Start-ups: India

(→2018: the best year for unicorns) |

m (Reverted edits by Jyoti (talk) to last revision by Parvez Dewan (Pdewan)) |

||

| Line 6: | Line 6: | ||

|} | |} | ||

| − | + | [[Category:India |E ]] | |

| − | + | [[Category:Economy-Industry-Resources |E ]] | |

| − | + | ||

| − | + | ||

| − | [ | + | |

| − | [[ | + | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

=Countries that have invested in Indian start-ups= | =Countries that have invested in Indian start-ups= | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==2017: USA, Japan...== | ==2017: USA, Japan...== | ||

[https://timesofindia.indiatimes.com/business/over-50-foreign-funding-in-startups-from-non-us-investors/articleshow/65004681.cms Over 50% foreign funding in Indian startups from non-US investors, July 16, 2018: ''The Times of India''] | [https://timesofindia.indiatimes.com/business/over-50-foreign-funding-in-startups-from-non-us-investors/articleshow/65004681.cms Over 50% foreign funding in Indian startups from non-US investors, July 16, 2018: ''The Times of India''] | ||

| Line 97: | Line 19: | ||

=Demographics of startup founders= | =Demographics of startup founders= | ||

==2015== | ==2015== | ||

| + | |||

[[File: Demography of startup founders.jpg|Demography of startup founders; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=23_10_2015_022_041_002&type=P&artUrl=YOUNG-AND-EDUCATED-23102015022041&eid=31808 ''The Times of India'']|frame|500px]] | [[File: Demography of startup founders.jpg|Demography of startup founders; Graphic courtesy: [http://epaperbeta.timesofindia.com/Gallery.aspx?id=23_10_2015_022_041_002&type=P&artUrl=YOUNG-AND-EDUCATED-23102015022041&eid=31808 ''The Times of India'']|frame|500px]] | ||

| − | + | See graphic, 'Demography of startup founders' | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

=Funding= | =Funding= | ||

| Line 175: | Line 67: | ||

The number of exits in India have been few. In contrast, the CB Insights report said tech companies in Beijing and Shanghai tend to raise a lot of money and end up highly valued at exit. Since 2012, Beijing has seen over 30 large (over $100-million) exits, with logistics tech giant JD.com seeing an IPO valued at about $26 billion. Shanghai has clocked nearly 20 such exits. | The number of exits in India have been few. In contrast, the CB Insights report said tech companies in Beijing and Shanghai tend to raise a lot of money and end up highly valued at exit. Since 2012, Beijing has seen over 30 large (over $100-million) exits, with logistics tech giant JD.com seeing an IPO valued at about $26 billion. Shanghai has clocked nearly 20 such exits. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==2015: Alumni of prestigious institutes get more funding== | ==2015: Alumni of prestigious institutes get more funding== | ||

| Line 384: | Line 238: | ||

The government has recognised 8,765 startups, with 88 eligible for benefits, such as tax exemption on profits made during three of seven years of operations. Abhishek said initial estimates from around 7,000 startups indicate that over 81,000 jobs will be generated with a bulk of them being in the IT services space. Among the startups recognised by the government for various incentives, Maharashtra has seen maximum number, followed by Karnataka and Delhi. He said state rankings would be on the basis of initiatives taken to develop startup ecosystem. The ranking framework covers seven areas of intervention and 38 action points, including policy support, incubation centres, seed funding, angel and venture funding. | The government has recognised 8,765 startups, with 88 eligible for benefits, such as tax exemption on profits made during three of seven years of operations. Abhishek said initial estimates from around 7,000 startups indicate that over 81,000 jobs will be generated with a bulk of them being in the IT services space. Among the startups recognised by the government for various incentives, Maharashtra has seen maximum number, followed by Karnataka and Delhi. He said state rankings would be on the basis of initiatives taken to develop startup ecosystem. The ranking framework covers seven areas of intervention and 38 action points, including policy support, incubation centres, seed funding, angel and venture funding. | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

=Profile of founders = | =Profile of founders = | ||

| Line 529: | Line 368: | ||

Despite the optimism, firms need to be cautious and keep goals in sight as the startup universe has another unique term: unicorpse. That’s a former unicorn which is failing, and India has seen a few. Will 2019 bring more unicorns or unicorpses? | Despite the optimism, firms need to be cautious and keep goals in sight as the startup universe has another unique term: unicorpse. That’s a former unicorn which is failing, and India has seen a few. Will 2019 bring more unicorns or unicorpses? | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

=Women= | =Women= | ||

| Line 624: | Line 442: | ||

''Inflation and currency exchange rates make the cost of generating startup business far higher in India than other countries'' | ''Inflation and currency exchange rates make the cost of generating startup business far higher in India than other countries'' | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

Revision as of 08:30, 17 December 2020

This is a collection of articles archived for the excellence of their content. the Facebook community, Indpaedia.com. All information used will be acknowledged in your name. |

Countries that have invested in Indian start-ups

2017: USA, Japan...

Over 50% foreign funding in Indian startups from non-US investors, July 16, 2018: The Times of India

The lower strip is: Amount invested.

From: Over 50% foreign funding in Indian startups from non-US investors, July 16, 2018: The Times of India

More than 220 foreign investors put $1.2 billion into Indian startups in the first half of 2017. Japanese investors were fewer in number, but the amount of funding they brought was second only to the US, which had the most investors.

Demographics of startup founders

2015

See graphic, 'Demography of startup founders'

Funding

2014, 2015: Funding deals

The Times of India, November 14, 2015

Though there's much hullabaloo about some startups retrenching employees and struggling to raise fresh rounds, data shows that many more funding deals are happening now than earlier in 2015 or, indeed in 2014. However, the cheque sizes are shrinking, indicating that investors want their firms to be more careful about their spends.

In August- Oct 2015, there was an average of 53 funding deals a month, compared to 43 transactions in the first three months of 2015. In the first 10 months of 2014, there was an average of 24 deals a month, shows data from Tracxn, a startup data collection and analysis firm. The deals include startups that have been funded for the first time and funded companies getting subsequent rounds of investments. The overall number of deals this year, till October, stands at 494, compared to just 237 during the same period last year.

GSF, one of the country's most successful accelerators, said that seed rounds and Series A deals were flowing thick and fast. It saw three startups from its current batch getting Series A funding last month. It expects to announce another four to five deals by the end of this year for which term sheets have already signed. “I don't see any slowdown at seed stage or Series A stage for quality companies. Despite all the noise about a slowdown, I will go by data which shows the ecosystem is robust,“ said Rajesh Sawhney , founder of GSF. He, however, said there were valuation concerns that were resulting in slowdown in funding at later stages. For the startup ecosystem, Sawhney sees the base of the pyramid as being more important and the numbers indicate it is only getting stronger.

Vani Kola, founder and of Kalaari Capital, too, said Kalaari was continuing to see the same pace of investments as previously .

However, Aashish Bhinde, executive director (digital media and technology) at Avendus Capital, a leading investment bank in India, said the number of deals at the angel, seed or even Series A do not matter if the venture cannot raise subsequent rounds of funding. But he noted that markets have a tendency to overdo bullishness and bearishness and compared the situation to that in 2012-13 when investments came down after a big year in 2011.

One sign of growing cautiousness even in early stage funding can be seen in the deal sizes. The average value of a deal has dropped from $8 million in the first quarter of this year to $6 million in the latest quarter (excluding deals above $100 million). “Venture capital investors are becoming wary of the cash burn rate of startups,“ said Sawhney .

The MD of a major venture capital firm, who did not want to be named, said VCs were putting more effort into trying to understand every startup's business.

2014 to 2016

See graphic, ' Top 10 funded start-ups (2014 to 2016) '

2014-18: Bengaluru, New Delhi nos. 6, 8 in world

Shilpa Phadnis, B’luru, Delhi top in startup funding, July 10, 2018: The Times of India

From: Shilpa Phadnis, B’luru, Delhi top in startup funding, July 10, 2018: The Times of India

New Delhi and Bengaluru had among the highest number of startup investment rounds greater than $100 million since 2014. Bengaluru had 21 and New Delhi 18, according to a report by US venture capital and startup database CB Insights.

The report shows that each of the Indian cities had about the same number as London (19), and significantly higher numbers than Boston

(13) and Tel Aviv (2), cities that are often regarded as strong startup hubs. Mega rounds are reflective of the opportunity that the startup holds.

Silicon Valley (158), Beijing (128), Shanghai (58) and New York (40) dominated these mega-rounds. Some of the big-ticket deals in India included those to Flipkart, Ola and Paytm, and to those like online grocer Bigbasket ($300 million in series-E funding led by Alibaba) and Swiggy’s $100-million fund-raise led by South African internet and media giant Naspers. The big acceleration for Indian companies came from Japanese internet giant SoftBank that has invested more than $7 billion in the Indian ecosystem, including in Flipkart and Ola.

The report said the Japanese company’s portfolio includes more than 65 companies in the Asian hubs, showing how a single investor has propelled the rise of tech in Asia, particularly China and South Korea.

Ravi Gururaj, president of startup association TiE Bangalore, said, “Bengaluru is well positioned on many dimensions — the number of unicorns, mega rounds, aggregate funding, early-stage startups raising rounds, foreign investor interest, even Soft-Bank portfolio growth. The primary remaining hurdle is the exit or liquidity dimension, which we will hopefully crack in the next couple of years with the recent Flipkart-Walmart mega deal providing the necessary impetus and confidence to dealmakers.”

The number of exits in India have been few. In contrast, the CB Insights report said tech companies in Beijing and Shanghai tend to raise a lot of money and end up highly valued at exit. Since 2012, Beijing has seen over 30 large (over $100-million) exits, with logistics tech giant JD.com seeing an IPO valued at about $26 billion. Shanghai has clocked nearly 20 such exits.

2015: Alumni of prestigious institutes get more funding

Anand J &ShilpaPhadnis

How the new caste system - FILTERS FUNDING CHOICES

Startup research firm Tracxn finds that 37% of the 3,373 startups founded in 2015 has been founded by alumni of at least one of the following prestigious institutes -IIT, IIM, BITS, and NIT (National Institutes of Technology). But as much as 67% of the $7 billion of funding raised in 2015 has gone to these startups.

Similarly, only 13% of the registered startups on online deal-making platform LetsVentureis founded by what it calls Ivy League founders -those from IIT, IIM, BITS, Indian School of Business (ISB), Oxford, Cambridge, and US Ivy League colleges. But these ventures ac count for 27% of the funded ventures, and 34% of total funding. Sutanu Banerjee did a degree in Chinese language from the Jawaharlal Nehru University (JNU) and has been running the New Delhi-based travel organizer Prakriti Inbound profitably for the past 15 years. He recently decided to raise some private funds to expand.

2016: Funding drops 50% from levels of 2015

Funding for startups almost halved this year, down to $3.8 billion compared to $7.6 billion in 2015, as risk investor pushed back with caution after two years of unprecedented exuberance.

The funding crunch impacted the overall ecosystem with the number of startups founded this year going down dramatically , data from startup tracking firm Tracxn showed.More than 9,462 startups (including non-technology startups) were founded in 2015, compared to 3,029 in 2016, according to Tracxn data.

Sluggishness in funding has been felt globally with some of the high-flying startups seeing their valuation being cut as sentiments around technology financing took a hit last year.

The number of startups that shut shop rose to 212 from 144 last year. However, the number of funding deals stood almost the same at 1,031compared to 1,024 last year.

Padmaja Ruparel, president at Indian Angel Network (IAN) attributed the decline this year to the lack of big fund raising by the unicorns. IAN was the most active investor this year with 36 funding rounds. “There was a lot of hype, last year, which has subsided a bit. We have seen a lot more committed entrepreneurs this year,“ Ruparel said.

The big startups that raised multiple rounds of funding last year like Flipkart, Quikr, and Grofers did not raise fresh capital in 2016. Among the top ten technology deals were the Ibibo Group and Makemytrip merger, Yatra (acquired by Nasdaqlisted Terrapin for $218 million), and fund raising by Bookmyshow and Hike.

While overall funding was weak, flow of early-stage deals did not see a slowdown. For IAN, the average funding round in 2016 has remained the same as 2015 at around Rs 2.5 crore, Ruparel said. While last year, they received 6,000 applications, this year IAN received 7,500 applications. “We have seen a wider spectrum of startups coming up, with a sharper focus on top and bottom line.“

All the major venture capital funds, which are flush with dry powder, as they have together raised more than $2 billion to invest in Indian startups, took selective bets this year.New York-based Tiger Global, which was one of the most active funds last year with more than 30 investments, has almost retreated from India as it did not make any new investments this year.

As numerous startups struggled to remain afloat, M&A activity also rose marginally indicating that companies opted for consolidation to avoid shutting down.

2016, 44% decline in Mumbai, 61% increase in Pune

Sheen Off Image As Hub, Epicentre Of Boom Powai Hit Hard

Mumbai, which spawned a bunch of high-profile startups like Housing.com and attracted millions of dollars in investor capital, registered a 44% decline in funding deals in 2016, even as Pune managed to buck the slowdown.

Mumbai struggled as its startup epi center Powai saw many shutdowns last year, including the likes of TinyOwl, taking away the sheen from the city as a prime location for young ventures to flourish. The city racked up $232 million (over Rs 1,550 crore at current exchange rate) worth of funding across 151deals last year; falling from 233 deals accounting for $419 million (about Rs 2,800 crore) in 2015, said data released by VCCEdge, a NewsCorp-owned online financial research platform.

Pune, on the other hand, received $52 million (Rs 350 crore) worth of funding last year compared to $39 million (Rs 260 crore) in 2015. It also registered a 69% annual increase in the number of financing deals compared to Mumbai.The number of funding deals in Pune went up from 35 in 2015 to 59 last year.

Investments in startups have come down dramatically after a few years of excessive capital coming into young tech startups in India. Last year, startups in Maharashtra collectively scooped up $285 million (Rs 1,910 crore) as against $496 million (Rs 3,300 crore) in 2015; a drop of about 42% in terms of deal value, the data said.

“One of the reasons is that a lot of startups have moved from Mumbai to places like Bengaluru where there is a bigger tech pool and cheaper talent, along with a lower cost of living,“ said Aseem Khare, founder of hyper-local startup Taskbob, which recently shut operations.

Despite the decline in big financing rounds, angel and seed funding of startups in Maharashtra as a percentage of the total number of deals touched a five-year high of 80% in 2016. “The rise in early-stage funding in the state is encouraging from the viewpoint of promising business ideas. However, the fall in growth capital is indicative of these startups failing to achieve scale, which highlights the need for more startup incubators in the state,“ said Nita Kapoor, head, India New Ventures, News Corp, and CEO, News Corp VCCircle.

Rehan Yar Khan, founder and partner at venture capital fund, Orios Venture Partners, said, “Mumbai does not have any big startups because as these companies grow, they move to cities like Bengaluru which have cheaper talent. Ola and Quikr originated in Mumbai but moved to Bengaluru when they needed to expand and hire more people.Cities like Bengaluru, Hyderabad and Pune are technically cheaper cities with easy access to talent.“

Financial technology received the maximum funding with $27 million (Rs 185 crore) last year.

2016-18: Seed- stage investments decline

From: https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F11%2F28&entity=Ar02814&sk=9CDE8165&mode=text Sindhu Hariharan, Early-stage deals hit as unicorns reap benefits, November 28, 2018: The Times of India]

Is India’s unicorn companies having a funding economy of their own? As the Indian startup ecosystem records successive years of record-making investment activity, more particularly chasing unicorns, research shows that the activity is terribly skewed against early stage funding.

Investment tracker, CB Insights noted that India closed just $206 million of angel- and seed-stage deals in 2017- a decline from the $283 million raised in 2016, and just 2% of the total amount raised. The number of deals at this stage also saw a steep drop from 710 in 2016 to just 462 in 2017. The research found that every surge in India’s funding has been driven by companies valued at over $1 billion, stating that “it’s almost as if India’s unicorn companies have a funding economy of their own.”

Investment data accessed by TOI from research platform Tracxn showed that the trend continued in 2018 as well. As per Tracxn’s analysis, the number of deals at the seed stage has seen a steady decline from 2016 onwards - 2016 saw 756 deals valuing $289 million in the seed stage, 2017 recorded 581 deals at $272 million, and there were only 364 seed investments in 2018 at $215 million (till Nov 23). However, Series E and F rounds - typically fuelling growth of unicorns - grew 330% and 113% in terms of value, with deal counts growing at 33% and 150% respectively.

KS Viswanathan, VP industry initiative, NASSCOM, attributed this to a priority mismatch.

“The investor community continues to be fond of investing in consumer tech space, but there has been a shift in the interest of emerging entrepreneurs to start up in deep tech areas,” he told TOI.

Padmaja Ruparel, co-founder & president, Indian Angel Network (IAN) said the regulatory climate may have a role to play.

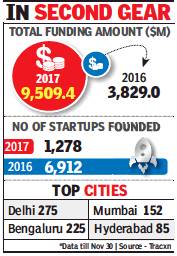

2017/ Overall funding: $9.5 billion

Shalina Pillai, Other than the big 3, startups feel the pain, December 30, 2017: The Times of India

From: Shalina Pillai, Other than the big 3, startups feel the pain, December 30, 2017: The Times of India

The year 2017 was for cautious investments and mindful entrepreneurial activity. Although it saw a huge rise in overall funding — thanks to the big three of the startup world: Flipkart, Ola, and Paytm — the funding scenario for all the others remained bleak.

According to data analytics firm Tracxn (data till 30 November), 2017 was subdued in terms of both funding and entrepreneurship. While the total funding raised by Indian startups this year was $9.5 billion, much higher than the 2016 figure of $3.8 billion, $7 billion out of it was raised by the e-commerce, ride-sharing, and mobile wallet platforms put together.

KS Vishwanathan, head of Nasscom’s 10K Program, said that unlike 2015, which saw a lot of entrepreneurs in the consumer space start their ventures, this year saw business-to-business (B2C), and enterprise-focused startups come aboard.

“India’s vibrant startup space, which has witnessed quite a few crests and troughs in its journey so far, entered a phase of maturity in 2017. It was encouraging to see enterprise and SMB-focused horizontal solutions (especially SaaS) find favour with the funders. A noteworthy trend that should catalyse many more enterprise-driven accelerator programmes,” he said.

Nasscom, too, released a report earlier this year, which noted a drop in funding activity, including a 53% drop in seed (or, the earliest stage of) funding in the first half of 2017. A major reason was the controversial angel tax, which taxed any investment raised above the fair value (as determined by the CBDT) as income in the hands of the startup.

“I would largely attribute the cautious sentiment due to macro factors like demonetisation and GST, and to the angel tax. The one sector that stood out in terms of general interest in 2017 was fintech...One could attribute this to the Bitcoin ripple effect,” said Ishan Singh, investor at Mumbai Angels, and founder of co-working space RevStart.

2018: Venture Catalysts tops angel, seed funding chart

John Sarkar, December 22, 2018: The Times of India

Early-stage investment firm Venture Catalysts has emerged as the most prolific investor in the Indian startup chart by closing 60 deals worth Rs 380 crore in 2018.

The Mumbai-headquartered incubator platform that typically invests between Rs 2 crore and Rs 7 crore in earlystage startups, has focused on the fast moving consumer goods (FMCG) segment this year rather than consumer technology, which accounts for more than 60% of all venture capital (VC) investments in India.

The next on the list of top angel and seed investors in terms of the number of deals is Axilor Ventures with 25 deals, followed by Blume Ventures and LetsVenture, according to data from startup research firm Tracxn.

“The number from last seven years shows that the FMCG sector offers huge M&A and growth opportunities,” said co-founder of Venture Catalysts, Apoorv Ranjan

Sharma. “Compared to tech startups, FMCG startups earn high gross margins and therefore don’t bleed.”

Some of the FMCG startups in Venture Catalysts’ portfolio, include PeeSafe, which makes personal hygiene products for women, ecofriendly diaper company Superbottoms and organic lingerie brand Inner Sense. It had also invested in men’s grooming company Beardo, in which FMCG major Marico picked up a 45% stake.

“With disposable incomes of Indians on the rise, segments such as personal care, wellness and food & beverage have high growth potential,” said Sharma, who is looking at a few exits next year. With increasing maturity of the India start-up ecosystem, exits are expected to increase with around 80% start-up founders expecting investor exits by 2024, revealed a study by Bain & Co. India is among one of the top startup ecosystems in the world, housing more than 3,500 funded start-ups growing rapidly at 30%. VC deal value in India grew five times in last 10 years with the total number of deals in 2017 valued at $3.4 billlion.

Management

Founders vis-à-vis outside leaders/ 2018

From: October 7, 2018: The Times of India

See graphic:

As in 2018, India was still bucking the trend of founders vis-à-vis outside leaders

Number of start-ups in India

2010-15

See graphic:

Number of start-ups found in Indian tech space, 2010-15

2015-16: 36% increase

The Times of India, May 13 2016

Startup rush: No. of new pvt cos up 36% in 2015-16

Lubna Kably

The burgeoning startup ecosystem seems to have boosted growth of non-government or private companies. During the year 2015-16, as many as 60,414 private companies with an aggregate authorized capital of Rs 10,845 crore were registered (statistics are up to December 31) -a hike of 36% over the previous corresponding period (see table). Experts say that a private company is the best legal entity form for incorporation of a startup, especially one which is growth-oriented.

At the same time, traditional businessmen functioning as solo proprietors continued to show their preference for one-person companies (OPCs), with registrations almost doubling to 2,761during the financial year 2015-16 (up to December 31), according to the latest annual report released by the Ministry of Corporate Affairs (MCA). The collective authorized capital of the newly regis tered OPCs was nearly Rs 67 crore. The business services sector dominated, with 58% of OPCs falling in this category .While OPCs enable a single proprietor to corporatize his business, it isn't an ideal entity for startups claim experts.

Lionel Charles, CEO of Indiafilings.com, says, “Venture capitalists (VCs) do not recommend OPCs as the shares can be held by one person only and equity funding by VCs isn't feasible. An OPC is also required to mandatorily convert into a private company once its turnover exceeds Rs 2 crore or share capital exceeds Rs 50 lakh.“

Harish H V , partner at Grant Thornton, says, “Typically, startups have more than one founder. They also aim at equity infusion from angel investors and VCs. Esops are also granted to employees who ultimately hold a stake in the startup. This makes a private company form more suitable. Moreover, a minimum share capital of Rs 1 lakh is no longer required for incorporation, adding to their popularity .“

Government officials are of the view that the current year will see a further increase in the number of registrations of private companies in the backdrop of the `Startup India' programme. Recently , the govern ment carved out a separate definition for startups and offered various sops, including a tax holiday .

Eligible startups, subject to meeting certain conditions, are entitled to a tax holiday for a block of three out of the initial five years. To claim eligibility, the company must be incorporated between April 1, 2016 up to March 31, 2019, its total turnover must not exceed Rs 25 crore in any financial year and it must have obtained a certificate of eligible business from the Inter-Ministerial Board.

An amendment to the Finance Bill added limited liability partnership (LLP) in the definition of the term `startup'. LLPs are a hybrid model which provides personal immunity to the partners and offers a corporate structure. In India, professional services companies have largely adopted the LLP structure. However, for startups, especially those looking at VC funding, an LLP structure in not ideal in the long run.

2017

From: December 24, 2017: The Times of India

See graphic: Total startup base in India, 2017

2018

Tax clarity on angel funding soon, April 6, 2018: The Times of India

Key sectors among recognised startups

Top states for recognised startups

From: Tax clarity on angel funding soon, April 6, 2018: The Times of India

The government is set to clear the air on taxing angel investor funding of startups and is expected to specify a threshold up to which investment in identified companies will not face tax scrutiny, even if it is above the fair market value, a senior government official said. The issue will address concerns as tax authorities have been issuing notices on investments above the market value, since a premium can be added to the income of a company.

The move is part of the latest policy boost for startups and a notification specifying the details will be issued soon, industrial policy and promotion secretary Ramesh Abhishek told reporters. Experts, however, suggested that a comprehensive solution is needed. “The issue of taxing the excess premium received by companies needs a complete solution. Carving one exception at a time, and that too with several riders, only adds to complexity and creates a further non-level playing field between Indian and foreign investors,” said Abhishek Goenka, a partner at consulting firm PricewaterhouseCoopers.

The industry secretary said the government was keen to address all concerns and was pushing states to put in place a favourable regime for startups. Several initiatives, including a ranking of states on various parameters, were being undertaken.

The government has recognised 8,765 startups, with 88 eligible for benefits, such as tax exemption on profits made during three of seven years of operations. Abhishek said initial estimates from around 7,000 startups indicate that over 81,000 jobs will be generated with a bulk of them being in the IT services space. Among the startups recognised by the government for various incentives, Maharashtra has seen maximum number, followed by Karnataka and Delhi. He said state rankings would be on the basis of initiatives taken to develop startup ecosystem. The ranking framework covers seven areas of intervention and 38 action points, including policy support, incubation centres, seed funding, angel and venture funding.

Profile of founders

Age profile of startup founders

June 16, 2018: The Times of India

From: June 16, 2018: The Times of India

More than 70 per cent of startup founders in India are under 35 years — that’s the most in the world. Millennials account for over half the country’s population. By 2020, millennials will form 50% of the global workforce...

Education and gender

July 5, 2018: The Times of India

From: July 5, 2018: The Times of India

See graphic:

The Education and gender of Start-up founders in India, presumably as in 2017

An analysis of the educational qualifications of startup founders in India shows that most tend to be engineers -- and 91% of them are male.

Start-up Ecosystem

2017: employees prefer small companies (total strength of 10)

Startups with lesser workers preferred more in 2017, March 29, 2018: The Times of India

From: Startups with lesser workers preferred more in 2017, March 29, 2018: The Times of India

A new set of data released by Nasscom Indian Startup Ecosystem 2017 shows that around 86 per cent workers were interested in working at small companies (with a total strength of 10) in 2017 compared to mere 17 per cent in 2012. In companies whose employee strength was between 50 and 100, only 1 per cent workforce showed interest in 2017 compared to 16 per cent in 2012.

Steps to encourage start-ups

2016: National Student Start-up Policy

The Hindu Business Line, November 25, 2016

To create 1,00,000 start-ups and one million new jobs by 2025, President Pranab Mukherjee has released a National Student Start-up Policy at Rashtrapati Bhavan, an official release said.

The policy, formulated by All India Council for Technical Education (AICTE) and which aims to make start-ups a mainstream career choice for students of all AICTE-approved colleges, was approved by the Executive Committee of AICTE in its 100th meeting held on June 28, 2016.

According to a release, the policy lays thrust on developing an “ideal entrepreneurial ecosystem and promoting strong inter-institutional partnerships among technical institutions” with the aim of guiding and grooming students to take up entrepreneurial careers and successfully launch start-ups.

The policy will also work towards re-orienting academic curriculum and pedagogy .

Government incentives, 2016

See graphic:

Government incentives for start-ups and some limitations

Startup India Action Plan

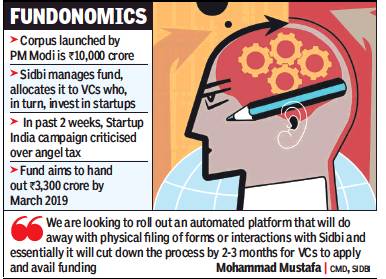

Fund allocates 19% to VCs in 3 years

From: Digbijay Mishra, Startup India fund allocates just 19% to VCs in 3 years, December 31, 2018: The Times of India

Aims For 33% In FY19, Eyes Automation For Faster Disbursals

The Startup India initiative has allocated just under 20% of its Rs 10,000-crore corpus to venture capital (VC) funds.

Mohammad Mustafa, chairman and managing director of the Small Industries Development Bank of India (Sidbi), which manages the fund-of-funds for the Startup India Action Plan, said Rs 1,900 crore had been committed to VC firms by the end of December 2018. According to figures available publicly, the allocation had stood at close to Rs 1,500 crore by the end of September 2018. Mustafa said the fund-of-funds will close the financial year with a Rs 3,300-crore allocation to VCs.

The government launched the initiative to help startups get funding in early stages. The fund doesn’t directly invest in startups. Instead, it allocates money to VCs, which are required to invest at least twice the amount of contribution received from the government.

Over the past two weeks, the Startup India initiative has come under criticism after hundreds of entrepreneurs complained of harassment by I-T authorities who sent them ‘angel tax’ notices. For now, the government has assured them there won’t be any coercive action to demand taxes from startups. The government had made similar promises a year ago when the issue first came to the fore.

Mustafa also said the Startup India fund, leveraging on technology, will bring in ‘automation’ by next fiscal, which will ensure faster disbursals to VC firms looking to raise capital from the government’s initiative. “There is a lot of demand, and VC firms are reaching out for capital. We are looking to roll out an automated platform that will do away with physical filing of forms or interactions with Sidbi. Essentially, it will cut down the process by two-three months for VCs to apply and avail of funding,” said Mustafa.

It currently takes four-five months for a VC to apply for and get fund approval. According to official records, Kae Capital, Orios Venture Partners, Stellaris Venture Partners and Alteria Capital, among others, received capital from the government’s fund-of-funds.

The Startup India fund is supposed to be deployed during the 14th and 15th Finance Commission cycles. Over the past few years, the government has been showing interest in focusing on startups since they play an important role in creation of jobs. Startup India was one of the initiatives highlighted in the G20 summit in Argentina this year.

Unicorns

2000-18: How long it takes to be a unicorn in India

From: July 1, 2018: The Times of India

See graphic:

2000-18: How long it takes to be a unicorn in India?

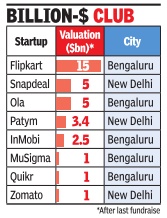

2015: Indian ‘unicorns’

The Times of India, Oct 12 2015

Shilpa Phadnis & Shalina Pillai

5 of 8 Indian unicorns in B'luru

Bengaluru is the unicorn capital of the country .Building on its IT services legacy , the city has emerged as he tech entrepreneurial hub and plays host to five out of the eight homegrown unicorns -Flipkart, Ola, InMobi, Quikr and MuSigma. E-tailer Snapdeal, restaurant discovery startup Zomato and mobile wallet startup Paytm, the other three Indian unicorns, are based in New Delhi. Unicorn is a term popularized by venture investor Ai een Lee to describe startups hat are valued at $1billion or more. CB Insights data show here are 140 unicorns global y with a cumulative valua ion of $503 billion.

E-commerce biggie Flipkart, which raised nearly $2 billion last year, is at the top of he Indian pecking order, va ued at $15 billion, showed da ta from Wall Street Journal.Taxi-hailing startup Ola, which moved its headquarters from Mumbai to Bengaluru, is valued at $5 billion.Mobile advertising platform InMobi boasts of a valuation of $2.5 billion, while data analytics firm MuSigma and online classifieds service Quikr have recorded valuations of $1billion each.

The number of companies entering the unicorn ros ter has grown significantly globally, with taxi hailing app Uber leading the club with a valuation of over $50 billion.

“Bangalore's tech-first cul ture lends itself to its startups taking category leadership This has contributed to the ci ty having more homegrown Unicorns than other cities in India,“ said Sharad Sharma co-founder of software pro ducts think tank Ispirt.

Ravi Gururaj, chairman of Nasscom Product Council believes the city's early mo ver advantage meant that it became a natural choice for startups as the primary place of business. “Why do you rob a bank? Because that's where the money is,“ he said. “Why do unicorns grow in Bangalo re? Because that's where the nurturing ecosystem is..where you can discover ta lent, connect with investors hire from MNC R&D centres and large IT service compa nies, learn from other peer startups and enjoy great weather. All of that combined make Bangalore India's most attractive city for leading startups,“ he said.

Bengaluru is the bedrock of the country's $146-billion IT sector where global IT brands like Infosys and Wipro were built and that has kicked off this virtuous cycle. The rub-off effect is obvious. MNCs flocked in big numbers to set up R&D outposts to leverage its technology talent pool. The city houses 350 global captive centres (GICs), including Target and Shell, out of 1,000 GICs in India.

The density of engineering talent and linkages with the Silicon Valley have contributed to the startup success story . Take InMobi, dubbed as the Indian challenger to Google, for instance. The mobile advertising platform relocated from Mumbai to Bengaluru to hire the best-inclass engineering talent.

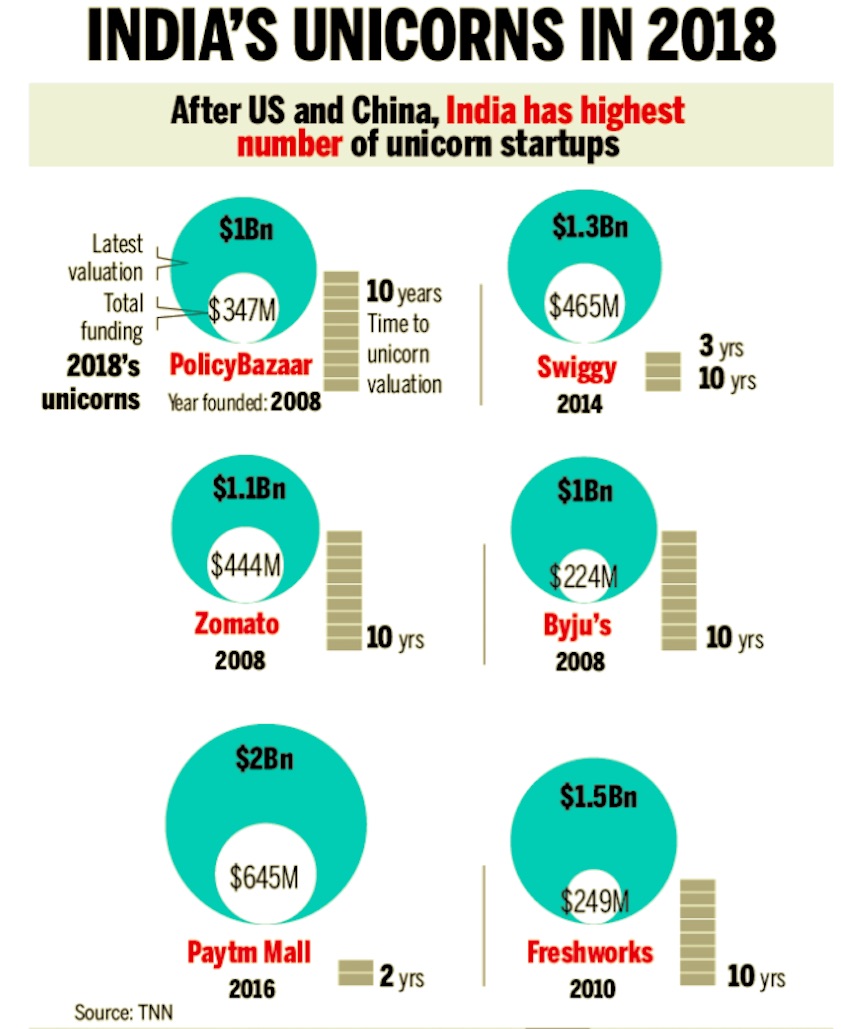

2018: India is world no.3

August 3, 2018: The Times of India

From: August 3, 2018: The Times of India

See graphic;

India's unicorns in 2018

Six startups have joined the unicorn club of companies with a valuation of $1 billion or more this year. Freshdesk is the latest with its $100m-round this week. In 2017, however, no company crossed $1bn in value. Only two managed to did so in 2014 and 2016, respectively.

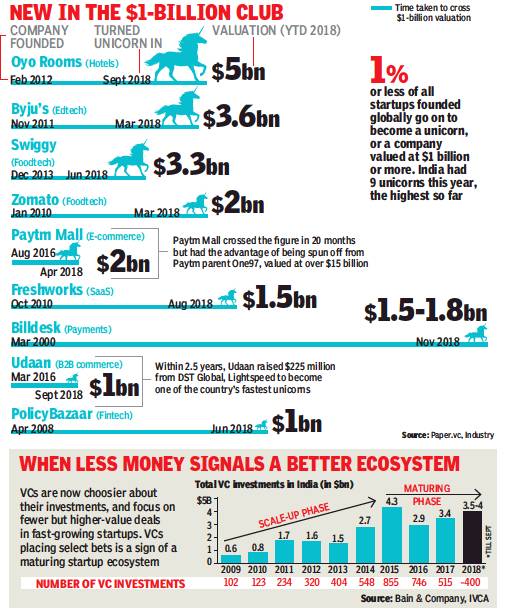

2018: the best year for unicorns

Digbijay Mishra, Why 2018 was the best year to spot a unicorn, December 31, 2018: The Times of India

ii)The number of investments, 2009-18

From: Digbijay Mishra, Why 2018 was the best year to spot a unicorn, December 31, 2018: The Times of India

In folklore, unicorns are near impossible to glimpse. But in India, there was no better year than 2018 to spot one, with an unprecedented nine companies crossing a valuation of $1 billion by the end of September. After a tough period in the 18 months preceding 2018, investors returned with more capital for Indian startups. This time, they backed proven models and most funding went to market leaders and fast-growing startups.

Edtech startup Byju’s was first off the blocks this year: It turned unicorn in March after raising funds from Tencent, and ended the year with a $540-million round at a valuation of at least $3.6 billion. Byju’s, Oyo Rooms (which raised new capital at a valuation of $5 billion) and Swiggy are now among the country’s top five most valued internet-based companies. With 18 unicorns, India is at number three — behind US and China — in terms of total number of unicorns.

No startup touched $1 billion (Rs 7,000 crore) in valuation in 2017. Even in the years when money flowed freely, no more than four startups reached the figure in a year since the first unicorn was created in 2011. This year, venture capital (VC) firms raised $2.3 billion for investment in India, according to a study by Bain & Company and Indian Venture Capital Association. India tech investments were on the road to recovery after the less than $1 billion raised in 2017. The year before, VCs allocated $2.8 billion. (Both years saw higher investments as earlier funds were tapped.) “The recent rise in valuations of tech startups is the result of a rapidly deepening market opportunity. Growth in mobile internet users, explosion in data consumption, pervasive 4G coverage, and the expected rise in disposable income, driven by increasing GDP per capita, are key factors that investors are betting on. Finally, there are a number of high-quality, experienced founders. This trend is expected to continue,” said Tarun Davda, MD, Matrix India, a VC firm that has placed several bets on startups, including Ola.

Deep Kalra, chairman, MakeMyTrip, told TOI successful global models were replicated in e-commerce and on-demand services, but future opportunities lie in IoT and deep tech. “There is an unbridled amount of capital for entrepreneurs to get their ducks in a row given how macroeconomic fundamentals are fertile and digital infrastructure is finally coming of age to support the new-age economy. Another reason for big cheques is that private markets have become deep,” he said.

One can’t talk of the growing number of unicorns and not to mention Japanese investor SoftBank. Its $100-billion Vision Fund has emerged as one of the most influential investors, pouring about $8 billion into India. Oyo Rooms’ aggressive China expansion is due to SoftBank’s backing, and Paytm is growing at an astounding rate too. Two existing unicorns are seeking money from SoftBank, and other startups could enter the club riding on its back.

Despite the optimism, firms need to be cautious and keep goals in sight as the startup universe has another unique term: unicorpse. That’s a former unicorn which is failing, and India has seen a few. Will 2019 bring more unicorns or unicorpses?

Women

Employees, 2018; founders: 2015-17

Women employees, presumably as in 2018;

2015-17: Women founders

From: September 30, 2018: The Times of India

See graphic:

Indian Start-ups:

Women employees, presumably as in 2018;

2015-17: Women founders

Rank/ position of Indian start-ups in the world

2015

ii) In terms of the number of startups in a city, Bangalore is followed by Mumbai and Delhi.

iii) Delhi, Mumbai and Bangalore lead the whole world in the number companies focussed on business through mobile phones.

The Times of India

2015: Bengaluru has youngest entrepreneurs in world

The Times of India, Jul 29 2015

Shalina Pillai & Anand J

At average 28.5 yrs, Bengaluru has youngest entrepreneurs in world

Bangalore has the youngest startup ecosystem in the world, with the average founder's age at 28.5 years, according to a survey of the top 20 global startup ecosystems. In Silicon Valley , the world's largest startup hub, the average age is eight years older than in Bengaluru at 36.2 years. Kuala Lumpur comes closest to Bengaluru, at 30.5 years, followed by Sao Paulo, 31.7 years, and Berlin, 31.8%. Sydney has the highest average age among startup founders, at 40.3 years, according to The Startup Ecosystem report by San Francisco-based Compass, a research firm that provides global benchmarking tools.

Compass also finds that Bengaluru moved up four positions to rank 15 in 2015 among the top 20 startup ecosystems, advancing from rank 19 in the 2012 ranking. It was amongst those who made the biggest leaps. Others who made similar leaps were New York, Austin, Singapore, Berlin and Chicago. Silicon Valley retains the top spot in the survey that looks at performance, funding, market reach, talent, and startup experience.

There were only three cities Bengaluru, Singapore, and Sydney from Asia Pacific in the top 20. Many of the cities in the top 20 were US ones. New Delhi was not in the top 20, but was among the runners up, together with Kuala Lumpur, Hong Kong, and Jakarta in Asia Pacific.

Bengaluru saw the most growth in seed fund rounds over the last three years, with an annual average growth of 53%. It was followed by Sydney (33%) and Austin (30%). According to the report, which was compiled with the help of global startup database CrunchBase, Bengaluru has done well in the funding parameter with a rank of 6, just below Chicago.

2015: Number of Indian startup No. 3 in world

The Times of India, Oct 14 2015

India bags No. 3 spot in world's startup ecosystem

Fuelled by $100 million flowing into the country's startups every week, the number of startups founded in the country has grown by 40% in 2015 over the previous year, said Nasscom's latest report on the Indian startup ecosystem. India is the third biggest startup ecosystem with more than 4,200 founded and it is expected that the country will receive $6.5 billion in funding in 2015. The largest startup ecosystems are the US (47,000-48,000 startups) and UK (4,500-5,000). Israel and China follow India.

India saw 1,200 startups being born in 2015. Currently, three-four startups are born each day . The number of startups is projected to grow to around 12,000 by 2020. The startups now employ around 85,000 people directly .

The report, launched in partnership with consulting firm Zinnov and Google, finds that 72% of the founders are less than 35 years old. The number of female entrepreneurs still constitutes only 9% of the entrepreneurs in the country , but the absolute number grew by 50% over the past year.

R Chandrashekhar, president, Nasscom, said, “The emergence of unicorns (startups with a valuation of $1 billion or more) and the big exits have created a lot of confidence in the ecosystem. Startups are now creating innovative technology solutions that are addressing social problems.“

2016

India, 3rd highest number of startup incubators and accelerators

Anand J, India has more startup incubators than Israel, May 06 2017: The Times of India

The government's initiative to establish 30 incubators in educational institutions in 2016 under the Startup India programme has enabled India to surpass Israel as the country with the third highest number of startup incubators and accelerators.

India now has 140 such institutions, ahead of Israel's 130, says a report by IT industry body Nasscom and consulting firm Zinnov. India added 40 new incubatorsaccelerators in 2016.China and the US have the highest numbers.

Incubators and accelerators perform the critical function of giving founders clear direction and advice on what is working and what is not. Some accelerators also help startups to find custo mers and funding. The US has more than 1,500 incubatorsaccelerators.

“Our aim was not to create billion-dollar valuations, but build remarkable companies that solve problems,“ Sangeeta Gupta, senior vice-president at Nasscom, told TOI.Nasscom too incubates startups through its Startup Warehouses in different cities. “The Indian startup ecosystem is at a growing stage, where accelerators and incubators are also maturing along with the ecosystem,“ Gupta said.

The report said that more than 50% of the institutions were outside the metro cities, thus helping startups to be created and nurtured across the country . The report contrasted this with the UK, where 60% of the institutions were in London. “Some 66% of the incubators established in 2016 were in tier 2 and 3 towns,“ Gupta said.

Around 50% of the incubators are in academic institutions, like IIT-Madras' Rural Technology and Business Incubator (RTBI) or IIM-Ahmedabad's Centre for Innovation Incubation and Entrepreneurship (CIIE). Around 10% of the incubators and accelerators are supported by corporates like PayPal, Target, SAP Labs, Cisco, Microsoft and Airbus. Government supported institutions include Kochi's SmartCity , T-Hub of Telangana and Nasscom's Warehouses.

2018

From: December 31, 2018: The Times of India

See graphic:

Indian startups in 2018

India costliest to generate startup business

From: March 25, 2018: The Times of India

See graphic:

Inflation and currency exchange rates make the cost of generating startup business far higher in India than other countries