Indian money in offshore entities: The Panama Papers

The International Consortium of Investigative Journalists and, |

Contents |

A: 2016

The Suddeutsche Zeitung, ICIJ and The Indian Express investigation

The treasure trove of records was accessed by Munich-based newspaper Suddeutsche Zeitung which a year ago collaborated with the International Consortium of Investigative Journalists (ICIJ) and, in turn, with over 100 media organisations to investigate its contents.

In July 2015, The Indian Express signed an agreement with ICIJ for being the Indian partner for The Panama Papers project. Since then, a team of 25 reporters, led by the newspaper’s investigative team, joined 375 journalists in 76 countries.

The Indian Express reporters did field visits across the country to check on addresses mentioned in these records.

The Indian Express asked each one named whether they had informed RBI or the Income Tax department about these companies.

The results of that investigation — that begin in a series starting today — tell a story that’s as much about draconian foreign investment laws as it’s about glaring gaps in the regulatory apparatus.

Clearly, it covers the period when India began signing tax agreements with other countries to accelerate cooperation on undisclosed and untaxed assets. And the years when tracking black money has become the centre of political and economic discourse.

The worldwide expose also comes just six months after the 90-day “compliance scheme” for declarations of offshore assets and accounts ended on September 30, 2015 and brought just Rs 3,770 crore from 637 declarants.

The window now closed, strict penalties and a jail term have been announced for anyone found to have undisclosed and undeclared foreign assets and accounts.

The Panama Papers is the third successive collaborative project done by The Indian Express with the ICIJ on offshore investments.

The first was in 2013, titled “Offshore Leaks.” There were 612 Indians on that list which included two politicians who were then Members of Parliament (including Vijay Mallaya) and several top industrialists.

The revelations led to several persons getting tax notices and subsequently being prosecuted for non-declaration of the offshore companies.

The second ICIJ-The Indian Express collaboration, under the aegis of the French newspaper, Le Monde, was published in February 2015. It was called “Swiss Leaks” and contained data of HSBC (Geneva) account holders — balances dating to 2006-07 — among whom there were 1,195 Indian account holders. (See Indian money in HSBC, Switzerland )

Significantly, this was almost double of the 628 names given by the French authorities to the Indian government in 2011 and the scope of the HSBC probe was expanded following the expose.

Indians in the names released by Panama Papers

See graphic

The main findings

[In 2015], it was Swiss Leaks, a global list with over 1,100 Indians with secret bank accounts in HSBC Geneva, which shaped the debate over black money parked overseas. (See Indian money in HSBC, Switzerland and other similar Indpaedia pages.)

Now come The Panama Papers.

- Panama Papers: 424 names in probe, 49 are by Enforcement Directorate

- Panama Papers: 424 under probe, India gets data on 165 cases with links to offshore firms

- Panama papers: SC to hear plea seeking court monitored CBI investigation

- Panama Papers: Lahore HC rejects plea seeking PM Nawaz Sharif's removal

- Panama Papers: 415 Indians under scanner as probe widens

More than 11 million documents from the secret files of Mossack Fonseca, a law firm headquartered in tax haven Panama, known for its factory-like production of offshore companies for its worldwide clientele of the well-heeled.

These records reveal a list of individuals who have paid the firm — and bought the benefits of the secretive, lax regulatory system in which it operates — to set up offshore entities in tax havens around the world.

Over 500 Indians figure on the firm’s list of offshore companies, foundations and trusts. There are also 234 Indian passports (handed over by clients as part of the incorporation process), an eight-month-long investigation of over 36,000 files by The Indian Express has revealed.

Of these, The Indian Express has checked the authenticity of over 300 addresses.

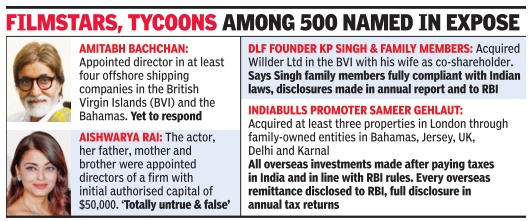

From film stars Amitabh Bachchan and Aishwarya Rai Bachchan to corporates including DLF owner K P Singh and nine members of his family, and the promoters of Apollo Tyres and Indiabulls to Gautam Adani’s elder brother Vinod Adani. Two politicians who figure on the list are Shishir Bajoria from West Bengal and Anurag Kejriwal, the former chief of the Delhi unit of Loksatta Party.

From Mumbai ganglord the late Iqbal Mirchi, the list includes scores of businessmen with addresses in nondescript neighbourhoods in Panchkula, Dehradun, Vadodara and Mandsaur. Addresses of individuals, in many cases, The Indian Express found out, led to physical locations, but with no trace of the individual.

Or, as in one case, belonged to a tenement in a chawl in Mumbai.

Not just individuals, a close scrutiny of The Panama Papers by The Indian Express also reveals details of hitherto unknown deals, in some cases involving the government, too.

These include cricket franchise deals and, in several cases, linkages to those who have previously been under CBI or Income Tax scrutiny.

As per RBI norms, no Indian citizen could float an overseas entity before 2003 — in 2004, for the first time individuals were allowed to remit funds of up to $25,000 a year under the Liberalised Remittance Scheme, and this limit stands at $250,000 a year now.

But while RBI let individuals buy shares under LRS, it never allowed them to set up companies abroad, having clarified it through an FAQ mid-way in September 2010.

In most of the cases in The Panama Papers, companies were set up long before the rules were changed and the purpose, experts said, was to park foreign exchange in a tax haven. It was only in August 2013 that individuals were allowed to set up subsidiaries or invest in joint ventures under the Overseas Direct Investment window.

The Panama Papers come at a time when the Special Investigating Team (SIT) on black money headed by former Supreme Court Judge M B Shah is finalising its new action-taken report.

The formation of the SIT was the very first decision taken by the Narendra Modi Government in May 2014.

2018/ Panama Papers: The Aftermath

Panama Papers - The Aftermath: The fresh investigation of Indian individuals and entities reveals how Mossack Fonseca, which serviced their accounts, scrambled to respond to an unprecedented global crackdown. Significantly, it also confirms the existence of several customers who had hitherto denied any links. And lifts the veil on the financial trail of new clients.

Two years after the Panama Papers blew the lid off how the global elite, including over 500 Indians, park and move their money in and out of secret tax havens, the Panama Papers are back — to reveal telling new details. More than 1.2 million fresh documents, at least 12,000 of them linked to Indians, have been investigated by The Indian Express, in collaboration with the International Consortium of Investigative Journalists and German newspaper Suddeutsche Zeitung. Just as was done with the earlier set of over 11.5 million documents in 2016.

This fresh investigation of Indian individuals and entities who figure in this new set of papers reveals how Panamanian law firm Mossack Fonseca, which serviced their accounts, scrambled to respond to an unprecedented global crackdown. Significantly, confirming, in the process, the existence of several customers who had hitherto denied any links. And lifting the veil on the financial trail of new clients.

Clearly, this new set — Panama Papers: The Aftermath — which The Indian Express has investigated, , will provide further teeth to the inquiries and audits ordered by the government and its investigative agencies.

This second lot of the Panama Papers highlights details of offshore companies incorporated by a clutch of Indian businessmen who did not figure in the 2016 leak. These include Ajay Bijli, owner of PVR cinemas, and members of his family; Kavin Bharti Mittal, CEO of Hike Messenger and son of Sunil Mittal; and, Jalaj Ashwin Dani, son of Asian Paints promoter Ashwin Dani.

The new papers also show that several companies set up by Indians were, first, sent notices by Mossack Fonseca (several by November 2016) to produce missing information and these letters mentioned the name/s of the Beneficial Owner (BO), wherever available, or demanded that the name be immediately disclosed.

In the next stage, Mossack Fonseca served 90-day notices to clients informing them that the firm would resign as Registered Agent because the companies failed to meet legal due diligence requirements.

Those whose links to offshore entities have been confirmed by Mossack Fonseca in a series of messages include Shiv Khemka, Amitabh Bachchan, Jehangir Sorabjee, K P Singh of the DLF Group and his immediate family, Anurag Kejriwal, Navin Mehra of Mehrasons Jewellers and Hajra Iqbal Memon and his family.

An illustrative case is how, shortly after the 2016 expose, Mossack Fonseca, in its communications, named Amitabh Bachchan as director of two companies Lady Shipping Ltd and Treasure Shipping Ltd and, subsequently, served the 90-day notice to him via UK-based Minerva Trust — the administrator for these companies — addressing him as director of a third company, Sea Bulk Shipping Company Ltd. The notice conveyed Mossack Fonseca’s intent to resign as the company’s agent saying that Sea Bulk Shipping did not fulfil “our due diligence requirements”.

Bachchan, who is under official scrutiny in connection with the Panama Papers, has denied any link to these companies and did not respond to an email sent by The Indian Express earlier this week.

Panama Papers: New records reveal fresh financial secrets of Indian clientsThousands of new documents connected to Mossack Fonseca’s Indian clients also reveal a disparate pattern — while some Indian owners of offshore companies rushed to liquidate their firms, others asked Mossack Fonseca to continue as their agent. Some even increased their holdings — like Lokesh Sharma, owner of British Virgin Islands-based Mardi Gras Holdings, who increased the authorised share capital 30 times in February 2017.

While P R S Oberoi resigned as director of J&W Inc, a Bahamas company, in May 2016, Shishir Bajoria, who claimed his name in Mossack Fonseca records was a clerical mistake, contacted Mossack Fonseca through an intermediary to change the beneficial ownership of Haptic (BVI) Ltd which was liquidated in May 2016…

Particularly revealing is a May 9, 2016 email received by Mossack Fonseca from P P Shah and Associates, a Mumbai-based accountancy firm, in connection with offshore entity Whitefield Global Investments Ltd, whose beneficiaries are Baroda-based Chirayu Amin and members of his family.

It couldn’t be more direct: “Huge turbulence is started in the financial world including India. We need to respond to the Indian authorities asap as they have initiated inquiries based on the leaked report and documents which we understand are by and large correct information and documents…”

The very day of the Panama Papers expose, the Indian government had announced a probe by a Multi Agency Group (MAG).

Panama Papers: Two years on

Two years on, the information from the Central Board of Direct Taxes (CBDT) — which heads the probe unit — is that in all, 426 Indians named in the Panama Papers have been put under the scanner and, until June 2018, Rs 1,088 crore ($162.4 million) of undisclosed income has been detected.

The tax authorities continue to take action against those named in the Panama Papers and until November 2017, searches and surveys have been conducted in 58 cases. Prosecutions against 16 Indians named in the Panama Papers have been filed in courts.

As recently as June 13, three Delhi-based owners of entities were subject of early-morning simultaneous searches. They are Devesh Bahl and Rajeev Vaid (BVI entity: Pythhos Technology); Mohit Jain (BVI entity: Om Metals SPRL Limited) and Gurpal Singh Khurana (BVI entity: Top India Limited).

See also

Indian money in offshore entities: The Panama Papers

Indian money in offshore entities: The ‘Paradise Papers’

Indian money in HSBC, Switzerland

Indian money in Liechtenstein banks