Unicorns: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Unicorns in India

2000-18: How long it takes to be a unicorn in India

From: July 1, 2018: The Times of India

See graphic:

2000-18: How long it takes to be a unicorn in India?

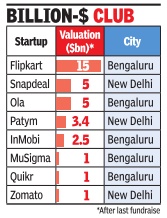

2015: Indian ‘unicorns’

The Times of India, Oct 12 2015

Shilpa Phadnis & Shalina Pillai

5 of 8 Indian unicorns in B'luru

Bengaluru is the unicorn capital of the country .Building on its IT services legacy , the city has emerged as he tech entrepreneurial hub and plays host to five out of the eight homegrown unicorns -Flipkart, Ola, InMobi, Quikr and MuSigma. E-tailer Snapdeal, restaurant discovery startup Zomato and mobile wallet startup Paytm, the other three Indian unicorns, are based in New Delhi. Unicorn is a term popularized by venture investor Ai een Lee to describe startups hat are valued at $1billion or more. CB Insights data show here are 140 unicorns global y with a cumulative valua ion of $503 billion.

E-commerce biggie Flipkart, which raised nearly $2 billion last year, is at the top of he Indian pecking order, va ued at $15 billion, showed da ta from Wall Street Journal.Taxi-hailing startup Ola, which moved its headquarters from Mumbai to Bengaluru, is valued at $5 billion.Mobile advertising platform InMobi boasts of a valuation of $2.5 billion, while data analytics firm MuSigma and online classifieds service Quikr have recorded valuations of $1billion each.

The number of companies entering the unicorn ros ter has grown significantly globally, with taxi hailing app Uber leading the club with a valuation of over $50 billion.

“Bangalore's tech-first cul ture lends itself to its startups taking category leadership This has contributed to the ci ty having more homegrown Unicorns than other cities in India,“ said Sharad Sharma co-founder of software pro ducts think tank Ispirt.

Ravi Gururaj, chairman of Nasscom Product Council believes the city's early mo ver advantage meant that it became a natural choice for startups as the primary place of business. “Why do you rob a bank? Because that's where the money is,“ he said. “Why do unicorns grow in Bangalo re? Because that's where the nurturing ecosystem is..where you can discover ta lent, connect with investors hire from MNC R&D centres and large IT service compa nies, learn from other peer startups and enjoy great weather. All of that combined make Bangalore India's most attractive city for leading startups,“ he said.

Bengaluru is the bedrock of the country's $146-billion IT sector where global IT brands like Infosys and Wipro were built and that has kicked off this virtuous cycle. The rub-off effect is obvious. MNCs flocked in big numbers to set up R&D outposts to leverage its technology talent pool. The city houses 350 global captive centres (GICs), including Target and Shell, out of 1,000 GICs in India.

The density of engineering talent and linkages with the Silicon Valley have contributed to the startup success story . Take InMobi, dubbed as the Indian challenger to Google, for instance. The mobile advertising platform relocated from Mumbai to Bengaluru to hire the best-inclass engineering talent.

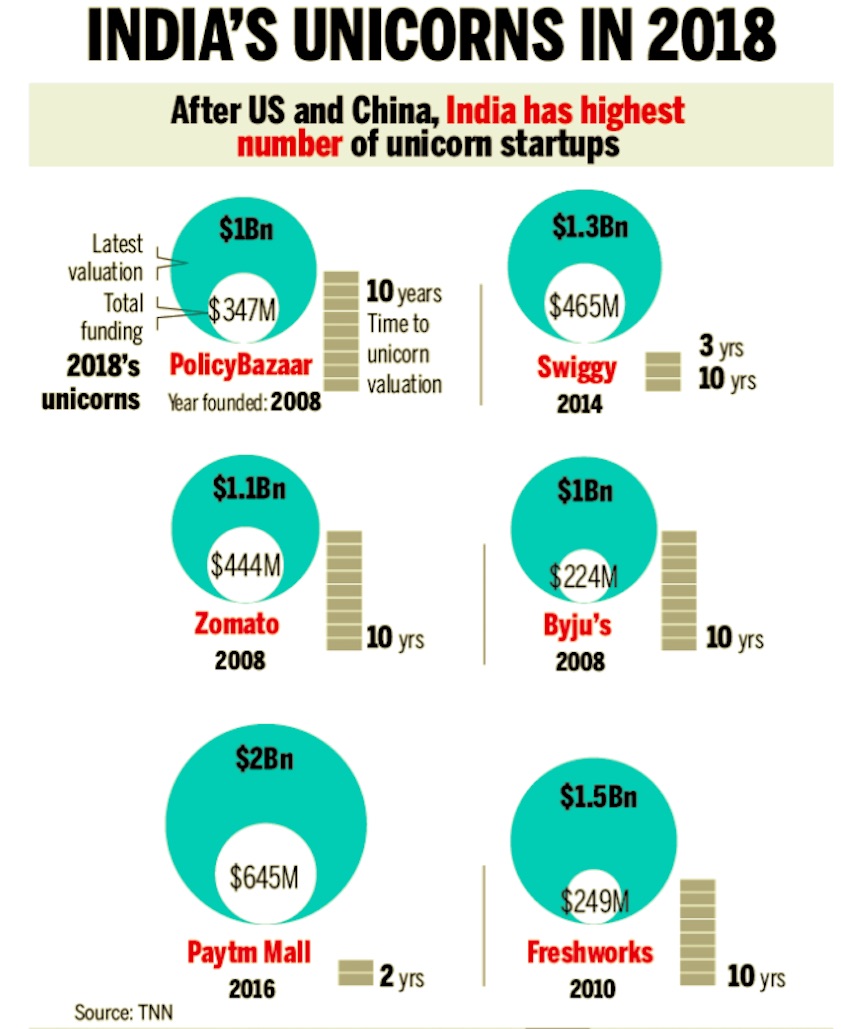

2018: India is world no.3

August 3, 2018: The Times of India

From: August 3, 2018: The Times of India

See graphic;

India's unicorns in 2018

Six startups have joined the unicorn club of companies with a valuation of $1 billion or more this year. Freshdesk is the latest with its $100m-round this week. In 2017, however, no company crossed $1bn in value. Only two managed to did so in 2014 and 2016, respectively.

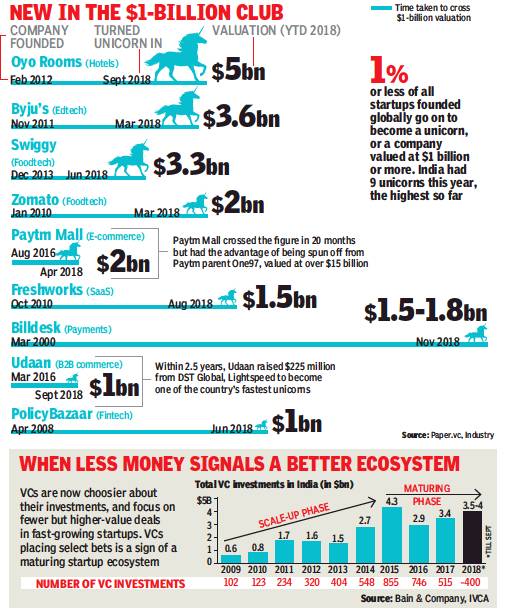

2018: the best year for unicorns

Digbijay Mishra, Why 2018 was the best year to spot a unicorn, December 31, 2018: The Times of India

ii)The number of investments, 2009-18

From: Digbijay Mishra, Why 2018 was the best year to spot a unicorn, December 31, 2018: The Times of India

In folklore, unicorns are near impossible to glimpse. But in India, there was no better year than 2018 to spot one, with an unprecedented nine companies crossing a valuation of $1 billion by the end of September. After a tough period in the 18 months preceding 2018, investors returned with more capital for Indian startups. This time, they backed proven models and most funding went to market leaders and fast-growing startups.

Edtech startup Byju’s was first off the blocks this year: It turned unicorn in March after raising funds from Tencent, and ended the year with a $540-million round at a valuation of at least $3.6 billion. Byju’s, Oyo Rooms (which raised new capital at a valuation of $5 billion) and Swiggy are now among the country’s top five most valued internet-based companies. With 18 unicorns, India is at number three — behind US and China — in terms of total number of unicorns.

No startup touched $1 billion (Rs 7,000 crore) in valuation in 2017. Even in the years when money flowed freely, no more than four startups reached the figure in a year since the first unicorn was created in 2011. This year, venture capital (VC) firms raised $2.3 billion for investment in India, according to a study by Bain & Company and Indian Venture Capital Association. India tech investments were on the road to recovery after the less than $1 billion raised in 2017. The year before, VCs allocated $2.8 billion. (Both years saw higher investments as earlier funds were tapped.) “The recent rise in valuations of tech startups is the result of a rapidly deepening market opportunity. Growth in mobile internet users, explosion in data consumption, pervasive 4G coverage, and the expected rise in disposable income, driven by increasing GDP per capita, are key factors that investors are betting on. Finally, there are a number of high-quality, experienced founders. This trend is expected to continue,” said Tarun Davda, MD, Matrix India, a VC firm that has placed several bets on startups, including Ola.

Deep Kalra, chairman, MakeMyTrip, told TOI successful global models were replicated in e-commerce and on-demand services, but future opportunities lie in IoT and deep tech. “There is an unbridled amount of capital for entrepreneurs to get their ducks in a row given how macroeconomic fundamentals are fertile and digital infrastructure is finally coming of age to support the new-age economy. Another reason for big cheques is that private markets have become deep,” he said.

One can’t talk of the growing number of unicorns and not to mention Japanese investor SoftBank. Its $100-billion Vision Fund has emerged as one of the most influential investors, pouring about $8 billion into India. Oyo Rooms’ aggressive China expansion is due to SoftBank’s backing, and Paytm is growing at an astounding rate too. Two existing unicorns are seeking money from SoftBank, and other startups could enter the club riding on its back.

Despite the optimism, firms need to be cautious and keep goals in sight as the startup universe has another unique term: unicorpse. That’s a former unicorn which is failing, and India has seen a few. Will 2019 bring more unicorns or unicorpses?

2020: nine unicorns, despite pandemic

Digbijay Mishra, December 16, 2020: The Times of India

From: Digbijay Mishra, December 16, 2020: The Times of India

Zenoti, which makes software for large spas and salon chains, has become a unicorn (a privately held firm valued at $1 billion or more). The company has raised $160 million in new funding from US private equity major Advent International at a valuation of over $1 billion, the ninth startup to achieve that milestone this year.

The others that became unicorns this year are Pine Labs, FirstCry, Nykaa, Zerodha, Postman, Unacademy, Razorpay and Cars24.

Based out of Hyderabad and Seattle, Zenoti’s valuation has nearly tripled after the latest fund-raise compared to when it last got capital from Tiger Global and Steadview in quick succession last year. Tiger Global and Steadview have also participated in this round and the firm has now raised $250 million in total. Zenoti is the second startup in the software-as-a-service (SaaS) space to hit the milestone this year after Postman, which raised $150 million at a valuation of $2 billion. Firms offering enterprise software solutions have seen aggressive funding this year. Pune and San Francisco -based Mindtickle got the backing of SoftBank last month with its valuation estimated at around $500 million.

Zenoti, founded by Sudheer Koneru in 2010, will use the capital for expansion and acquisitions as it eyes another year of 100% growth. Zenoti also plans to increase the team size by around 50%. Zenoti’s solution helps companies in customer management, retention via online bookings, appointment scheduling, self check-ins, payments and marketing automation.

“Salons wanted to reopen with the touchless experience, where people don’t need to come to the desk, touch devices. That helped us. People were willing to adopt the tech much faster and our platform was mature enough to on-board big brands quickly. During Covid-19, one of the largest brands with 700 salons in the US was on-boarded in 40 days,” said Koneru.

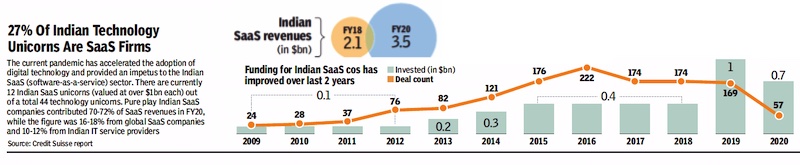

SaaS companies

Funding, 2009-20

From: April 12, 2021: The Times of India

See graphic:

Funding for Indian SaaS companies, 2009-20