Mergers and acquisitions: India

This is a collection of articles archived for the excellence of their content. |

Contents |

Top M&A deals in India

2008-18

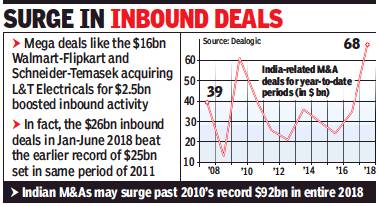

From: Reeba Zachariah & Boby Kurian, After record first half, M&A deals face election jitters, July 2, 2018: The Times of India

See graphic:

India- related M&A deals, 2008-18

2017, 2018 H1: a surge

Recover From Note Ban, GST Impact To Clock $68Bn In Jan-June

Bulge-bracket buyout opportunities have soared as Indian merger and acquisition (M&A) activity notched up a record-breaking first half in 2018.

Both foreign interest in Indian assets — or inbound activity — and domestic-consolidation deals were the highest in a decade, recovering from the disruptions caused by demonetisation and GST rollout. The tediously progressing bankruptcy cases also added buoyancy to deal street even as outbound acquisitions by Indian companies, a major theme in the last decade, lost sheen.

The big story was the return of foreign strategic acquirers after a few tepid years. Walmart’s $16-billion acquisition of online retailer Flipkart rallied sentiments of overseas buyers as the first six months saw Schneider along with Temasek buying L&T Electricals for $2.5 billion and Teleperformance snapping up BPO firm Intelenet for around $1 billion.

Dealogic data showed inbound activity in the first half of 2018 at almost $26 billion, dribbling past the previous high of $25 billion in 2011. Similarly, domestic consolidation deals swelled to about $39 billion — well past $30 billion in the first six months of 2010. In terms of full-year highs, the previous record for inbound deals was more than $29 billion in 2011 and for domestic activity about $49 billion in 2010.

Overall, Indian M&A activity — including outbound deals — stood at $68 billion in the first half, surging past $65 billion in entire 2017 and looking to eclipse $92 billion reported in 2010.

Foreign strategic buyers and private equity funds are chasing large buyout deals worth at least $20 billion in the second half of the current calendar. Among these are sale of GSK Consumer’s sale of Horlicks and other health food drinks; Kraft Heinz’s divestment of Complan, Glucon-D and Nycil; Punjab National Bank and Carlyle selling PNB Housing Finance; bidding process for Fortis Healthcare; and imminent sale of Ramky Infra.

ArcelorMittal and Russian investor VTB-led Numetal are chasing the Essar Steel acquisition through the bankruptcy sale process, which is expected to pick up momentum amid high drama in the coming weeks. About $210 billion worth of stressed assets are up for grabs, several of them clogging the country’s National Company Law Tribunal.

There are deals that are not in the public domain, such as KKR & Co’s talks with Allied Blenders & Distillers and discussions around Piramal and TPG’s exit from Shriram Capital. Financial services firm Ambit Group’s CEO Ashok Wadhwa said, “There is a long list of potential acquirers for generally good, liquid assets like PNB Housing and Fortis Healthcare.” Private equity, global pension funds and sovereign wealth managers like Blackstone, KKR, CPPIB and GIC of Singapore remain bullish on Indian buyouts.

If the momentum continues, domestic and inbound M&A deals would set new highs in 2018. But there are worries that several ongoing large deals could be pushed back as the economy gears up for bruising general elections and corporate earnings don’t keep pace with valuations. A section of bankers are predicting a sharp deceleration, as witnessed during the second half of 2011, as anti-corruption campaigns signalled the descent of the earlier United Progressive Alliance government.

EY partner and M&A head Ajay Arora said large private equity investors, which have been in the country for long and seen multiple election cycles, would stay on course with buyout opportunities pouring into the market. “The recent set of large deals in the market might also attract foreign strategic acquirers keen on leading Indian assets,” Arora added.

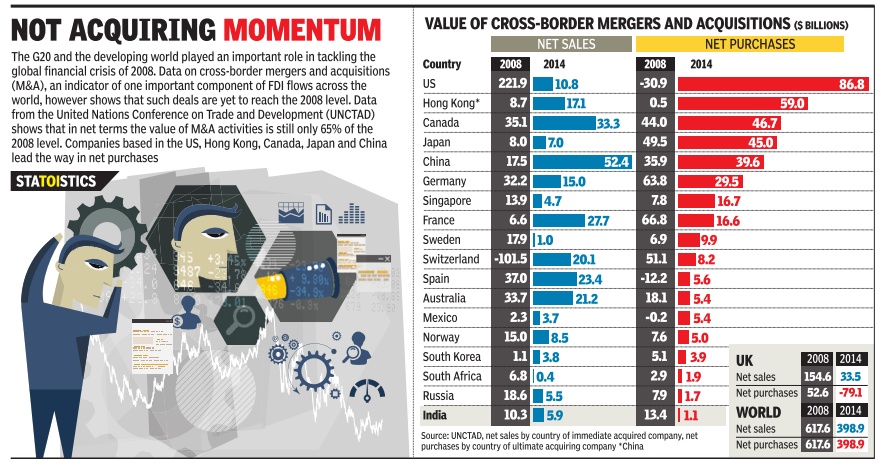

2014

See graphic:

India and the world, value of cross-border mergers and acquisitions, 2014

Mid-2016: M&As up as consolidation sets in

The Times of India, Aug 03 2016

Anand J

Startup M&As surge on funds crunch

As venture funding slows down, startups seem eager to sell themselves off. This is showing up in a surge in mergers & acquisitions (M&As).

In July 2016, there were as many as 36 M&As, almost twice that in June and about three times the January and February numbers, according to data from startup research firm Xeler8. The second quarter of this year saw three big distress sales -FabFurnish, Jabong and Hiree.

Data from Tracxn, another startup research firm, also shows a significant increase from the second half of last year, when funding started slowing down. From 32 M&As in the second half of 2014, the figure went up to 67 in the first half of 2015, to 79 in the second half of last year and was 75 in the first half of this year. The data is collected based on media reports, and announcements in social media, blogs and websites.

Another VC investor, who did not wish to be named, said that in most segments market leaders are emerging. “This was expected. Cash is air for startups. When you don't have money to pay , employees leave and that creates so much negative sentiment in the company that entrepreneurs lose heart,“ he said. While Indian startups raised around $3.5 billion in the first half of 2015, the funding dropped to $2 billion in the first half of 2016, says a report by KPMG and startup research firm CB Insights.

Xeler8 finds that the mostfunded sectors and the ones that attracted the highest number of entrepreneurs -including local commerce and e-commerce -have seen the biggest consolidation. Delhi-NCR, which is estimated to have the highest number of local commerce and e-commerce startups, saw 29 M&A deals in the first half of this year, followed by Bengaluru at 26 and Mumbai at 16.

The year's biggest acquisition was by Quikr, which bought online real estate platform CommonFloor for around $100 million, while the asking price was around $160 million. Myntra acquired Jabong for $70 million.

March 2017, top mergers

See graphic:

Top mergers and acquisitions in India, March 2017

Till May 2018

From: Samidha Sharma, World’s largest company buys India’s most valuable startup in biggest global e-comm deal, May 10, 2018: The Times of India

See graphic:

Top M&A deals in India, till May 2018

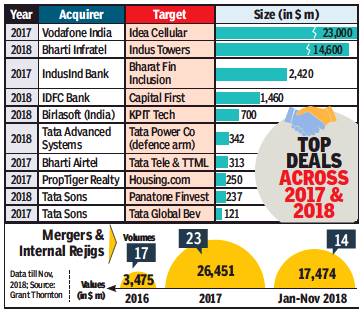

2017, 2018

From: Namrata Singh, ‘Mergers can result in 7-20% job losses’, December 10, 2018: The Times of India

See graphic:

Top mergers and acquisitions in India, 2017, 2018

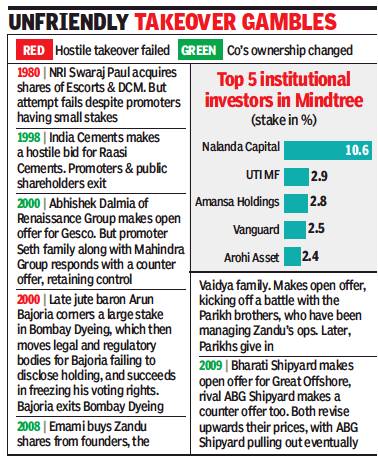

Hostile takeovers

1980-2009: some prominent cases

From: Reeba Zachariah, L&T unveils near ₹11k-crore unsolicited bid for Mindtree, March 19, 2019: The Times of India

Buys Out Siddhartha’s 20%, Eyes Another 46% From Public

In an unsolicited takeover attempt that India Inc has not seen in recent times, the $18-billion diversified conglomerate Larsen & Toubro (L&T) has unveiled a Rs 10,669-crore bid for Mindtree as part of its strategy to “focus on services and assetlight businesses to drive profitable future growth”.

The S N Subrahmanyan-led L&T signed an agreement to acquire Mindtree’s largest shareholder V G Siddhartha’s 20.32% for Rs 3,269 crore, or Rs 980 apiece. L&T has also placed an order with its broker for an additional 15% of Mindtree at the same price of Rs 980 apiece, signalling that it is in control of the transaction. Besides, it is making an open offer for a further 31%, in line with the takeover regulations.

If L&T’s move succeeds, it will acquire 66.32% of Mindtree for Rs 10,669 crore. In a statement, L&T said that it has sufficient financial flexibility to fund the entire transaction through its existing financial resources. After a successful acquisition, L&T intends to maintain Mindtree as an independent listed entity.

L&T’s statement added that Mindtree will benefit from access to a larger client base and wider product offerings under a common parentage, giving higher returns to shareholders of Mindtree.

However, the promoters of Mindtree, who together own 13.3%, are resisting the L&T bid. To fend off L&T, the promoters would need a white knight that would match the engineering major’s financial muscle. Interestingly, Siddhartha, who also owns the Cafe Coffee Day chain, has been a white knight for Mindtree for almost two decades.

If the Mindtree promoters decide to make a counter bid, they will have to offer a price higher than Rs 980. The Rs 980 price values Mindtree at Rs 16,088 crore. On Monday, the shares of Mindtree closed 1.7% higher at Rs 963 on the BSE. Mindtree’s management has already reached out to key non-promoter shareholders to fend off L&T’s takeover bid.

“The acquisition will help propel L&T’s technology portfolio into the top tier of Indian IT companies,” said Subrahmanyan. In the past, L&T had looked at several IT companies, including Satyam, Mphasis and Hexaware, but none of these translated into any successful M&A deals.

L&T’s announcement comes a couple of days ahead of the Mindtree board’s meeting scheduled for Wednesday, when it will consider a share buyback proposal. Rules allow a company to repurchase its own shares up to 10% of its reserves. But since L&T has already announced its acquisition move, rules now don’t allow Mindtree to use the 10% of its reserves for a share buyback programme.

The L&T-Mindtree deal, where KPMG Corporate Finance is lead transaction adviser, is subject to regulatory and other customary approvals. Interestingly, L&T itself has been a hostile takeover target in the past. And it has successfully managed to thwart overtures by the Ambanis and Birlas.

Merits, demerits of M&As

Mergers can result in 7-20% job losses: 2017, 2018 data

Namrata Singh, ‘Mergers can result in 7-20% job losses’, December 10, 2018: The Times of India

Consolidation Creates Redundancies, Cuts Candidates’ Bargaining Power: Experts

In the world of business, if there’s one trend that has stood out and is making people jittery on the jobs front, it is consolidation. Beginning with the mega merger between Vodafone and Idea Cellular last year, the trend has further accelerated in 2018 following the coming together of Walmart and Flipkart, and the proposed deal that will see GSK Consumer Healthcare amalgamating with Hindustan Unilever.

A merger between similar businesses can result in redundancies and an oversupply situation than can impact the bargaining power of candidates. While consolidation makes good sense on the financial front, the same may not augur well for jobs.

Siddharth Reddy, MD & CEO of BI Worldwide India, a global employee engagement and recognition solutions provider, said, “Given the spate of consolidations over the last two years, there could be job losses in the range of 7-20%, depending on how identical the businesses are. It could impact compensation levels if the supply exceeds demand and this is driven by market forces. However, it would also depend on the sentiment of growth in the economy, which is unpredictable right now.”

Other M&As over the last two years include Bharti Infratel-Indus Towers as well as Bharti Airtel-Tata Teleservices & Tata Teleservices Maharashtra (consumer telecom business), taking the total value of deals in domestic mergers and internal restructuring, according to Grant Thornton, to around $44 billion since 2017.

Reddy said cross-border deals seldom see job losses. However, when there are identical businesses that get consolidated, redundancies come up. “Job losses then become inevitable as several positions are common and companies look to drive efficiencies and economies of scale with common brand messages. This was the case in Myntra-Jabong,” said Reddy.

There’s always a bit of uncertainty when M&As happen. “They unnerve people,” said Ronesh Puri, MD of Executive Access India. “When there’s a new ecosystem in place, there are adaptability issues that lead to job losses. But apart from that, a flight of talent takes place even before an M&A comes through,” said Puri.

Sunil Goel, MD of recruitment firm GlobalHunt, said while such M&As may not depress the job market, they would certainly reduce bargains. He added that such consolidations usually have a major impact on people employed in last-mile jobs, that is, the salesforce.

On the flip side, while more people would be looking out for jobs, it would offer an opportunity for other companies to get this talent that was not available earlier. Whether or not this could have a negative impact on compensation, according to Puri, would depend on the talent and the job situation. “Employers certainly tend to negotiate harder, which will be the case now as well, but that does not mean it is all over for candidates. If they have a good record to show, they will leverage that experience and can have a good bargaining position. Companies are always on the lookout for exceptional talent,” said Puri.