Corporate Tax: India

This is a collection of articles archived for the excellence of their content.

|

Contents |

PART A

THE BROAD PICTURE

Exemptions

A brief history of their phasing out

Sep 21, 2019: The Times of India

The idea of cutting corporate tax rates while simultaneously phasing out exemptions has been in the air for several years but successive governments have shied away from biting the bullet. Indeed, this was one of the recommendations of a panel set up by UPA under Parthasarathi Shome.

While India Inc has consistently clamoured for lower taxes, many among them would hem and haw when asked if they’d be okay with a simpler system with lower taxes but no set-offs. In his 2015-16 Budget speech, Arun Jaitley had proposed to reduce the rate of corporate tax from 30% to 25% over the next 4 years. He had said that would lead to higher level of investment, higher growth and more jobs.

Jaitley had also said that this process of reduction needed to be accompanied by rationalisation and removal of various kinds of tax exemptions and incentives to corporate taxpayers, which incidentally account for a large number of tax disputes. But revenue consideration had forced him to scale back implementation of his original plan.

In the 2015-16, Jaitley had announced the reduction of corporate tax rate to 25% for companies whose turnover was less than Rs 50 crore, which he said would benefit 96% of companies filing tax returns. He followed that up in the 2016-17 Budget by announcing, “Towards fulfilment of my promise to reduce corporate tax rate in a phased manner, I now propose to extend the benefit of this reduced rate of 25% also to companies who have reported turnover up to Rs 250 crore in the financial year 2016-17.”

He had vowed to fully implement the roadmap for extending the benefits of lower corporate tax rates for all companies when revenues improve due to GST. Now, finance minister Nirmala Sitharaman has completed the unfinished agenda backed by Prime Minister Narendra Modi who has taken the bold political call to go ahead with the sharp cut, foregoing Rs 1.45 lakh crore in revenues.

India vis-à-vis the world

2018

From: Nov 28, 2019: The Times of India

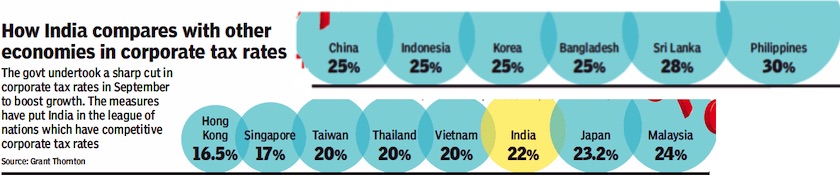

See graphic:

Corporate Tax rates in India vis-à-vis those in Bangladesh, Sri Lanka and other Asian countries, presumably as in 2018

PART B

YEAR-WISE DEVELOPMENTS

1991-2019: Corporate Tax rates

Corporate Tax rates in comparable countries, presumably as in 2019

The implications of the lower rate of Sept 2019.

From: Sidhartha , Sep 21, 2019: The Times of India

From: Sep 21, 2019: The Times of India

From: Sep 21, 2019: The Times of India

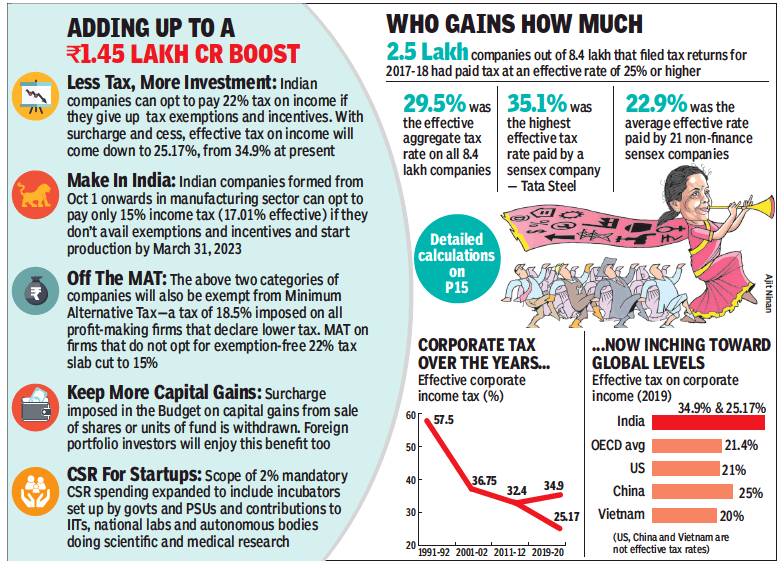

See graphics:

1991-2019: Corporate Tax rates in India (There are two figures for 2019: the higher one was announce in the Union Budget and the lower one in Sept 2019).

Corporate Tax rates in comparable countries, presumably as in 2019

The implications of the lower rate of Sept 2019.

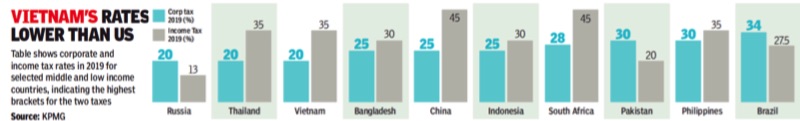

Corporate and income tax rates in Bangladesh, China, Pakistan, Russia and other comparable countries, presumably as in 2019

Corporate and income tax rates in OECD/ ‘1st world’ countries, presumably as in 2019

2014: The Times of India’s guide

TIMES GUIDE TO CORPORATE TAX

COMPILED & POWERED BY EY

Proposal: No change in tax rates, surcharge and education cess

Impact: The effective corporate tax rate for domestic companies would continue to be at 33.99% and the effective minimum alternate tax rate would continue to be at 20.96% (applicable where the total income of the company exceeds Rs 10 crore)

P: Change in the mechanism of computing dividend distribution tax on a gross basis

I: Effective increase in outflow of dividend distribution tax (which is 17% approximately on dividend declared) and likely consequential reduction in dividend received by the shareholder

P: Sunset clause extended to March 31, 2017, for claiming deduction under section 80IA to power sector undertakings

I: This would incentivize investments in power sector, ie, generation and distribution of power, transmission or distribution lines and renovation and modernization of existing lines

P: Beneficial withholding tax of 5% now extended to long-term bonds of an Indian company subject to certain conditions

I: Earlier only long-term infrastructure bonds were eligible for the beneficial withholding tax of 5%. Liberalizing this requirement by extending the benefit to long-term corporate bonds will further augment long-term low cost funds from abroad for companies

P: Expenditure incurred on Corporate Social Responsibility (`CSR') not an allowable business expenditure. However, specific expenses covered under Sections 30 to 36 of the Act will be allowed

I: Such specific expenses include repairs, depreciation or expenditure towards specific notified projects. Disallowing as a business expenditure could result in an additional burden for India Inc

P: Retrospective amendment in relation to indirect transfer of shares has been retained. All fresh cases to be referred to a high level committee before initiating any action

I: The ambiguity would continue on the outcome of pending cases

P: Coverage of advance ruling provisions extended to residents

I: Earlier, an advance ruling could be availed by a resident only in respect of transactions with non-residents. Now, resident taxpayers can seek clarity on taxability with regard to domestic transactions as well

P: Dividends received from foreign subsidiaries by India Inc will continue to be taxed at the concessional rate in the future (without any sunset period).

Thus, the effective tax rate will be approximately 17% with surcharge and cess

I: This should continue to incentivize Indian companies to repatriate excess cash lying in overseas subsidiaries to India

P: Disallowance of expenditure on nondeduction of appropriate taxes now extended to also cover salary payments and director fees

I: If an employer fails to deduct tax at source against salary income or against director fees, such expenses shall be disallowed as a deduction from business profits

P: Taxability of capital gains on transfer of an asset on account of compulsory acquisition to be at the time when the final order providing for compensation is made

I: This will provide much needed clarity with respect to taxability of gains arising on compulsory acquisition of capital asset, such as land and reduce tax litigation

P: Currently, entire amount paid to residents such as rent, commission, professional fees, royalty which are subject to TDS, are not allowed as a deduction where appropriate taxes have not been deducted and/or deposited.

Now, the disallowance is restricted to 30% of such amount

I: This would reduce the impact of tax liability for the taxpayer arising on account of the above disallowance

P: Income of foreign portfolio investors (FPIs) from transactions in securities to be treated as capital gains. Presence of fund managers managing the funds of the investor in India may not have adverse tax consequence.

I: This will provide clarity with respect to taxability of FPI as well as the fund managers and reduce tax litigation

P: Expenses such as royalty, fees for technical services or commission where the tax has been deducted during the year and deposited before the due date of filing the return of income will be allowed as a business deduction, even in respect of payments made to nonresidents

I: Earlier, if the tax was deducted and not deposited by March 31, the deduction was not available for that year. Now, even if the tax is deposited before the filing of the return, the business deduction will be available

P: Transfer pricing provisions are amended to permit use of multiple-year data for comparability study to determine arm's length pricing, instead of only single-year data

I: This proposal would result in a fall in transfer pricing litigation. Also, often tax payers face challenges because the single-year data is not available when they undertook the transfer pricing study

P: Keeping in line with international tax practice, effective from October 1, 2014, rollback provisions are being proposed in advance pricing agreement (APA), wherein APA could also cover the four previous years immediately preceding the first year covered under the APA

I: At present, a taxpayer could apply for an APA only for future years for an existing transaction, although in substance the transaction was a continuing one. Subject to conditions that may be prescribed in this regard, this would provide relief to taxpayers facing litigation for such transactions

P: Investment allowance of 15% of cost of new assets now available if such assets are installed by March 31, 2017, and cost exceeds Rs 100 crore. For MSMEs, the same benefit is available where the cost exceeds Rs 25 crore

I: This will provide a further boost to the manufacturing sector and encourage investments in new plant and machinery

P: Real Estate Investment Trust (REIT) and Infrastructure Investment Trust (Invit), which are listed on recognized stock exchanges, would be treated as pass-through entities

I: Capital gains on disposal of assets shall be taxable in the hands of the trust. Dividend and capital gains income of REIT and Invit distributed to unit holders will be exempt from tax

P: It has been proposed to strengthen the administrative set-up of the APA programme as well as constitute new benches of AAR

I: This would help in expediting processing and disposal of the APA and AAR applications

P: The circumstances under which the commissioner can cancel the registration of the trusts have been modified

I: Earlier, the commissioner had powers to cancel registration of trusts when the activities of the trust were not genuine or were not carried out for the purpose of its objects. The powers of the commissioner to cancel the registration of a trust have been modified to cover cases where income of the trust is applied for the benefit of specified persons like the trustees or for the benefit of a particular religious community or caste. The powers also cover cases of trusts where funds are invested in prohibited modes or income is not applied for the benefit of the general public

2018-19: What the Top Firms Actually Paid

Sep 21, 2019: The Times of India

From: Sep 21, 2019: The Times of India

An exemption-free tax rate of 22% — 25.17% including cesses and surcharge — sounds attractive, but an analysis of the tax liability of firms listed in Sensex suggests more than half have reason to stick to the existing tax regime. Budget data shows the average effective tax rate (ETR) — taxes as a percentage of pretax profits — for roughly 8.4 lakh firms that filed returns for 2017-18 was just over 29%. A TOI analysis of the 21 nonfinancial firms in the Sensex shows only 10 faced an ETR of over 25% in 2018-19. The remaining 11 had an ETR below the 25.17% that they would have to shell out if they migrated to the new regime.

Banks and financial sector firms were excluded from the analysis because their taxes are calculated somewhat differently (mainly because of provisioning) and including them might have distorted the overall picture. After excluding the nine financial sector firms in the sensex, the overall average ETR worked out to 22.9% in 2018-19. But individual ETRs vary widely — from Sun Pharma with a negative tax burden of 13.5%, to Tata Steel, which paid 35% of its pre-tax profits as tax.

The actual tax paid can, however, include refunds for extra tax paid in earlier years or additional liability for deferred taxes (ETR1 in the accompanying graphic). We therefore looked also at the current tax as a percentage of the profit before taxes (ETR2 in the graphic). By this measure, the average for these 21 firms was 25.7%, close to what the new regime would offer.

Again, about half the firms might not have a compelling reason to make the shift. Even firms just over the 25% mark in this chart might think twice since once exemptions are given up they cannot be availed of in future. Having said that, a number of corporate tax specialists TOI spoke to said most large companies would transition to the new regime because over the last several years, exemptions have been whittled down.

Notably, almost all IT firms are below the 25% ETR level — clearly because of tax incentives given to the sector — as is Reliance Industries, the company paying the highest taxes on this list but with an ETR of barely 20% if one looks at the current tax liability.