiss banks) |

||

| Line 12: | Line 12: | ||

[[Category:Crime|S]] | [[Category:Crime|S]] | ||

[[Category:Pakistan|S]] | [[Category:Pakistan|S]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

=14 offshore accounts linked to RIL: ''The Indian Express'' = | =14 offshore accounts linked to RIL: ''The Indian Express'' = | ||

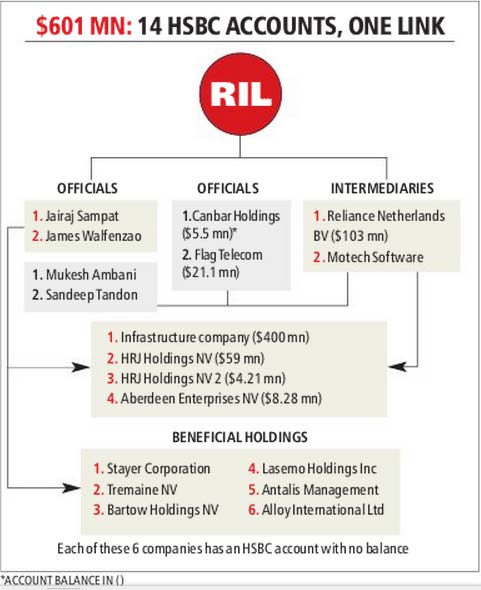

(Below is a summary. A graphic from the report {$601m. in 14 accounts linked to RIL} appears elsewhere on this page. The full report can be read at [http://indianexpress.com/article/india/india-others/600-mn-trail-to-ril-in-maze-of-14-accounts/ ''The Indian Express'' ]) | (Below is a summary. A graphic from the report {$601m. in 14 accounts linked to RIL} appears elsewhere on this page. The full report can be read at [http://indianexpress.com/article/india/india-others/600-mn-trail-to-ril-in-maze-of-14-accounts/ ''The Indian Express'' ]) | ||

Revision as of 19:27, 11 February 2019

When news broke that Mahima Chaudhry—and not some Chopra, Khan or Kanth saar—was Filmistan’s sole representative on Swiss Leaks' list of Indians with accounts with the Swiss HSBC, Filmistan was amused rather than impressed, envious or, heaven forbid, sanctimonious.

‘Mahima Swiss’ jokes went viral. Among them were:

Mahima Chaudhary has black money??? How much was she paid for Pardes that it has lasted 17 years [almost 18 years, actually] and she still has some stashed away! and

Now for sure these Swiss accounts have no minimum balance criteria. RT @Truly Monica: Mahima Chaudhary has a Swiss bank account!!!

These cuts were slightly unkind, because Mahima’s A+ debut with Pardes (1997) was followed by more than ten A list film roles in a career that did reasonably well till 2002. (Her complete Filmography can be seen at Mahima Chaudhary)

But, yes, the point of all these jokes remains: Mahima Chaudhary has a Swiss bank account???

This page is a summary of a three-month-long global project (2014-15) |

Contents |

14 offshore accounts linked to RIL: The Indian Express

(Below is a summary. A graphic from the report {$601m. in 14 accounts linked to RIL} appears elsewhere on this page. The full report can be read at The Indian Express )

$600-mn trail to RIL in maze of 14 accounts

Appu Esthose Suresh | The Indian Express February 10, 2015

Documents related to the HSBC account holders lend an insight into the $601-million (Rs 3,726 crore) held through companies, officials and associates of Mukesh Ambani-led Reliance Industries Ltd (RIL).

While there is no clarity on the ultimate beneficial owners, an analysis of 14 HSBC bank accounts, which in turn are held by 14 offshore entities, show that these accounts are linked to RIL. These companies are interlinked through inter-corporate ownership and common officials.

A spokesperson for RIL said: “Neither RIL nor Mr Mukesh Ambani have or had any illegitimate bank accounts anywhere in the world.”

Bank data shows that a majority of these entities opened HSBC accounts a few months before the division of the erstwhile Reliance empire between the two brothers — Mukesh Ambani and Anil Ambani — on June 18, 2005.

The Walfenzaos of Monaco

The first in the series of accounts that can be clustered together under Mukesh Ambani-led RIL was opened on February 2, 2004 — Infrastructure Company Ltd. The Monaco-registered company had the largest account: $400 million (Rs 2,520 crore).

The three officials linked to Infrastructure Company Ltd are Chimanlal Jivandas Damani, James and Cathy Walfenzao.

James Walfenzao is a fiduciary management expert which specialises in setting up trusts and tax-exempt vehicles in offshore jurisdictions.

On February 2, 2004, half-an-hour after Infrastructure Company Ltd opened an account with HSBC, another account was opened: Motech Software Pvt Ltd, then headed by [Reliance’s chief liaison officer] Sandeep Tandon [see under ‘T’].

A second set of companies, which do not show any balance for 2006-07, are in turn beneficial holders of the previous set of companies which hold balance amounts. Stayer, Tremaine, Bartow are registered in the Netherlands, while Alloy and Antalis are registered in the British Virgin Islands and Lasemo in St Lucia.

The ultimate beneficial owners of these companies are not known but, according to documents maintained by HSBC, two names are common to these companies — James Walfenzao and Jairaj Sampat.

Jairaj Sampat is Managing Director of Reliance Global BV based out of the Netherlands.

In Canbar Holdings and Flag Telecom, senior RIL officials were listed as officials. In case of Canbar, where the beneficial owners are Mukesh Ambani and Anil Ambani, Sandeep Tandon was listed as an official. Similarly, in Flag Telecom, PMS Prasad (now with RIL), Sandeep Tandon and Parminder Dost were listed as officials while Anil Ambani and Mukesh Ambani were listed as beneficial owners.

Swiss HSBC’s Top 100 Indian account holders

#swissleaks: Top 100 HSBC account holders with Indian addresses

Express News Service | February 9, 2015 For the full report please click this link.

Here is the full #swissleaks list

1. Uttamchandani Gopaldas Wadhumal/Family $54,573,535

2. Mehta Rihan Harshad/ Family $53,631,788

3. Tharani Mahesh Thikamdas $40,615,288

4. Gupta Shravan $32,398,796

5. Kothari Bhadrashyam Harshad/ Family $31,555,874

6. Shaunak Jitendra Parikh/Family $30,137,608

7. Tandon Sandeep $26,838,488

8. Ambani Mukesh Dhirubhai $26,654,991

9. Ambani Anil $26,654,991

10. Krishna Bhagwan Ramchand $23,853,117

11. Dost Parimal Pal Singh $21,110,345

12. Goyal Naresh Kumar $18,716,015

13. Mehta Ravichandra Vadilal $18,250,253

14. Patel Kanubhai Ashabhai $16,059,129

15. Sachiv Rajesh Mehta $12,341,074

16. Anurag Dalmia/Family $9,609,371

17. Ravichandran Mehta Balkrishna $8,757,113

18. Kumudchandra Shantilal Mehta/Family $8,450,703

19. Patel Rajeshkumar Govindlal/Family $6,908,661

20. Hemant Dhiraj $6,237,932

21. Anup Mehta/Family $5,976,998

22. Tandon Annu $5,728,042

23. Sidharth Burman $5,401,579

24. Salgoacar Dipti Dattaraj $5,178,668

25. Dabriwala Surbhit/Family $5,000,000

26. Vaghela Balwantkumar Dullabhai $4,405,465

27. Dilipkumar Dalpatlal Mehta $4,255,230

28. Kuldip & Gurbachan Singh Dhingra $4,144,256

29. Lakhani Jamna Thakurdas $4,123,673

30. Rajiv Gupta $4,113,705

31. Sawhney Arminder Singh $3,965,881

32. Israni Loveen Gurumukhdas $3,824,104

33. Natvarlal Bhimbhai Desai/Family $3,746,078

34. Tulsiani Jawaharlal Gulabrai/Family $3,730,145

35. Gupta Rajiv $3,545,416

36. Jaiswal Ladli Pershad $3,496,063

37. Carvahlo Aloysius Joseph $3,313,788

38. Pradip Burman $3,199,875

39. Tulsiani Sham Gulabrai/Family $3,066,991

40. Vithaldas Janaki Kishore $3,031,220

41. Kumar Venu Raman $3,063,064

42. Thakkar Dilip Jayantilal $2,989,534

43. Tulsiani Partab Gulabrai $2,901,435

44. Adenwalla Dhun Dorab/Family $2,863,271

45. Burman Pradip $2,831,238

46. Tulsiani Naraindas Gulbari $2,818,300

47. Dasot Praveen $2,801,634

48. Patel Lalitaben Chimanbhai $2,741,488

49. Chatha Joginder Singh $2,732,838

50. Shyam Prasad Murarka $2,546,516

51. Dhurvendra Prakash Goel $2,488,239

52. Nanda Suresh/Family $2,303,713

53. Gidwani Anan Nelum $2,228,582

54. Pratap Chhaganlal Joisher/Family $2,209,346

55. Mehta Devaunshi Anoop $2,136,830

56. Shaw Mohammad Haseeb/Family $2,133,581

57. Ahmed Rizwan Syed/Family $2,125,644

58. Vinita Sunil Chugani $2,085,158

59. Sawney Bhushan Lal $2,043,474

60. Parminder Singh Kalra $2,042,180

61. Chowdhury Ratan Singh $1,987,504

62. Dhirani Vikram $1,915,148

63. Nanda Sardarilal Mathradas $1,824,849

64. Wilkinson Martha $1,824,717

65. Sahney Devinder Singh $1,763,835

66. Taneja Dharam Vir $1,748,541

67. Dhindsa Komal $1,597,425

68. Chatwani Trikamji/Family $1,594,114

69. Pittie Madhusudanlal Narayanlal $1,462,594

70. Bhardwaj Anil $1,435,781

71. Dipendu Bapalal Shah $1,362,441

72. Bhartia Alok $1,349,044

73. Singh Shubha Sunil $1,348,983

74. Dansinghani Shewak Jivatsing/Family $1,267,743

75. Kumar Davinder/Family $1,231,088

76. Jasdanwalla Arshad Husain Adamsi/Family $1,229,723

77. Jhaveri Harish Shantichand/ Family $1,191,144

78. Singhvi Ganpat $1,194,388

79. Milan Mehta/Family $1,153,957

80. Tuksiani Ashok Gulabrai $1,140,890

81. Modi Krishan Kumar $1,139,967

82. Garodia Bishwanath $1,071,858

83. Jagasia Anuradha Anil $1,039,648

84. Vithaldas Kishore/Family $1,020,028

85. Chandrashekar Kadirvelu Babu/Family $1,007,357

86. Galani Dipak Varandma/Family $940,191

87. Sawhney Arun Ravindranath $914,698

88. Merwah Chander Mohan $909,309

89. Patel Atul Thakorbhai $813,295

90. Nathani Kumar Saturgun $751,747

91. Sathe Subhash/Family $749,370

92. Shah Anil Pannalal/Family $742,187

93. Madhiok Romesh $719,559

94. Bhaven Prematlal Jhaveri $717,654

95. Kinariwala Kalpesh Harshad $713,340

96. Gokal Bhavesh Ravindra $699,184

97. Lamba Sanjiv $644,923

98. Shobha Bharat Kumar Asher $641,387

99. Kathoria Rakesh Kumar $589,753

100. Bhansali Alkesh Pratap Chandra $579,609

Statistics

2015

The Times of India, Nov 03 2015

Govt lacks seriousness on stashed cash: Whistleblower

Man who leaked HSBC list says a lot of info hasn't been used

Claiming that “millions of crores worth of illicit funds“ were flowing out of India, HSBC whistleblower Hervé Falciani said he was willing to cooperate with investigative agencies on tracing black money, but felt “disappointed“ by the response so far.

Falciani is facing charges in Switzerland of leaking bank account details from HSBC's Geneva branch -a list that reached the French government and was subsequently shared with New Delhi because it listed accounts of Indians who had stashed funds abroad.

“We are not here to talk about merely figures, but about possible solutions,“ Falciani said, adding that there is a “lot of information that has not been used by the Indian authorities“.

Falciani said he would require protection if he were to assist the authorities in India. Falciani has in recent months written to India twice offering his assistance in the black money probe. In April, he wrote to PM Modi, while in August he wrote to special investigation team (SIT) chief Justice M B Shah (Retd). He, however, said he was disappointed with the response and “lack of seriousness of the Indian government“.

Earlier in 2015, he had hinted that he possessed addi tional information on the lines of the list of 628 Indian entities holding accounts with the bank in Geneva. In the letter dated August 21, 2015, Falciani said,“There is an urgent need to focus... on unravelling the role of financial intermediaries. The investigation must not be restricted to interrogating clients just to find out how much they have in accounts but also how they proceeded. If this is not done, status quo will prevail as far as the black money problem in India is concerned.“ In his letter, Falciani had apparently said that the then SIT adviser K V Chowdary had met him in Paris in December, 2014, with regard to seeking assistance.

2016: Indian money in Swiss banks at Rs 4,500 crore

Indians' money in Swiss banks hit record low at Rs 4,500 crore , Jun 29, 2017: The Times of India

HIGHLIGHTS

The total money of Indians fell by 45% during 2016

The issue of black money has been a matter of big debate in India and Switzerland.

Swiss banks have also said Indians have "few deposits" in Swiss banks compared to other global financial hubs

ZURICH/NEW DELHI: Money parked by Indians in Switzerland's banks nearly halved to 676 Swiss francs (about Rs 4,500 crore) in 2016 to hit a record low amid a continuing clampdown on the suspected black money stashed behind their famed secrecy walls.

In comparison, the total funds held by all foreign clients of Swiss banks somewhat rose to CHF 1.42 trillion or about Rs 96 lakh crore (from CHF 1.41 trillion a year ago).

The total funds held by Indians directly with Swiss banks stood at CHF 664.8 million at the end of 2016, while the same held through fiduciaries was nearly $11 million, as per the latest data published today by the country's central banking authority SNB (Swiss National Bank).

The total money of Indians fell by 45 per cent during 2016 to CHF 675.75 million, marking the biggest ever yearly decline in such funds.

This included nearly CHF 377 million in form of customer deposits, about CHF 98 million owed to Indians through other banks and CHF 190 million in form of other 'liabilities'.

The figures fell sharply across all categories last year, the SNB data showed.

This is the lowest amount of funds held by Indians in the Swiss banks ever since the Alpine nation began making the data public in 1987 and marks the third straight year of decline.

The funds held through fiduciaries or wealth managers alone used to be in billions till 2007 but has been falling amid fears of regulatory crackdown.

The funds held by Indians with Swiss banks stood at a record high of CHF 6.5 billion (Rs 23,000 crore) at 2006-end, but has now come down to nearly one-tenth of that level in about a decade.

The quantum of these funds has been falling since then, except for in 2011 and in 2013 when Indians' money had risen by over 12 per cent and 42 per cent, respectively.

As per the available data since 1987, the earlier lowest ever figure was recorded in 1995 at CHF 723 million.

The latest data from Zurich-based SNB comes ahead of a new framework for automatic exchange of information between Switzerland and India to help check the black money menace.

While Switzerland has already begun sharing foreign client details on evidence of wrongdoing provided by India and some other countries, it has agreed to further expand its cooperation on India's fight against black money with a new pact for automatic information exchange from next year.

There have been several rounds of discussions between Indian and Swiss government officials on the new framework and also for expediting the pending information requests about suspected illicit accounts of Indians in Swiss banks.

The funds, described by SNB as 'liabilities' of Swiss banks or 'amounts due to' their clients, are the official figures disclosed by the Swiss authorities and do not indicate to the quantum of the much-debated alleged black money held by Indians in the safe havens of Switzerland.

SNB's official figures also do not include the money that Indians, NRIs or others might have in Swiss banks in the names of entities from different countries.

There is a view that the Indians alleged to have parked their illicit money in Swiss banks in the past may have shifted the funds to other locations after a global clampdown began on the mighty banking secrecy practices in Switzerland.

Swiss banks have also said Indians have "few deposits" in Swiss banks compared to other global financial hubs like Singapore and Hong Kong amid stepped-up efforts to check the black money menace.

On directions of the Supreme Court, India has also constituted a Special Investigation Team (SIT) to probe cases of alleged black money of Indians, including funds stashed abroad in places like Switzerland.

A number of strategies have been deployed by the government to combat the stash-funds menace, in both overseas and domestic domain, which include enactment of a new law to tackle stashing of black money abroad, amendments in the anti-money laundering Act and compliance windows for people to declare their hidden assets.

The Income Tax department had also detected over Rs 13,000 crore black money post investigations on global leaks about Indians stashing funds abroad and has launched prosecution against hundreds of entities, including those with accounts in Geneva branch of HSBC.

The taxmen had detected Rs 8,186 crore of undisclosed income against those whose names figured in the HSBC list that was obtained by India in 2011 through the French government.

Out of the total 628 cases under this list, the department got "actionable" evidence in 415 cases and assessments have been completed in 398 cases.

The Enforcement Directorate (ED) has also begun taking action, including seizure of properties, of those named in the HSBC list under a new clause in the the Foreign Exchange Management Act (FEMA).

Earlier this month, Switzerland ratified automatic exchange of financial account information with India and 40 other jurisdictions to facilitate immediate sharing of details about suspected black money even as it sought strict adherence to confidentiality and data security.

Adopting the dispatch on introduction of the AEOI, a global convention for automatic information exchange on tax matters, the Swiss Federal Council said on June 16 that the implementation is planned for 2018 and the first set of data should be exchanged in 2019.

The council, which is the top governing body of the European nation, will soon notify the Indian government about the exact date from which the automatic exchange would begin.

As per the draft notification approved by the council, the decision is not subject to any referendum -- which means there should be no further procedural delay in its implementation.

The issue of black money has been a matter of big debate in India and Switzerland has been long perceived as one of the safest havens for the illicit wealth allegedly stashed abroad by Indians.

Earlier in 2015, the money held by Indians in Swiss banks had fallen by nearly one-third to CHF 1,217.6 million (over Rs 8,000 crore).

At the end of 2015, the total funds held in Swiss banks by Indians directly stood at CHF 1,206.71 million (down from CHF 1,776 million a year ago), while the money held through 'fiduciaries' or wealth managers was down at CHF 10.89 million (from CHF 37.92 million at 2014-end). The total stood at CHF 1,814 million at the end of 2014.

The total "amounts due to customers' savings and deposit accounts" fell from CHF 425.8 million at 2015-end to CHF 376.97 million, while the money held through other banks declined from CHF 270.4 million to CHF 97.8 million (after more than doubling during the previous year).

The 'other liabilities' of Swiss banks towards Indian clients, which include funds held through securities etc, declined from CHF 510.4 million to CHF 190 million. As per the SNB data, the total money held in Swiss banks by all their foreign clients from across the world however rose from CHF 1.41 trillion (USD 1.45 trillion or about Rs 98 lakh crore) to CHF 1.42 trillion ($1.48 trillion) in 2016.

The total assets of Swiss banks in India fell from CHF 4.8 billion in 2015 to CHF 3.9 billion in 2016. This does not include any tangible assets like real estate and properties, while the amount due to Swiss banks from their customers stood at about CHF 407 million (down from CHF 570 million in 2015).

See also

Indian money in foreign banks <> Indian money in HSBC, Switzerland<> Indian money in Liechtenstein banks <> Sri Lankan money in Swiss banks<> Rich List: India <>