Migration: India, Investments and savings (personal): India

(→Outward migration from India) |

(→2019) |

||

| Line 7: | Line 7: | ||

|} | |} | ||

| − | |||

| − | |||

| − | |||

| − | = | + | |

| − | == | + | |

| − | [[File: | + | = India’s investable, personal wealth= |

| + | ==2017: India was no.11 in the world== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F10%2F09&entity=Ar02413&sk=187C4BED&mode=text India’s personal wealth may grow at 13%: Report, October 9, 2018: ''The Times of India''] | ||

| + | |||

| + | |||

| + | The US leads the chart in terms of total personal wealth with $80 trillion in 2017, which is projected to touch $100 trillion by 2022. China is ranked second, with a total personal wealth of $21 trillion, which is expected to more than double to $43 trillion by 2022. | ||

| + | |||

| + | The report noted that India constitutes the second largest pool of wealth from emerging markets in the coming years, with $2.2 billion. It is the fifth largest Asian market in number of affluent, high net worth, and ultra high net worth individuals. There were 322,000 affluents, 87,000 high net worth individuals and 4,000 ultra high net worth individuals in the country in 2017, according to the report. It observed that nearly 70% of the country’s personal financial wealth would be accessible to wealth managers in 2022. | ||

| + | |||

| + | The 70% investable wealth in the country includes listed equity, bonds, investment funds, currency and deposits, and other smaller asset classes, while 30% non-investable wealth includes life insurance and pensions, unlisted equity and other equity. | ||

| + | |||

| + | =Investment in stock markets, banks, mutual funds, gold= | ||

| + | ==1995-2015== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=A-20-year-long-journey-02112015022004 ''The Times of India''], Nov 02 2015 | ||

| + | |||

| + | Uma Shashikant | ||

| + | |||

| + | | ||

| + | '''Much has changed in the way India invests since 1995, and mostly for the better''' | ||

| + | |||

| + | Everyone is celebrating 20-year milestones these days. The nice thing about history is that we can attempt to explain the present by looking at the past, with the benefit of hindsight. What then seemed tough, foolish and difficult, seems pathbreaking today. Then there are things that do not change, ever. It's my turn to do the 20-year flashback this week. | ||

| + | Stock markets | ||

| + | |||

| + | In June 1994, a new wholesale market for debt was set up. Funded by institutions, it used the best satellite technologies and tried to create a market where institutions would buy and sell debt securities.But the debt markets in India were not ready for it. The leaders changed course and deployed the systems to create a new equity market. It wasn't easy . | ||

| + | |||

| + | Equity markets were already being served by 20+ stock exchanges, the oldest and largest in the same city as the new one. The new market went ahead nevertheless, permitting trades in equity shares listed on other exchanges on its satellite-linked electronic system. | ||

| + | |||

| + | In 1995, the experiment succeeded.The new market overtook the old in business. The National Stock Exchange (NSE) is an example of how a new entity can bring about positive change. How it can create a new system with higher efficiency , lower costs, wider participation, better technology and higher integrity .NSE modified how investors trade in India, creating a trading, clearing and settlement system on par with the best. | ||

| + | |||

| + | ===Banks=== | ||

| + | |||

| + | In January 1995, HDFC Bank opened its first branch in Mumbai. In March 1995, it offered shares to the public in an IPO priced at `10 per share, to mobilise `50 crore. The issue was oversubscribed 55 times and opened to trade at `40. The popular opinion was that the bank would soon merge with its illustrious parent. | ||

| + | |||

| + | All through the 1990s, public sector banks hogged the limelight for their equity offerings. No one gave private sector banks much of a bright prospect. | ||

| + | |||

| + | The PSU banks were well entrenched.They were bankers to the government and public entities. The cost of funds for the public sector banks was low, and the regulatory requirements was uniformly applicable to the new private banks too.If the new banks tried to bring in sophistication and technology , they had to face competition from foreign banks, that held a monopoly over the NRI and remittance businesses, apart from working with the large private corporate treasuries. Where was the room for new private banks? | ||

| + | Twenty years on, private banks have built a new retail lending market that is large and growing. They have captured a large share of the institutional business. They offer superior technologies and service, and have managed to do so at a lower cost compared to their public sector counterparts, and have stronger, better and bigger balance sheets. | ||

| + | |||

| + | ===Mutual Funds=== | ||

| + | If one looked at mutual funds in 1995, UTI dominated with over 90% market share.While the other players were trying to find their feet, UTI was launching a slew of monthly income plans (MIPs) which promised double digit returns. The other public sector mutual funds were suffering the consequences of faulty product launches in 1991-92. They had sold 7-year closed end equity funds, with the promise of doubling and tripling the returns, and the NAVs were nowhere near target. | ||

| + | |||

| + | The new private sector funds did their best to market their products, but did not mobilise much money from investors who were worried about the lack of liquidity . Mutual funds had to list on the market and it was common for prices to be lower than the NAV . Approvals were tough to get. Banks and institutions were not selling funds, yet. | ||

| + | |||

| + | It was in 1995 the first wave of process innovation hit the mutual fund industry with open-ended funds with account statements and no certificates. Dividend and growth options were offered and banking distribution was tied up. But the struggle was with the idea of assured returns that investors clamoured after. | ||

| + | |||

| + | In 1995, when global investors were asking for depository and T+3 rolling settlement, what we had then seemed rudimentary . Today, the NSE has helped set up several stock markets across the world and is a model for risk management and settlement guarantees. In 1995, it seemed banking belonged to the public sector.Today , the success of private banks has established that PSU banks will have to restructure or fade away . | ||

| + | |||

| + | As for mutual funds, there is enough evidence to establish that a diversified portfolio over the long run beats all other investment options. But investors seem busy trading stocks and investing in bank deposits, and not engaging enough with funds. The plague of new schemes sold with inflated promises and performing schemes staying in the background has not changed. Not in 20 years. | ||

| + | |||

| + | ==2007-16== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GOLD-OR-STOCKS-OR-MUTUAL-FUNDSBEST-TO-SPREAD-02022017032008 The Times of India], Feb 02 2017 | ||

| + | |||

| + | [[File: 1,3,5 and 10 year return, accoring to asset class, Jan 1 2016-Dec 31, 2016.jpg|1,3,5 and 10 year return, accoring to asset class, Jan 1 2016-Dec 31, 2016; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GOLD-OR-STOCKS-OR-MUTUAL-FUNDSBEST-TO-SPREAD-02022017032008 The Times of India], Feb 02 2017|frame|500px]] | ||

| + | |||

| + | [[File: Steps to make one's career the best asset, 1-3.jpg|Steps to make one's career the best asset; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=WHY-CAREER-IS-YOUR-BIGGEST-ASSET-02022017013005 The Times of India], Feb 2, 2017|frame|500px]] | ||

| + | |||

| + | [[File: Steps to make one's career the best asset2.jpg|Steps to make one's career the best asset2; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=WHY-CAREER-IS-YOUR-BIGGEST-ASSET-02022017013005 The Times of India], Feb 2, 2017|frame|500px]] | ||

| + | |||

| + | [[File: 10 rules for investment, how fast will one's money grow, a legal aspect.jpg|10 rules for investment, how fast will one's money grow, a legal aspect; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GOLD-OR-STOCKS-OR-MUTUAL-FUNDSBEST-TO-SPREAD-02022017032008 The Times of India], Feb 02 2017|frame|500px]] | ||

| + | |||

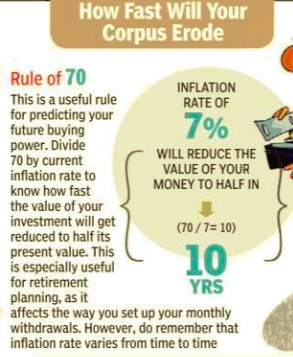

| + | [[File: How fast will one's corpus erode, a legal aspect.jpg|How fast will one's corpus erode, a legal aspect; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GOLD-OR-STOCKS-OR-MUTUAL-FUNDSBEST-TO-SPREAD-02022017032008 The Times of India], Feb 02 2017|frame|500px]] | ||

| + | |||

| + | [[File: Some other rules to take care of investment.jpg|Some other rules to take care of investment; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GOLD-OR-STOCKS-OR-MUTUAL-FUNDSBEST-TO-SPREAD-02022017032008 The Times of India], Feb 02 2017|frame|500px]] | ||

| + | |||

| + | [[File: How to consider oneself wealthy.jpg|How to consider oneself wealthy; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=GOLD-OR-STOCKS-OR-MUTUAL-FUNDSBEST-TO-SPREAD-02022017032008 The Times of India], Feb 02 2017|frame|500px]] | ||

| + | |||

| + | No one asset outperforms others consistently over time. In the past one year, equity mutual funds and government securities gave higher returns than other assets. Over 10 years, it's gold that beats all other asset classes. For consistent long-term gains, put your eggs in several baskets. Of course, returns is only one of the three criteria to look for before investing--safety and liquidity are the other two. Government securities, the safest investment option, matched returns from equity funds last year. But this is a rare occurence | ||

| + | |||

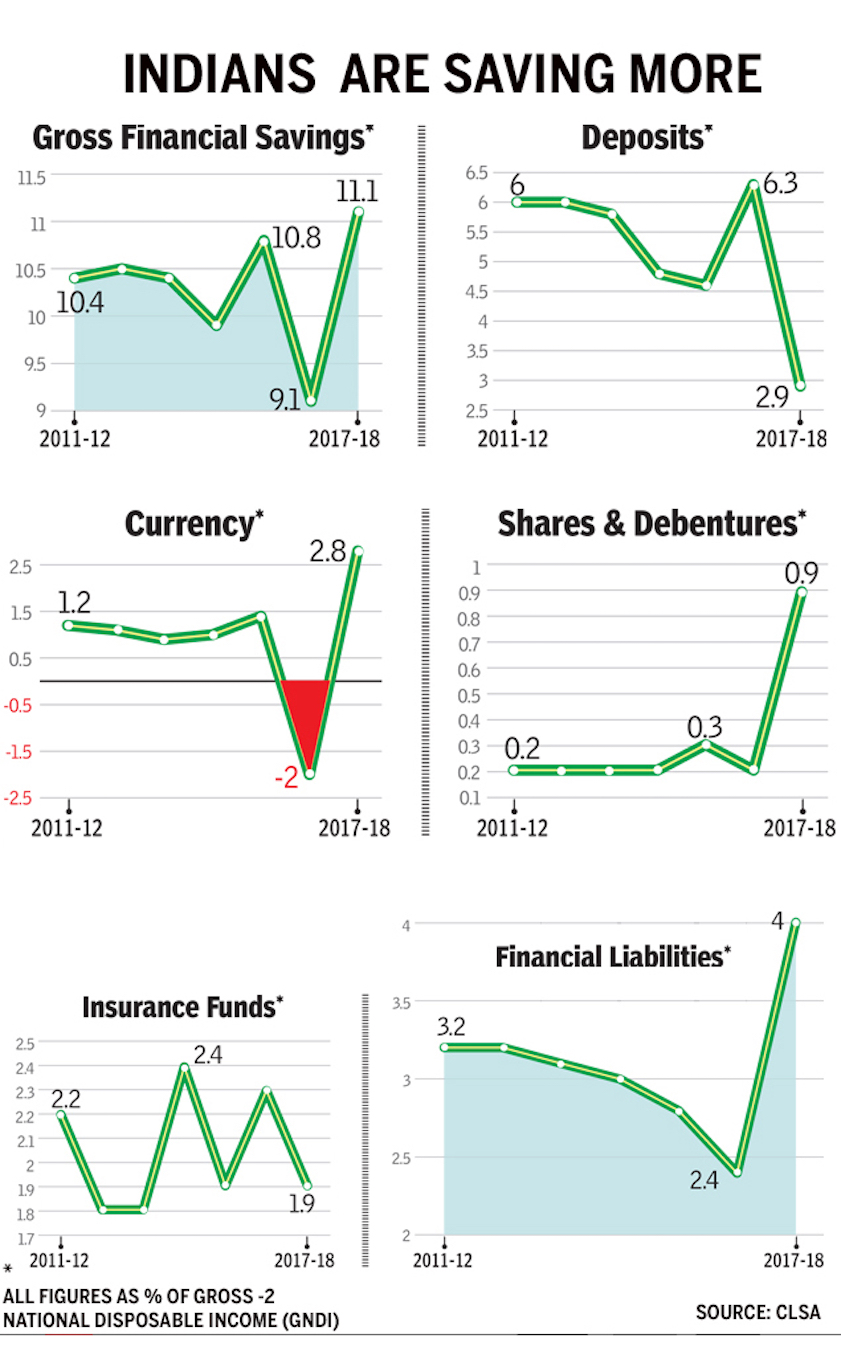

| + | ==2008, 2014-19== | ||

| + | [[File: 2008, 2014-19- household savings in India.jpg| 2008, 2014-19: household savings in India <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2020%2F02%2F02&entity=Ar00804&sk=9F1D85C0&mode=image February 2, 2020: ''The Times of India'']|frame|500px]] | ||

'''See graphic''': | '''See graphic''': | ||

| − | '' | + | '' 2008, 2014-19: household savings in India '' |

| − | + | [[Category:Economy-Industry-Resources|S | |

| − | + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | |

| − | [ | + | [[Category:India|S |

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | ==2011-18: household savings== | ||

| + | [https://timesofindia.indiatimes.com/business/indias-household-financial-savings-at-a-new-high/articleshow/66875988.cms India’s household financial savings at a new high, November 30, 2018: ''The Times of India''] | ||

| − | [[File: | + | [[File: 2011-18- household savings in India.jpg|2011-18: household savings in India <br/> From: [https://timesofindia.indiatimes.com/business/indias-household-financial-savings-at-a-new-high/articleshow/66875988.cms India’s household financial savings at a new high, November 30, 2018: ''The Times of India'']|frame|500px]] |

| − | |||

| − | + | The share of financial savings by Indian households has touched a high of 11.1% of gross national disposable income (GNDI). However, the share of deposits, which rose to a high of 6.3% on the back of demonetisation in 2016-17, has shrunk to 2.9% of GNDI. But households are borrowing much more, as reflected in the financial liabilities, which has grown to a high of 4%. | |

| − | + | ==2016: FDs top== | |

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=FDs-most-preferred-saving-option-Survey-06042017019028 FDs most preferred saving option: Survey, April 6, 2017: The Times of India] | ||

| + | [[File: Why households avoid equities.jpg|Why households avoid equities; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=FDs-most-preferred-saving-option-Survey-06042017019028 FDs most preferred saving option: Survey, April 6, 2017: The Times of India]|frame|500px]] | ||

| − | |||

| − | + | More than 95% households prefer to park their money in bank deposits, while less than 10% opt to invest in mutual funds or stocks. Life insurance was the second most preferred investment vehicle, followed by precious metals, post office savings instruments and real estate, a survey by Sebi showed. It also showed that mutual funds came in at the sixth place (9.7%), followed by stocks (8.1%), pension schemes, company deposits, debentures, derivatives and commodity futures (1%) as investment vehicles for the urban households. Respondents were allowed to select multiple options. | |

| − | + | The survey , conducted across urban and rural areas of the country , showed that among rural households, not even 1% of the survey respondents were investors, while even the awareness about mutual funds and equities was dismal at just 1.4%. | |

| − | + | However, 95% of rural survey respondents had bank accounts, 47% life insurance, 29% post office deposits and 11% saved in precious metals. On a positive note, the survey found the investor base in India increasing, as nearly 75% of the respondents said they had participated in securities markets for the first time in the last five years. The survey had a sample size of 50,453 households and using a bootstrapping methodology , it was estimated there were a total of 3.37 crore investor households in India. Of these, 70% reside in urban areas. | |

| − | = | + | ==2017: 8 lakh crore equities and mutual funds== |

| − | + | [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F12%2F13&entity=Ar02717&sk=700FD646&mode=text Indians invested more in stocks than in FDs in FY17, December 13, 2017: ''The Times of India''] | |

| − | [ | + | |

| + | |||

| + | [[File: Total wealth, in FDs & bonds, stocks, insurance, savings deposits, PF, MFs and others, FY16, FY17.jpg|Total wealth, in FDs & bonds, stocks, insurance, savings deposits, PF, MFs and others, FY16, FY17 <br/> From: [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F12%2F13&entity=Ar02717&sk=700FD646&mode=text Indians invested more in stocks than in FDs in FY17, December 13, 2017: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Indian investors are finally moving from bank fixed deposits (FDs), real estate and gold, the traditional investment products, to equities and mutual funds. In fiscal 2017, Indians invested Rs 8 lakh crore in stocks compared to Rs 3.4 lakh crore in FDs. | ||

| + | |||

| + | At the end of FY17, total investments by Indians in equities at Rs 37.6 lakh crore was just Rs 2.5 lakh crore short of total FDs, pegged at Rs 40.1 lakh crore. This is the closest that the total equity wealth of Indian investors have ever come to bank FDs, a report by Karvy Private Wealth showed. At the end of FY16, the difference was over Rs 7 lakh crore with Rs 36.8 lakh crore in FDs compared to Rs 29.6 lakh crore in stocks, the report showed. | ||

| + | |||

| + | The firm believes total investments by Indians in equities will surpass wealth in bank FDs by the end of the current fiscal. “After losing a bit of traction, financial assets have regained their pole position in FY17. Wealth creation through equities has not been restricted to big institutional investors as individual participation, too, saw a huge jump via the direct as well as mutual funds route,” said Abhijit Bhave, CEO, Karvy Private Wealth. | ||

| + | |||

| + | ==2018-19: Realty, gold top picks for HNIs== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F30&entity=Ar02119&sk=8E3FB2DA&mode=text Rupali Mukherjee, August 30, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: HNIs, their investments and leisure activities- presumably as in 2018-19.jpg| HNIs, their investments and leisure activities: presumably as in 2018-19 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F30&entity=Ar02119&sk=8E3FB2DA&mode=text Rupali Mukherjee, August 30, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Real estate is the most preferred investment asset class for high net-worth individuals (HNIs) in next 3 years, followed by stock markets, according to the Hurun Indian Luxury Consumer Survey. This is despite the slowdown in real estate witnessed over the last three years, and turbulence in stock markets over the past 18 months. This is the first year of an India survey by Hurun Research Institute, which aims to track changes and preferences of lifestyle, consumption habits and brand cognition of HNIs. | ||

| + | |||

| + | Around 31% respondents believe that their investment allocation towards real estate sector will grow in the next two years. In line with IMF’s prediction of economic growth, equity markets followed by fixed income is the second and third choice, respectively. Interestingly, 21% respondents want to reduce allocation to real estate in the short term, and around 20% want to reduce exposure to gold. While 9.5% said investments into real estate will be at a status quo, the remainder believed that it would decline. | ||

| + | |||

| + | The UK is the most popular investment destination for HNIs. Singapore takes second place, and Canada along with the US, which is forecast to grow 2-4% (at constant exchange rates this year), rank third. Nearly a fourth (24%) are “very confident” about the Indian economy over the next three years, 40% “confident”, while around 36% are pessimistic. As many as 36% of HNIs said their investment philosophy for this year would be “avoiding risk”, while only 14% will make “active investments”. | ||

| + | |||

| + | Among collectibles, HNIs prefer to spend the most on art and jewellery. Nearly half the respondents have two to three cars, 37% have only one car and 6% have more than five cars. Up to 46% of them renew their car every three to four years. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:India|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:Pages with broken file links|INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | |||

| + | |||

| + | |||

| + | [[Category:Economy-Industry-Resources|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:India|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:Pages with broken file links|INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | |||

| + | ==2019== | ||

| + | [ Oct 27, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Wealth held by individual Indians in physical form, 2019.jpg|Wealth held by individual Indians in physical form, 2019 <br/> From: |frame|500px]] | ||

| + | |||

| + | See graphic, ‘Wealth held by individual Indians in physical form, 2019 ' | ||

| + | |||

| + | ==As in 2021 Jan== | ||

| + | [[File: Investment in stock markets, banks, mutual funds, gold, in the period ending 2021 Jan.jpg| <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F02%2F02&entity=Ar00406&sk=BFD40CBF&mode=image February 2, 2021: ''The Times of India'']|frame|500px]] | ||

'''See graphic''': | '''See graphic''': | ||

| − | '' | + | '' Investment in stock markets, banks, mutual funds, gold, in the period ending 2021 Jan '' |

| − | + | [[Category:Economy-Industry-Resources|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | |

| − | + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | |

| − | [ | + | [[Category:India|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA |

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:Pages with broken file links|INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| − | + | =Returns= | |

| + | ==2006-15== | ||

| + | [[File: Returns from stocks, gold and fixed income in India, 2006-15.jpg| Returns from stocks, gold and fixed income in India, 2006-15; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=18_01_2016_020_012_014&type=P&artUrl=Time-to-rebalance-portfolio-18012016020012&eid=31808 ''The Times of India'']|frame|500px]] | ||

| − | + | '''See graphic''': | |

| − | + | ''Returns from stocks, gold and fixed income in India, 2006-15'' | |

| − | + | ||

| − | + | ==2007-2017== | |

| + | ===Safe investments vs. riskier ones=== | ||

| + | '''See graphic''': | ||

| − | + | ''Returns on equity funds, gilt funds, gold ETFs and liquid funds, 2007-2017'' | |

| − | + | [[File: Returns on equity funds, gilt funds, gold ETFs and liquid funds, 2007-2017.jpg|Returns on equity funds, gilt funds, gold ETFs and liquid funds, 2007-2017 <br/> From: [http://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2017%2F12%2F18&entity=Ar02401&sk=1E5C5907&mode=text NARENDRA NATHAN, December 18, 2017: ''The Times of India'']|frame|500px]] | |

| − | + | =Saving habits= | |

| + | ==2011-16: Indians invest more in equity, debt== | ||

| + | [[File: 2011-16 Investment by individual Indians in shares, bank deposits, insurance.jpg|2011-16: Investment by individual Indians in shares, bank deposits, insurance. |frame|500px]] | ||

| − | + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Indians-invest-more-in-equity-debt-29092016025036 Allirajan M, Indians invest more in equity, debt, Sep 29 2016 : The Times of India] | |

| + | Indian households are increasingly putting more money in equities and debentures. Investments by households in shares and debentures jumped 72.2% year-on-year (yo-y) or by `38,491crore to `91,763 crore in 2015-16, Reserve Bank of India (RBI) data showed. | ||

| − | + | In contrast, their investments in bank deposits advanced by a mere 3.8% y-o-y or by `22,594 crore to around `6.16 lakh crore. | |

| − | + | ||

| − | + | Household investments in shares and debentures have surged more than five times between 2012-13 and 2015-16. But their savings in bank deposits have moved up by a measly 7.1% during the timeframe, RBI data showed. Incidentally, households held a record `6.48 lakh crore in bank deposits in 2013-14. Household investments in life insurance products, another favourite, increased 9.8% y-o-y to around `2.72 lakh crore. | |

| − | + | The interest in equities and debentures has been growing at a robust pace over the last three years. The steady decline in interest offered by banks for deposits following a series of rate cuts by the RBI has acted as a dampener for those looking to invest in traditional instruments such as FDs. Though there have been corrections, equity markets have risen steadily in last three years with benchmark indices hitting new highs. | |

| − | + | ==2011-18== | |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F08%2F31&entity=Ar00400&sk=C6A8A304&mode=text# August 31, 2018: ''The Times of India''] | ||

| − | + | [[File: 2011-18- The kinds of personal investments that Indians made.jpg|2011-18- The kinds of personal investments that Indians made <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F08%2F31&entity=Ar00400&sk=C6A8A304&mode=text# August 31, 2018: ''The Times of India'']|frame|500px]] | |

| + | Indian families held a record share of their income in the form of cash in 2017-18. Preference for cash is usually a sign of risk aversion. But in the same year, share of savings in stocks grew over 4 times, reflecting higher risk acceptance. Since Indians are also investing more in pensions and keeping much less of their incomes in deposits than before it’s safe to assume that spike in cash is a temporary effect of the cash drought caused by demonetisation in 2016-17. Overall, Indians are saving more, and better, than before | ||

| − | + | ==2013-15: Saving habits== | |

| + | [[File: Some facts about investment patterns in India.jpg|Some facts about investment patterns in India; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=20_02_2016_031_046_002&type=P&artUrl=LIFE-INSURANCE-TOP-INVESTMENT-INFLATION-BIG-WORRY-20022016031046&eid=31808 ''The Times of India''], February 20, 2016|frame|500px]] | ||

| − | + | '''See graphic''': | |

| − | + | ''Some facts about investment patterns in India'' | |

| − | + | ==2014-18, state-wise== | |

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F09%2F04&entity=Ar02019&sk=73AB90C7&mode=text September 4, 2018: ''The Times of India''] | ||

| − | + | [[File: The saving habits of Indians, 2014-18, state-wise.jpg|The saving habits of Indians, 2014-18, state-wise <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F09%2F04&entity=Ar02019&sk=73AB90C7&mode=text September 4, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | '''See graphic''': | |

| − | + | ||

| + | ''The saving habits of Indians, 2014-18, state-wise'' | ||

| − | + | Investors in Gujarat are biggest risk-takers with 42% of their mutual fund money going into equities. Investors in Bengal, with 38% of their money in equities, are not far behind and do better than Delhi (36%), Karnataka (36%) & Maharashtra (32%) | |

| − | + | ==2017: even the poor and young want real estate, gold== | |

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Balance-Sheet-Of-Indian-Families-A-Matter-Of-07092017015012 Subodh Varma, Balance Sheet Of Indian Families A Matter Of Life And Debt, September 7, 2017: ''The Times of India''] | ||

| − | + | [[File: Assets and liabilities as % of total wealth of households in India, China, Germany, the USA and the UK, 2017.jpg|Assets and liabilities as % of total wealth of households in India, China, Germany, the USA and the UK, 2017; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Balance-Sheet-Of-Indian-Families-A-Matter-Of-07092017015012 Subodh Varma, Balance Sheet Of Indian Families A Matter Of Life And Debt, September 7, 2017: ''The Times of India'']|frame|500px]] | |

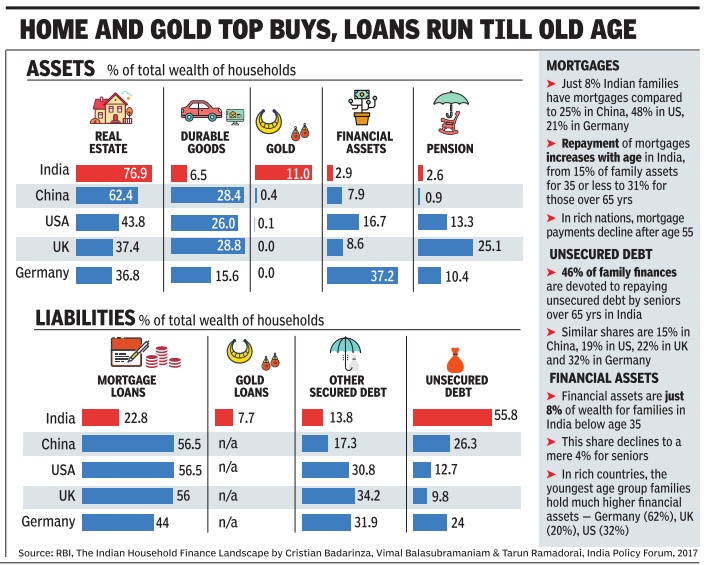

| − | + | Indian families borrow and invest in very different ways than families in the US, UK or Germany , and even those in China. The depth of these differences, across all ages and economic levels, is revealed in a recent report on household finances prepared by the RBI. | |

| + | It shows that a major proportion of household wealth in Indian families is kept as real estate or gold, even among younger families, and even by the poorest 40% of population. | ||

| − | + | This is not the case in other countries. Institutional borrowings by Indian families are low in early life and go on increasing leaving many retired persons with a debt overhang, unlike advanced countries where mortgages reduce after retirement.And, pensions are virtually absent in India while in most Western countries they are a major asset in old age. | |

| − | + | More than three quarters of family wealth is invested in real estate (land and dwelling units) by an average Indian family compared to just 44% in the US, and 37% in UK and Germany . In China, about 62% of wealth goes into real estate. Even among the poorest 20% of the population, 59% have some land or dwelling unit in India, while in China, the similar proportion is 61%. | |

| − | + | But in the rich countries a minuscule share of the poorest quintile has real estate -4% in US, and less than 1% in UK and Germany . | |

| − | + | This may sound bizarre considering India's poverty but here is the thing: average value of the main residence in the poorest Indian households is Rs 22,000, while it is Rs 15 lakh in Germany and Rs 3.7 lakh in the US. | |

| − | + | The RBI report is talking of proportion of different types of family wealth. Their absolute values are obviously very different. | |

| − | + | Besides real estate, the other main target of investment in India is gold. About 11% of family wealth goes into buying gold. Families in other countries spend virtually nothing on this, with the Chinese spending a mere 0.4% of their wealth on gold. Indian families also have gold loans amounting to about 8% of their total liabilities, again a feature not found anywhere else. | |

| − | + | ||

| − | + | “Most households use debt to cope with emergency expenses, such as hospitalisation, or property damage due to a natural disaster. The interest rates on unsecured debt are very high. Therefore, households prefer to put their savings in real estate and gold, which can also be used as collateral,“ RBI's Household Finance Committee chairman Tarun Ramadorai of Imperial College, London, told TOI. Detailed data on countries drawn from various surveys is available in a paper by Ramadorai and coauthors published in 2017. | |

| − | + | ||

| − | + | ||

| − | + | Although 73% of families in India have financial assets like cash, bank accounts and pension accounts, they hold very small amounts adding up to just 5% of their total wealth, he added. | |

| − | + | Medical emergencies, especially among the elderly , are one of the main reasons why families in India seek loans at usurious rates from money lenders. Such unsecured loans make up nearly 56% of all liabilities for Indian families, much higher than China at 26%, US (13%) and Germany (24%). The RBI report notes that “some of these risks could be mitigated through strengthening the public provision of health and social welfare services.“ | |

| − | + | Indian families are also exceptional in that housing loans are low in early life and rise beyond retirement ages.In other countries such loans rise in middle age but fall off at retirement. This happens because Indian families borrow later in life and it is customary to bequeath property to future generations who in turn look after the elderly. | |

| − | + | These traditional structures are increasingly under pressure from shifting demographic patterns, social norms, and changing economic conditions, introducing risks to economic well-being especially as households age, the report says. | |

| − | + | =Small savings= | |

| − | + | ==Small savings rates/ April 2015- August 2016== | |

| − | + | [[File: Small savings rates, April 2015- August 2016.jpg| Small savings rates, April 2015- August 2016; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=12_09_2016_020_020_009&type=P&artUrl=Get-ready-for-cut-in-EPF-rate-12092016020020&eid=31808 ''The Times of India''], September 12, 2016|frame|500px]] | |

| − | + | See graphic, 'Small savings rates, April 2015- August 2016' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | = | + | ==2017-18== |

| − | + | [[File: Small savings in India, state-wise, 2017-18.jpg|Small savings in India, state-wise, 2017-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2021%2F04%2F02&entity=Ar00718&sk=28EA6C30&mode=text April 2, 2021: ''The Times of India'']|frame|500px]] | |

| − | [[File: | + | |

'''See graphic''': | '''See graphic''': | ||

| − | '' | + | '' Small savings in India, state-wise, 2017-18 '' |

| + | |||

| + | ==Post offices vs banks/ 2018== | ||

| + | [[File: Savings in Post offices vs banks, state-wise, 2018.jpg| Savings in Post offices vs banks, state-wise / 2018 <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL/2021/04/20&entity=Ar01503&sk=988F0325&mode=image April 20, 2021: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| − | + | '' Savings in Post offices vs banks, state-wise/ 2018 '' | |

| − | + | ||

| − | [ | + | [[Category:Economy-Industry-Resources|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA |

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:India|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:Pages with broken file links|INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| − | + | = Gold Bonds= | |

| + | ==2019: benefits of different types of bonds== | ||

| + | [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F02&entity=Ar00201&sk=EE58EF27&mode=text July 2, 2019: ''The Times of India''] | ||

| − | [[File: | + | [[File: 2019- the benefits of different types of gold bonds and physical gold..jpg| 2019: the benefits of different types of gold bonds and physical gold <br/> From: [https://epaper.timesgroup.com/olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F07%2F02&entity=Ar00201&sk=EE58EF27&mode=text July 2, 2019: ''The Times of India'']|frame|500px]] |

| + | You can now hold gold in either its physical form or on paper — through gold bonds or through mutual funds that trade in gold. What should you do? The answer depends on what you are looking for. If you want liquidity, and are planning to take a loan against your stock of gold, then physical gold is your best bet. But, remember, you will need to pay a capital gains tax when you sell physical gold. But if you are looking at gold as a long-term investment, then a gold bond is what you might want to go for. Not only are you spared capital gains tax when you redeem these, you also earn a small interest. A look at the different options that are now available | ||

| − | + | [[Category:Economy-Industry-Resources|S INVESTMENTS AND SAVINGS (PERSONAL): INDIA | |

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:India|S INVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| − | + | =Systematic investment plans = | |

| + | == 2016>18: a 53% increase in inflows== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F04%2F18&entity=Ar02318&sk=F356968B&mode=text Allirajan M, MF SIP kitty crosses $10bn mark in FY18, April 18, 2018: ''The Times of India''] | ||

| − | + | [[File: SIP contribution, January-March, 2017-18.jpg|SIP contribution, January-March, 2017-18 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F04%2F18&entity=Ar02318&sk=F356968B&mode=text Allirajan M, MF SIP kitty crosses $10bn mark in FY18, April 18, 2018: ''The Times of India'']|frame|500px]] | |

| − | + | ''Sees 53% Jump From FY17, Mobilises Record $1Bn In Mar'' | |

| − | + | There is no stopping the mutual fund SIP juggernaut. Investors have committed about $10.3 billion (Rs 67,190 crore) through SIPs (systematic investment plans), the bedrock of inflows into equity MFs, in 2017-18, a massive 53% increase over the previous financial year. This is the highest ever mobilisation in a financial year. | |

| − | + | Inflows into SIPs stood at around $1.1 billion (Rs 7,119 crore) in March alone, the highest ever for a month. MF SIP accounts stood at 2.11 crore at the end of March, data with the Association of Mutual Funds in India (AMFI) showed. Incidentally, the total number of SIP accounts crossed the 1 crore mark only in August 2016. | |

| − | + | SIP is an investment option offered by fund houses where one could invest a fixed amount in an MF scheme periodically at fixed intervals—say once a month instead of making a lump-sum investment. The SIP instalment amount could be as small as Rs 500 per month. SIP is similar to a recurring deposit where you deposit a small /fixed amount every month. | |

| + | The MF industry added 9.70 lakh SIP accounts on average each month during 2017-18 against an average of 6.27 lakh SIP accounts added each month during 2016-17. AMFI data showed. The average SIP size was about Rs 3375 per SIP account. | ||

| − | + | SIPs are done almost entirely in equity schemes. The fixed income segment contributes only about 5% in volume terms and about 2% in value terms to overall SIPs. SIP is a convenient method of investing through standing instructions to debit the investor’s bank account every month, without the hassle of having to write out cheques. | |

| − | + | ||

| − | + | ||

| − | + | “SIPs account for 50% of new MF accounts. They have become a brand of their own,” says Raghav Iyengar, executive vice president, ICICI Prudential MF. “SIPs have been getting traction as investors are not trying to time the market,” says Srikanth Meenakshi, co-founder and COO, Fundsindia.com, an investment platform for MFs. | |

| − | + | “The fast pace of growth (in SIPs) is due to the network effect. People are buying MFs through SIPs as most others are doing so,” he explains. “This is the one of the easiest ways to start a new investment,” Raghav says. | |

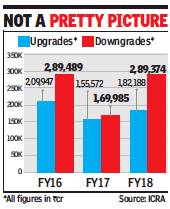

| − | + | =Upgrades, downgrades= | |

| + | ==2016> 2018== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F04%2F03&entity=Ar01810&sk=3AA24171&mode=text Nearly ₹3L-cr bonds downgraded in FY18, April 3, 2018: ''The Times of India''] | ||

| − | + | [[File: Bonds upgraded or downgraded in 2016, 2017 and 2018.jpg|Bonds upgraded or downgraded in 2016, 2017 and 2018 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F04%2F03&entity=Ar01810&sk=3AA24171&mode=text Nearly ₹3L-cr bonds downgraded in FY18, April 3, 2018: ''The Times of India'']|frame|500px]] | |

| − | |||

| − | + | ''Default Rate May Go Up In Current Financial Year On Higher Interest Cost, Says ICRA'' | |

| − | + | The quality of Indian debt soured considerably in FY18 with Rs 3 lakh crore worth of bonds being downgraded compared to Rs 1.7 lakh crore in FY17. Over half the downgrades were of papers issued by lenders, of which 70% pertained to bonds issued by public sector banks (PSBs). | |

| − | + | Going by the number of entities upgraded versus the number of downgrades, FY18 presents a positive image with 646 upgrades by rating agency ICRA versus 418 downgrades. But the volume reveals the overall quality of total outstanding debt in the country. | |

| − | + | ||

| − | + | As against the Rs 3 lakh crore of downgrades, the volume of debt upgraded in FY18 was only Rs 1.8 lakh crore — up 17% from Rs 1.5 lakh crore in the previous year. The largest proportion of debt rated by ICRA (65%) continues to remain concentrated in the sub-investment grade category. A bulk of the ratings have an ‘ICRA B’ rating, while the median rating category is ‘ICRA BB’. Fund managers consider BBB and above as an investment-grade rating, while those with lower ratings are considered speculative. | |

| − | + | PSBs, which were hit by bad debt provisions as the RBI tightened income-recognition norms, accounted for a third of downgrade volumes. According to ICRA, the overall quality of Indian debt could worsen in FY19. ICRA head of credit policy Jitin Makkar said in a webinar, “The default rate could go up in fiscal year 2019 on higher interest cost, deteriorating business conditions and likely difficulty in getting bank funding, given the challenges in the banking system.” ICRA said, looking ahead, credit quality pressures will “take longer to dissipate” as hardening interest rates and banking sector woes will create hindrances for businesses. | |

| − | + | ||

| − | + | According to ICRA, telecom, chemicals and healthcare saw weakening performance along with greater number of downgrades than upgrades. | |

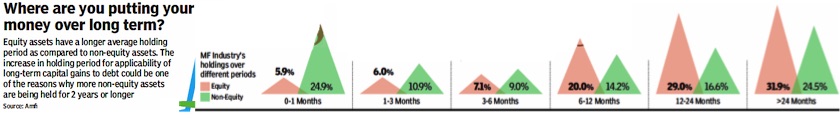

| − | + | =Periods for which investment is held= | |

| + | ==As in 2019== | ||

| + | [[File: MF industry’s holdings over different periods, presumably as in 2019.jpg|MF industry’s holdings over different periods, presumably as in 2019 <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F08%2F05&entity=Ar01900&sk=C287084D&mode=image August 5, 2019: ''The Times of India'']|frame|500px]] | ||

| − | + | '''See graphic’'': | |

| − | + | '' MF industry’s holdings over different periods, presumably as in 2019 '' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | = | + | =PART C: LEGAL ISSUES= |

| − | == | + | =Depositors’ interests= |

| − | + | ==Inter-corporate deposits do not come under MPID Act/ HC== | |

| − | + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F09%2F16&entity=Ar01711&sk=2777E21F&mode=text Swati Deshpande, Sep 16, 2019: ''The Times of India''] | |

| − | + | ||

| − | [ | + | [[File: The case so far, as on September 16, 2019- Depositors’ interests.jpg| The case so far, as on September 16, 2019- Depositors’ interests <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F09%2F16&entity=Ar01711&sk=2777E21F&mode=text Swati Deshpande, Sep 16, 2019: ''The Times of India'']|frame|500px]] |

| − | |||

| − | |||

| − | + | The Bombay high court has held that inter-corporate deposits do not come under the ambit of the Maharashtra Protection of Interest of Depositors (MPID) Act, a stringent law meant to protect the interests of small depositors. | |

| + | The judgment by a bench of Justices Ranjit More and N J Jamadar was on a petition filed by Ashish Mahendrakar, director of a Yash Birla-promoted company, Birla Power Solutions. The company and its directors are accused under MPID Act of cheating depositors after raising funds for its businesses. The state Economic Offences Wing (EOW) had registered a case in December 2013 on a complaint by the Hajarimal Somani Memorial Trust, which placed a deposit of Rs 1 crore with Birla Power Solutions in 2012 to be repaid with interest. Birla Power Solutions had defaulted. | ||

| − | + | Yash Birla Group has Rs 89 crore of unpaid inter-corporate loans in all. The case argued by Kevic Setalvad and counsel Sunny Punamiya was that such loans or deposits do not fall under MPID Act as they are given by one corporate to another. The company’s assets, including Birla House at Walkeshwar, have been attached. These properties were valued at Rs 525 crore in 2016, said the petition, arguing that it far exceeded the amounts due to investors. | |

| − | + | Special public prosecutor for the EOW of Mumbai police, Prakash Salsingekar, opposed the petition, arguing that the MPID Act — enacted to protect investors — itself enumerates amounts that don’t fall within the term ‘deposits’ and that the “court cannot supplant the exclusion clause by adding an item”, which was not in the law. He argued that a distinction cannot be carved out between depositors as it would defeat the purpose of the Act. | |

| − | + | The court held that loan advanced or deposit made by a company with another company registered under the Companies Act would not amount to a “deposit” under the meaning of the MPID Act. | |

| − | + | ||

| − | + | The HC analysed provisions of MPID Act, the Companies Act as well as a Tamil Nadu law meant to protect depositors. The Supreme Court, it noted, had said the three Acts were meant to “protect the interests of small depositors from fraud...”. | |

| − | + | [[Category:Economy-Industry-Resources|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | |

| − | [[ | + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] |

| − | + | [[Category:India|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | |

| − | [[ | + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] |

| + | [[Category:Pages with broken file links|INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| − | [[ | + | =See also= |

| + | [[Mutual Funds: India]] | ||

| − | [[ | + | [[Category:Economy-Industry-Resources|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA |

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

| + | [[Category:India|S INVESTMENTS AND SAVINGS (PERSONAL): INDIAINVESTMENTS AND SAVINGS (PERSONAL): INDIA | ||

| + | INVESTMENTS AND SAVINGS (PERSONAL): INDIA]] | ||

Revision as of 11:57, 12 June 2021

This is a collection of articles archived for the excellence of their content. |

India’s investable, personal wealth

2017: India was no.11 in the world

India’s personal wealth may grow at 13%: Report, October 9, 2018: The Times of India

The US leads the chart in terms of total personal wealth with $80 trillion in 2017, which is projected to touch $100 trillion by 2022. China is ranked second, with a total personal wealth of $21 trillion, which is expected to more than double to $43 trillion by 2022.

The report noted that India constitutes the second largest pool of wealth from emerging markets in the coming years, with $2.2 billion. It is the fifth largest Asian market in number of affluent, high net worth, and ultra high net worth individuals. There were 322,000 affluents, 87,000 high net worth individuals and 4,000 ultra high net worth individuals in the country in 2017, according to the report. It observed that nearly 70% of the country’s personal financial wealth would be accessible to wealth managers in 2022.

The 70% investable wealth in the country includes listed equity, bonds, investment funds, currency and deposits, and other smaller asset classes, while 30% non-investable wealth includes life insurance and pensions, unlisted equity and other equity.

Investment in stock markets, banks, mutual funds, gold

1995-2015

The Times of India, Nov 02 2015

Uma Shashikant

Much has changed in the way India invests since 1995, and mostly for the better

Everyone is celebrating 20-year milestones these days. The nice thing about history is that we can attempt to explain the present by looking at the past, with the benefit of hindsight. What then seemed tough, foolish and difficult, seems pathbreaking today. Then there are things that do not change, ever. It's my turn to do the 20-year flashback this week. Stock markets

In June 1994, a new wholesale market for debt was set up. Funded by institutions, it used the best satellite technologies and tried to create a market where institutions would buy and sell debt securities.But the debt markets in India were not ready for it. The leaders changed course and deployed the systems to create a new equity market. It wasn't easy .

Equity markets were already being served by 20+ stock exchanges, the oldest and largest in the same city as the new one. The new market went ahead nevertheless, permitting trades in equity shares listed on other exchanges on its satellite-linked electronic system.

In 1995, the experiment succeeded.The new market overtook the old in business. The National Stock Exchange (NSE) is an example of how a new entity can bring about positive change. How it can create a new system with higher efficiency , lower costs, wider participation, better technology and higher integrity .NSE modified how investors trade in India, creating a trading, clearing and settlement system on par with the best.

Banks

In January 1995, HDFC Bank opened its first branch in Mumbai. In March 1995, it offered shares to the public in an IPO priced at `10 per share, to mobilise `50 crore. The issue was oversubscribed 55 times and opened to trade at `40. The popular opinion was that the bank would soon merge with its illustrious parent.

All through the 1990s, public sector banks hogged the limelight for their equity offerings. No one gave private sector banks much of a bright prospect.

The PSU banks were well entrenched.They were bankers to the government and public entities. The cost of funds for the public sector banks was low, and the regulatory requirements was uniformly applicable to the new private banks too.If the new banks tried to bring in sophistication and technology , they had to face competition from foreign banks, that held a monopoly over the NRI and remittance businesses, apart from working with the large private corporate treasuries. Where was the room for new private banks? Twenty years on, private banks have built a new retail lending market that is large and growing. They have captured a large share of the institutional business. They offer superior technologies and service, and have managed to do so at a lower cost compared to their public sector counterparts, and have stronger, better and bigger balance sheets.

Mutual Funds

If one looked at mutual funds in 1995, UTI dominated with over 90% market share.While the other players were trying to find their feet, UTI was launching a slew of monthly income plans (MIPs) which promised double digit returns. The other public sector mutual funds were suffering the consequences of faulty product launches in 1991-92. They had sold 7-year closed end equity funds, with the promise of doubling and tripling the returns, and the NAVs were nowhere near target.

The new private sector funds did their best to market their products, but did not mobilise much money from investors who were worried about the lack of liquidity . Mutual funds had to list on the market and it was common for prices to be lower than the NAV . Approvals were tough to get. Banks and institutions were not selling funds, yet.

It was in 1995 the first wave of process innovation hit the mutual fund industry with open-ended funds with account statements and no certificates. Dividend and growth options were offered and banking distribution was tied up. But the struggle was with the idea of assured returns that investors clamoured after.

In 1995, when global investors were asking for depository and T+3 rolling settlement, what we had then seemed rudimentary . Today, the NSE has helped set up several stock markets across the world and is a model for risk management and settlement guarantees. In 1995, it seemed banking belonged to the public sector.Today , the success of private banks has established that PSU banks will have to restructure or fade away .

As for mutual funds, there is enough evidence to establish that a diversified portfolio over the long run beats all other investment options. But investors seem busy trading stocks and investing in bank deposits, and not engaging enough with funds. The plague of new schemes sold with inflated promises and performing schemes staying in the background has not changed. Not in 20 years.

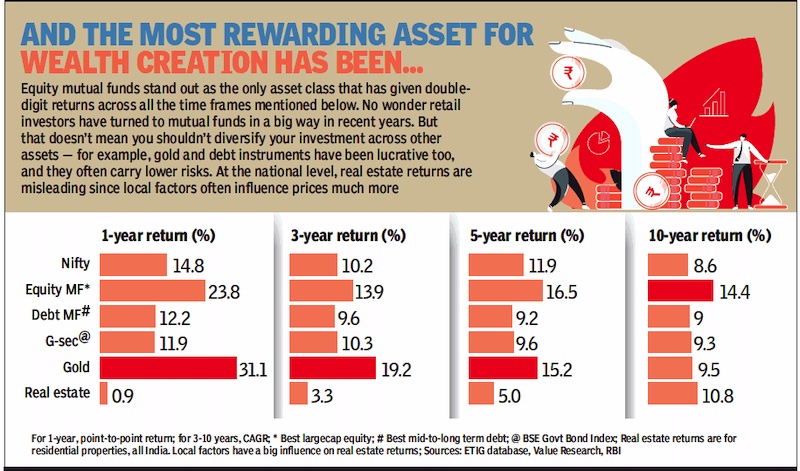

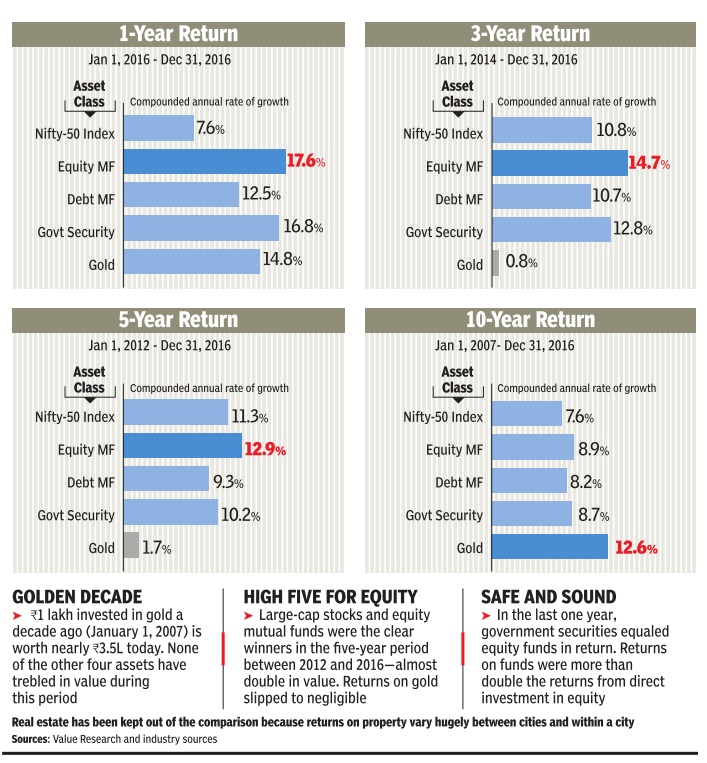

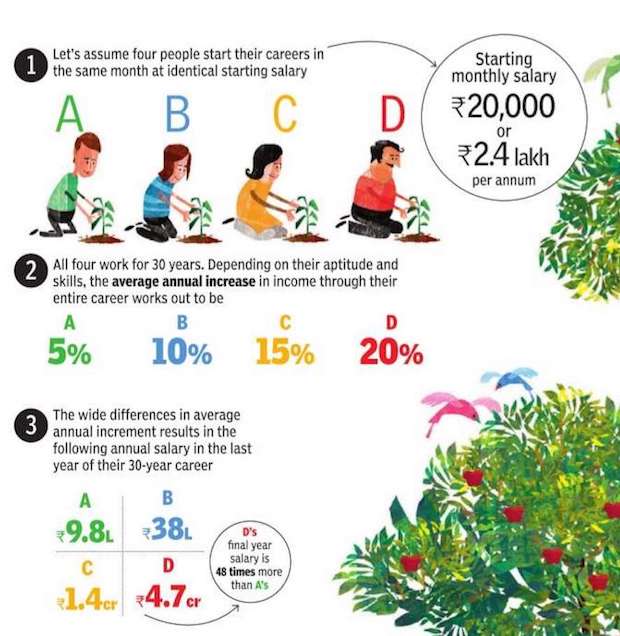

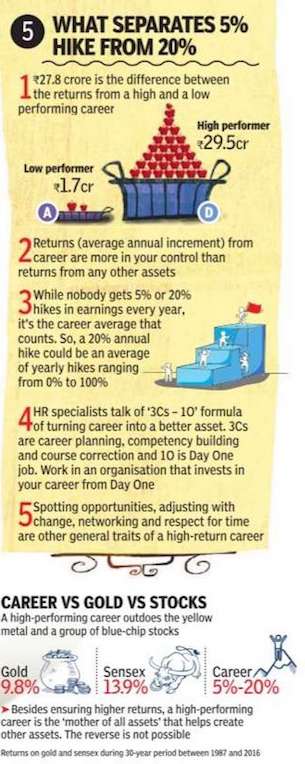

2007-16

The Times of India, Feb 02 2017

No one asset outperforms others consistently over time. In the past one year, equity mutual funds and government securities gave higher returns than other assets. Over 10 years, it's gold that beats all other asset classes. For consistent long-term gains, put your eggs in several baskets. Of course, returns is only one of the three criteria to look for before investing--safety and liquidity are the other two. Government securities, the safest investment option, matched returns from equity funds last year. But this is a rare occurence

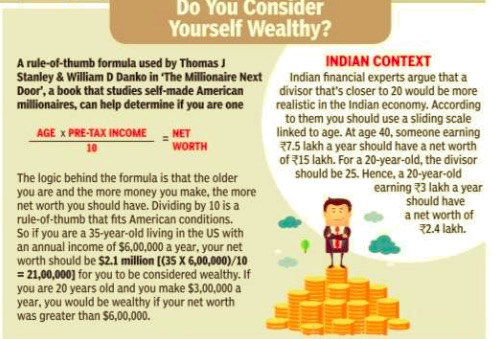

2008, 2014-19

From: February 2, 2020: The Times of India

See graphic:

2008, 2014-19: household savings in India

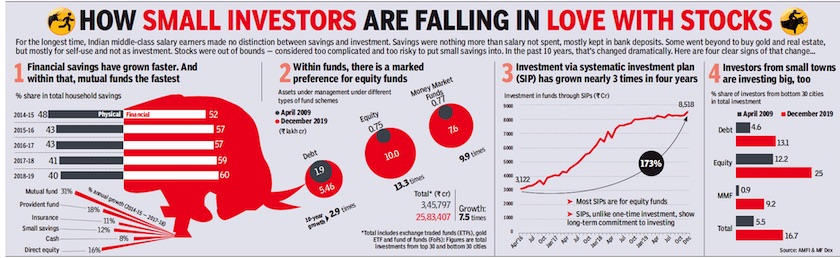

2011-18: household savings

India’s household financial savings at a new high, November 30, 2018: The Times of India

From: India’s household financial savings at a new high, November 30, 2018: The Times of India

The share of financial savings by Indian households has touched a high of 11.1% of gross national disposable income (GNDI). However, the share of deposits, which rose to a high of 6.3% on the back of demonetisation in 2016-17, has shrunk to 2.9% of GNDI. But households are borrowing much more, as reflected in the financial liabilities, which has grown to a high of 4%.

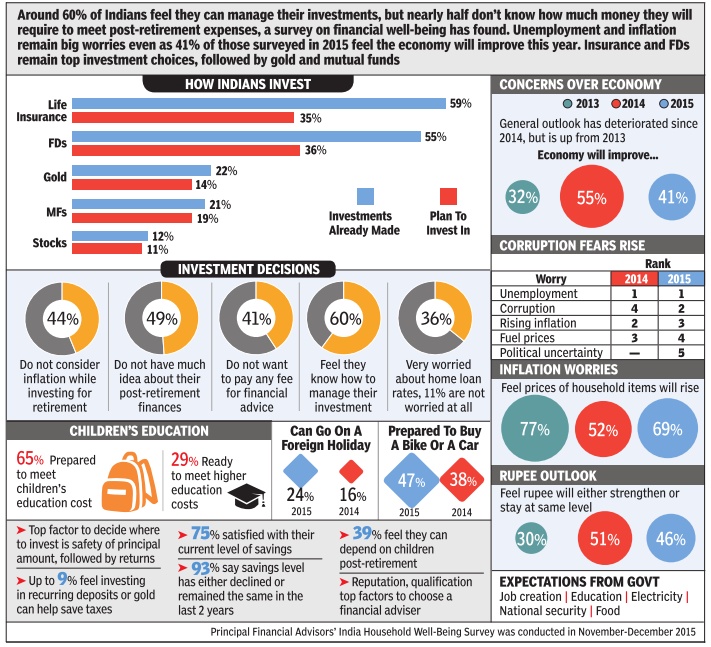

2016: FDs top

FDs most preferred saving option: Survey, April 6, 2017: The Times of India

More than 95% households prefer to park their money in bank deposits, while less than 10% opt to invest in mutual funds or stocks. Life insurance was the second most preferred investment vehicle, followed by precious metals, post office savings instruments and real estate, a survey by Sebi showed. It also showed that mutual funds came in at the sixth place (9.7%), followed by stocks (8.1%), pension schemes, company deposits, debentures, derivatives and commodity futures (1%) as investment vehicles for the urban households. Respondents were allowed to select multiple options.

The survey , conducted across urban and rural areas of the country , showed that among rural households, not even 1% of the survey respondents were investors, while even the awareness about mutual funds and equities was dismal at just 1.4%.

However, 95% of rural survey respondents had bank accounts, 47% life insurance, 29% post office deposits and 11% saved in precious metals. On a positive note, the survey found the investor base in India increasing, as nearly 75% of the respondents said they had participated in securities markets for the first time in the last five years. The survey had a sample size of 50,453 households and using a bootstrapping methodology , it was estimated there were a total of 3.37 crore investor households in India. Of these, 70% reside in urban areas.

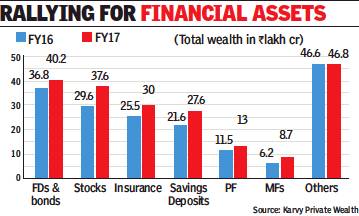

2017: 8 lakh crore equities and mutual funds

Indians invested more in stocks than in FDs in FY17, December 13, 2017: The Times of India

From: Indians invested more in stocks than in FDs in FY17, December 13, 2017: The Times of India

Indian investors are finally moving from bank fixed deposits (FDs), real estate and gold, the traditional investment products, to equities and mutual funds. In fiscal 2017, Indians invested Rs 8 lakh crore in stocks compared to Rs 3.4 lakh crore in FDs.

At the end of FY17, total investments by Indians in equities at Rs 37.6 lakh crore was just Rs 2.5 lakh crore short of total FDs, pegged at Rs 40.1 lakh crore. This is the closest that the total equity wealth of Indian investors have ever come to bank FDs, a report by Karvy Private Wealth showed. At the end of FY16, the difference was over Rs 7 lakh crore with Rs 36.8 lakh crore in FDs compared to Rs 29.6 lakh crore in stocks, the report showed.

The firm believes total investments by Indians in equities will surpass wealth in bank FDs by the end of the current fiscal. “After losing a bit of traction, financial assets have regained their pole position in FY17. Wealth creation through equities has not been restricted to big institutional investors as individual participation, too, saw a huge jump via the direct as well as mutual funds route,” said Abhijit Bhave, CEO, Karvy Private Wealth.

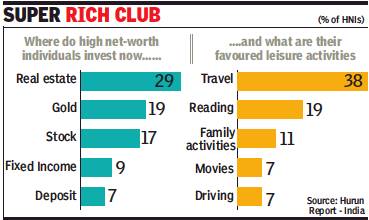

2018-19: Realty, gold top picks for HNIs

Rupali Mukherjee, August 30, 2019: The Times of India

From: Rupali Mukherjee, August 30, 2019: The Times of India

Real estate is the most preferred investment asset class for high net-worth individuals (HNIs) in next 3 years, followed by stock markets, according to the Hurun Indian Luxury Consumer Survey. This is despite the slowdown in real estate witnessed over the last three years, and turbulence in stock markets over the past 18 months. This is the first year of an India survey by Hurun Research Institute, which aims to track changes and preferences of lifestyle, consumption habits and brand cognition of HNIs.

Around 31% respondents believe that their investment allocation towards real estate sector will grow in the next two years. In line with IMF’s prediction of economic growth, equity markets followed by fixed income is the second and third choice, respectively. Interestingly, 21% respondents want to reduce allocation to real estate in the short term, and around 20% want to reduce exposure to gold. While 9.5% said investments into real estate will be at a status quo, the remainder believed that it would decline.

The UK is the most popular investment destination for HNIs. Singapore takes second place, and Canada along with the US, which is forecast to grow 2-4% (at constant exchange rates this year), rank third. Nearly a fourth (24%) are “very confident” about the Indian economy over the next three years, 40% “confident”, while around 36% are pessimistic. As many as 36% of HNIs said their investment philosophy for this year would be “avoiding risk”, while only 14% will make “active investments”.

Among collectibles, HNIs prefer to spend the most on art and jewellery. Nearly half the respondents have two to three cars, 37% have only one car and 6% have more than five cars. Up to 46% of them renew their car every three to four years.

2019

[ Oct 27, 2019: The Times of India]

See graphic, ‘Wealth held by individual Indians in physical form, 2019 '

As in 2021 Jan

See graphic:

Investment in stock markets, banks, mutual funds, gold, in the period ending 2021 Jan

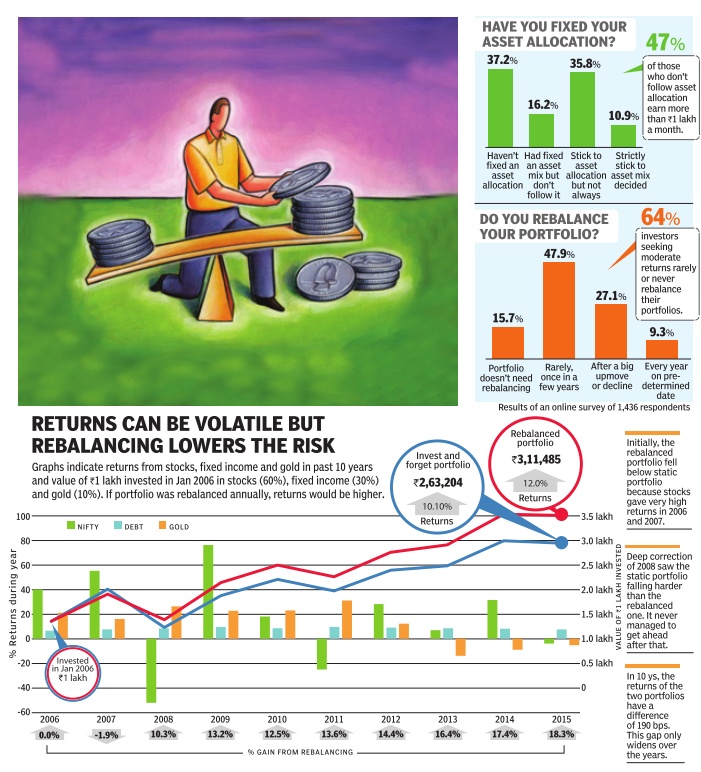

Returns

2006-15

See graphic:

Returns from stocks, gold and fixed income in India, 2006-15

2007-2017

Safe investments vs. riskier ones

See graphic:

Returns on equity funds, gilt funds, gold ETFs and liquid funds, 2007-2017

From: NARENDRA NATHAN, December 18, 2017: The Times of India

Saving habits

2011-16: Indians invest more in equity, debt

Allirajan M, Indians invest more in equity, debt, Sep 29 2016 : The Times of India

Indian households are increasingly putting more money in equities and debentures. Investments by households in shares and debentures jumped 72.2% year-on-year (yo-y) or by `38,491crore to `91,763 crore in 2015-16, Reserve Bank of India (RBI) data showed.

In contrast, their investments in bank deposits advanced by a mere 3.8% y-o-y or by `22,594 crore to around `6.16 lakh crore.

Household investments in shares and debentures have surged more than five times between 2012-13 and 2015-16. But their savings in bank deposits have moved up by a measly 7.1% during the timeframe, RBI data showed. Incidentally, households held a record `6.48 lakh crore in bank deposits in 2013-14. Household investments in life insurance products, another favourite, increased 9.8% y-o-y to around `2.72 lakh crore.

The interest in equities and debentures has been growing at a robust pace over the last three years. The steady decline in interest offered by banks for deposits following a series of rate cuts by the RBI has acted as a dampener for those looking to invest in traditional instruments such as FDs. Though there have been corrections, equity markets have risen steadily in last three years with benchmark indices hitting new highs.

2011-18

August 31, 2018: The Times of India

From: August 31, 2018: The Times of India

Indian families held a record share of their income in the form of cash in 2017-18. Preference for cash is usually a sign of risk aversion. But in the same year, share of savings in stocks grew over 4 times, reflecting higher risk acceptance. Since Indians are also investing more in pensions and keeping much less of their incomes in deposits than before it’s safe to assume that spike in cash is a temporary effect of the cash drought caused by demonetisation in 2016-17. Overall, Indians are saving more, and better, than before

2013-15: Saving habits

See graphic:

Some facts about investment patterns in India

2014-18, state-wise

September 4, 2018: The Times of India

From: September 4, 2018: The Times of India

See graphic:

The saving habits of Indians, 2014-18, state-wise

Investors in Gujarat are biggest risk-takers with 42% of their mutual fund money going into equities. Investors in Bengal, with 38% of their money in equities, are not far behind and do better than Delhi (36%), Karnataka (36%) & Maharashtra (32%)

2017: even the poor and young want real estate, gold

Indian families borrow and invest in very different ways than families in the US, UK or Germany , and even those in China. The depth of these differences, across all ages and economic levels, is revealed in a recent report on household finances prepared by the RBI.

It shows that a major proportion of household wealth in Indian families is kept as real estate or gold, even among younger families, and even by the poorest 40% of population.

This is not the case in other countries. Institutional borrowings by Indian families are low in early life and go on increasing leaving many retired persons with a debt overhang, unlike advanced countries where mortgages reduce after retirement.And, pensions are virtually absent in India while in most Western countries they are a major asset in old age.

More than three quarters of family wealth is invested in real estate (land and dwelling units) by an average Indian family compared to just 44% in the US, and 37% in UK and Germany . In China, about 62% of wealth goes into real estate. Even among the poorest 20% of the population, 59% have some land or dwelling unit in India, while in China, the similar proportion is 61%.

But in the rich countries a minuscule share of the poorest quintile has real estate -4% in US, and less than 1% in UK and Germany .

This may sound bizarre considering India's poverty but here is the thing: average value of the main residence in the poorest Indian households is Rs 22,000, while it is Rs 15 lakh in Germany and Rs 3.7 lakh in the US.

The RBI report is talking of proportion of different types of family wealth. Their absolute values are obviously very different.

Besides real estate, the other main target of investment in India is gold. About 11% of family wealth goes into buying gold. Families in other countries spend virtually nothing on this, with the Chinese spending a mere 0.4% of their wealth on gold. Indian families also have gold loans amounting to about 8% of their total liabilities, again a feature not found anywhere else.

“Most households use debt to cope with emergency expenses, such as hospitalisation, or property damage due to a natural disaster. The interest rates on unsecured debt are very high. Therefore, households prefer to put their savings in real estate and gold, which can also be used as collateral,“ RBI's Household Finance Committee chairman Tarun Ramadorai of Imperial College, London, told TOI. Detailed data on countries drawn from various surveys is available in a paper by Ramadorai and coauthors published in 2017.

Although 73% of families in India have financial assets like cash, bank accounts and pension accounts, they hold very small amounts adding up to just 5% of their total wealth, he added.

Medical emergencies, especially among the elderly , are one of the main reasons why families in India seek loans at usurious rates from money lenders. Such unsecured loans make up nearly 56% of all liabilities for Indian families, much higher than China at 26%, US (13%) and Germany (24%). The RBI report notes that “some of these risks could be mitigated through strengthening the public provision of health and social welfare services.“

Indian families are also exceptional in that housing loans are low in early life and rise beyond retirement ages.In other countries such loans rise in middle age but fall off at retirement. This happens because Indian families borrow later in life and it is customary to bequeath property to future generations who in turn look after the elderly.

These traditional structures are increasingly under pressure from shifting demographic patterns, social norms, and changing economic conditions, introducing risks to economic well-being especially as households age, the report says.

Small savings

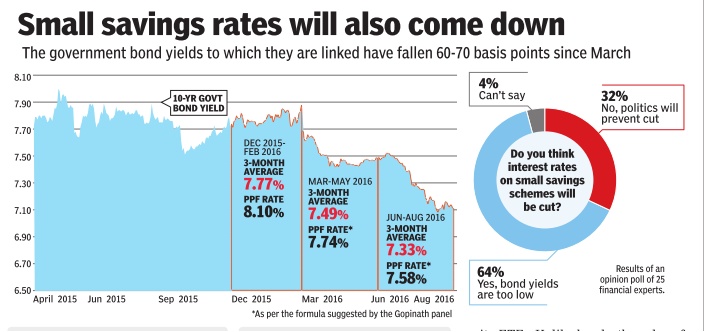

Small savings rates/ April 2015- August 2016

See graphic, 'Small savings rates, April 2015- August 2016'

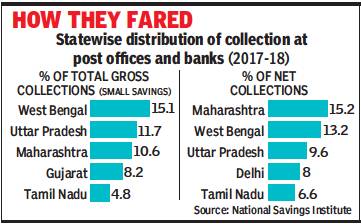

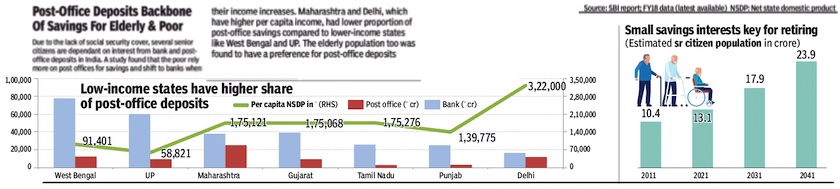

2017-18

From: April 2, 2021: The Times of India

See graphic:

Small savings in India, state-wise, 2017-18

Post offices vs banks/ 2018

From: April 20, 2021: The Times of India

See graphic:

Savings in Post offices vs banks, state-wise/ 2018

Gold Bonds

2019: benefits of different types of bonds

July 2, 2019: The Times of India

From: July 2, 2019: The Times of India

You can now hold gold in either its physical form or on paper — through gold bonds or through mutual funds that trade in gold. What should you do? The answer depends on what you are looking for. If you want liquidity, and are planning to take a loan against your stock of gold, then physical gold is your best bet. But, remember, you will need to pay a capital gains tax when you sell physical gold. But if you are looking at gold as a long-term investment, then a gold bond is what you might want to go for. Not only are you spared capital gains tax when you redeem these, you also earn a small interest. A look at the different options that are now available

Systematic investment plans

2016>18: a 53% increase in inflows

Allirajan M, MF SIP kitty crosses $10bn mark in FY18, April 18, 2018: The Times of India

From: Allirajan M, MF SIP kitty crosses $10bn mark in FY18, April 18, 2018: The Times of India

Sees 53% Jump From FY17, Mobilises Record $1Bn In Mar

There is no stopping the mutual fund SIP juggernaut. Investors have committed about $10.3 billion (Rs 67,190 crore) through SIPs (systematic investment plans), the bedrock of inflows into equity MFs, in 2017-18, a massive 53% increase over the previous financial year. This is the highest ever mobilisation in a financial year.

Inflows into SIPs stood at around $1.1 billion (Rs 7,119 crore) in March alone, the highest ever for a month. MF SIP accounts stood at 2.11 crore at the end of March, data with the Association of Mutual Funds in India (AMFI) showed. Incidentally, the total number of SIP accounts crossed the 1 crore mark only in August 2016.

SIP is an investment option offered by fund houses where one could invest a fixed amount in an MF scheme periodically at fixed intervals—say once a month instead of making a lump-sum investment. The SIP instalment amount could be as small as Rs 500 per month. SIP is similar to a recurring deposit where you deposit a small /fixed amount every month.

The MF industry added 9.70 lakh SIP accounts on average each month during 2017-18 against an average of 6.27 lakh SIP accounts added each month during 2016-17. AMFI data showed. The average SIP size was about Rs 3375 per SIP account.

SIPs are done almost entirely in equity schemes. The fixed income segment contributes only about 5% in volume terms and about 2% in value terms to overall SIPs. SIP is a convenient method of investing through standing instructions to debit the investor’s bank account every month, without the hassle of having to write out cheques.

“SIPs account for 50% of new MF accounts. They have become a brand of their own,” says Raghav Iyengar, executive vice president, ICICI Prudential MF. “SIPs have been getting traction as investors are not trying to time the market,” says Srikanth Meenakshi, co-founder and COO, Fundsindia.com, an investment platform for MFs.

“The fast pace of growth (in SIPs) is due to the network effect. People are buying MFs through SIPs as most others are doing so,” he explains. “This is the one of the easiest ways to start a new investment,” Raghav says.

Upgrades, downgrades

2016> 2018

Nearly ₹3L-cr bonds downgraded in FY18, April 3, 2018: The Times of India

From: Nearly ₹3L-cr bonds downgraded in FY18, April 3, 2018: The Times of India

Default Rate May Go Up In Current Financial Year On Higher Interest Cost, Says ICRA

The quality of Indian debt soured considerably in FY18 with Rs 3 lakh crore worth of bonds being downgraded compared to Rs 1.7 lakh crore in FY17. Over half the downgrades were of papers issued by lenders, of which 70% pertained to bonds issued by public sector banks (PSBs).

Going by the number of entities upgraded versus the number of downgrades, FY18 presents a positive image with 646 upgrades by rating agency ICRA versus 418 downgrades. But the volume reveals the overall quality of total outstanding debt in the country.

As against the Rs 3 lakh crore of downgrades, the volume of debt upgraded in FY18 was only Rs 1.8 lakh crore — up 17% from Rs 1.5 lakh crore in the previous year. The largest proportion of debt rated by ICRA (65%) continues to remain concentrated in the sub-investment grade category. A bulk of the ratings have an ‘ICRA B’ rating, while the median rating category is ‘ICRA BB’. Fund managers consider BBB and above as an investment-grade rating, while those with lower ratings are considered speculative.

PSBs, which were hit by bad debt provisions as the RBI tightened income-recognition norms, accounted for a third of downgrade volumes. According to ICRA, the overall quality of Indian debt could worsen in FY19. ICRA head of credit policy Jitin Makkar said in a webinar, “The default rate could go up in fiscal year 2019 on higher interest cost, deteriorating business conditions and likely difficulty in getting bank funding, given the challenges in the banking system.” ICRA said, looking ahead, credit quality pressures will “take longer to dissipate” as hardening interest rates and banking sector woes will create hindrances for businesses.

According to ICRA, telecom, chemicals and healthcare saw weakening performance along with greater number of downgrades than upgrades.

Periods for which investment is held

As in 2019

From: August 5, 2019: The Times of India

'See graphic’:

MF industry’s holdings over different periods, presumably as in 2019

PART C: LEGAL ISSUES

Depositors’ interests

Inter-corporate deposits do not come under MPID Act/ HC

Swati Deshpande, Sep 16, 2019: The Times of India

From: Swati Deshpande, Sep 16, 2019: The Times of India

The Bombay high court has held that inter-corporate deposits do not come under the ambit of the Maharashtra Protection of Interest of Depositors (MPID) Act, a stringent law meant to protect the interests of small depositors.

The judgment by a bench of Justices Ranjit More and N J Jamadar was on a petition filed by Ashish Mahendrakar, director of a Yash Birla-promoted company, Birla Power Solutions. The company and its directors are accused under MPID Act of cheating depositors after raising funds for its businesses. The state Economic Offences Wing (EOW) had registered a case in December 2013 on a complaint by the Hajarimal Somani Memorial Trust, which placed a deposit of Rs 1 crore with Birla Power Solutions in 2012 to be repaid with interest. Birla Power Solutions had defaulted.

Yash Birla Group has Rs 89 crore of unpaid inter-corporate loans in all. The case argued by Kevic Setalvad and counsel Sunny Punamiya was that such loans or deposits do not fall under MPID Act as they are given by one corporate to another. The company’s assets, including Birla House at Walkeshwar, have been attached. These properties were valued at Rs 525 crore in 2016, said the petition, arguing that it far exceeded the amounts due to investors.

Special public prosecutor for the EOW of Mumbai police, Prakash Salsingekar, opposed the petition, arguing that the MPID Act — enacted to protect investors — itself enumerates amounts that don’t fall within the term ‘deposits’ and that the “court cannot supplant the exclusion clause by adding an item”, which was not in the law. He argued that a distinction cannot be carved out between depositors as it would defeat the purpose of the Act. The court held that loan advanced or deposit made by a company with another company registered under the Companies Act would not amount to a “deposit” under the meaning of the MPID Act.

The HC analysed provisions of MPID Act, the Companies Act as well as a Tamil Nadu law meant to protect depositors. The Supreme Court, it noted, had said the three Acts were meant to “protect the interests of small depositors from fraud...”.