Real estate: India

(→2016) |

|||

| Line 157: | Line 157: | ||

Hong Kong (Central) became the highest-priced office market with an overall prime occupancy costs of USD 290 per sq ft per annum, followed by LondonCentral (West End) with annual occupancy cost of USD 262.29. | Hong Kong (Central) became the highest-priced office market with an overall prime occupancy costs of USD 290 per sq ft per annum, followed by LondonCentral (West End) with annual occupancy cost of USD 262.29. | ||

| + | |||

| + | =Buying and selling, 2017= | ||

| + | ==Economics of buying vs. renting== | ||

| + | See graphic. | ||

| + | |||

| + | [[File: Economics of buying and selling, city-wise, 2017.jpg|Economics of buying and selling, city-wise, 2017; [http://epaperbeta.timesofindia.com/Article.aspx?eid=31808&articlexml=STATOISTICS-WHY-IT-IS-WISER-TO-RENT-AND-08042017010007 The Times of India], April 8, 2017 |frame|500px]] | ||

| + | |||

=House rents= | =House rents= | ||

==Change in rents, 2012-16== | ==Change in rents, 2012-16== | ||

Revision as of 23:56, 21 May 2017

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

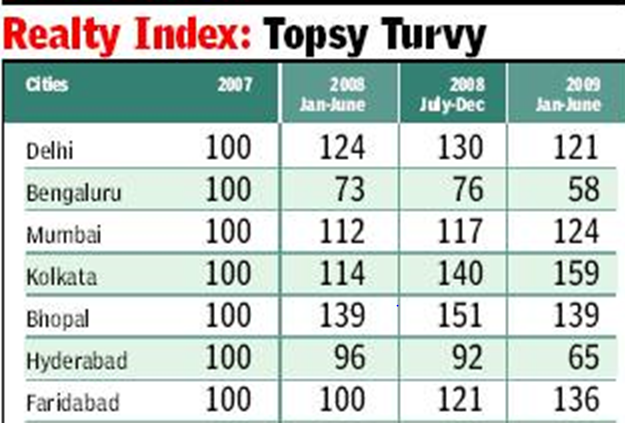

Realty index: 2007-2009

Office space: rents and occupancy costs, March 2013

‘CP world’s fifth costliest office mkt’

TIMES NEWS NETWORK

Delhi

Despite weakening demand for office space Connaught Place remains the fifth most expensive office market in the world.

In property consultant CBRE’s semi-annual Prime Office Occupancy Costs survey, CP has retained its earlier ranking in the list of the world’s 50 most expensive office markets. The latest survey provides data on office rents and occupancy costs as of March 2013 across 133 countries.

“Though demand for office space has reduced, occupancy costs remain high, especially in Connaught Place, due to limited supply in the near future,” said Anshuman Magazine, chairman and managing director, CBRE.

Downturn, around 2014

2016: Circle rates lowered

The Times of India, June 3, 2016

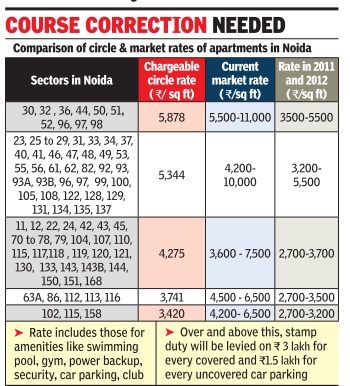

These are hard times for the real estate industry in NCR. One factor that has gnawed away at interest in buying or selling property is the unreasonable circle rates. While Gurgaon proposed a 15% cut [May 2016], circle rates there, and in most of Noida, are higher than the market rates, virtually slowing transactions to a trickle.

The property market in NCR is at its lowest ebb.Prices have either plateaued out or fallen over the past couple of years. Like any bear run, this ought to have got buyers looking for long-term returns interested. But that hasn't happened. As much as the trust-deficit has spooked in vestors, a devil hiding in the detail has further queered the sales pitch. It's called the circle rate.

By definition, circle rate is the minimum value at which a plot, house, apartment or commercial property can be sold.The rate is decided by a state's revenue department in consonance with market rates. But in hot property markets like Gurgaon and Noida, the circle rate has stopped keeping in touch with the market rate. So, while market rates depreciated due to bad buying sentiment, circle rates didn't.

What this created is an environment in which neither buyer nor seller is interested in making a transaction. Why?

Say an apartment's market price is Rs 1crore but its value, according to the circle rate, is Rs 1.5 crore. It means both the stamp duty the buyer has to pay to register the flat and the tax component of the seller will be calculated on Rs 1.5 crore, the circle rate. It's a transaction in which both parties lose.

Acknowledging this, the Gurgaon administration recently made the unprecedented proposal of cutting circle rates by a steep 15% for the 2016-17 fiscal year. The industry hopes the Delhi and UP governments will follow suit.Gurgaon divisional commissioner D Suresh said the proposal reflected the reality.

Unlike in Gurgaon, where circle rates were not revised for the last two years, Noida continued to raise them despite the gloom. Updesh Bharadwaj, a resident of Sector 72, owns a shop in a mall in Sector 18 that he wants to sell. “The market price of the shop is Rs 1.5 crore but it's Rs 2.5 crore as per the circle rate. I have been looking for a buyer for two years. But no one is interested because of the huge gap in rates,“ he said.

Gurgaon

And the gap in office realestate occupancy cost between central business districts (CBDs) such as Connaught Place and suburbs such as Gurgaon (ranked 72nd) stays wide.

Mumbai:

In Mumbai the occupancy costs in Nariman Point, the country’s first planned CBD, have reduced further. In the CBRE survey, Nariman Point dropped to 26th position at $90 per sq ft per annum. In December 2012, it had ranked 25th.

But the Bandra-Kurla Complex (BKC) retained its earlier ranking (11th) among expensive office markets, CBRE said.

CBRE analysts said the Mumbai CBD — including the micro markets of Nariman Point, Fort and Cuffe Parade — had seen office space absorption of only 8,000 to 10,000 sq ft during the quarter. Office rental values in these micro markets declined 3-4% sequentially in January-March, they said.

2014: NCR, Mumbai

Dec 31 2014

‘CP 6th costliest office location in world’

BKC and Nariman Point are among the top 50 costliest office spaces globally, according to CBRE’s survey released in December, 2014. BKC, which is the city’s alternative business district, retained its 16th rank, while Nariman Point is ranked 32nd on the top 50 list.

At nearly $160 per sq ft per annum, Delhi’s Central Business District (CBD) of Connaught Place bagged the sixth slot.

“London’s West End remained the world’s highestpriced office market, but Asia continued to dominate the world’s most expensive office locations, accounting for three of the top five markets,” said the CBRE report.

London West End’s overall prime occupancy costs of $274 per sq ft per year topped the “most expensive” list.

Hong Kong Central followed with total prime occupancy costs of $251 per sq ft, Beij ing’s Finance Street ($198 per sq ft), Beijing’s CBD ($189 per sq ft) and Moscow ($165 per sq ft) rounded out the top five.

“Although New Delhi’s Connaught Place moved up two places to the sixth spot on the global top 10 rankings over the first quarter of 2014, annual occupancy costs here remained stable because of rupee appreciation since the first quarter,“ said CBRE south Asia CMD Anshuman Magazine. Annual office occupancy costs in Gurgaon remained stable, while that of Nariman Point dropped by about 2% and BKC by about 6%. Bangalore’s CBD, which saw a nearly 9% drop, was among the top five global prime office markets to witness a decrease in yearly occupancy costs.

Global prime office occupancy costs rose 2.5% yearover-year, led by the Americas (up 4.1%) and Asia Pacific (up 2.8%).

Luxury homes

Bangalore No. 1 market in India for luxury homes

While Bangalore reports sales of close to 100 luxury units — including villas — on a quarterly basis, Mumbai and NCR, in comparison, see only around a dozen such sales.

Anshul Dhamija, TNN | Apr 20, 2014 The Times of India

BANGALORE: When it comes to luxury homes — units priced above Rs 5 crore — Bangalore is setting benchmarks to emerge as the country's top luxury home market, says a report by JLL India, an international property consultancy firm.

Quality of construction, design, ventilation, floor-to- ceiling height, amenities, floor plans, building elevation and configuration aspects are among the factors fuelling Bangalore's rise to the top, the report says.

Most importantly, pricing of luxury residential properties in the country's IT capital is seen to be far more reasonable and realistic than Mumbai and NCR, says JLL's report, shared exclusively with TOI.

"Luxury properties in Bangalore are 20% to 30% cheaper. While luxury apartments that cost between Rs 6 crore and Rs 30 crore may seem exorbitant, they are in fact very reasonable when compared to the rates going in premium locations of established cities like Delhi and Mumbai," notes Om Ahuja, CEO-residential services, JLL India.

Citing research data, Ahuja adds: "A luxury apartment in Indiranagar or Koramangala is still an attainable reality with prices ranging from Rs 9,000 to Rs 12,000 per square foot. No other premium locations of other major Indian cities offer such prices in the luxury segment."

While Bangalore reports sales of close to 100 luxury units — including villas — on a quarterly basis, Mumbai and NCR, in comparison, see only around a dozen such sales.

Data shared by the consultancy firm LJ Hooker shows that Bangalore has around 5,400 luxury units under various stages of construction and planning.

After Mumbai and NCR, Bangalore is the third largest market for luxury property sales and product offerings. It is also the third largest real estate investment hub for high net-worth individuals (HNIs), but tops the list in terms of investments from NRIs looking at settling down in India.

While much of the city's luxury homes demand is fuelled by millionaires from the IT/ ITeS sectors, the demand is also being driven by Kolkata and Chennai-based HNIs. JLL estimates Bangalore to have over 10,000 dollar millionaires.

In terms of product, JLL reported that luxury residential offerings in Mumbai and NCR fall more or less in the vanilla category when compared to products in Bangalore. "In Mumbai and NCR, location aspects such as sea view or PIN code tend to define the flair and profile of a property far more than the positioning of the product in terms of luxury and design parameters," says Ahuja.

Demand across all metros for luxury residential products was subdued over three to four financial quarters, but has picked up in the past 60 days, say analysts tracking the real estate sector.

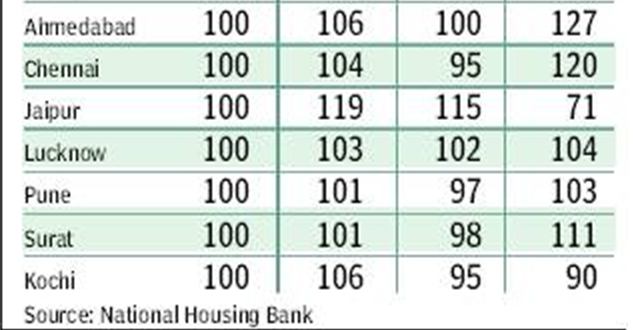

NHB Residex

New Integrated Licencing Policy (NILP), 2015

The Times of India, Oct 24 2015

Manvir Saini

Haryana policy gives big housing a push

The Haryana government has reduced the minimum land requirement to build townships from 100 acres to 25 in its new integrated licencing policy (NILP), which it unveiled. The state expects the NILP to help energise the real estate market that has been going through a prolonged slump, particularly in NCR. The policy is applicable to high and hyper potential areas in NCR and the state capital region (SCR).

The lowering of the mi nimum land quantum for large housing projects to 25 acres also means acquisitions of this scale won't attract tough clauses of the Land Acquisition, Rehabilitation and Resettlement Act, which is applicable for acquisitions above 50 acres.

Only 12 housing project licences have been issued since the Manohar Lal Khattar-led BJP government took the reins of the Haryana government in October 2014.But the investment climate alone is not to be blamed for this. The state stopped issuing licences to builders in September 2014 when the model code of conduct for the assembly polls came into effect. The new government only resumed giving out housing licences in June.

The NILP will cover Gurgaon and Manesar, Faridabad, Ballabgarh, Sohna, So nipat, Kundli and Panchkula. The government expects it to generate a revenue of Rs 1.25 lakh crore. While unveiling the policy in Chandigarh, chief minister Khattar said he was hopeful that 2 lakh dwelling units under the affordable housing scheme would be built by 2020.

Besides bringing down the minimum area requirement for obtaining the licence, the NILP also plugs an illegal practice of developers signing memoranda of understanding (MoU) to fulfil the 100-acre cap. There had been instances in the past when builders have inked MoUs with landowners and apply for a licence.

Now builders, who want to use farmers' land for their projects, will have to sign a transferable development rights (TDR) agreement.“This will ensure that far mers or landowners will get the market price from the builder for their land. The government will be a facilitator as the custodian of farmers' interests. The TDR certificate will be valid for two years from the date of issuance,“ said Khattar.

2016

Connaught Place, BandraKurla, Nariman Point most expensive

The Times of India, Jun 16, 2016

CP world's 7th costliest office space

Connaught Place has slipped one notch to become the world's seventh most costliest office destination, according to property consultant CBRE. Mumbai's BandraKurla Complex (BKC) is at the 19th position and Nariman Point at 34th, according to CBRE Research's Global Prime Office Occupancy Costs bi-annual survey .

“With annual occupancy cost of USD 149.71 per sq ft, New Delhi's Central Business District (CBD) of Connaught Place ranks as the seventh most expensive prime office market in the world,“ CBRE said in a statement.

Hong Kong (Central) became the highest-priced office market with an overall prime occupancy costs of USD 290 per sq ft per annum, followed by LondonCentral (West End) with annual occupancy cost of USD 262.29.

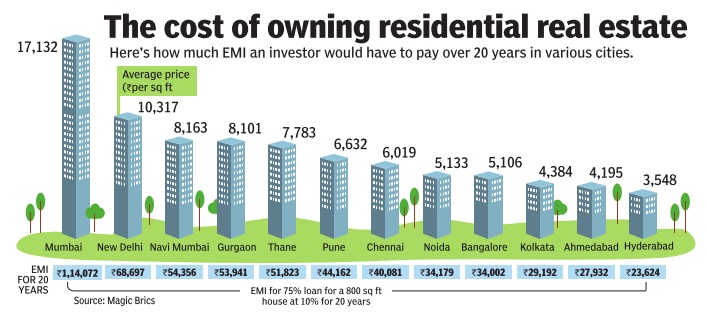

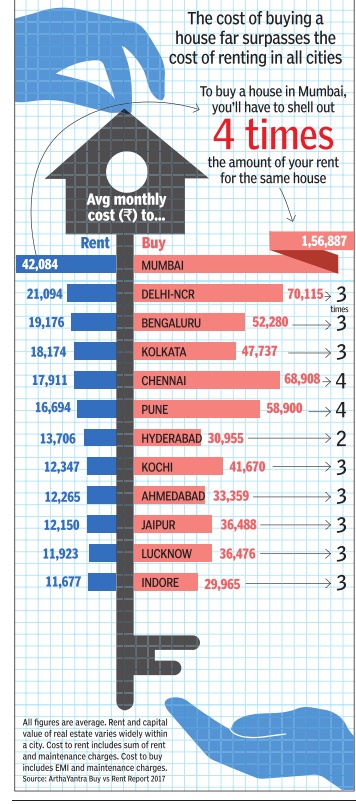

Buying and selling, 2017

Economics of buying vs. renting

See graphic.

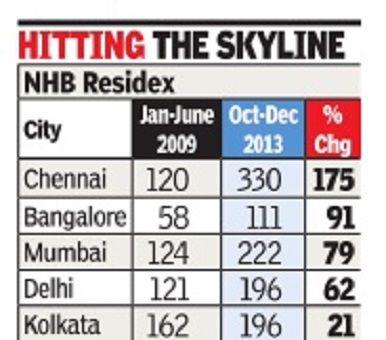

House rents

Change in rents, 2012-16

HOUSE RENTS HAVE RISEN THE MOST IN DELHI, LEAST IN UTTARAKHAND, Sep 17 2016 : The Times of India

Recently released data on consumer prices indicates that housing cost (a proxy for rent in CPI) recorded the highest increase in Delhi, while Uttarakhand saw the minimum rise among major states. This data is for the period between 2012, the base year of the current index, and August 2016, the month for which the latest data is available

See graphic.

Real Estate (Regulation & Development) Act

Some states dilute provisions, give builders exemptions

Dipak Dash, UP, Gujarat dilute new realty law, Nov 04 2016 : The Times of India

Make It Builder-Friendly By Giving Exemptions To Ongoing Projects

States led by UP and Gujarat have begun diluting provisions of the Real Estate (Regulation & Development) Act, which notify the rules for regulation of the sector. Both states have let off most ongoing real estate projects which have been delayed for long and remain a worry for thousands of home buyers awaiting delivery .

While UP has come up with four exemptions to exclude incomplete projects from the category of “ongoing projects“, Gujarat has exempted all projects launched before notification of the rules. This means such projects won't have to be registered with the real estate regulator in these states.

On the contrary , the law enacted by the Centre earlier this year provides for manda tory registration of all “ongoing projects“ that have not received completion certificate. “The central law, which is binding on all states, does not differentiate between ongoing and future projects for registration. However, it provides for registration of incomplete projects within three months from the commencement of the Act,“ said an official here.

The norms notified by UP excluded projects in which services had been handed over to the local authority for maintenance, common areas and facilities that had been handed over to RWAs for maintenance and where development work had been completed and sale and lease deeds of 60% houses execu ted. “This dilutes norms laid down in the law and will help builders avoid the mandatory regulatory provisions,“ the central government official said.

Defending their move, a Gujarat government official said, “We have notified the rules primarily for setting up the regulator ahead of the October 31 deadline. Once the operative part of the law comes into effect, we may revisit the norms“.

But central government sources said states must notify specific rules in compliance with the law and it wouldn't take not more than a couple of days to make all provisions operative.

On its part, the Uttar Pradesh government has also provided a handle for developers to retain some land in their projects under the guise of commercial activity rather than hand over such land to house owners.

While the central law clearly says that all community and commercial facilities in a project will be treated as common areas, rules notified by UP says, “Community and commercial facilities shall include only those facilities, which have been provided as common areas.“

Real Estate Investment Trusts (REIT)

Blackstone likely to be India's first listed on REIT

REITs are listed trusts holding income generating properties, earnings from which are distributed to shareholders. Market regulator Sebi came out with REIT guidelines [in 2014], helping real estate developers list their rent-yielding assets, and also providing large and small stock market investors with an inflation indexed product.

The world's largest private equity manager Blackstone Group, which is also the most prolific investor in Indian commercial properties, is finalizing plans to raise Rs 4,000 crore (about $600 million), through a listing of Real Estate Investment Trust (REIT) on the domestic stock exchanges, people directly familiar with the matter said. This will perhaps be India's first REIT listing and a test case for global investors who have poured big bucks into the country's rent-yielding commercial assets, especially tenanted office spaces.

Blackstone, through its joint ventures with Bangalore-based Embassy Group and Pune's Panchshil, is on the road to build 50 million sqft tenanted office buildings--of which 30 million are already leased--across top Indian cities. It could target a possible listing during the first quarter next calendar, though a decision on timing would be taken only after filing for permission with Sebi.