Police: India, Income Tax India: Laws

(→Vacancies) |

(→The main changes) |

||

| Line 5: | Line 5: | ||

|} | |} | ||

| − | [[Category:India| | + | [[Category:India|I]] |

| − | [[Category: | + | [[Category: Economy-Industry-Resources |I]] |

| − | [[Category: | + | [[Category: Law,Constitution,Judiciary|I]] |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | =Basic tenets= | |

| + | Adapted from [http://economictimes.indiatimes.com/personal-finance/et-wealth/how-well-do-you-know-the-tax-rules/articleshow/31671843.cms EconomicTimes] March 2014 | ||

| − | + | 1) The interest earned on a bank fixed deposit is...Interest on FDs is fully taxable as income at the rate applicable to the taxpayer. | |

| − | + | 2) Travel insurance policies are not tax deductible for salaried individuals. | |

| − | + | ||

| − | + | 3) An individual won't get tax deduction for... | |

| + | employer's contribution to PF. | ||

| − | + | 4) Gifts worth over Rs 50,000 in a year are taxed as income of recipient. | |

| − | + | 5) Any income of a minor child will be clubbed with that of the parent. HRA is not tax-exempt if you pay rent to... Your minor child. | |

| − | + | 6) A disabled dependant gets you a deduction under Section 80DD. This is an additional tax benefit | |

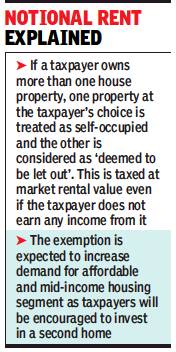

| − | + | 7) f you have a second house lying vacant, you have to... | |

| − | + | a. Pay tax on rent not received. b. Include in wealth tax. c. Pay property tax on it. All the three conditions apply on a second house lying vacant. | |

| − | + | 8) If one earns rent on property, how much of it is taxable? | |

| + | Rental income is eligible for 30% standard deduction. | ||

| − | + | 9) Only those with income below the basic exemption are exempt from filing tax returns. | |

| − | + | 10) The RGESS deduction is available only to first-time investors in equities. | |

| − | + | == Section 80C== | |

| + | [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F12%2F12&entity=Ar01506&sk=A2A88911&mode=text December 12, 2017: ''The Times of India''] | ||

| − | + | To boost the habit of savings and investments, the government has allowed every individual taxpayer to invest and buy certain financial products which will allow them to avail of tax deductions. Under section 80C of Income Tax Act 1961, a taxpayer could invest a total of Rs 1.5 lakh per annum in ELSS of mutual fund houses, EPF, PPF, tax-saving FDs, NPS, life insurance products and some other approved financial products, which will reduce the person’s total tax liability. Payment of home loan principal and tuition fee of children also come under this section for tax deductions. | |

| − | + | ||

| − | + | ||

| − | [ | + | ==Section 80 D== |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F01%2F23&entity=Ar01911&sk=D6250823&mode=text January 23, 2018: ''The Times of India''] | ||

| − | |||

| − | + | ''WHAT ARE SECTION 80D TAX BENEFITS?'' | |

| − | + | Section 80D under the Income Tax Act provides for tax deductions for buying health insurance policies, popularly called mediclaim plans. In an era of increasing healthcare costs, the government, to encourage people to take mediclaim policies, allows taxpayers some sops for these policies. A taxpayer can get claim deductions of up to Rs 25,000 per year for payment towards premium for health insurance plans for the taxpayer, spouse and dependent children. The limit is enhanced up to Rs 30,000 even if either the taxpayer or the spouse is a senior citizen. Within these limits one can also claim deductions of up to Rs 5,000 per year as a cost for preventive health check up. The government also allows mediclaim premium of up to Rs 30,000 for policies taken for parents. | |

| − | + | =Rates of income tax in India= | |

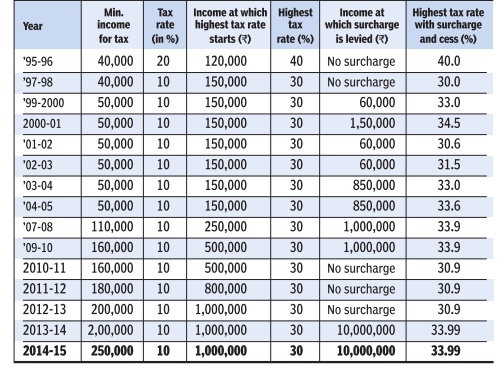

| + | ==1995-2015== | ||

| + | '''See the chart on this page''' | ||

| − | + | '''See graphic''': | |

| + | |||

| + | ''Income tax rates in India: 1995-2015'' | ||

| + | |||

| + | [[File: Income tax rates 1995-2015.jpg|Income tax rates in India: 1995-2015 Source: [http://epaperbeta.timesofindia.com//Gallery.aspx?id=11_07_2014_003_028_002&type=P&artUrl=YOUR-TAX-BURDEN-OVER-THE-YEARS-11072014003028&eid=31808 The Times of India ]|frame|500px]] | ||

| + | |||

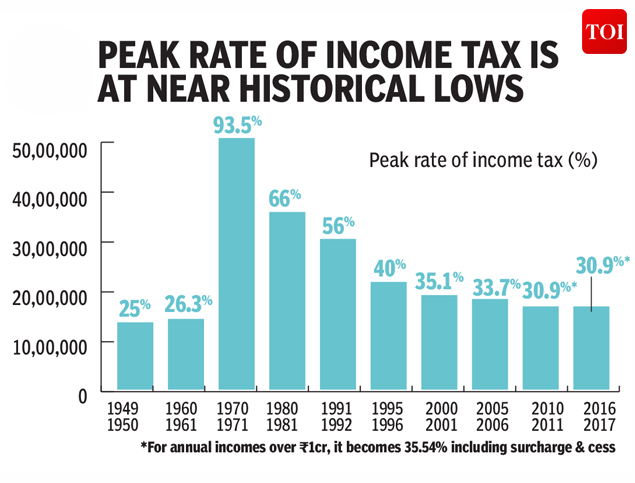

| + | ==1949-2017: peak rate of Income Tax== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/toi-budget-special-how-you-pay-less-tax-than-your-grandpa/articleshow/62458093.cms January 15, 2018: ''The Times of India''] | ||

| + | |||

| + | [[File: 1949-2017- peak rate of Income Tax.jpg|1949-2017: peak rate of Income Tax <br/> From: [https://timesofindia.indiatimes.com/business/india-business/toi-budget-special-how-you-pay-less-tax-than-your-grandpa/articleshow/62458093.cms January 15, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | ''1949-2017: peak rate of Income Tax'' | ||

| − | |||

| − | + | '''Highlights''' | |

| − | + | We know you absolutely hate a part of your annual income going into to the government's kitty in the form of taxes. After all, you worked hard the whole year and wish the exemption limit would be set higher. Whether that would be done or not will be known till Budget 2018 is presented, but you should take heart from the fact that you pay much less tax than what your grandfather did during his time. | |

| − | + | While exemption limit today stands at Rs 2.5 lakh annually, it was Rs 1,500 way back in 1949-50. Though this may seem a meagre amount to you, a back of the envelope calculation shows this works out to be Rs 80,000 in today's terms. So your grandfather started paying tax at annual income of Rs 80,000, while you enjoy tax-free income that is nearly three times more than it. | |

| − | + | Tax rates are another reason for you to cheer about. The peak tax rate today stands at 30.9%. But during 1970-71 it was a staggering 93.5%, a massive increase from the 25% Indians paid in 1949-50. | |

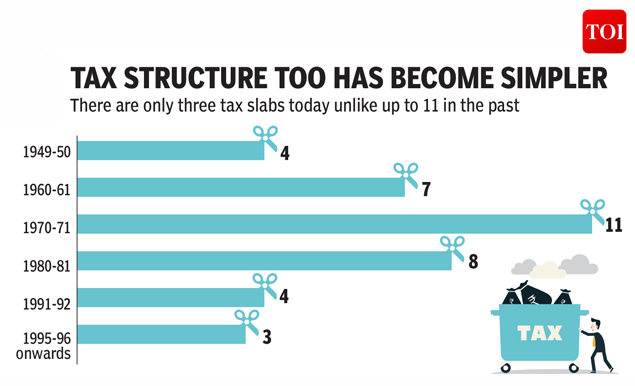

| − | + | You may find three tax slabs cumbersome for tax calculation, but thank your stars, your parents or grandparents had to deal with as many as 11 tax slabs. | |

| − | = | + | ==1949, and since 1995: The number of tax slabs== |

| − | + | [[File: The number of tax slabs in 1949, and since 1995.jpg| The number of tax slabs in 1949, and since 1995 <br/> From [https://timesofindia.indiatimes.com/business/india-business/toi-budget-special-how-you-pay-less-tax-than-your-grandpa/articleshow/62458093.cms January 15, 2018: ''The Times of India ''] |frame|500px]] | |

| − | [[File: | + | |

'''See graphic''': | '''See graphic''': | ||

| − | '' | + | ''The number of tax slabs in 1949, and since 1995'' |

| + | =Appeals= | ||

| + | ==2015: Appeals only for Rs 10 lakh +== | ||

| + | '''Sources:''' | ||

| − | == | + | 1. [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=I-T-appeals-only-for-Rs-10L-and-13122015001059 ''The Times of India''], Dec 13 2015 |

| − | [ | + | 2. [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=To-rein-in-frivolous-appeals-CBDT-ties-I-13122015012026 ''The Times of India''], Dec 13 2015, Rubna Kably |

| − | |||

| + | '''I-T appeals only for Rs 10L and above''' | ||

| − | |||

| − | + | In a bid to reduce litigation and spare taxpayers harassment, the Central Board of Direct Taxes has increased from Rs 4 lakh to Rs 10 lakh the threshold for filing an appeal before the Income Tax Appellate Tribunal, reports Rubna Kably. | |

| − | + | The threshold limit for an appeal by the I-T department before the high courts has been doubled to Rs 20 lakh. The threshold for I-T department appeals before SC remains at Rs 25 lakh. | |

| − | + | ||

| − | + | ||

| − | ''' | + | '''To rein in frivolous appeals, CBDT ties I-T hands by raising `tax effect' limit''' |

| − | |||

| − | + | The Central Board of Direct Taxes (CBDT) continues with its plan to reduce litigation and be more taxpayer-friendly. By significantly increasing the threshold limits for filing of appeals, at various judicial levels, by the Income-tax (I-T) department, the CBDT hopes to mitigate taxpayer harassment and create efficacy in the functioning of the I-T department. | |

| + | At times, the I-T department files appeals with higher courts, with an eye on revenue, when the decision in the lower court is in favour of the taxpayer. Such frivolous litigation adds to the costs for both parties and results in taxpayer harassment. | ||

| − | + | The threshold limit for filing an appeal before the Income-Tax Appellate Tribunal (ITAT) by the I-T department has now been raised from Rs 4 lakh to Rs 10 lakh. Similarly , the limit for an appeal before the high courts has been doubled to Rs 20 lakh. While such revisions are an annual affair, the recently announced upward revisions are significant. | |

| − | + | However, no change has been made in the threshold for appeals filed before the Supreme Court, which remains at Rs 25 lakh. Appeals before the ITAT and courts can now be filed by the I-T department only if the `tax effect' exceeds the threshold limits (see table). This move will help not only corporates, but also high net-worth individuals who find themselves embroiled in I-T litigation. | |

| − | + | The CBDT has also clarified, in its circular dated December 10, that the revised limits will apply retrospectively and pending appeals below the specified threshold limits should be withdrawn or not pressed. | |

| − | + | The `tax effect', as defined in CBDT's circular, means the difference between the tax on the total income assessed by the I-T department and the tax that would have been charged if the total income of the taxpayer was reduced by the income relating to disputed issues. | |

| − | + | The CBDT has also instructed that merit must be the guiding factor while filing an appeal with higher judicial bodies -both the ITATs and courts. “It is clarified that an appeal should not be filed merely because the tax effect in a case exceeds the monetary limits (ie: threshold limits for appeals) prescribed,“ states the circular. | |

| − | + | Tax experts view that the increase in threshold limits and withdrawal of pending appeals falling below the revised thresholds will ease litigation. The impact will be more favourable at the ITAT level, which is the first level of appeal. It is learnt that pan-India, 1.06 lakh cases were pending across various ITAT benches as of June 1. The maximum pendency was in Mumbai and Delhi, with 25,039 and 20,499 pending cases. Howev er, the exact number of pend ng cases, which will now fall below the revised threshold imits and be withdrawn, was not available. | |

| − | + | However, to safeguard the nterests of the I-T department, certain caveats have been built into the instruc ions. For instance, just because on a particular disputed ssue, the I-T department has not appealed as the tax effect is ow, it does not preclude it from iling an appeal on the same issue for another taxpayer where the tax effect is beyond he prescribed threshold). | |

| − | + | Further, the instructions on not filing an appeal if the ax effect is below the prescribed monetary limit will not apply in certain instances. These instances include: where the constitutional val dity of a tax provision is challenged; where the CBDT's circular has been held illegal or even when the audit objection has been accepted by the I-T department. | |

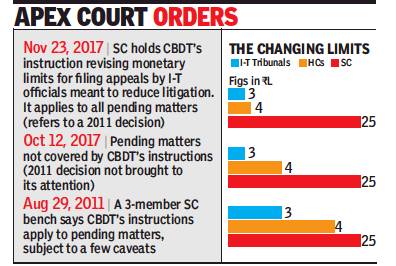

| − | + | ==2017: ‘Higher appeals limit applies to pending cases,’ SC== | |

| + | [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F11%2F28&entity=Ar01514&sk=7C5C11DB&mode=text Higher I-T appeals limit also applies to pending cases, says SC, November 28, 2017: ''The Times of India''] | ||

| − | + | [[File: The honorable Supreme Court orders regarding CBDT's instruction revising monetary limits.jpg|The honorable Supreme Court orders regarding CBDT's instruction revising monetary limits <br/> From: [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F11%2F28&entity=Ar01514&sk=7C5C11DB&mode=text Higher I-T appeals limit also applies to pending cases, says SC, November 28, 2017: ''The Times of India'']|frame|500px]] | |

| − | + | ||

| − | [ | + | |

| + | The Supreme Court has held that the higher monetary threshold limits prescribed for filing of appeals by the income-tax authorities would apply both to appeals filed after the date of the instruction revising the limits and also to all pending matters. This brings respite to taxpayers who feared matters pending on the date of the instruction would be revived and lead to a tiring bout of litigation. | ||

| − | + | On November 23, the SC upheld the retrospective nature of the Central Board of Direct Taxes (CBDT) instruction setting down the thresholds for I-T appeals. | |

| − | + | This order departs from an October order of the apex court which had taken a contrary view. After this decision, individual taxpayers and businessmen facing low denomination disputes had feared that I-T officials would rake up old matters discarded after upward revision of the threshold. | |

| − | + | From time to time, CBDT, responsible for tax administration, enhances the monetary limits for filing of I-T appeals. Officials are not permitted to file appeals where the “tax effect” is low (as defined by the monetary limit), except for the few exceptions carved out. It helps cut down litigation, including pending litigation, and saves costs. “Tax effect” denotes the difference between the tax on income determined by I-T officials and the I-T chargeable on the income of the taxpayer after excluding the disputed income. | |

| − | + | CBDT’s instruction, the subject matter of litigation before the SC, was dated February 9, 2011. It had provided that appeals cannot to be filed by I-T officials before high courts is the “tax effect” was less than Rs 10 lakh (the earlier circular on March 27, 2000, had pegged it at Rs 4 lakh). It did not change the monetary threshold for appeals before I-T tribunals and the SC, which remained at Rs 3 lakh and Rs 25 lakh, respectively. | |

| − | + | Since then, another set of instructions have been issued, which provides that if the tax effect is Rs 10 lakh or less, an appeal cannot be filed even with the tax tribunals. For high courts, the limit is set at Rs 20 lakh and for the SC, it is Rs 25 lakh. Before the SC, the I-T department contended that the CBDT instruction had a prospective effect only. Thus cases pending in high courts on February 9, 2011, could not be dismissed merely based on the instruction. But the SC decided in favour of the taxpayer, SRMB Dairy Farming, a private limited company, by holding that CBDT’s instructions will also apply to all pending matters. | |

| − | + | “The SC has rightly pointed out that the interpretation of CBDT’s instruction had to be done in the context of the purpose for which it was issued, which is to reduce litigation that had choked the legal system. Thus the apex court held that the instructions applied to pending matters also, as such an interpretation would facilitate achievement of the objectives of the National Litigation Policy aimed at bringing down the pendency of litigation cases,” said Gautam Nayak, tax partner, CNK & Associates, a firm of chartered accountants. | |

| − | + | Interestingly, the latest instruction issued by the CBDT on December 11, 2015, not only significantly hiked the monetary threshold limits but categorically mentioned that: “This instruction will apply retrospectively to pending appeals and appeals to be filed henceforth in courts and tribunals. Pending appeals below the specified tax limits may be withdrawn.” | |

| − | + | ||

| + | Nayak said: “This showcases the intent of the instructions and the SC has rightly acted on it.” | ||

| − | + | =Artists= | |

| + | ==Fashion designers== | ||

| + | [http://epaper.timesofindia.com/Default/Client.asp?Daily=CAP&showST=true&login=default&pub=TOI&Enter=true&Skin=TOINEW&AW=1393708348876 Times of India] | ||

| − | + | ‘Fashion designers are artists, eligible for I-T exemption’ | |

| + | Shibu Thomas | ||

| − | + | Mumbai: A fashion designer is an artist, the Bombay High Court has said and ruled that they are eligible for incometax exemptions available under the category. Ten years after the income-tax department first objected to tax benefits claimed by one of India’s leading fashion designers, Tarun Tahiliani, a division bench of Justice Dhananjay Chandrachud and Justice J P Devadhar on Monday said the designer should get tax privileges extended to the artists. | |

| − | + | Tahiliani opened the country’s first fashion boutique, Ensemble, and is credited with being one of the designers who have brought high couture to India. Tahiliani’s IT woes began in October 2000 when he sought tax exemption for his income of Rs 83.90 lakh. Under Section 80 RR of the Income-Tax Act, a resident of India, who is an an author, playwright, artist, musician, actor or sports person can claim exemption of 75% of his income earned from foreign assignments. Tahiliani said that applying the exemptions, his taxable income for that year would be Rs 53.24 lakh. | |

| − | + | The tax department, however, refused to accept that the fashion designer was an artist. It also contested deductions sought by sought by Tahiliani on his taxable income for 1999-2000 and 2001-2002. The income-tax appellate tribunal ruled in Tahiliani’s favour, upholding his claim that he was a creative artist. The IT department challenged the order before the high court. | |

| + | |||

| + | The department’s lawyer contended that a fashion designer didn’t belong to the creative profession as the vocation was classified under applied arts and not fine arts. The IT department said that the benefit of exemption was granted to aid the artists, who represent Indian culture abroad. | ||

| + | |||

| + | The HC dismissed the IT department’s petition and held that fashion designers were entitled to tax exemptions meant for artists. | ||

| − | + | = Capital gains= | |

| + | See [[Capital gains: India]] | ||

| − | + | =Corporates’ promotional activities= | |

| + | == Pharmaceutical companies’ junkets for doctors== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=I-T-trips-pharma-cos-on-doc-junkets-20092016010015 Lubna Kably, I-T trips pharma cos on doc junkets, Sep 20 2016 : The Times of India] | ||

| − | + | Tribunal Disallows Expenses | |

| − | + | The Mumbai bench of the Income-Tax Apellate Tribunal (ITAT) has nipped the `unholy' doctor-pharma nexus whereby medical practitioners are offered various incentives, like overseas trips, to encourage them to prescribe specific medicines or lines of treatment. | |

| − | + | It has done so by upholding a disallowance of Rs 76.55 lakh, made by an I-T officer at the assessment stage. The expenditure was incurred by Liva Healthcare (a pharma company specialising in skincare formulations) to wards overseas trips for doctors and their spouses. | |

| − | + | ||

| − | + | The immediate impact of the order is a higher I-T liability for the pharma company for financial year 2008-09, to which this case pertains, as the disallowed expenditure will be added back to the taxable component of income. In addition, the order will act as a reminder to pharma compa nies to adopt practices that are above board. The maximum rate of income tax on companies currently is 30% plus applicable surcharge and cess. | |

| + | The ITAT's September 12 order observes, “The payment of overseas trips of doctors and their spouses for entertainment, by the pharma company , in lieu of expectation of getting patient re ferrals from doctors for its products so as to generate more business and profits, by any stretch of imagination cannot be accepted as legal.Undoubtedly it is not a fair practice and has to be termed as against the public policy.“ | ||

| − | + | Section 37 of the I-T Act, which is a residual section, permits a business entity to claim as a deduction revenue expenditure incurred by it, `wholly and exclusively for the purpose of the business'.However, an explanation to this section provides that expenses incurred for any purpose which is an offence or is prohibited by law shall not be deemed to have incurred for the purpose of the business.Consequently , such expenditure cannot be allowed as a deduction from taxable income. | |

| − | + | The code of conduct prescribed by the MCI debars doctors from receiving favours in return for referring, recommending or procuring of patients for medical, surgical or any other treatment. | |

| − | + | = Donations to NGOs’ projects= | |

| + | ==Halved in 2017== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Share-of-donations-to-projects-under-Sec-35AC-04032017026075 Share of donations to projects under Sec 35AC halved in FY16, March 4, 2017: The Times of India] | ||

| − | |||

| − | + | '''Sec 35AC Sunset Clause Will Expire On March 31''' | |

| − | + | Donations made to hundreds of projects carried out by NGOs across the country will no longer be eligible for a 100% income tax (I-T) deduction in the hands of the donor from April 1. While tax savings are not the main purpose, if donations are made in March towards eligible projects, then donors comprising salaried employees could reap an I-T benefit. | |

| − | + | At present, donations made for specific projects run by NGOs that have been certified under section 35AC entitle the donor to a 100% I-T deduction under section 80GGA in respect of the donated amount. | |

| − | + | ||

| + | However, section 35AC has a sunset clause which expires this March. Section 80GGA is not as widely known as section 80G, which permits a 100% I-T deduction in respect of certain donations (such as PM's National Relief Fund) and a 50% I-T deduction in most other cases (see table). | ||

| − | + | “Taxpayers who do not earn income under the head `profits and gains of business and profession', such as salaried employees, can claim the benefit of section 80GGA. While the employer cannot consider the donations made, while computing tax to be deducted at source against salary income, the employee can claim the benefit of the same in his I-T return and claim an I-T refund, if applicable,“ says Pradeep Mahtani, director, HelpYourNGO Foundation. A chartered accountant says, “In fact, if there has been a short deduction of tax at source and advance tax has not been paid by the salaried employee, by making donations eligible for I-T deduction up to March 31, the salaried taxpayer could mitigate his I-T penalty . Donors should ensure that they get the appropriate receipt.“ | |

| − | A | + | |

| − | + | Notifications are issued by the finance ministry from time to time, certifying the projects that are eligible under section 35AC, the period of eligibility and also the total cost of the eligible project. For instance, as regards NGOs registered in Ma harashtra, these include projects by Magic Bus (skill development and livelihood programme), Association of Palliative Care (for a palliative care centre), Foundation of Promotion for Sports and Games (Olympic Gold Quest project) and Mesco (educational scholarships). | |

| − | + | HelpYourNGO, an online donation platform, has on its portal 45 NGOs that run 90 projects eligible under section 35AC, These include some well known names such as Akshaya Patra's midday meals, projects by Childline and People for Animals. | |

| − | + | In view of the sunset clause, a government-appointed national committee -which approves projects that would be eligible under section 35AC -had ceased to accept requests after December last year. “Donation stems from fundamental reasons, which are deep-rooted among each donor whether that's joy , guilt, remembrance or duty . However, everyone does think of saving I-T after having donated. Just like the insurance and the investment industry , which makes people aware of I-T savings available to them, for donations it is incumbent upon NGOs to make people aware of taxes they can save as a result of the donation they have made,“ says Dhaval Udani, founder of Danamojo, a payments platform for NGOs. | |

| − | + | Perhaps awareness of a 100% I-T deduction for donations made to section 35AC-eligible projects has been low. HelpYourNGO did a dipstick sample survey of 12 NGOs, for which data was readily available. It showed that the percenta ge of donations towards 35ACeligible projects as compared to total donations received by NGOs has declined from 14.7% in fiscal 2014-15 to 7.9% in the next fiscal. | |

| − | + | Deval Sanghavi, partner and co-founder at Dasra, a strategic philanthropy foundation, points out, “Our experience has shown that donors see the I-T deduction more as a government certification, which in essence states the organisation is compliant with laws and adheres to missiondriven principles vis-à-vis a giver donating more because of the I-T deduction.“ | |

| − | + | The number of individuals who donate money to charity has shown a rise in India.As many as 203 million Indians donated money during 2015, opposed to just 183 million in 2014, according to the World Giving Index 2016. | |

| − | + | =Educational institutions= | |

| + | ==Profits not taxable: SC== | ||

| − | The | + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Educational-institutions-profits-not-taxable-SC-19032015015012 ''The Times of India''] |

| − | + | Mar 19 2015 | |

| − | + | ||

| − | + | ||

| − | + | Amit Choudhary | |

| − | + | The Supreme Court has ruled that surplus income earned by educational institutions cannot be taxed, and imparting education not termed a for-profit activity simply because it yielded high returns. | |

| + | Dismissing the revenue department's submission that an educational institution ceased to be a solely scholastic endevaour if it generated high profits, the court noted that their income was exempt from tax under the Income Tax Act. | ||

| − | + | “Where an educational institution carries on the activity of education primarily for educating persons, the fact that it makes a surplus does not lead to the conclusion that it ceases to exist solely for educational purposes and becomes an institution for the purpose of making profit,“ a bench of Justice T S Thakur and Justice Rohinton F Nariman said. | |

| − | + | ||

| − | + | “A distinction must be drawn between the making of a surplus and an institution being carried on `for profit'. If, after meeting expenditure, a surplus arises incidentally... it will not cease to be one existing solely for educational purposes,“ the bench added. | |

| − | + | The court, however, said the government must examine activities of such institutions to ensure that the purpose of education is not taken over by a profit-making motive. “If they are not genuine, or are not being carried out in accordance with all or any of the conditions subject to which approval has been given, such exemption must be withdrawn,“ it said. | |

| − | + | The court passed the order on a bunch of petitions filed by Queen Educational Society challenging an Uttarakhand High Court order allowing I-T authorities to tax its surplus income of around Rs 7 lakh for the assessment year 2000-01. | |

| − | + | =Exemptions= | |

| + | ==1950: residential palace of erstwhile ruler exempted from IT== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Cant-tax-income-from-palace-rent-SC-06122016019026 AmitAnand Choudhary, Can't tax income from palace rent: SC, Dec 6, 2016: The Times of India] | ||

| − | + | '''Court Raps I-T Dept For Pursuing Case Against Erstwhile Ruler Of Kota''' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | |||

| − | |||

| − | = | + | The Supreme Court held that the income earned by erstwhile rulers of a princely state or their heirs by renting out a portion of the residential palace was not taxable and rapped the Income Tax department for pursuing a case despite their income being exempted under IT law. |

| − | ==2017: | + | |

| − | [https:// | + | A bench of Justices Ranjan Gogoi and Abhay Manohar Sapre allowed a plea of the ruler of the former princely state of Kota, now a part of Rajasthan, challenging the high court order for bringing his income from rent in the Income Tax net. The ruler owns extensive properties, including two residential pa laces known as Umed Bhawan Palace and the City Palace. The ruler is using Umed Bhawan Palace for his residence and a portion of it was rented out to the ministry of defence way back in 1976. |

| + | |||

| + | Although the Centre had in 1950 declared residential palace of an erstwhile ruler, situated within the state, as his inalienable ancestral property to be exempted from payment of income-tax, the I-T department had in 1984 initiated proceedings for assessment of income earned from renting out a portion of the palace. The Centre had incorporated Section 10(19A) in the IT Act to give exemption to former rulers. | ||

| + | |||

| + | The department contended that IT exemption was given for personal use and income earned from the rent was taxable. Commissioner of Income Tax and Income Tax Appellate Tribunal, however, turned down the plea of the IT department which had moved the Rajasthan HC. | ||

| + | |||

| + | The HC had ruled that as so long as the ruler continued to remain in occupation of his official palace for his own use, he would be entitled to claim exemption but if he let out any part of his palace, he became disentitled to claim benefit of exemption available under Section 10(19A) for the entire palace. | ||

| + | |||

| + | “In such circumstances, he is required to pay income-tax on the income derived by him from the portion let out in accordance with the provisions of the I T Act and the benefit of exemption remains available only to the extent of portion which is in his occupation as residence,“ the HC had said. | ||

| + | |||

| + | Quashing the HC order, the Supreme Court held that Section 10(19A) has used the term “palace“ for considering the grant of exemption to the ruler and income earned from renting out a portion of the palace was also exempted. | ||

| + | |||

| + | “We cannot ignore this distinction while interpreting Section 10(19A) which, in our view, is significant. In our considered opinion, if the Legislature intended to spilt the Palace in part(s), alike houses for taxing the subject, it would have said so by employing appropriate language in Section 10(19A) of the IT Act.We, however, do not find such language employed in the section,“ the bench said.. “Once the assessee is able to fulfil the conditions specified in section for claiming exemption under the Act then provisions dealing with grant of exemption should be construed liberally because the exemptions are for the benefit of the assessee,“ it said. | ||

| + | |||

| + | == Scheduled tribes, Sikkimese, agriculture, institutions, hospitals, trusts== | ||

| + | [http://timesofindia.indiatimes.com/india/Heres-why-scrapped-notes-are-flying-off-to-the-northeast/articleshow/55590761.cms Here's why scrapped notes are flying off to the northeast, TNN | Updated: Nov 24, 2016, The Times of India] | ||

| + | |||

| + | HIGHLIGHTS | ||

| + | |||

| + | I-T laws allow exemptions for various categories of incomes or individuals | ||

| + | |||

| + | Among those are members of ST communities in Nagaland, Manipur, Tripura, Arunachal and Mizoram | ||

| + | |||

| + | A similar exemption is available to all those defined as "Sikkimese" | ||

| + | |||

| + | Among those exempt from paying income tax are members of scheduled tribe communities in Nagaland, Manipur, Tripura, Arunachal Pradesh and Mizoram. Scheduled tribes in North Cachar Hills and Mikir Hills in Assam, the Khasi Hills, Garo Hills and Jaintia Hills in Meghalaya and Ladakh in Jammu & Kashmir also don't have to pay income tax. The exemption applies to income arising from any source in these areas or from dividends or interest on securities from anywhere. | ||

| + | |||

| + | A similar exemption is available to all those defined as "Sikkimese" in the I-T Act. This again is for any income generated from Sikkim itself and for income from dividend or interest on securities generated anywhere. The intent behind these exemptions is to provide fiscal concessions to backward areas and communities. In times like now, it becomes a useful route for people looking to turn undisclosed incomes legitimate. | ||

| + | |||

| + | Apart from these geographically restricted exemptions, there is of course the exemption for agricultural income. That includes any rent or revenue derived from agricultural land. | ||

| + | |||

| + | There are several ''' institutions ''' that are tax exempt under the IT Act. Again, it is not difficult to see why the lawmakers would have decided not to tax them. For instance, income of a public charitable trust or not for profit society established for development of khadi and village industries is exempt from tax. Educational institutions including universities existing solely for educational purposes and not for profit are exempt from paying tax on their incomes under various sub-sections of the IT Act. | ||

| + | |||

| + | Similarly, not for profit hospitals too are exempt, different kinds being covered by different sub-sections. | ||

| + | |||

| + | Income of a charitable institution or fund approved by the prescribed authority is not required to pay taxes on its income either. Nor are public religious or public charitable trusts approved by the prescribed authority. Political parties and electoral trusts are also exempt from tax on their incomes. It is another matter that a major chunk of the money flowing to parties never enters any books anyway. | ||

| + | |||

| + | ==Yoga == | ||

| + | ===`Medical relief,' `imparting education' are charitable purposes=== | ||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Ramdev-trust-wins-I-T-war-on-tax-18022017013006 Lubna Kably, Ramdev trust wins I-T war on tax-exempt tag for yoga, Feb 18, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | Baba Ramdev's Patanjali Yogpeeth (a public charitable trust) has succeeded in its appeal before the Income-tax Appellate Tribunal (ITAT), which has accepted its tax exempt status. | ||

| + | |||

| + | The ITAT (Delhi bench) held that Yoga entails providing medical relief and camps also provide education, and that both `medical relief ' and `imparting education' fall within the meaning of charitable purpose, entitling the trust to claim I-T exempt status under sections 11 and 12 of the Income Tax Act. | ||

| + | |||

| + | “The finding of I-T authorities that propagation of yoga by Patanjali Yogpeeth does not qualify as medical relief or imparting of education is not justified,“ stated the ITAT in its order dated Feburary 9.Even as the litigation settled by the ITAT, relates to the 200809, the ITAT has also referred to subsequent amendment in the I-T Act, which came into effect from April 1, 2016. This amendment specifically inserted `yoga' within the definition of `charitable purpose'. If the exempt status not been upheld by the ITAT, Patanjali Yogpeeth would have been liable to pay income tax. The total income of this trust is not brought out in the ITAT order. | ||

| + | |||

| + | The ITAT also held that corpus donations aggregating to Rs 43.98 crore received by Patanjali Yogpeeth, predominantly for construction of cottages under its Vanprasth Ashram Scheme (which provides accommodation to those attending residential yoga courses), were capital receipts not liable to I-T. Such donations included land donated, whose market value was pegged by I-T authorities at Rs 65 lakh. In its order, the ITAT pointed out that “Corpus donations are not taxable, even in circumstances where the trust is not eligible for I-T exemption“. | ||

| + | |||

| + | Various additions to the trust's income made by the I-T authorities, including a Rs 96 lakh addition made for services made by the trust to Vedic Broadcasting in which Acharya Balkrishnan, a trustee and close aide of Baba Ramdev holds substantial interest were deleted by the ITAT, on the ground that the I-T authorities had not understood the facts. | ||

| + | |||

| + | The ITAT also agreed with the submissions made by the trust and observed that certain inferences by the I-T authorities such as provision of benefits to certain persons or receipt of anonymous donations were made without fully appreciating the facts. | ||

| + | |||

| + | =Expatriates= | ||

| + | == Salary paid in India won’t face tax, if Non-resident== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F15&entity=Ar02416&sk=1A619CBE&mode=text Lubna Kably, Non-resident expats’ salary paid in India won’t face tax, February 15, 2018: ''The Times of India''] | ||

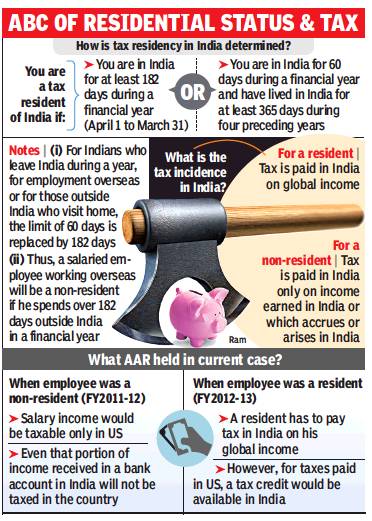

| + | |||

| + | [[File: How tax residency in India is determined.jpg|How tax residency in India is determined <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F02%2F15&entity=Ar02416&sk=1A619CBE&mode=text Lubna Kably, Non-resident expats’ salary paid in India won’t face tax, February 15, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | The Authority of Advance Rulings (AAR) has held that the salary income of a nonresident individual for services rendered overseas cannot be taxed in India, even when such salary is paid into a bank account in India. | ||

| + | |||

| + | The ruling stands out because apart from providing relief from double taxation under the Indo-US tax treaty, the AAR additionally held that the sums received in India would not be taxable here under the domestic tax laws. | ||

| + | |||

| + | Unlike a tribunal or court order, a ruling by AAR, a quasi-judicial body, does not set a precedent. But it does have persuasive value and is well-considered. Thus, the ruling may benefit expat workers, in particular the over one lakh Indian workers who work in the US, largely on H1B visas. | ||

| + | |||

| + | Typically, when white-collared workers are ‘seconded’ on an overseas assignment by an Indian company, a split salary arrangement is worked out. Under ‘secondment’, the employee is transferred on the payroll of the overseas parent or group company, which pays the basic salary and certain allowances, in the overseas country. However, the Indian company deposits a part of the salary in the employee’s bank account in India. This enables the employee to meet certain obligations in India—such as repayment of housing loan or household expenses (as the family could be in India). | ||

| + | |||

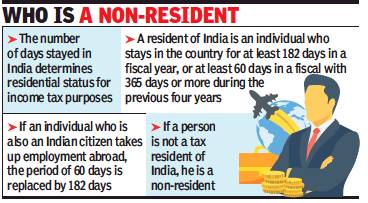

| + | While an Indian residing abroad is popularly referred to as a non-resident Indian (NRI), the nomenclature is different under tax laws. It is not the country of origin, but the number of days’ stay in India, which determine whether a person will be a resident or non-resident for tax purposes. | ||

| + | |||

| + | Resident individuals are taxable in India on their global income, irrespective of where it was earned. In the case of non-residents, only income that accrues or arises in India (say, bank interest from a savings account in India or rental income from a house in Mumbai) is treated as taxable in India (see table). There is a third category, that is, resident but not ordinarily resident (RNOR), for whom the tax incidence is the same as for non-residents. | ||

| + | |||

| + | “Thus, salary received by non-residents in a bank account overseas for services performed outside India is not subject to tax in India. However, salary received in India is considered as taxable under the Indian domestic tax laws (along with being taxed in the country where they are working as most countries adopt the source method of taxation). Typically, a split salary mechanism results in litigation, as income-tax (I-T) authorities seek to bring to tax the income received in India. In such cases, employees claim relief under a tax treaty, which ensures that the same income is not taxed twice,” says Maulik Doshi, tax partner, SKP Group, a consultancy firm. | ||

| + | |||

| + | In this case, the employee, T N Santhosh Kumar, was seconded by Texas Instruments to Texas Inc, a US company, for a period of two years. As is typically the case, a split salary mechanism was adopted. Kumar was paid monthly a part of the salary and certain bonuses in India by Texas India. | ||

| + | |||

| + | A communique by EY India states: “Based on the India-US tax treaty, the AAR held that the place where the employee performs their duties is what is considered and not where the income is received or where the company providing the remuneration is based. As the salary is paid for work performed in the US, the income would be taxable in the US alone and no tax would be required to be withheld in India.” | ||

| + | |||

| + | “It is interesting to note that the AAR also held that such salary payments received in India by the non-resident would not be taxable in India even under its domestic tax laws,” says Doshi and adds, “in cases where there is no tax treaty (such as with Hong Kong) or in peculiar situations where the taxpayer is unable to access a tax treaty owing to lack of certain documents, this ruling will be very helpful.” In simple terms, the word accrue in India refers to something that is due in India. | ||

| + | |||

| + | Kumar was deputed for a two-year term. In the second year, in which he returned to India (that is, 2012-13) he was a resident of India and liable to tax on his global income. The US would also tax his US source salary income. Here, the AAR held he would be entitled to a tax credit in India for US taxes. | ||

| + | |||

| + | =Family trusts= | ||

| + | ==No `gift' tax on property received from individual== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=No-levy-on-transfer-of-assets-to-family-24032017026045 No levy on transfer of assets to family trust, March 24, 2017: ''The Times of India''] | ||

| + | |||

| + | |||

| + | `Gift' tax provisions will not apply to property received from an individual by a family trust, according to an amendment made in the Finance Bill passed by the Lok Sabha. | ||

| + | |||

| + | High net worth individuals (HNWI) commonly use family trusts as a tool for succession planning, as it provides an upfront solution to any possible future disputes that may arise, including any challenges to a will by relatives at a later date. Family trusts also ring fence assets from any future liabilities.Shares, immovable property et al are settled (transferred) to the trust for the benefit of spouse, children and other relatives. The trust dis tributes income to the beneficiaries. | ||

| + | |||

| + | The Finance Bill had introduced clause (x) in section 56(2). It provided that receipt of money or property by `any person' (which includes individuals and other entities such as private trusts and companies) without consideration or for inadequate consideration in excess of Rs 50,000 shall be subject to Income-tax (I-T) in the hands of the recipient, under the head `Income from other sources'.“The budget proposals had created uncertainty around family trusts receiving such gifts. The enacted change will bring relief to families intending to create trusts for legitimate succession planning,“ says Pranav Sayta, family business services leader at EY India. | ||

| + | |||

| + | =Film actors= | ||

| + | ==Promotion of film: actor not expected to incur expenditure== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Money-spent-by-Hrithik-to-promote-film-taxable-30112016021038 Money spent by Hrithik to promote film `taxable', Nov 30, 2016: The Times of India] | ||

| + | |||

| + | |||

| + | It is not an actor's responsibility or obligation to incur expenditure on promotion of his film, the Mumbai bench of the Income Tax Appellate Tribunal (ITAT) ruled recently . It disallowed an expenditure of Rs 5.6 lakh, incurred for promotion of `Gujarish', which was claimed by the lead actor, Hrithik Roshan, as deduction from his income in 2010-11. | ||

| + | |||

| + | While verifying Hrithik's income-tax (I-T) returns, the officer noticed that Hrithik had shown an expenditure of Rs 7 lakh for promotion of his film.The actor said it was paid to seven contestants of `Saregama', a TV show, for promotion his brand image, as he was the lead actor in the film. `Guzaarish' was a 2010 release, composed and directed by Sanjay Leela Bhansali, which also had Aishwarya Rai in the lead role. The officer held that expenditure relating to the film's making, its promotion et all was the producer's responsibility . He disallowed the expenditure claimed by the actor in his I-T computation as a business deduction. | ||

| + | |||

| + | =Foreign tax credit (FTC)= | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Claiming-credit-in-India-for-taxes-paid-overseas-01072016025026 The Times of India], Jul 01, 2016 | ||

| + | |||

| + | Lubna Kably | ||

| + | |||

| + | In a bid to reduce litigation, the Central Board of Direct Taxes (CBDT) has made it easier for Indian-resident taxpayers, including large Indian companies having overseas operations, to claim credit for the taxes borne by them abroad. | ||

| + | Credit of foreign taxes (referred to as foreign tax credit, or FTC) were allowed under tax treaties with other countries and the Income Tax Act, but the absence of specific rules often led to litigation.Denial of FTC by tax authorities also resulted in double taxation on the same income in the hands of Indian-resident taxpayers. | ||

| + | |||

| + | FTC rules issued by the CBDT provide that credit for foreign taxes can be claimed against taxes paid in India, like income tax (be it personal or corporate), cess and surcharge. Further, Indian companies can also claim FTC against Minimum Alternate Tax (MAT). Taxpayers have to submit proof of the tax paid or deducted at source in the foreign country to claim FTC. | ||

| + | |||

| + | The earlier draft rules, issued in April, had excluded disputed foreign taxes from the ambit of FTC. Now credit can be claimed in respect of disputed foreign taxes, subject to meeting compliance requirements. | ||

| + | |||

| + | Indian-resident taxpayers pay taxes on their global income in India, including on foreign source income which has already been subject to tax overseas (see graphic). FTC eliminates double taxation on the same income. To illustrate: A parent company headquartered in India earns interest on debt given to its Sri Lankan (SL) subsidiary and is subject to a 10% withholding tax. The Indian company will pay tax in India on its global income (including the foreign source interest income). The new rules will make it easier for it to claim an FTC for the 10% tax with held in Sri Lanka. | ||

| + | |||

| + | According to RBI data, India Inc's overseas investments by way of debt and equity amounted to $750 million in May . FTC rules will help Indian companies with global operations get benefit of credits for foreign taxes. The rules will also help high net worth individuals who make overseas investments and bear foreign taxes on their dividend or interest income. “Clarity on grant of FTC against the MAT liability is a big positive as is the move to provide credit for `disputed foreign taxes' upon final settlement of dispute. However, the modus operandi for allowing such credit -especially when the assessments are time-barred -needs to be prescribed,“ says Girish Vanvari, tax leader at KPMG India. | ||

| + | |||

| + | Some hiccups remain.Gautam Nayak, tax partner, CNK & Associates, says, “The rules provide clarity about the extent of FTC available and documents to be submitted for that. However, difficulties faced by certain taxpayers have not been addressed.FTC would not be available for taxes not covered by the relevant tax treaty , such as state taxes paid in the US or branch profits' taxes paid overseas.Besides, the tax credit would be restricted to the rate of tax payable under the tax treaty , even if the actual tax paid as well as the Indian tax payable is higher. So, if excess taxes have been withheld by the foreign payer out of abundant precaution, or on account of their local laws, tax credit would be available only for tax payable under the treaty terms. For example, the US levies a higher rate of withholding of 30% if a foreign entity (say an Indian company) does not have a tax identification number. In such cases, credit in India would be available only to the extent of applicable rate prescribed under the tax treaty.“ | ||

| + | |||

| + | =Gifts= | ||

| + | ==Need not be camouflaged remuneration== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=SRKs-RS15cr-Dubai-villa-cant-be-taxed-24082017009040 Lubna Kably, `SRK's RS15cr Dubai villa can't be taxed', August 24, 2017: The Times of India] | ||

| + | |||

| + | |||

| + | The income-tax appellate tribunal (ITAT) has rejected the tax department's view that a villa in Dubai gifted to Bollywood actor Shah Rukh Khan a decade ago was a camouflage to evade income tax. The tribunal has held that the value of the villa cannot be treated as the actor's taxable income. | ||

| + | |||

| + | The villa had been gifted to Khan under a formal gift deed in 2007, after he obtained the RBI's approval. | ||

| + | |||

| + | I-T authorities were of the view that the donor, Nakheel PJSC, a Dubai-based company known for the famous Palm Projects, had gifted the villa as it was keen on using the actor's image and brand.The actor is a globally known figure and has endorsed various foreign brands for remuneration running into a few crores. Thus, the gift was seen as remuneration to Khan for utilising his brand image and in lieu of his stage performance at the company's annual day event. In light of this, the I-T authorities sought to tax the value of the villa as income in SRK's hands. | ||

| + | |||

| + | During the assessment for the financial year 200708, I-T officials added the value of the villa -Rs 17.85 crore -to the income of Rs 126.3 crore declared by Khan in his I-T return. The actor would have had to pay I-T on this additional sum. At the first stage of appeal, the commissioner (appeals), agreed with the I-T authorities. Based on a valuation report, though, he reduced the addition to Rs 14.7 crore. | ||

| + | |||

| + | Appealing before ITAT, Khan, through his counsel, said the chairman of the company, Sultan Ahmed Bin Sulayem, was his friend and thus wished to make the gift. He admitted to attending the annual day event, but said he merely addressed the employees and did not perform on stage, which would have amounted to brand endorsement. On taxation of a gift in kind, ITAT pointed out that for the relevant financial year, gifts of immovable property made without any consideration were out of the tax ambit. | ||

| + | |||

| + | =Gratuity= | ||

| + | ==Payment of Gratuity(Amendment) Bill 2017== | ||

| + | [https://timesofindia.indiatimes.com/business/india-business/tax-free-gratuity-limit-doubled-parliament-passes-bill/articleshow/63411961.cms March 22, 2018: ''The Times of India''] | ||

'''HIGHLIGHTS''' | '''HIGHLIGHTS''' | ||

| − | + | Parliament has passed Payment of Gratuity(Amendment) Bill 2017 paving the way for doubling the limit of tax free gratuity to Rs 20 lakh | |

| − | + | The Bill also notifies period of maternity leave as part of continuous service | |

| − | + | Parliament passed Payment of Gratuity(Amendment) Bill 2017 paving the way for doubling the limit of tax free gratuity to Rs 20 lakh and empowering the government to fix the ceiling of the retirement benefit through an executive order. | |

| + | The Rajya Sabha passed the bill, which was approved by the Lok Sabha on March 15. Besides enabling the central government to fix the ceiling of tax free gratuity, the bill will also empower it to fix the period of maternity leave through executive order. | ||

| − | + | It also notifies the period of maternity leave as part of continuous service and proposes to empower the central government to notify the gratuity ceiling from time to time without amending the law. | |

| − | + | Rajya Sabha Chairman M Venkaiah Naidu said in the Upper House that he had met leaders of various parties in the morning and it was decided that the House would take up the crucial Payment of Gratuity (Amendment) Bill as it was of importance to the employees. | |

| − | + | Labour Minister Santosh Kumar Gangwar then moved the bill for consideration and passage. It was passed by a voice vote without a debate. | |

| − | + | The labour ministry later said in a statement that the Bill also envisages amending the provisions relating to calculation of continuous service for the purpose of gratuity in case of female employees who are on maternity leave from "twelve weeks" to such period as may be notified by the central government from time to time. | |

| − | + | Prime Minister Narendra Modi tweeted: "A significant pro-people measure passed in Parliament. Will benefit lakhs of Indians." | |

| − | + | ||

| − | + | After implementation of the 7th Central Pay Commission, the ceiling of tax free gratuity amount for central government employees was increased from Rs 10 lakh to Rs 20 lakh. The unions have been demanding for inclusion of the change in the Act. | |

| − | + | At present, formal sector workers with five or more years of service are eligible for Rs 10 lakh tax-free gratuity after leaving job or at time of superannuation. | |

| + | A senior government official had earlier said that the government wants to provide tax-free gratuity of Rs 20 lakh to organised sector workers at par with the central government. | ||

| − | The | + | The Payment of Gratuity Act, 1972, was enacted to provide for gratuity payment to employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops or other establishments. |

| − | + | The law is applicable to employees, who have completed at least five years of continuous service in an establishment that has 10 or more persons. | |

| − | + | The amendment will also allow the central government to notify the maternity leave period for "female employees as deemed to be in continuous service in place of existing twelve weeks". | |

| − | + | The proposal comes against the backdrop of the Maternity Benefit (Amendment) Act, 2017 enhancing the maximum maternity leave period to 26 weeks. | |

| − | + | ||

| − | + | =House rent allowance= | |

| + | == Proof needed of rent paid to kin== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=For-tax-relief-you-need-proof-of-rent-11042017001063 Lubna Kably, For tax relief, you need proof of rent paid to kin, April 11, 2017: The Times of India] | ||

| − | |||

| − | + | The Mumbai income tax appellate tribunal (ITAT) denied a claim on house rent allowance (HRA) by a taxpayer. | |

| − | + | ||

| − | + | ||

| − | + | She had paid rent in cash to her mother, but was unable to substantiate it. On the other hand, the Ahmedabad ITAT allowed the HRA exemption claimed by a taxpayer who had paid rent to his spouse. | |

| + | Given that the avenues available to save tax are limited for the salaried class, some employees try and take the `fullest' advantage of the income tax exemption available for HRA by paying rent to a family member with whom they are residing. It is another matter if the rent is actually paid to the relative, or if the rent receipts are genuine. | ||

| − | ' | + | Where do these seemingly contrary ITAT decisions leave the taxpayer? The bottom line is it isn't illegal to pay rent to a close relative, but it carries a risk of a deeper probe by I-T officials and if genuineness cannot be proved, the claim would be denied, with attendant consequences. |

| − | + | The bottom line is precautions are necessary when paying rent to a relative. For instance, it is better to enter into a leave and licence agreement and make payments via banking channels. Under section 10 (13A) of the I-T Act, a salaried taxpayer can claim exemption on HRA for an accommodation occupied by him, if the property is not owned by him and he has actually incurred rent expenditure on it. | |

| − | + | Amarpal S Chadha, partner, people advisory services at EY-India, says: “Payment of rent to a parent or spouse will not impact the eligibility to claim HRA exemption as long as the above mentioned conditions are met and the transaction is genuine.“ “The transaction should not be a mechanism to avoid tax,“ he stresses. | |

| − | + | So decisions by the Mumbai and Ahmedabad ITATs -one accepting the tax exemption claim on payment of rent to a relative and the other denying it -may seem contrary , but the orders were based on specific facts in each case. | |

| − | + | Rent paid to spouse, HRA claim allowed: In 2013, the Ahmedabad ITAT bench in Bajrang Prasad Ramdharani's case, allowed an HRA exemption claim by the taxpayer, even though rent was paid by him to his spouse. He was living with his wife but paid her rent via bank transfers. The ITAT held that the taxpayer had fulfilled the twin requirement of occupying a house not owned by him and payment of rent. | |

| − | + | Rent paid to mother, HRA claim disallowed: But more recently , the Mumbai bench disallowed the HRA claim by Meena Vaswani who had contended that she lived with her aging mother to take care of her and paid rent to her mother in cash. While rent receipts were obtained by her, as the transaction was with her mother, she had not entered into any formal contract. Vaswani was not able to produce proof of cash withdrawals from her bank to substantiate the rental payments. Moreover, the authorities were able to prove that she was not residing with her mother, but in another apart ment nearby with her husband and daughter. The ITAT agreed with I-T authorities that the transaction was a sham to obtain a tax benefit. | |

| − | The | + | The fine print: “There is nothing in the I-T Act to prevent a salaried person from claiming exemption under section 10(13A) on the basis of rent paid to a close relative. However, section 143(2) empowers the I-T officer to examine the genuineness of such expense,“ says Ameet Patel, tax partner at Manohar Chowdhry & Associates, a CA firm. “In the normal course, a taxpayer would not pay rent to his spouse or parent. I personally would never advise any client to enter into such a transaction. It is but natural for the I-T officer to look upon such arrangements with suspicion,“ adds Patel. |

| − | + | The Mumbai ITAT placed reliance on the Indian Evidence Act, 1872, and took the position that the onus of proving that the rental transaction was real lay with the taxpayer. | |

| − | + | = Income Tax returns= | |

| + | ==Who has to file income tax returns== | ||

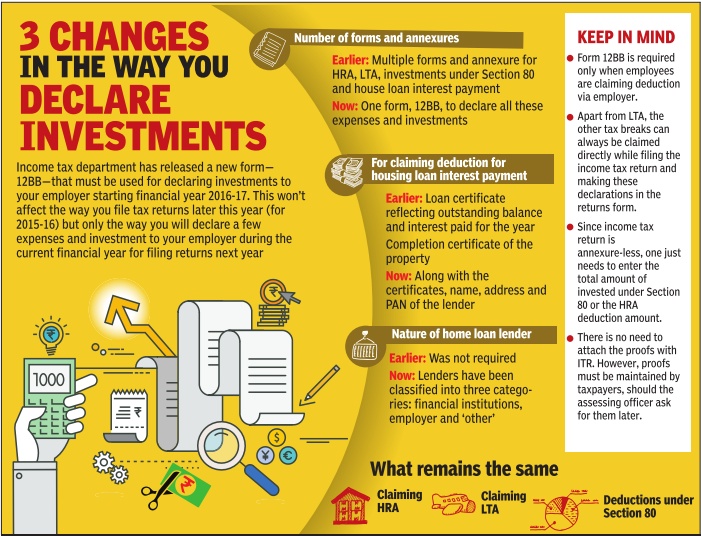

| + | [[File: Declaring investments through Form 12BB, 2016 onwards.jpg| Declaring investments through Form 12BB, 2016 onwards; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=08_05_2016_035_016_002&type=P&artUrl=3-CHANGES-IN-THE-WAY-YOU-DECLARE-INVESTMENTS-08052016035016&eid=31808 ''The Times of India''], May 8, 2016|frame|500px]] | ||

| − | + | ''Salaried persons earning up to Rs 5 lakh annually'' | |

| − | + | '''Salaried persons earning up to Rs 5 lakh annually will have to file income tax returns: Central Board of Direct Taxes''' | |

| − | + | PTI | Jul 22, 2013 | |

| − | + | ||

| − | + | ||

| + | [http://timesofindia.indiatimes.com/business/india-business/Salary-earners-up-to-Rs-5-lakh-need-to-file-I-T-return-CBDT/articleshow/21248270.cms The Times of India] | ||

| − | |||

| − | The | + | The CBDT had exempted salaried employees having a total income of up to Rs 5 lakh including income from other sources up to Rs 10,000 from the requirement of filing income tax return for assessment year 2011-12 and 2012-13, respectively. |

| − | + | However, for the assessment year 2013-14 and thereafter, salaried persons earning up to Rs 5 lakh annually will have to file income tax returns, Central Board of Direct Taxes (CBDT) said on Monday. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | Earlier in May 2013, the CBDT had made E-filing of income tax return compulsory for the assessment year 2013-14 for persons having total assessable income exceeding Rs 5 lakh. | |

| − | + | The CBDT said that the exemption has been not been extended as the facility for online filing of returns has been made "user-friendly with the advantage of pre-filled return forms". | |

| − | + | These e-filed forms also get electronically processed at the central processing centre in a speedy manner, it said. | |

| − | + | For filing returns, an assessee can transmit the data in the return electronically by downloading ITRs, or by online filing. | |

| − | + | Thereafter the assessee had to submit the verification of the return from ITR-V for acknowledgement after signature to Central Processing Centre. | |

| − | = | + | ==Not filing I-T returns?Imprisonment,fine== |

| − | + | ''' Not filed I-T returns? You face jail & fine ''' | |

| − | + | ||

| − | + | ||

| + | TNN | Aug 17, 2013- | ||

| − | + | [http://timesofindia.indiatimes.com/city/mumbai/Not-filed-I-T-returns-You-face-jail-fine/articleshow/21871680.cms The Times of India] | |

| − | + | MUMBAI: Those defaulting in filing income tax returns are liable to prosecution, the I-T department has said. | |

| − | + | If the tax evaded exceeds Rs 25 lakh, the defaulter can be sentenced to a minimum imprisonment of six months and maximum of seven years, besides being asked to pay a fine. If the tax evasion amount is less than Rs 25 lakh, the imprisonment could range between three months to two years in addition to fine. | |

| − | + | Recently, the additional chief metropolitan magistrate, New Delhi, sentenced a taxpayer to six months' imprisonment in one assessment year and one year imprisonment in subsequent assessment year for repeating the offence of not filing income tax returns. | |

| − | '' | + | ==2018: Changed format== |

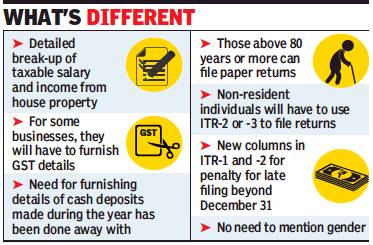

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F04%2F07&entity=Ar02812&sk=8B686481&mode=text Changes you need to know for I-T returns, April 7, 2018: ''The Times of India''] | ||

| − | + | [[File: What’s different in the I-T return forms notified for the assessment year 2018-19.jpg|What’s different in the I-T return forms notified for the assessment year 2018-19 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F04%2F07&entity=Ar02812&sk=8B686481&mode=text Changes you need to know for I-T returns, April 7, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | When you file your income tax (I-T) returns in July, you will have to fill details such as allowances that are not exempt, value of perks, and profits in lieu of salary in the new I-T return forms notified for the assessment year 2018-19. | |

| − | + | A one-page simplified ITR Form-1 (Sahaj) can be filed by an individual who is a resident having income up to Rs 50 lakh and who is receiving income from salary, one house property and other income (interest, etc), the I-T department said. The detailed break-up of salary was not part of ITR forms last year but has been added this year. | |

| − | + | Similar details have to provided for income from house property. Gender mention requirement has been removed from ITR-1. Non-resident individuals cannot use ITR-1 to file returns and will have to use ITR-2 or -3, depending on their nature of income in India. Tax experts said this could raise their compliance costs. | |

| − | + | ||

| − | + | ||

| − | + | The ITR-1form is similar to the one for the previous assessment year, which had been used by 3 crore taxpayers who filed their returns using this form. You will also have to provide details of all bank accounts held in the country at any time during the previous year, except dormant accounts. | |

| − | + | The requirement of furnishing details of cash deposit made during a specified period as provided in the ITR form for the assessment year 2017-18 has been done away. This provision was added in the aftermath of the demonetisation drive. | |

| − | + | ITR Form-2 has also been rationalised by providing that Individuals and HUFs (Hindu Undivided Families), having income under any head other than business or profession, shall be eligible to file returns under this form. The Individuals and HUFs, having income under the head business or profession, shall file either ITR Form-3 or ITR Form-4, the department said. | |

| − | + | “There are more than 25 key changes in current year ITR forms in comparison to last year. Some of these changes suggest that the focus of new ITR forms is to get more information from unlisted companies, trusts and taxpayers, who have opted for presumptive taxation scheme,” said Naveen Wadhwa, deputy general manager at Taxman. | |

| − | + | “Further, the ITR forms also require the business entities to report the GST transaction, which would help the department to independently reconcile the transactions reported by them in income-tax returns and GST returns,” he said. | |

| − | + | In case of non-residents, the requirement of furnishing details of any one foreign bank account has been provided for credit of refund. “There is no change in the manner of filing of ITR forms as compared to last year. All these ITR forms are to be filed electronically,” the department said. | |

| − | + | ||

| − | + | Any individual who is 80-year-old or more has the option to file paper returns as well as an Individual or HUF whose income does not exceed Rs 5 lakh and who has not claimed any refund in the return of income. | |

| − | + | Tax experts said additional fields for penalty due to delayed filing have been added in ITR-1 and ITR-2. | |

| − | + | “The new Form ITR-1 (Sahaj) for assessment year 2018-19 does not request for the residential status of the individual and it is neither applicable to individuals qualifying as Not Ordinarily resident (NOR) nor to non-residents (NR). So Indian employees who have left India for overseas employment in the first half of the year and qualifying as non-resident would be required to file their India tax returns in ITR-2, even though they have annual taxable income up to Rs 50 lakh,” said Alok Agarwal, senior director at Deloitte. | |

| − | ''' | + | =='Returns can be filed after I-T notice is issued'== |

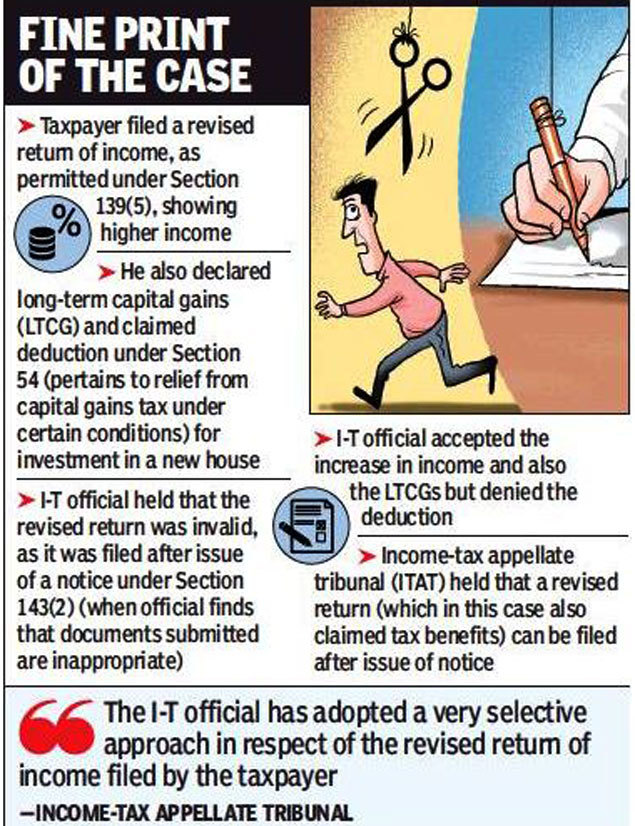

| + | [https://timesofindia.indiatimes.com/business/india-business/itat-can-file-revised-return-after-notice-issued-by-i-t/articleshow/64689438.cms Lubna Kably, ITAT: Can file revised return after notice issued by I-T, June 22, 2018: ''The Times of India''] | ||

| − | + | [[File: ITAT- Can file revised return after notice issued by I-T; The details of the case.jpg|ITAT- Can file revised return after notice issued by I-T; The details of the case <br/> From: [https://timesofindia.indiatimes.com/business/india-business/itat-can-file-revised-return-after-notice-issued-by-i-t/articleshow/64689438.cms Lubna Kably, ITAT: Can file revised return after notice issued by I-T, June 22, 2018: ''The Times of India'']|frame|500px]] | |

| − | |||

| − | + | '''HIGHLIGHTS''' | |

| − | + | Tax benefit claimed by taxpayers in revised income-tax returns cannot be denied byI-T officers because the revised return has been filed after issue of notice | |

| − | + | Currently, the time limit for filing a revised return is before the expiry of twelve months from the last day of the financial year or before the completion of I-T assessment, whichever is earlier | |

| − | |||

| − | + | A tax benefit claimed by a taxpayer in his revised income-tax return cannot be denied outright by an income-tax (I-T) officer merely because the revised return has been filed after issue of notice, income-tax appellate tribunal (ITAT) has said. | |

| + | However, the revised return needs to be filed within the time limits set out in the I-T Act. This order of the Mumbai bench of the ITAT, passed on June 20, will provide relief to several taxpayers. When a mistake is made in the original I-T return, such as not disclosing an income correctly or not claiming a tax deduction, section 139 (5) the I-T Act permits a revised return to be filed to correct the errors. | ||

| − | + | Currently, the time limit for filing a revised return is before the expiry of twelve months from the last day of the financial year or before the completion of I-T assessment, whichever is earlier. | |

| − | + | ||

| − | + | In this case before the ITAT, Mahesh Hinduja had declared a total income of Rs 4.91 lakh in his original return for the financial year 2010-11. He later filed a revised return declaring a total income of Rs 6.24 lakh. In this revised return he also disclosed long-term capital gains (LTCG) of nearly Rs 50 lakh. However, as he had invested 1.15 crore in a new residential house, he claimed a deduction under Section 54 of the I-T Act. Thus, capital gains were not offered for tax. | |

| − | + | Under the Act, if an investment is made in another house in India, within the stipulated period of time, then the 'cost of the new house' is deducted and only the balance component of the LTCG is taxable. Thus, if the amount of capital gains is equal to or less than the cost of the new house, the entire sum of LTCG is not taxable. | |

| − | As | + | To ensure that the taxpayer has not underreported his income or paid less tax, the I-T Act empowers I-T officials to issue a notice asking for further evidence. As the revised return was filed by Hinduja after he had received a notice under section 143(2), the I-T official rejected his claim for deduction. The litigation finally reached the level of the ITAT. |

| − | The | + | The ITAT noted that the I-T official had rejected the revised return of income as invalid but at the same time had accepted the higher income offered in the revised return, including the LTCGs. Only the claim of deduction under Section 54 had been rejected. "The I-T official has adopted a very selective approach in respect of the revised return of income filed by the taxpayer," remarked the ITAT. |

| − | + | The ITAT held that the I-T Act does not bar a taxpayer from filing a revised I-T return after issue of notice under Section 143 (2). Hinduja's case was sent back to the I-T official for examining and allowing the deduction, subject to the fulfilment of conditions prescribed for such claim. | |

| − | == | + | ==Wrong information in I-T returns== |

| − | + | [https://timesofindia.indiatimes.com/business/india-business/filing-wrong-itrs-by-salaried-class-will-lead-to-complaint-to-employers/articleshow/63816022.cms April 19, 2018: ''The Times of India''] | |

| − | [ | + | |

| − | |||

| − | + | '''HIGHLIGHTS''' | |

| − | + | I-T department has said those who file wrong ITR will be prosecuted and their employers will be intimated to take action | |

| − | + | ||

| − | + | The advsiory comes in the backdrop of the investigation wing of the department, in January, unearthing a racket of extracting fraudulent tax refunds by employees | |

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | The Central Processing Centre (CPC) of the department in Bengaluru, that receives and processes the Income Tax Returns (ITRs), has issued an advisory specifying such taxpayers should not "fall prey" to unscrupulous tax advisors or planners who help them in preparing wrong claims to get tax benefits. | |

| − | + | ||

| − | + | ||

| + | Calling it a "cautionary advisory" on reports of tax evasion by under-reporting of income or inflating deductions or exemptions by salaried taxpayers, the department said such attempts "aided and abetted by unscrupulous intermediaries have been noted with concern". | ||

| − | + | "Such offences are punishable under various penal and prosecution provisions of the Income Tax Act," it said. | |

| − | + | The advsiory comes in the backdrop of the investigation wing of the department, in January, unearthing a racket of extracting fraudulent tax refunds by employees of bellwether information technology companies based in Bengaluru, in alleged connivance with a tax advisor. | |

| − | + | The CBI recently registered a criminal case to probe this nexus. | |

| − | + | The tax filing season for salaried class taxpayers has just begun with the Central Board of Direct Taxes (CBDT), that frames policy for the department, recently notifying the new ITRs. | |

| + | The one-page advisory added that if the department notices any fraudulent claims in their ITRs, such claims "may be punishable under provisions of the IT Act and this may also delay issuance of their refunds." | ||

| − | + | "Taxpayers, are, therefore strictly advised not to fall prey to false promises or mis-advice by unscrupulous intermediaries and submit wrong claims in their ITRs, which would be treated as cases of tax evasion. | |

| − | + | "In the cases of such wrong claims by the government/PSU employees, reference would be made to the concerned vigilance division for action under conduct rules," it added. | |

| − | + | The advisory added that the department possesses an "extensive risk analysis system" that is aimed at identifying persons who are non-compliant and aim to subvert the trust based-system "envisioned" while processing of ITRs at the CPC, which it said is automated and devoid of any human interface. | |

| − | + | "In all such cases of high risk , the department may examine and verify the details submitted by taxpayers in their ITR subsequent to the processing of returns," it said. | |

| − | + | It also asked tax planners and advisors to "confine their advice to taxpayers within the four corners of the IT Act" and warned that the violators will be prosecuted and such instances will also be referred to enforcement agencies like the CBI and the Enforcement Directorate (ED) for criminal prosecution. | |

| − | + | =Joint I-T liability= | |

| + | ==Co-ownership of property== | ||

| + | [http://epaperbeta.timesofindia.com//Article.aspx?eid=31808&articlexml=Co-ownership-of-property-doesnt-mean-joint-I-13082016021026 ''The Times of India''], Aug 13 2016 | ||

| − | + | Lubna Kably | |

| − | + | ||

| − | + | If the spouse has not invested in a property and is merely a co-holder, then on sale of such property , she cannot be liable for tax on capital gains, the Mumbai IncomeTax Appellate Tribunal (ITAT) has recently ruled. | |

| + | The ITAT order will help many taxpayers as married couples are increasingly opting for property registration in joint names, even if only one of them is the investor. | ||

| − | + | Anil Harish, an advocate specializing in real estate, said: “Co-holding of property is popular. Often the name of a spouse (say wife) is added to provide a sense of comfort, to ensure ease of succession on death of the partner or other reasons such as facilitating voting in a general body meeting of the housing society .“ | |

| − | + | The ITAT gave the order on Wednesday while hearing a case of a medical professio nal, Vandana Bhulchandani. | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | An I-T officer, based on information in his possession, noted that Bhulchandani had not disclosed the capital gains arising from the Rs 2.12-crore sale of a property in Parel that she jointly held with her husband in her I-T return for the financial year 2008-09. | |

| − | + | ||

| − | + | ||

| + | She informed the I-T officer that her husband had made the entire investment and the property was reflected in his books of accounts--from the date of purchase till the date of sale. The officer also observed that Bhulchandani's husband did not incur any I-T liability on the capital gains arising from the sale--the husband had set off the short-term capital gains arising from the Parel property sale against the short-term capital losses incurred by him on the sale of shares. Under the I-T Act, short-term capital losses can be set off against capital gains arising in the same financial year and only the surplus, if any , is taxable. | ||

| − | + | But the I-T officer claimed that the entire arrangement was done to avoid tax payment and held Bhulchandani liable for 50% of the total short-term capital gains arising from the property sale and added Rs 45.38 lakh to her taxable income. Short-term capital gains are taxed at the applicable I-T slab rates, which depending on an individual's income varies between 10% and 30% in addition to applicable surcharge and cess. | |

| − | + | Bhulchandani approached the commissioner of income-tax (appeals) who directed deletion of the addition.The I-T officer then filed an appeal before the ITAT. But the tribunal took into cognizance that the husband had bought the property , which was duly reflected in his books of accounts, and had also disclosed the details of the sale in his I-T return and thus, dismissed the appeal. | |