Delhi: Economy

(→2017, 2018/) |

(→2017, 2018/ government finances) |

||

| Line 45: | Line 45: | ||

''Excise collections in Delhi, April- July, 2017, 2018'' | ''Excise collections in Delhi, April- July, 2017, 2018'' | ||

| + | |||

| + | ==2015-19: tax collection== | ||

| + | [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F01%2F04&entity=Ar00214&sk=2F526874&mode=text Paras Singh, January 4, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: 2015-19- tax collection by the Government of Delhi and the implementation of the 5th Delhi Finance Commission report.jpg|2015-19: tax collection by the Government of Delhi and the implementation of the 5th Delhi Finance Commission report <br/> From: [https://epaper.timesgroup.com/Olive/ODN/TimesOfIndia/shared/ShowArticle.aspx?doc=TOIDEL%2F2019%2F01%2F04&entity=Ar00214&sk=2F526874&mode=text Paras Singh, January 4, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | Finance officials of the east corporation say that though they will be better off compared to the 3rd DFC allocations, the fund distribution was much better for them under the 4th DFC recommendations. They estimate that they will get approximately Rs 900 cr against an allocation of Rs 590 cr under the 3rd DFC. “Under the 4th DFC, east corporation was to get 42% of the total funds being given to all three civic bodies while now we will get only 35%. East Delhi will be at a disadvantage,” rued the official. | ||

| + | |||

| + | Under the new arrangement, officials said, the intercorporation distribution formula of the 4th DFC for the entire 12.5% devolution of funds has been applied on 6%. “The plan fund allocations (in education, health sectors), which were earlier a separate component, have now been scrapped. The funds for these sectors will now be made a part of these devolution allocations. A Delhi government committee will decide on the allocations annually,” the official added. | ||

| + | |||

| + | A senior south corporation official said that fund allocations have not been proportionately increased keeping the 4th DFC in mind. “The south corporation has got a bad deal. We suffer both in terms of not getting arrears and getting zero funds under the 3% component which is meant for the cash-strapped bodies,”’ he said. “Contrary to popular perception, the finances of SDMC are not in a very good state. A recent report by the municipal valuation committee has projected a revenue deficit of Rs 7156 cr in 2020-21.” | ||

| + | |||

==2017, 2018/ government finances== | ==2017, 2018/ government finances== | ||

Revision as of 22:05, 5 January 2019

This is a collection of articles archived for the excellence of their content. the Facebook community, Indpaedia.com. All information used will be acknowledged in your name. |

Contents |

Developmental/ economic indicators

2014-15

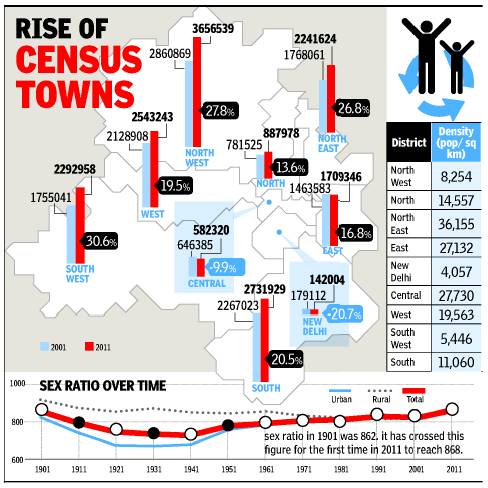

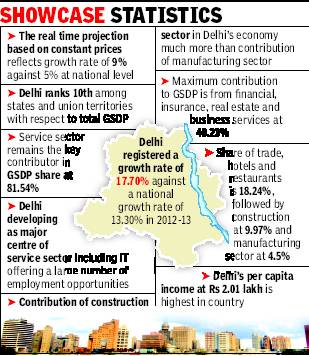

See graphic: Delhi Economy, demography, forest and farm sectors, housing and water supply, transport, health, education and power (2014-15)

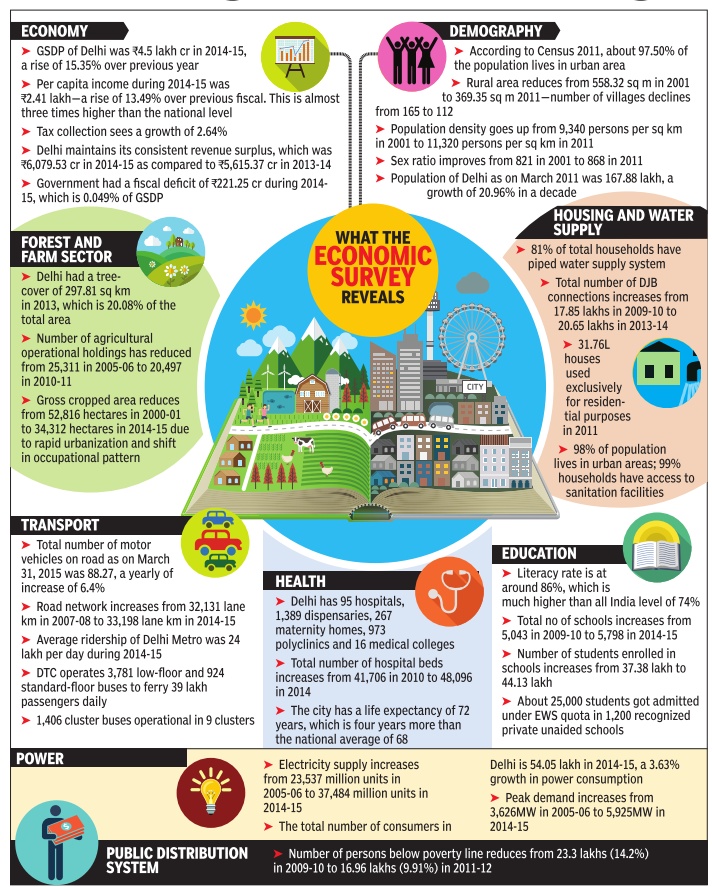

2015-16

See graphic, Delhi, 2016, some economic indicators

2015> 2017

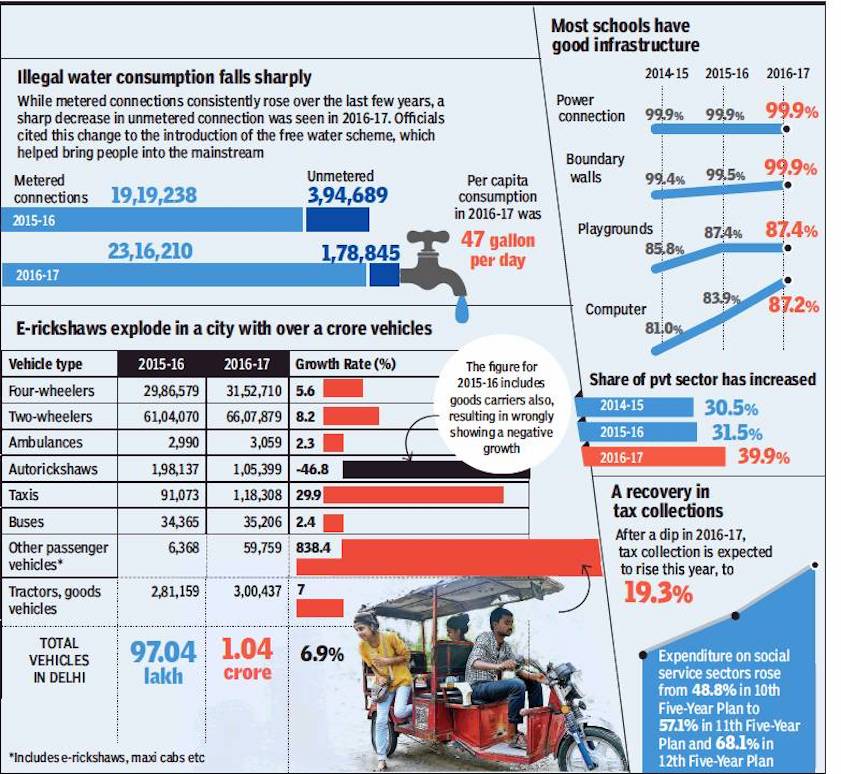

From: March 20, 2018: The Times of India

See graphic: Delhi, 2015- 2017, some economic indicators

Delhi, 2015- 2017, some economic indicators

Government finances

2012-18

Receipts and expenditure

From: March 23, 2018: The Times of India

Tax revenues as % state GDP;

Expenditure on establishment

From: March 23, 2018: The Times of India

See graphics:

Government finances, Delhi: 2012-18

Receipts and expenditure

Fiscal surplus or deficit as % of Delhi's state GDP, 2013-18;

Tax revenues as % state GDP;

Expenditure on establishment

Excise collections

2017, 2018/ Q2

From: AlokKN Mishra, July 26, 2018: The Times of India

See graphic:

Excise collections in Delhi, April- July, 2017, 2018

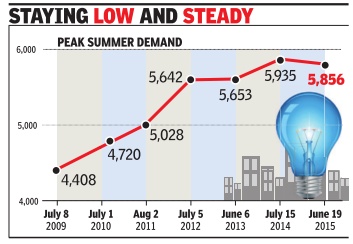

2015-19: tax collection

Paras Singh, January 4, 2019: The Times of India

From: Paras Singh, January 4, 2019: The Times of India

Finance officials of the east corporation say that though they will be better off compared to the 3rd DFC allocations, the fund distribution was much better for them under the 4th DFC recommendations. They estimate that they will get approximately Rs 900 cr against an allocation of Rs 590 cr under the 3rd DFC. “Under the 4th DFC, east corporation was to get 42% of the total funds being given to all three civic bodies while now we will get only 35%. East Delhi will be at a disadvantage,” rued the official.

Under the new arrangement, officials said, the intercorporation distribution formula of the 4th DFC for the entire 12.5% devolution of funds has been applied on 6%. “The plan fund allocations (in education, health sectors), which were earlier a separate component, have now been scrapped. The funds for these sectors will now be made a part of these devolution allocations. A Delhi government committee will decide on the allocations annually,” the official added.

A senior south corporation official said that fund allocations have not been proportionately increased keeping the 4th DFC in mind. “The south corporation has got a bad deal. We suffer both in terms of not getting arrears and getting zero funds under the 3% component which is meant for the cash-strapped bodies,”’ he said. “Contrary to popular perception, the finances of SDMC are not in a very good state. A recent report by the municipal valuation committee has projected a revenue deficit of Rs 7156 cr in 2020-21.”

2017, 2018/ government finances

Alok KN Mishra, Tax evasion down, Delhi’s revenue up, November 22, 2018: The Times of India

From: Alok KN Mishra, Tax evasion down, Delhi’s revenue up, November 22, 2018: The Times of India

In the first two quarters of the current financial year, Delhi government collected Rs 21,000 crore in taxes. The total tax generation in the corresponding period in the last financial year was Rs 19,869 crore. Sources in the government said that the implementation of the e-Way bill seems to have played a key role in boosting tax collection by increasing better compliance of the Goods and Services Tax. Stamps and registration fees and land revenue have also recorded growths.

The e-Way bill, the electronic document generated on the GST portal for the movement of goods valued higher than Rs 50,000, has played a key role in preventing tax evasion. It has also ensured that the transactions complied with the GST laws.

A government official said that the major factor behind the rise in revenue is the easy tax scrutiny facilitated by the GST regime. The Aam Aadmi Party government, however, maintained that the revenue collection has increased because “the government is honest.”

The revenue department, which manages the sale of stamps and registration fees and land revenue, returned a collection of Rs 2,617.6 crore, a big increase from Rs 2,280.9 crore in 2017-18. This is 60.9% of the budget estimate under this head.

Revenue collected by the excise & entertainment tax department on commodities and services in the first two quarters of this year also went up from Rs 2,648.1 crore last year to Rs 2,794.2 crore. This figure represents 53.7% of the budge estimate.

The tax collected by the transport department has gone down slightly. In 2017-18, the department collected Rs 1,220.1 crore as taxes on vehicles, but till the second quarter this year, it had collected only Rs 1,160.6 crore, or 46.4% of the budget estimate.

An official described the tax collection in the two quarters of the year as ‘impressive’ and ‘indicative of good revenue generation for the government’, which will ultimately help the government fund its various schemes and projects.

While the robust collection augurs well for the departments with schemes to implement, there is no likelihood, however, of budgets for some departments being decreased in the revised budget estimates being currently prepared. The revised budget estimate will be presented in the winter session of the Assembly. In case of poor revenue collection, the budgets for some departments, mostly for low priority projects, are normally cut in the revised estimates.

Since coming to power in 2015, the AAP government’s budgetary expenditure has been growing steadily, and has gone from Rs 41,129 crore in 2015-16 to Rs 53,000 crore in 2018-19. In 2016-17, it was Rs 46,600 crore, rising to Rs 48,000 crore in 2017-18. Delhi government has earmarked the largest shares of allocations for education and health.

Growth (of city)

2001-2011: Delhi gobbled up villages to grow

Sex ratio, 1901-2011; census towns, 2001, 2011

One Third Of Population In Urbanized Villages In Lal Dora Areas That Doubled In Past Decade

Rukmini Shrinivasan TIG 2013/06/12

New Delhi: The capital’s growth in the decade 2001-11 has overwhelmingly come from the city swallowing up rural areas, newly released census data shows. The number of census towns—essentially newly urbanized villages in the lal dora areas—nearly doubled over the last decade, taking the proportion of Delhi’s residents who live in these areas to an unprecedented third of the population.

Varsha Joshi, director of census operations for Delhi, released the Primary Census Abstract for the National Capital Territory of Delhi on Tuesday. PCA gives the final population totals for every ward and village in NCT, as well as their literacy rates and sex ratios; provisional numbers were released last year.

The census redefines a village as a census town when it is densely populated and over three-quarters of its men work outside agriculture. In 2011, India had 3,894 census towns, home to half its urban population. The new numbers show that nearly 50 lakh people in Delhi, of a total population of 1.6 crore, live in census towns, which range in size from the 1,178-strong Shakarpur Baramad in east Delhi to Karawal Nagar, home to 2.24 lakh people, in north-east Delhi.

In 2001, 25 lakh people lived in Delhi’s census towns and they formed 18% of the population. By 2011, the proportion of rural residents in NCT had shrunk to just 2.5%. Simultaneously, the number of census nearly doubled to 110. About 30% of the NCT’s population now lives in these census towns. In fact, of the 29 lakh people added to Delhi’s population in the last decade, 24 lakh were added in census towns alone.

Of Delhi’s nine districts, north-west has seen the highest growth in population (22%) and is Delhi’s most populated district with over 36 lakh residents. Over 35% of the north-west lives in census towns. Saraswati Vihar in north-west Delhi has the highest population of any of the NCT’s 27 sub-divisions. Both New Delhi and central Delhi on the other hand have fewer residents than in 2001.

Population numbers at the ward level show that just four years after delimitation, the population of different wards varies wildly, from 1.5 lakh residents in Hastsal to just 15,000 in Kashmere Gate, which saw large-scale slum demolitions.

As The Times of India had reported earlier, Delhi has India’s lowest female workforce participation rate, with just 8.25 lakh women or roughly 10% reporting as workers. In contrast, there are 48 lakh male workers; over half of males across ages in the NCT report as workers. Seelampur reports the lowest female workforce participation of just over 5%. “We took a lot of steps to improve enumeration of women workers, but this is still what we have found. It’s really something we are worried about,” Joshi said. Over 95% of Delhi’s workers are ‘main workers’, meaning that they do economically productive work for over six months in the year. Connaught Place has the highest work participation rates for both men and women.

The proportion of scheduled castes in Delhi’s population has remained nearly constant at 16.75%.

Growth of economy

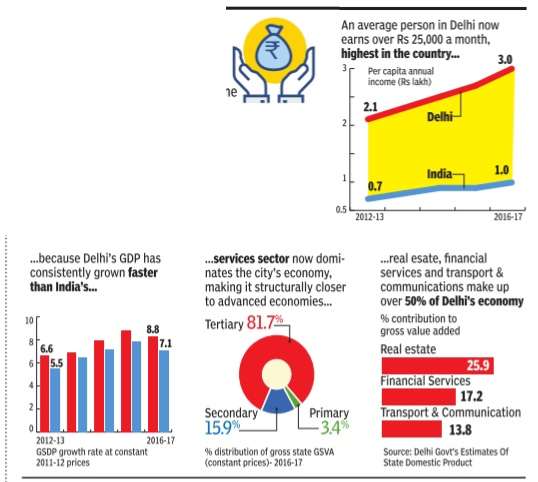

2012-17

See graphic, ' Economy, Delhi, 2012-13 and 2016-17 '

2013: Jobs, Economy Growing Faster Than National Average

Delhi vis-à-vis other major states

TIMES NEWS NETWORK

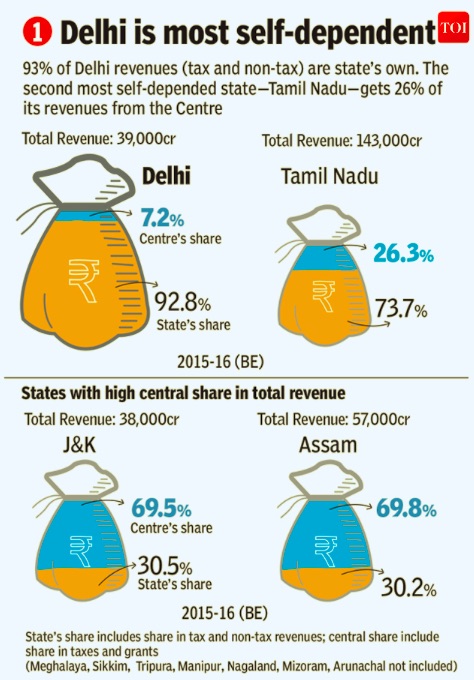

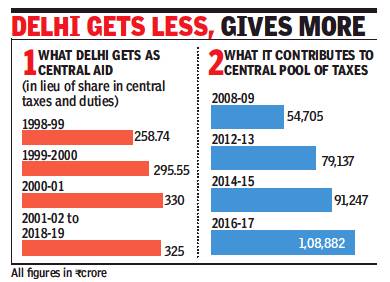

This grphic shows Delhi’s lack of dependence on central grants vis-à-vis the greater dependence of other states

The Times of India, March 9, 2017

What Delhi received as Central Aid; and

What Delhi contributed to the Central pool of taxes

From: October 6, 2018: The Times of India

2013: Services once again accounted for the largest share (81.54%) of Delhi’s state gross domestic product (GSDP) in the previous financial year, according to the report “E s t i m a t e s o f S t a t e D o m e s t i c P r o d - u c t — 2 0 1 2 - 1 3 o f D e l h i ” compiled by the Directorate of Economics & Statistics .

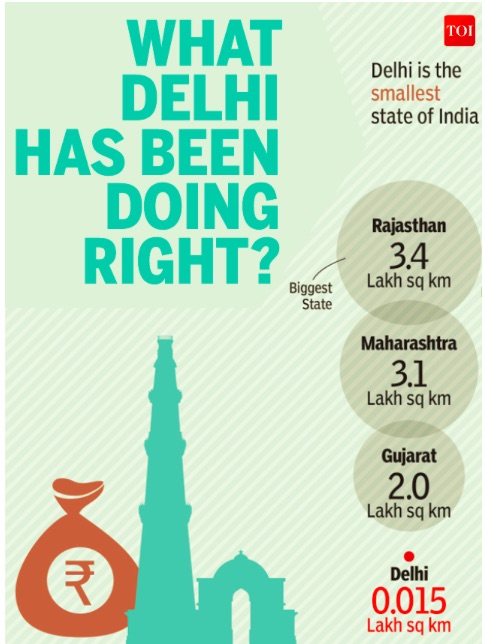

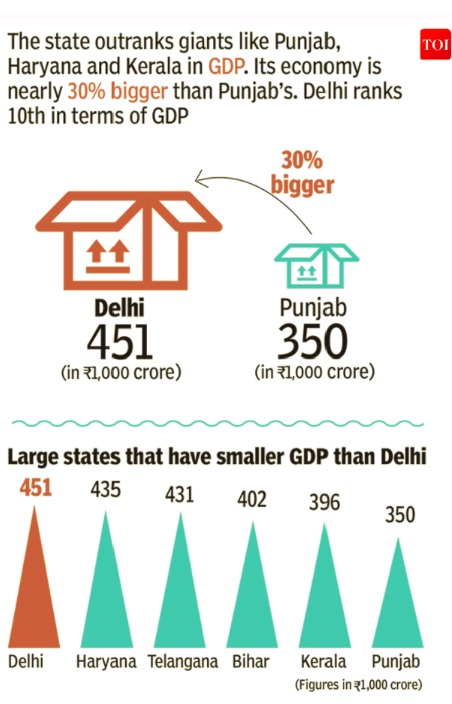

The report said Delhi has become the most attractive city for youths seeking work across the country, thanks to her government’s pragmatic economic policies. It added that the 17.7% growth in Delhi’s GSDP, compared to 13.3% at the national level, reflects the city’s economic health. After accounting for inflation, the growth amounts to 9%, compared to 5% at the national level. The report states that Delhi’s GSDP is the 10th largest in India.

The predominance of services in Delhi’s economy is in line with the city’s industrial policy that promotes non-polluting units. The secondary sector (industry) contributes 17.69% and the primary sector (agriculture) 0.77% of the GSDP, the report states.

Finance, insurance, real estate and business services make up 40.23% of the service pie, followed by trade, hotels and restaurants with 18.24%, and construction (9.97%). Large-scale construction across the city has increased the contribution of this sector.

The report states that the ratio of Delhi’s GSDP to the all-India GDP at both current and constant prices has increased steadily. Delhi contributes 3.87% of the national GDP with only 1.42% of the population. Since 1998-99, Delhi’s GSDP has risen from Rs 53,226 crore to Rs 3.65 lakh crore—an increase of 687% “during the last 14 years of the present government,” a statement from the CM’s office stated.

Per capita income in Delhi is Rs 2.01 lakh compared to Rs 1.73 lakh in 2011-12—an increase of 15.77%. It is three times the national average of Rs 68,747. Per capita income crossed the Rs 1 lakh mark in 2008-09, and increased to Rs 1.27 lakh in 2009-10. In 1998-99, it was only Rs 40,060.

Growth: per capita income

Delhi's per capita income highest in India: Report

PTI | Aug 31, 2013

NEW DELHI: Delhi's average per capita income, at more than Rs 2 lakh per year in 2012-13, is the highest in India, a official report said Saturday.

"The average per capita income in Delhi is nearly three times the estimate for the all India average. During the seven year period from 2005-06 to 2012-13, it grew at the rate of about seven percent per annum vis-a-vis around three percent for India," said the Delhi Human Development Report 2013.

"The sustained growth in per capita income has been associated with a reduction in poverty to single-digit figures to 9.9 percent in 2011-12 from approximately 13 percent in 2004-05," it added.

Industry

2012-13: Factory output increases 13.7%

The Times of India, Sep 09 2015

City's factory output increases by 13.7%

3,183 Units Employ Nearly 1.26L Workers

Delhi witnessed a 13.7% growth in its factory output in 2012-13. There were around 1.26 lakh workers, mostly engaged in the areas of leather, textile and apparel manufacturing as well as repairing of vehicles during this period.

Of 3,183 factories, 1,022 came into existence after 2000 and 134 after 2011. About 1,266 factories are classified as private limited companies, 1,055 are under individual proprietorship and 775 are under partnership, said deputy CM Manish Sisodia while releasing a report on Annual Survey of Industries 2012-13.

The total output of 3,183 factories increased from Rs 50,900 crore in 2011-12 to Rs 57, 858 crore in 2012-13. The value of input material used in these factories increased from Rs 43,949 crore in 2011-12 to Rs 49,024 crore in 2012-13.

“The total emoluments paid to these employees increased from Rs 2,260 crore to Rs 2,577 crore,“ says the report prepared by the directorate of economics & statistics of the Delhi government.

The average emoluments per employee working in the registered factories were a mere Rs 2.04 lakh, just about Rs 17,000 a month. The data also shows that even those work ing in the organized sector are earning less than Rs 20,000 a month. The district-wise average shows that the all-inclusive package lacks uniformity .

For instance, the highest annual emoluments were recorded in Central district where it was Rs 5.58 lakh per annum followed by Rs 2.87 lakh in Southwest district, Rs 2.20 lakh in East district and Rs 2.03 lakh in West district. North district recorded the lowest income of Rs 1.59 lakh per annum.

The report reveals that in 1,426 factories, the number of workers in each factory is 100 or above. In 204 factories, the number of workers is 500 and above. Sisodia said the total number of employees working in these factories increased from 1.19 lakhs in 2011-12 to 1.26 lakhs in 2012-13.

Inflation

2007-15: Rise of wholesale prices of foodstuffs

The Times of India, Jun 25 2015

Neha Lalchandani

In 7 years, prices of pulses, oil & mutton nearly doubled

In the past seven years, the prices of many food items seem to have doubled in Delhi. The Economic Survey of Delhi for 2014-15 shows that pulses, oil and even mutton are now twice as costly . Interestingly, Delhi's consumer price index during 2014 at 223 was lesser than the national average of 247, indicating that inflation in Delhi since 2001 has actually been lower than in most other cities. The survey , however, shows that potato and onion have registered an insignificant rise in their wholesale price since 2007 onion has gone up from Rs 1,107 per quintal to Rs 1,200 per quintal while potato is up from Rs 685 per quintal to Rs 750 per quintal. Against this, the price of pulses has risen exponentially in the wholesale market and its impact has been felt more acutely in the retail market. Arhar has gone up from Rs 3,365 per quintal to Rs 6,400 per quintal while price of moong has risen from Rs 3,784 per quintal to Rs 6,550 per quintal.

“Barring seasonal fluctuations in some commodities like onion, potato and wheat due to decline in arrivals, inclement weather in the major producing areas, transportation bottlenecks, increase in cost of movement and lower stocks the retail prices of most essential commodities have exhibited a steady trend in all metro cities in India.“ It has attributed the rise in prices to low production, market inefficiencies, wastage due to inadequate storage facilities etc.

In the case of pulses, Naresh Gupta, president of the grain merchants association, says a change in the minimum supply price has been instrumental in the sharp rise in prices, but more importantly , a shortage in supply is responsible for the rise in the price of grains. “Moong is the major crop grown in India but the rest is largely imported.The dollar exchange rate has also gone up significantly in he past 10 years. When we have been unable to meet demand, the prices will, of course, rise,“ he said.

Labour and migration

1999-2000 to 2011-12

See also Delhi: migration to

The tightening of the labour market has contributed to the lowering of poverty.

During 1999-2000 to 2011-12, an additional 1.3 million people were added to Delhi's workforce taking the total figure to 5.56 million.

Although, the rate of migration has stabilized in Delhi during the last decade, around 75,000 people still come to Delhi every year in search of a livelihood, said the report.

"The city has absorbed the migrants rather well, with the migrants rating themselves better than the non-migrants in terms of several indicators of well-being," it said.

While one third of the migrant population perceived that work opportunities in Delhi had improved over the last three years, two thirds of households considered their income to be stable.

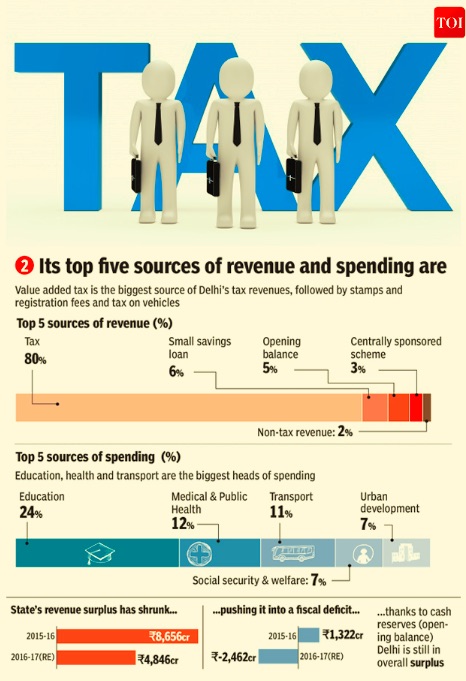

Power consumption

As in July 2015

The Times of India, Jul 20 2015

City records dip in peak power demand this season

Delhi's power demand seems to have finally plateaued. From a constant 10%-15% surge in demand every year in the past decade, it appears the peak power demand for the current year is unlikely to surpass the previous year's. Delhi's power demand on Friday was 5,051 MW and power sector officials said it will dip further or stay constant in days to come if rains continue.Meanwhile, trends have shown that Delhi's annual power demand usually peaks within the first fortnight of Ju ly, and now it appears unlikely that Delhi will cross last year's all-time peak demand of 5,925 MW recorded on July 15. This would mark the first time in almost a decade that peak power demand does not exceed the previous years.

So far, Delhi recorded 2015's highest power consumption on June 19 when the demand touched 5,856 MW . Delhi government and the power companies had been anticipating that the year's peak demand would touch 6,200-6,300 MW by July when humidity was at its maximum and most households switched to airconditioners round-the-clock. “However, unless there is an unexpected surge in power consumption towards the end of July, it is unlikely that Delhi will now cross last year's peak demand. From a steady increase over the past ten years or so, it seems that power consumption in the capital has finally reached its peak and will stay within 6000 MW , said an expert.

With one exception in 2011, trends show that Delhi reaches its peak in power consumption either in June or July. “Only once in 2011, the city reached its peak power demand on August 2. So while it is still possible that we may see a similar situation in 2015 as well, the chances seem doubtful. The weather so far appears to be favorable and seeing a 1,000 MW increase in power consumption over the next two weeks is off the mark, said another expert.

While power sector officials said it was difficult to assess exactly why the demand had plateaued, experts said it could be due to a combination of increased use of energy efficient gadgets as well as optimum use of energy resources.“The fact that Delhi's power demand is not rising as much as it did a few years ago is good news for the city . Discoms will now be in a better position to forecast demand and make arrangements accordingly , said an official.

Rules that curb ‘development’

The Times of India, Sep 05 2015

Risha Chitlangia

Muddled rules stall city's growth

Policies not framed with ground realities in view, difficult to implement

Residents of Golf Links and Sunder Nagar are resisting the de-notification of these areas from Lutyens' Bungalow Zone (LBZ). They say the upscale colonies will become commercialized like other residential areas and the density of population will increase once the development norms of Master Plan for Delhi-2021 become applicable to them. “Bigger buildings will be allowed without increasing the infrastructure,“ a resident of Golf Links said.

While Delhiites appreciate the government's decision to increase the floor area ratio (FAR) and the height of buildings in MPD-2021, they say growth of infrastructure is not keeping pace with the pressure of population.

“It should have been binding on the civic agency to augment the civic infrastructure while sanctioning plans as per the new development norms. Due to lack of enforcement, people are blatantly violating norms,“ said Chetan Sharma, chairman, GK-II RWA complexes. Problems like parking, waterlogging, shortage of drinking water, etc., have worsened after the new provisions were implemented.MPD-2021 requires that the civic agencies upgrade their infrastructure but this isn't happening.

MPD recommended redevelopment of plotted areas to meet the growing demand for houses in a planned way. But it placed the condition that the minimum plot size should be 3,000 sqm, which is nearly impossible to achieve, so only a government project in Kidwai Nagar has been approved so far. “It is a good provision, but difficult to achieve under the present norms as 3,000 sqm is a huge area,“ said A K Jain, former planning com missioner of DDA. He added that the redevelopment norms should be made peo ple-friendly.

In villages, redevelop ment can be done on a plot of 1,670 sqm or more.

Residents say the develop ment norms are not in sync with the ground realities and should be framed after study ing the problems faced by the residents. For instance, there is a need to combine small plots for redevelopment. At present, only plots measur ing up to 64 sqm can be com bined in villages, industrial areas and some parts of Rohini but the government is likely to raise the limit to 200 sqm.“There are many small plots in the city. People should be allowed to amalgamate plots and reconstruct. The provisions have to be implemented in the right spirit,“ said Neeraj Gupta, president of Hblock RWA in New Rajinder Nagar.

Rules related to subdivision of plots are also impractical as the FAR of the smaller plots is based on the size of the original plot. Municipal corporation officials say building plans are not being sanctioned in unauthorized regularized colonies and villages due to this rule. People in these colonies are building illegally as they can't get the FAR that other colonies are allowed.

“Although the provision recognizes each subdivided plot as a single entity, it doesn't allow FAR as per the MPD norms. In most cases, the permissible FAR is used up by the other subdivided plots, leaving little scope to construct on available vacant land, said a senior South Corporation official.

Experts say there is a need to reconsider the development provisions so that people can get their plans sanctioned without any hassle.

Sex ratio

Elsewhere on this page see the graphic, Delhi’s census towns, and population density, in 2001 and 2011

Sex ratio in Delhi, 1901-2011.

2011

In 2011 Delhi had a higher proportion of women in its population than it has had at any time in over a century. The sex ratio – number of females of all ages for every 1,000 males – was 868 in 2011, the first time that it has crossed 862, the previous highest set way back in 1901. This change has taken place despite no significant improvements in Delhi’s child sex ratio which stands at 871 girls for every 1,000 boys between the ages of 0 and 6. The figure for 2001 was only marginally lower at 868. There seemed to be more family migration taking place and fewer single male migrants, Varsha Joshi, director of census operations for Delhi, had said earlier. That could partly explain the dramatic improvement in the overall sex ratio between 2001, when it was 821, and 2011.

Tax bases

Property tax

Mayank Manohar, House tax waiver will paralyse corps: Experts, March 26, 2017: The Times of India

See graphics

Key sources of revenue in Delhi.jpg|Key sources of revenue in Delhi

Property tax in Delhi: statistics, 2012-17

Delhi CM Arvind Kejriwal's announcement that AAP will do away with the property tax collection from residential units and waive dues of all defaulters if it wins the civic elections has not gone down well with former municipal commissioners and ruling party leaders in the corporations. They claim that the step will weaken the revenue generation mechanism of the municipalities and “effectively paralyse the civic bodies“.

In 2004, when the unit area method was introduced by the erstwhile MCD, the colonies were divided into different categories from A to H. The base unit area value was fixed depending on their location and the nature of area. For instance, the base unit area value for A-category colonies is Rs 630 (maximum) and while this is Rs 100 (minimum) for H-category ones. Former municipal commissioner Rakesh Mehta cla ims if property tax is not collected from residential colonies, the concept of categorisation will become meaningless.In that case, services given to people living in Greater Kailash will be the same as that of Seelampur, he said.

As of now only 30-35% of the entire Delhi's population is paying property tax while the remaining 65-70% are not in this tax bracket. The property tax is collected from residential, commercial and industrial units as well as mixed land use.The south corporation has 4.75 lakh tax payers among its 11 lakh households. The north civic body has approximately 3.35 lakh property tax payers among 10 lakh properties un der its jurisdiction while the east corporation has 2.28 lakh tax payers out of over four lakh property owners.

In 2016-17, the south, north and east corporations collected Rs 775 crore, Rs 435 crore and Rs 128 crore respectively , which is almost 30% of their total revenue. The revenue collected as property tax helps the corporations in providing services to the public.

“In every country , local bodies collect taxes. This is because the government provides only a portion of the total revenue and the civic bodies have to arrange the rest of the funds themselves. Services like sanitation, primary education and health will be badly affected if property tax is abolished,“ said Mehta.

K S Mehra, another excommissioner, said the basic logic for civic bodies to have revenue sources is to ensure that they can become self-reliant.“Property tax has always been a major source of revenue and the collection should be increased instead of doing away with it,“ he said.

Post trifurcation, a large number of number of A and B category colonies came under the south corporations, while the north had mostly B and Ccategory colonies and the east corporation was left with a good number of E,F ,G and Hclass colonies.

“Property tax is a major re venue source. If this step is implemented, alternative measures are required to fill the revenue gap and to ensure that civic bodies don't get into financial trouble. The south corporation is financially stable because it has seen a huge rise in the property tax collection,“ said Radha Krishnan, assessor & collector of SDMC.

Senior officials warn that the cash-strapped north and east civic bodies will face further crisis if the property tax waiver comes into effect. “We are already financially weak and if we stop collecting property tax from residential units, we will never be able to deal with the situation,“ said a senior finance official (east corporation).

Senior leaders said that such a move will paralyse the functioning of corporations and they will never be able to become self-reliant. “If civic bodies stop collecting taxes, how are we going to extend services to the public,“ asked V P Pandey , leader of the House (north).

Unemployment

1997-2015

Number of jobless people on the rise, Mar 08 2017, The Times of India

The Economic Survey 2016-17 shows that the number of unemployed in the capital has been rising consistently since 2010. There were over 10 lakh jobless people in 2014 and 2015.Unemployment growth rate was the lowest at 6.51% in 2015, as compared to the last four years.

In 2015, the total unemployed people in Delhi were 10,83,896. This number was 10,17,569 in 2014. Between 1997 and 2015, there were phases when the number of unemployed youth declined. However, after 2010, when there were 4,93,384 unemployed, the number has only been rising.It shot up to 7,74,569 in 2012 and went up to 8,55,292 in 2013.

In 2011, the growth rate of unemployed persons over the previous year was a steep 30.39%. The growth rate was 20.41% in 2012, 10.42% in 2013, 18.97% in 2014 and 6.51% in 2015.