Defence exports: India

(→2010-14; 2015-19) |

m (Jyoti moved page Arms exports: India to Defence exports: India) |

Revision as of 22:12, 14 August 2021

This is a collection of articles archived for the excellence of their content. |

Contents |

YEAR-WISE STATISTICS

2016-17: 5% growth

India is among the fastest growing arms exporters: The Times of India

New role: India, traditionally, has been an arms buyer — largely from Russia, and increasingly from the US, Israel and France. In fact, India accounted for 12% of the world’s arms imports between 2013 and 2017. But did you know India is the fourth fastest growing arms exporter, as well?

The data released by the Stockholm International Peace Research Institute says India’s arms sales grew by over 5% in 2016-17, a growth rate that is faster than the US’ (under 2%) and lower than only France, Germany and Russia — all three around 10%. Caveat: The think tank doesn’t track Chinese arms export.

Missile diplomacy: Though India’s arms export is dwarfed by that of the US, Russia and other Western nations in absolute terms, the growth rate highlights India’s changing relationship with the global weapons market and a more assertive foreign policy. This summer, India held talks with Vietnam to export its surface-to-air Akash missile and the supersonic Brahmos missiles. In 2016, India had offered Vietnam a $500 m defence loan during PM Modi’s visit.

Curated: India’s sale of arms and defence equipment, however, is more a geopolitical strategy than business. Consider some of the buyers besides Vietnam: Maldives (maritime security and surveillance equipment), Seychelles (HAL-made Dornier aircraft and a $100 million line of credit), Afghanistan (Mi-24 attack helicopter). These nations are of strategic value to India either by locating close to Pakistan (as in the case of Afghanistan) or on or nearby the Indian Ocean, where China has been increasing its presence.

Dragon fire: The potential sale of weapons to Vietnam perhaps represent the more ambitious nature of India’s defence as the Communist-ruled nation is located on the South China Sea, which China claims in entirety, threatening not just Vietnam but the Philippines and Japan as well. Yet the truth is India’s defence sale is no threat to China’s — Beijing’s weapons exports are worth nearly 25-times that of India’s.

2010-14; 2015-19

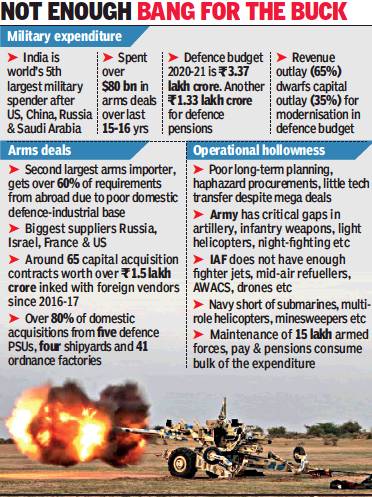

Rajat Pandit, March 10, 2020: The Times of India

From: Rajat Pandit, March 10, 2020: The Times of India

India continues to languish in the strategically vulnerable position of being the world’s second-largest arms importer, just behind Saudi Arabia. The only silver lining is that India has clawed its way to the 23rd position among the top 25 weapon exporters, with Myanmar, Sri Lanka and Mauritius being its biggest clients, though it constitutes a negligible 0.2% share of the total global figure.

The latest data on international arms transfers released by the Stockholm International Peace Research Institute (Sipri) shows India accounted for 9.2% of the total global arms imports during 2015-2019, while Saudi Arabia registered 12%. China stood at the fifth position (4.3%), while Pakistan was at 11th (2.6%).

“Between 2010-14 and 2015-19, arms imports by India and Pakistan decreased by 32% and 39%, respectively. While both countries have long-standing aims to produce their own major arms, they remain largely dependent on imports and have substantial outstanding orders and plans for imports of all types of major arms,” said the think-tank.

Sipri, in fact, cited the example of India’s Balakot air strikes and Pakistan’s attempted counter-strike in February last year to show the overwhelming dependence of the two on foreign weapons. If India deployed French (Mirage-2000s) and Russian (Sukhoi-30MKIs and MiG-21s) fighters, along with Israeli precision-guided bombs (Spice-2000s) and Swedish artillery (Bofors), Pakistan used American (F-16s) and Chinese (JF-17s) jets, and Swedish AWACS during the face-off.

Russia remained the largest arms supplier to India in 2010-14 and 2015-19, but deliveries fell by 47% and its share of total Indian imports slid from 76% to 56%. Imports from the US, which became India’s second-largest arms supplier in 2010-14 as part of the growing strategic partnership, also fell by 51% in 2015-19. “In contrast, arms imports from Israel and France increased, by 175% and 715% respectively, making them the second and third largest suppliers to India in 2015-19,” said Sipri.

As per Sipri data, China accounts for 73% of its allweather ally Pakistan’s arms imports, followed by Russia (6.6%) and Italy (6.1%). The US, which earlier supplied 30% of the arms imported by Pakistan, was down to just 4.1% in 2015-19 after it decided to stop military aid to it.

India’s continuance at the very top in the global arms import rankings reinforces the persisting failure to build a strong defence industrial base, with the NDA government’s ‘Make in India’ policy also yet to actually take-off.

India’s arms exports have picked up. Official figures show they jumped from Rs 2,060 crore in 2015-16 to Rs 10,746 crore in 2018-19. The figure for 2019-20 stood at Rs 5,883 crore in December 31, 2019.

2018: India vis-à-vis other countries

From: Dec 10, 2019 Times of India

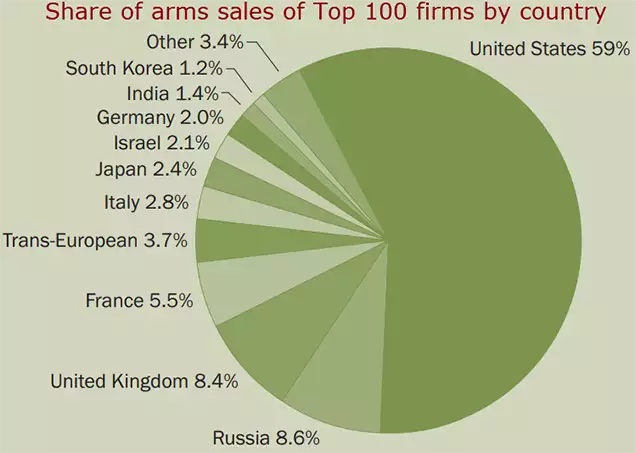

NEW DELHI: The world's 100 biggest arms-producing and military services companies saw a turnover of $420 billion in 2018, a 5% increase over the previous year, according to a report published by the Stockholm International Peace Research Institute (SIPRI) on Monday.

GUNS AND DOLLARS

New data from SIPRI's Arms Industry Database shows that sales of arms and military services by companies listed in the top 100 have increased by 47% since 2002. The database excludes Chinese companies due to the lack of data to make a reliable estimate. Eighty of the 100 top arms producers in 2018 were based in the US, Europe and Russia. Of the remaining 20, 6 were based in Japan, 3 in Israel, India and South Korea, respectively, 2 in Turkey and 1 each in Australia, Canada and Singapore, the report said.

THE BIG GUNS

US manufacturers were the biggest sellers with a turnover of $246 billion, 59% of the market. The US firm Lockheed Martin continues to be the world's largest arms maker (since 2009) with a turnover of $47.3 billion, which is 11% of the world market. Trump administration's decision to reinforce its position against China and Russia has come as a big boost to US companies.

According to the report, for the first time since 2002, the top five spots in the ranking are held exclusively by arms companies based in the US: Lockheed Martin is followed by Boeing, Northrop Grumman, Raytheon and General Dynamics. These five companies alone accounted for $148 billion and 35% of total top 100 arms sales in 2018. Russia comes a distant second with 8.6% of the market. The combined arms sales of the 10 Russian companies in the 2018 ranking were $36.2 billion—a marginal decrease of 0.4 per cent on 2017.

Russia was followed by the United Kingdom at 8.4% and France at 5.5%. The study did not include China due to insufficient data, though SIPRI estimates that there were 3 to 7 Chinese businesses in the top 100 arms manufacturers.

DESI GUNS

Three Indian state-owned companies that figure among the world's 100 top arms suppliers — Hindustan Aeronautics (ranked 38th), Indian Ordnance Factories (56) and Bharat Electronics (62) — with combined arms sales of $5.9 billion (a decrease of 6.9% from 2017) accounted for just 1.4% of the total top 100 arms sales.

"All three are state-owned and are almost entirely dependent on domestic demand. Arms sales by Hindustan Aeronautics and Bharat Electronics increased in 2018—by 3.5 and 5.9 per cent, respectively. However, these increases were offset by a 27% fall in the arms sales of Indian Ordnance Factories...The decrease was because of a reduction in orders from the Indian Army," the report said. On the other hand, arms purchase by India helped French manufacturer Dassault Aviation Groupe (ranked 34th) post a sharp increase of 30% in arms sales to $2.9 billion.

JAPAN, ISRAEL, SOUTH KOREA AND TURKEY

The combined arms sales of the six Japanese companies remained relatively stable in 2018. At $9.9 billion, they accounted for 2.4% of the top 100 total, it said. The three Israeli companies' arms sales of $8.7 billion accounted for 2.1% of the top 100 total. Elbit Systems, Israel Aerospace Industries and Rafael all increased their arms sales in 2018, the report said.

The three companies based in South Korea had combined arms sales of $5.2 billion in 2018, equivalent to 1.2% of the top 100 total.

Arms sales by Turkish companies listed in the top 100 increased by 22% in 2018, to $2.8 billion. Turkey aims to develop and modernise its arms industry and Turkish companies continued to benefit from these efforts in 2018.

WHAT IT MEANS FOR INDIA

The lack of defence manufacturing coupled with India's position as the world's second-largest arms importer (behind Saudi Arabia) reinforces the persisting failure to build strong indigenous defence industrial base, which can make the country strategically vulnerable if supplies are choked in times of conflict.