Soap industry: India

| Line 1: | Line 1: | ||

| − | {| | + | |

| + | {| class="wikitable" | ||

|- | |- | ||

|colspan="0"|<div style="font-size:100%"> | |colspan="0"|<div style="font-size:100%"> | ||

This is a collection of articles archived for the excellence of their content.<br/> | This is a collection of articles archived for the excellence of their content.<br/> | ||

| + | Additional information may please be sent as messages to the Facebook <br/>community, [http://www.facebook.com/Indpaedia Indpaedia.com]. All information used will be gratefully <br/>acknowledged in your name. | ||

</div> | </div> | ||

|} | |} | ||

| + | |||

| Line 49: | Line 52: | ||

[[Category:India|S | [[Category:India|S | ||

SOAP INDUSTRY: INDIA]] | SOAP INDUSTRY: INDIA]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|S SOAP INDUSTRY: INDIA | ||

| + | SOAP INDUSTRY: INDIA]] | ||

| + | [[Category:India|S SOAP INDUSTRY: INDIA | ||

| + | SOAP INDUSTRY: INDIA]] | ||

| + | [[Category:Pages with broken file links|SOAP INDUSTRY: INDIA]] | ||

Revision as of 18:21, 24 August 2021

This is a collection of articles archived for the excellence of their content. |

2018

From: Namrata Singh, Has Santoor overtaken Lux as India’s No. 2 soap brand?, June 13, 2018: The Times of India

The toilet soaps market may have become slippery for some brands to hold on to their positions in the pecking order. Santoor, from Wipro Consumer Care & Lighting (WCCL), is within striking distance of the Rs 2,000-crore turnover mark — a feat so far achieved only by Hindustan Unilever’s (HUL’s) Lifebuoy soap, the leading brand of the category.

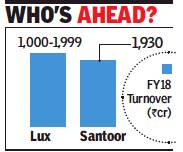

Santoor closed the financial year 2018 with a turnover of Rs 1,930 crore and chances are it may have overtaken HUL’s beauty soap brand Lux to become the secondlargest toilet soap brand in the country. While there is no confirmation on Lux’s exact annual turnover, it figures in the list of HUL’s Rs 1,000-crore-plus brands. The turnover of Lux could thus be anywhere in the Rs 1,000-1,999 crore range. Even if one were to presume Lux closed the previous fiscal with a turnover that was more than Santoor’s Rs 1,930 crore, the gap between the two brands would be very narrow, making the race to the Rs 2,000-crore mark a close one.

WCCL CEO Vineet Agrawal told TOI, “Santoor has clocked Rs 1,930 crore in financial year 2017-18.” He said the brand’s rural market shares are significantly higher than urban. “In Telangana and Andhra Pradesh (AP), our market share is 38-40%. The No. 2 brand would be onefourth our size in this market. Santoor is No. 1 in AP, Karnataka, Maharashtra and Gujarat (rural), and in AP & Telangana (urban and rural combined),” he added.

An HUL spokesperson said Lux has grown well in the last year. “It (Lux) is the second-largest soap brand in India after Lifebuoy,” said the HUL spokesperson, without commenting on or disclosing individual brand growth numbers. Agrawal said, “The advertising (of Santoor) has stuck to the ‘younger looking skin’ platform for the last 25+ years. Even in rural India, we stuck to the same communication. This is because India had opened up and rural people were exposed to urban aspects.”

2019/ Q1

Namrata Singh, June 26, 2019: The Times of India

From: Namrata Singh, June 26, 2019: The Times of India

Santoor 1st desi soap to hit ₹2k-cr sales

Mumbai:

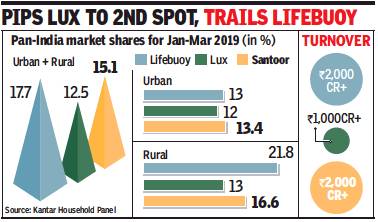

Santoor has become the first soap brand from an Indian FMCG company to breach annual sales of Rs 2,000 crore. Wipro Consumer Care, the maker of Santoor, confirmed the number to TOI. With a turnover of over Rs 2,000 crore, Santoor has clearly overtaken HUL’s soap brand Lux, and is now challenging the numero uno Lifebuoy. HUL’s latest annual report places Lifebuoy and Lux in the Rs 2,000-crore and Rs 1,000-crore plus sales bracket, respectively.

Wipro Consumer Care and Lighting CEO Vineet Agrawal said, “Santoor has grown consistently across urban and rural markets. It is now among the Rs 2,000-crore plus consumer brands — first and only Indian soap brand to do so.”

According to industry sources quoting Kantar Household panel data, Santoor’s all-India market share in January-March 2019, at 15.1%, has exceeded Lux’s 12.5%, but is less than Lifebuoy’s 17.7%. The urban market data, however, shows Santoor (13.4%) ahead of both Lux (12%) and Lifebuoy (13%). Kantar declined to comment on this data. Industry sources quoting Nielsen data said Santoor (9.3%) is the third-largest brand after Lifebuoy (13.7%) and Lux (12%) for January-March 2019. When contacted, an HUL company spokesperson said, “Lux continues to be the second-largest soap brand in India after Lifebuoy. As a policy, we do not comment on market shares.”

Insights into data from Worldpanel Division of Kantar reveal that Santoor’s penetration is much higher than Lux in South and parts of West regions. However, at a national level, Santoor has a much lesser penetration than Lux (34% against 60%).

Lux’s penetration is driven by the Rs 10-pack (about 55g), with 60% of Lux-buying homes purchasing this pack. On the other hand, Santoor’s penetration is driven largely by its 75g+ pack, with 70% of Santoor-buying homes purchasing this pack. According to the data from Worldpanel Division of Kantar, Santoor also has a higher number of buying occasions than Lux (Santoor buyers purchase about 45% more times than Lux buyers). As a result, the overall volumes of Santoor have gone ahead of Lux in recent times.