Meghalaya, Foreign Direct Investment (FDI): India

(→FESTIVALS) |

(→2011-18) |

||

| Line 1: | Line 1: | ||

| − | {| | + | {| Class="wikitable" |

|- | |- | ||

|colspan="0"|<div style="font-size:100%"> | |colspan="0"|<div style="font-size:100%"> | ||

| − | This is a collection of articles archived for the excellence of their content | + | This is a collection of articles archived for the excellence of their content.<br/> |

| − | + | </div> | |

| − | + | ||

| − | + | ||

| − | + | ||

|} | |} | ||

| − | [[Category: India | | + | [[Category:India |F ]] |

| − | [[Category: | + | [[Category:Economy-Industry-Resources |F ]] |

| − | [[Category: | + | |

| − | [[Category: | + | =FDI in India: A timeline= |

| + | ==1991-2016== | ||

| + | [http://www.thehindu.com/specials/the-big-ticket-fdi-reform/article8755687.ece ''The Hindu''], June 21, 2016 | ||

| + | |||

| + | ''' Twenty-five years of changes in FDI policy: highlights ''' | ||

| + | |||

| + | ''' ''1991'' ''' | ||

| + | |||

| + | '''July''': New industrial policy of Narasimha Rao government as part of the Union Budget presented by Manmohan Singh, which led to a substantive opening up of the Indian economy. | ||

| + | |||

| + | '''August''': FDI up to 51 per cent opened up in 47 high-priority sectors, including software (with 34 sectors under automatic route), with a condition that capital goods imports be financed by foreign equity. Export trading firms, hotels and tourism businesses also allowed 51 per cent FDI. | ||

| + | |||

| + | Foreign Investment Promotion Board (FIPB) set up in the PMO to vet FDI proposals, with a Finance Minister-headed panel deciding on investments taking a call on FDI over Rs 300 crore. | ||

| + | |||

| + | ''' ''1992'' ''' | ||

| + | |||

| + | '''April''': FDI in software also put on automatic route. | ||

| + | |||

| + | '''May''': Use of foreign brand names allowed. | ||

| + | |||

| + | '''June''': Dividend balancing norms for FDI-backed firms, linking dividend payments to export income, scrapped for all but consumer goods firms. | ||

| + | |||

| + | ''' ''1994'' ''' | ||

| + | |||

| + | '''October''': FDI in Pharma up to 51 per cent put on automatic approval route, except for recombinant DNA technologies. | ||

| + | |||

| + | ''' ''1996'' ''' | ||

| + | |||

| + | FIPB transferred to Department of Industrial Policy and Promotion (DIPP); approvals up to Rs. 600 crore by Industry Minister, Cabinet Committee for nods over Rs. 600 crore. | ||

| + | |||

| + | '''November''': Condition linking import of capital goods to foreign equity investments scrapped. | ||

| + | |||

| + | ''' ''1998'' ''' | ||

| + | |||

| + | '''October''': 49 per cent FDI allowed in mobile telephony by satellite. | ||

| + | |||

| + | ''' ''1999'' ''' | ||

| + | |||

| + | '''January''': FDI in construction of highways, toll roads and ports raised from 74 per cent to 100 per cent. | ||

| + | |||

| + | '''March''': Timeline for considering FDI proposals slashed from six weeks to 30 days. | ||

| + | |||

| + | ''' ''2000'' ''' | ||

| + | |||

| + | '''March''': Eases norms for 100 per cent FDI in NBFCs. | ||

| + | |||

| + | '''October''': 26 per cent FDI in insurance sector. | ||

| + | |||

| + | ''' ''2001'' ''' | ||

| + | |||

| + | '''May''': 100 per cent FDI in drug manufacturing and pharma, airports, hotel, tourisms, 26 per cent FDI in defence, 74 per cent in select activities of telecom sector, 49 per cent FDI in banking sector. | ||

| + | |||

| + | ''' ''2004'' ''' | ||

| + | |||

| + | '''January''': 100 per cent FDI in petroleum product marketing, oil exploration, petroleum production and natural gas pipelines. | ||

| + | |||

| + | '''March''': 74 per cent FDI in private banks. | ||

| + | |||

| + | ''' ''2005'' ''' | ||

| + | |||

| + | '''March''': 100 per cent FDI in townships. | ||

| + | |||

| + | '''November''': 74 per cent FDIin telecom, 20 per cent FDI in radio broadcasting. | ||

| + | |||

| + | ''' ''2006'' ''' | ||

| + | |||

| + | '''February''': 51 per cent FDI in single brand retail. | ||

| + | |||

| + | '''March''': 74 per cent FDI in telecom. | ||

| + | |||

| + | ''' ''2008'' ''' | ||

| + | |||

| + | '''March''': 100 per cent FDIin airports, 74 per cent FDI in non-scheduled air transport services. | ||

| + | |||

| + | ''' ''2009'' ''' | ||

| + | |||

| + | '''January''': 100 per cent FDI in fax publication of foreign newspapers, 26 per cent FDI in publication of Indian versions of foreign publications. | ||

| + | |||

| + | ''' ''2011'' ''' | ||

| + | |||

| + | '''November''': 100 per cent FDI in brownfield pharmaceutical projects (earlier only in greenfield). | ||

| + | |||

| + | ''' ''2012'' ''' | ||

| + | |||

| + | '''January''': 100 per cent FDI in single brand retail. | ||

| + | |||

| + | '''September''': 52 per cent FDI in multi-brand retail. 49 per cent FDI in aviation companies, power exchanges. 74 per cent FDI in teleports, mobile TV. | ||

| + | |||

| + | ''' ''2014'' ''' | ||

| + | |||

| + | '''August''': 49 per cent FDI in defence sector, 100 per cent FDI in some aspects of rail infrastructure. | ||

| + | |||

| + | ''' ''2015'' ''' | ||

| + | |||

| + | '''March, April''': 49 per cent FDI in insurance, pension sectors. | ||

| + | |||

| + | ''' ''2016'' ''' | ||

| + | |||

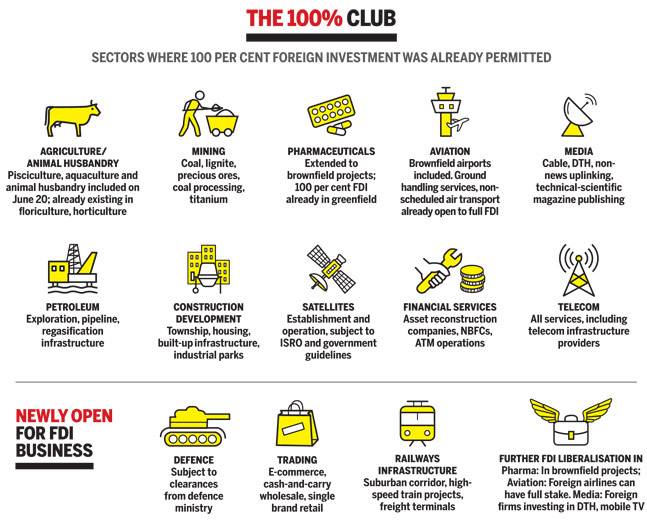

| + | '''June''': 100 per cent FDI in trading including through e-commerce, amendments to FDI in defence sector policy, 100 per cent FDI in teleports, DTH, mobile TV, 100 per cent FDI in brownfield aviation projects, 74 per cent FDI in private security agencies, amendments to FDI in animal husbandry policy, relaxing norms in single brand retail. | ||

| + | |||

| + | ==2004-16: FDI inflows into India== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Modis-Make-in-India-a-success-Moodys-08042016026031 ''The Times of India''], April 8, 2016 | ||

| + | |||

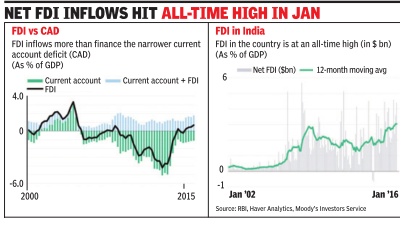

| + | [[File: FDI inflows 2000-2015.jpg| FDI inflows 2000-2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Modis-Make-in-India-a-success-Moodys-08042016026031 ''The Times of India''], April 8, 2016|frame|500px]] | ||

| + | | ||

| + | '''FDI Financing CAD First Time Since 2004''' | ||

| + | |||

| + | Ratings agency Moody's has said that net foreign direct investment (FDI) inflows have hit an all-time high in early 2016, highlighting the success of Narendra Modi's `Make in India' initiative. The ratings agency said that the FDI in flows have more than financed the current account deficit (CAD) for the first time since 2004. A country is known to be facing a CAD when the value of its imports is more than the value of its exports. | ||

| + | |||

| + | “The rise in FDI points to stronger investor interest in India on the back of ro bust economic growth. Higher inflows also suggest that recent government policies, such as efforts to liberalize foreign investment limits in several sectors and the `Make in India' initiative, are bearing fruit,“ said Moody's in a report released on Thursday . | ||

| + | |||

| + | Net FDI inflows into India hit an all-time high in January 2016 at $3 billion on a 12-month moving average basis. India's current account deficit is now more than covered by its FDI inflows. The basic balance (the sum of the current account balance and net FDI) returned to surplus in 2015 after being in deficit from 2003-2014. | ||

| + | |||

| + | This is good news for the do mestic currency whose value has been determined by capital flows due to the country's per manent trade deficit. The only dark cloud has been the drop in remittances. Money sent by overseas Indians dropped 30% year-on-year in the SeptemberDecember 2015 quarter due to turmoil in the Middle East economy . But Moody's said that In dia's external financing needs have diminished sharply over the last three years due to a crash in commodity prices. | ||

| + | |||

| + | On FDI, Moody's said that the development of industrial corridors, investment & manufacturing zones, and `smart cities' will further bolster investment inflows. “In particular, flows into the manufacturing sector are likely to accelerate as the government seeks to boost the sector's share of gross domestic product (GDP) to 25% by 2022.Government investment in infrastructure will help address some of India's deficiencies in this area and foster FDI,“ the report added. | ||

| + | |||

| + | ==2011-16== | ||

| + | |||

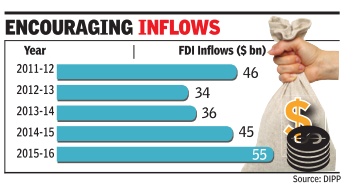

| + | [[File: FDI inflows in India, year-wise, 2011-16.jpg|FDI inflows in India, year-wise, 2011-16; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=10_06_2016_025_026_011&type=P&artUrl=Govt-mulls-up-to-49-pharma-FDI-without-10062016025026&eid=31808 The Times of India], June 11, 2016|frame|500px]] | ||

| + | |||

| + | See graphic, 'FDI inflows in India, year-wise, 2011-16' | ||

| + | |||

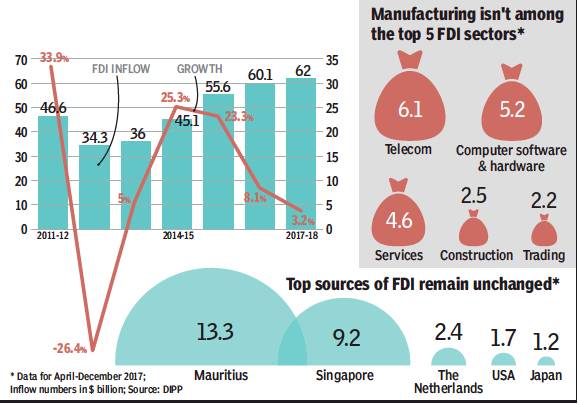

| + | ==2011-18== | ||

| + | [[File: Foreign direct investment in India, 2011-18; The main countries from which Foreign direct investment comes into India; and ; The five main sectors that attract Foreign direct investment into India.jpg|i) Foreign direct investment in India, 2011-18; <br/> ii) The main countries from which Foreign direct investment comes into India; and <br/> iii) The five main sectors that attract Foreign direct investment into India <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F09&entity=Ar02119&sk=1F29C4AB&mode=text June 9, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''i) Foreign direct investment in India, 2011-18; <br/> ii) The main countries from which Foreign direct investment comes into India; and <br/> iii) The five main sectors that attract Foreign direct investment into India.'' | ||

| + | |||

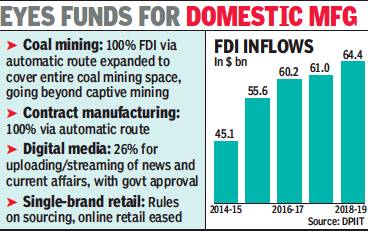

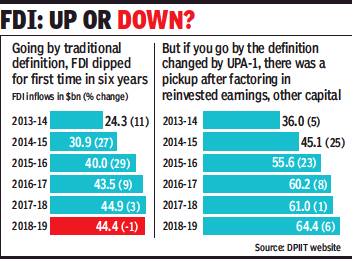

| + | ==2014-19== | ||

| + | [[File: FDI inflows into India, year-wise, 2014-19.jpg|FDI inflows into India, year-wise, 2014-19 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F29&entity=Ar00304&sk=972D9675&mode=text August 29, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' FDI inflows into India, year-wise, 2014-19 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | [[Category:India|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | [[Category:Pages with broken file links|FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | |||

| + | ==2017: inflows decreased 9%, outflows doubled== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F08&entity=Ar02206&sk=F97F2195&mode=text FDI into India slipped 9% to $40bn last year: UN report, June 8, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | Foreign Direct Investment (FDI) to India decreased 9% to $40 billion last year from $44 billion in 2016 while outflows from India, the main source of investment in South Asia, more than doubled, according to a new trade report by the UN. | ||

| + | |||

| + | According to the World Investment Report 2018 by the UN Conference on Trade and Development (UNCTAD) global foreign direct investment flows fell by 23% in 2017, to $1.4 trillion from $1.9 trillion in 2016. “Downward pressure on FDI and the slowdown in global value chains are a major concern for policymakers worldwide, and especially in developing countries,” UNCTAD secretarygeneral Mukhisa Kituyi said. | ||

| + | |||

| + | FDI to India decreased from $44 billion in 2016 to $40 billion in 2017. But outflows from India, the main source of FDI in South Asia, more than doubled to $11 billion, the report said. | ||

| + | |||

| + | The report cited India’s state-owned oil and gas company ONGC’s active investment in foreign assets in recent years. After acquiring a 26% stake in Vankorneft, an affiliate of Russia’s national oil company Rosneft PJSC, in 2016, ONGC bought a 15% stake in an offshore field in Namibia from Tullow Oil in 2017. By the end of 2017, ONGC had 39 projects in 18 countries, producing 285,000 barrels of oil and oilequivalent gas per day, the report said. | ||

| + | |||

| + | === 3% growth in FDI slowest in four years=== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F09&entity=Ar00112&sk=A5EE3477&mode=text June 8, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | Foreign direct inflows into India rose 3% to $62 billion during 2017-18, the slowest pace of expansion since the Narendra Modi government came to office four years ago. FDI inflows during the previous financial year were estimated at a shade over $60 billion. | ||

| + | |||

| + | The slowdown in growth in FDI flows comes even as domestic private investment has remained muted, which commerce and industry minister Suresh Prabhu said was on account of surplus production capacity now getting used up. | ||

| + | |||

| + | He said that during the four years of the Modi government, foreign inflows jumped to $223 billion from $152 billion in the previous four-year period. | ||

| + | |||

| + | ==2016== | ||

| + | [[File: Sectors where 100 per cent foreign investment was already permitted , India Today , June 23,2016 .jpg| Sectors where 100 per cent foreign investment was already permitted , India Today , June 23,2016 |frame|500px]] | ||

| + | |||

| + | === India: World's top greenfield FDI destination === | ||

| + | [http://timesofindia.indiatimes.com/business/india-business/india-retains-worlds-highest-fdi-recipient-crown-report/articleshow/58844573.cms India retains world's highest FDI recipient crown: Report, May 25, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | ''' HIGHLIGHTS ''' | ||

| + | |||

| + | India attracted USD 62.3 billion in 2016, says the FDI Report 2017 | ||

| + | |||

| + | India has remained ahead of China and the US as far as FDI inflows were concerned in the last year, it states. | ||

| + | |||

| + | FDI by capital investment saw an increase of 2 per cent to USD 62.3 billion in 809 projects during 2016 in India | ||

| + | |||

| + | India retained its numero uno position of being the world's top most greenfield FDI investment destination for the second consecutive year, attracting US $62.3 billion in 2016, says a report. | ||

| + | |||

| + | India has remained ahead of China and the US as far as FDI inflows were concerned in the last year, said the fDi Report 2017 compiled by fDi Intelligence, a division of The Financial Times Ltd. | ||

| + | |||

| + | FDI by capital investment saw an increase of 2 per cent to US $62.3 billion in 809 projects during 2016 in India. | ||

| + | |||

| + | "India managed to keep the crown as the world's number one location for greenfield capital investment for the second year running - ahead of China and the US," the report said. | ||

| + | The report said, global investment landscape has changed considerably in 2016 as FDI gravitated to locations experiencing the strongest economic growth, while locations in recession or facing high levels of uncertainty saw major declines. | ||

| + | |||

| + | In 2016, greenfield FDI continued to rise worldwide, with capital investment increasing by more than 6 per cent to US $776.2 billion, its highest since 2011, alongside an increase in job creation by 5 per cent to 2.02 million. The number of FDI projects, however, declined 3 per cent to 12,644. | ||

| + | China has overtaken the US to become the second biggest country for FDI by capital investment, recording US $59 billion of announced FDI, compared with US $48 billion-worth in the US. | ||

| + | |||

| + | Globally, the real estate sector has claimed the top spot for capital investment, with US $157.5 billion of announced FDI recorded in 2016, following an increase of 58 per cent. | ||

| + | In value terms, coal and natural gas witnessed an inflow of US $121 billion, followed by alternate and renewable energy at US $77 billion. | ||

| + | |||

| + | === Defence === | ||

| + | [http://indiatoday.intoday.in/story/narendra-modi-fdi-raghuram-rajan/1/698804.html Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang “India Today” 23 6 2016] | ||

| + | |||

| + | [[File: FDI in defence , India Today , July 4,2016 .jpg| FDI in defence , India Today , July 4,2016 [http://indiatoday.intoday.in/story/narendra-modi-fdi-raghuram-rajan/1/698804.html Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang “India Today” 23 6 2016]|frame|500px]] | ||

| + | |||

| + | === Pharma === | ||

| + | [http://indiatoday.intoday.in/story/narendra-modi-fdi-raghuram-rajan/1/698804.html Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang , 23/6/2016] | ||

| + | |||

| + | [[File: FDI in Pharma , India Today , June 23, 2016 .jpg| FDI in Pharma , India Today , June 23, 2016 |frame|500px]] | ||

| + | |||

| + | === India at Global level === | ||

| + | ''' See graphic ''' | ||

| + | |||

| + | [http://indiatoday.intoday.in/story/narendra-modi-fdi-raghuram-rajan/1/698804.html Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang “India Today” 4/7/2016] | ||

| + | [[File: India Today , July 4,2016 .jpg| India Today , July 4,2016 |frame|500px]] | ||

| + | |||

| + | === Retail === | ||

| + | ''' See graphic ''' | ||

| + | |||

| + | [http://indiatoday.intoday.in/story/narendra-modi-fdi-raghuram-rajan/1/698804.html Shweta Punj Sandeep Unnithan MG Arun , The FDI big bang “India Today” 4/7/2016] | ||

| + | |||

| + | [[File: India Today , July 4 ,2016 .jpg| India Today , July 4 ,2016 |frame|500px]] | ||

| + | |||

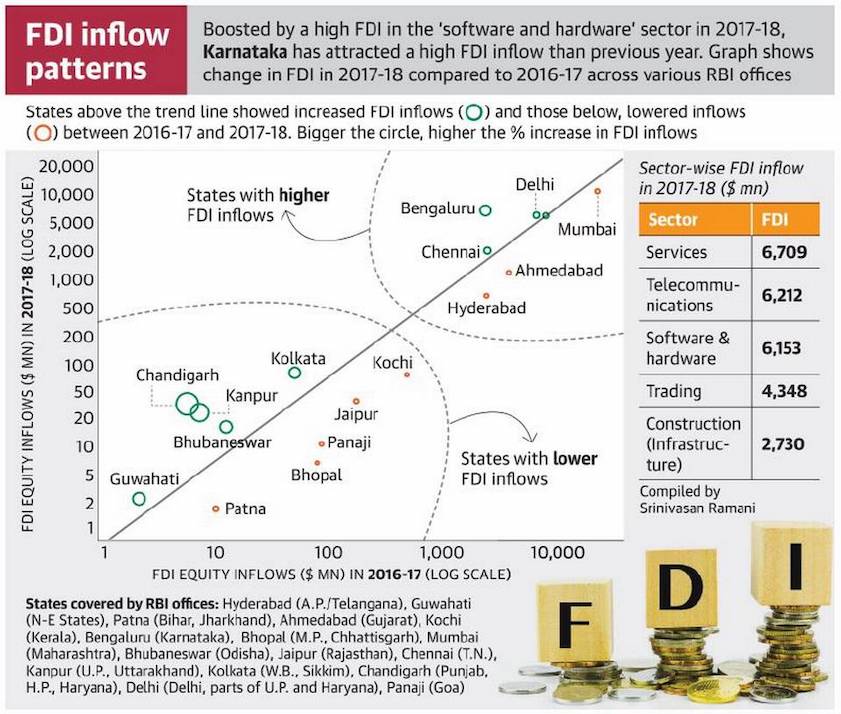

| + | ==2017-Mar 2018, FDI inflow, state-wise== | ||

| + | [https://www.thehindu.com/news/national/karnataka-sees-300-jump-in-fdi-inflows-tn-rebounds/article24497788.ece Sangeetha Kandavel and Sanjay Vijayakumar, Karnataka sees 300% jump in FDI inflows, T.N. rebounds, July 23, 2018: ''The Hindu''] | ||

| + | |||

| + | [[File: The graph shows change in FDI in 2017-18 compared to 2016-17 across various RBI offices.jpg|The graph shows change in FDI in 2017-18 compared to 2016-17 across various RBI offices <br/> From: [https://www.thehindu.com/news/national/karnataka-sees-300-jump-in-fdi-inflows-tn-rebounds/article24497788.ece Sangeetha Kandavel and Sanjay Vijayakumar, Karnataka sees 300% jump in FDI inflows, T.N. rebounds, July 23, 2018: ''The Hindu'']|frame|500px]] | ||

| + | |||

| + | ''Services sector top recipient despite 23% drop'' | ||

| + | |||

| + | Karnataka registered the biggest increase in Foreign Direct Investment (FDI) last year, as inflows from overseas jumped 300% in the 12 months ended March 2018. Tamil Nadu too saw a rebound reversing a slowdown in the preceding period, while Gujarat, Maharashtra and Andhra Pradesh all saw a drop in FDI inflows, data from the Reserve Bank of India (RBI) presented in Parliament show. | ||

| + | |||

| + | While Karnataka received $8.58 billion in 2017/18, a sharp increase from the $2.13 billion in the previous fiscal, Tamil Nadu netted $3.47 billion, a 56% increase from the $2.22 billion in the prior period, as the State appeared to buck concerns about the investment climate. Investment had halved in 2016/17 from the previous 12 months ($4.53 billion) in an election year that also saw some political uncertainty in the wake of then Chief Minister J. Jayalalithaa’s hospitalisation and demise. | ||

| + | |||

| + | The data from the Chennai Regional Office of the RBI, covers Tamil Nadu and Puducherry. | ||

| + | |||

| + | Other major states Maharashtra, Gujarat and Andhra Pradesh saw a dip in FDI inflows, according to Minister of State for Commerce and Industry C.R. Chaudhary, in a written reply to the Lok Sabha on Monday. | ||

| + | |||

| + | Data from the Mumbai office of RBI, which covers Maharashtra, Dadra and Nagar Haveli, Daman and Diu, show inflows dropped to $13.4 billion in 2017/18 from $19.7 billion. FDI inflows into Gujarat fell almost 38% to $2.09 billion in 2017-18, from $3.37 billion. | ||

| + | |||

| + | Andhra Pradesh saw FDI inflows drop 43% to $1.25 billion in 2017/18. | ||

| + | |||

| + | Biswajit Dhar, Professor at Centre for Economic Studies and Planning in the School of Social Sciences at Jawaharlal Nehru University, pointed out that there was no way to assess whether the inflows were helping a State in its development efforts. | ||

| + | |||

| + | “When you look at the breakdown of FDI, it has a lot of components to it – firstly, you have long term inflows and then you have short term inflows like private equity,” he pointed out. | ||

| + | |||

| + | Overall, sector-wise investment data show that computer software and hardware gained from a 68% jump in FDI last year to $6.15 billion. | ||

| + | |||

| + | Interestingly, the services sector which comprises finance, banking, insurance and outsourcing among others, remained the top recipient of FDI despite seeing a 23% decline in inflows at $6.71 billion. | ||

| + | |||

| + | ==2019-20: 18% growth== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F05%2F29&entity=Ar02015&sk=55EE777B&mode=text FDI inflows surge 18% in 2019-20 to record $74bn, May 29, 2020: ''The Times of India''] | ||

| + | |||

| + | [[File: FDI inflow into India, 2015-20..jpg| FDI inflow into India, 2015-20. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F05%2F29&entity=Ar02015&sk=55EE777B&mode=text FDI inflows surge 18% in 2019-20 to record $74bn, May 29, 2020: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | India’s FDI inflows, including reinvested earnings, rose 18% to a record $73.5 billion during 2019-20, buoyed by a spurt in inflows into computer hardware & software, telecom, and hotel & tourism, while services, the traditional mainstay, witnessed a decline. | ||

| + | |||

| + | Excluding reinvested earnings, inflows were 14% higher at just a shade under $50 billion, which is also an all-time high. In fact, the large flows acted as a counterweight to low FII inflows during the year, which were estimated at $247 million (on a net basis) during the last financial year. | ||

| + | |||

| + | The data naturally led to some celebration in government, given the overall gloomy economic situation and weak domestic investment. “In another strong vote of confidence in Make in India, total FDI into India grew 18% in 2019-20 to reach $73 billion. Total FDI has doubled from 13-14 when it was only $36 billion. This long-term investment will spur job creation,” commerce and industry minister Piyush Goyal tweeted. | ||

| + | |||

| + | The year saw several large deals, involving overseas, with large inflows expected during the current year as well, with Reliance Jio alone announcing several transactions so far. Besides, some of the earlier announcements such as Saudi Aramco’s stake acquisition in Reliance Industries and Brookfield’s proposed investment in the tower arm are pending. | ||

| + | |||

| + | While Maharashtra remained the top destination for overseas investors, Karnataka came second, although data for the October-March period was released by the department for promotion of industry and internal trade. | ||

| + | |||

| + | In terms of the countries, Singapore remained the top source for the second straight year, although inflows from the island nation dropped almost 10% to $14.7 billion. Mauritius was a distant second with investments of $8.2 billion routed via India’s close ally, with a sharp spike seen from the Netherlands, with inflows rising 1.7 times to $6.5 billion. | ||

| + | |||

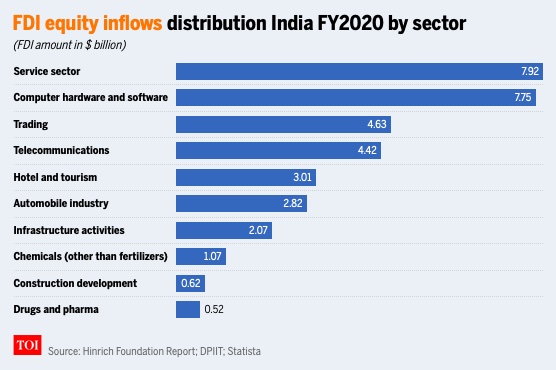

| + | ==2020== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F01%2F26&entity=Ar03316&sk=5932555D&mode=text January 26, 2021: ''The Times of India''] | ||

| + | |||

| + | [[File: India and the world, % change in FDI inflows in 2020.jpg|India and the world, % change in FDI inflows in 2020 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F01%2F26&entity=Ar03316&sk=5932555D&mode=text January 26, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: FDI equity inflows distribution India FY2020 by sector.jpg|FDI equity inflows distribution India FY2020 by sector <br/> From: [https://timesofindia.indiatimes.com/business/india-business/how-india-can-become-a-major-tech-hub/articleshow/81764046.cms March 30, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphics''': | ||

| + | |||

| + | ''India and the world, % change in FDI inflows in 2020'' | ||

| + | |||

| + | '' FDI equity inflows distribution India FY2020 by sector '' | ||

| + | |||

| + | |||

| + | |||

| + | FDI inflows into India jump by 13% to $57bn in 2020: UN | ||

| + | |||

| + | At $163Bn, China Pips US, Becomes Largest Global Recipient | ||

| + | |||

| + | New Delhi: | ||

| + | |||

| + | India witnessed a 13% rise in foreign direct investment (FDI) to $57 billion in 2020 compared to the previous year. The domestic figure was boosted by investments in the digital economy, while China overtook the US as the largest recipient of FDI globally, according to an UNCTAD report. | ||

| + | |||

| + | India and China were the only two countries which saw FDI rising in 2020, while the rest of the world, including developed economies such as the UK and the US, saw sharp declines. This was revealed by the UNCTAD’s investment trends monitor’s findings. | ||

| + | |||

| + | India’s FDI inflows were propped up by acquisitions in the digital economy. The report said cross-border M&A sales grew 83% to $27 billion, a notable deal being the acquisition of nearly 10% of Jio Platforms by Jaadhu — owned by Facebook — for $5.7 billion. It also said that infrastructure and energy propped up M&A deal values in the country. | ||

| + | The Indian economy is staging a sharp recovery after plunging to record levels due to the impact of the strictest lockdown imposed to prevent the spread of the deadly Covid. | ||

| + | |||

| + | The report said China became the largest recipient of FDI, attracting an estimated $163 billion in inflows, followed by the US with $134 billion. It said that in relative terms, flows declined most strongly in the UK, Italy, Russia, Germany, Brazil and the US. FDI inflows to China increased by 4% compared to the previous year. | ||

| + | |||

| + | The pandemic triggered havoc across global economies and the report said global FDI collapsed in 2020, falling by 42% to an estimated $859 billion from $1.5 trillion in 2019. It said that FDI finished 2020 more than 30% below the trough after the global financial crisis. Flows to developed countries fell drastically by 69% to values last seen 25 years ago. | ||

| + | |||

| + | FDI in Asean — an engine of FDI growth throughout the last decade — was down by 31%. | ||

| + | |||

| + | UNCTAD said global FDI flows will remain weak in 2021. “The uncharacteristic immediacy of the FDI reaction to the crisis caused by the pandemic was due to physical lockdowns and other mitigation measures making the implementation of ongoing projects more difficult but the effects of the recession will linger and an FDI recovery is not expected to start before 2022. Investor uncertainty related to further waves of the pandemic and to developments in the global policy environment for investment will also continue to affect FDI,” the report cautioned. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | [[Category:India|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | [[Category:India|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | [[Category:Pages with broken file links|FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | |||

| + | =Foreign companies registered in India= | ||

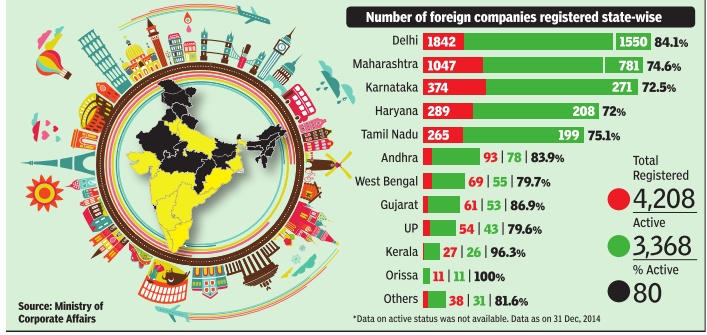

| + | [[File: foreign companies.jpg|2014:Foreign companies in India,state-wise|frame|500px]] | ||

| + | |||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Gokalpur-has-never-repeated-MLAs-09022015004006 ''The Times of India''] | ||

| + | |||

| + | Feb 09 2015 | ||

| + | |||

| + | ''' DESTINATION INDIA ''' | ||

| + | |||

| + | As of December, 2014, there were over 4,000 foreign companies registered in the country. Of these, a little over 79% were active.Interestingly. the national capital had the highest number of such companies. It was followed by Maharashtra, Karnataka, Haryana and Tamil Nadu, usually perceived as some of the most industrialized states. The relatively large number of companies registered in Haryana seems to be linked to MNCs located in Gurgaon, one of the NCR's leading business hubs | ||

| + | |||

| + | =Amount invested= | ||

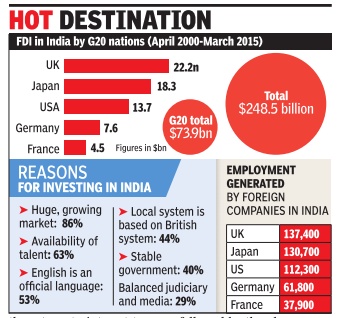

| + | ==FDI by G20 nations: 2000-15== | ||

| + | |||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=UK-leads-G20-nations-flow-to-India-in-02092015023030 ''The Times of India''] ,Sep 02 2015 | ||

| + | |||

| + | [[File: FDI in India by G20 nations (April 2000-March 2015).jpg|FDI in India by G20 nations (April 2000-March 2015); Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=UK-leads-G20-nations-flow-to-India-in-02092015023030 ''The Times of India''] ,Sep 02 2015|frame|500px]] | ||

| + | |||

| + | Kounteya Sinha | ||

| + | |||

| + | '''UK leads G20 nations flow to India in FDIHOT''' | ||

| + | | ||

| + | The latest data to confirm Britain's increasing interest in investing in India will make PM Narendra Modi happy a couple of months before he embarks on his maiden visit to the United Kingdom. | ||

| + | The UK has become the largest investor in India among all G20 countries with a combined revenue of more than $54 billion in India. | ||

| + | |||

| + | Between the year 2000 and 2015, UK's FDI into India amounts to $22 billion -9% of all FDI in the country . | ||

| + | |||

| + | In total, G20 nations invested $ 73.9 billion in India between 2000-2015 with the UK being the single largest G20 investor into India followed by Japan ($ 18.3 bn), the US ($13.7bn), Germany ($ 7.6 bn) and France ($ 4.5 billion). | ||

| + | |||

| + | As India's largest employer, UK firms employ around 691,000 people across the country -5.5% of total organized private sector jobs in the country . Between 2000 and 2015, UK FDI generated around 138,000 direct jobs, 7% of the total 1.96 million jobs generated by FDI in India. | ||

| + | |||

| + | India's massive talent pool was the main reason for 63% of the British companies to believe in India's potential while India's recent growth story made 86% of them turn to interest towards the Asian giant. English being an official language has helped, too, with 53% of the companies relying on it while 40% said it was the country's stable government. | ||

| + | |||

| + | Confederation for British Industry's first Sterling Assets India report sponsored by PwC UK and brought out in association with the UK India Business Council says that Maharashtra and Delhi have attracted the bulk of Britain's FDI into India -26% and 20% respectively . | ||

| + | |||

| + | The chemicals sector attracts the lion's share of British investment in India, at $5.78 billion (26% of UK FDI), followed by the pharmaceutical sector at $3.76 billion (17% of UK FDI) and the food processing sector at $3.05 billion (14% of UK FDI). | ||

| + | |||

| + | Katja Hall, the confederation's deputy DG, said, “The economic relationship between India and the UK is in fine fettle. The UK has played a significant role in India's growth journey , investing more and creating more jobs than any other G20 nation.PM Modi's steps to improve the ease of doing business in India are a great boost and we look forward to the EU-India FTA talks resuming.“ | ||

| + | == 60% increase, Oct 2014-Sept 2016== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=FDI-jumps-60-in-Oct-2014-Sept-2016-22112016022034 FDI jumps 60% in Oct 2014-Sept 2016, Nov 22 2016 : The Times of India] | ||

| + | |||

| + | |||

| + | FDI went up 60% to $77.9 billion after the launch of `Make in India' initiative in September 2014, the government said on Monday. | ||

| + | |||

| + | Commerce and industry minister Nirmala Sitharaman said that after the launch of this initiative, there has been an “unprecedented“ increase in FDI into the country. | ||

| + | |||

| + | “During the period October 2014 to September 2016, total FDI equity inflows of $77.9 billion was recorded as against $48.5 billion received during the preceding 24 months with an increase of 60%,“ she said in a written reply to the Lok Sabha. | ||

| + | |||

| + | Make in India was launched with an aim to promote India as an important investment destination and a global hub for manufacturing. Replying to a separate question, she said a total of 19,666 comp laints were received by the National Consumer Helpline during April-October this year. In 2015-16, this number was 23,955. | ||

| + | |||

| + | “24 e-commerce companies were incorporated registered in India during the last two years (2014-15 and 2015-16),“ she added. | ||

| + | |||

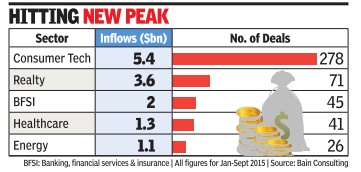

| + | ==Private Equity (PE) investments: 2014, 2015== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PE-inflows-may-hit-record-20bn-this-year-22102015023032 ''The Times of India''], Oct 22 2015 | ||

| + | |||

| + | [[File: PE investments, Jan-Sept 2015.jpg|PE investments: Jan-Sept 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=PE-inflows-may-hit-record-20bn-this-year-22102015023032 ''The Times of India''], Oct 22 2015|frame|500px]] | ||

| + | |||

| + | Reeba Zachariah | ||

| + | |||

| + | '''PE inflows may hit record $20bn in 2015''' | ||

| + | | ||

| + | |||

| + | If the last nine months of private equity (PE) activity are any indication, PE investments are poised for a strong finish in 2015. Bain Consulting, the leader in consulting to PE firms in India and globally , predicts that PE transactions will touch a record $20 billion this year, higher than the previous record of $17.1 billion in 2007.Heightened financing in consumer technology space and bigticket investments in real estate and financial services will propel PE activity to hit a new high this calendar. | ||

| + | PE investments for the first nine months of 2015 have al ready hit $16.7 billion, outpacing 2014's total PE deal value of $15.2 billion. “The growth trend indicates that PE investment activity this year will surpass 2007, which was the best period so far,“ said Madhur Singhal, consulting principal, private equity practice, Bain Consulting. | ||

| + | |||

| + | The deal activity has been chiefly driven by the country's booming consumer technology sector, which attracted $5.4 billion of investments, followed by real estate and financial services with $3.6 billion and $2 billion, respectively , during the first nine months of 2015. | ||

| + | |||

| + | Bain Consulting's PE deals database doesn't include transactions where deal value is not disclosed. The three sectors accounted for 65% of the total deal value in the January-September period of 2015 and are expected to keep up the momentum in the October to December period too. “The consumer tech space needs more capital to scale up and will continue to attract more private equity ,“ Singhal said. Early-stage and growth investments dominated 85% of the deals in the first nine months of 2015. | ||

| + | |||

| + | PE funds such as Tiger Global, Blackstone, Temasek, Advent, SoftBank, Actis and GIC have invested about $125 billion in 5,400 deals between 2005 and September-end of 2015. However, exits from portfolio companies continue to remain challenging.Many funds have been forced to hold on to their investments for a longer number of years than originally envisaged. | ||

| + | |||

| + | Exits reached $4.5 billion in the first nine months of this year, driven by public market and secondary sales. Real estate, financial services and telecom witnessed the highest number of exits. The top 10 big-ticket exits, including TPG Capital selling its stake in Shriram City Union Finance for $386 million and New Silk Route offloading its interest in PNB Housing Finance for $257 million, constituted 40% of the total PE exit value in the first nine months of 2015. | ||

| + | |||

| + | ==Confusion over ''Financial Times'' figures== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Why-FDI-data-on-India-is-causing-confusion-01102015011018 ''The Times of India''], Oct 01 2015 | ||

| + | [[File: Foreign Fund flows in India, 2014-15.jpg|Foreign Fund flows in India, 2014-15; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Why-FDI-data-on-India-is-causing-confusion-01102015011018 ''The Times of India''], Oct 01 2015|frame|500px]] | ||

| + | Subodh Varma | ||

| + | | ||

| + | |||

| + | '''RBI pegs fund flow at $20.6Bn in first half of 2015 against FT estimate of $31Bn''' | ||

| + | |||

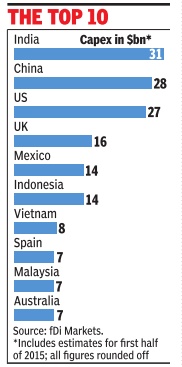

| + | A recent report by a data consultancy owned by the FT of London created a stir by estimating that India is now the most favourite destination for foreign direct investment, beating China and the USA. The fine print indicates that they are talking about “estimated capital expenditures“ in greenfield, that is, new ventures. By this estimate, India attracted $31 billion compared to China's $28 billion in the first half of 2015. | ||

| + | Reserve Bank of India (RBI) data for foreign investment flows does not appear to reflect this, causing much puzzlement in India. The total foreign direct investment that flowed into India between January and June 2015 is pegged at $20.6 billion. If you deduct the outflow from India in the form of outgoing FDI from India, this gets pared down to $19 billion. | ||

| + | |||

| + | Besides this inflow, there is also foreign portfolio investment mainly by institutional investors in the stock market. This was about $17 billion in the first half of 2015. | ||

| + | |||

| + | When put together, these two components of investment direct and portfolio yields about $31.5 billion for the same period. But this could hardly be what the FT report is talking about since much of this is neither greenfield nor capital investment. | ||

| + | |||

| + | The other puzzling aspect of the FT report is the com parison with China. | ||

| + | |||

| + | According to the National Statistical Bureau of China, foreign direct investment into China in the first half of 2015 was a whopping $68.4 billion, more than three times that of India's $20.6 billion, between January and June 2015. | ||

| + | |||

| + | A comparison of RBI data between the first halves of 2014 and 2015 shows that incoming FDI has increased by about 16% in 2015 but outgoing FDI has drastically declined, probably due to weakening economies around the world. Hence net FDI inflow to India has jumped up from $8.8 billion to $19 billion. | ||

| + | |||

| + | Analysis of this data by India's Department of Industrial Policy and Promotion (DIPP) indicates that most of the foreign direct investment has come into the IT sector followed by automobiles, trade and the financial sector. Major sources of FDI in India remain Singapore and Mauritius followed by the Netherlands, US and Germany . | ||

| + | |||

| + | Net portfolio investment has, however, sharply declined by about 23% from $21.7 billion in the first half of 2014 to $16.8 billion in the comparable period of 2015. | ||

| + | |||

| + | As a result of these opposing trends, the net foreign flows into India have shown only a marginal increase from $30.5 billion to $31.5 billion between the first halves of 2014 and 2015. | ||

| + | |||

| + | ==2013-19== | ||

| + | [[File: Foreign Direct Investment (FDI)- India- 2013-19.jpg|Foreign Direct Investment (FDI): India: 2013-19 <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F05%2F29&entity=Ar00307&sk=AB38BC42&mode=text Sidhartha, May 28, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | ''' See graphic ''': | ||

| + | |||

| + | '' Foreign Direct Investment (FDI): India: 2013-19 '' | ||

| + | |||

| + | =Countries that invest most in India= | ||

| + | ==2000-19== | ||

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F05%2F29&entity=Ar00307&sk=AB38BC42&mode=text Sidhartha, May 29, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Singapore’s investments in India vis-à-vis Mauritius’- 2009-2019.jpg|Singapore’s investments in India vis-à-vis Mauritius’: 2009>2019 <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F05%2F29&entity=Ar00307&sk=AB38BC42&mode=text Sidhartha, May 29, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Foreign direct investment (FDI) inflows from Singapore were twice that from Mauritius during the last financial year as companies opted to route funds into the country via the southeast Asian city-state, instead of the island nation in the Indian Ocean, the most preferred route for overseas flows so far, after the tax treaty with both the countries was reworked. | ||

| + | |||

| + | |||

| + | In 2018-19, inflows from Singapore were estimated at $16.2 billion, compared with $8.1 billion from Mauritius, latest government data showed. This is only the third time inflows from Singapore have topped those from Mauritius, with investment advisers attributing the change to the revamped tax treaty. After 33 years, India and Mauritius had agreed to amend the tax treaty, allowing authorities there to tax capital gains on transfer of Indian shares acquired from April 2017. | ||

| + | |||

| + | |||

| + | ''' ‘PE investors in S’pore boost FDI into India’ ''' | ||

| + | |||

| + | A similar amendment was made in the tax treaty with Singapore, which also came into force from April 1, 2017. Unlike the tax treaty with Singapore, the original pact with Mauritius did not require “significant presence”. | ||

| + | |||

| + | As a result, since April 2000, 32% of the inflows have come through Mauritius because investors from the US, the UK and Germany too opted to route their investment via this window. Tax consultants said given the parity in tax treatment now, investors are preferring to route investments via Singapore. | ||

| + | |||

| + | “The choice of source of investment depends a lot on the bilateral tax agreement. Besides, Singapore offers other advantages on the ease of doing business front,” said Dhiraj Mathur, who was involved with FDI policy before turning a consultant. | ||

| + | |||

| + | Akash Gupt, partner and leader for regulatory practice at PwC India, said the presence of a large number of private equity investors in Singapore also helped boost inflows into India. “Now that there is tax neutrality, people are opting for Singapore as it is more accessible and approachable and offers tax incentives through lower tax rates if you locate your regional headquarters there,” added EY India’s Rajiv Chugh. | ||

| + | |||

| + | Besides, companies such as Walmart, which acquired Flipkart in a $14 billion deal, made the payments in the island nation as the e-tailer was registered in Singapore. As a result, the fresh investment of $2 billion came through Singapore. The change is significant since a decade ago, inflows from Mauritius were almost four times the investment from Singapore. The full year FDI data also showed FDI into the country went up 6% to top $64 billion. | ||

| + | |||

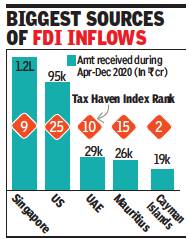

| + | ==2020== | ||

| + | [[File: Biggest sources of FDI inflows, April- December 2020.jpg|Biggest sources of FDI inflows, April- December 2020 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F03%2F10&entity=Ar00320&sk=F21A306F&mode=text March 10, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Biggest sources of FDI inflows, April- December 2020 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | [[Category:India|F FOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIAFOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | [[Category:Pages with broken file links|FOREIGN DIRECT INVESTMENT (FDI): INDIA | ||

| + | FOREIGN DIRECT INVESTMENT (FDI): INDIA]] | ||

| + | |||

| + | =India’s share in global FDI= | ||

| + | ==2014: India no.9 in the world== | ||

| + | [[File: India and the world, The 15 countries that received the highest FDI in 2014. India was no 9.jpg| India and the world: The 15 countries that received the highest FDI in 2014. India was no. 9; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=05_10_2015_010_063_002&type=P&artUrl=STATOISTICS-WEAK-PULL-05102015010063&eid=31808 ''The Times of India''], October 5, 2015|frame|500px]] | ||

| + | See graphic: 'India and the world, The 15 countries that received the highest FDI in 2014. India was no 9' | ||

| + | |||

| + | ==2015: India no. 1 destination== | ||

| + | [[File: India and the other top nine FDI destinations, Jan-Jun 2015.jpg|India and the other top nine FDI destinations: Jan-Jun 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=India-pips-US-China-as-No-1-FDI-30092015001025 ''The Times of India''], Sep 30 2015|frame|500px]] | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=India-pips-US-China-as-No-1-FDI-30092015001025 ''The Times of India''], Sep 30 2015 | ||

| + | [[File: EY analyses why India is suddenly the most favoured investment destination in 2015.jpg| EY analyses why India is suddenly the most favoured investment destination in 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=15_10_2015_025_030_002&type=P&artUrl=INDIA-CALLING-15102015025030&eid=31808 ''The Times of India''], October 15, 2015|frame|500px]] | ||

| + | '''India pips US, China as No. 1 FDI destination''' | ||

| + | |||

| + | ''Rises 16 llaces in ranking of competitiveness'' | ||

| + | |||

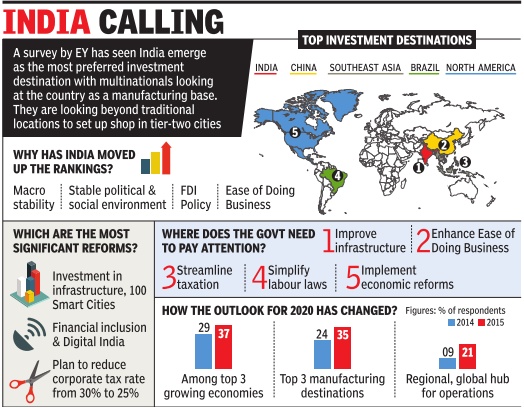

| + | India has emerged on top of the foreign direct investment (FDI) league table, overtaking China and the US, according to fDi Markets, the FT data service. | ||

| + | A ranking of the top destinations for greenfield investment (measured by estimated capital expenditure) in the first half of 2015 shows India at number one, having attracted roughly $3 billion more than China and $4 billion more than the US. | ||

| + | |||

| + | India has also moved up on the World Economic Forum's Global Competitiveness Index by 16 places to 55th position from 71st. | ||

| − | + | The two reports come as a shot in the arm for the Modi government, which has taken several steps to attract foreign investment and has helped revive the mood of investors since it came to office in May 2014. | |

| − | + | “Satisying, our efforts are paying off,“ finance minister Arun Jaitley tweeted. | |

| − | + | The government has unveiled several initiatives like `Make in India' and `Digital India' to lure investors. | |

| − | ' | + | It has moved to ensure that the country moves up on the World Bank's Ease of Doing Business and states have also started their clean-up act on this parameter. |

| − | + | But experts say there are several areas where the government needs to step up reforms. The areas where investors want more reforms include tax policy, labour laws, cutting red tape and issues linked to land acquisition. | |

| − | + | Investors have started taking interest in India and the recent visit of PM Modi to Silicon Valley triggered enormous interest from software and technology czars. India's growth is expected to be the fastest among large economies. Several multilateral agencies have also pointed out that India is a beacon of hope at a time when emerging economies are taking a hit and the Chinese stock market is witnessing volatility. Experts say India is expected to benefit from the slowdown in China and the overall sluggishness in global commodity prices including crude oil is expected to provide a cushion to the growth fortunes of Asia's third largest economy . The government is confident of achieving close to 8% growth in the current fiscal year. India has also moved up on Global Competitiveness Index by 16 places to 55th position. | |

| − | + | The FT said that for the past several years, China and the US have vied for FDI supremacy and fought each other nearly to a draw last year, with the US ranking as the number one greenfield destination by number of projects and China coming in first by capital expenditure. | |

| − | + | It said India ranked fifth last year for capital investment, after China, the US, the UK and Mexico. In a year when many other major FDI destinations posted declines, India experienced one of 2014's best FDI growth rates, increasing its number of projects by 47%, the article said. | |

| − | + | “India is tracking well ahead of where it was at this time last year: it has more than doubled its midyear investment levels, attracting $30 billion by the end of June 2015 compared with $12 billion in the first half of last year,“ the newspaper said. | |

| − | + | “Research from fDi Markets found 97 of 154 countries typically classed as emerging markets experiencing declines in capital expenditure on greenfield investment projects in the first six months of this year compared with the same time period last year,“ it said. | |

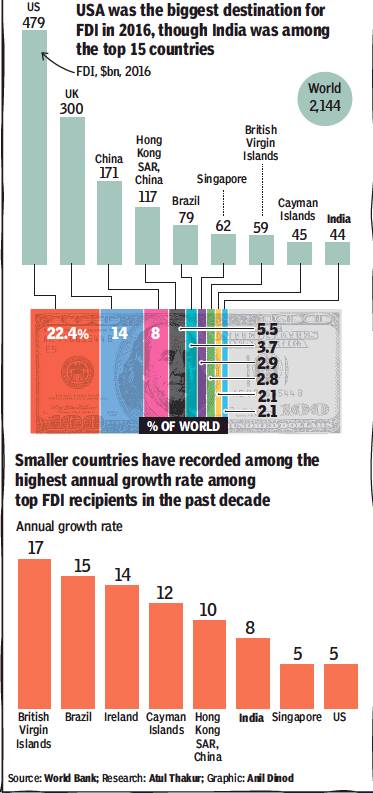

| − | + | ==2016: India was among Top 15, but got 2% of global FDI== | |

| + | '''See graphic:''' | ||

| − | ''' | + | ''Biggest FDI destinations, 2016; Annual growth rate among top FDI recipients, 2006-16'' |

| − | + | [[File: Biggest FDI destinations, 2016; Annual growth rate among top FDI recipients, 2006-16.jpg|Biggest FDI destinations, 2016; Annual growth rate among top FDI recipients, 2006-16 <br/> From: [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F11%2F23&entity=Ar01118&sk=CEA32D50&mode=text November 23, 2017: ''The Times of India'']|frame|500px]] | |

| − | == | + | == FDI confidence: India 8th in 2017, 11th in 2018== |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F05%2F03&entity=Ar02816&sk=439C771E&mode=text India ranks 11th in FDI confidence, May 3, 2018: ''The Times of India''] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | India was ranked 11th in A T Kearney’s FDI confidence index and retained its position as the second highest ranking emerging market. | |

| − | + | But, India was down three notches in the overall ranking from last year. US topped the list, followed by Canada, while Germany dropped to the third place. Overall, India remains among the top investment destinations due to its market size and rapid economic growth. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | and | + | |

| − | + | “We are in a very exciting space of growth, opportunity and transformation. For long, India has been a very exciting destination for investors. Now, especially with the current political stability and positive reforms environment, India will only gain its attractiveness as an investment destination,” said Vikas Kaushal, MD and country head, A T Kearney India. The IMF projects India’s economy will grow by 7.4% in 2018, the fastest growth rate of any major economy. Inward FDI flows already increased to an estimated $45 billion in 2017, a record high. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | == | + | ==2017: India moved to top 10 FDI-hosts== |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F06%2F10&entity=Ar01508&sk=836783CF&mode=text June 10, 2018: ''The Times of India''] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | India has moved up a notch to enter the top 10 FDI host economies in 2017 despite the challenging condition of global foreign direct investment flows. | |

| − | + | According to the World Investment Report 2018, global flows of FDI fell by 23% in 2017, largely due to contraction across developed economies. FDI flows across developing economies, especially in Asia have remained stable, even though the growth has been flat, according to the commerce ministry. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | “2018 is slated to be a tough year with the slowing pace of international production and stagnation of growth in GVCs. Having said that, the Ministry of Commerce & Industry working on critical aspects such as modernising existing bilateral, multilateral and plurilateral treaties, and releasing the new industrial policy focussed on making the Indian industry future ready,” a statement from the ministry said. | |

| − | + | ||

| + | Data showed FDI inflows into India rose 3% to $62 billion during 2017-18, the slowest pace of expansion since the Modi government came to office four years ago. FDI inflows during the previous fiscal were estimated at a shade over $60 billion. | ||

| − | + | ==2017: 11% dip in FDI for India == | |

| + | [https://timesofindia.indiatimes.com/business/india-sees-dip-in-fdi-flow-us-china-retain-top-slots/articleshow/66428995.cms October 30, 2018: ''The Times of India''] | ||

| − | + | [[File: India and other major economies- FDI received, and Change over 2016.jpg|India and other major economies: FDI received, and <br/> Change over 2016 <br/> From: [https://timesofindia.indiatimes.com/business/india-sees-dip-in-fdi-flow-us-china-retain-top-slots/articleshow/66428995.cms October 30, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | [[File: Other major Asian FDI destinations, 2017.jpg|Other major Asian FDI destinations, 2017 <br/> From: [https://timesofindia.indiatimes.com/business/india-sees-dip-in-fdi-flow-us-china-retain-top-slots/articleshow/66428995.cms October 30, 2018: ''The Times of India'']|frame|500px]] | |

| − | |||

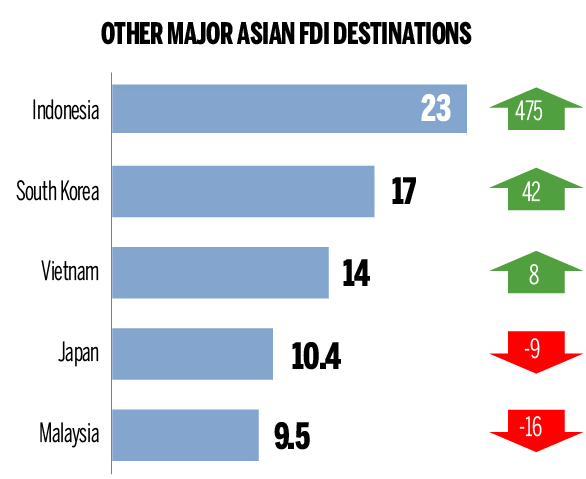

| − | + | Despite a downturn in investment, Asia remained the largest recipient of foreign direct investment (FDI) in 2017, attracting over 36% of global FDI — up from nearly 28% in the previous year. The US retained the top slot, while China remained the favourite destination in Asia. India, however, saw an 11% dip in FDI flow to $40 billion. | |

| − | + | '''See graphics''': | |

| − | + | ''India and other major economies: FDI received, and <br/> Change over 2016'' | |

| − | + | ''Other major Asian FDI destinations, 2017'' | |

| − | + | ==2018: India, 5<sup>th</sup> most attractive investment destination== | |

| + | [https://timesofindia.indiatimes.com/business/india-business/global-ceos-see-india-as-5th-most-attractive-investment-destination/articleshow/62609122.cms Sidhartha, Global CEOs see India as 5th most attractive investment destination, January 22, 2018: ''The Times of India''] | ||

| − | + | [[File: Top 10 investment destinations (2018).jpg|Top 10 investment destinations (2018) <br/> From: [https://timesofindia.indiatimes.com/business/india-business/global-ceos-see-india-as-5th-most-attractive-investment-destination/articleshow/62609122.cms Sidhartha, Global CEOs see India as 5th most attractive investment destination, January 22, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | '''See graphic''': | |

| − | + | ''Top 10 investment destinations (2018)'' | |

| − | |||

| − | + | India moved up a notch to overtake Japan as the fifth most attractive investment destination in a survey of global CEOs, even as the International Monetary Fund said that the country will once again emerge as fastest growing major economy in 2018 amid signs of an improvement in the overall economic environment. | |

| − | + | In a survey conducted by consulting firm PricewaterhouseCoopers, chief executives said that excluding their home market they are most likely to invest in the US, followed by China with the world's largest economy expanding its gap as corporate chiefs expect more rapid growth in America. While China held on to its popularity, India moved a up slightly but still trailed Germany and the UK as an investment destination. | |

| − | The | + | The survey will come as a booster for Prime Minister Narendra Modi who will court international investors+ on Monday and Tuesday in a bid to get more investment into the country, especially in the manufacturing sector, which has remained sluggish and is crucial to job creation. |

| − | + | "Backed by definitive structural reforms, the India story has been looking better in the past one year. Most of our clients are optimistic about their growth. The government has made efforts to address concerns around areas like infrastructure, manufacturing and skilling, although newer threats like cybersecurity and climate change are beginning to play on the minds of our clients," said Shyamal Mukherjee, chairman, PwC India. | |

| − | + | Aided by opening up of several key sectors over the last few years, foreign direct investment in India surged 17% to over $25 billion during the first half of the current financial year, even as private investment has remained muted due to excess capacity and high financial stress. It had for the first time topped $60 billion in 2016-17 but remains less than half of China's $137 billion in 2017, which was an increase of around 8%. | |

| − | + | But IMF on Monday reiterated its earlier estimate that India will grow 7.4% in 2018 and accelerate to 7.8% in 2019 from 6.7% last year. In contrast, China, which IMF estimates suggested grew 6.8%, a ad faster than India, is estimated to slow down to 6.6% in 2018 and further to 6.4% next year. | |

| − | + | At a press conference, IMF chief Christine Lagarde urged global policymakers to "fix the roof" while the going was good, calling for a more inclusive development strategy as nearly one-fifth of developing and emerging economies saw their per capita income decline in 2017. | |

| − | + | She also asked for structural or fiscal reforms and called upon leaders to put together a robust global collaboration to fight corruption, improve conditions for trade, stop tax evasion and prevent catastrophic climate change. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | == | + | ==2018: India overtakes China== |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F12%2F29&entity=Ar02421&sk=840AD02E&mode=text&fbclid=IwAR2hqkcg2D_tgygj2JEh0n_j9unNYKjN7z7GEh7dC61GKSr3kfRVe0CclR8 India pips China in attracting FDI in 2018, December 29, 2018: ''The Times of India''] | ||

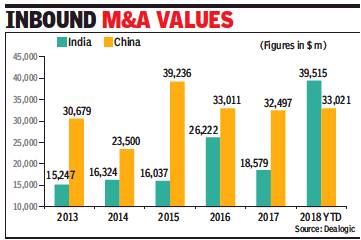

| − | + | [[File: Inbound M&A values in India and China, 2013-18.jpg|Inbound M&A values in India and China, 2013-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F12%2F29&entity=Ar02421&sk=840AD02E&mode=text&fbclid=IwAR2hqkcg2D_tgygj2JEh0n_j9unNYKjN7z7GEh7dC61GKSr3kfRVe0CclR8 India pips China in attracting FDI in 2018, December 29, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | |||

| − | + | For the first time in years, annual foreign direct investment (FDI) into India has been more than that in China in 2018. | |

| − | + | Riding on mega deals by Walmart’s buyout of online retail marketplace Flipkart, along with acquisitions by Unilver and Schneider Electric, the year that will end soon has recorded inbound M&A deals worth $39.5 billion in India, compared to $33 billion in China, data from Dealogic showed. In 2017, China’s inbound M&A deals aggregated at $32.5 billion, which was almost 80% more than India’s $18.6 billion. | |

| − | + | For India, relatively stable economic fundamentals with low inflation rate, strict management of fiscal deficits and introduction of a bankruptcy code tilted the country among investment destinations among global investors. On other hand, for China, ensuing trade war with the US is keeping foreign investors on the back foot, market players said. | |

| − | + | Going into 2019, foreign investors feel India will still remain an attractive investment destination. | |

| − | + | =Regions that attract the most FDI= | |

| − | + | ==2017> 19: Top regions, sectors== | |

| − | + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F04&entity=Ar00117&sk=E82DFC80&mode=text Allirajan M, NCR overtakes Maha as top destination for FDI equity, March 4, 2019: ''The Times of India''] | |

| − | == | + | [[File: The six regions that attracted the most FDI, 2017-19..jpg|The six regions that attracted the most FDI, 2017> 19. <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F03%2F04&entity=Ar00117&sk=E82DFC80&mode=text Allirajan M, NCR overtakes Maha as top destination for FDI equity, March 4, 2019: ''The Times of India'']|frame|500px]] |

| − | + | ''Share Of Inflows Rises From 14% To 25% In 3 Yrs'' | |

| − | + | ||

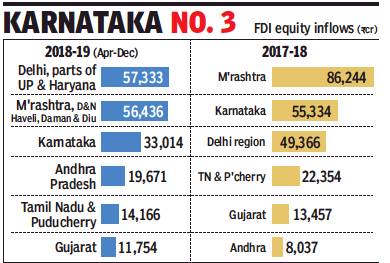

| − | + | The National Capital Region has pipped long-standing leader Maharashtra in attracting FDI (foreign direct investment) equity inflows into the country. | |

| − | + | A report by Department of Industrial Policy and Promotion (DIPP) mentions that the ‘New Delhi region’, covering the national capital and parts of UP and Haryana (which is broadly contiguous with NCR), received FDI equity inflows of Rs 57,333 crore ($8.3 billion) in the first nine months of 2018-19. FDI equity inflows aggregated about $33.5 billion in the first nine months of fiscal year 2018-19, a 7% decline compared with the same period in the previous fiscal year. | |

| − | + | Maharashtra, which had the highest share of FDI in the first nine months of fiscal 2016-17 (49%), has witnessed a consistent drop in its share. Its share in total FDI flows fell to 32% during the corresponding period in fiscal 2017-18 and further to 24% in the same period in FY2018-19. | |

| − | + | In contrast, NCR has seen a sustained increase in its share in total FDI equity inflows — from 14% in the first nine months of FY2016-17 to 17% in FY2017-18 and further to 25% in the same period in FY2018-19. | |

| − | + | Maharashtra’s FDI inflows fell 30% year-on-year (y-o-y) to Rs 56,346 crore ($8 billion) in the first nine months of FY19 while that of Tamil Nadu contracted 26% y-o-y to Rs 14,166 crore ($2.1 billion). | |

| − | + | Maharashtra, Delhi, Tamil Nadu, Karnataka and Gujarat received nearly 75% of the total FDI equity inflows into the country in the first nine months of FY2018-19. | |

| − | |||

| − | + | '''Top five sectors account for 65% of FDI equity inflows''' | |

| − | + | ||

| − | + | ||

| + | Tamil Nadu’s share in FDI inflows declined to 14% in the first nine months of FY2018-19 from 18% during the corresponding period in FY2017-18, but it was much higher than the 3% share in the same period in FY2016-17, data showed. FDI inflows into Karnataka also slumped 26% y-o-y to Rs 33,014 crore ($4.74 billion). Gujarat, however, saw higher inflows — from $787 million in the first nine months of FY2017-18 to about $1.7 billion in the same period in FY2018-19. | ||

| − | + | States that have been laggards in the past in attracting FDI, are also catching up fast. Andhra Pradesh, West Bengal, Kerala, Rajasthan, Punjab, Haryana and Himachal Pradesh collectively received nearly 15% of FDI equity inflows in the first nine months of FY2018-19. | |

| − | + | They had only a 4% collective share in the comparable period the previous year. “Investments in emerging economies were lower partly due to uncertainty in the global markets,” said Rucha Ranadive, economist, CARE Ratings. “Foreign investments in emerging markets have mainly been adversely impacted by global headwinds such as the slowdown in the global economy, trade war between the US and China, concerns over Brexit, tightening of monetary policies by major global central banks, rupee depreciation and geo-political tensions among others.” | |

| − | + | ||

| − | + | The top-5 sectors — services, computer hardware and software, chemicals, telecommunication and trading— accounted for nearly 65% of total FDI equity inflows. During the first nine months of FY2018-19, chemicals received highest FDI inflows of $6.07 billion, which was 18% of the total FDI equity inflows during this timeframe. | |

| − | + | It was much higher than the 3% share of the sector in the comparable period last year and was five times more than the inflows amounting to $1.1 billion in the first nine months of FY2017-18. It was followed by services with nearly 17.7% share and by computer software and hardware (14% share). While inflows in the services sector grew by 28% y-o-y, it declined 8% in computer hardware and software. | |

| − | + | =Rules, changes in= | |

| + | ==November 2015: Rules changed for 15 sectors== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Govt-tries-to-move-beyond-Bihar-goes-for-11112015001044 ''The Times of India''], November 11, 2015 | ||

| + | [[File: FDI in India, the measures announced for 15 sectors in November 2015.jpg|FDI in India: The measures announced for 15 sectors in November 2015; Graphic courtesy: [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Govt-tries-to-move-beyond-Bihar-goes-for-11112015001044 ''The Times of India''], November 11, 2015|frame|500px]] | ||

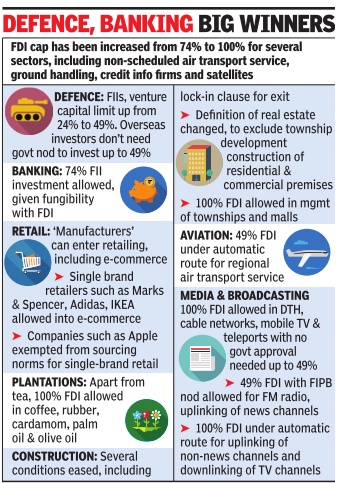

| − | + | '''Govt tries to move beyond Bihar, goes for FDI reforms''' | |

| − | + | The government announced a raft of changes in the foreign direct investment (FDI) rules for 15 sectors -including retail, defence, construction, banking and electronic media. The PM also was keen to ensure that the rules provide a boost to those manufacturing locally , with sources pointing to the decision to allow “Indian manufacturers“ to retail their goods, including on e-commerce plat forms -a move that will benefit the likes of Fabindia and Hidesign. Other “manufacturers“ too have been allowed to enter the retail arena without the government's approval. In a move that will make it easier for private banks to raise capital, the government has permitted full fungibility of foreign investment in private banks. This means that there will be no sub-limits for foreign portfolio investors (FPIs). | |

| + | While foreign direct investment of up to 74% was permitted until now, portfolio investment -investments by foreign institutional investors -was capped at 49%. Also, banks had to approach the foreign investment promotion board (FIPB) for any increase in foreign investment above 49%. | ||

| + | The introduction of fungibility does not, however, mean that strategic investors get a free hand in picking up chunky stakes in banks. RBI regulations require that individual investor holding is capped at below 5%. Also, even promoters of banks are required to dilute their stake below 20% over a period of time. | ||

| + | The relaxation of cap on sub-limits is in keeping with the government's proposal to announce composite caps for FDI in various sectors announced in July 2015. However, at the time of the announcement banks were kept out as they were considered `sensitive'. | ||

| + | ==2016: Liberalised FDI rules== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Foreigners-can-now-hold-100-stake-in-food-21062016001042 ''The Times of India''], Jun 21 2016 | ||

| − | + | '''Foreigners can now hold 100% stake in food retail, airlines''' | |

| − | |||

| − | + | The Modi government announced fresh liberalisation of foreign direct investment (FDI) rules by throwing open food retail, airlines and private security firms to higher overseas flows. In addition, rules were eased for those looking to invest in defence, DTH services and single-brand retail as the Modi administration sought to showcase India as the “most open“ FDI destination in the world with only a handful of sectors requiring government clearance. | |

| − | + | “The Centre has radically liberalised the FDI regime, with the objective of providing major impetus to employment and job creation in India,“ the PMO tweeted. | |

| − | + | The government suggested that the pitch will now change to how most sectors don't face FDI restrictions.“We will soon issue a negative list of sectors and all the others will be open to FDI,“ industrial policy and promotion (IPP) secretary Ramesh Abhishek told reporters after the changes were cleared at a high-level meeting chaired by the prime minister. | |

| − | + | Although the finance ministry had kicked off discussions and the department of IPP had begun work on easing rules a few weeks ago, the decision came on the first working day after Raghuram Rajan's announcement to return to the US on completion of his term as RBI governor in September. | |

| − | + | Government officials said too much should not be read into the announcements sin ce Modi had scheduled the meeting earlier. But the market saw in the decisions the government's determination to counter any slide in business and market confidence and a signal to the world that reforms would continue. In particular, they come amid fe ars of the rupee coming under renewed pressure on account of a possible withdrawal of some of the $20 billionplus foreign currency deposits that are due for redemption later this year. But the urgency could be gauged from the fact that the PM used special powers to announce the decisions and did not wait for a green light from the cabinet, which was scheduled to meet on Wednesday.Modi had used the powers for a similar liberalization initiative in November 2015. | |

| − | + | For the government, this is at least the fourth round of major FDI changes since it took office two years ago and the second since last November when the rules for a number of sectors-aviation, construction and retail, among others--were eased. Earlier, the Modi government had raised FDI caps on insurance and defence while allowing overseas flows into railways, which had remained shut two decades after the 1991 reforms. The steps fuelled a 54% jump in FDI flows in the last financial year, to a record $55.5 billion. | |

| − | + | This time, the focus has been on removing the stiff conditions that often came with opening up a sector and which tended to deter investors. The government has therefore eased rules for defence manufacturing companies where foreign ownership is in excess of 49%. Earlier, FDI was allowed only if foreign funds were accompanied with “state of the art“ technology. Now the rules say “modern technology“ will need to come, which is seen to be more flexible.“If the defence forces need some goods and it is produced using modern technology as opposed to state of the art, a local manufacturing facility can come up,“ said a senior government official. | |

| − | + | ||

| − | + | ||

| − | + | Consultants acknowledged that rules had been simplified. “Defence is extremely technology-driven and OEMs (original equipment manufacturers) invest huge sums of money generating technology and intellectual property. The fact that there was no control permitted earlier was a major issue that was cited for not investing in India. That obstacle has now been removed and coupled with major simplification in the DPP (defence procurement procedure), OEMs should respond positively and proactively to these path-breaking reforms,“ said Dhiraj Mathur, a partner at global consulting firm PricewaterhouseCoopers. | |

| − | + | Even in case of food retailing, the PM chose to ignore protests from the food processing ministry on mandating sourcing norms for retailers in a segment where 100% FDI has been permitted without riders, including in e-commerce. | |

| + | The government also eased norms for setting up branch office, liaison office or project office. It also simplified rules for FDI in animal husbandry. | ||

| − | + | ==2016: Abolition of Foreign Investment Promotion Board (FIPB)== | |

| + | [http://www.thehindu.com/business/budget/Centre-to-phase-out-2-decade-old-FIPB/article17127341.ece Pradeesh Chandran, Centre to abolish FIPB, Feb 1, 2017: The Hindu Business Line] | ||

| − | |||

| − | + | '''Government has shown its clear intent towards fast-tracking inflow of Foreign Direct Investments''' | |

| − | + | The Budget 2017-18 has given a clear indication of the government’s intent to further liberalise policies related to foreign direct investment. | |

| − | + | It also seeks to dismantle a two-decades-old body that was formed as a beacon of the economic liberalisation of 1993: the Foreign Investment Promotion Board (FIPB). The 1993 round of reforms under the P.V. Narasimha Rao regime, for the first time, threw the doors open to foreign investors. | |

| − | + | One of the major announcements in Finance Minister Arun Jaitley’s Budget speech was the abolition of the FIPB. | |

| − | + | The board has offered a single window clearance for applications of prospective foreign investors in sectors falling in the approval route. The board has handled investment proposals worth up to ₹5,000 crore. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | '''Creation of FIPB''' | |

| − | + | The FIPB was formed under the Prime Minister’s Office in the mid-1990s as part of the first round of Indian economic reforms. It was reconstituted in 1996 and transferred to the Department of Industrial Policy and Promotion. | |

| − | the | + | It was transferred to the Department of Economic Affairs under the Ministry of Finance in 2003, according to its website. |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | of | + | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | According to government rules, foreign investments in sectors under the automatic route do not require prior approval from the FIPB and are subject to sectoral rules. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | “More than 90% of the total FDI inflows are now through the automatic route. The Foreign Investment Promotion Board has successfully implemented e-filing and online processing of FDI applications.” | |

| − | + | ||

| − | than | + | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | “We have now reached a stage where FIPB can be phased out. We have therefore decided to abolish the FIPB in 2017-18,” Mr. Jaitley said. | |

| − | + | ||

| − | + | ||