Mutual Funds: India

| Line 29: | Line 29: | ||

Barring odd instances such as the market meltdown in 2008 when the rout that followed the global financial crisis triggered a massive pullout by FIIs, overseas investors have stood head and shoulders above their domestic peers in investments into Indian stocks. | Barring odd instances such as the market meltdown in 2008 when the rout that followed the global financial crisis triggered a massive pullout by FIIs, overseas investors have stood head and shoulders above their domestic peers in investments into Indian stocks. | ||

| + | |||

| + | =CEO remunerations= | ||

| + | ==2017: UTI leads== | ||

| + | [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=Despite-UTI-MF-not-being-top-fund-its-09052017018019 Allirajan M, Despite UTI MF not being top fund, its CEO highest paid , May 9, 2017: The Times of India] | ||

| + | |||

| + | The Unit Trust of India (UTI), the original pioneer of mutual funds (MFs) in the country , may have lost its leadership position to private sector peers. But the fund house's top honcho and its employees are now the best paid in the MF industry. | ||

| + | |||

| + | Leo Puri, MD and CEO of UTI MF , was the highest paid executive in the MF industry in 2016-17. He took home Rs 7.07 crore as annual salary (fixed and variable pay) during the year, a 23% increase compared with the previous fiscal, pipping Milind Barve, the MD and CEO at HDFC MF , the highest paid executive in 2015-16. | ||

| + | |||

| + | The median remuneration at UTI -which stood at Rs 19.6 lakh during the year, more than twice the average pay of employees at the country's top-4 fund houses by assets under management (AUM) -is high as the average tenure of employees is more than 20 years. Incidentally, UTI is only the sixth largest fund house by AUM, and lost its place in the top-5 league to SBI MF in April last year. Kamlesh Dangi, group president & head HR , UTI MF , said, “Since we do not have a long-term incentive plan, the salary (cash) component is high.“ | ||

| + | |||

| + | While the median remuneration of employees at ICICI Prudential MF -the largest fund house by AUM -was Rs 5.84 lakh, employees at HDFC MF , the second largest fund manager got Rs 8.77 lakh as average pay . Employees at Reliance MF and Birla Sun Life MF , the third and fourth largest fund houses respectively , got an average pay of around Rs 8.5 lakh and Rs 7 lakh respectively . | ||

| + | |||

| + | More than a dozen executives at UTI were paid in excess of Rs 1 crore in 2016-17. Sundeep Sikka, the executive director and CEO of Reliance MF , got the highest pay rise among executives of top-6 fund houses in the country . Sikka earned Rs 5.01 crore as annual salary (fixed and variable pay) during 2016-17, a 43.1% jump on a yearon-year basis. In addition, he also got a one-time payment of Rs 3.41crore for the year. | ||

| + | |||

| + | Despite the stellar show by equity MFs, which touched record highs, soaring past the Rs 5-lakh-crore AUM mark in 201617, the top-2 equity fund managers saw negligible hike in their annual pay . While Sankaran Naren, the ED of ICICI Prudential MF , who also heads the fund house's equities team, saw no change in remuneration during the year, the annual pay of Prashant Jain, ED of HDFC MF , who dons a similar role, inched up by 3.9%. | ||

| + | |||

| + | The annual salary of Jain, however, remained the highest in the industry among fund managers. Incidentally , HDFC MF's average AUM in the equity category increased 18.4% yo-y to Rs 80,592 crore while ICICI Prudential's average AUM surged 33% y-o-y to Rs 77,223 crore for 2016-17. MFs would not disclose the remuneration paid to its star fund managers earlier. They would disclose compensation paid to key managerial personnel (KMP), which included the MD. Interestingly , KMP included the MD and CEO, CFO and company secretary and not CIOs who run the fund management business. | ||

=See also= | =See also= | ||

| − | [[Sensex ]] <> [[The stock market: India]] <> [[Mutual Funds: India ]] <> [[Rupee: India ]] | + | [[Sensex ]] <> [[The stock market: India]] <> [[Mutual Funds: India ]] <> [[Rupee: India ]] <> [[Chief Executive Officers: India]] |

Revision as of 06:34, 27 June 2017

This is a collection of articles archived for the excellence of their content. |

Contents |

2015: Equity MFs beat FIIs

The Times of India, November 20, 2015

Allirajan M

Equity MF investors beat FIIs in 2015

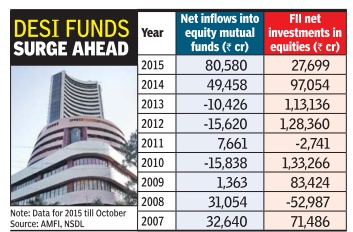

For years, equity mutual funds (MFs) were the poor cousins of the stock markets as foreign institutional investors (FIIs) always poured more money into direct equities. But for the first time ever, equity MF investors are overshadowing their overseas peers, having pumped nearly three times more funds into equity schemes in the current year than FIIs. Equity MFs (including equity-linked savings schemes, or ELSS) have seen net inflows of Rs 80,580 crore, or about $12.5 billion, so far in 2015 (till October) -the highest on record. In contrast, FIIs have made net investments of Rs 27,699 crore, or around $4.25 billion, during the period.

In fact, net investments made by MF investors have al ready surpassed the highs hit in 2014. The surge in inflows into equity schemes has prompted fund houses to deploy money in shares in a big way .Equity MFs have deployed about $950 million per month on an average in 2015. Fund deployments peaked to an all-time monthly high in August af ter the stock markets plunged in the wake of the global turmoil in equity markets amid a sharp selloff in China.

“Investors are gradually realizing that equities are the best option on a tax-adjusted basis over the long term. So they are putting a bigger portion of their savings in equiti es,“ says Sunil Singhania, head (equities), Reliance Capital Asset Management.

Gopal Agrawal, CIO, Mirae Asset Global Investments India, says, “Interest (in equities) has been quite consistent among investors. Other asset classes such as gold and real estate have not done well and this has also helped. There is a clear shift in investment patterns. Investors have become a lot more mature. The attractiveness of other asset classes has diminished to a large extent. But the long-term outlook is quite positive for equities.“

Barring odd instances such as the market meltdown in 2008 when the rout that followed the global financial crisis triggered a massive pullout by FIIs, overseas investors have stood head and shoulders above their domestic peers in investments into Indian stocks.

CEO remunerations

2017: UTI leads

The Unit Trust of India (UTI), the original pioneer of mutual funds (MFs) in the country , may have lost its leadership position to private sector peers. But the fund house's top honcho and its employees are now the best paid in the MF industry.

Leo Puri, MD and CEO of UTI MF , was the highest paid executive in the MF industry in 2016-17. He took home Rs 7.07 crore as annual salary (fixed and variable pay) during the year, a 23% increase compared with the previous fiscal, pipping Milind Barve, the MD and CEO at HDFC MF , the highest paid executive in 2015-16.

The median remuneration at UTI -which stood at Rs 19.6 lakh during the year, more than twice the average pay of employees at the country's top-4 fund houses by assets under management (AUM) -is high as the average tenure of employees is more than 20 years. Incidentally, UTI is only the sixth largest fund house by AUM, and lost its place in the top-5 league to SBI MF in April last year. Kamlesh Dangi, group president & head HR , UTI MF , said, “Since we do not have a long-term incentive plan, the salary (cash) component is high.“

While the median remuneration of employees at ICICI Prudential MF -the largest fund house by AUM -was Rs 5.84 lakh, employees at HDFC MF , the second largest fund manager got Rs 8.77 lakh as average pay . Employees at Reliance MF and Birla Sun Life MF , the third and fourth largest fund houses respectively , got an average pay of around Rs 8.5 lakh and Rs 7 lakh respectively .

More than a dozen executives at UTI were paid in excess of Rs 1 crore in 2016-17. Sundeep Sikka, the executive director and CEO of Reliance MF , got the highest pay rise among executives of top-6 fund houses in the country . Sikka earned Rs 5.01 crore as annual salary (fixed and variable pay) during 2016-17, a 43.1% jump on a yearon-year basis. In addition, he also got a one-time payment of Rs 3.41crore for the year.

Despite the stellar show by equity MFs, which touched record highs, soaring past the Rs 5-lakh-crore AUM mark in 201617, the top-2 equity fund managers saw negligible hike in their annual pay . While Sankaran Naren, the ED of ICICI Prudential MF , who also heads the fund house's equities team, saw no change in remuneration during the year, the annual pay of Prashant Jain, ED of HDFC MF , who dons a similar role, inched up by 3.9%.

The annual salary of Jain, however, remained the highest in the industry among fund managers. Incidentally , HDFC MF's average AUM in the equity category increased 18.4% yo-y to Rs 80,592 crore while ICICI Prudential's average AUM surged 33% y-o-y to Rs 77,223 crore for 2016-17. MFs would not disclose the remuneration paid to its star fund managers earlier. They would disclose compensation paid to key managerial personnel (KMP), which included the MD. Interestingly , KMP included the MD and CEO, CFO and company secretary and not CIOs who run the fund management business.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India <> Chief Executive Officers: India