Corporations, corporate performance: India

(→Sales vis-à-vis inventories) |

(→Shareholding of promoters, non-promoters=) |

||

| Line 231: | Line 231: | ||

For quarter ending June, inventories as percentage of sales for listed non-finance companies climbed up to a 23-quarter high. The highest build-up was with makers of commercial vehicles, readymade garments and machinery. Is this a sign of demand slowdown towards the end of the last quarter or expectations of a high demand in the forthcoming busy season (Oct-Dec)? Experts are betting on the latter | For quarter ending June, inventories as percentage of sales for listed non-finance companies climbed up to a 23-quarter high. The highest build-up was with makers of commercial vehicles, readymade garments and machinery. Is this a sign of demand slowdown towards the end of the last quarter or expectations of a high demand in the forthcoming busy season (Oct-Dec)? Experts are betting on the latter | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | + | [[Category:Economy-Industry-Resources|C CORPORATE PERFORMANCE: INDIACORPORATE PERFORMANCE: INDIACORPORATIONS, CORPORATE PERFORMANCE: INDIA | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | [[Category:Economy-Industry-Resources|C CORPORATE PERFORMANCE: INDIACORPORATE PERFORMANCE: INDIA | + | |

CORPORATIONS, CORPORATE PERFORMANCE: INDIA]] | CORPORATIONS, CORPORATE PERFORMANCE: INDIA]] | ||

| − | [[Category:India|C CORPORATE PERFORMANCE: INDIACORPORATE PERFORMANCE: INDIA | + | [[Category:India|C CORPORATE PERFORMANCE: INDIACORPORATE PERFORMANCE: INDIACORPORATIONS, CORPORATE PERFORMANCE: INDIA |

CORPORATIONS, CORPORATE PERFORMANCE: INDIA]] | CORPORATIONS, CORPORATE PERFORMANCE: INDIA]] | ||

| + | [[Category:Pages with broken file links|CORPORATIONS, CORPORATE PERFORMANCE: INDIA]] | ||

=Sector-wise performance= | =Sector-wise performance= | ||

Revision as of 11:53, 16 December 2020

This is a collection of articles archived for the excellence of their content. |

Brands, the most valued

2017

April 16, 2018: The Times of India

From: April 16, 2018: The Times of India

See graphic:

The most valued Indian brands of 2017

Despite the growth in the entertainment and telecom sector, five of the top 10 most valuable Indian brands remain banks and financial institutions. While the combined value of the country’s top 50 brands is estimated at $105 billion, over half of that value is held by the top 10 alone.

Market capitalisation

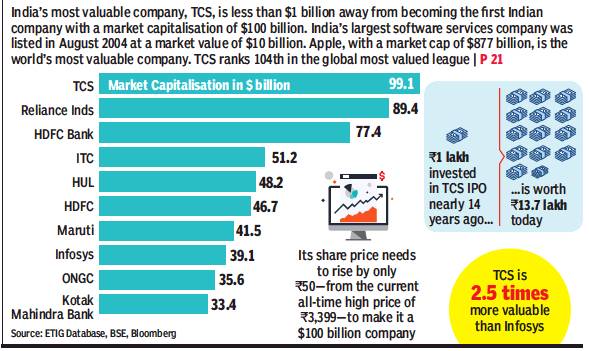

From: April 21, 2018: The Times of India

See graphic:

The Market capitalisation of India’s top ten companies, presumably in early 2018

Corporate debt

2016/ debt-to-GDP ratio is 55%

Corporate debt in emerging market economies including India, which used to average at 49% GDP nearly a decade ago, has now risen to 55% of the GDP , according to a latest RBI report.

India stands at the seventh place when measuring its government debt-to-GDP ratio -far behind countries such as China, Indonesia and Malaysia. The report also sheds light on how the system could be setting itself up for more cases of wilful defaulters like the now defunct Kingfisher Airlines. In a study of firms with more than $1-billion assets over 19 years, it was found that bigger corporates tend to be more leveraged post a crisis, compared to smaller firms.

Why it matters? In December, the RBI, in its fifth bimonthly policy statement, held rates for the first time in 2016, given the excess liquidity entering the system post-demonetisation. From some qu arters, the low-interest rate regime was hailed as the right time for pushing more loans to consumers, but the latest RBI report cautions against such a move. Titled, `Corporate Leverage in EMEs: Has the Global Financial Crisis Changed the Determinants?', the report draws parallels to the 2008 financial crisis.

“The post crisis period was characterised by abundant global liquidity and search for yield, which possibly resulted in lenient creditscore evaluations and leverage built-up. It is also possible that these firms with low profit took advantage of their possible future upturn and borrowed cheaply from debt markets,“ said the report.

Given the RBI's successive interest rates and current neutral stance, it is possible that we are on the cusp of a change in the policy rate cycle. And its at this juncture, the reports warns that lenders need to exercise more prudence.

Corporate performance, year-wise

1999-2018-19

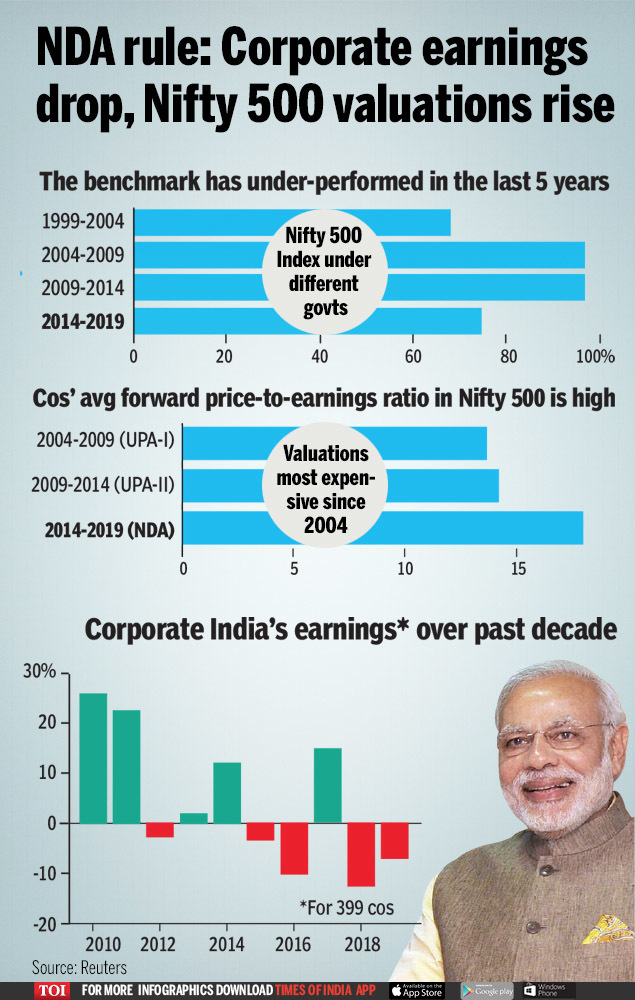

April 12, 2019: The Times of India

From: April 12, 2019: The Times of India

See graphic:

The performance of Indian corporations under NDA and UPA governments, 1999-March 2019.

It has been a mixed bag for the market and India Inc during Modi’s tenure. The growth of corporate earnings has dropped in four of the five years. Also, the rise in Nifty 500 index during the last five years lagged UPA’s two terms. However, under Modi, the valuations of Nifty 500 companies are at a higher level than the UPA regimes.

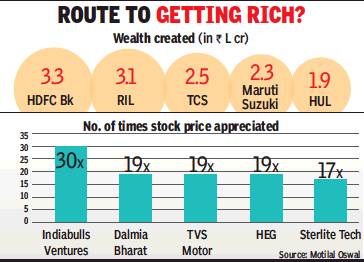

2013-18: HDFC Bank, RIL top

HDFC Bank, RIL create most wealth in FY13-FY18, November 6, 2018: The Times of India

From: HDFC Bank, RIL create most wealth in FY13-FY18, November 6, 2018: The Times of India

Consumer-Driven Cos Most Consistent: Study

Companies from sectors that are consumerdriven — like FMCG, retailfocused banks, passenger vehicles and cement — are the most consistent in creating wealth for shareholders in the long term. Of these sectors, banking and financial services companies have been emerging as the fastest wealth creators of late, according to a study by leading domestic financial services house Motilal Oswal.

The study also noted that Titan, the Tata Group company that’s a major player in the watches and jewellery sector, is the most consistent wealth creator in India, followed by Godrej Consumer. Both the companies are majority-owned by Parsi families, known for entrepreneurship and long-term business acumen.

The study also showed that HDFC Bank, Reliance Industries and TCS were the biggest wealth creators for their shareholders in the last five years, starting fiscal 2013, while Indiabulls Ventures, Dalmia Bharat and TVS Motors were the fastest wealth creators during the same period. The annual wealth-creation study, with market capitalisation as the proxy for wealth, is in its 23rd year.

The study found that between these five fiscals, private sector banking major HDFC Bank had created about Rs 3.25 lakh crore worth of wealth for its shareholders, followed by Reliance Industries (Rs 3.1 lakh crore) and TCS (Rs 2.5 lakh crore). Indian oil Corp is the only PSU in this list that created about Rs 1 lakh crore worth of shareholders’ wealth.

It also showed that Indiabulls Ventures nearly doubled its stock price every year during the last five fiscals, while Dalmia Bharat’s stock price, on an average, went up by 81% every year. For TVS Motor, the corresponding figure was 80%. The top 100 companies on BSE that were considered for this study together created value worth nearly Rs 45 lakh crore.

Inputs, raw materials as %age of net sales

2008-2020

Mahesh Vyas, December 5, 2020: The Times of India

Why profits rose sharply during lockdown

NEW DELHI: The main reason why the corporate sector made bumper profits in the quarter ended September 2020 was the significantly lower spending on inputs compared to the sales. Both, sales and expenses declined sharply during the lockdown quarters of June and September 2020. But, expenses fell more sharply than sales did. This helped the corporate sector record bumper profits.

Purchase of raw materials and finished goods for resale accounts for the bulk of the cost structure of non-finance companies. Traditionally, its share has been well over 50 per cent. Therefore, if expenses on account of these grow at a slower pace than the growth in sales, it has a huge impact on the profits. In the past two recessionary quarters when business has shrunk, the fall in expenses on raw materials and finished goods was significantly greater than the fall in the topline. The profits, therefore did not shrink and in fact grew even though the business shrank.

But, how can the growth in expenses on raw materials and purchased finished goods be lower than the growth in sales? This can happen because of one or a combination of more than one of the following three factors a shift in the terms of trade or, by a drawing down of inventories, or through efficiency gains.

A favourable shift in the terms of trade implies that the prices of raw materials and purchased finished goods rise at a slower rate compared to the increase in prices of the corresponding goods sold or, they fall at a faster rate compared to the fall in prices of goods sold.

In times of uncertainty such as the kind faced by the corporate sector during the lockdown, companies would prefer to use the raw materials and purchased finished goods available in their stock and not replenish them till these are drawn down substantially and the uncertainty of the business environment reduces.

During the lockdown, the logistics cost of replenishing stocks could have increased and this could be a cost companies would try and avoid. This would directly lead to a fall in raw material and purchased finished goods stock. But, companies would try their best to sell in a difficult market to meet their fixed cost. This positively impacted profits in the September 2020 quarter.

The third factor of efficiency gains usually plays out over the long run. Efficiency gains are obtained by companies engineering structural changes including inventory management to reduce the effective working capital cycle.

We can examine the impact of a shift in terms of trade using the wholesale price indices for manufactured goods on the one hand and, minerals, crude petroleum and gas, fuel and power, and non-food-non-mineral primary articles such as fibres and oilseeds which are inputs to manufacturing companies. Prima facie, manufactured companies did gain from favourable terms of trade in the September 2020 quarter.

The wholesale price index of manufactured products rose y-o-y by 1.19 per cent. However, the index for fuel and power fell 9.49 per cent, that for non-food-non-mineral articles fell by 2.41 per cent and crude oil and natural gas fell by 17.74 per cent. Only the index for minerals rose by 4.99 per cent. The minerals index has a weight of only 0.83 per cent in the WPI compared to crude petroleum and gas that has a weight of 2.41 per cent, non-food articles of 4.12 per cent and fuel and power of 13.15 per cent.

Manufacturing companies had favourable terms of trade even in the June 2020 quarter. Prices of manufactured goods fell by 0.03 per cent but those of fuels were down by 17.36 per cent, non-food articles by 3.23 per cent and crude petroleum and natural gas by 35.59 per cent. Only minerals rose 1.40 per cent.

Next, we examine the role of draw-down of inventories. A quick way of examining this would be the ratio of raw material costs as a per cent of sales. In the present case such a comparison will be partially confounded by the terms-of-trade factor described above. Nevertheless, it may be instructive to see the behaviour of this ratio in the past two quarters.

The raw materials to sales ratio dropped from over-50 per cent historically, to 44 in the June 2020 quarter. This is a very sharp fall and may not be explicable entirely by the change in terms of trade. It implies that companies spent less on raw materials than they earned through sales. This is possible through drawing down of inventories. But, inventories are not infinite. At some time they have to be replenished.

In the September 2020 quarter, the raw material to sales ratio climbed to 50 per cent. This is still lower than historical values which were higher than 50 per cent. Companies were still drawing upon inventories. But, this was much lesser than it was in the June 2020 quarter.

If, as is evident from the above, companies have been drawing down inventories for two consecutive quarters, then the need to replenish in the coming quarters will be correspondingly high. This could mean that sales growth would be lower than growth in expenses on raw materials and purchased finished goods.

But, it may not be wise to expect the replenishing of stocks to be an arithmetical phenomenon. Business managers do not waste a crisis easily. The lockdown is likely to have taught them lessons to manage with lower stocks. We say this with some confidence because historically, companies have been systematically reducing the ratio of raw materials and purchased finished goods to sales. A structural change is underway.

The ratio has come down from 60-65 per cent till 2014 to 55-58 per cent since then. It is possible that this ratio will structurally fall further as companies worry about the increased risks and uncertainties of the new post-pandemic world.

(Mahesh Vyas is an economist and CEO of Centre for Monitoring Indian Economy)

Integrity and corporate governance

2011-18

From: September 26, 2018: The Times of India

See graphic:

Integrity and corporate governance in India, 2011-18

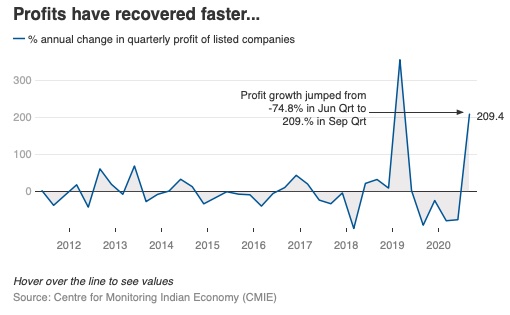

Profit growth

2012-2020

Mahesh Vyas, November 19, 2020: The Times of India

From: Mahesh Vyas, November 19, 2020: The Times of India

From: Mahesh Vyas, November 19, 2020: The Times of India

Covid-19: Why profits have rebounded faster than wages

NEW DELHI: Companies listed on the stock markets made bumper profits in the quarter ended September 2020. They registered their highest aggregate profits during the most recessionary times in Indian history. The economy is shrinking this year and companies have seen their sales decline year-on-year for five straight quarters. But, listed companies have never made profits like they made in the quarter ended September 2020. Understandably, shareholders are being awarded interim dividends or buy-backs. There is still very little interest in investing into new capacities.

Owners of capital have benefitted well in these very difficult times. But, labour has not been as lucky. Growth in profits in the September 2020 quarter was higher than in the top quartile of the distribution of profits growth over the past 60 quarters, which was 21.9 per cent. Wages grew by 3.8 per cent in the quarter of September 2020, which was lower than the bottom quartile of its distribution which was 7.8 per cent.

The average y-o-y growth in wages over the past 60 quarters has been of the order of 13 per cent. The low single-digit growth in wages in the last two quarters is therefore very low by historical standards and is in stark contrast to the extraordinary profits earned by companies.

It is enticing to compare the growth in profits against growth in wages. It harks back to a classic tussle between owners of capital and owners of labour. But, in business and for corporate honchos, there is no relation between growth in profits and growth in wages. The two move completely independently. Corporate managers would minimise their wage bill to maximise their profits.

Manufacturing companies witnessed a 9.1 per cent fall in wages in the June 2020 quarter. This was the toughest quarter. Sales had shrunk by 42 per cent and net profits by 62 per cent. An axe on the wage bill was understandable. Then, in the September 2020 quarter, while sales fell again by 9.7 per cent, profits sprang a surprise by scaling up by a handsome 17.8 per cent. Yet, wages declined by one per cent. Evidently, companies do not apportion resources to labour in any proportion of profits.

Labour has a structural relationship with other costs. In listed manufacturing companies, wages accounted for 4-5 per cent of net sales till 2014 and since then it has accounted for 5-6 per cent. In the June 2020 quarter in spite of a 9.1 per cent fall in the wage bill, its share in net sales went up to 8.6 per cent. In the September 2020 quarter it was 6.2 per cent, which was closer to its earlier level. This share is still higher than historical levels and this could make a case for a further cut by either a recovery in business and thereby an increase in other costs or through further cuts in the wage bill.

Labour plays a bigger role in the cost structure of the services sectors. In non-financial services, wages accounted for about 15 per cent of net sales till 2014. This has since risen to 20-21 per cent. In the June 2020 quarter, this spiked to 27.6 per cent. Then it came down to 24 per cent in the September 2020 quarter. But again, it is out of line with the past cost structures and therefore is likely to decline as a proportion of net sales as the business improves.

The non-financial services sector suffered losses on an aggregate basis in the March and June 2020 quarters. Profits were posted in the September 2020 quarter. However, the large sustained losses in the communications, aviation, trade and hotels and tourism industries may continue for some more quarters. This raises doubts about the ability of these labour intensive industries to provide employment again in the short term.

Employment in the corporate sector could recover if business picks up again and employment would grow only if the corporate sector starts investing into new capacities. New reports suggest that the banking and IT sectors have started awarding pay hikes and bonuses. But, these two sectors were outliers in the fall in sales and wages in the last two quarters. Wages in the banking industry grew by 23-24 per cent and in the IT sector they grew by 5-6 per cent during this period. The remaining sectors collectively saw a 9 per cent fall in wages in the June quarter and a 5 per cent fall in the second quarter.

The outstanding profit performance in the September 2020 quarter may contain any fall in the wage rate in the corporate sector for some time but, employment growth will depend upon a sustained revival of demand. The last quarter benefitted from an exceptionally good southwest monsoon, a correspondingly bumper kharif crop, increased spending on MGNREGA and pent-up demand.

The rising share of wages in the total cost structure of manufacturing and services companies could bring it under the managers’ axe if demand does not pick-up. The lockdown has taught companies a lesson or two on running business with fewer human resources. These lessons are unlikely to be forgotten.

(Mahesh Vyas is an economist and CEO of Centre for Monitoring Indian Economy)

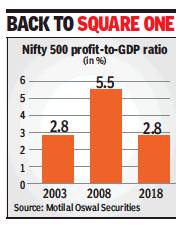

Profit-to-GDP ratio

2019: lowest in 15 years

Cos’ profit-to-GDP ratio at 15-year low, January 26, 2019: The Times of India

From: Cos’ profit-to-GDP ratio at 15-year low, January 26, 2019: The Times of India

The contribution of India Inc’s profitability to the country’s GDP dipped to a 15-year low in fiscal 2018, thanks mainly to the below-par performance by public sector banks. From a high of 5.5% in 2008, the ratio of corporate profitability to India’s GDP is currently at 2.8% — the same level it was in 2003.

The other sectors that contributed to this decline significantly were the metals and oil & gas sectors, where prices are dictated mainly by global factors, along with the telecom sector, which saw huge competition in the past few years. On the other hand, the sectors that cushioned the fall were private banks, NBFCs, autos and technology, all of which put up a good show, according to a report by domestic brokerage major Motilal Oswal Securities.

“Over the last decade, the corporate earnings distress in India has translated into corrosion in the Nifty 500 profitto-GDP ratio from 5.5% to 2.8%,” the report noted. “Sectors that have been most stable and rising to prominence over these 15 years are technology, NBFCs, private financials, autos and metals. Profits of these sectors as a percentage of GDP has increased by three-four times over 2003-18.”

The report pointed out that profit contribution to GDP of NBFCs is at a new high (0.40%), while that of PSU banks is at a new low (-0.44%).

Sales revenue

2015-16: worst year since 1991

Atul Thakur, February 12, 2018: The Times of India

profit after tax,

of 21,000 Indian companies

From: Atul Thakur, February 12, 2018: The Times of India

HIGHLIGHTS

Sales during 2015-16 grew at a mere 1.6 per cent, worst since the liberalisation of economy in 1991

Over these 26 years, there have been five years in which growth in sales revenue crossed 20 per cent, with the 27 per cent recorded in 1994-95 being the highest

The year 2015-16 was the worst corporate India has seen in the post-liberalisation era in terms of growth in sales revenue. Sales during that year grew at a mere 1.6 per cent, shows data from the Centre for Monitoring Indian Economy (CMIE), an independent agency that tracks economic and business data.

The data, which collates information for over 21,000 companies, shows that other indicators like profitability and growth in employee compensation during 2015-16 were also among the worst in the last 26 years.

The data for the period 1990-91 to 2015-16 shows that there were only six years in which the combined sales of all the companies being tracked grew at single-digit rates and 2015-16 was by far the worst. The growth in corporate sales was just over 3 per cent for 2001-02, the second-lowest in this period.

Over these 26 years, there have been five years in which growth in sales revenue crossed 20 per cent, with the 27 per cent recorded in 1994-95 being the highest.

Not surprisingly, profitability took a severe beating. In 2015-16, profit after taxes (PAT) for 21,588 companies for which CMIE compiled data fell by more than 19 per cent, the third-largest year-on-year decline since 1990-91. The worst was in 2011-12 when profits had shrunk by over 20 per cent. In 2008-09, the year of the global financial crisis, posttax profits had gone down by nearly 20 per cent.

What makes the profitability picture even gloomier is that it comes on the heels of really low growth rates in post-tax profit in the previous two years —nearly 4 per cent in 2013-14 and 1.5 per cent in 2014-15. As a result, if one looks at the five-year period from 2011-12 to 2015-16, what emerges is that profits in the last of those years was about 25 per cent lower than in 2010-11.

This five-year period stands out as an exception in the entire post-liberalisation era. The years immediately following liberalisation saw extraordinary jumps in corporate profits. In 1993-94 and 1994-95, PAT increased by more than 90 per cent, the highest for this period. Similarly, 2002-03 and 2003-04 saw almost 58 per cent and over 69 per cent increases, respectively, in profits.

Given stagnant sales and declining profits, it should come as no surprise that 2015-16 saw one of the lowest increases in total compensation to employees — just above 9 per cent, the lowest since 2010-11. To put that in perspective, even 2009-10, the year following the global financial crisis that witnessed job losses and salary rollbacks, saw a more than 7 per cent increase in employee's compensation. Stagnant sales and falling profits also explain a continued fall in private investment growth, which started in 2012-13.

The CMIE data, mercifully, suggests that there was some respite from this gloomy situation for India Inc with a smaller sample for 2016-17, which covered 7,152 companies, showing an improvement in all these indicators. Sales were up just over 6 per cent, PAT 18 per cent and employee compensation nearly 10 per cent. Whether this trend will hold when data for the full sample of over 21,000 companies becomes available remains to be seen.

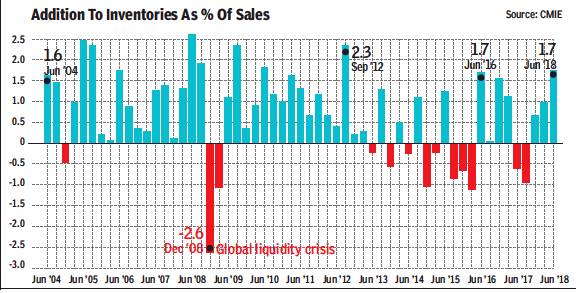

Sales vis-à-vis inventories

2004-2018

August 22, 2018: The Times of India

From: August 22, 2018: The Times of India

See graphic:

Addition to inventories as % of sales, 2004-2018, June

For quarter ending June, inventories as percentage of sales for listed non-finance companies climbed up to a 23-quarter high. The highest build-up was with makers of commercial vehicles, readymade garments and machinery. Is this a sign of demand slowdown towards the end of the last quarter or expectations of a high demand in the forthcoming busy season (Oct-Dec)? Experts are betting on the latter

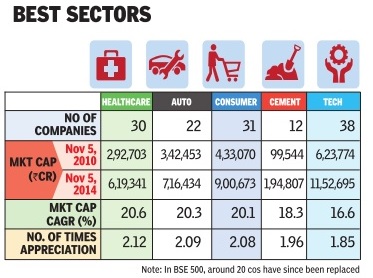

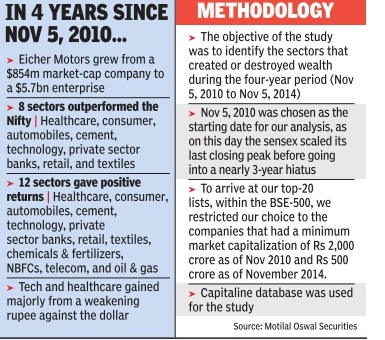

Sector-wise performance

2010-14

HIGH-GROWTH RIDE - Auto, Pharma top wealth creators in 4 years

The Times of India, Jan 01 2015

Partha Sinha & Shubham Mukherjee

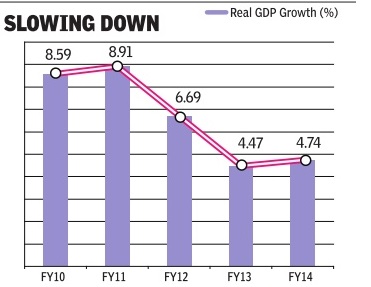

Realty, infra cos saw biggest value erosion since the 2010 highs as the economy went through a turmoil and the markets stagnated before rebounding to new peaks in 2014

Just over four years ago, the Indian economy was cruising at a near 9% annual rate of growth and on Di wali day in 2010, the sensex scaled a new high, closing above the 21,000 mark for the first time ever.However, since then as inflation rates spiked and interest rates spiralled, the government entered a phase of prolonged policy paralysis with the growth nearly halving to about 4.5% within two years. Rupee depreciation and widening current account deficit added to the negativity and it has since been a phase of almost flat GDP growth with muted corporate performance.

But a focused group of companies braved the headwinds and posted handsome returns for anyone who had invested in them, reveals a TOI-commissioned study done by Motilal Oswal Securities (See `Top Of The Charts' table). Significantly, most of these companies are not even leaders in the respective industries they operate in.Incidentally , the sectors that created wealth such as healthcare, consumer, automobiles, private sector banks and retail are all consumer-facing.

Topping the list of these outliers is Eicher Motors, makers of Royal Enfield bikes, with an eye-popping stock rise of about nine times in just four years. The stock rose from Rs 1,410 in early November 2010 to Rs 12,849 on this Diwali day . On the flip side, the biggest loser is MMTC with a current market capitalization of just about 5% of the value four years ago. So if you had invested Rs 100 in MMTC four years ago, you would be left with just Rs 5.

When contacted by TOI, Siddhartha Lal, MD & CEO, Eicher Motors, credited his performance to a differentiated product offering, providing a seamless chain between production to retail and an unrelenting focus on the two product lines motorcycles and commercial vehicles. “We are committed to the investor community and our longterm focus may have added to this (performance),“ he said.

Six of the top-20 wealth creators Eicher Motors, Motherson Sumi, TVS Motor, MRF , Wabco India and Apollo Tyres belong to automobiles. Consumer (Berger Paints, Bata India and Britannia), healthcare (Aurobindo Pharma, Sun Pharma and Torrent Pharma), and technology (Mindtree, HCL Technologies and Tech Mahindra) have contributed three companies each to the top-20 wealth creators' list. Besides, there are two NBFCs (Sundaram Finance and Bajaj Finance), a cement company (Shree Cement), a capital goods company (Havells India), and a Logistics company (Blue Dart Express).

Rajat Rajgarhia, MD, institutional equities, Motilal Oswal Securities, puts the findings of the study in perspective. “ Any time is the right time to buy stocks; the art lies in stock-picking. Even during the last four years, when the market indices have gone nowhere, numerous stocks have multiplied several times. On the flip side, hordes of stocks are now available at small fractions of their value four years ago,“ he said.

In contrast to the stocks that have grown investors' wealth multiple times, some of the worst performers have lost up to 95% of their value during this period, while a large number have witnessed around 75% value erosion (See `Bottom Of The Pile' table). All the stocks in the list of top-20 wealth destroyers have erased at wealth destroyers have erased at least 75% of their market capitali zation during the four-year period.

Some of the top laggards are from sectors which have been in a secular downturn for the past few years like power, real estate, infra structure and sugar. Companies like Shree Renuka Sugars, Bajaj Hindustan, JP Power Ventures, etc belong to this group.Metal companies like MMTC, Monnet Ispat and Hindustan Copper are in a cyclical downturn. There's a third group, consisting of companies which got into major controversies and faced regulatory scrutiny . DB Realty , Financial Technologies and Bhusan Steel belong to the third group.

Eight sectors outperformed the CNX Nifty over the four-year period: healthcare, consumer, automobiles, cement, technology , private sector banks, retail, and textiles (see `Best Sectors' table). All other sectors chemicals & fertilizers, NBFCs, telecom, oil & gas, capital goods, media, public sector banks, utilities, metals, real estate, and miscellaneous underperformed. A total of 12 sectors healthcare, consumer, automobiles, cement, technology , private sector banks, retail, textiles, chemicals & fertilizers, NBFCs, telecom, and oil & gas delivered positive returns. Seven sectors capital goods, media, public sector banks, utilities, metals, real estate, and miscellaneous delivered negative returns. The performance of the technology and healthcare sectors has been favourably impacted by a weakening rupee. Most of the sectors that destroyed wealth including real estate, metals, utilities, infrastructure, public sector banks, and capital goods are deeply cyclical and were affected by policy paralysis during the UPA-2 regime.