Taxes: India

(→Share of direct, corporate, income taxes) |

(→Tax collection) |

||

| Line 62: | Line 62: | ||

''%change in industrial production and tax collection ,2015-16'' | ''%change in industrial production and tax collection ,2015-16'' | ||

| − | [[Category:Economy-Industry-Resources|T | + | ==2011-21== |

| + | [[File: Tax receipts, direct and indirect, India, 2011-21.jpg| Tax receipts, direct and indirect, India: 2011-21 <br/> From: [https://epaper.timesgroup.com/article-share?article=19_04_2022_013_003_cap_TOI April 19, 2022: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Tax receipts, direct and indirect, India: 2011-21 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|T TAXES: INDIA | ||

TAXES: INDIA]] | TAXES: INDIA]] | ||

| − | [[Category:India|T | + | [[Category:India|T TAXES: INDIA |

| + | TAXES: INDIA]] | ||

| + | [[Category:Pages with broken file links|TAXES: INDIA | ||

TAXES: INDIA]] | TAXES: INDIA]] | ||

| − | |||

Revision as of 06:21, 6 May 2022

This is a collection of articles archived for the excellence of their content. |

Contents |

1995-2017

From: The Times of India, Feb 2, 2017

See graphic:

The share of direct taxes, service tax, excise duty and customs duty in the total tax collections of India, 1995-2017

1950-2021

From: February 2, 2022: The Times of India

See graphic:

The share of direct and direct, corporate and income taxes in the total tax collections of India, 1950-2021

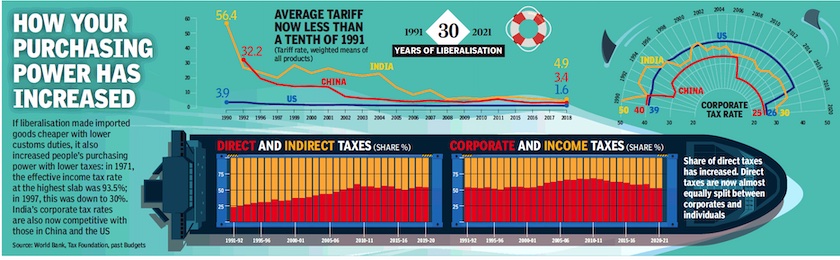

1991-21

The Share of direct, corporate, income taxes;

Tariff rates.

From: February 1, 2021: The Times of India

See graphic:

1991-21

The Share of direct, corporate, income taxes;

Tariff rates.

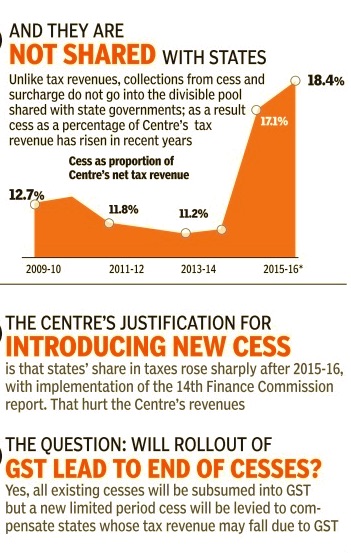

2009-16

From: The Times of India, Feb 2, 2017

See graphic:

Cess as proportion of centre's net tax revenue, 2009-16 and impact of GST on imposition of cesses

2009-19

From: The Times of India, Feb 2, 2017

See graphic:

Cess in Indian economy and revenue collection from cesses, 2009-17 and cesses and surcharges that fetch over Rs. 1000 crore annually

Tax collection

2015-16

From: The Times of India, Feb 11, 2017

See graphic:

%change in industrial production and tax collection ,2015-16

2011-21

From: April 19, 2022: The Times of India

See graphic:

Tax receipts, direct and indirect, India: 2011-21