Sweets/ Candy: India

This is a collection of articles archived for the excellence of their content. |

Hard-boiled candies (HBC)

2016: the leading players

The Times of India, Apr 19 2016

John Sarkar

Candy sales are on the fast track, thanks to hard-boiled candies (HBC) such as Mango Bite, Pulse Candy and Alpenliebe that are pushing the Rs 6,000-crore sweet candy market to grow at 1.5 times the FMCG industry growth in the country .

Despite constituting a third of the total candy market, the hard-boiled segment is witnessing heightened traction due to entry of new players and innovation. For instance, Dharampal Satyapal (DS) Group's Pulse Candy reached Rs 100 crore within just eight months of its launch, its maker said, equalling the record of Coca-Cola's diet drink Coke Zero.

“Éclairs and soft toffees segment grew in single digits in 2015 in comparison to hardboiled candy segment. Lollipops are the other segment witnessing healthy growth,“ said Vijay Udasi, senior VP at Nielsen India.

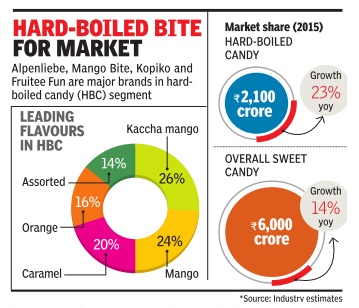

While the overall sweet candy market is growing at 14% Y-o-Y, the HBC segment, pegged at around Rs 2,100 crore, is growing at 24%, revealed data from Nielsen. “The category has low entry barriers that results in numerous new players entering the market every year. At the same time, there are fairly quick exits too. Low entry-exit barriers facilitate innovation on formats and flavours in the category ,“ Udasi said.

Industry experts said, Pulse Candy , a kaccha aam (raw mango) hard boiled candy with a tangy salt filled centre, was one such innovation. “We launched it at Re 1.Other companies followed suit. Before that, everybody was selling 4gm hard boiled candies for 50 paise,“ said Shashank Surana, VP, new product development, at DS Group, the maker of Rajnigand ha pan masala, Pass Pass and Catch spices.

Mandar Keskar, category head at Perfetti Van Melle India, agrees. “Although the confectionary category in India is highly cluttered and price-sensitive with nearly 40% of the category volumes still coming from 50-paise price point, an encouraging trend is consumers lapping up innovations at higher price points,“ he said.

While Perfetti leads in the caramel category , a flavour which constitutes 20% of the HBC segment, Parle is the dominant player with its Mango Bite brand. Interestingly , kaccha aam (26%) and mango flavour (24%) put together command 50% market share in the HBC category , followed by caramel and orange (16%). Inbisco is the other big player with its Kopico (coffee flavour) brand.

“The HBC segment is growing fast due to marketing push and innovations,“ said Pravin Kulkarni, marketing head at Parle Products. “The chocolate éclair and soft toffee category is struggling because margins are low due to the premium nature of the product. By selling a candy for Rs 1, an HBC maker will make more money than a chocolate éclair company .“

2017: the leading players

John Sarkar, Pulse No. 1 in hard-boiled candy mkt, June 9, 2017: The Times of India

Pulse candy has become the biggest player in the hard-boiled candy (HBC) market, doubling its sales to Rs 326 crore in 2016-17 over the previous year, said three industry executives quoting Nielsen data.Pulse, a centre-filled sugar candy, is closely followed by Indonesian coffee-flavoured brand Kopiko at around Rs 306 crore.

This mirrors a trend of hard-boiled candies driving the Rs 8,500-crore ($1.3-billion) Indian confectionery market with other prominent categories such as eclairs and gums showing sluggish growth due to lack of innovation.

“Innovations, new launches of brands and variants are driving candies segment growth to a 15% level, almost double the rate at which confectionery category is growing at,“ said Sameer Shukla, executive director at Nielsen India. From being just a third of the of the overall confectionery market last year, HBCs currently account for nearly half of the total confectionery market, according to Nielsen.

Pulse, which had disrupted the traditional HBC market with its tangy taste and masala centre, was launched by the DS Group (maker of Pass Pass and Baba Elaichi) only two years ago. Its instant popularity spawned a line of me-too products, including Patanjali's Kick.“With Pulse, we managed to lure adult consumers,“ said Shashank Surana, VP , new product development at DS Group.

But despite introducing three flavours, including guava and pineapple, raw mango accounts for 80% of Pulse's sales at present. “The HBC segment has strong sub-categories such as lacto candies, cough lozenges and digestive candies,“ said Krishna Rao, category head at Parle Products.