Mutual Funds: India

This is a collection of articles archived for the excellence of their content. |

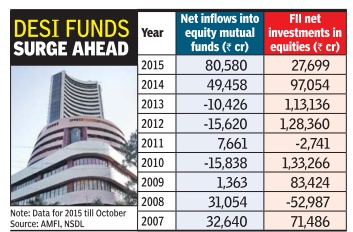

2015: Equity MFs beat FIIs

The Times of India, November 20, 2015

Allirajan M

Sensex cos' Q3 net to decline 2%

India Inc is likely to see a further moderation in earnings momentum in the third quarter of 2014-15.

The growth in earnings for sensex companies would fall to the lowest level since the quarter ending June 2013, estimates showed. The profit margins of the sensex companies are expected to decline on both year-on-year (y-o-y) as well as quarter-on-quarter basis.

The moderation in earnings would be predominantly concentrated in oil & gas and metals companies due to the sharp correction in commodity prices, estimates made by leading brokerages showed.

Export-oriented sectors such as IT (information technology) and pharmaceuticals would also be affected due to the cross-currency impact of 200-220bps (100 bps = 1 percentage point) on revenues since the dollar had appreciated 5.2% and 5.8% against the pound and the euro.

Though the lower commodity prices are a tailwind for India Inc, inventory losses and lacklustre domestic demand have played spoilsport, analysts said. “Given the weak demand, domestic consumption as well as investment-oriented sectors are expected to report subdued earnings growth,” experts said.

While the moderation in commodity prices is expect ed to boost ebitda (earnings before interest, taxes, depreciation and amortization) margins, it is unlikely to compensate for the subdued domestic demand, observers said. Ebitda margins, which have been improving over the past couple of quarters, are expected to increase on a qo-q basis on the back of the sharp correction in commodity prices. But companies would not be in a position to take full advantage of the cor rection due to inventory losses, analysts said.

“The benefits (of fall in input costs) would come with a lag of two-three months,” said GChokkalingam, founder and MD, Equinomics Research and Advisory.Alex Mathews, head (research), Geojit BNP Paribas Securities, said, “The next quarter would be much better due to the fall in commodity prices and the likely softening of interest rates.” The earnings of sensex companies are expected to either remain flat or decline around 2% to about Rs 58,50060,770 crore, estimates showed. “Domestic-oriented sectors are expected to post stable, but subdued earnings growth,” analysts at Edelweiss Securities said. The top line of sensex companies are also expected to remain flat. Net sales made by sensex companies would be around Rs 4.9 lakh crore during the quarter, estimates showed.

Re regains 63 level on rally in stocks

In a pull-back rally, the sensex closed 366 points higher at 27,275 and reversed a three-session losing streak on the back of strong buying in stocks like ITC, ICICI Bank, HDFC and HDFC Bank. The sensex's gains were also helped by short-covering by speculators in the closing hours as they rushed to buy at higher levels and cut their losses. The strong gains in the stock market helped the rupee strengthen against the dollar by 51 paise to above the 63-per-dollar mark for the first time in over three weeks, as it closed at 62.67. The strength of the rupee came on expectations that a strong stock market will attract foreign funds to invest in Indian stocks.

See also

Sensex <> The stock market: India <> Mutual Funds: India <> Rupee: India