Cryptocurrency: India

This is a collection of articles archived for the excellence of their content. |

Contents |

What is Bitcoin

May 17, 2017: The Economic Times

HOW BITCOIN CAME TO BE?

It's a mystery. Bitcoin was launched in 2009 by a person or group of people operating under the name Satoshi Nakamoto. Bitcoin was then adopted by a small clutch of enthusiasts. Nakamoto dropped off the map as bitcoin began to attract widespread attention. But proponents say that doesn't matter: The currency obeys its own internal logic.

An Australian entrepreneur in 2016 stepped forward and claimed to be the founder of bitcoin, only to say days later that he did not 'have the courage' to publish proof that he is.

Bitcoins are created as a reward for a process known as mining.

Without a central repository or single administrator, Bitcoin was invented by an unknown person or a group of people under the name 'Satoshi Nakamoto' and released as open source software in 2009. The system is peer-to-peer, and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called a blockhain. Bitcoins are created as a reward for a process known as bitcoin mining.

HOW BITCOINS WORK?

Bitcoin is not tied to a bank or government and allows users to spend money anonymously. The coins are created by users who 'mine' them by lending computing power to verify other users' transactions.

They receive bitcoins in exchange. The coins also can be bought and sold on exchanges with US dollars and other currencies.

Can one buy bitcoins in India?

Yes, one can buy the bitcoins via bitcoin wallets. There are wallet firms in India such as Unocoin (Bangalore-based), Zebpay (Mumbai, Ahmedabad-based) and Coinsecure (New Delhi-based). You can buy bitcoins in the Indian National Rupee (INR) by transferring money through NEFT/RTGS. And when you sell bitcoins, the money (in the Indian currency, of course) is transferred to the bank.

WHY ARE BITCOINS POPULAR?

Bitcoins are basically lines of computer code that are digitally signed each time they travel from one owner to the next. Transactions can be made anonymously, making the currency popular with libertarians as well as tech enthusiasts, speculators and criminals.

IS IT REALLY ANONYMOUS?

Yes, to a point. Transactions and accounts can be traced, but the account owners aren't necessarily known. However, investigators might be able to track down the owners when bitcoins are converted to regular currency.

For now, the three accounts tied to the ransomware attack appear untouched -- and it'll be difficult for perpetrators to cash in anytime soon without getting traced.

WHO IS USING BITCOIN?

Some businesses have jumped on the bitcoin bandwagon amid a flurry of media coverage. Overstock.com accepts payments in bitcoin, for example. The currency has become popular enough that more than 300,000 daily transactions have been occurring recently, according to bitcoin wallet site blockchain.info. A year ago, activity was closer to 230,000 transactions per day.

HOW ARE BITCOINS KEPT SECURE?

The bitcoin network works by harnessing individuals' greed for the collective good. A network of tech-savvy users called miners keep the system honest by pouring their computing power into a blockchain, a global running tally of every bitcoin transaction.

The blockchain prevents rogues from spending the same bitcoin twice, and the miners are rewarded for their efforts by being gifted with the occasional bitcoin. As long as miners keep the blockchain secure, counterfeiting shouldn't be an issue.

Change in value

2012-17

From: Aarati Krishnan, What’s behind the bitcoin boom?, December 3, 2017: The Hindu

See graphic:

Bitcoin, change in value/ November 30, 2012-December 1, 2017

Investment by Indians in Bitcoin

2015-17

May 17, 2017: The Economic Times

Despite the Reserve Bank's call for caution to people against the use of virtual currencies, a domestic Bitcoin exchange today said it is adding over 2,500 users a day and has reached five lakh downloads.

Zebpay, an app-absed Bitcoin exchange, said it has had five lakh downloads on the Android operating system and is adding more than 2,500 users every day.

The company, launched in 2015, said, the increasing downloads highlight the "growing acceptance of Bitcoins as one of the most popular emerging asset class."

The legal position

Supreme Court allows cryptocurrency trading

SC allows cryptocurrency trading, cancels RBI's 2018 circular, March 4, 2020: The Times of India

NEW DELHI: The Supreme Court allowed a plea challenging the Reserve Bank of India’s (RBI's) 2018 circular which barred banks from trading in cryptocurrencies.

"Trading in cryptocurrencies now will be allowed," the top court noted.

In April 2018, the RBI had issued a circular barring banking and financial services from dealing in virtual currency or cryptocurrency such as Bitcoin, most valued cryptocurrency in the world.

Cryptocurrencies are digital currencies in which encryption techniques are used to regulate the generation of currency units and verify the transfer of funds, operating independently of a central bank.

The RBI had stated that virtual currencies (VCs) (cryptocurrencies and crypto assets) "raise concerns of consumer protection, market integrity and money laundering." In view of the associated risks, banks were asked not to deal with crypto-related businesses.

This circular was challenged by an industry group Internet and Mobile Association of India (IMAI) before the SC.

"Investments had stopped and start-ups were staying away from starting business in the crypto and blockchain space in India which will change now that the Supreme Court has said that the RBI circular was unconstitutional," Nischal Shetty, CEO of WazirX, an Indian cryptocurrency exchange, tld news agency Reuters.

However, the industry still faces hurdles as a government panel, appointed to look into the matter, has recommended that India ought to ban all private cryptocurrencies. In July, the panel also recommended a jail term of up to 10 years and heavy fines for anyone dealing in digital currencies.

The government though is yet to act on these recommendations and is yet to finalse regulations around cryptocurrencies.

On several occasions, the government along with the central bank, had cautioned the public about the risks of cryptocurrencies. If the government follows the panel's recommendations, it could signal the end of the road for these digital currencies in India.

(With Reuters inputs)

2021: Relief in the Unicoin Bitcoin ATM case of 2018

Vasantha Kumar, February 19, 2021: The Times of India

From: Vasantha Kumar, February 19, 2021: The Times of India

HC relief for duo who set up Bitcoin ATM

Over two years after being booked for setting up a Bitcoin ATM in violation of RBI norms in a Bengaluru mall, co-founders of cryptocurrency exchange Unocoin, B V Harish and Sathvik Vishwanath, finally have something to cheer.

Unocoin said the Karnataka high court has dismissed the long-pending FIR against the firm. Unocoin had set up a kiosk in 2018 to allow customers to deposit money to or withdraw money from their Unocoin accounts. On the grounds that they had not been granted the necessary approvals for setting up the kiosk, the local police had detained Unocoin’s co-founders.

Following a Supreme Court decision, the Karnataka HC quashed the FIR registered against them by the cybercrime police. Last year, the SC in the Internet and Mobile Association of India case set aside the RBI’s April 2018 circular banning financial services companies from trading in virtual or cryptocurrency. Citing the same, Harish and Vishwanath had challenged the FIR.

Considering the current legal position, Justice H P Sandesh allowed their petition, noting that in view of the SC’s decision, the FIR as well as proceedings against the petitioners on the basis of the RBI circular cannot be continued further.

Unocoin said branding the kiosk as an ATM was a genuine mistake that led to confusion. The high court has declared the FIR invalid. Vishwanath, Unocoin’s CEO, said they were elated to emerge victorious. “This legal mishap was no less than a war and having cleared our stance feels like attaining victory,” he said.

In 2018, the Bitcoin ATM was set up at Kemp Fort mall in Bengaluru. Thereafter, the police had registered a case, citing violation of the RBI circular.

The cyber crime branch (CCB) had taken up the case and had filed a chargesheet against the duo in May 2019. Later, the additional chief metropolitan magistrate court (ACMM) took cognizance of the matter and thereafter their bank accounts were also frozen. The petitioners, who challenged the same, also sought de-freezing of their bank accounts.

Last year, Unocoin raised $5 million in a round led by Tim Draper’s Draper Associates, with participation from XBTO Ventures and 2020 Ventures.

Reason behind the boom

Aarati Krishnan, What’s behind the bitcoin boom?, December 3, 2017: The Hindu

While it has delivered stellar returns over the years, the volatile nature of the trade is not for the feeble-hearted

As the price of the bitcoin leapt past $10,000 in December 2017, marking a tenfold gain in 2017, many investors seemed to nurse a ‘missed-out’ feeling. The financial press ran ‘how-to-invest-in-bitcoin’ tutorials right alongside unflattering comparisons of the bitcoin boom to the Tulip mania. If you are among the Indian investors who are rueing their decision to skip bitcoins in favour of the stock market, here are some bitcoin facts that may make you feel better.

Scarcity premium

In the financial markets, asset bubbles are spotted by comparing the traded price of an asset to its fair value. For stocks, the valuation metric may be the price-to-earnings or book value multiple. For oil or gold, there’s the cost of producing each barrel or ounce. The rupee is assessed on real effective exchange rate. But it’s hard to say if there’s a bubble brewing in bitcoins because it has no such valuation measure. Its price is therefore decided mainly by demand-supply dynamics.

No one knows yet, if Bitcoin’s pseudonymous inventor Satoshi Nakamoto was a computer engineer, academic or Silicon Valley geek. But one subject that Nakamoto certainly understood was economics. He knew that when unlimited demand chases finite supply, the result is sky-rocketing prices.

So, while creating the original algorithm to ‘mine’ blocks of bitcoins (new bitcoins are created when you use computers to solve complex mathematical problems set by the system), he set a finite limit on the bitcoins that could be mined for all time to come. He also ensured that the algorithm got more complex over time and that the bitcoin yield shrank in geometric proportion with each new block.

This has effectively set a hard limit of 21 million on total bitcoin supply, of which an estimated 16.7 million (80 per cent) has already been mined. Mining new blocks now entails gigawatts of electricity and computing power.

To make things interesting, there’s uncertainty about the existing bitcoin supply as well. About a million bitcoins are said to have been spirited away by Nakamoto himself, a few million have gone missing due to lost hard disks and forgotten passwords, and a good number are out of circulation because they’re stockpiled by investors.

This scarcity factor and the lack of a fair value measure makes the bitcoin a great playground for speculators, but a very uncomfortable one for long-term investors.

High on volatility

Looking back today, bitcoin returns for the last five years are drool-worthy. The rupee-equivalent price of a bitcoin has zoomed from under ₹600 in November 2012 to more than ₹6.8 lakh by November 2017, a cool 300% annualised return. In the same period, the BSE Sensex has produced a staid 11.5% despite a bull market.

If this is making you regret choosing stocks over bitcoins, do note that you would have needed nerves of steel to stay invested in bitcoins. While delivering stellar returns, the bitcoin has subjected its investors to an extremely rocky ride.

Over the last five years, the maximum loss made by the BSE Sensex on any given day was 5.93%. Its biggest single-day gain was 3.8%. The rupee, with which the bitcoin competes as a virtual currency, saw a biggest single-day depreciation (against the dollar) of 3.6% and gained 3.4% on its best day.

But the bitcoin, on its bad days, has proved five times as volatile as the Sensex. On its worst day in the last five years, its price tanked by 28% in dollar terms. At its most euphoric, it shot up by 41% in a single session. Also, 10% single-day losses were not unusual for the bitcoin, with 36 such occasions in the last five years.

The short history of the bitcoin has been punctuated by quite a few stomach-roiling events too. In 2014, thousands of bitcoins were stolen from the leading exchange Mt Gox which had to be shuttered. The event saw a two-year lull in the bitcoin bull market. In August, a breakaway faction Bitcoin Cash, ‘forked’ off from the main bitcoin blockchain. This week, global bitcoin exchanges reported outages and flash crashes unable to handle the sharp surge in traffic.Due to such volatility, though it has proved a blockbuster investment, the bitcoin hasn’t really made headway as a global alternative to conventional money.

Regulatory approval

When originally introduced, virtual currencies, backed by the ultra-democratic blockchain technology, were expected to offer a border-less alternative to fiat currencies, which were being systematically debased by governments in the developed world. There was clamour for a globally-accepted medium of exchange that was free of political hegemony.

But trading volumes in cryptocurrencies have tended to become quite concentrated in a few regions lately. They’ve also proved quite sensitive to governmental actions. After galloping fivefold between January and September 2017, bitcoins suffered a 30% blip this September after the Chinese government, wary of capital flight, ordered the shut-down of leading bitcoin exchanges. In April, markets cheered Japan’s decision to officially recognise bitcoins as legal tender and license 11 exchanges.

Trading volumes have also flown from one region to another depending on how favourably disposed regulators have been towards bitcoins. Chinese exchanges dominated bitcoin trading a couple of years ago with a more than 80% volume share. But after the clampdown, Japanese and U.S. exchanges now control over two-thirds of volumes.

In India, the RBI is still undecided on the issue of how and if at all it will regulate virtual currencies. Meanwhile, it has issued disclaimers that it hasn’t authorised bitcoins as a medium of exchange, warning investors of potential ‘financial, operational, legal, customer protection and security-related risks’ if they dabble in them.

Why are the prices rising so sharply?

Bitcoin prices have risen sharply in the past year-and-a-half. In September 2016, bitcoins were priced around $600-700 in the international market and in December 2017, the prices are hovering around $10,000-$11,000. Bitcoin prices are rising chiefly because of a proliferation of interest in it and an ever-growing speculation that the currency, being based on the technology of blockchain, will continue to grow by leaps and bounds.

According to research produced by Cambridge University in 2017, there are 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoins. Besides this, new bitcoins are created in a regular and limited numbers which are halved from time to time. The next halving will happen in the mid-2020.

Scams/ frauds

Gujarat: 2016-18

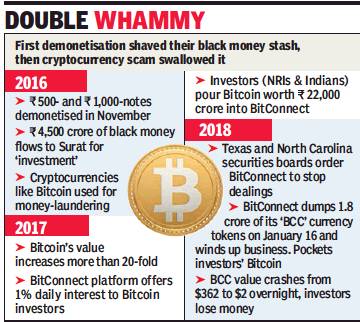

Parth Shastri, Bitcoin fraud: How investors lost ₹22k cr, August 14, 2018: The Times of India

From: Parth Shastri, Bitcoin fraud: How investors lost ₹22k cr, August 14, 2018: The Times of India

BitConnect Promised 1% Daily Interest

It was too good a deal — earn 1% daily interest and double your money in 100 days. Too good to be true, hordes of rich investors in Gujarat realised a year later when the BitConnect platform folded up after pocketing roughly Rs 22,000 crore of their money in Bitcoin.

For many, it was a double whammy after the jolt of demonetisation. In fact, the Bitcoin craze had started in the state as people looked for safe ways to launder their piles of black money after November 2016. “The transactions were anonymous, it did not require any proof and, best of all, it could be operated from anywhere in the world. A cryptocurrency boom started overnight,” Sunny Vaghela, CTO of an Ahmedabad-based IT firm, told TOI. Surat became the trade’s hub with numerous ‘equity brokers’, who juggled different cryptocurrencies for maximum profit.

Bloomberg also reported that most Google searches for laundering money in that period were made from Gujarat, and Indians were willing to pay up to 25% more for Bitcoin. Throughout 2017, Bitcoin gained value like nothing else. The price of one Bitcoin shot up from $900 to $20,000. It became a must-have asset. If you were greedy, you had to be invested in it.

While demand alone was driving up Bitcoin’s price, along came an offer that made holding it even more lucrative. BitConnect, a similar sounding but unrelated cryptocurrency platform, offered to pay 1% daily interest to Bitcoin owners, and more if they got other owners on board. Investors loaned their Bitcoin to BitConnect, which issued them its own token currency called BCC, and made all principal and interest payments in BCC as well.

It was a classic Ponzi scheme, and the fact that they were signing away their precious Bitcoin should have alarmed investors. Many experts had been calling Bit-Connect a scam from the beginning, but with the returns so high, investors kept their eyes tightly shut.

BitConnect’s scheme was simple. It had a fixed number of BCC ‘coins’. Their value increased with demand. Its sky-high interest rate kept pushing up demand, so the price went on rising until the securities boards of Texas and North Carolina ordered it to stop dealing in January.

“The investors got happy with notional gains. The coins, bought at $50-100, became worth $362 in a year,” said an investigator working on the case. But when the bubble burst on January 16 this year, BCC crashed to $2 overnight, and now it trades below half a dollar. BitConnect promptly repaid investors in practically worthless BCC, and walked away with their Bitcoin.

Altogether, BitConnect may have siphoned off more money than Nirav Modi, but police have not received many complaints, possibly because many of the investors used black money to buy Bitcoin. “So far, we have received complaints for cheating worth Rs 1.14 crore,” said Ashish Bhatia, DGP, CID (crime).

But some influential investors have tried squeezing out their money in unlawful ways. In March, Surat realtor Shailesh Bhatt complained that he was abducted by some policemen and made to transfer 176 Bitcoins from his digital wallet. About a dozen cops were arrested in connection with the conspiracy till July, and the name of former BJP MLA Nalin Kotadiya also cropped up in the investigation. Later, it was alleged that Bhatt himself had abducted a BitConnect promoter, Dhaval Mavani, and his employee Piyush Savaliya, to extort 2,256 Bitcoins. One of Bhatt’s alleged partners in crime, Kirit Paladiya, then doublecrossed him to get more than his fair share of the cryptocurrency ransom.

Usage of Cryptocurrency in India

2021: tech cos use crypto for pay, perks

Mamtha A, March 6, 2021: The Times of India

From: Mamtha A, March 6, 2021: The Times of India

New-age tech companies are satiating their young workforce’s growing desire for digital money by using a workaround to pay either part of their salary, bonus or other incentives in cryptocurrency. For employers, this is a quick and easy transaction, while for employees the lure is the possibility of the crypto appreciating in value.

There are two approaches taken by employers. One is to register their entities in crypto-friendly nations and pay their employees in cryptocurrency to avoid any legal or tax hurdles. The second is to record the payment as a rupee transaction in their books, but to facilitate the conversion of the rupee into cryptocurrency.

An executive from a gateway company, which facilitates payments for cryptocurrency through banking channels, said, “Generally, we use a stable coin/cryptocurrency like Tether (USDt) to pay salaries. Employees can cash them out immediately or hold on to them.” Since Tether is pegged to the dollar, a systems engineer with a pay package of $60,000 per annum will get 60,000 USDt.

In India, cryptocurrency continues to be a grey area and both employees and employers are worried about the tax implications. “After encashment of altcoins via cryptocurrency exchanges, I file that amount as income from consultant fee for tax returns,” said Sujeet Kumar, a Patna-based consultant for use cases of blockchain and cryptocurrency.

Kumar gets paid in altcoin like Ethereum, Plaas Token and Audio Coin, which he encashes through Indian cryptocurrency exchanges. “I usually convert the coins according to my need. Most of my clients are in the cryptocurrency market, thus making the transactions easier and faster. I have taken my last year’s bonus via cryptocurrency too.”

The CEO of a cryptocurrency news website said, “We follow a method where we pay salaries in cryptocurrency and draw a salary slip in rupee. This spares employees from any concerns if their salary slips are in crypto.”

Opinder Preet Singh, who heads a crypto hedge fund called Chain Assets Capital, said, “With too many legal regulations and lack of clarification on recognising cryptocurrency in India, we have registered our company in a crypto-friendly jurisdiction abroad. This allows us to pay salary, bonuses and incentives or spend money in India and also around the globe, especially for freelancers hired overseas.”

Views on Cryptocurrency

Government of India/ FM Arun Jaitley

Government doesn’t recognise bitcoin as legal: FM Arun Jaitley, December 1, 2017: The Economic Times

With virtual currency gaining traction among investors, Finance Minister Arun Jaitley today said India does not recognise cryptocurrency as legal tender.

“Recommendations are being worked at. The government’s position is clear, we don’t recognise this as legal currency as of now,” Jaitley said when asked whether the government has taken any decision on the cryptocurrency.

He had informed the Parliament IN aUGUST 2017 that taking cognisance of concerns raised at various fora from time to time on increasing use of virtual currencies (VCs) and the regulatory challenges, the Department of Economic Affairs (DEA) constituted a committee with representations from DEA, Department of Financial Services (DFS), Ministry of Home Affairs (MHA), RBI, Niti Aayog and SBI.

Reserve Bank of India

May 17, 2017: The Economic Times

RBI WARNING OVER BITCOIN:

RBI has been repeatedly flagging concerns on virtual currencies like Bitcoins, stating that they pose potential financial, legal, customer protection and security-related risks.

In cyber attacks, "ransomware" hackers held victims hostage by encrypting their data and demanding them to send payments in bitcoins to regain access to their computers.

Bitcoin is a digital currency that allows people to buy goods and services and exchange money without involving banks, credit card issuers or other third parties.

Cryptocurrencies will boost illegal transactions: RBI to SC

‘They are immune from government interference’

The Reserve Bank of India (RBI) said dealing in cryptocurrency will encourage illegal transactions. The RBI has already issued a circular prohibiting use of these virtual currencies.

Cryptocurrencies are “a stateless digital currency” in which encryption techniques are used for trading and these ‘currencies’ operate independently of a Central bank like the RBI, “rendering it immune from government interference”.

A Bench, led by Chief Justice Dipak Misra, was informed by senior advocate Shyam Divan, appearing for the RBI, that a committee has been set up by the Centre to deal with issues relating to cryptocurrencies.

The federal bank and the Central government sought three weeks time from the Bench, which also comprised justices A.M. Khanwilkar and D.Y. Chandrachud, for filing their responses to a clutch of petitions on the issue. The Bench granted till September 11. The apex court had also sought the assistance of Attorney General K.K. Venugopal in the matter. One of the petitions was filed by Siddharth Dalmia and Vijay Pal Dalmia and they had said that the RBI, through its circular, had directed banks and financial institutions to freeze the bank accounts of those individuals and companies dealing in the illegal trade of virtual currencies.

Mr. Dalmia, in his plea, has sought a direction to the Centre to take steps to restrain sale and purchase of illegal cryptocurrencies like Bitcoins, which were being traded openly for “illegal activities” like funding terrorism and insurgency.