Insurance (life): India

(→2017: Most plaints pertain to mis-selling) |

(→Private life insurers, 2010-14) |

||

| Line 168: | Line 168: | ||

=Private life insurers, 2010-14= | =Private life insurers, 2010-14= | ||

| + | [[File: The distribution mix of new business obtained by private life insurers, 2010-14.jpg| The distribution mix of new business obtained by private life insurers, 2010-14; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=18_04_2016_017_028_009&type=P&artUrl=IRDAI-to-insurers-Dont-depend-on-banks-to-18042016017028&eid=31808 ''The Times of India''], April 18, 2016|frame|500px]] | ||

| + | |||

'''See graphic''': | '''See graphic''': | ||

''The distribution mix of new business obtained by private life insurers, 2010-14'' | ''The distribution mix of new business obtained by private life insurers, 2010-14'' | ||

| − | + | =Premium, year-wise= | |

| − | + | ==2018: Premium up 10% to record ₹4.6L cr = | |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F01%2F16&entity=Ar02416&sk=6C8715BC&mode=text Rachel Chitra, Life premium up 10% to record ₹4.6L cr in FY18, January 16, 2019: ''The Times of India''] | ||

| + | |||

| + | |||

| + | ''Insurance Penetration Increases To 2.8%'' | ||

| + | |||

| + | India’s life insurance industry hit a record high by collecting Rs 4.6 lakh crore in premium for 2017-18, which is an increase of 10% over the previous financial year. Life insurance density — calculated by dividing the total insurance premium by the population — increased to $55 in 2017-18 from $46.5 in 2016-17, said IRDAI in its annual report. Life insurance penetration (premium as a percentage of GDP) in the country increased to 2.8% from 2.5% over the same period. | ||

| + | |||

| + | The life business expansion has been fuelled by the 23 private sector insurers, which saw growth accelerate to 19.2% last fiscal from 17.4% in 2016-17. The government-owned Life Insurance Corporation (LIC), however, saw growth dip to 5.9% from 12.8%. This resulted in LIC’s marketshare come down to 69.4% from 71.8%, while private players increased their share of the pie to 30.6% from 28.2%. | ||

| + | |||

| + | LIC’s total premium for the year was Rs 3.2 lakh crore versus Rs 1.4 lakh crore for private companies. LIC, however, grew its marketshare in terms of number of policies sold — implying that it sold more affordable products than private companies. Of the nearly 282 lakh new individual policies sold in FY18, over 213 lakh policies (almost 76%) were issued by LIC and just under 69 lakh (over 24%) by private insurers. LIC showed better performance in persistency and in single-premium policies sales. Its income from renewal premium for 2017-18 was Rs 1.8 lakh crore. | ||

| + | |||

| + | When it came to new business premium, LIC collected Rs 1.3 lakh crore, compared to private players booking Rs 59,482 crore — mostly on the back of selling a large number of single-premium policies. “Further bifurcation of new business premium indicates singlepremium products continue to play a major role for LIC as they contributed 33.5% of LIC’s total premium income (versus 32.7% in the previous year).” | ||

=See also= | =See also= | ||

Revision as of 10:16, 18 January 2019

This article has been sourced from an authoritative, official readers who wish to update or add further details can do so on a ‘Part II’ of this article. |

Contents |

Complaints

2017: Most plaints pertain to mis-selling

Mayur Shetty, November 14, 2018: The Times of India

In life segment,

In non-life segment- 2017

From: Mayur Shetty, November 14, 2018: The Times of India

A bulk of the complaints received by the insurance ombudsman in the life sector are in respect of mis-selling of policies by intermediaries. In non-life, however, rejections of health claims on grounds of a pre-existing ailment is the primary cause of dispute.

According to the annual report of the Executive Council of Insurers (ECOI), which facilitates the institution of Insurance Ombudsman in India, mis-selling is done by forging the proposer’s signature on forms or by selling longterm plans even though the proposer does not have the capacity to maintain the policy beyond the initial payment.

While the regulator IRDAI has made it mandatory for insurers to follow up with verification calls, the report states that the intermediaries (brokers and agents) have been tutoring customers to accept all terms when verification calls are received.

According to secretary general M M L Verma, on an all-India basis, the complaints are almost equally divided between life insurance and non-life insurance.

However, complaints within non-life insurance were overwhelmingly in respect of health insurance.

“After the amendment to the rules last year, the ombudsman can pass orders against insurance companies as well as intermediaries. This means that we can issue an order against banks, but we hold the insurance company responsible because the agents are representatives of the company,” said Milind Kharat, insurance ombudsman, Mumbai and Goa.

According to Kharat, the ombudsman office is a very effective forum for redressing customer complaints as there are no fees and no requirement of a lawyer and customers can register their complaint via email. He said that the awards for mis-selling were limited to refund of premium as the ombudsman did not have the power to impose penalties.

The other limitation is that the maximum award that an Ombudsman can issue is for Rs 30 lakh.

Entitlement to claim: Rules/ court rulings

Death after refusing treatment

The Times of India, May 24 2016

Ajay Sura

The family of a terminally ill person who decides to stop treatment against medical advice and dies cannot be denied insurance claim, the Punjab and Haryana high court has ruled.

The high court has also clarified that a patient's desire not to be treated is an issue of `patient autonomy' and `embracing dignity in death'.

It is an important development since many insurance companies tend to use Leave Against Medical Advice (LAMA) as an excuse to deny the family of the deceased their claims, say medical experts.

The judgment comes in a case where the insurance company challenged the order of a claims tribunal to pay Rs 35.46 lakh to the family of a deceased who was admitted to hospital after suffering severe head injury in a road accident but decided to leave against doctors' advice when they did not see much chance of recovery . The insurance company claimed it was not liable for the damages because the deceased had left the hospital against medical advice. The high court rejected their plea and ruled in favour of the family of the deceased.

“Whether the patient shall be allowed to die by withdrawal of life support is quite different from a patient expressing desire not to be treated. In the former, we are broaching issue of passive euthanasia and in the latter, it is an issue of patient autonomy ,“ the bench of Justice K Kannan said in its order that could come as major relief to many such families who are burdened with huge medical costs. Justice Kannan, in his or der delivered last week, took the subject to a higher level stating that patient autonomy in the manner of treatment is a facet of human right and it cannot be ever contended in court that the patient ought to have taken treatment that had a good prognosis for recovery.“There have been instances where due to religious beliefs (for instance, Jehovah's witnesses' denial of blood transfusion), patients have declined to take treatment and courts have confronted these problems as well and come to decisions of hands-off approach,“ he said.

The court passed these orders while dismissing an appeal by Oriental Insurance Company , which had stated that a family of an insured person leaving treatment against medical advice was not entitled for a claim after death.

Death within 90 days of taking a ‘policy’

Dipak Dash, 90-day limit no basis to deny insurance claim, February 10, 2018: The Times of India

Pay Up With Interest, Says Consumer Panel

An insurance company can’t deny paying the assured amount even if the policy holder dies within 90 days from taking a policy. The National Consumer Disputes Redressal Commission (NCDRC) has ordered an insurance company to pay Rs 2.5 lakh with 9% interest to the kin of a deceased who had died on the 90th day of the purchase of a policy.

The case refers to one Kulwinder Singh of Fazilka in Punjab, who had paid Rs 45,999 to HDFC Standard Life Insurance on May 26, 2010. He passed away due to a heart attack on August 25 in that year. When the family sought the full assured amount, the insurance firm paid them only the premium that Singh had paid.

While directing the insurance firm to pay the full assured amount, the singlemember bench of M Shreesha also referred to an order from the insurance regulator IRDA on June 27, 2012 involving the same insurance company. Based on the order, NCDRC upheld that the insurance companies cannot apply the 90-day waiting period and reject claims. The IRDA had ordered Rs 1 crore penalty on the same insurance company for rejecting 21 claims citing the same 90 days waiting period.

The NCDRC also observed, “Even in the instant case, the deferred period was 90 days and it’s not as if the time of death was planned only to take advantage under the policy expecting that the insured may not live beyond the period of 90 days.”

Singh’s family submitted how the deceased had made the premium payment in cash on May 26, 2010 but the policy became effective from May 29. Singh’s family had pleaded that since the premium was paid in cash, so the risk cover began from that date.

The NCDRC also took into consideration of other policies held by the deceased from other companies. In those cases, the risk of coverage invariably begins from the date of proposal.

Singh’s family had moved the NCDRC in 2014 after the state consumer commission had turned down the order of district forum to pay Rs 2.5 lakh to Singh’s kin.

NCDRC: Murder is accidental death

Dipak Dash, ‘Murder is accidental death, give payout’, September 28, 2018: The Times of India

NCDRC Asks Insurance Co To Process Claim

An insurance company cannot deny claim in case of the murder of a person insured for accidental death unless such crimes are excepted in the policy, the apex consumer body has ruled.

The ruling by National Consumer Disputes Commission (NCDRC) came in connection with a 2009 murder case in which it upheld the decision of the Maharsahtra state consumer disputes redressal commission to direct the insurance company- Royal Sundaram- to pay the insured amount of Rs 20 lakh to one Pawan Muchandani whose father was murdered. The apex consumer body directed the firm to pay Rs 2 lakh compensation, over and above the claim, to the victim’s kin while terming the insurance company’s approach as an “unfair trade practice”.

NCDRC has asked the company to pay the compensation within four weeks. The two-member bench comprising S M Kantikar and Dinesh Singh has also asked the company to amend its terms and conditions and explicitly convey its position in respect of “murder” so that consumers can understand it easily at the time of purchase of the policy.

The company has been asked to file a compliance report with the commission within three months.

The NCDRC bench passed the order on Tuesday while hearing an appeal filed by the insurance company challenging the decision of the Maharashtra consumer body.

“Murder was not specifically excepted in the policy. If ‘murder is not an accident’ had to be adopted by the insurance company, or if every/select murder had to be inquired into and determined whether or not it was an accident covered under the policy, the same should have been explicitly stated in the policy. In the absence of ‘murder’ in the exceptions and in the absence of such explicit and categorical averment in the policy, a reasonable man of normal intelligence would conclude that murder is an accident within the terms of the policy,” the NCDRC bench said in the order.

It added that the onus of being explicit and categorical from the beginning on its terms and conditions lied with the insurance company and not on the insured. “First not including murder in the exceptions and then, on murder occurring and claim being filed, raising the plea that ‘murder is not an accident’ and repudiating the claim, at its own end, as per its own interpretation, tantamount to unfair trade practice,” it said.

Suicide/ euthanasia more than a year after insurance

Dhananjay Mahapatra, March 11, 2018: The Times of India

HIGHLIGHTS

If the insurer commits suicide more than a year after commencement of policy, then the insurance company is bound to give full policy money to the kin.

The earlier clause was that is claim payment would be entertained if policy holder committed suicide within three years of commencement of the policy.

The Supreme Court ruling permitting a ‘living will’ that specifies that a person should be taken off life support if he or she slips into a vegetative state or is beyond medical help is not likely to impact insurance payouts as most policies are bound to honour their terms after one year of issuance.

A section of senior citizens on Saturday flagged the Supreme Court’s decision, which permitted a person to specify a future medical condition where life support system is withdrawn, to express concern whether death through passive euthanasia will impact sum assured under life insurance policies.

‘Kin to get policy money if insured kills self within 1 yr’

A 65-year old confided about his happiness that a ‘living will’ can provide for passive euthunasia and end suffering during irreversible critical illness period, but was worried if his multiple life insurance policies would be affected if his end is not to be counted as normal death. “Would it not be viewed as suicide by the insurance companies to deny my children the full sum assured in case of death under these policies,” he asked.

His concern was echoed on several social media networks. TOI asked independent financial consultant Mahesh Tanwar, who advises people on investments in insurance and mutual funds, about the life insurance companies honouring their commitment to pay full benefits even if they decide to equate passive euthanasia with suicide, in the worst case scenario.

Tanwar said the standard clause governing suicide in most life insurance policies at present provides - “The policy shall be void, if the Life Assured commits suicide (whether sane or insane at the time) at any time or after the date on which the risk under the policy has commenced but before the expiry of one year from the date of commencement of the policy.” In such a scenario, policy holder’s kin would get no money at all, he said.

He said if a person commits suicide more than a year after commencement of the life insurance policy, then the insurance company is legally bound to make full payment of the sum assured to the kin of the deceased. In the past, the life insurance policy clause used to specify a period of three years- that is no claim payment would be entertained if policy holder committed suicide within three years of commencement of the policy, he said.

However, from January 1, 2014, the Insurance Regulatory and Development Authority of India mandated the companies selling insurance policies to effect changes in their agreements to make provision for some payment to the kin even if a policy holder committed suicide within a year.

The change in life insurance agreement was applied to two categories of policies, one which is market-linked and the other, traditional life insurance policies. If a person who has taken a market-linked life insurance policy and commits suicide within one year of commencement of the policy, then his nominee would be entitled to receive 100% of the policy fund value.

This means, if a person had paid a premium of Rs 1 lakh for the first year and of which the insurance company invested 80,000 in mutual funds and kept rest for insurance cover, then upon his suicide, his nominee would get back Rs 80,000, said Tanwar.

But, in traditional life insurance plans, there is confusion whether nominee would get any money if the policy holder committed suicide within a year. While some portals claimed that after the 2014 IRDAI directive, the nominee was entitled to 80% of the premium already paid by the policy holder in the event of committing suicide within a year of commencement of the policy, Tanwar maintained that generally no insurance company pays anything in a traditional life insurance policy if the holder commits suicide within one year.

Fee for assigning policies

HC quashes LIC fee for assigning policies

Shibu Thomas | TNN

From the archives of The Times of India 2007, 2009

Mumbai: In a relief for thousands of persons who pledge their insurance policies to raise loans, the Bombay High Court quashed a three-year-old rule by the country’s biggest insurance provider, Life Insurance Corporation, to charge a fee for assigning insurance policies to financial companies.

‘‘The service charge/fee is not authorised by law,’’ said a division bench of Justice F I Rebello and Justice J H Bhatia, while ruling that LIC’s demand for a fee violated the fundamental right of financial companies who advance loans on insurance policies to carry on trade and business. The circular levying a fee of Rs 250 if a policy holder assigns his insurance policy in favour of ‘‘financial organisations’’ also infringed on the Constitutional right of petitioner Dravya Finance Pvt Ltd’s by depriving it of its property without the authority of law, the high court held.

With 19 crore policy holders, LIC is the market leader with a 55 % share of the insurance industry. As per rules, a policy holder can transfer his interest in the life insurance policy to another person or institution as a security for a house loan or just emergency cash. These institutions reap ‘‘windfall gains’’ in the form of taxexempted returns, according to LIC.

Trading in life insurance policies, where a company purchases insurance policies from policy holders and then sells it to banks and financial institutions, is a lucrative business worldwide.

Earlier in 2003, LIC tried to rein in the practice by banning trading in insurance policies. The high court in 2007, however, set aside the rule and held that insurance policies are ‘‘movable property’’ that can be traded and assigned freely.

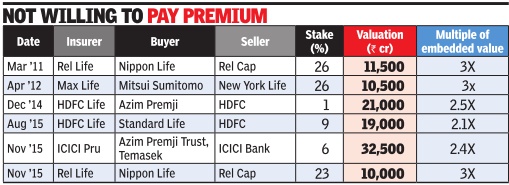

`Indian control' norms affect insurers' valuations

The Times of India, Nov 27 2015

Mayur Shetty

`Indian control' norms hurt insurers' valuation

The valuation of a inancial services firm is usually a straightforward business as there are ample benchmarks available. But in the case of insurance, a host of issues are queering the pitch for arriving at a value appropriate for a stake sale. Primary among his is the issue of Indian-owned and controlled', which is among the softer aspects of negotiations outside he hard numbers. By January , each of the 24 life insurance companies will have to rework their joint venture agreements to ensure that they are in compliance with the norms pertaining to Indian management. According to Sanket Kawatkar, head of life insurance consulting for Milliman India, which has conducted valua ions for 17 of the 24 companies, “A large component of the va uation would include softer aspects -the keenness of the oreign partner to do business n India and the desire to conti nue with the Indian partner.“

This is weighed with the fact that, under the new norms, multinationals can no longer enter into agreements which give them a veto power.

Companies' promoters are now scrambling to find out the worth of the business they have invested in. The traditional method of computing an insurance firm's valuation would be to arrive at an embedded value -a number which factors in not just present earnings but also takes into account future profits. But this global measure is not the basis on which deals are being worked out.

Foreign promoters running joint ventures will suddenly find themselves in a weaker position than they were in before the legislation allowing 49% was passed. This has changed the dynamics and many are unwilling to pay the premium they might have done earlier. In the case of Reliance Life, the deal for sale of an additional 23% stake to Nippon Life valued the company at Rs 10,000 crore -marginally lo wer than the Rs 11,500 crore at which the earlier investment was done. In HDFC Life, the foreign partner has bought stake at a lower valuation when compared to what strategic investor Azim Premji paid in 2014.

The other disruptions in the valuation process has been the regulator's push for an open architecture in banks.

“People also tend to forget that interest rate on 10-year government bonds had fallen close to 5.5% some years back. If this happens, the margins in some policies will turn negative because of the assured maturity benefits,“ said Kawatkar. He added that the assured maturity benefit portfolio of private insurance companies ranged between 10-20%.

The other disruption is likely to come from online. “India is arguably leading the way in the online experience. It is quite likely that future entrants will not follow what others are doing and will take the direct route for selling,“ said Richard Holloway , MD, South East Asia & India, Milliman.

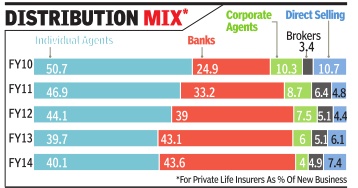

Private life insurers, 2010-14

See graphic:

The distribution mix of new business obtained by private life insurers, 2010-14

Premium, year-wise

=2018: Premium up 10% to record ₹4.6L cr

Rachel Chitra, Life premium up 10% to record ₹4.6L cr in FY18, January 16, 2019: The Times of India

Insurance Penetration Increases To 2.8%

India’s life insurance industry hit a record high by collecting Rs 4.6 lakh crore in premium for 2017-18, which is an increase of 10% over the previous financial year. Life insurance density — calculated by dividing the total insurance premium by the population — increased to $55 in 2017-18 from $46.5 in 2016-17, said IRDAI in its annual report. Life insurance penetration (premium as a percentage of GDP) in the country increased to 2.8% from 2.5% over the same period.

The life business expansion has been fuelled by the 23 private sector insurers, which saw growth accelerate to 19.2% last fiscal from 17.4% in 2016-17. The government-owned Life Insurance Corporation (LIC), however, saw growth dip to 5.9% from 12.8%. This resulted in LIC’s marketshare come down to 69.4% from 71.8%, while private players increased their share of the pie to 30.6% from 28.2%.

LIC’s total premium for the year was Rs 3.2 lakh crore versus Rs 1.4 lakh crore for private companies. LIC, however, grew its marketshare in terms of number of policies sold — implying that it sold more affordable products than private companies. Of the nearly 282 lakh new individual policies sold in FY18, over 213 lakh policies (almost 76%) were issued by LIC and just under 69 lakh (over 24%) by private insurers. LIC showed better performance in persistency and in single-premium policies sales. Its income from renewal premium for 2017-18 was Rs 1.8 lakh crore.

When it came to new business premium, LIC collected Rs 1.3 lakh crore, compared to private players booking Rs 59,482 crore — mostly on the back of selling a large number of single-premium policies. “Further bifurcation of new business premium indicates singlepremium products continue to play a major role for LIC as they contributed 33.5% of LIC’s total premium income (versus 32.7% in the previous year).”

See also

Insurance, life and general: India

Insurance (life): India