Logistics Ease Across Different States

(Created page with "{| Class="wikitable" |- |colspan="0"|<div style="font-size:100%"> This is a collection of articles archived for the excellence of their content.<br/> </div> |} [[Category:Ind...") |

|||

| Line 1: | Line 1: | ||

| + | ''' The title ‘Logistics sector (private)’ indicates that this page is not about the much bigger defence logistics sector. ''' | ||

| + | |||

{| Class="wikitable" | {| Class="wikitable" | ||

|- | |- | ||

| Line 6: | Line 8: | ||

|} | |} | ||

| − | [ | + | |

| − | [[ | + | |

| − | + | =Investments in the sector= | |

| + | ==2018-19== | ||

| + | [https://epaper.timesgroup.com/olive/apa/timesofindia/SharedView.Article.aspx?href=TOIM%2F2019%2F06%2F17&id=Ar01919&sk=5BC88072&viewMode=text SINDHU HARIHARAN, June 17, 2019: ''The Times of India''] | ||

| + | |||

| + | [[File: Investments and M&As in the logistics sector, 2018-19.jpg|Investments and M&As in the logistics sector, 2018-19 <br/> From: [https://epaper.timesgroup.com/olive/apa/timesofindia/SharedView.Article.aspx?href=TOIM%2F2019%2F06%2F17&id=Ar01919&sk=5BC88072&viewMode=text SINDHU HARIHARAN, June 17, 2019: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | PEs, VCs bet big on logistics biz | ||

| + | |||

| + | Chennai: | ||

| + | |||

| + | Rising e-commerce transactions and GST implementation have triggered a wave of activity in the conventional and under-the-radar logistics sector, which has emerged as a darling of private equity (PE) and venture capital (VC) investors this year. | ||

| + | |||

| + | While the world’s largest PE firm Blackstone recently called logistics their “highest conviction” sector, PE-VC funding in Indian logistics sector in 2019 (YTD) is already at thrice the value of 2018. Data from research firm Venture Intelligence shows around $620-million investment in logistics across 12 deals this year, compared to $265 million in 2018. | ||

| + | |||

| + | Fundraising by new-age logistics players Delhivery ($413 million, which also achieved unicorn status this year), BlackBuck ($132 million), Rivigo ($36 million), Locus ($26 million) and others, are a few top deals that have helped 2019 reach record highs for the past five-year period. | ||

| + | The merger and acquisition (M&A) action in the sector has clocked $603 million across 10 deals, with a bulk of them being strategic deals in warehousing. Global ports operator DP World’s acquisition of KRIBCHO Infrastructure for $145 million and Logos’ entry into the Indian warehousing market with the Casagrand Distripark buy are a few top deals. | ||

| + | Kushal Nahata, co-founder and CEO of logistics tech provider FarEye, calls it the Amazon and Alibaba effect. “Large enterprises today seek to achieve the same experience that customers have come to expect from Amazon or Flipkart,” he said. | ||

| + | |||

| + | Starting off as a B2C wave, B2B logistics startups engaged in last-mile delivery, warehousing, freight, supply chain optimisation, etc are now enjoying investor patronage. | ||

| + | |||

| + | Supil Chachan, director of trucking platform BlackBuck, says a large total addressable market (logistics spends in India are at almost $300 billion) and huge inefficiencies requiring tech, has attracted investors. BlackBuck raised close to $230 million in equity till date since 2015 and is on track to reach the unicorn status — a milestone Chachan feels is small given the size of the sector. | ||

| + | |||

| + | “BlackBuck, through its asset-light marketplace model, has already proven to be a game changer and has successfully solved legacy problems like fleet under-utilisation and price opaqueness,” said Accel partner Sameer Gandhi, while investing in the startup. | ||

| + | |||

| + | Nishith Rastogi, co-founder and CEO of logistics optimisation platform Locus, says logistics and supply chain have long been unstructured and chaotic in India — both aspects that can be best solved using emerging tech such as AI and machine learning. | ||

=The LEADS (Logistics Ease Across Different States) Index= | =The LEADS (Logistics Ease Across Different States) Index= | ||

| Line 41: | Line 67: | ||

=See also= | =See also= | ||

[[Exports, imports (international trade): India]] | [[Exports, imports (international trade): India]] | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|L | ||

| + | LOGISTICS EASE ACROSS DIFFERENT STATES]] | ||

| + | [[Category:Government|L | ||

| + | LOGISTICS EASE ACROSS DIFFERENT STATES]] | ||

| + | [[Category:India|L | ||

| + | LOGISTICS EASE ACROSS DIFFERENT STATES]] | ||

Revision as of 04:41, 5 December 2020

The title ‘Logistics sector (private)’ indicates that this page is not about the much bigger defence logistics sector.

This is a collection of articles archived for the excellence of their content. |

Contents |

Investments in the sector

2018-19

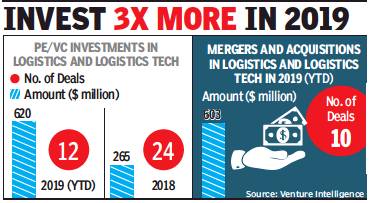

SINDHU HARIHARAN, June 17, 2019: The Times of India

From: SINDHU HARIHARAN, June 17, 2019: The Times of India

PEs, VCs bet big on logistics biz

Chennai:

Rising e-commerce transactions and GST implementation have triggered a wave of activity in the conventional and under-the-radar logistics sector, which has emerged as a darling of private equity (PE) and venture capital (VC) investors this year.

While the world’s largest PE firm Blackstone recently called logistics their “highest conviction” sector, PE-VC funding in Indian logistics sector in 2019 (YTD) is already at thrice the value of 2018. Data from research firm Venture Intelligence shows around $620-million investment in logistics across 12 deals this year, compared to $265 million in 2018.

Fundraising by new-age logistics players Delhivery ($413 million, which also achieved unicorn status this year), BlackBuck ($132 million), Rivigo ($36 million), Locus ($26 million) and others, are a few top deals that have helped 2019 reach record highs for the past five-year period. The merger and acquisition (M&A) action in the sector has clocked $603 million across 10 deals, with a bulk of them being strategic deals in warehousing. Global ports operator DP World’s acquisition of KRIBCHO Infrastructure for $145 million and Logos’ entry into the Indian warehousing market with the Casagrand Distripark buy are a few top deals. Kushal Nahata, co-founder and CEO of logistics tech provider FarEye, calls it the Amazon and Alibaba effect. “Large enterprises today seek to achieve the same experience that customers have come to expect from Amazon or Flipkart,” he said.

Starting off as a B2C wave, B2B logistics startups engaged in last-mile delivery, warehousing, freight, supply chain optimisation, etc are now enjoying investor patronage.

Supil Chachan, director of trucking platform BlackBuck, says a large total addressable market (logistics spends in India are at almost $300 billion) and huge inefficiencies requiring tech, has attracted investors. BlackBuck raised close to $230 million in equity till date since 2015 and is on track to reach the unicorn status — a milestone Chachan feels is small given the size of the sector.

“BlackBuck, through its asset-light marketplace model, has already proven to be a game changer and has successfully solved legacy problems like fleet under-utilisation and price opaqueness,” said Accel partner Sameer Gandhi, while investing in the startup.

Nishith Rastogi, co-founder and CEO of logistics optimisation platform Locus, says logistics and supply chain have long been unstructured and chaotic in India — both aspects that can be best solved using emerging tech such as AI and machine learning.

The LEADS (Logistics Ease Across Different States) Index

2018

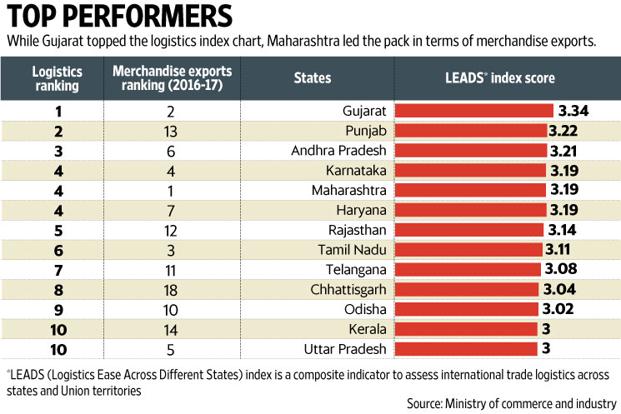

From: Asit Ranjan Mishra, Gujarat topped the Logistics Ease Across Different States (LEADS) index, Punjab and Andhra Pradesh took the second and third positions, respectively, January 9, 2018: Livemint

From: January 9, 2018: The Times of India

The logistics performance of Indian states and Union territories is “sub-par” owing to a host of inefficiencies, according to a study which also suggests measures for improvement.

The Logistics Ease Across Different States (LEADS) index, a composite indicator to assess international trade logistics across states and Union territories, is based on a stakeholders’ survey conducted by Deloitte for the ministry of commerce and industry. While Gujarat topped the first-of-its-kind index, Punjab and Andhra Pradesh took the second and third positions, respectively.

Logistics, or the management of the flow of resources such as cargo, documents, information and funds through a range of activities and services between points of origin and destination, is a key parameter in deciding the trade competitiveness of a state or country.

In a major push to developing an integrated logistics framework in the country, including industrial parks, cold chains and warehousing facilities, the government in November granted infrastructure status to the logistics sector, enabling the industry to access cheaper finances. The government also created the position of a special secretary in the commerce ministry to exclusively handle logistics and appointed former director general of the Directorate General of Supplies and Disposals, Binoy Kumar, to the post.

LEADS is loosely based on the World Bank’s biannual Logistics Performance Index (LPI), on which India was ranked 35 among 160 countries in 2016, up from 54 in 2014. LEADS is based on eight parameters such as infrastructure, services, timeliness, track and trace, competitiveness of pricing, safety of cargo, operating environment and regulatory process. The study is based on a perception-based survey of 2,885 respondents across the country over a six-week period.

The study found that supply chain efficiencies and economies of scale are yet to be unlocked, mostly due to suboptimal investment in building scale in infrastructure, automation, human capital and technology. It highlighted problems such as inadequate terminal capacity, poor last-mile terminal connectivity and issues in regulatory services provided by government agencies, among others. It also underlined issues specific to certain states. For example, respondents reported that labour unions created impediments for trade efficiency in states like West Bengal, Kerala, Maharashtra and Himachal Pradesh.

The study identified indicative focus areas such as enhancing capacity, developing integrated and balanced multimodal logistics and transport infrastructure, focussing on standardization, developing regulatory infrastructure, modernizing logistics infrastructure and transport fleet,

Commerce and industry minister Suresh Prabhu said Indian logistics costs are said to be among the highest in the world—in the vicinity of 13% of gross domestic product (GDP). “Germany’s costs in comparison average just above 8% of its GDP, providing its industry a huge competitive edge in the global market,” he added.

After the third meeting of the Council for Trade Development and Promotion on Monday that includes state industry ministers, Prabhu said his ministry will develop a strategy with the policy think tank NITI Aayog for supporting states that encourage exports. India’s merchandise exports increased 13% to $271 billion during the January-November 2017 period while its services exports rose 4% to $135 billion during the same period.

The managing director of a logistics firm, who did not wish to be named, said the study should be used by states to put their house in order. The point-based index clearly shows the areas that states need to work upon, he said. Performance improvements by states on the logistics index would help them attract industries, the person said.