The Adani group

(→Colombo port, shipping container terminal) |

(→2024) |

||

| (4 intermediate revisions by one user not shown) | |||

| Line 57: | Line 57: | ||

AEL earned revenues of Rs 26,824 crore, and made a net profit of Rs 720.70 crore during fiscal 2022, according to the BSE website. During the second quarter ended September 2022, it reported a revenue of Rs 22,136 crore, and a net profit of Rs 469 crore. | AEL earned revenues of Rs 26,824 crore, and made a net profit of Rs 720.70 crore during fiscal 2022, according to the BSE website. During the second quarter ended September 2022, it reported a revenue of Rs 22,136 crore, and a net profit of Rs 469 crore. | ||

| + | =Coal= | ||

| + | ==2024/ FT report on ‘low quality’ coal false: Adani Group== | ||

| + | [https://epaper.indiatimes.com/article-share?article=23_05_2024_011_017_cap_TOI May 23, 2024: ''The Times of India''] | ||

| + | |||

| + | |||

| + | New Delhi : The Adani Group said any suggestion that one of its companies supplied inferior coal to the Tamil Nadu Generation and Distribution company (TANGEDCO), as compared to the quality standards laid down in the tender and purchase order (PO), is incorrect and asserted that it operates a robust corporate governance framework and is strongly committed to following all laws and regulations in all jurisdictions. | ||

| + | |||

| + |

The company was responding to a report published in the Financial Times which alleged that the Adani Group passed off low-quality coal as far more expensive cleaner fuelin transactions with an Indian state power utility. The newspaper cited evidence it had seen and said it throws fresh light on allegations of a long-running coal scam. | ||

| + | |||

| + |

“Your allegations are false and baseless, and we strongly reject any suggestion that the Adani portfolio of companies did not act as per regulations,” the Adani group said in a detailed rebuttal of the newspaper report. | ||

| + | |||

| + |

“The PO 89 of TANGEDCO was a fixed price contract, won through an open, competitive, global bidding process, wherein Adani Global Pte Ltd was contractually obliged to supply coal to TANGEDCO at a pre-determined price. So, the supply price was market-determined and TANGEDCO had contractually insulated itself from any kind of supply risk, including on price,” the Adani Group said in a statement. | ||

| + | |||

| + |

“Any upside or downside due to price fluctuations was to be completely borne by the supplier, needless to say the risk of which was very high due to the volatility in coal prices,” said the Adani Group statement.

| ||

| + | |||

| + | The FT report claimed that the documents secured by the Organised Crime and Corruption Reporting project (OCCRP) and reviewed by the newspaper added a “potential environmental dimension” to accusations of corruption associated with the Indian conglomerate. | ||

| + | |||

| + |

“They suggest that Adani may have fraudulently obtained bumper profits at the expense of air quality, since low-grade coal for power means burning more of the fuel,” the FT report alleged. The Adani Group said that the suggestion that Adani Global Pte Ltd supplied to TANGEDCO inferior coal, as compared to the quality standards laid down in the tender and PO, was incorrect.

| ||

| + | |||

| + | “While it is difficult for us to comment on individual cases due to the sheer volume of data and the elapsed time, not to add the contractual and legal obligations, it is important to note that the coal supplied, irrespective of the declaration by the supplier, is tested for quality at the receiving plant,” said the Adani statement.

| ||

| + | |||

| + | Adani Group’s market capitalisation regained $200 billion-mark (Rs 16.9 lakh crore) after its listed firms gained Rs 11,300 croreas investors brushed off the allegations made by the London-based newspaper. | ||

| + | |||

| + |

With Rs 11,300 crore gain on Wednesday, the apples-to-airport conglomerate gained Rs 56,250 crore in market capitalisation in the last two trading sessions, stock exchange data showed. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

=Colombo port, shipping container terminal= | =Colombo port, shipping container terminal= | ||

| Line 125: | Line 156: | ||

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

[[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| Line 215: | Line 223: | ||

Common sense suggests that a law firm with whose partners Adani directors have family ties presents a potential for conflict. The legal fees paid to CAM are not important to a group of Adani’s size. But India Inc’s culture of disclosure — or its absence — ought to be. |

Common sense suggests that a law firm with whose partners Adani directors have family ties presents a potential for conflict. The legal fees paid to CAM are not important to a group of Adani’s size. But India Inc’s culture of disclosure — or its absence — ought to be. | ||

| + | |||

| + | =Penna Cement Industries= | ||

| + | ==Purchase in 2024== | ||

| + | [https://epaper.indiatimes.com/article-share?article=14_06_2024_022_014_cap_TOI Reeba Zachariah & Swati Bharadwaj TNN, June 14, 2024: ''The Times of India''] | ||

| + | |||

| + | [[File: Cement capacity, UltraTech, Ambuja, Shree Cement, FY24.jpg|Cement capacity, UltraTech, Ambuja, Shree Cement, FY24 <br/> From: [https://epaper.indiatimes.com/article-share?article=14_06_2024_022_014_cap_TOI Reeba Zachariah & Swati Bharadwaj TNN, June 14, 2024: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | Mumbai/Hyderabad: The Gautam Adani family owned Ambuja Cements is buying Penna Cement Industries in a deal valued at Rs 10,442 crore including debt, expanding its presence in the south. The transaction marks Ambuja’s fourth M&A after Adani checked into the sector through the former in Sept 2022. | ||

| + | |||

| + |

Hyderabad-based Penna, promoted by P Prathap Reddy and family, has an annual production capacity of 14 million tons (of which 4 million tons is under construction). It also has limestone reserves and captive power plants. | ||

| + | |||

| + |

The Penna acquisition, to be financed by internal accruals, will improve Ambuja’s share by 8% in south India and comes months after market leader UltraTech Cement ramped up its play in the region by buying Kesoram Industries’ building materials units. As of April end, Ambuja had cash of Rs 24,338 crore on its books, having received warrant money of Rs 8,339 crore from the Adani family. | ||

| + | |||

| + |

The Penna transaction will help Ambuja and its arms, including ACC and Sanghi Industries, beef up capacity to 89 million tons, moving towards its larger goal of 140 million tons by 2028. UltraTech, owned by Kumar Mangalam Birla, has a capacity of over 150 million tons. In April, India’s third-largest player Shree Cement, led by Hari Mohan Bangur, inaugurated a3-million-ton plant in Andhra Pradesh to bolster its capacity to 56 million tons. | ||

| + | |||

| + |

Ambuja previously acquired Gujarat-based Sanghi, My Home’s cement unit in Tamil Nadu and Asian Concretes and Cements’ plants in Hima- chal Pradesh and Punjab. | ||

| + | |||

| + |

Prathap Reddy had earlier looked at an IPO for his cement business but subsequently changed plans. In Oct 2021, Penna received markets regulator Sebi’s nod for a Rs 1,550-crore IPO but did not proceed with it. “Initially we thought (of an IPO) but it got delayed. I have decided to do (away) with (the cement business),” Reddy told TOI. | ||

| + | |||

| + |

The businessman, known as ‘Penna’ Reddy in Hyderabad circles, was considered a confidant of former Andhra Pradesh CM YS Jagan Mohan Reddy’s father YS Rajasekhara Reddy, the unified Andhra Pradesh CM who died in a chopper crash in Sept 2009. Reddy was made an accused in the Penna chargesheet in the Jagan disproportionate assets case that is being probed by CBI and ED. Jagan’s YSR Congress Party lost the recent Andhra assembly polls to Nara Chandrababu Naidu-led Telugu Desam Party.

| ||

| + | |||

| + | Incorporated in Oct 1991, Penna had a turnover of Rs 1,241 crore in FY24. In FY22, its turnover was Rs 3,204 crore. In May 2019, Penna had acquired Sri Lanka-based Singha Cement that operates a 0.5 mtpa cement packing terminal in Colombo. | ||

| + | |||

| + |

Penna’s seven plants in Andhra Pradesh, Telangana and Rajasthan (under construction) and limestone reserves “provide an opportunity to increase cement capacity through debottlenecking and additional investment”, said Ambuja Cements CEO Ajay Kapur . “Importantly, the bulk cement terminals will prove to be a game-changer by giving access to the eastern and southern parts of peninsular India, apart from an entry to Sri Lanka, through the sea route,” Kapur added. | ||

| + | |||

=Vinod Adani-= | =Vinod Adani-= | ||

| Line 795: | Line 829: | ||

Records of offshore corporate service provider Trident Trust accessed by The Indian Express as part of the Pandora Papers investigation showed that these two shell companies registered in the BVI, were, indeed, linked to the Adani Group. | Records of offshore corporate service provider Trident Trust accessed by The Indian Express as part of the Pandora Papers investigation showed that these two shell companies registered in the BVI, were, indeed, linked to the Adani Group. | ||

| − | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | =2024= |

| + | ==Hindenburg 2.0: SEBI chief’s involvement== | ||

| + | [https://epaper.indiatimes.com/article-share?article=11_08_2024_001_006_cap_TOI Partha Sinha, August 11, 2024: ''The Times of India''] | ||

| + | |||

| + | [[File: Madhabi Puri Buch, allegations, 2015- 2022.jpg|Madhabi Puri Buch, allegations, 2015- 2022 <br/> From: [https://epaper.indiatimes.com/article-share?article=11_08_2024_001_006_cap_TOI Partha Sinha, August 11, 2024: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | Mumbai : Hindenburg Research, the US short-seller that in Jan 2023 had alleged extensive corporate fraud by the Adani group using offshore vehicles, cited whistleblower documents claiming that Sebi chairperson Madhabi Puri Buch, with husband Dhaval, had also invested in the same offshore entities. | ||

| + | |||

| + |

Sebi chief and her husband, through 360 One WAM (IIFL’s wealth management arm), had allegedly invested in Global Dynamic Opportunities Fund, the same fund that Vinod Adani, elder brother of Gautam Adani, had used to invest in Adani group’s stocks, Hindenburg said. The Adani group refuted all of Hindenburg’s allegations. The report that was released late Saturday evening alleged that Sebi “drew a blank” in its probe against Adani due to alleged investments by Buch and her husband in the offshore funds. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP |

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP |

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

Revision as of 06:24, 16 August 2024

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

Adani Enterprises Ltd: the flagship

As in 2023/ early Feb

George Mathew , Sandeep Singh, February 4, 2023: The Indian Express

From: George Mathew , Sandeep Singh, February 4, 2023: The Indian Express

Starting as a small-time commodity trading business, Adani Enterprises Ltd (AEL), the flagship of the Adani Group founded by Gautam Adani, went on to incubate half-a-dozen companies and grew through acquisitions. The scorching run of Adani companies led by AEL on the stock exchanges took the Group to the numero uno position in market capitalisation and made Gautam Adani the third richest man in the world before the Hindenburg Research report triggered a collapse in the share prices of Group companies.

AEL stock since Jan 25

As the Adani Enterprises follow-on-public offering (FPO) to raise Rs 20,000 crore opened for subscription on January 25 for anchor investors, US-based Hindenburg Research released a report on the Adani group, accusing the group of “brazen stock manipulation and accounting fraud”.

Even as the Adani group termed the report “maliciously mischievous”, and even said that it was planning to sue Hindenburg, shares of all nine listed group companies came under pressure. Over the last seven trading sessions, they have lost an aggregate of Rs 9.1 lakh crore in market capitalisation — 47.4 per cent of their market cap. The group market cap fell from Rs 19.18 lakh crore on January 24 to Rs 10.07 lakh crore on February 3.

The flagship Adani Enterprises came under huge selling pressure on Wednesday and Thursday. Over the last seven trading sessions, its stock has fallen by 54 per cent.

The group had to call off AEL’s FPO a day after it managed to get full subscription to the issue, following interest from non-institutional investors and family offices of large corporations. The shares were called off after they plunged by over 25 per cent on Wednesday. Gautam Adani said that he would refund the investors’ money, and that the decision was taken to safeguard the interest of investors.

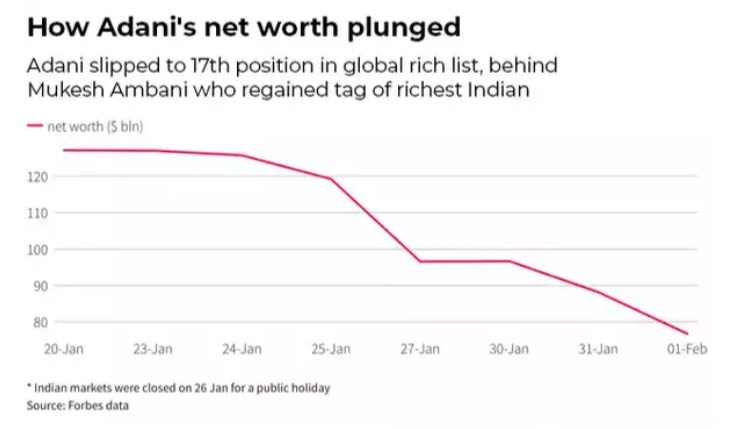

The decline in share prices of the Adani group has led to significant erosion in the net worth of Gautam Adani, who slipped from 3rd spot to 17th spot on the index of global billionaires February 3, with a net worth of $61.7 billion.

AEL growth trajectory

Gautam Adani, then 26 and a school dropout who had done short stints as a diamond sorter and managing a small plastic unit, established AEL as a partnership firm in 1988. It was registered and incorporated in Ahmedabad as Adani Exports Ltd on March 2, 1993; the name was subsequently changed to Adani Enterprises Ltd to reflect changes in its business strategies. A fresh certificate of incorporation was issued by the Registrar of Companies on August 10, 2006.

The company acquired coal mines in India, Indonesia, and Australia, and became the country’s largest private coal importer. The power unit it promoted became the largest private power producer. AEL also entered the ports and airport sectors, and acquired Ambuja Cements and ACC in May 2022.

The company operates and manages seven airports — in Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, and Thiruvananthapuram — and is developing a greenfield airport in Navi Mumbai. As of September 30, 2022, it had 14 road assets, of which three have started commercial operations.

AEL offers mining services including contract mining, development, production-related and other services, as well as integrated resource management services of coal, which involves accessing coal from diverse global pockets and providing just-in-time delivery to Indian customers. It also recently acquired mines to conduct commercial mining activities.

It also manufactures, markets, and brands food FMCG products, and is developing a super-app, “Adani One”, to complement the group’s consumer serving businesses.

According to the prospectus, the company intends to manufacture petrochemicals, copper and similar metals, and strategic military and defence products that enhance India’s self-reliance.

The AEL board

While Gautam Adani is the chairman of the board, his younger brother Rajesh Adani is managing director. Pranav Adani, son of Gautam’s elder brother Vinod Adani, is also on the board.

Other members include M Narendra, former chairman and MD of Indian Overseas Bank; V Subramanian, a former Secretary in the Ministry of New and Renewable Energy; H Nerurkar, a former MD of Tata Steel; Omkar Goswami, founder of CERG Advisory and a former consultant to the World Bank, IMF, ADB, and OECD; Vinay Prakash, CEO of Adani Natural Resources; and Vijaylaxmi Joshi, a former Secretary in the Ministry of Panchayati Raj.

Gautam Adani has two sons — Karan is the CEO of Adani Ports, and Jeet is Vice President (Group Finance).

AEL’s performance

AEL earned revenues of Rs 26,824 crore, and made a net profit of Rs 720.70 crore during fiscal 2022, according to the BSE website. During the second quarter ended September 2022, it reported a revenue of Rs 22,136 crore, and a net profit of Rs 469 crore.

Coal

2024/ FT report on ‘low quality’ coal false: Adani Group

May 23, 2024: The Times of India

New Delhi : The Adani Group said any suggestion that one of its companies supplied inferior coal to the Tamil Nadu Generation and Distribution company (TANGEDCO), as compared to the quality standards laid down in the tender and purchase order (PO), is incorrect and asserted that it operates a robust corporate governance framework and is strongly committed to following all laws and regulations in all jurisdictions.

The company was responding to a report published in the Financial Times which alleged that the Adani Group passed off low-quality coal as far more expensive cleaner fuelin transactions with an Indian state power utility. The newspaper cited evidence it had seen and said it throws fresh light on allegations of a long-running coal scam.

“Your allegations are false and baseless, and we strongly reject any suggestion that the Adani portfolio of companies did not act as per regulations,” the Adani group said in a detailed rebuttal of the newspaper report.

“The PO 89 of TANGEDCO was a fixed price contract, won through an open, competitive, global bidding process, wherein Adani Global Pte Ltd was contractually obliged to supply coal to TANGEDCO at a pre-determined price. So, the supply price was market-determined and TANGEDCO had contractually insulated itself from any kind of supply risk, including on price,” the Adani Group said in a statement.

“Any upside or downside due to price fluctuations was to be completely borne by the supplier, needless to say the risk of which was very high due to the volatility in coal prices,” said the Adani Group statement.

The FT report claimed that the documents secured by the Organised Crime and Corruption Reporting project (OCCRP) and reviewed by the newspaper added a “potential environmental dimension” to accusations of corruption associated with the Indian conglomerate.

“They suggest that Adani may have fraudulently obtained bumper profits at the expense of air quality, since low-grade coal for power means burning more of the fuel,” the FT report alleged. The Adani Group said that the suggestion that Adani Global Pte Ltd supplied to TANGEDCO inferior coal, as compared to the quality standards laid down in the tender and PO, was incorrect.

“While it is difficult for us to comment on individual cases due to the sheer volume of data and the elapsed time, not to add the contractual and legal obligations, it is important to note that the coal supplied, irrespective of the declaration by the supplier, is tested for quality at the receiving plant,” said the Adani statement.

Adani Group’s market capitalisation regained $200 billion-mark (Rs 16.9 lakh crore) after its listed firms gained Rs 11,300 croreas investors brushed off the allegations made by the London-based newspaper.

With Rs 11,300 crore gain on Wednesday, the apples-to-airport conglomerate gained Rs 56,250 crore in market capitalisation in the last two trading sessions, stock exchange data showed.

Colombo port, shipping container terminal

2023: $553 million US funding

Nov 9, 2023: The Times of India

New Delhi : In a move that signals Washington’s intent to confront China’s growing influence in India’s neighbourhood and has come as a shot in arm for the Adani Group, the US International Development Finance Corporation (DFC) announced a funding of $553 million (around Rs 4,600 crore) for a deepwater shipping container terminal at Colombo Port, which is being developed with Adani Ports as a JV partner.

The US financing for the largest and busiest transshipment port in the Indian Ocean is seen as a bid to counterbalance China’s influence in the country, where it built a deepwater port in Hambantota, as well as the South Asia region. TNN

Defence production

Amrita Nayak Dutta, February 12, 2023: The Indian Express

The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, among others.

Congress leader Rahul Gandhi this week referred to the Adani Group’s defence interests, alleging that the group, which has no experience in this sector, benefited from government patronage.

The Adani Group, a relatively new entrant in the defence sector, has charted an extraordinary growth journey over the last five years, with new subsidiaries diversifying its defence offerings, through acquisitions of both new and legacy companies in the strategic space, as well as through partnerships with foreign private firms.

Subsidiaries, acquisitions

The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, Adani Naval Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, along with PLR Systems Pvt Ltd and Adani-Elbit Advanced Systems India Ltd.

The first four of these were incorporated starting 2015. In 2019, Adani Defence Systems acquired the 2003-incorporated Alpha Design Technologies Pvt Ltd. In 2020, it acquired a majority stake in PLR Systems Private Ltd, making it a joint venture with Israel Weapon Industries (IWI).

In 2018, the group started the joint venture company Adani-Elbit Advanced Systems India Ltd with Israeli firm Elbit Systems.

The Adani Group is currently in the process of acquiring Air Works, one of India’s oldest maintenance repair and overhaul (MRO) units, which will cement its foothold in MRO activities. Range of products

The group actively started its defence businesses in 2018, and has since expanded its offerings in air defence systems, UAVs for various purposes including Intelligence-Surveillance-Reconnaissance, and small arms and ammunition — all of which are of vital importance to the Indian armed forces.

Most of the group’s defence businesses over the last few years have been carried out by Adani Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, and PLR Systems Pvt Ltd. Besides the Indian armed forces, and central paramilitary and state police forces, the group’s customers include the armed forces of some foreign countries, including Israel.

“Within a short time, the Company built a comprehensive ecosystem of defence products across small arms, precision guided munitions, unmanned aerial systems, structures, electronics, radars, EW systems and simulators, among others,” the annual report of the company for 2021-22 said. According to the annual report, the company had bagged contracts for over Rs1,000 crore from the Indian armed forces, including the first ever small arms contract awarded to a private sector manufacturer of small arms; besides separate contracts for the delivery of 56 air defence radars to the Army by 2024, and for the supply of seekers for the medium range surface to air missile (MRSAM).

Small arms, ammo

PLR Systems Pvt Ltd manufactures a range of small arms such as TAVOR X95 assault rifles, NEGEV light machine guns and Galil sniper rifles, which are already in service with the Indian armed forces. The PLR Systems website says the TAVOR and Galil rifles were used by Indian special forces during the surgical strikes of 2016. Some of these weapons were earlier imported by India from Israel. Last year the Adani group announced an investment of almost Rs 1,500 crore to set up South Asia’s largest ammunition manufacturing facility in the Uttar Pradesh Defence Corridor.

Adani Defence has also ventured into the highly technical sphere of manufacturing long range glide bombs for the Indian Air Force, as well as the Very Short Range Air Defence (VSHORAD) System and other precision guided munition as a development and production partner with the Defence Research and Development Organisation (DRDO).

Aerospace and avionics

As per the annual report of Adani Enterprises Ltd (AEL), Alpha Design Technologies Ltd (ADTL) — which is involved in manufacturing satellite and ground equipment, electronic warfare and military communications equipment, and aerospace assembly — has operationalised a simulator for the IAF’s MiG-29 aircraft in Adampur under a 20-year Build Operate Maintain contract.

Last year, Elbit Systems and the Bangalore-based ADTL formed a joint venture company called Vignan Technologies, which has started a facility for R&D and innovation.

ADTL is also the first Indian offset partner for Israel Aerospace Industries (IAI) for production of Air Defence Fire Control Radars, 66 of which have been delivered to the Army. ADTL is also understood to be manufacturing combat net radio sets for the Army’s armoured vehicles, and upgrading its old radio sets.

The Adani-Elbit joint venture is manufacturing a range of unmanned platforms, including the Hermes 900 Medium Altitude Long Endurance UAV, which it looks to export, as well as offer to the Indian armed forces when the services issue a Request for Proposal.

Adani Defence and Elbit set up a private UAV facility in 2018 in Hyderabad for manufacturing the Hermes 900 Medium Altitude Long Endurance UAV.

The Adani group is also manufacturing counter-drone systems. It conducted the first live demonstration of the state-of-the-art Rudrav counter drone system at Ahmedabad’s Sardar Vallabhbhai International Airport.

The company had been in partnership talks with the Swedish aerospace and defence company Saab in 2017 to make the Gripen E fighter in India. However, last month Saab said it will not go ahead with the agreement.

Paridhi Adani

Andy Mukherjee, June 20, 2023: The Times of India

Paridhi Adani’s involvement, however, may have to be viewed differently. The head of the Ahmedabad office at Cyril Amarchand Mangaldas (CAM), a top Indian law firm, Paridhi is married to Karan Adani, the older of chairman Gautam Adani’s two sons and the chief executive officer of the ports business. She and her husband are the two designated partners in Adani Infracon. In response to my emailed questions, a CAM spokesperson said that the advocate is “not a director nor holds any position of any nature in the business of Adani Group”, and that Infracon is “a personal entity currently holding art objects”.

No disclosures

But perhaps more significant than that, on her law firm’s website, she advertises her involvement in mergers and acquisitions (M&A) activity that, I believe, is of vital importance to Adani’s financial health and its valuation. Yet, the group hasn’t made any disclosures that show her or her law firm as a related party, or describe the deals as related-party transactions.

Although the conglomerate denied all of Hindenburg’s accusations, the ensuing $150bn loss of market wealth over just about a month led the Supreme Court to set up an expert committee. It was asked to investigate whether there had been any regulatory failure in dealing with “the alleged contravention of laws pertaining to the securities market”. Related-party deals is one of the areas the panel looked at. According to the short-seller, seven key listed entities of the Adani Group collectively have 578 subsidiaries and have engaged in a total of 6,025 such transactions in the financial year that ended in March 2022. Why are the numbers so high? Adani said in its reply to Hindenburg that in the infrastructure business, financiers and regulators insist on housing separate projects in different companies.

Considering that the Securities and Exchange Board of India (Sebi) has been asked by the apex court to wind up its inquiry by August 14, it has little time to review all the transactions highlighted in the Hindenburg report. But there may be a simple way to obtain a flavour of India Inc’s potential disclosure deficit: Look at someone who neither came up in Hindenburg’s January 24 report, nor in the group’s January 29 rebuttal. Paridhi Adani. CAM’s website lists three past deals under her professional experience:

Adani Ports & Special Economic Zone’s acquisition of 75% of Krishnapatnam Ports closed in October 2020; Adani Green Energy’s solar joint venture with TotalEnergies kicked off the same year. The French energy giant took a 37.4% stake in the firm now known as Adani Total Gas in February 2020.

The ‘missing’ person

But the annual reports of Adani Ports, Adani Green Energy and Adani Total Gas (or its predecessor, Adani Gas) have made no mention of utilising the services of a law firm where a close family member is a partner. While Gautam, Karan, Gautam’s younger brother Rajesh, his son Sagar and Vinod’s son Pranav do feature in the section “key managerial personnel and their relatives” in disclosures, Paridhi does not.

While this omission could potentially be problematic in itself, a bigger concern is that Paridhi Adani is the daughter of CAM’s managing partner Cyril Shroff. The firm, and Paridhi Adani, were also involved in the Adani Group’s mega acquisition last year of Holcim’s cement business in India. To be clear, the lawyer and her firm are under no obligation to report their association to the market regulator.

The entire issue is about whether the in-laws were lax in disclosing her (and her firm’s) role in their business. The legal and accounting professionals I spoke to — by presenting them with the situation as a hypothetical — gave different answers.

According to one, Paridhi Adani should have been disclosed as a related party. A second said no, as publicly traded companies didn’t deal directly with her, but added that her firm becomes a related party under Indian rules because the daughter-in-law is a partner there.

A third expert said neither party has that status until it could be proven that she exercised significant control over CAM. A fourth said it would be enough for Adani directors related to her to have recused themselves when they awarded the M&A mandates.

An Adani spokesperson said this in response to my emailed questions about the lack of disclosures:

“We firmly assert that the stated findings and conclusions are misleading and do not display accurate understanding of the Indian regulatory framework and its disclosure requirements. It is important to note that Ms Paridhi Adani, Partner at Cyril Amarchand Mangaldas (CAM), does not qualify as a related party under all prevalent laws and regulations. CAM and all its partners offer professional services to the Adani Group in adherence to regulatory requirements and we have made all necessary disclosures in this regard. To meet our business requirements, the Adani portfolio of companies engages and maintains professional relationships with several international and Indian law firms. Your insinuations and aspersions concerning potential conflicts of interest with CAM or any other law firm or its partners are unfounded.”

What the results said

My questions to the group on potential conflict of interest stemmed from the recent full-year results.

A note accompanying Adani Green Energy’s May 1 financial statement said that the group had undertaken a review of the transactions mentioned in the short-seller’s report and “obtained opinions from independent law firms in respect of evaluating relationships with parties having transactions” with the holding company and its subsidiaries. Everything was found to be in compliance with the law.

A day later, however, Adani Total Gas’s financial results used somewhat different language. In notes to the accounts, the company said that the Adani Group had undertaken a review of the transactions cited by Hindenburg through an independent assessment by a law firm. “The report confirms company’s compliance of applicable laws and regulations.”

Does it mean that Adani Total Gas got its legal assessment from a firm that was not independent? Could that have come from CAM? I asked the Adani Group. Their reply, reproduced above, did not directly address this question. Once again, there is no hint that CAM, even if it did give an opinion, acted inappropriately.

The auditor’s commentary on Adani Total Gas’s results reiterated the management’s position, but added that pending the completion of court proceedings and investigations by regulators, “we are unable to comment on the possible consequential effects thereof, if any, on this statement”. With that, Shah Dhandharia & Co, which had only last year got a second five-year mandate to audit the firm, resigned its commission “due to increased professional preoccupation” and not because of “an inability to obtain sufficient appropriate audit evidence”, it said.

Awaiting resolution

The auditors didn’t respond to my emailed questions about which law firm’s assessment was used. The Adani Group has previously told The Morning Context, a news website, that it is not mandatory to disclose the details of the lawyer’s report. However, investors, creditors and partners are waiting for a resolution of the Hindenburg allegations. France’s Total put its multi-billion-dollar plan to produce green hydrogen with Adani on hold after the short-seller’s report. The related-party question flared up again when Deloitte Haskins & Sells raised concerns about Adani Ports’ May 30 results. The auditor said it couldn’t confirm that three entities, with which the port unit had transactions, were indeed unrelated as claimed by the company. Further, it said that the legal evaluation sought by the group on the veracity of Hindenburg’s allegations was insufficient for the audit. It signed off on the books with what’s called a “qualified opinion”, Bloomberg News has reported.

In its listing obligations and disclosure regulations of 2015, the market watchdog ordered publicly traded firms to report transfer of resources with directors or key management personnel, or their relatives, regardless of whether money had changed hands. Last year, Sebi tightened the rules — both for transactions that only had to be disclosed and ones that required shareholder approval.

All this suggests an improving arc of governance. But if experts can’t agree on whether simple dealings with Paridhi Adani’s law firm should be disclosed and how, then how will Sebi ever get to the bottom of the short-seller’s insinuations about Vinod Adani’s alleged (and allegedly more complex) involvement? Something is clearly amiss with the regulations.

The fix does not lie in burying the spirit of the law further into a bottomless pit of rules. The regulator needs to start afresh by clearly laying out the principle it wants to uphold. After that, the fairness of commercial transactions is for the market to decide. The failure to disclose them is what Sebi needs to go after in its enforcement action.

Common sense suggests that a law firm with whose partners Adani directors have family ties presents a potential for conflict. The legal fees paid to CAM are not important to a group of Adani’s size. But India Inc’s culture of disclosure — or its absence — ought to be.

Penna Cement Industries

Purchase in 2024

Reeba Zachariah & Swati Bharadwaj TNN, June 14, 2024: The Times of India

From: Reeba Zachariah & Swati Bharadwaj TNN, June 14, 2024: The Times of India

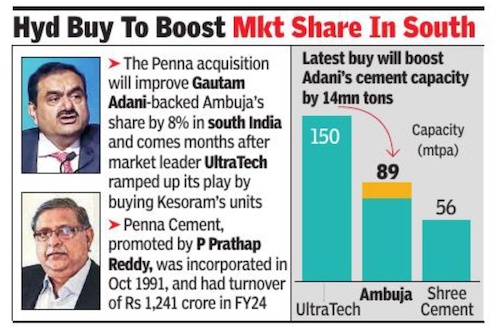

Mumbai/Hyderabad: The Gautam Adani family owned Ambuja Cements is buying Penna Cement Industries in a deal valued at Rs 10,442 crore including debt, expanding its presence in the south. The transaction marks Ambuja’s fourth M&A after Adani checked into the sector through the former in Sept 2022.

Hyderabad-based Penna, promoted by P Prathap Reddy and family, has an annual production capacity of 14 million tons (of which 4 million tons is under construction). It also has limestone reserves and captive power plants.

The Penna acquisition, to be financed by internal accruals, will improve Ambuja’s share by 8% in south India and comes months after market leader UltraTech Cement ramped up its play in the region by buying Kesoram Industries’ building materials units. As of April end, Ambuja had cash of Rs 24,338 crore on its books, having received warrant money of Rs 8,339 crore from the Adani family.

The Penna transaction will help Ambuja and its arms, including ACC and Sanghi Industries, beef up capacity to 89 million tons, moving towards its larger goal of 140 million tons by 2028. UltraTech, owned by Kumar Mangalam Birla, has a capacity of over 150 million tons. In April, India’s third-largest player Shree Cement, led by Hari Mohan Bangur, inaugurated a3-million-ton plant in Andhra Pradesh to bolster its capacity to 56 million tons.

Ambuja previously acquired Gujarat-based Sanghi, My Home’s cement unit in Tamil Nadu and Asian Concretes and Cements’ plants in Hima- chal Pradesh and Punjab.

Prathap Reddy had earlier looked at an IPO for his cement business but subsequently changed plans. In Oct 2021, Penna received markets regulator Sebi’s nod for a Rs 1,550-crore IPO but did not proceed with it. “Initially we thought (of an IPO) but it got delayed. I have decided to do (away) with (the cement business),” Reddy told TOI.

The businessman, known as ‘Penna’ Reddy in Hyderabad circles, was considered a confidant of former Andhra Pradesh CM YS Jagan Mohan Reddy’s father YS Rajasekhara Reddy, the unified Andhra Pradesh CM who died in a chopper crash in Sept 2009. Reddy was made an accused in the Penna chargesheet in the Jagan disproportionate assets case that is being probed by CBI and ED. Jagan’s YSR Congress Party lost the recent Andhra assembly polls to Nara Chandrababu Naidu-led Telugu Desam Party.

Incorporated in Oct 1991, Penna had a turnover of Rs 1,241 crore in FY24. In FY22, its turnover was Rs 3,204 crore. In May 2019, Penna had acquired Sri Lanka-based Singha Cement that operates a 0.5 mtpa cement packing terminal in Colombo.

Penna’s seven plants in Andhra Pradesh, Telangana and Rajasthan (under construction) and limestone reserves “provide an opportunity to increase cement capacity through debottlenecking and additional investment”, said Ambuja Cements CEO Ajay Kapur . “Importantly, the bulk cement terminals will prove to be a game-changer by giving access to the eastern and southern parts of peninsular India, apart from an entry to Sri Lanka, through the sea route,” Kapur added.

Vinod Adani-

As in 2023 Deb

Bloomberg , February 25, 2023: The Times of India

MUMBAI: In August, as India’s Adani group neared the completion of its $10.5 billion purchase of two cement businesses, the conglomerate and its banks put out some particularly complicated filings.

On page 21 of an 85-page document, was a diagram of seven unlisted firms registered in the British Virgin Islands, Mauritius and Dubai. They were interlinked to each other, and one would be buying the cement company’s shares in the open market.

But the ultimate beneficiary of the seven entities wasn’t listed as the group’s public face and chairman, billionaire Gautam Adani. Instead, the filings said their beneficial owners were his older brother, Vinod, and Vinod’s wife Ranjanben.

Neither Vinod nor Ranjanben hold managerial positions in any listed Adani companies, and they aren’t among the top executives listed on the conglomerate’s website. Yet, the appearance of their names in connection with the group’s largest ever acquisition suggests the influence that Adani’s little-known brother wields in the sprawling empire — as well as the family’s style of using a maze of small companies when doing big business.

In recent weeks, Vinod — who has worked out of Dubai for years and is described in filings as a Cypriot national — has come into the international spotlight after short seller Hindenburg Research named him prominently in its scathing report on the Adani group that fueled a rout of more than $140 billion in its shares.

“Vinod Adani, through several close associates, manages a vast labyrinth of offshore shell entities,” the report said identifying entities in Mauritius, Cyprus, the United Arab Emirates, Singapore, and several Caribbean Islands. These entities “regularly and surreptitiously transact with Adani,” it said. Hindenburg didn’t delve into the details of the cement acquisition.

The Adani group has published a 413-page rebuttal denying all Hindenburg’s allegations.

Staffers at Vinod’s Dubai offices directed requests for comment to the conglomerate’s headquarters in India.

“Vinod Adani does not hold any managerial position in any Adani listed entities or their subsidiaries and has no role in their day-to-day affairs,” an Adani group spokesperson said in response to a detailed set of questions sent by Bloomberg News. “These questions are of no relevance, and we cannot comment on the business dealings and transactions of Mr. Vinod Adani.”

The conglomerate didn’t respond to requests to make Vinod or Ranjanben — who is described as an interior designer in a Cyprus filing — available for comment.

Complex conglomerate

Even though Vinod doesn’t hold any formal positions or participate in daily operations, he’s a key negotiator for the Adani group when it’s raising funds from international markets and is involved in planning the group’s strategic direction, a person familiar with the matter said. A close confidant of Gautam, Vinod likes to keep a low profile and deals directly with family members, the person said. The family doesn’t believe it has done anything improper with business structures involving Vinod, according to the person.

Still, the Adani family plans to look more closely at some of the entities it has built to see how best to structure them going forward in order to reassure investors, the person said.

The network of small firms built by the Adani dynasty offers one of the starkest reminders yet of how complex family-run conglomerates can be in India, now one of the world’s fastest growing economies. While many companies have hired professional managers, others are still dominated by familial ties that can make it harder for banks and investors to fully know whom they are doing business with, where the money is flowing and what regulatory minefields might loom.

Vinod is a billionaire via his share holdings in listed Adani group companies. Still, he lives a largely quiet life in Dubai, people familiar with the matter said. A filing in Cyprus puts his age at 74.

The Adani group is a vast conglomerate with listed and unlisted subsidiaries doing business in everything from ports to power, with a reach spanning from India to Africa and Australia. Several debt filings include Vinod as a key figure within the conglomerate, saying the Adani group should be understood to mean Vinod, Gautam and another brother Rajesh, who is managing director, as well as other entities such as a family trust.

RN Bhaskar, the author of a new biography on Gautam said “all overseas transactions are monitored closely by Vinod,” but noted that he knew little else about Vinod.

In the days when Gautam was a student and stayed with Vinod, he considered him a father figure and Vinod was his official guardian, Bhaskar said. “Today, they are more or less equals. I have met them at a social gathering, and I found the chemistry warm and affable.”

Mauritius address

Last year, when the Adani group bought Swiss giant Holcim AG’s cement assets in India, the deal for Ambuja Cements Ltd and ACC Ltd. was completed via a Mauritius-based entity called Endeavour Trade and Investment. Indian regulators approved the open offer.

At the address listed for Endeavour in Mauritius were the offices of Amicorp, an outside company that provides legal and administrative services to corporations. Hindenburg alleges in its report that Amicorp has worked widely to help the Adani group to build a network of offshore entities. Amicorp didn’t respond to a request for comment.

Alex Cobham, an economist and chief executive of the UK-based Tax Justice Network said that the multiple layers, the relative lack of transparency of the jurisdictions and the type of entities used for the cement deal pose several risks for investors and regulators.

“These include the risk that timely updates to beneficial ownership are not made; the risk that the complexity allows abuse of tax and regulation in the jurisdictions where real activity takes place,” Cobham said. “And, perhaps most relevant here, the risk that investors may be harmed because they are denied the information necessary to value a company accurately.”

In Dubai, other ties between Vinod and Gautam are on show in Jumeirah Lake Towers, a cluster of sleek skyscrapers with views of the water front. Popular addresses for financial firms, they are home to businesses belonging to the Adani group as well as others to Vinod.

On the 36th floor of one tower is an office with three name plates outside saying: Emerging Market Investment DMCC, RVG Exim DMCC, and Adani Global Investment DMCC. A staff member said it was Vinod’s family office. On its website, Emerging Market Investment DMCC says Vinod is its promoter, the term used in India for founders and owners.

The three company names are also mentioned in the Hindenburg report as being among dozens of shell entities in offshore tax havens.

Emerging Market Investment DMCC has played prominently in the back-and-forth between the Adani group and Hindenburg. Hindenburg said the firm lent $1 billion to a subsidiary of a listed unit called Adani Power, and questioned the source of those funds.

The Adani group said the allegation was “incorrect’ and the money wasn’t lent. In reality, Emerging Market Investment DMCC acquired the unsustainable debt of a power business from lenders for $100, the conglomerate said.

Shell companies “are part and parcel of the Indian investment scene,” said Milan Vaishnav, director of the South Asia Program at the Carnegie Endowment for International Peace. “What caught people’s attention was the number of shell entities involved and the linkages to Gautam Adani’s brother,” Vaishnav said about the Hindenburg report.

Occupying the 27th floor of another building in Jumeirah Lake Towers, are the white and glass-walled offices of Adani Global FZE — a commodity distributor that’s part of the Adani group. The biggest cabin in this office is used by Vinod, a sign of respect granted to an older family member, said one person familiar with the matter, who asked not to be named because they weren’t authorized to speak publicly. Vinod spends two or three hours in this office daily but doesn’t get involved in the day-to-day operations, the person said.

Vinod Shantilal Adani, like his brother Gautam, was born into a family of a small textile merchant from the Western Indian state of Gujarat. After starting his career running power looms for a business in Mumbai in 1976, Vinod expanded his commodities portfolio to Singapore, according to advertorials published about him in the Indian press seven years ago.

Vinod moved to Singapore briefly before relocating to Dubai where he made his fortune in trading sugar, oil, aluminum, copper and iron scrap, the media reports said. The billionaire is a follower of the Jain religion that emphasizes vegetarianism and non-violence.

The Hindenburg report fueled stock declines that have now erased $72.9 billion of Gautam’s wealth. Vinod suffered his own hit as the value of his shares held through Emerging Market Investment DMCC dropped. Worth $1.4 billion before the report, Vinod’s holdings are now valued at about $1 billion, according to the Bloomberg Billionaires Index.

In India, the head of a major family-controlled firm, who asked not to be identified to talk freely about one of the country’s most powerful tycoons, said the allegations against Adani have shone a bad light on the country and in particular companies run by a network of relatives.

The allegations about the Adani family risk tarring large swathes of Indian industry, even though many businesses have largely professionalized their management over recent years, this person said.

Alice Wang, a London-based portfolio manager at Quaero Capital LLP, said that in emerging markets like India, family networks can be critical in the early stages of developing a business.

“But family structures can become liabilities later,” she said. “When companies try to institutionalize, internationalize, or form succession plans.”

2023, Apr: Steps down from 3 cos linked to Australia coal mine

April 27, 2023: The Times of India

In late February, as questions mounted and Adani Group’s share prices plunged, Gautam Adani’s older brother Vinod stepped down as director of three companies — Carmichael Rail and Port Singapore, Carmichael Rail Singapore and Abbot Point Terminal Expansion — connected to the family’s coal mine in Australia, on which it has staked billions of dollars. He remains on the board of Singapore-based Abbot Point Port Holdings.

These resignations, which haven’t previously been reported, happened just days before the SC ordered a committee to probe if regulators had failed to oversee Adani Group. Meanwhile, Sebi is examining whether some transactions between the group and Vinod were properly disclosed.

An Adani Group representative said Vinod, aside from being a shareholder of certain entities, had no management role in the development of the Carmichael mine or its related infrastructure. Adani Group didn’t address a question about the resignations. Vinod didn’t respond to emailed questions.

Hindenburg’s January 24 report said dozens of shell companies controlled by Vinod had moved billions of dollars in and out of Adani Group companies, seemingly to embellish shares and results.

Adani Group acknowledged that Vinod is part of the promoter group and said it made all required disclosures. It largely rejected questions about the brother’s business affairs, saying they’re irrelevant given he’s not a manager at the group’s public companies or their subsidiaries.

Bloomberg reported he has a cabin in the Dubai office of Adani Global — a commodity distributor owned by one of the family’s listed firms — and spends two or three hours daily there. When asked about this, an Adani Group representative repeated that such queries were “of no relevance”.

Until recently, few had heard of Gautam’s 74-year-old brother. He’s believed to have made a fortune trading commodities and is worth at least $1. 2 billion. He runs a family investment office in Dubai.

Over the years, he’s been involved in some of Adani Group’s largest undertakings, from acquisitions of cement companies to green energy. Carmichael is one of the longest-running examples.

BLOOMBERG

YEAR-WISE DEVELOPMENTS

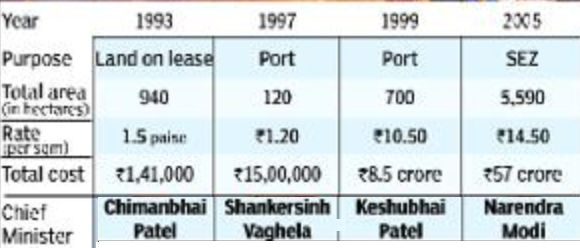

1993-2005: The allotment of [mainly government] land to the Adani group

4 Gujarat CMs have given land to Adani

TNN | Apr 16, 2014 The Times of India

Records show the Adani group first got wasteland in Mundra from the Cogress-backed Chimanbhai Patel government in 1993 and then from another Cogress-supported government headed by Shankersinh Vaghela in 1997.

The group subsequently got more wasteland from BJP governments headed by Keshubhai Patel in 1999 and Narendra Modi in 2005. While it has been alleged that land given to Adani was of the size of Vadodara, the Ahmedabad-based group has got 7,350 hectares, as against Vadodara city's area of 15,900 hectares.

The largest chunk — 5,590 hectares at Rs 14.50 per sqm — was handed over to the group in 2005 by the Modi regime for development of an SEZ. Adani group officials insist that the entire stretch where the Adani port and SEZ is now located was completely barren.

2010: Rajesh Adani gets bail

February 28, 2010: The Indian Express

The Central Bureau of Investigation (CBI) today arrested Rajesh S Adani,the Managing Director of the Rs 26,000 crore Adani Enterprises Ltd,on the charges of evasion of customs duty and undervaluation fraud tentatively pegged at Rs 1.7 crore in Goa. The CBI team from Goa picked him from his home at Vastrapur in Ahmedabad around 7 am.

Later in the evening,Adani was granted interim bail from the Gujarat High Court.

Designated senior counsel B B Naik who appeared for Rajesh Adani,said Rajesh’s elder brother Vasant Adani had moved a habeaus corpus petition in the Gujarat High Court seeking that he should be produced before the court immediately as CBI has detained him without providing any reasons or details. The next hearing in the case is posted for March 2.

The CBI had originally planned to present Adani at the Rural Magistrates Court here to seek a transit remand and a large crowd of media persons and lawyers of the Adani group waited for them there to turn up. But,the investigating agency changed its plans at the last moment and a CBI team flew with Adani to Mumbai in the evening en route to Goa where they said he will be presented before a magistrate. CBI sources said this was because the situation was getting heated up in Gujarat.

Rajesh Adani is the younger brother of the groups founder chairman Gautam Adani,who figures among the 10 richest Indians in the Forbes list.

Rishiraj Singh,CBI deputy director (Western region),told The Sunday Express that Rajesh Adani was arrested for undervaluation fraud related to import of naphta and petroleum products in Goa during 2006-2007. Singh said CBI sleuths also raided Adanis home and premises during the day. According to Singh,the CBI sleuths had also raided the Mumbai home of the co-accused in the case,Ramakant Pilani,who heads a Mumbai-based firm Ganseh Benzoplast Ltd,but failed to nab him.

A case in this regard was registered in January 2008 by the Goa Anti-Corruption Bureau of the CBI. Singh added that cases have been filed against nine senior officials of the Goa Customs in the same case.

This is the second time that Rajesh Adani had been arrested. In 1999,the Directorate of Revenue Intelligence had arrested him at Bhuj charging him with a similar duty evasion fraud worth Rs 1.4 crore. Soon after his arrest and orders of the local magistrate to remand him,Adani had claimed to have backache and spent time at a Bhuj hospital,until an appeal was moved at the Gujarat High Court which allowed him bail.

This time,CBI decided to take Adani to the Civil Hospital in Gandhinagar for a full check up,and then to the Cardiology department of the Ahmedabad Civil Hospital,before presenting him before the local magistrate to seek the transit remand to take him to Goa.

Dipak Damor,SP CBI (Gujarat),said the CBI team from Goa had arrived on Friday evening but arrested Adani from his home only in the morning. The CBI decided to take him for medical examination before the transit so as to avoid any claims of medical complications later.

The Adani group,meanwhile,issued a statement claiming that the petroleum products that they imported were on behalf of the license and permission holders and it was the latter who were responsible for fulfilling all formalities and the payment of duties.

It observed that the Customs had not issued any showcause notice to Rajesh Adani or the Adani group in this regard and maintained that the CBI had issued his arrest memo without providing any reasons or details.

Significantly,the Adani group statement also claimed that Rajesh Adani was not responsible for any day-to-day business operations. On the other hand,the groups website says: He (Rajesh Adani) is in charge of day-to-day operations of the Company and has been responsible for developing the business relationships of the Company. He also handles the marketing and finance aspects of the Company.”

Meanwhile,Adanis residence 14,Surajya Bungalows,Vastrapur remained deserted except for armed private security personnel. The guards said his family left immediately after the CBI sleuths had arrived at the house.

Imported consignments

- Three consignments of imported naptha and furnace oil were kept by the Adani group at a warehouse in Goa,which was licenced to store only restricted items. According to CBI officials,the licence of the warehouse had expired as well. CBI sources said Adani Enterprises Ltd had reportedly been trading with Ganesh Benzoplast for a long time and is suspected to have stored other earlier consignments there as well.

- CBI officials said these consignments were kept at the Goa warehouse after being imported by Adani Enterprises Ltd,earlier known as Adani Exports.

- CBI sources said they are now verifying all the documents of the Advani group’s imports in the recent past. The details of the warehouses where the group stores imported goods are now being ascertained,said an official.

2019

HC relief for in ₹29k cr imports case

Oct 18, 2019: The Times of India

A Bombay high court order has brought to a halt an overseas investigation by the Directorate of Revenue Intelligence into the alleged Rs 29,000-crore overvaulation of Indonesian coal imports by the Adani Group.

The high court quashed all Letters Rogatory (LR) sent by DRI to 14 countries, including Singapore and UAE, seeking information into the alleged overvaluation. An LR is a formal request to another country, seeking judicial assistance in accessing information on an offshore entity in a probe.

DRI is probing at least 40 companies, including the Essar Group, for overvaluation of imports. TOI was the first to report on the scam in its December 14, 2014, edition.

Making it clear that it hasn’t gone into the merits of the LRs, the high court said: “We have only dealt with the contention as to whether it was permissible for the magistrate to issue such a Letter Rogatory without following the procedure mandated under the Criminal Procedure Code.”

The DRI began probing a non-cognisable offence without obtaining the necessary permission from the magistrate and in such circumstances, the LRs issued do not meet the test, said a bench of Justices Bharati Dangre and Ranjit More.

Implication

The case deals with a fundamental question regarding the commission of offence punishable under Customs Act, 1962 and whether or not, DRI is entitled to take recourse to the provisions of the Code of Criminal Procedure, 1973 for issuance of the Letter of Rogatory by the Magistrate. The Bombay high court held that this provision of the CrPC is not an independent island on which any investigating/ inquiring authority can jump on without taking recourse to filing of a FIR and hence the letter rogatory issued by the DRI stands quashed.

2023

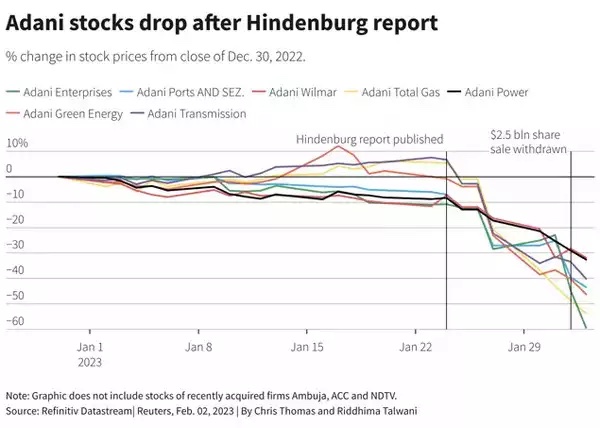

The Hindenburg Research report and its impact/ Jan-Feb

February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

From: February 2, 2023: The Times of India

Hindenburg released its report 2 days before Adani Enterprises' Rs 20,000 crore FPO was about to open. The company had already raised Rs 5,985 crore by allotting shares to anchor investors.

In the report, Hindenburg accused Adani Group of a "brazen stock manipulation and accounting fraud scheme." It cited 2 years of research, including talks with former senior executives of the company and reviews of several documents.

The report comprised 32,000 words and alleged various kinds of frauds and account manipulations by Adani Group companies over the years. It said that key listed Adani companies have taken on substantial debt, including pledging shares of their inflated stocks for loans, putting the entire group on precarious financial footing.

It also said that seven Adani listed companies have an 85% downside on a fundamental basis due to what it called "sky-high valuations”.

Further, the report highlighted accounting irregularities and sketchy dealings enabled by virtually non-existent financial controls. "Adani Enterprises has had 5 chief financial officers over the course of 8 years, a key red flag indicating potential accounting issues," it said.

Citing evidence of stock manipulation, Hindenburg gave reference to Sebi's investigation and prosecution of more than 70 listed entities and individuals over the years, including Adani promoters, for pumping Adani Enterprises' stock.

Hindenburg also has short positions in Adani companies through US-traded bonds and non-Indian-traded derivative instruments.

Adani denied allegations

Caught in the corporate-cum-stock market storm, Adani Group issued a statement on January 29 against Hindenburg's allegations few days later and likened the damning allegations to a "calculated attack" on India, its institutions and growth story.

Stating that all accusations were nothing but a lie, the group said that 68 of the 88 questions posed by Hindenburg were already addressed by it through annual reports of various group companies, offer documents and stock market disclosures.

Of the remaining 20 questions, 16 were relating to public shareholders and their sources of funds, while the rest four were baseless allegations, it added.

"The report is rife with conflict of interest and intended only to create a false market in securities," Adani Group claimed.

It also highlighted that mala fide intentions were apparent given the timing of the report when Adani Enterprises was about to undertake the largest equity FPO.

"Needless to say that Hindenburg has created these questions to divert the attention of its target audience while managing its short trades to benefit at the cost of investors," they added.

In addition, the group said that at various points in the report, it was clear that Hindenburg Research didn't have a good understanding of the Indian legal system, the accounting practices and how the fund-raising processes work in the Indian capital market.

As an example, it said that Hindenburg Research had falsely claimed that Emerging Market Investment DMCC gave a loan of $1 billion to Mahan Energen.

In reality, "Emerging Market acquired the $1-billion 'unsustainable debt' of Mahan Energen from its lenders for $100 as part of a resolution plan duly approved by the National Company Law Tribunal (NCLT) under the Indian Bankruptcy Code. These are mala fide attempts to question bona fide transactions," the rebuttal noted.

Hindenburg's counter statement

In response to Adani's rebuttal, Hindenburg on January 30, dismissed charges that its report was a "calculated attack on India".

In its defence, the US short seller said that fraud cannot be obfuscated by nationalism or a bloated response that ignored key allegations.

Standing by its report that alleged "fraud" at the second largest conglomerate in India run by the world's then-third richest man, Hindenburg said it disagrees with Adani group's assertion of its report being an attack on India.

"To be clear, we believe India is a vibrant democracy and an emerging superpower with an exciting future," it said. "We also believe India's future is being held back by the Adani Group, which has draped itself in the Indian flag while systematically looting the nation.”

A "fraud is fraud, even when it's perpetrated by one of the wealthiest individuals in the world," it said, adding, "Adani also claimed we have committed a 'flagrant breach of applicable securities and foreign exchange laws'. Despite Adani's failure to identify any such laws, this is another serious accusation that we categorically deny.”

Hindenburg said it "found Adani's lack of direct and transparent answers" on the allegations of use of offshore entities "telling".

Market rout continues

On January 24, the day Hindenburg released this report, a share of Adani Enterprise costed Rs 3,442.75 at close of day's trade. Today, the stock is priced at Rs 1,564.70, that is, a fall of 54.55% in just 6 sessions.

On Thursday as well, the stock tanked 26.5%. Most of the other group firms also declined.

If we look at Adani Ports, the stock has declined 39%, Adani Power 26.43%, Adani Transmission 43.49%, Adani Green Energy 45.75%, Adani Total Gas 56%, and Adani Wilmar fell by 26.46%. Cumulatively, in 6 days, stocks have faced an combined erosion of over Rs 8.76 lakh crore.

Global rankings fall

As a result of this massive drag in stock prices of companies, Gautam Adani's position in Forbes real-time global richest ranking has slipped to 17.

Adani has now lost his tag as richest Asian person. His wealth now stands at $64.2 billion.

However, according to Bloomberg Billionaires Index, Adani is placed at 13th position with a total wealth of $72.1 billion.

In September last year, Adani's wealth had surged to over $155 billion, making him the 2nd richest person in global billionaires ranking and the first Indian (and Asian) to break into the top 3 list. In a little over two and half years, Gautam Adani's wealth had galloped over 13 times. In January 2020 just before the onset of Covid pandemic, his net worth was about $10 billion.

Adani withdraws FPO

Seeing the beating Adani group companies suffered on the bourses since last week, the Board of Directors of the group decided to call fully subscribed FPO of Adani Enterprises. In a regulatory statement to the bourses, Adani Group said that it has decided not to proceed with FPO in the interest of its subscribers.

"Given the unprecedented situation and the current market volatility the company aims to protect the interest of its investing community by returning the FPO proceeds and withdraws the completed transaction," Adani Group said in its official release.

The Rs 20,000 crore worth FPO was fully subscribed just a day ago as investors pumped funds into the flagship firm. However, the flagship company of the Adani Group had a lacklustre start to its FPO, with only a 1% subscription on the first day of the share sale. The offer was opened for public subscription from January 27-31.

But, it managed to get investors on the last day of the share close on Tuesday.

Total bids for 5.1 crore shares were received, against the offer size of 4.6 crore shares, on January 31, the third and final day of retail bidding, representing a 112% subscription. This excludes the Rs 5,985-crore anchor book, a part of the QIB portion, that was completely subscribed a day before the FPO had opened on January 28.

Adani Group said that it will return money to investors and thanked them for their support and commitment towards the group.

The fundraising was critical for Adani, not just because it was seen as a move to cut his group's debt, but also because it is was being seen by some as a gauge of confidence at a time when the tycoon faces one of his biggest business and reputational challenges. RBI, Sebi start scrutiny

The Securities and Exchange Board of India (Sebi) has started examining the constant crash in shares of Adani Group.

It is also looking into any possible irregularities in a share sale by its flagship company, a Reuters report said.

Sebi is undertaking a full-scale examination of the fall in shares, a source told Reuters, declining to be identified as the matter is confidential.

Meanwhile, Reserve Bank of India (RBI) has also sought details about lenders' exposures to the Adani Group.

Country's largest lender SBI had said it's exposure to Adani group is fully secured by cash generating assets, in an attempt to assuage investor concerns.

Another public sector lender Bank of Baroda has said its total exposure to the embattled group stood at Rs 7,000 crore, which are also fully secured.

Government-owned life insurance behemoth Life Insurance Corporation (LIC) has disclosed of having an exposure of Rs 36,474.78 crore to Adani group's debt and equity, and added that the amount is less than one per cent of its total investments.

Share of mutual funds in Adani

Mutual funds from India and elsewhere hold just 3.4% of Adani Enterprises, 2.8% of Adani Total Gas and 3.6% of Adani Green Energy. Promoters of the companies hold most of the shares.

Adani Enterprises and Adani Port are constituents of the Nifty 50, so they are automatically in portfolios of some exchange-traded funds (ETFs) and index funds. But active funds have very little exposure to Adani stocks and are largely unscathed by their fall. US-listed iShares MSCI India ETF , which at the end of December had a combined holding of $172 million in Adani Transmission, Adani Total Gas and Adani Enterprises, has lost 2.7% over the past week.

Among active funds, the Kotak Balanced Advantage fund , which has positions in Adani Enterprises and Adani Ports and Special Economic Zone, has shed just 0.5%.

Exposure to debts

According to analysts quoted by Reuters, the shock to the system comes because of Adani's heft and influence, rather than exposure.

His conglomerate spans ports, coal mines, food businesses, airports and lately media, and before the rout its seven companies had accounted for more than 6% of the National Stock Exchange market value.

While the Adani Group has total gross debt of Rs 2.2 lakh crore ($26.86 billion), top banks have said their credit exposures to the group are small, as per a Reuters report. Shares of the firm are closely held, mutual funds have low exposure too.

"Everybody’s keeping a very close eye on those debts," Pankaj Pathak, a fund manager at Quantum Asset Management told Reuters. "But on the domestic debt side, we hardly see any impact on the broader corporate bond market because of what is happening in Adani," he said, pointing to the limited ownership of those bonds.

Citigroup, Credit Suisse worry

As regulators step in, banks are distancing themselves, with Citigroup's wealth unit saying it has stopped extending margin loans to its clients against Adani securities, and Bloomberg News reporting that Credit Suisse had done likewise.

Investment research firm TS Lombard said the Adani allegations had "hastened the decline we expected in Indian equities as foreign investors rebalance their portfolios on China’s reopening" but that the declines would be limited for several reasons, including Adani being “too unique to fail”.

When one of mightiest conglomerates of a country calls off its fully subscribed follow on public offer (FPO), stating that it would be "morally incorrect", it is sure to spook investors.

The Gautam Adani-led Adani Group, who's stocks were one of the key drivers of stock markets since the past 3 years, is now finding it hard to even stay in the positive zone. And, all of it happened in just 1 week.

In other words, a major part of his over $100 billion earnings in the last 3 years was wiped out in the last week.

The fall has been so massive that the group's market losses have now swelled to over $100 billion, sparking worries about their potential systemic impact.

The market rout started January 25, after a US short-seller Hindenburg Research published a report alleging stock manipulation by the Adani Group and raised concerns about high debt and valuations.

(With inputs from agencies)

The higher the PE ratio of an Adani stock, the sharper the fall\ February

Aseem Gujar, February 27, 2023: The Times of India

From: Aseem Gujar, February 27, 2023: The Times of India

MUMBAI: Adani Group stocks have been falling relentlessly since the damning report by Hindenburg was published on January 24. Over Rs 12 lakh crore in terms of market capitalisation of the Adani scrips has been wiped out, but not all group stocks have fallen in sync. This is where the valuation of individual stocks comes into play. The deep plunge has been possible due to sky-high valuations.

The Adani Total Gas stock has crashed nearly 81% since January 24, while Adani Ports has dived 27% in the same period — the fall is in sync with how overvalued they were. Adani Total Gas stock was trading at a multiple of 844 times its earnings on January 24, a number that not even the best disruptive technology company can boast of, while Adani Ports was at 30 times, according to price-to-earnings (PE) ratios sourced from Refinitiv database. Stocks that had relatively lower valuations have fallen less. ACC, which had a PE ratio of 54, has fallen the least (26%) among the 10 Adani Group stocks, followed by Adani Ports (27%) and Ambuja Cements (31%).

A company’s PE ratio is one of the indicators of how undervalued or overpriced a scrip is in relation to its profit. Technology and consumer brands, apart from other high-growth companies, usually command steeper valuations than infrastructure or state-owned companies. For instance, TCS has a PE ratio of 31, but Tata Steel has 5. Indraprastha Gas has a PE ratio of 18, while Mahanagar Gas has 13 — both these are in the same business as Adani Total Gas.

A stock price indicates the market’s perception. But when there is a meteoric rise in a particular share, as was seen in the case of Adani scrips amid the pandemic, alarm bells start to ring. In May 2021, ET reported that CLSA had dropped coverage on Adani Transmission with the foreign brokerage saying that the stock is driven by speculative interest, keeping valuation at a stratospheric 16 times premium to the sector. That month, Adani Transmission had a PE ratio of 114, which had more than doubled to 351 by January 24 this year. Currently, it is at 73. The May 2021 ET report was quoted by Hindenburg Research in its study.

In November 2022, V K Vijayakumar, chief investment strategist at Geojit Financial Services, had alluded to ‘stratospheric’ valuations too. “A major disconnect between profits and market cap can be seen in the case of Adani stocks. Gautam Adani has proven expertise in executing large infrastructure projects, but the stratospheric valuations of Adani stocks are a matter of concern,” he had said in a report. When contacted, a representative of Geojit Financial Services said the firm doesn’t track Adani Group.

Interestingly, Adani companies may not be a steal deal even after the selloff. Adani Total Gas, which is stuck in a rut of hitting lower circuits since the report, is still available at 156 times its earnings. “Stock-specific actions will continue in Adani Group,” Kranthi Bathini, director (equity strategy) at WealthMills Securities, said.

The Organised Crime and Corruption Reporting Project

Anand Mangnale, Ravi Nair, and NBR Arcadio, occrp.org

Two men who secretly invested in the massive conglomerate turn out to have close ties to its majority owners, the Adani family, raising questions about violations of Indian law.

It became one of the largest economic scandals in the history of modern India: The Adani Group, a massive conglomerate with interests in everything from airports to television stations, was accused of brazen stock manipulation.

The allegation, leveled this January by a New York-based short seller, caused Adani stock to plummet, triggered protests, and prompted an investigation by India’s Supreme Court.

But the expert committee convened by the court was unable to get to the bottom of the scandal, which has serious political implications because of the group’s widely perceived closeness to Prime Minister Narendra Modi and its central role in his plan for developing the country.

The essence of the allegations was that some of the Adani Group’s key “public” investors were in fact Adani insiders, a possible violation of Indian securities law. But none of the agencies contacted by the committee were able to identify those investors, since they were hidden behind secretive offshore structures.

Now, exclusive documents obtained by OCCRP and shared with The Guardian and Financial Times — including files from multiple tax havens, bank records, and internal Adani Group emails — shed light on that very matter.

These documents, which have been corroborated by people with direct knowledge of the Adani Group’s business and public records from multiple countries, show how hundreds of millions of dollars were invested in publicly traded Adani stock through opaque investment funds based in the island nation of Mauritius.