Insolvency, bankruptcy: India

(→Impact of 2016 law) |

(→Impact of 2016 law) |

||

| Line 195: | Line 195: | ||

= Impact of 2016 law= | = Impact of 2016 law= | ||

[[File: What are national Company Law Tribunal and National Company Law Appellate Tribunal.jpg|What are national Company Law Tribunal and National Company Law Appellate Tribunal? <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F09%2F14&entity=Ar02313&sk=6D5FC1E1&mode=text Dhananjay Mahapatra, SC: NCLT should reduce interference, September 14, 2018: ''The Times of India'']|frame|500px]] | [[File: What are national Company Law Tribunal and National Company Law Appellate Tribunal.jpg|What are national Company Law Tribunal and National Company Law Appellate Tribunal? <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2018%2F09%2F14&entity=Ar02313&sk=6D5FC1E1&mode=text Dhananjay Mahapatra, SC: NCLT should reduce interference, September 14, 2018: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | [[File: Impact of law .jpg| Impact of law [https://www.indiatoday.in/magazine/nation/story/20170731-insolvency-and-bankruptcy-code-loans-reserve-bank-of-india-banking-regulation-act-essar-sbi-1025306-2017-07-24 “India Today” 31/7/2017]|frame|500px]] | ||

'''See graphic''': | '''See graphic''': | ||

''What are national Company Law Tribunal and National Company Law Appellate Tribunal?'' | ''What are national Company Law Tribunal and National Company Law Appellate Tribunal?'' | ||

| + | |||

| + | ''Impact of law'' | ||

==SC asks NCLT to reduce interference/ 2018== | ==SC asks NCLT to reduce interference/ 2018== | ||

Revision as of 16:30, 7 October 2018

This is a collection of articles archived for the excellence of their content. |

Insolvency and Bankruptcy Code 2016

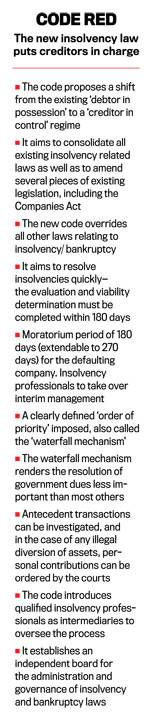

2016: Parliament passes comprehensive bankruptcy code

The Times of India, May 12 2016

Insolvency code to ease closure of sick units gets House nod

Parliament passed a comprehensive bankruptcy code, a longpending grudge with international investors, which will help speed up closure of unviable companies and revival of viable entities.

The lack of a bankruptcy code is one of the key reasons for India ranking low on the ease of doing business rankings, since it takes several years to wind up a business. Currently , there are a dozen laws dealing with various aspects of sickness and closure, and the one related to insolvency is over a century old.

Through the new law, which was cleared by the Rajya Sabha on Wednesday evening, the government is trying to put in place a speedy process for early identifi cation of financial stress and resolve the strain if the business is found viable. It has stipulated a time-bound revival. The new law comes at a time when lenders are dealing with a record pile of bad debt, for which the government has also sought to amend existing laws to make recoveries smoother.

“The essential idea of the new law is that when a firm defaults on its debt, control shifts from the shareholderspromoters to a committee of creditors, who have 180 days in which to evaluate proposals from various players about resuscitating the company or taking it into liquidation. When decisions are taken in a time-bound manner, there is a greater chance that the firm can be saved as a going concern, and the productive resources of the economy (the labour and the capital) can be put to the best use. This is in complete departure with the experience under the SICA (Sick Industrial Companies Act) regime where there were delays leading to destruction of the value of the firm,“ the finance ministry said in a statement.

The new system provides for two processes for resolution of individual cases -fresh start and insolvency resolution.

It also puts the dues of the employees at the top of the pile with certain creditors getting preference over the government. In addition, it provides for powers to acquire overseas assets of a defaulter, for which the government has to sign global agreements.

FM seeks opposition support for GST

New Delhi: FM Arun Jaitley on again urged Congress to support the bill that seeks to amend the Constitution for the introduction of goods and services tax (GST) after the principal opposition party suggested it would offer support, provided its three key recommendations are accepted.

“For heaven's sake, I beseech you in the interest of Indian democracy not to go on this misadventure (judge-headed panel)...With the manner in which encroachment of legislative and executive authority by India's judiciary is taking place, probably fi nancial power and budget making is the last power that you have left. Taxation is the only power which states have,“ he said during the debate on the finance bill in the Rajya Sabha.

The minister said it was “wholly misconceived“ for any political party to hand over the taxation power to judiciary . Jaitley asked Congress to “reconsider“ its stance on GST, which is held up as Congress wants the government to specify the GST rate in the bill, provide for an independent dispute resolution mechanism, and drop the plan for an additional 1% levy by manufacturing states.

The extent of the problem

See graphic, 'Major defaulters on bank loans, 2017 '

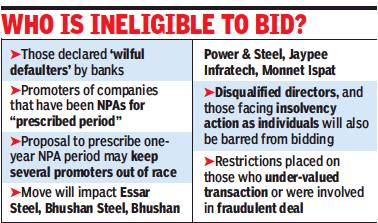

Promoters of insolvent companies cannot bid for ailing entities

New ordinance to strike loan defaulters another body blow, November 23, 2017:The Times of India

From: New ordinance to strike loan defaulters another body blow, November 23, 2017:The Times of India

The government recommended an ordinance to significantly tighten the norms to bar promoters of companies facing.

insolvency proceedings from bidding for the ailing entities, a move that will shut out several business families from vying with competitors and overseas funds.

Apart from seeking to ban bidding by wilful defaulters, the Insolvency & Bankruptcy Code will be amended to disqualify a tainted promoter in control of an entity that has been a ‘non-performing asset’ for a “prescribed period”, which may be fixed at one year. A continuous loan default for 90 days forces banks to classify a borrower as an NPA.

The one-year clause will make promoters of some of the 12 large companies facing insolvency action — like the Ruias of Essar Steel and Singhals of Bhushan Steel — ineligible to submit bids for their companies next month. Bankers said both were classified as NPAs in 2015.

Insolvency board gets more powers to prescribe eligibility norms for bidders

The one-year clause may help reduce competition for companies such as JSW, Tata Steel, Arcelor Mittal and Nippon Steel and comes with the risk of bids being less aggressive.

The 12 companies, which account for nearly a quarter of the NPAs, were referred to the National Company Law Tribunal by banks led by State Bank of India and IDBI Bank after the Reserve Bank of India stepped in to clean up the unprecedented pile of bad debt that added up to nearly Rs 8.4 lakh crore on last count. The list includes Bhushan Power & Steel, Jaypee Infratech, Monnet Ispat, Amtek Auto and ABG Shipyard.

Finance minister Arun Jaitley told reporters that the cabinet had recommended amendments but did not comment on the provisions. Details of the ordinance are expected only after President Ram Nath Kovind approves it. With the winter session expected to be convened on December 15, the ordinance is likely to be promulgated over the next few days.

The government had enacted the Insolvency & Bankruptcy Code last year, which provides for a revival plan in a maximum of 270 days. During this period, the company is handled by an NCLT-appointed resolution professional. The government opted to amend the law in less than a

year as it feared that some promoters may end up acquiring the company at a steep discount, leaving banks to grapple with the pile of loans.

“A number of cases are likely to have long-pending default requiring deep haircut for the creditors. It is, therefore, necessary to ensure that promoters of the corporate debtor or the company, who are found to have contributed to the default, need to be prevented from regaining control through back door entry in the garb of a resolution applicant,” said a source.

The ordinance also gives more powers to the Insolvency and Bankruptcy Board of India to prescribe eligibility norms for prospective bidders or resolution applicants while keeping in mind the complexity and scale of operations of business of the ailing company.

Lenders as well as industry experts are closely watching how the government defines the “prescribed period” and its implications on the overall business environment. “A company gets into financial stress because of various reasons such as technological obsolescence or sudden change in policies, including court pronouncements such as cancellation of coal blocks or spectrum. By barring all promoters, you may be hitting the entrepreneurship environment,” said a top executive with a leading bank.

Industry experts also said that some of the norms proposed by the government opened the doors to further litigation. For instance, a promoter can be classified as a wilful defaulter and not allowed to bid but the court overturns the lender’s decision later.

“The disqualification on account of the debtor being a non performing account is harsh as there could be genuine reasons for default. Businesses succeed but also fail and a bonafide failure should not be punished. As a society we need to learn to forgive an unfortunate debtor and give him a second chance. Failure can also be as legitimate as success,” said Sumant Batra, managing partner at law firm Kesar Dass B & Associates, who is involved in several cases.

Apart from the 12 companies which are already in various stages of resolution, at least 40 other companies are being reviewed by banks after an RBI directive and the ordinance will also have an impact on them.

Impact: banks get tough with defaulting promoters/ 2017

Till now, the business phrase “exit policy“ meant the exit of workers, to allow owners to survive and flourish. Now, for the first time, India has an exit policy for owners that allows workers to survive and flourish. If it succeeds, it may go down as Narendra Modi's finest achievement.

India is famous for having many sick industries but no sick industrialists, whose political clout (and legal delays) precluded seizure of their assets by lenders. That has changed dramatically with the enforcement of the Insolvency and Bankruptcy Code 2016. The RBI is using this to force banks to get tough with defaulting promoters, forcing them to sell assets to repay debts and make their companies solvent. If this does not work, the banks will eject the promoters, and appoint a professional manager to run the company till it is auctioned to new buyers.

This is a revolutionary change. In June, the RBI identified 12 major companies for insolvency proceedings, each owing over Rs 5,000 crores. Bhushan Steel, Electosteel Steel and Lanco Infratech headed the dirty dozen, owing a whopping Rs 1,75,000 crore (almost a quarter of all bad bank loans).

Reports say the RBI has prepared a second list of 40 companies, including giants like Videocon and Jindal Steel and Power Ltd. The top 500 defaulters face similar action. The finance ministry backs a “zero tolerance“ policy for bad loans.

Many questions remain. Will new buyers be available? Will these ask for such high loan forgiveness in the takeover package that banks will refuse, leading to stalemates? Will old owners regain control at bargain prices via benami companies in tax havens? Time will tell. Yet let's hope for a new era where industrial might is no protec tion against the rule of law, and the exit of celebrated but defaulting industrialists is not only possible but happening. True capitalism requires exit for capitalists no less than workers.

Once, Vijay Mallya was politically so powerful that banks kept ever-greening loans to his sinking Kingfisher Airlines. He hoped to survive a debt of Rs 9,000 crore, as industrialists always had.But when the BJP government moved to arrest him, he fled abroad in 2016. His assets in India -including holdings in United Breweries and United Spirits -have been seized. The Enforcement Directorate claims these assets will cover his bank dues of Rs 9,000 crore, and awaits court clearance for an auction.

The Essar Group ran up huge debts to expand its empire, among allegations of inflated capital costs. Lenders have forced it to sell Essar Oil, which includes India's second biggest oil refinery, its captive port at Vadinar, a power station of 1,010MW capacity, and 3,500 filling stations. The $12.9 billion sale to Rosneft will enable the group to halve its debts, and probably hang on to indebted Essar Steel. However, the group's debts remain huge at Rs 70,000 crore.

The Jaiprakash Group (Jaypee) had a spectacular rise in the 2000s as it borrowed hugely to fund enormous infrastructure projects and real estate. That bubble then burst. The initial reaction of banks was to keep extending their loans to Jaypee despite defaults: this was business as usual. But in today's new era, they have leaned on Jaypee to sell its cement plants to the Birlas for a reported Rs 16,000 crore. As part of its debt recasting plan, the banks are reported to have taken over Jaypee's land assets worth over Rs 13,000 crore. Never before have owners ever been obliged to part with such massive, profitable assets to repay old debts.

Ousting promoters is not an end in itself.Many promoters were unlucky, including those hit by land acquisition delays, and those who built power plants but could not get fuel from Coal India. “Resolution“ in banking terminology means a deal where the lenders and owners (and sometimes trade unions) all agree to take a hit so that the enterprise becomes viable again.Resolution is the simplest and most preferred outcome. But it is feasible only when company assets are still substantial and the business is fundamentally viable. Resolution will not work for run-down companies with worthless assets.

In the old days, banks kept lending till a company became worthless, and closed without paying workers. The new approach is to seize a defaulting company while it still has good assets, revive it through resolution, or else go for a forced sale to a new buyer. The owner will exit but most workers will remain employed. It remains to be seen if this works. If it does, how marvellous!

Lenders that abstain from voting process deemed to have voted against

Bankers plan to replicate the rigid timelines and forced decision-making that is ingrained in the Insolvency and Bankruptcy Code (IBC) in other forums where they meet to decide on resolution of bad loans outside bankruptcy proceedings.

A major highlight of the bankruptcy process is that lenders are not allowed to abstain from the meetings or voting process. If they do, they are deemed to have voted against the proposals. This has forced fence-sitters to be more active in the bankruptcy process. Besides the voting and compulsion to be present, a key feature of the IBC is the fixed timeline of six to nine months within which lenders have to agree on a resolution, failing which the business gets liquidated.

A senior banker with a large state-owned lender said that a decision has been taken in the Joint Lenders’ Forum (JLF) that banks will be forced to vote and a decision to abstain is treated as a vote against. The JLF as a forum was created by the Reserve Bank of India in 2014 to address cases of default where there are multiple lenders and the loan size is above Rs 100 crore. However, due to various shortcomings, the JLF was not able to successfully address the issue of nonperforming assets (NPAs).

Sapan Gupta, partner and head of banking and finance at Shardul Amarchand Mangaldas & Co, said, “The IBC is one of the methods for banks to pursue recovery and, in the current environment, IBC is the first option. At some point of time, banks will have to examine various other options including the JLF. So the learning from one framework can get transferred to others.”

According to Gupta, the biggest contribution of IBC is that it makes it compulsory for everyone to attend and if they do not attend it is a ‘no’ vote. “Voting has to happen either immediately when 100% of the committee of creditors (CoC) is present or within 72 hours of the CoC meeting through electronic vote. Those timelines are not there in JLF which leads to indecisiveness,” said Gupta. “Also, the voting is related to loan exposure as against JLF which goes by number of votes. JLF also needs to take into account different types of lenders including non-institutional.”

Another issue that currently comes in the way of resolution is that different lenders choose different forums to pursue recovery. “Bankers can take a stand that, when a bad loan is being pursued under JLF, the lenders will not seek any other remedy so that the borrower can focus and provide a solution,” said Gupta.

2018: Home buyers get more say in insolvency

June 7, 2018: The Times of India

From: June 7, 2018: The Times of India

IBC Ordinance Lifts Ban On Bidding By MSME Promoters

The government promulgated an ordinance to amend the Insolvency and Bankruptcy Code (IBC) and treat home buyers in ailing real estate companies on a par with banks in the resolution process. The tag of financial creditors will allow buyers of apartments in Jaypee Infratech and Amrapali projects to have a say in ensuring that their interests are not compromised during the resolution process.

Corporate affairs secretary Injeti Srinivas told reporters that the ordinance empowers even a single home buyer to approach the National Company Law Tribunal to initiate insolvency proceedings. But it is not sufficient to offer them the same rights as the lenders in case the company goes into liquidation as the home buyers will have to prove that they are secured creditors. “It will depend on the agreement that the home buyers have signed. But the ordinance recognises the special status that home buyers should get,” said Srinivas, adding that rules regarding their representation on the committee of creditors (CoC) will be notified soon. In some states, there are two agreements — one for the land and the other for the house, which allows home buyers to be treated as secured creditors.

“The ordinance provides significant relief to home buyers by recognising their status as financial creditors. This would give them due representation in the CoC and make them an integral part of the decision-making process,” an official statement said.

The other major change concerns micro, small and medium enterprises (MSMEs), where the earlier ban on promoters from bidding has been lifted. Further, finance companies that had picked up shares of the ailing companies are also eligible to bid now. “While the idea is to keep those who are not desirable out of the process, we also need to ensure enough competition,” Srinivas said. The statement said that the ordinance also empowers the central government to allow further exemptions or modifications related to MSMEs. The government has, however, stuck to the current legal definition of MSMEs — which mandates investment of up to Rs 10 crore in plant and machinery — ignoring suggestions of the Rs 250 crore turnover limit.

2018: Homebuyers, depositors in stressed companies can nominate representative

Homebuyers can name rep to decide stressed co’s fate, July 5, 2018: The Times of India

2018 empower homebuyers, depositors

From: Homebuyers can name rep to decide stressed co’s fate, July 5, 2018: The Times of India

Rules Detail Process, Timeline To Decide Successful Bidder

Homebuyers and depositors in companies facing insolvency action will get to nominate their representative from a panel of three insolvency professionals to represent them on the committee of creditors (CoC) — the decision-making body that decides the fate of stressed companies.

The move follows an amendment to the Insolvency and Bankruptcy Code (IBC) in the wake of action against realtors such as Jaypee Infratech and Amrapali, with homebuyers now given a representation in the committee of creditors to have a say in deciding the fate of the stressed company. Earlier, the fear was that lenders who were the sole representatives will put together a deal that does not factor in the interests of other stakeholders.

The rules notified by the regulator Insolvency and Bankruptcy Board of India (IBBI) stipulate that every category of creditor — including depositor, security holder and homebuyer in case of a housing company — which has at least 10 entities or individuals will get to nominate its representative in CoC. “The insolvency professional, who is the choice of the highest number of creditors in the class, shall be appointed as the authorised representative of the creditors of the respective class,” it said in a statement.

IBBI has also given detailed norms for the resolution professional to decide the evaluation matrix, given that there have been accusations of favouritism in some of the cases that are currently being decided. “The request for resolution plans (RFRP) shall detail each step in the process, and the manner and purposes of interaction between the resolution professional and the prospective resolution applicant, along with corresponding timelines,” it said.

The resolution plan prepared by bidders will have to show how the reason for default is being addressed, whether it’s feasible and viable, provisions for its effective implementation and capability of the applicant to implement it, among other things.

As reported by TOI, the guidelines are seen to have come in the wake of the initial cases, especially the high-profile ones getting delayed, prompting the government to suggest that detailed norms should be issued, much like the Companies Act. It is also aimed at ensuring transparency in the process and protection to members of CoC. The rules have also provided a detailed timeline for each action to ensure that the whole process is completed within the 180-day deadline provided in the law.

Laws, rules, court judgements

Personal assets of guarantors cannot be liquidated in companies facing insolvency

Allirajan M, Guarantors’ own assets get shield, March 8, 2018: The Times of India

Creditors Cannot Liquidate Personal Property Under IBC, Says NCLAT

In a landmark judgment, the National Company Law Appellate Tribunal (NCLAT) has ruled that personal assets of guarantors, who in most cases are promoters, cannot be liquidated in companies facing corporate insolvency resolution process under IBC. The moratorium on sale of assets applies not just to corporate debtors but also personal guarantors under the Insolvency and Bankruptcy Code (IBC), the tribunal said.

NCLAT’s latest ruling has huge ramifications as it offers relief for the personal assets of promoters. This also effectively overturns another important ruling where the National Company Law Board’s (NCLT’s) Mumbai bench held that the promoter cannot escape the liquidation of personal assets by simply filing for bankruptcy. NCLT-Mumbai had ordered lenders to go after the personal properties of Schweitzer Systemtek India in July 2017, though the company brought voluntary bankruptcy proceedings.

The NCLAT said, “From the IBC provisions, it is clear that resolution plan, if approved by the committee of creditors and if the same meets the requirements as referred to in sub-section (2) of Section 30 and once approved by the adjudicating authority, is not only binding on the corporate debtor, but also on its employees, members, creditors, guarantors and other stakeholders involved in the resolution plan, including the personal guarantor.” “In view of the provisions, we hold that the ‘moratorium’ (on sale of assets) will not only be applicable to the property of the corporate debtor but also on the personal guarantor,” the NCLAT ruled in an appeal filed by SBI against V Ramakrishnan, a director in the Tiruchibased Veesons Energy Systems and who is the personal guarantor for the company.

K S Ravichandran of KSR & Co Company Secretaries said, “The NCLAT has removed inconsistencies in decisions of benches of NCLT. This also removes language deficiency in Section 14 of IBC.” Section 14 of the IBC empowers the adjudicating authority to declare a moratorium on the transfer, alienation or disposal of assets of the corporate debtor.

SBI invoked its right under SARFAESI (Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, 2002 against the personal guarantor in August 2015 for recovery of Rs 61.1 crore.

The notice was challenged by the corporate debtor (Veesons Energy) in the Madras high court, which was dismissed with costs in November 2016. Following this, SBI issued a possession notice and took symbolic possession of the secured assets. The personal guarantor filed an application in NCLT-Chennai for stay of proceedings under the SARFAESI Act, 2002, including the auction notice dated July 12, 2017. The tribunal restrained SBI from proceeding against the personal guarantor till the moratorium period is over.

Sale of corporate debtor’s assets as going concern

Allirajan M, Insolvency resolutions get a boost, March 31, 2018: The Times of India

IBBI Amendments Allow Sale Of Corporate Debtor’s Assets As Going Concern

The Insolvency and Bankruptcy Board of India has amended the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2018 to fix a time frame for identifying resolution applicants. As the amended regulation makes it mandatory to identify the applicants by the 105th day, experts say the resolution process can be completed in a timely manner within the stipulated 180 days.

There is no deadline for identifying resolution applicants. Generally, the identification process and criteria keep changing till the fag end of the resolution period, which leads to delays in completion of the entire process. K S Ravichandran of KSR & Co Company Secretaries said, “It (the amendment) means bids must be invited under section 25 much before the 105th day.”

Monish Panda, founder of legal firm Monish Panda & Associates, said, “Hopefully, the new amendment will ensure timely completion of the resolution process.”

However, the lack of a fixed time frame for identifying resolution professionals (RPs) was only one of the several factors behind the stretched bankruptcy resolution processes. Recent weeks have seen legal challenges dragging the outcome in some of the prominent cases.

The IBBI (Liquidation Process) (Amendment) Regulations, 2018 also come into play after the insolvency resolution process is not successful. Earlier, regulation 32 of the principal regulations provided four modes for liquidation of corporate debtor — sale on a stand-alone basis, slump sale, sell the assets in parcel, and sell the assets collectively. After the latest amendment, the IBBI has added a fifth method of selling assets of the corporate debtor — ‘as a going concern’.

Panda said, “A going concern indicates that the company has not completely dissolved yet, even though its valuation may be considerably lower. This inclusion is in line with the spirit of the code.” He added, “The objective of the code is to ensure continuity of the corporate debtor as a going concern to realise maximum value for creditors and ensure welfare of employees of the corporate debtor.”

The amendment contemplates a scenario where, despite failure of the resolution process, the corporate debtor continues as a going concern. The liquidator then has the option to sell it as such, rather than in parcels if he/she feels that selling the company as a going concern will fetch a better value than in bits and pieces.

Ravichandran said, “This amendment brings to the fore the need to preserve, if possible, the status of the undertaking as a going concern, which will bring more value rather than selling assets of a closed undertaking. This method of sale will protect contracts and arrangements that are under way and employees and stakeholders will benefit from the continued operations of the undertaking.”

Impact of 2016 law

From: Dhananjay Mahapatra, SC: NCLT should reduce interference, September 14, 2018: The Times of India

See graphic:

What are national Company Law Tribunal and National Company Law Appellate Tribunal?

Impact of law

SC asks NCLT to reduce interference/ 2018

Dhananjay Mahapatra, SC: NCLT should reduce interference, September 14, 2018: The Times of India

Litigants taking recourse to moving the National Company Law Tribunal (NCLT) to stall proceedings before finalisation of a resolution plan must stop and and tribunal should not be allowed to intervene till the committee of creditors took a final view, the Supreme Court said.

The SC’s comments came after it expressed disgust on NCLT acting as a “super supervisor” at each stage of proceedings against debt-ridden companies under the Insolvency and Bankruptcy Code, virtually defeating the IBC’s objective of speedy resolution or liquidation of loan defaults running into lakhs of crores of rupees.

When a bench of Justices R F Nariman and Indu Malhotra sought suggestions to improve the bleak situation which resembled the snailpaced BIFR proceedings, senior advocate Harish Salve said the SC must give a purposive interpretation to the IBC provisions. He said the court should debar NCLT from interfering till the committee of creditors (CoC) completed its deliberations on the resolution plan submitted by the resolution professional (RP) after examining bids.

The bench said, “That is absolutely correct. That should be made mandatory. That is the single most important point. Otherwise, it becomes a meaninglessly endless exercise despite IBC stipulation for finalisation of resolution plan within 270 days of NCLT admitting insolvency petition by banks and financial institutions against a corporate loan defaulter. The mechanism adopted by litigants to attempt stalling of proceedings at every stage before the finalisation of resolution plan by moving NCLT every now and then must stop.”

When Salve said NCLT was not a super supervising authority for the RP or CoC, Justice Nariman agreed and said, “absolutely”. Salve said the SC must interpret provisions to say NCLT would not come into the picture till the RP finalised proposals and the CoC took a final view on that. Justice Nariman said “100% correct” and added, “Top to bottom, what is going on at present — the manner in which NCLT going into every issue dealt by RP or CoC is completely wrong.” Salve reiterated that the SC must do a “purposive interpretation”.

Justices Nariman and Malhotra stressed the sanctity of the 270-day period for finalising a resolution plan and said some time limit must be fixed for NCLT and the appellate tribunal (NCLAT) to decide disputes after finalisation of a resolution plan. Salve said NCLT was saddled with too many responsibilities — company law disputes to insolvency, merger and de-merger to acquisition.

Procedure

The government said insolvency resolution plans, such as sale and transfer of assets, do not require approval from shareholders or the company as the law provides a detailed process from the receipt of the resolution plan to approval by the adjudicating authority.

The clarification by the ministry of corporate affairs is expected to speed up the process of resolving cases facing insolvency action in various benches of the National Company Law Tribunal (NCLT), which range from large steel companies such as Essar Steel and Bhushan Steel to real estate players such as Jaypee Infratech and some of the companies of the Amrapali Group. A number of these cases are now nearing the deadline for working out a resolution plan, which is fixed at 180 days, with a 90-day extension possible.

It will also help push through resolution in insolvency cases where the original promoters of the company seek to block a plan by insisting on a vote in line with the provi sions of the Companies Act or Sebi norms.

The government is of the view that Insolvency and Bankruptcy Code (IBC) provides that the resolution plan will be binding on a company , its shareholders, lenders, employees, guarantors and other stakeholders if approved by NCLT. But it has suggested that the onus of ensuring that the plan is in line with norms is with the committee of lenders and the insolvency resolution professional. “It is understood that the requirements... of the Code (IBC) ensure that resolution plan(s) considered and approved by the committee of creditors and the adjudicating authority is compliant with the provisions of the applicable laws and therefore is legally implementable,“ the ministry said. It pointed out that a resolution plan should not allow for 100% foreign investment when the FDI ceiling for the sector is 75%.“The purpose is to prevent approval to resolution plans, which are not legally implementable,“ it said.

Sources said that there was confusion due to different legal opinion given by insolvency lawyers, some of whom believed that any resolution plan needed to be endorsed by shareholders. There was an opposite views as well, which were heard by the ministry and the Insolvency and Bankruptcy Board of India, the agency responsible for the new law, which decided to issue the circular to ensure clarity.

Year-wise trends

2018: Realisation from bankrupt cos. Increases

From: Sidhartha, Banks see jump in realisation from cos hit by bankruptcy, June 11, 2018: The Times of India

Businesses Eyeing Expansion Find Value In Distressed Assets

Lenders to companies facing bankruptcy proceedings saw their entire claims settled in a third of the cases resolved during the March quarter, while average realisation from the dozen companies was close to 70% — more than twice the level seen up to December.

Latest data released by regulator Insolvency and Bankruptcy Board of India (IBBI), showed that against the admitted claims of Rs 4,405 crore by the financial creditors, Rs 3,070 crore were realised — which was more than twice the liquidation value.

In contrast, in the first 10 cases resolved up to the December quarter, the Economic Survey had said that of the Rs 5,530-crore claims made by financial creditors, in nine out of the 10 cases, they could recover Rs 1,853 crore or 33% of the claims.

Although no immediate reason was available, market players said that for companies looking to expand their businesses, the distressed companies with a good asset base offered an attractive option. Officials said the data suggested that fears of a sharp drop in valuations — after the government decided to keep out the promoters — were unfounded.

“The system is stabilising and there is greater awareness, resulting in more competition for companies. If the trend continues, banks can hope to see even better realisation,” said an official.

IBBI said that early initiation of the resolution process helps creditors realise a better value. “Many of the corporates ending up in liquidation had long-pending dues and hence were left with little organisational capital. Therefore, in most cases, the resolution value offered was either below the liquidation value, the resolution plan came from ineligible parties or there was no resolution plan at all,” it said.

Till the end of March, 701 cases had been admitted by the National Company Law Tribunal (NCLT), with 525 companies undergoing the resolution process, IBBI data showed. So far, 176 cases have seen closure in various benches of the NCLT, but almost half (87) went into liquidation, while 22 have been resolved — including the dozen in the March quarter.

While there were four cases where financial creditors managed to realise 100% or more of the claims admitted, on cases of Trinity Components, the realisation was 99.98%, the data showed, with almost the entire Rs 17.38 crore of the claims realised.

The data also revealed that of the 701 cases, 310 (44%) were moved by operational creditors, such as vendors and suppliers, while 262 (37%) came from financial creditors, and the remaining 129 were filed by companies.

Officials said that the numbers suggested that smaller suppliers were often using the IBC to get their dues back from companies especially as 2,100 cases involving Rs 83,000 crore of claims were settled as soon as they were filed and had not been admitted by the NCLT.