The Adani group

(→Vinod Adani-) |

(→Adani Enterprises Ltd: the flagship) |

||

| (14 intermediate revisions by 2 users not shown) | |||

| Line 56: | Line 56: | ||

AEL earned revenues of Rs 26,824 crore, and made a net profit of Rs 720.70 crore during fiscal 2022, according to the BSE website. During the second quarter ended September 2022, it reported a revenue of Rs 22,136 crore, and a net profit of Rs 469 crore. | AEL earned revenues of Rs 26,824 crore, and made a net profit of Rs 720.70 crore during fiscal 2022, according to the BSE website. During the second quarter ended September 2022, it reported a revenue of Rs 22,136 crore, and a net profit of Rs 469 crore. | ||

| + | |||

| + | =Airports= | ||

| + | ==Kenyan court halts Adani’s proposal for Nairobi airport/ 2024== | ||

| + | [https://epaper.indiatimes.com/article-share?article=11_09_2024_019_002_cap_TOI Sep 11, 2024: ''The Times of India''] | ||

| + | |||

| + | |||

| + | A Kenyan court suspended a govt plan to allow Adani Airport Holdings to operate its main airport for 30 years until it rules on the matter. | ||

| + | |||

| + |

The high court issued the order prohibiting any person from implementing or acting on the privately initiated proposal by Adani until the matter is determined, according to Faith Odhiambo, president of the Law Society of Kenya, an applicant in the case. Adani didn’t immediately respond to a request for comment when contacted outside office hours. | ||

| + | |||

| + |

The lawyers’ body and the Kenya Human Rights Commission, a non-governmental organisation, are challenging govt’s right to lease the Jomo Kenyatta International Airport in the capital, Nairobi, to Adani Airport as it breaches the constitution. | ||

| + | |||

| + |

“Leasing the strategic and profitable JKIA to a private entity is irrational” and contravenes the constitutional principles of “good governance, accountability, transparency, and prudent and responsible use of public money,” they said in their filings.

| ||

| + | |||

| + | The parties also argue that the $1.85 billion deal between govt and Adani Airport is “unaffordable, threatens job losses, exposes the public disproportionately to fiscal risk, and offers no value for money to the taxpayer”. They claim that Kenya can independently raise the funds to expand JKIA without leasing it for 30 years, according to their filings.

| ||

| + | |||

| + | Under the terms of the build-operate deal, Gautam Adani’s company would upgrade Kenya’s largest aviation facility and East Africa’s busiest airport and construct a second runway and a new passenger terminal.

BLOOMBERG | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | |||

| + | =Coal= | ||

| + | ==2024/ FT report on ‘low quality’ coal false: Adani Group== | ||

| + | [https://epaper.indiatimes.com/article-share?article=23_05_2024_011_017_cap_TOI May 23, 2024: ''The Times of India''] | ||

| + | |||

| + | |||

| + | New Delhi : The Adani Group said any suggestion that one of its companies supplied inferior coal to the Tamil Nadu Generation and Distribution company (TANGEDCO), as compared to the quality standards laid down in the tender and purchase order (PO), is incorrect and asserted that it operates a robust corporate governance framework and is strongly committed to following all laws and regulations in all jurisdictions. | ||

| + | |||

| + |

The company was responding to a report published in the Financial Times which alleged that the Adani Group passed off low-quality coal as far more expensive cleaner fuelin transactions with an Indian state power utility. The newspaper cited evidence it had seen and said it throws fresh light on allegations of a long-running coal scam. | ||

| + | |||

| + |

“Your allegations are false and baseless, and we strongly reject any suggestion that the Adani portfolio of companies did not act as per regulations,” the Adani group said in a detailed rebuttal of the newspaper report. | ||

| + | |||

| + |

“The PO 89 of TANGEDCO was a fixed price contract, won through an open, competitive, global bidding process, wherein Adani Global Pte Ltd was contractually obliged to supply coal to TANGEDCO at a pre-determined price. So, the supply price was market-determined and TANGEDCO had contractually insulated itself from any kind of supply risk, including on price,” the Adani Group said in a statement. | ||

| + | |||

| + |

“Any upside or downside due to price fluctuations was to be completely borne by the supplier, needless to say the risk of which was very high due to the volatility in coal prices,” said the Adani Group statement.

| ||

| + | |||

| + | The FT report claimed that the documents secured by the Organised Crime and Corruption Reporting project (OCCRP) and reviewed by the newspaper added a “potential environmental dimension” to accusations of corruption associated with the Indian conglomerate. | ||

| + | |||

| + |

“They suggest that Adani may have fraudulently obtained bumper profits at the expense of air quality, since low-grade coal for power means burning more of the fuel,” the FT report alleged. The Adani Group said that the suggestion that Adani Global Pte Ltd supplied to TANGEDCO inferior coal, as compared to the quality standards laid down in the tender and PO, was incorrect.

| ||

| + | |||

| + | “While it is difficult for us to comment on individual cases due to the sheer volume of data and the elapsed time, not to add the contractual and legal obligations, it is important to note that the coal supplied, irrespective of the declaration by the supplier, is tested for quality at the receiving plant,” said the Adani statement.

| ||

| + | |||

| + | Adani Group’s market capitalisation regained $200 billion-mark (Rs 16.9 lakh crore) after its listed firms gained Rs 11,300 croreas investors brushed off the allegations made by the London-based newspaper. | ||

| + | |||

| + |

With Rs 11,300 crore gain on Wednesday, the apples-to-airport conglomerate gained Rs 56,250 crore in market capitalisation in the last two trading sessions, stock exchange data showed. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | |||

| + | =Colombo port, shipping container terminal= | ||

| + | ==2023: $553 million US funding== | ||

| + | [https://epaper.indiatimes.com/article-share?article=09_11_2023_001_001_cap_TOI Nov 9, 2023: ''The Times of India''] | ||

| + | |||

| + | New Delhi : In a move that signals Washington’s intent to confront China’s growing influence in India’s neighbourhood and has come as a shot in arm for the Adani Group, the US International Development Finance Corporation (DFC) announced a funding of $553 million (around Rs 4,600 crore) for a deepwater shipping container terminal at Colombo Port, which is being developed with Adani Ports as a JV partner. | ||

| + | |||

| + |

The US financing for the largest and busiest transshipment port in the Indian Ocean is seen as a bid to counterbalance China’s influence in the country, where it built a deepwater port in Hambantota, as well as the South Asia region. TNN | ||

| + | |||

| + | |||

| + | =Defence production= | ||

| + | [https://indianexpress.com/article/explained/explained-economics/adani-defence-footprint-small-arms-uavs-explained-8438838/?utm_source=newzmate&utm_medium=email&utm_campaign=explained&utm_content=6386461&pnespid=B_Ig_lBb8idMiluQu5jRG05GpBcoxrlsuQwXRaYBPMDKFxjpEg4R7fHfyxo6rOKNG63FTMLm Amrita Nayak Dutta, February 12, 2023: ''The Indian Express''] | ||

| + | |||

| + | |||

| + | The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, among others. | ||

| + | |||

| + | Congress leader Rahul Gandhi this week referred to the Adani Group’s defence interests, alleging that the group, which has no experience in this sector, benefited from government patronage. | ||

| + | |||

| + | The Adani Group, a relatively new entrant in the defence sector, has charted an extraordinary growth journey over the last five years, with new subsidiaries diversifying its defence offerings, through acquisitions of both new and legacy companies in the strategic space, as well as through partnerships with foreign private firms. | ||

| + | |||

| + | ''' Subsidiaries, acquisitions ''' | ||

| + | |||

| + | The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, Adani Naval Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, along with PLR Systems Pvt Ltd and Adani-Elbit Advanced Systems India Ltd. | ||

| + | |||

| + | The first four of these were incorporated starting 2015. In 2019, Adani Defence Systems acquired the 2003-incorporated Alpha Design Technologies Pvt Ltd. In 2020, it acquired a majority stake in PLR Systems Private Ltd, making it a joint venture with Israel Weapon Industries (IWI). | ||

| + | |||

| + | In 2018, the group started the joint venture company Adani-Elbit Advanced Systems India Ltd with Israeli firm Elbit Systems. | ||

| + | |||

| + | The Adani Group is currently in the process of acquiring Air Works, one of India’s oldest maintenance repair and overhaul (MRO) units, which will cement its foothold in MRO activities. | ||

| + | ''' Range of products ''' | ||

| + | |||

| + | The group actively started its defence businesses in 2018, and has since expanded its offerings in air defence systems, UAVs for various purposes including Intelligence-Surveillance-Reconnaissance, and small arms and ammunition — all of which are of vital importance to the Indian armed forces. | ||

| + | |||

| + | Most of the group’s defence businesses over the last few years have been carried out by Adani Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, and PLR Systems Pvt Ltd. Besides the Indian armed forces, and central paramilitary and state police forces, the group’s customers include the armed forces of some foreign countries, including Israel. | ||

| + | |||

| + | “Within a short time, the Company built a comprehensive ecosystem of defence products across small arms, precision guided munitions, unmanned aerial systems, structures, electronics, radars, EW systems and simulators, among others,” the annual report of the company for 2021-22 said. | ||

| + | According to the annual report, the company had bagged contracts for over Rs1,000 crore from the Indian armed forces, including the first ever small arms contract awarded to a private sector manufacturer of small arms; besides separate contracts for the delivery of 56 air defence radars to the Army by 2024, and for the supply of seekers for the medium range surface to air missile (MRSAM). | ||

| + | |||

| + | ''' Small arms, ammo ''' | ||

| + | |||

| + | PLR Systems Pvt Ltd manufactures a range of small arms such as TAVOR X95 assault rifles, NEGEV light machine guns and Galil sniper rifles, which are already in service with the Indian armed forces. The PLR Systems website says the TAVOR and Galil rifles were used by Indian special forces during the surgical strikes of 2016. Some of these weapons were earlier imported by India from Israel. | ||

| + | Last year the Adani group announced an investment of almost Rs 1,500 crore to set up South Asia’s largest ammunition manufacturing facility in the Uttar Pradesh Defence Corridor. | ||

| + | |||

| + | Adani Defence has also ventured into the highly technical sphere of manufacturing long range glide bombs for the Indian Air Force, as well as the Very Short Range Air Defence (VSHORAD) System and other precision guided munition as a development and production partner with the Defence Research and Development Organisation (DRDO). | ||

| + | |||

| + | ''' Aerospace and avionics ''' | ||

| + | |||

| + | As per the annual report of Adani Enterprises Ltd (AEL), Alpha Design Technologies Ltd (ADTL) — which is involved in manufacturing satellite and ground equipment, electronic warfare and military communications equipment, and aerospace assembly — has operationalised a simulator for the IAF’s MiG-29 aircraft in Adampur under a 20-year Build Operate Maintain contract. | ||

| + | |||

| + | Last year, Elbit Systems and the Bangalore-based ADTL formed a joint venture company called Vignan Technologies, which has started a facility for R&D and innovation. | ||

| + | |||

| + | ADTL is also the first Indian offset partner for Israel Aerospace Industries (IAI) for production of Air Defence Fire Control Radars, 66 of which have been delivered to the Army. ADTL is also understood to be manufacturing combat net radio sets for the Army’s armoured vehicles, and upgrading its old radio sets. | ||

| + | |||

| + | The Adani-Elbit joint venture is manufacturing a range of unmanned platforms, including the Hermes 900 Medium Altitude Long Endurance UAV, which it looks to export, as well as offer to the Indian armed forces when the services issue a Request for Proposal. | ||

| + | |||

| + | Adani Defence and Elbit set up a private UAV facility in 2018 in Hyderabad for manufacturing the Hermes 900 Medium Altitude Long Endurance UAV. | ||

| + | |||

| + | The Adani group is also manufacturing counter-drone systems. It conducted the first live demonstration of the state-of-the-art Rudrav counter drone system at Ahmedabad’s Sardar Vallabhbhai International Airport. | ||

| + | |||

| + | The company had been in partnership talks with the Swedish aerospace and defence company Saab in 2017 to make the Gripen E fighter in India. However, last month Saab said it will not go ahead with the agreement. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | |||

| + | |||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | |||

| + | =Paridhi Adani= | ||

| + | [https://timesofindia.indiatimes.com/india/why-doesnt-adani-disclose-potential-conflicts/articleshow/101108047.cms Andy Mukherjee, June 20, 2023: ''The Times of India''] | ||

| + | |||

| + | Paridhi Adani’s involvement, however, may have to be viewed differently. The head of the Ahmedabad office at Cyril Amarchand Mangaldas (CAM), a top Indian law firm, Paridhi is married to Karan Adani, the older of chairman Gautam Adani’s two sons and the chief executive officer of the ports business. She and her husband are the two designated partners in Adani Infracon. | ||

| + |

In response to my emailed questions, a CAM spokesperson said that the advocate is “not a director nor holds any position of any nature in the business of Adani Group”, and that Infracon is “a personal entity currently holding art objects”.

| ||

| + | |||

| + | ''' No disclosures ''' | ||

| + | |||

| + |

But perhaps more significant than that, on her law firm’s website, she advertises her involvement in mergers and acquisitions (M&A) activity that, I believe, is of vital importance to Adani’s financial health and its valuation. Yet, the group hasn’t made any disclosures that show her or her law firm as a related party, or describe the deals as related-party transactions. | ||

| + | |||

| + |

Although the conglomerate denied all of Hindenburg’s accusations, the ensuing $150bn loss of market wealth over just about a month led the Supreme Court to set up an expert committee. It was asked to investigate whether there had been any regulatory failure in dealing with “the alleged contravention of laws pertaining to the securities market”. Related-party deals is one of the areas the panel looked at. | ||

| + |

According to the short-seller, seven key listed entities of the Adani Group collectively have 578 subsidiaries and have engaged in a total of 6,025 such transactions in the financial year that ended in March 2022. Why are the numbers so high? Adani said in its reply to Hindenburg that in the infrastructure business, financiers and regulators insist on housing separate projects in different companies. | ||

| + | |||

| + | Considering that the Securities and Exchange Board of India (Sebi) has been asked by the apex court to wind up its inquiry by August 14, it has little time to review all the transactions highlighted in the Hindenburg report. But there may be a simple way to obtain a flavour of India Inc’s potential disclosure deficit: Look at someone who neither came up in Hindenburg’s January 24 report, nor in the group’s January 29 rebuttal. Paridhi Adani. | ||

| + |

CAM’s website lists three past deals under her professional experience:

| ||

| + | |||

| + | Adani Ports & Special Economic Zone’s acquisition of 75% of Krishnapatnam Ports closed in October 2020; Adani Green Energy’s solar joint venture with TotalEnergies kicked off the same year. The French energy giant took a 37.4% stake in the firm now known as Adani Total Gas in February 2020.

| ||

| + | |||

| + | ''' The ‘missing’ person '''

| ||

| + | |||

| + | But the annual reports of Adani Ports, Adani Green Energy and Adani Total Gas (or its predecessor, Adani Gas) have made no mention of utilising the services of a law firm where a close family member is a partner. While Gautam, Karan, Gautam’s younger brother Rajesh, his son Sagar and Vinod’s son Pranav do feature in the section “key managerial personnel and their relatives” in disclosures, Paridhi does not. | ||

| + | |||

| + |

While this omission could potentially be problematic in itself, a bigger concern is that Paridhi Adani is the daughter of CAM’s managing partner Cyril Shroff. The firm, and Paridhi Adani, were also involved in the Adani Group’s mega acquisition last year of Holcim’s cement business in India. To be clear, the lawyer and her firm are under no obligation to report their association to the market regulator. | ||

| + | |||

| + |

The entire issue is about whether the in-laws were lax in disclosing her (and her firm’s) role in their business. The legal and accounting professionals I spoke to — by presenting them with the situation as a hypothetical — gave different answers. | ||

| + | |||

| + | According to one, Paridhi Adani should have been disclosed as a related party. A second said no, as publicly traded companies didn’t deal directly with her, but added that her firm becomes a related party under Indian rules because the daughter-in-law is a partner there. | ||

| + | |||

| + |

A third expert said neither party has that status until it could be proven that she exercised significant control over CAM. A fourth said it would be enough for Adani directors related to her to have recused themselves when they awarded the M&A mandates. | ||

| + | |||

| + |

An Adani spokesperson said this in response to my emailed questions about the lack of disclosures: | ||

| + | |||

| + |

“We firmly assert that the stated findings and conclusions are misleading and do not display accurate understanding of the Indian regulatory framework and its disclosure requirements. It is important to note that Ms Paridhi Adani, Partner at Cyril Amarchand Mangaldas (CAM), does not qualify as a related party under all prevalent laws and regulations. CAM and all its partners offer professional services to the Adani Group in adherence to regulatory requirements and we have made all necessary disclosures in this regard. To meet our business requirements, the Adani portfolio of companies engages and maintains professional relationships with several international and Indian law firms. Your insinuations and aspersions concerning potential conflicts of interest with CAM or any other law firm or its partners are unfounded.”

| ||

| + | |||

| + | ''' What the results said '''

| ||

| + | |||

| + | My questions to the group on potential conflict of interest stemmed from the recent full-year results.

| ||

| + | |||

| + | A note accompanying Adani Green Energy’s May 1 financial statement said that the group had undertaken a review of the transactions mentioned in the short-seller’s report and “obtained opinions from independent law firms in respect of evaluating relationships with parties having transactions” with the holding company and its subsidiaries. Everything was found to be in compliance with the law. | ||

| + | |||

| + |

A day later, however, Adani Total Gas’s financial results used somewhat different language. In notes to the accounts, the company said that the Adani Group had undertaken a review of the transactions cited by Hindenburg through an independent assessment by a law firm. “The report confirms company’s compliance of applicable laws and regulations.” | ||

| + | |||

| + | Does it mean that Adani Total Gas got its legal assessment from a firm that was not independent? Could that have come from CAM? I asked the Adani Group. Their reply, reproduced above, did not directly address this question. Once again, there is no hint that CAM, even if it did give an opinion, acted inappropriately. | ||

| + | |||

| + |

The auditor’s commentary on Adani Total Gas’s results reiterated the management’s position, but added that pending the completion of court proceedings and investigations by regulators, “we are unable to comment on the possible consequential effects thereof, if any, on this statement”. With that, Shah Dhandharia & Co, which had only last year got a second five-year mandate to audit the firm, resigned its commission “due to increased professional preoccupation” and not because of “an inability to obtain sufficient appropriate audit evidence”, it said.

| ||

| + | |||

| + | ''' Awaiting resolution '''

| ||

| + | |||

| + | The auditors didn’t respond to my emailed questions about which law firm’s assessment was used. The Adani Group has previously told The Morning Context, a news website, that it is not mandatory to disclose the details of the lawyer’s report. However, investors, creditors and partners are waiting for a resolution of the Hindenburg allegations. France’s Total put its multi-billion-dollar plan to produce green hydrogen with Adani on hold after the short-seller’s report.

| ||

| + | The related-party question flared up again when Deloitte Haskins & Sells raised concerns about Adani Ports’ May 30 results. The auditor said it couldn’t confirm that three entities, with which the port unit had transactions, were indeed unrelated as claimed by the company. Further, it said that the legal evaluation sought by the group on the veracity of Hindenburg’s allegations was insufficient for the audit. It signed off on the books with what’s called a “qualified opinion”, Bloomberg News has reported.

| ||

| + | |||

| + | In its listing obligations and disclosure regulations of 2015, the market watchdog ordered publicly traded firms to report transfer of resources with directors or key management personnel, or their relatives, regardless of whether money had changed hands. Last year, Sebi tightened the rules — both for transactions that only had to be disclosed and ones that required shareholder approval. | ||

| + | |||

| + | All this suggests an improving arc of governance. But if experts can’t agree on whether simple dealings with Paridhi Adani’s law firm should be disclosed and how, then how will Sebi ever get to the bottom of the short-seller’s insinuations about Vinod Adani’s alleged (and allegedly more complex) involvement? Something is clearly amiss with the regulations.

| ||

| + | |||

| + | The fix does not lie in burying the spirit of the law further into a bottomless pit of rules. The regulator needs to start afresh by clearly laying out the principle it wants to uphold. After that, the fairness of commercial transactions is for the market to decide. The failure to disclose them is what Sebi needs to go after in its enforcement action. | ||

| + | |||

| + |

Common sense suggests that a law firm with whose partners Adani directors have family ties presents a potential for conflict. The legal fees paid to CAM are not important to a group of Adani’s size. But India Inc’s culture of disclosure — or its absence — ought to be. | ||

| + | |||

| + | =Penna Cement Industries= | ||

| + | ==Purchase in 2024== | ||

| + | [https://epaper.indiatimes.com/article-share?article=14_06_2024_022_014_cap_TOI Reeba Zachariah & Swati Bharadwaj TNN, June 14, 2024: ''The Times of India''] | ||

| + | |||

| + | [[File: Cement capacity, UltraTech, Ambuja, Shree Cement, FY24.jpg|Cement capacity, UltraTech, Ambuja, Shree Cement, FY24 <br/> From: [https://epaper.indiatimes.com/article-share?article=14_06_2024_022_014_cap_TOI Reeba Zachariah & Swati Bharadwaj TNN, June 14, 2024: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

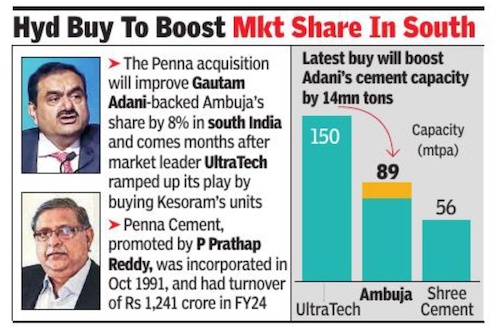

| + | Mumbai/Hyderabad: The Gautam Adani family owned Ambuja Cements is buying Penna Cement Industries in a deal valued at Rs 10,442 crore including debt, expanding its presence in the south. The transaction marks Ambuja’s fourth M&A after Adani checked into the sector through the former in Sept 2022. | ||

| + | |||

| + |

Hyderabad-based Penna, promoted by P Prathap Reddy and family, has an annual production capacity of 14 million tons (of which 4 million tons is under construction). It also has limestone reserves and captive power plants. | ||

| + | |||

| + |

The Penna acquisition, to be financed by internal accruals, will improve Ambuja’s share by 8% in south India and comes months after market leader UltraTech Cement ramped up its play in the region by buying Kesoram Industries’ building materials units. As of April end, Ambuja had cash of Rs 24,338 crore on its books, having received warrant money of Rs 8,339 crore from the Adani family. | ||

| + | |||

| + |

The Penna transaction will help Ambuja and its arms, including ACC and Sanghi Industries, beef up capacity to 89 million tons, moving towards its larger goal of 140 million tons by 2028. UltraTech, owned by Kumar Mangalam Birla, has a capacity of over 150 million tons. In April, India’s third-largest player Shree Cement, led by Hari Mohan Bangur, inaugurated a3-million-ton plant in Andhra Pradesh to bolster its capacity to 56 million tons. | ||

| + | |||

| + |

Ambuja previously acquired Gujarat-based Sanghi, My Home’s cement unit in Tamil Nadu and Asian Concretes and Cements’ plants in Hima- chal Pradesh and Punjab. | ||

| + | |||

| + |

Prathap Reddy had earlier looked at an IPO for his cement business but subsequently changed plans. In Oct 2021, Penna received markets regulator Sebi’s nod for a Rs 1,550-crore IPO but did not proceed with it. “Initially we thought (of an IPO) but it got delayed. I have decided to do (away) with (the cement business),” Reddy told TOI. | ||

| + | |||

| + |

The businessman, known as ‘Penna’ Reddy in Hyderabad circles, was considered a confidant of former Andhra Pradesh CM YS Jagan Mohan Reddy’s father YS Rajasekhara Reddy, the unified Andhra Pradesh CM who died in a chopper crash in Sept 2009. Reddy was made an accused in the Penna chargesheet in the Jagan disproportionate assets case that is being probed by CBI and ED. Jagan’s YSR Congress Party lost the recent Andhra assembly polls to Nara Chandrababu Naidu-led Telugu Desam Party.

| ||

| + | |||

| + | Incorporated in Oct 1991, Penna had a turnover of Rs 1,241 crore in FY24. In FY22, its turnover was Rs 3,204 crore. In May 2019, Penna had acquired Sri Lanka-based Singha Cement that operates a 0.5 mtpa cement packing terminal in Colombo. | ||

| + | |||

| + |

Penna’s seven plants in Andhra Pradesh, Telangana and Rajasthan (under construction) and limestone reserves “provide an opportunity to increase cement capacity through debottlenecking and additional investment”, said Ambuja Cements CEO Ajay Kapur . “Importantly, the bulk cement terminals will prove to be a game-changer by giving access to the eastern and southern parts of peninsular India, apart from an entry to Sri Lanka, through the sea route,” Kapur added. | ||

| Line 163: | Line 379: | ||

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | |||

| − | |||

| − | + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | |

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | + | ||

| − | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | |

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP |

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP |

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| Line 490: | Line 657: | ||

Interestingly, Adani companies may not be a steal deal even after the selloff. Adani Total Gas, which is stuck in a rut of hitting lower circuits since the report, is still available at 156 times its earnings. “Stock-specific actions will continue in Adani Group,” Kranthi Bathini, director (equity strategy) at WealthMills Securities, said. | Interestingly, Adani companies may not be a steal deal even after the selloff. Adani Total Gas, which is stuck in a rut of hitting lower circuits since the report, is still available at 156 times its earnings. “Stock-specific actions will continue in Adani Group,” Kranthi Bathini, director (equity strategy) at WealthMills Securities, said. | ||

| − | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | ==The Organised Crime and Corruption Reporting Project== |

| + | [https://www.occrp.org/en/investigations/documents-provide-fresh-insight-into-allegations-of-stock-manipulation-that-rocked-indias-powerful-adani-group Anand Mangnale, Ravi Nair, and NBR Arcadio, ''occrp.org''] | ||

| + | |||

| + | |||

| + | ''' Two men who secretly invested in the massive conglomerate turn out to have close ties to its majority owners, the Adani family, raising questions about violations of Indian law. ''' | ||

| + | |||

| + | It became one of the largest economic scandals in the history of modern India: The Adani Group, a massive conglomerate with interests in everything from airports to television stations, was accused of brazen stock manipulation. | ||

| + | |||

| + | The allegation, leveled this January by a New York-based short seller, caused Adani stock to plummet, triggered protests, and prompted an investigation by India’s Supreme Court. | ||

| + | |||

| + | But the expert committee convened by the court was unable to get to the bottom of the scandal, which has serious political implications because of the group’s widely perceived closeness to Prime Minister Narendra Modi and its central role in his plan for developing the country. | ||

| + | |||

| + | The essence of the allegations was that some of the Adani Group’s key “public” investors were in fact Adani insiders, a possible violation of Indian securities law. But none of the agencies contacted by the committee were able to identify those investors, since they were hidden behind secretive offshore structures. | ||

| + | |||

| + | Now, exclusive documents obtained by OCCRP and shared with The Guardian and Financial Times — including files from multiple tax havens, bank records, and internal Adani Group emails — shed light on that very matter. | ||

| + | |||

| + | These documents, which have been corroborated by people with direct knowledge of the Adani Group’s business and public records from multiple countries, show how hundreds of millions of dollars were invested in publicly traded Adani stock through opaque investment funds based in the island nation of Mauritius. | ||

| + | |||

| + | In at least two cases — representing Adani stock holdings that at one point reached $430 million — the mysterious investors turn out to have widely reported ties to the group’s majority shareholders, the Adani family. | ||

| + | |||

| + | The two men, Nasser Ali Shaban Ahli and Chang Chung-Ling, have longtime business ties to the family and have also served as directors and shareholders in Adani Group companies and companies associated with one of the family’s senior members, Vinod Adani. | ||

| + | |||

| + | The documents show that, through the Mauritius funds, they spent years buying and selling Adani stock through offshore structures that obscured their involvement — and made considerable profits in the process. They also show that the management company in charge of their investments paid a Vinod Adani company to advise them in their investments. | ||

| + | |||

| + | The question of whether this arrangement is a violation of the law rests on whether Ahli and Chang should be considered to be acting on behalf of Adani “promoters,” a term used in India to refer to the majority owners of a business holding and its affiliated parties. If so, their stake in the Adani Group would mean that insiders altogether owned more than the 75 percent allowed by law. | ||

| + | |||

| + | “When the company buys its own shares above 75 percent … it’s not just illegal, but it’s share price manipulation,” says Arun Agarwal, an Indian market specialist and transparency advocate. “This way the company [creates] artificial scarcity, and thus increases its share value — and thus its own market capitalization.” | ||

| + | |||

| + | “This helps them gain an image that they are doing very well, which helps them get loans, take valuations of companies to a new high, and then float new companies,” he said. | ||

| + | |||

| + | In response to requests for comment for this story, a representative of the Adani Group noted that the Mauritius funds investigated by reporters had already been named in the “Hindenburg report,” referring to the short-seller that sparked this year’s scandal. (The report did name these offshore companies, but did not reveal who was using them to make investments in Adani stock.) | ||

| + | |||

| + | The Adani representative also cited the Supreme Court’s expert committee, which described a financial regulator’s efforts to get to the bottom of the matter as “not proved.” | ||

| + | |||

| + | “In light of these facts,these allegations are not only baseless and unsubstantiated but are rehashed from Hindenburg’s allegations,” the representative wrote. “Further, it is categorically stated that all the Adani Group’s publicly listed entities are in compliance with all applicable laws including the regulation relating to public share holdings.” | ||

| + | |||

| + | Ahli and Chang did not respond to OCCRP’s requests for comment. | ||

| + | |||

| + | In an interview with a reporter from the Guardian, Chang said he knew nothing about any secret purchases of Adani stock. He did not say whether he had bought any, but asked why journalists were not interested in his other investments. “We are a simple business,” he said, before ending the interview. | ||

| + | |||

| + | Vinod Adani did not respond to requests for comment. Though the Adani Group has denied that he has a role in running the conglomerate, it admitted this March that he was part of its “promoter group” — meaning he had control over the affairs of the company and was meant to be informed of all holdings in Adani Group stock. An Adani Group representative told reporters that Vinod Adani’s involvement had been “duly disclosed,” adding that he is a “foreign national … residing abroad for the last three decades,” and “does not hold any managerial position in any Adani listed entities or their subsidiaries.” | ||

| + | |||

| + | ''' ‘Brazen Stock Manipulation’ ''' | ||

| + | |||

| + | The Adani Group’s rise has been staggering, growing from under $8 billion in market capitalization in September 2013 — the year before Modi became prime minister — to $260 billion last year. | ||

| + | |||

| + | The conglomerate is active in a dizzying array of fields, including transportation and logistics, natural gas distribution, coal trade and production, power generation and transmission, road construction, data centers, and real estate. | ||

| + | |||

| + | It has also won many of the state’s largest tenders, including 50-year contracts to operate or redevelop a number of India’s airports. Recently, it even took a controlling stake in one of the country’s last independent television stations. | ||

| + | |||

| + | But Adani’s rise has not been without controversy. Opposition politicians allege that the firm has received preferential treatment from the government to secure its lucrative state contracts. Analysts also describe its chairman, Gautam Adani, as benefiting from a cozy relationship with Modi. Adani has denied that Modi or his policies are responsible for his business empire’s success. | ||

| + | |||

| + | The conglomerate suffered a major setback at the end of January when the New York-based short seller, Hindenburg Research, issued its scathing report, claiming that the group had spent decades engaged in “brazen stock manipulation” and “accounting fraud.” | ||

| + | |||

| + | Gautam Adani, the headline read, was “pulling the largest con in corporate history.” | ||

| + | |||

| + | The central issue, the report claimed, was that the company was in violation of Indian securities law, which requires at least 25 percent of the stock of any publicly traded company to be available to the public for purchase. | ||

| + | |||

| + | Following the report’s publication, shares in the group’s companies plummeted. Gautam Adani lost more than $60 billion in just a few days, dropping from third-richest man in the world to 24th. | ||

| + | |||

| + | In response, the Adani Group issued denials and wrapped itself in the Indian flag. “This is not merely an unwarranted attack on any specific company,” the Group wrote in a note to stakeholders, “but a calculated attack on India, the independence, integrity, and quality of Indian institutions, and the growth story and ambition of India.” | ||

| + | |||

| + | Many investors appear to have bought this narrative, with shares of major Adani group companies recovering much of their losses. | ||

| + | |||

| + | ''' Hitting a Wall ''' | ||

| + | |||

| + | Meanwhile, in response to the Hindenburg report, India’s Supreme Court convened an expert committee to look into the allegations. The committee’s conclusions, published this May, revealed that the Adani Group had already been investigated by SEBI, the Indian financial regulator. | ||

| + | |||

| + | According to the committee, SEBI had suspected for years that “some of [the Adani Group’s] public shareholders are not truly public shareholders and they could be fronts for [Adani Group] promoters.” In 2020, it launched an investigation into 13 overseas entities holding Adani stock. | ||

| + | |||

| + | But the investigation “hit a wall,” the expert committee’s report reads, because SEBI investigators could not conclusively determine who was behind the money. | ||

| + | |||

| + | Attempting to do so would be a “journey without a destination,” the committee concluded, because multiple layers of opaque corporate ownership could be used to disguise the ultimate owners of the stock. | ||

| + | |||

| + | Documents obtained by reporters do, however, reveal the “destination” in two cases involving two of the 13 offshore entities: A pair of Mauritius-based investment funds. | ||

| + | |||

| + | From the outside these funds, called Emerging India Focus Fund (EIFF) and EM Resurgent Fund (EMRF), appear to be typical offshore investment vehicles, operated on behalf of a number of wealthy investors. | ||

| + | |||

| + | Documents obtained by reporters show that a large percentage of the money was placed into these funds by two foreign investors — Chang from Taiwan and Ahli from the United Arab Emirates — who used them to trade large amounts of shares in four Adani companies between 2013 and 2018. | ||

| + | |||

| + | At one point in March 2017, the value of the investments in Adani Group stock was $430 million. | ||

| + | |||

| + | The money followed a convoluted trail, making it exceedingly difficult to follow. It was channeled through four companies and a Bermuda-based investment fund called the Global Opportunities Fund (GOF). | ||

| + | |||

| + | ''' The Four Companies ''' | ||

| + | |||

| + | The four companies used in the investments were Lingo Investment Ltd (BVI), owned by Chang; Gulf Arij Trading FZE (UAE), owned by Ahli; Mid East Ocean Trade (Mauritius), of which Ahli was the beneficial owner; and Gulf Asia Trade & Investment Ltd (BVI), of which Ahli was the “controlling person.” | ||

| + | |||

| + | According to documents obtained by reporters, these investments resulted in significant profits, netting hundreds of millions over the years as EIFF and EMRF repeatedly bought Adani stock low and sold it high. | ||

| + | |||

| + | Between them, at the peak of their investment in June 2016, the two funds held free-floating shares of four Adani Group companies ranging from 8 to nearly 14 percent: Adani Power, Adani Enterprises, Adani Ports, and Adani Transmissions. | ||

| + | |||

| + | Chang and Ahli’s connections to the Adani family have been widely reported over the years. The men were linked to the family in two separate government investigations into alleged wrongdoing by the Adani Group. Both cases were eventually dismissed. | ||

| + | |||

| + | The first case involved a 2007 investigation into an allegedly illegal diamond trading scheme by the Directorate of Revenue Intelligence (DRI), India’s premier investigative agency under the Ministry of Finance. A DRI report described Chang as the director of three Adani companies involved in the scheme, while Ahli represented a trading firm that was also involved. As part of the case, it was revealed that Chang shared a Singapore residential address with Vinod Adani, the low-profile older brother of the Adani Group’s chairman, Gautam Adani. | ||

| + | |||

| + | The second case was an alleged over-invoicing scam revealed in a separate 2014 DRI investigation. The agency claimed that Adani Group companies were illegally funneling money out of India by overpaying their own foreign subsidiary by as much as $1 billion for imported power generation equipment. | ||

| + | |||

| + | Here, too, Chang and Ahli’s names appeared. At separate times, the two men were directors of two companies later owned by Vinod Adani that handled the proceeds from the scheme, one in the UAE and one in Mauritius. | ||

| + | |||

| + | According to the Hindenburg report, Chang was also either a director or shareholder in a Singapore company that was listed as a “related party” in a disclosure by an Adani company. | ||

| + | |||

| + | ''' Direct Instructions ''' | ||

| + | |||

| + | Aside from these past links to the Adanis, there is evidence that Chang and Ahli’s trading in Adani stock was coordinated with the family. | ||

| + | |||

| + | According to a source familiar with the Adani Group’s business who cannot be named to ensure their safety, the fund managers in charge of Chang and Ahli’s investments in EIFF and EMRF received direct instructions on the investments from an Adani company. | ||

| + | |||

| + | The company that the source named, Excel Investment and Advisory Services Limited, is based in a secretive offshore zone in the United Arab Emirates where corporate records are not available. | ||

| + | |||

| + | However, documents obtained by reporters corroborate the source’s account: | ||

| + | |||

| + | An agreement for Excel to provide advisory services to EIFF and EMRF was signed for Excel by Vinod Adani himself in 2011.

| ||

| + | As recently as 2015, Excel was owned by a company called Assent Trade & Investment Pvt Ltd., which a 2016 email stated was ultimately owned by Vinod Adani and his wife.

| ||

| + | Though current corporate records from Mauritius, where Assent is registered, do not show who owns the company, they do show that Vinod Adani is on its board of directors.

| ||

| + | Invoices and transaction records show that the management companies of EIFF, EMRF, and the Bermuda-based GOF paid over $1.4 million in “advisory” fees to Excel between June 2012 and August 2014.

| ||

| + | An internal email exchange suggests that, in connection with an upcoming audit, fund managers were concerned that they didn’t have sufficient paperwork to justify following Excel’s investment advice. In one of the emails, a manager instructs several employees to produce records that would justify the reasoning behind the investments. In another, a manager makes a request to obtain a report from Excel which should recommend investing in “more than the number of securities into which the fund has [actually] invested so that it can be demonstrated that the [investment manager] used their discretion to make the selection of investments.” | ||

| + | |||

| + | ''' ‘Siphoned-off money’ ''' | ||

| + | |||

| + | There is no evidence that Chang and Ahli’s money for their Adani Group investments came from the Adani family. The source of the funds is unknown. | ||

| + | |||

| + | But documents obtained by OCCRP show that Vinod Adani used one of the same Mauritius funds to make his own investments. | ||

| + | |||

| + | Reporters obtained a letter SEBI, the Indian regulator, received from the DRI in 2014, in which the DRI said it had evidence that money from the alleged over-invoicing scheme it were investigating had been sent to Mauritius. | ||

| + | |||

| + | “There are indications that a part of the siphoned-off money may have found its way to stock markets in India as investment and disinvestment in the Adani Group,” wrote Najib Shah, the DRI’s director general at the time, in the letter. | ||

| + | According to the DRI case, money from the alleged scheme was sent to an Emirati company called Electrogen Infra FZE. This company then forwarded the resulting proceeds of about $1 billion to a Mauritius-based holding company ultimately owned by Vinod Adani that had a similar name, Electrogen Infra Holding Pvt. Ltd. | ||

| + | |||

| + | Reporters were able to trace the onward flow of over $100 million of these funds. | ||

| + | |||

| + | The Mauritius company loaned the money to another Vinod Adani company, Assent Trade & Investment Pvt Ltd, “to invest in [the] Asian equity market.” | ||

| + | |||

| + | As the beneficial owner of both Electrogen Infra Holding and Assent, Vinod Adani signed the loan document as both the lender and as the borrower. | ||

| + | |||

| + | Finally, the money was placed into the GOF, the same intermediary used by Chang and Ahli, and then invested in both EIFF and Asia Vision Fund, another Mauritius-based investment vehicle. | ||

| + | |||

| + | SEBI did not respond to reporters’ requests for comment about the letter it received in 2014. | ||

| + | |||

| + | In the wake of the Hindenburg allegations this year, in addition to appointing its expert committee, India’s Supreme Court directed SEBI to investigate. Its report is due next month. | ||

| + | |||

| + | Fact-checking was provided by the OCCRP Fact-Checking Desk. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP |

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

| − | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP |

| + | THE ADANI GROUP]] | ||

| + | |||

| + | == Pandora probe confirms Adani link to BVI shell firms== | ||

| + | [https://indianexpress.com/article/india/pandora-probe-confirms-adani-link-to-bvi-shell-firms-named-in-report-8918531/ Jay Mazoomdaar, Pandora probe confirms Adani link to BVI shell firms named in report / To pick up and trade in Adani stocks, funds from unknown sources, reported FT, were channelled by these BVI shell companies through the Emerging India/ ''The Indian Express'' / September 1, 2023] | ||

| + | |||

| + | |||

| + | Corporate records, accessed by The Indian Express, reveal the web of networks through which office-bearers and employees of Adani companies controlled these two BVI shell companies. | ||

| + | |||

| + | The two offshore shell companies registered in British Virgin Islands (BVI), named by Financial Times as vehicles that invested in Adani stocks, are linked to the Adani Group, according to records of offshore corporate service provider Trident Trust accessed by The Indian Express as part of the Pandora Papers investigation with the International Consortium of Investigative Journalists. | ||

| + | |||

| + | According to Financial Times, based on documents accessed by Organised Crime and Corruption Reporting Network, a global journalists’ network, the two individuals behind these firms were associates of Adani Group chairperson Gautam Adani’s brother Vinod Adani: United Arab Emirates national Nasser Ali Shaban Ahli and Taiwan national Chang Chung-Ling. | ||

| + | |||

| + | While Ahli used Gulf Asia Trade and Investment Limited, Chang used Lingo Investment Limited. | ||

| + | |||

| + | ==Emerging India Fund Management Ltd, Mauritius/ 2022-== | ||

| + | [https://indianexpress.com/article/india/money-laundering-laws-firm-linked-to-adani-investors-lost-licences-in-mauritius-8941826/ Jay Mazoomdaar, Sep 16, 2023: ''The Indian Express''] | ||

| + | |||

| + | In May 2022, a full eight months before the Hindenburg report flagged alleged irregularities in the Adani Group, Mauritian financial regulator Financial Services Commission (FSC) revoked the business and investment licences of Emerging India Fund Management Ltd (EIFM), the controlling shareholder of two Mauritius-based funds that invested in listed Adani companies and are now under probe. | ||

| + | |||

| + | The FSC Enforcement Committee’s decision alleged breach by EIFM of several provisions of laws meant to curb money laundering and ensure corporate governance. | ||

| + | |||

| + | In its licence revocation notice on May 12, 2022, a copy of which is available on the regulator’s website, the FSC held that EIFM “acted in breach” of various sections of the Financial Services Act, the Securities Act, the Financial Intelligence and Anti-Money Laundering Regulations (2003 and 2018) and the Code on the Prevention of Money Laundering and Terrorist Financing. | ||

| + | |||

| + | These alleged breaches relate to non-compliance on maintaining records of clients and transactions, accounting and auditing standards; safeguards against dummy officers; corporate governance and the prescribed internal mechanism to identify risks of money laundering and terrorist financing. | ||

| + | This assumes significance given that under the Prevention of Money Laundering Act (PMLA), SEBI records show, Emerging India Focus Funds and EM Resurgent Fund, two of the 13 overseas Adani investors under investigation, had declared EIFM as their controlling shareholder. | ||

| + | |||

| + | The revocation of licences means EIFM, effectively, began winding down operations. | ||

| + | |||

| + | Confirming this, a spokesperson for the FSC told The Indian Express: “When a licence is revoked, it is on a permanent basis. Following the revocation… licensees are directed to initiate the necessary actions for the orderly dissolution of their business and the discharge of their liabilities.” | ||

| + | |||

| + | Asked about the implication of the revocation of EIFM’s licences, an Adani Group spokesperson said: “We will not be able to comment on matters pertaining to independent individual shareholders.” | ||

| + | |||

| + | The EIFM, incidentally, found no mention in the Hindenburg report. According to the FSC, EM Resurgent Fund was dissolved in February 2022 while Emerging India Focus Funds is a live company. | ||

| + | |||

| + | After the publication of the Hindenburg report this January, a top official of the Mauritian FSC had said, in an interview, that an “initial assessment” of the entities associated with the Adani Group in Mauritius did not reveal any breach of law. | ||

| + | |||

| + | The Indian Express asked the FSC spokesperson whether EIFM was part of that assessment. The spokesperson said the FSC “is unable to share any further information on this matter since it is constrained by the provisions of the FSA in its ability to share confidential information about its licensees.” | ||

| + | |||

| + | Significantly, EIFM was held guilty of breaching both the 2003 and 2018 versions of Mauritius’s Financial Intelligence and Anti-Money Laundering Regulations. | ||

| + | |||

| + | During March-April 2018, as per last available records, EIFM’s two Mauritius funds held 3.9% of Adani Power Limited, 3.86% of Adani Transmission Limited, and, at least, 1.73% of Adani Enterprise Limited. | ||

| + | |||

| + | Last month, based on documents accessed by a reporters’ consortium, Organized Crime and Corruption Reporting Project (OCCRP), British daily Financial Times claimed that to pick up and trade in Adani stocks, funds from unknown sources were channelled by two British Virgin Islands shell companies – United Arab Emirates national Nasser Ali Shaban Adil’s Gulf Asia Trade and Investment Limited and Taiwan national Chang Cung-Ling’s Lingo Investment Limited — through the Emerging India Focus Funds (Mauritius) and the EM Resurgent Fund (Mauritius) under the Global Opportunities Fund (Bermuda). | ||

| + | |||

| + | Both these individuals were associates of Adani Group chairperson Gautam Adani’s brother Vinod Adani, FT reported. | ||

| + | |||

| + | Records of offshore corporate service provider Trident Trust accessed by The Indian Express as part of the Pandora Papers investigation showed that these two shell companies registered in the BVI, were, indeed, linked to the Adani Group. | ||

| + | |||

| + | =2024= | ||

| + | ==Hindenburg 2.0: SEBI chief’s involvement== | ||

| + | [https://epaper.indiatimes.com/article-share?article=11_08_2024_001_006_cap_TOI Partha Sinha, August 11, 2024: ''The Times of India''] | ||

| + | |||

| + | [[File: Madhabi Puri Buch, allegations, 2015- 2022.jpg|Madhabi Puri Buch, allegations, 2015- 2022 <br/> From: [https://epaper.indiatimes.com/article-share?article=11_08_2024_001_006_cap_TOI Partha Sinha, August 11, 2024: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | Mumbai : Hindenburg Research, the US short-seller that in Jan 2023 had alleged extensive corporate fraud by the Adani group using offshore vehicles, cited whistleblower documents claiming that Sebi chairperson Madhabi Puri Buch, with husband Dhaval, had also invested in the same offshore entities. | ||

| + | |||

| + |

Sebi chief and her husband, through 360 One WAM (IIFL’s wealth management arm), had allegedly invested in Global Dynamic Opportunities Fund, the same fund that Vinod Adani, elder brother of Gautam Adani, had used to invest in Adani group’s stocks, Hindenburg said. The Adani group refuted all of Hindenburg’s allegations. The report that was released late Saturday evening alleged that Sebi “drew a blank” in its probe against Adani due to alleged investments by Buch and her husband in the offshore funds. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:India|ATHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

| + | THE ADANI GROUP]] | ||

| + | [[Category:Pages with broken file links|THE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUPTHE ADANI GROUP | ||

THE ADANI GROUP]] | THE ADANI GROUP]] | ||

Latest revision as of 21:06, 26 December 2024

This is a collection of articles archived for the excellence of their content. Readers will be able to edit existing articles and post new articles directly |

[edit] Adani Enterprises Ltd: the flagship

[edit] As in 2023/ early Feb

George Mathew , Sandeep Singh, February 4, 2023: The Indian Express

From: George Mathew , Sandeep Singh, February 4, 2023: The Indian Express

Starting as a small-time commodity trading business, Adani Enterprises Ltd (AEL), the flagship of the Adani Group founded by Gautam Adani, went on to incubate half-a-dozen companies and grew through acquisitions. The scorching run of Adani companies led by AEL on the stock exchanges took the Group to the numero uno position in market capitalisation and made Gautam Adani the third richest man in the world before the Hindenburg Research report triggered a collapse in the share prices of Group companies.

AEL stock since Jan 25

As the Adani Enterprises follow-on-public offering (FPO) to raise Rs 20,000 crore opened for subscription on January 25 for anchor investors, US-based Hindenburg Research released a report on the Adani group, accusing the group of “brazen stock manipulation and accounting fraud”.

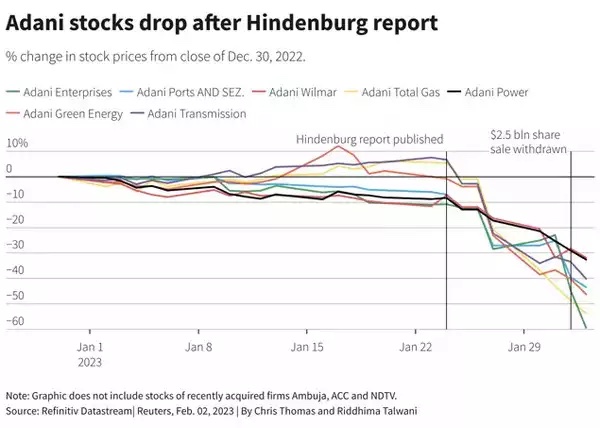

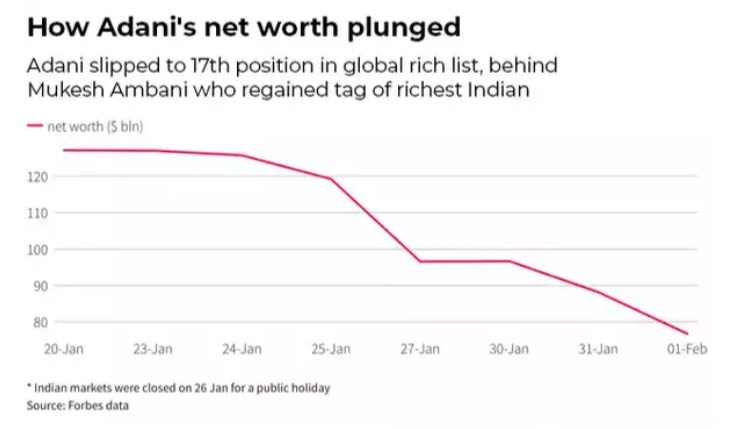

Even as the Adani group termed the report “maliciously mischievous”, and even said that it was planning to sue Hindenburg, shares of all nine listed group companies came under pressure. Over the last seven trading sessions, they have lost an aggregate of Rs 9.1 lakh crore in market capitalisation — 47.4 per cent of their market cap. The group market cap fell from Rs 19.18 lakh crore on January 24 to Rs 10.07 lakh crore on February 3.

The flagship Adani Enterprises came under huge selling pressure on Wednesday and Thursday. Over the last seven trading sessions, its stock has fallen by 54 per cent.

The group had to call off AEL’s FPO a day after it managed to get full subscription to the issue, following interest from non-institutional investors and family offices of large corporations. The shares were called off after they plunged by over 25 per cent on Wednesday. Gautam Adani said that he would refund the investors’ money, and that the decision was taken to safeguard the interest of investors.

The decline in share prices of the Adani group has led to significant erosion in the net worth of Gautam Adani, who slipped from 3rd spot to 17th spot on the index of global billionaires February 3, with a net worth of $61.7 billion.

AEL growth trajectory

Gautam Adani, then 26 and a school dropout who had done short stints as a diamond sorter and managing a small plastic unit, established AEL as a partnership firm in 1988. It was registered and incorporated in Ahmedabad as Adani Exports Ltd on March 2, 1993; the name was subsequently changed to Adani Enterprises Ltd to reflect changes in its business strategies. A fresh certificate of incorporation was issued by the Registrar of Companies on August 10, 2006.

The company acquired coal mines in India, Indonesia, and Australia, and became the country’s largest private coal importer. The power unit it promoted became the largest private power producer. AEL also entered the ports and airport sectors, and acquired Ambuja Cements and ACC in May 2022.

The company operates and manages seven airports — in Mumbai, Ahmedabad, Lucknow, Mangaluru, Jaipur, Guwahati, and Thiruvananthapuram — and is developing a greenfield airport in Navi Mumbai. As of September 30, 2022, it had 14 road assets, of which three have started commercial operations.

AEL offers mining services including contract mining, development, production-related and other services, as well as integrated resource management services of coal, which involves accessing coal from diverse global pockets and providing just-in-time delivery to Indian customers. It also recently acquired mines to conduct commercial mining activities.

It also manufactures, markets, and brands food FMCG products, and is developing a super-app, “Adani One”, to complement the group’s consumer serving businesses.

According to the prospectus, the company intends to manufacture petrochemicals, copper and similar metals, and strategic military and defence products that enhance India’s self-reliance.

The AEL board

While Gautam Adani is the chairman of the board, his younger brother Rajesh Adani is managing director. Pranav Adani, son of Gautam’s elder brother Vinod Adani, is also on the board.

Other members include M Narendra, former chairman and MD of Indian Overseas Bank; V Subramanian, a former Secretary in the Ministry of New and Renewable Energy; H Nerurkar, a former MD of Tata Steel; Omkar Goswami, founder of CERG Advisory and a former consultant to the World Bank, IMF, ADB, and OECD; Vinay Prakash, CEO of Adani Natural Resources; and Vijaylaxmi Joshi, a former Secretary in the Ministry of Panchayati Raj.

Gautam Adani has two sons — Karan is the CEO of Adani Ports, and Jeet is Vice President (Group Finance).

AEL’s performance

AEL earned revenues of Rs 26,824 crore, and made a net profit of Rs 720.70 crore during fiscal 2022, according to the BSE website. During the second quarter ended September 2022, it reported a revenue of Rs 22,136 crore, and a net profit of Rs 469 crore.

[edit] Airports

[edit] Kenyan court halts Adani’s proposal for Nairobi airport/ 2024

Sep 11, 2024: The Times of India

A Kenyan court suspended a govt plan to allow Adani Airport Holdings to operate its main airport for 30 years until it rules on the matter.

The high court issued the order prohibiting any person from implementing or acting on the privately initiated proposal by Adani until the matter is determined, according to Faith Odhiambo, president of the Law Society of Kenya, an applicant in the case. Adani didn’t immediately respond to a request for comment when contacted outside office hours.

The lawyers’ body and the Kenya Human Rights Commission, a non-governmental organisation, are challenging govt’s right to lease the Jomo Kenyatta International Airport in the capital, Nairobi, to Adani Airport as it breaches the constitution.

“Leasing the strategic and profitable JKIA to a private entity is irrational” and contravenes the constitutional principles of “good governance, accountability, transparency, and prudent and responsible use of public money,” they said in their filings.

The parties also argue that the $1.85 billion deal between govt and Adani Airport is “unaffordable, threatens job losses, exposes the public disproportionately to fiscal risk, and offers no value for money to the taxpayer”. They claim that Kenya can independently raise the funds to expand JKIA without leasing it for 30 years, according to their filings.

Under the terms of the build-operate deal, Gautam Adani’s company would upgrade Kenya’s largest aviation facility and East Africa’s busiest airport and construct a second runway and a new passenger terminal. BLOOMBERG

[edit] Coal

[edit] 2024/ FT report on ‘low quality’ coal false: Adani Group

May 23, 2024: The Times of India

New Delhi : The Adani Group said any suggestion that one of its companies supplied inferior coal to the Tamil Nadu Generation and Distribution company (TANGEDCO), as compared to the quality standards laid down in the tender and purchase order (PO), is incorrect and asserted that it operates a robust corporate governance framework and is strongly committed to following all laws and regulations in all jurisdictions.

The company was responding to a report published in the Financial Times which alleged that the Adani Group passed off low-quality coal as far more expensive cleaner fuelin transactions with an Indian state power utility. The newspaper cited evidence it had seen and said it throws fresh light on allegations of a long-running coal scam.

“Your allegations are false and baseless, and we strongly reject any suggestion that the Adani portfolio of companies did not act as per regulations,” the Adani group said in a detailed rebuttal of the newspaper report.

“The PO 89 of TANGEDCO was a fixed price contract, won through an open, competitive, global bidding process, wherein Adani Global Pte Ltd was contractually obliged to supply coal to TANGEDCO at a pre-determined price. So, the supply price was market-determined and TANGEDCO had contractually insulated itself from any kind of supply risk, including on price,” the Adani Group said in a statement.

“Any upside or downside due to price fluctuations was to be completely borne by the supplier, needless to say the risk of which was very high due to the volatility in coal prices,” said the Adani Group statement.

The FT report claimed that the documents secured by the Organised Crime and Corruption Reporting project (OCCRP) and reviewed by the newspaper added a “potential environmental dimension” to accusations of corruption associated with the Indian conglomerate.

“They suggest that Adani may have fraudulently obtained bumper profits at the expense of air quality, since low-grade coal for power means burning more of the fuel,” the FT report alleged. The Adani Group said that the suggestion that Adani Global Pte Ltd supplied to TANGEDCO inferior coal, as compared to the quality standards laid down in the tender and PO, was incorrect.

“While it is difficult for us to comment on individual cases due to the sheer volume of data and the elapsed time, not to add the contractual and legal obligations, it is important to note that the coal supplied, irrespective of the declaration by the supplier, is tested for quality at the receiving plant,” said the Adani statement.

Adani Group’s market capitalisation regained $200 billion-mark (Rs 16.9 lakh crore) after its listed firms gained Rs 11,300 croreas investors brushed off the allegations made by the London-based newspaper.

With Rs 11,300 crore gain on Wednesday, the apples-to-airport conglomerate gained Rs 56,250 crore in market capitalisation in the last two trading sessions, stock exchange data showed.

[edit] Colombo port, shipping container terminal

[edit] 2023: $553 million US funding

Nov 9, 2023: The Times of India

New Delhi : In a move that signals Washington’s intent to confront China’s growing influence in India’s neighbourhood and has come as a shot in arm for the Adani Group, the US International Development Finance Corporation (DFC) announced a funding of $553 million (around Rs 4,600 crore) for a deepwater shipping container terminal at Colombo Port, which is being developed with Adani Ports as a JV partner.

The US financing for the largest and busiest transshipment port in the Indian Ocean is seen as a bid to counterbalance China’s influence in the country, where it built a deepwater port in Hambantota, as well as the South Asia region. TNN

[edit] Defence production

Amrita Nayak Dutta, February 12, 2023: The Indian Express

The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, among others.

Congress leader Rahul Gandhi this week referred to the Adani Group’s defence interests, alleging that the group, which has no experience in this sector, benefited from government patronage.

The Adani Group, a relatively new entrant in the defence sector, has charted an extraordinary growth journey over the last five years, with new subsidiaries diversifying its defence offerings, through acquisitions of both new and legacy companies in the strategic space, as well as through partnerships with foreign private firms.

Subsidiaries, acquisitions

The defence footprint of the Adani Group is spread across multiple companies such as Adani Defence Systems and Technologies Ltd, Ordefence Systems Ltd, Adani Aerospace and Defence Ltd, Adani Naval Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, along with PLR Systems Pvt Ltd and Adani-Elbit Advanced Systems India Ltd.

The first four of these were incorporated starting 2015. In 2019, Adani Defence Systems acquired the 2003-incorporated Alpha Design Technologies Pvt Ltd. In 2020, it acquired a majority stake in PLR Systems Private Ltd, making it a joint venture with Israel Weapon Industries (IWI).

In 2018, the group started the joint venture company Adani-Elbit Advanced Systems India Ltd with Israeli firm Elbit Systems.

The Adani Group is currently in the process of acquiring Air Works, one of India’s oldest maintenance repair and overhaul (MRO) units, which will cement its foothold in MRO activities. Range of products

The group actively started its defence businesses in 2018, and has since expanded its offerings in air defence systems, UAVs for various purposes including Intelligence-Surveillance-Reconnaissance, and small arms and ammunition — all of which are of vital importance to the Indian armed forces.

Most of the group’s defence businesses over the last few years have been carried out by Adani Defence Systems and Technologies Ltd, Alpha Design Technologies Pvt Ltd, and PLR Systems Pvt Ltd. Besides the Indian armed forces, and central paramilitary and state police forces, the group’s customers include the armed forces of some foreign countries, including Israel.

“Within a short time, the Company built a comprehensive ecosystem of defence products across small arms, precision guided munitions, unmanned aerial systems, structures, electronics, radars, EW systems and simulators, among others,” the annual report of the company for 2021-22 said. According to the annual report, the company had bagged contracts for over Rs1,000 crore from the Indian armed forces, including the first ever small arms contract awarded to a private sector manufacturer of small arms; besides separate contracts for the delivery of 56 air defence radars to the Army by 2024, and for the supply of seekers for the medium range surface to air missile (MRSAM).

Small arms, ammo

PLR Systems Pvt Ltd manufactures a range of small arms such as TAVOR X95 assault rifles, NEGEV light machine guns and Galil sniper rifles, which are already in service with the Indian armed forces. The PLR Systems website says the TAVOR and Galil rifles were used by Indian special forces during the surgical strikes of 2016. Some of these weapons were earlier imported by India from Israel. Last year the Adani group announced an investment of almost Rs 1,500 crore to set up South Asia’s largest ammunition manufacturing facility in the Uttar Pradesh Defence Corridor.

Adani Defence has also ventured into the highly technical sphere of manufacturing long range glide bombs for the Indian Air Force, as well as the Very Short Range Air Defence (VSHORAD) System and other precision guided munition as a development and production partner with the Defence Research and Development Organisation (DRDO).

Aerospace and avionics

As per the annual report of Adani Enterprises Ltd (AEL), Alpha Design Technologies Ltd (ADTL) — which is involved in manufacturing satellite and ground equipment, electronic warfare and military communications equipment, and aerospace assembly — has operationalised a simulator for the IAF’s MiG-29 aircraft in Adampur under a 20-year Build Operate Maintain contract.

Last year, Elbit Systems and the Bangalore-based ADTL formed a joint venture company called Vignan Technologies, which has started a facility for R&D and innovation.

ADTL is also the first Indian offset partner for Israel Aerospace Industries (IAI) for production of Air Defence Fire Control Radars, 66 of which have been delivered to the Army. ADTL is also understood to be manufacturing combat net radio sets for the Army’s armoured vehicles, and upgrading its old radio sets.

The Adani-Elbit joint venture is manufacturing a range of unmanned platforms, including the Hermes 900 Medium Altitude Long Endurance UAV, which it looks to export, as well as offer to the Indian armed forces when the services issue a Request for Proposal.

Adani Defence and Elbit set up a private UAV facility in 2018 in Hyderabad for manufacturing the Hermes 900 Medium Altitude Long Endurance UAV.

The Adani group is also manufacturing counter-drone systems. It conducted the first live demonstration of the state-of-the-art Rudrav counter drone system at Ahmedabad’s Sardar Vallabhbhai International Airport.

The company had been in partnership talks with the Swedish aerospace and defence company Saab in 2017 to make the Gripen E fighter in India. However, last month Saab said it will not go ahead with the agreement.

[edit] Paridhi Adani

Andy Mukherjee, June 20, 2023: The Times of India

Paridhi Adani’s involvement, however, may have to be viewed differently. The head of the Ahmedabad office at Cyril Amarchand Mangaldas (CAM), a top Indian law firm, Paridhi is married to Karan Adani, the older of chairman Gautam Adani’s two sons and the chief executive officer of the ports business. She and her husband are the two designated partners in Adani Infracon. In response to my emailed questions, a CAM spokesperson said that the advocate is “not a director nor holds any position of any nature in the business of Adani Group”, and that Infracon is “a personal entity currently holding art objects”.

No disclosures

But perhaps more significant than that, on her law firm’s website, she advertises her involvement in mergers and acquisitions (M&A) activity that, I believe, is of vital importance to Adani’s financial health and its valuation. Yet, the group hasn’t made any disclosures that show her or her law firm as a related party, or describe the deals as related-party transactions.