Microfinance: India

(→Status) |

(→2019: TN, West Bengal account for 29%) |

||

| Line 13: | Line 13: | ||

Two states, Tamil Nadu and West Bengal, account for 29% of loans from microfinance institutions (MFIs) in the country and the top 10 states account for 83% of all small loans outstanding as of March 2019. | Two states, Tamil Nadu and West Bengal, account for 29% of loans from microfinance institutions (MFIs) in the country and the top 10 states account for 83% of all small loans outstanding as of March 2019. | ||

| − | |||

The total outstanding microfinance loans in West Bengal was 15% and 14% Tamil Nadu. The eight other states among the top ten are Bihar (10%), Karnataka (8.5%). Maharashtra (7%), Assam (6.7%), Odisha (6.4%), Uttar Pradesh (6%), Madhya Pradesh (5.5%) and Kerala (3.8%). According to Microfinance Plus, a report brought out jointly by Sidbi and Equifax, the highest growth in MFI loans was recorded in Bihar followed by Assam. | The total outstanding microfinance loans in West Bengal was 15% and 14% Tamil Nadu. The eight other states among the top ten are Bihar (10%), Karnataka (8.5%). Maharashtra (7%), Assam (6.7%), Odisha (6.4%), Uttar Pradesh (6%), Madhya Pradesh (5.5%) and Kerala (3.8%). According to Microfinance Plus, a report brought out jointly by Sidbi and Equifax, the highest growth in MFI loans was recorded in Bihar followed by Assam. | ||

| Line 21: | Line 20: | ||

Delinquency level improved across all the days past due categories. Portfolio at risk, which indicates the early delinquency rates, has comedown to1.4% in FY19 from 4.7% in FY18. | Delinquency level improved across all the days past due categories. Portfolio at risk, which indicates the early delinquency rates, has comedown to1.4% in FY19 from 4.7% in FY18. | ||

| + | ==2022== | ||

| + | [[File: Indian states with the highest penetration of micro finance, presumably as in 2022.jpg|Indian states with the highest penetration of micro finance, presumably as in 2022 <br/> From: [https://epaper.timesgroup.com/article-share?article=21_06_2023_019_012_cap_TOI June 21, 2023: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | '''See graphic''': | ||

| + | |||

| + | '' Indian states with the highest penetration of micro finance, presumably as in 2022 '' | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|M MICROFINANCE: INDIAMICROFINANCE: INDIAMICROFINANCE: INDIA | ||

| + | MICROFINANCE: INDIA]] | ||

| + | [[Category:India|M MICROFINANCE: INDIAMICROFINANCE: INDIAMICROFINANCE: INDIA | ||

| + | MICROFINANCE: INDIA]] | ||

| + | [[Category:Pages with broken file links|MICROFINANCE: INDIA]] | ||

=Status= | =Status= | ||

Latest revision as of 04:16, 14 July 2023

This is a collection of articles archived for the excellence of their content. |

Contents |

[edit] The top recipients of loans

[edit] 2019: TN, West Bengal account for 29%

July 12, 2019: The Times of India

Two states, Tamil Nadu and West Bengal, account for 29% of loans from microfinance institutions (MFIs) in the country and the top 10 states account for 83% of all small loans outstanding as of March 2019.

The total outstanding microfinance loans in West Bengal was 15% and 14% Tamil Nadu. The eight other states among the top ten are Bihar (10%), Karnataka (8.5%). Maharashtra (7%), Assam (6.7%), Odisha (6.4%), Uttar Pradesh (6%), Madhya Pradesh (5.5%) and Kerala (3.8%). According to Microfinance Plus, a report brought out jointly by Sidbi and Equifax, the highest growth in MFI loans was recorded in Bihar followed by Assam.

In FY19, fresh loan disbursal stood at Rs 2.1 lakh crore, an increase of 36% over FY18, while disbursal in terms of volume grew 20%. NBFC-MFIs hold the largest share of portfolio in microcredit with a total loan outstanding of Rs 68,156 crore, accounting for 38% of the total industry portfolio.

Delinquency level improved across all the days past due categories. Portfolio at risk, which indicates the early delinquency rates, has comedown to1.4% in FY19 from 4.7% in FY18.

[edit] 2022

From: June 21, 2023: The Times of India

See graphic:

Indian states with the highest penetration of micro finance, presumably as in 2022

[edit] Status

[edit] Growth, 2017-19; Delinquent districts

May 13, 2019: The Times of India

Microfinance in India: the ten districts with the most defaults, presumably as in 2018.

From: May 13, 2019: The Times of India

See graphics:

Microfinance in India: Growth, 2017-19;

Microfinance in India: the ten districts with the most defaults, presumably as in 2018.

Microfinance recovers

India's microfinance industry — anchored by banks, NBFCs and MFIs – now has a clientele of more than 42 million. The sector hit a hard patch during demonetisation. And in the months following demonetisation, non-performing assets (NPAs) as a percentage of loans hit highs of 14-15%. But the sector has since recovered. Despite loan waivers and election season, the microfinance sector in India now has a default rate of 2.9%. However, there are still some districts and regions which show stress.

[edit] 2019-22

From: March 26, 2022: The Times of India

See graphic:

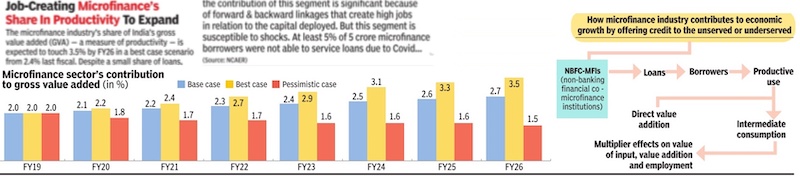

Microfinance sector’s contribution to gross value added, 2019- 22