Jan Dhan Yojana

(→2020) |

(→Performance) |

||

| Line 202: | Line 202: | ||

'' Jan Dhan deposits, 2014- 2019, Apr 10 '' | '' Jan Dhan deposits, 2014- 2019, Apr 10 '' | ||

| − | [[Category:Economy-Industry-Resources|J | + | |

| + | =State-wise performance= | ||

| + | ==Bihar: 2015-20== | ||

| + | [https://epaper.timesgroup.com/article-share?article=29_04_2022_020_014_cap_TOI Praveen Kumar, Madnesh Kumar Mishra, Sandeep Kandikuppa, April 29, 2022: ''The Times of India''] | ||

| + | |||

| + | [[File: PMJDY beneficiaries in Bihar, 2022.jpg|PMJDY beneficiaries in Bihar, 2022. <br/> From: [https://epaper.timesgroup.com/article-share?article=29_04_2022_020_014_cap_TOI Praveen Kumar, Madnesh Kumar Mishra, Sandeep Kandikuppa, April 29, 2022: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | |||

| + | The Pradhan Mantri Jan Dhan Yojana, launched in 2014, is a national mission on financial inclusion that aims to ensure that all Indians, particularly low-income groups and weaker sections, have access to financial services, including a basic savings bank account, needbased credit, remittances, low-cost life and general insurance and pension. The scheme also envisages a robust financial literacy programme, with a key objective being to enable the beneficiaries to leverage digital technology and internet-based banking.

In Bihar, PMJDY has covered more than 5 crore beneficiaries, of whom more than 3. 67 crore are in rural areas. Since 2015, more than 3. 8 crore RuPay debit cards have been issued in the state. The reach of this scheme is indeed impressive. | ||

| + |

However, two key questions need to be asked: 1) Has increased and relatively easy access to banking channels resulted in a corresponding increase in the utilisation of banking services, including among the women?; 2) Has financial literacy under PMJDY contributed to increased utilisation of digital banking?

We examined the account level data provided by 12 public sector banks for over 73 lakh out of 82 lakh beneficiaries, whose accounts were opened in 2015. We analysed the financial behaviour of these 73 lakh account holders from 2015 to early 2020 (till March). Almost 53% of these beneficiaries were women, and 45% were men. Approximately 47% hailed from rural areas. While providing this data, the banks deidentified the accounts. | ||

| + | |||

| + |

In answering our first question we examined trends in the average number of deposits and withdrawals undertaken per account per year between 2015-20. To address the second question we examined 1) the average number of debit card transactions per account per year; and 2) the number of digital transactions as a percentage of total number of transactions undertaken by PMJDY beneficiaries. | ||

| + | |||

| + | ''' Banking the unbanked ''' | ||

| + | |||

| + | The basic banking services – deposits and withdrawals – have witnessed a significant increase among women. The number of deposits per account per year among women was less than two in 2015 across all 38 districts of Bihar. By 2020, it increased to more than eight deposits per account per year in 26 districts. From 2017 through 2020, women have outnumbered men in the average number of deposits per year (see figure).

These trends are across both rural and urban areas, and could be partly attributed to central and state government initiatives to make women the primary recipients of various development schemes.

There has also been an increase in the per capita number of withdrawals by women beneficiaries of PMJDY. While this figure stood at less than one in 29 districts of Bihar in 2015, it rose to between four and six in 24 districts by 2020. Begusarai, East and West Champaran, and Samastipur witnessed a relatively higher (>6) per capita number of withdrawals among women compared to other districts. There has been an average annual increase of approximately 59% over the preceding year in the average number of withdrawals among women in rural areas.

The increase in withdrawals is particularly significant as it indicates a deeper engagement with banking services. Women are not just passive recipients of benefits from the government but are actively utilising their bank accounts in their day-to-day lives. It is worth noting that the percentage of women-held accounts with one or more withdrawals witnessed a jump of 30 percentage points from 24% in 2015 to 54% in 2020. | ||

| + | |||

| + | |||

| + | '''Leveraging digital technology''' | ||

| + | |||

| + | Perhaps the most interesting finding from this studyis the increase in the uptake of digital banking services by all genders. This outcome points to the efficacy of the financial literacy efforts as part of the PMJDY.

In 29 out of 38 districts, digital transactions represented only 10% of all transactions in 2015. By 2020, 40% of the transactions undertaken by women across all districts in Bihar were digital. | ||

| + | |||

| + | Interestingly, it is not the urbanised districts like Patna and Gaya which witnessed the highest increase in the uptake of digital banking but predominantly rural districts like Sitamarhi, Buxar, Madhubani and Samastipur.

The proportion of accounts undertaking one or more digital transactions has also shown an upward trend. Whereas only about 5% of the accounts held by women in Bihar saw some digital transactions in 2015, this figure nearly tripled to more than 15% by 2020.

Precise reasons for this encouraging trend in the uptake of digital banking services among women, including those in rural areas, merit further granular studies. However, there is a strong likelihood that the systematic mapping of each district into sub-service areas and the large-scale deployment of bank mitras have contributed to the increase in the utilisation of banking services across demographic segments. These combined strategies ensured that households could find banking services within a short distance or even at their doorsteps, even as financial literacy was enhanced among previously unbanked or under-banked communities.

Kumar is Assistant Professor at Boston College, US. | ||

| + | |||

| + | Mishra is former Joint Secretary, Department of Financial Services, GoI. Kandikuppa is Research Fellow at the East-West Centre, Hawaii, US | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|J JAN DHAN YOJANA | ||

JAN DHAN YOJANA]] | JAN DHAN YOJANA]] | ||

| − | [[Category:Gender issues|J | + | [[Category:Gender issues|J JAN DHAN YOJANA |

JAN DHAN YOJANA]] | JAN DHAN YOJANA]] | ||

| − | [[Category:Government|J | + | [[Category:Government|J JAN DHAN YOJANA |

JAN DHAN YOJANA]] | JAN DHAN YOJANA]] | ||

| − | [[Category:India|J | + | [[Category:India|J JAN DHAN YOJANA |

| + | JAN DHAN YOJANA]] | ||

| + | [[Category:Pages with broken file links|JAN DHAN YOJANAJAN DHAN YOJANA | ||

JAN DHAN YOJANA]] | JAN DHAN YOJANA]] | ||

Revision as of 07:43, 14 May 2022

This is a collection of articles archived for the excellence of their content. |

Contents |

Analysis

Jan 2018: 10% gender gap in opening accounts

Nagesh Prabhu, 10% gender gap in Jan Dhan accounts: study, January 6, 2018: The Hindu

Difference is 21% in Madhya Pradesh

A World Bank paper has noted a 10% gender gap in opening accounts under the country’s flagship financial inclusion programme — Jan Dhan Yojana — with 73 % men applying for accounts against 63 % women. Madhya Pradesh recorded the largest gender gap of 21%. The World Bank’s policy research working paper ‘Making It Easier to Apply for a Bank Account: A Study of the Indian Market’ (2017) by Asli Demirguc-Kunt, Leora Klapper, Saniya Ansar and Aditya Jagati also noted an income gap — 64% being poorer adults and 71 % richer adults — in applying for an account.

The share of wage earners (72%) was higher than the share of adults who are out of the workforce and applied for an account (64%). Among adults with primary school education, 62% applied as compared with 70% of adults who had completed secondary school education (and 84 % of adults with a graduate degree).

The survey was carried out between January and March of 2016 in 12 States — Andhra Pradesh (including Telangana), Bihar, Chhattisgarh, Himachal Pradesh, Jharkhand, Kerala, Madhya Pradesh, Maharashtra, Odisha, Punjab, Rajasthan, Uttar Pradesh — which make up about 70% of the country’s population.

The paper explored the costs of opening an account, the efficiency of the account application process, and demographic differences between those who choose to apply and those who do not.

The research said despite initial successes, people who wished to apply for an account continued to incur a range of costs, including the cost of travelling to bank branches, the cost of collecting documentation and various other monetary costs. The confluence of these factors makes account opening a tedious task, researchers said.

Some adults declined to get an account as they were unable to afford the fees for maintaining and using an account, or think the fees are not worth it. Yet 40 % of adults cited lack of trust in financial institutions as reason for not opening an account.

2017: Women hold over 50% of Jan Dhan a/cs

February 15, 2018: The Times of India

From: February 15, 2018: The Times of India

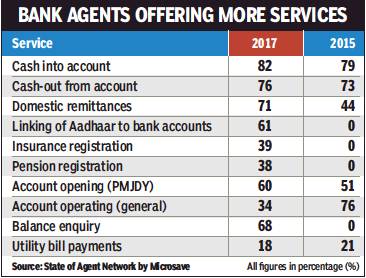

In what marks a boost for financial inclusion, more than half of PM Jan Dhan Yojna account-holders are women and they are also carrying out transactions rather than merely opening accounts, a sample survey by a financial inclusion consulting firm has indicated.

The “State of the Agent Network 2017” report released by Microsave on Wednesday found that there has been a more than 200% increase in volumes of cashin, cash-out between 2015 and 2017. The Modi government’s drive to encourage opening of these accounts was to offer banking services to the poor for more reliable transfer of government benefits and to enable the less well off to avail credit or loans.

The transactions are increasing as the bank agents or business correspondents offer more products and services such as linking of Aadhaar to bank accounts, insurance registration and balance inquiry. Moreover, government-to-people payments such as direct transfer of cash, has led to increase in transactions. Aadhar linkage and mobile use are key elements in the inclusion scheme.

Banks appoint entities and individuals as agents for providing basic banking services in remote areas where they can’t practically start a branch.

Releasing the agent network report, chief economic advisor Arvind Subramanian said while India has made a lot of progress on the financial inclusion front, gaps remain. “You have gas cylinders but you need consistent gas offtake; you have bank accounts but you need to make genuine inclusion; your toilets are built, but are they used? I think that’s the next stage we need to work on....That is why, the banking correspondents story needs more work,” he said.

The report has recommended the need to take steps to increase the share of women agents from the present of only 2%, which could give a fillip to the financial inclusion of women. The report is based on a nationwide representative research that covered 3,048 businesses correspondents.

Gender-wise savings

2020

August 19, 2021: The Times of India

From: August 19, 2021: The Times of India

Average balances maintained by women in Jan Dhan Yojana accounts are 30% more than men, according to an industry report. The study, published by Women’s World Banking and Bank of Baroda, estimates that by serving 10 crore lowincome women, public sector banks could attract Rs 25,000 crore in deposits and empower 40 crore low-income Indians.

The report recommends that banks design products for women that allows them to make small deposits and overcome inhibiting factors. To get them to use the accounts, it asks banks to promote awareness and nudge customers. It has called for transforming business correspondents from human ATMs into relationship managers offering rural women all financial products. Finally, it calls upon banks to disaggregate their Jan Dhan account data according to gender.

“We are blessed to have a platform like the Jan Dhan Yojana accounts, which can be the world’s largest women-empowerment opportunity,” said Women’s World Banking executive VP (Asia) Sriraman Jagannathan. According to him, in any other country, a women-empowerment programme would have to be run using a pilot programme. In India, most women already have the Jan Dhan accounts.

Bank of Baroda MD & CEO Sanjiv Chadha said, “A good percentage of women, especially those in the lowincome group, still shy away from realising the full potential of bank accounts. Rather, they still view it only as a channel to receive and withdraw cash. And, therein lies an unutilised opportunity and an untapped potential from banking perspective.”

Guidelines by RBI

Vague RBI guidelines allow banks to cap free transactions

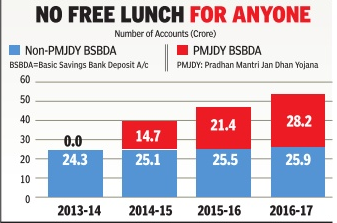

Crores of Pradhan Mantri Jan Dhan Yojana (PMJDY) account-holders risk either having their accounts frozen or having charges imposed if they exceed four debit transactions in a month. Vague wording of the Reserve Bank of India's guidelines on basic savings bank deposit accounts (BSBDA), which include PMJDY accounts, has led to banks conjuring up ways to cap free transactions.

The norms applicable to PMJDY accounts are those that are prescribed for the BSBDA by the RBI. The BSBDA was earlier known as a `no-frills' banking account-a service under which banks were to provide free basic banking facilities without any minimum balance requirement. Almost every bank today is violating the RBI's norms because of the unclear wording.

The frailties in the BSBDA have been highlighted in a report by Ashish Das, professor at the Indian Institute of Technology, Bombay .The report shows how banks are freezing transactions, imposing minimum balance requirement or levying charges when a customer exceeds the prescribed four free with drawals. State Bank of India, which has more than 9.9 crore PMJDY accounts, has chosen to freeze all debits once the free transaction limit are exhausted. A bank official said that customers can do more transactions by converting their accounts into regular savings accounts.Axis Bank is informing customers how the account will turn into a regular savings account when the limits are breached. ICICI Bank had earlier imposed charges but subsequently refunded them. HDFC Bank has said that transactions beyond four are chargeable.

To complicate matters, instead of speaking about withdrawals or ATM withdrawals, the guidelines desc ribe withdrawals as all debit transactions. This includes money going out of the account in any form; either by cash withdrawal at ATMs, at branches or through electronic fund transfers or debit card uses. The RBI definition of withdrawal is so wide, it also includes standing instructions for money going out towards EMI payments.

While the RBI has said that banks should allow at least four withdrawals in a month, it has also said that no charges can be imposed on these accounts. Banks are unsure of what to do beyond four withdrawals but do not want to provide an unlimited deposit and withdrawal facility for free. Each bank has decided to interpret this norm to safeguard its own interest.

There are over 54 crore BSBDA accounts in the country . These include the 22.4 crore PMJDY account holders with Rupay debit cards.The accounts were opened under the promise of zero charges.

“RBI's guidelines have kept the banks in difficulty and in a state of confusion, forcing many to become noncompliant of the regulations consciously or unconsciously, detriment to the interest of the depositors and the general public,“ said Das.

Since it is unreasonable to expect banks to provide unlimited free transactions in a basic account, the IIT report suggests some alternatives. One suggestion is that banks should be allowed to retain the account's status as a BSBDA while imposing reasonable charges beyond the mandated thresholds on cash transactions and certain value added services.Another suggestion is that to encourage use of debit cards and electronic payments, these should be allowed without any limits. To prevent the account from being misused, the report recommends that there should be a floor on the amount of cash deposits that can be made.

Impact…

…on society: People drinking less, saving more/ 2017

Surojit Gupta, How Jan Dhan a|cs keep villagers sober, October 16, 2017: The Times of India

Change In Habits As People Save More: Study

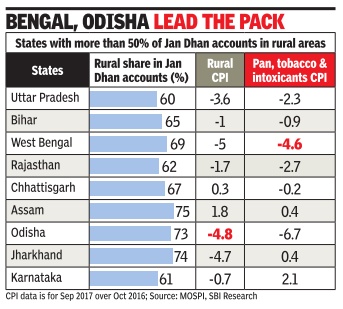

Village residents who opened bank accounts under the Prime Minister's Jan Dhan Yojana (PMJDY) may be saving more and cutting back on their consumption of alcohol and tobacco, a study by the economic research wing of the State Bank of India (SBI) suggests. This may have also slowed inflation in rural areas.

When the PMJDY pro gramme was launched there were fears that higher circulation of money would stoke inflation. The study using retail inflation data showed that states with more than 50% share of Jan Dhan accounts in villages had a “meaningful drop in inflation“.

Of the 30 crore-plus Jan Dhan accounts, many were opened after demonetisation last November. Just 10 states have 23 crore or 75% of the accounts, with Uttar Pradesh (4.7 crore) topping the list, followed by Bihar (3.2 crore) and West Bengal (2.9 crore).

The SBI study analysed state-wise impact of PMJDY accounts on rural and urban consumer price index (CPI).It is part of a research paper which is expected to be released later this year.

“The analysis confirms that besides formalisation of the economy, financial inclusion has had tangible benefits which is visible in the inflation data,“ the study said.

Besides inducing villagers to save, the Jan Dhan bank accounts also seem to have steered them away from intoxicants. “We observed that there is both statistically significant and economically meaningful drop in consumption of intoxicants such as alcohol and tobacco products in states where more PMJDY accounts were opened,“ the study conducted by Soumya Kanti Ghosh, group chief economic adviser at SBI, and his team showed. “This could be because of behavioural changes like less spending after demonetisation,“ the study said.

It also found an increase in household medical expenditure in states of Bihar, West Bengal, Maharashtra and Rajasthan since October 2016.

Experts said availability of banking channels can trigger change in behaviour. “It is well known that your spending behaviour changes when you have cash with you compared to money in the bank. It's the same when you have a credit card,“ said former chief statistician Pronab Sen.

“There could be behavioural changes happening.But the most important thing is that Jan Dhan accounts are promoting a culture of saving and helping to curb spending on alcohol and other such items,“ said N R Bhanumurthy , professor at the National Institute of Public Finance and Policy (NIPFP).

However, Ashok Gulati, Infosys chair professor of agriculture at the thinktank Indian Council for Research on International Economic Relations (ICRIER) said further analysis is needed to prove the correlation between Jan Dhan accounts and behavioural changes.

“We need more robust analysis before we can say for sure that because people now have bank accounts they are spending less on intoxicants,“ he said.

The professor added that other factors, such as developed infrastructure and links with markets in some states may have had a far greater impact on the price situation.

Performance

Aug. 2014- Nov. 2016

Authors' affiliation is as follows: Agarwal, Georgetown University; Alok, Indian School of Business; Pulak Ghosh, IIM Bangalore; Soumya Ghosh, State Bank of India; Piskorski, Columbia University; Seru, Stanford University

Is the NDA government's flagship initiative Jan Dhan Yojana bearing fruit on the ground?

There is a big debate about the activity role of financial markets and products in shaping consumer welfare and real economic . In developed economies, there is an increasing discussion that financial sector may have become inefficiently large and products offered to households may have become excessively complex. In contrast, in many developing countries, like India, there has been a significant push to increase the usage of financial products to “complete“ the market. While there is some empirical literature on the former, evidence on the latter is scant. To address this we conducted an extensive scientific study of the largest outreach programme in the world, the Pradhan Mantri Jan Dhan Yojana (JDY).JDY was launched in India on 28 August 2014, with the objective of providing banking services to a large proportion of the unbanked population in India.

Our study has two modest objectives.First, we document the initial uptake and subsequent usage of banking services that includes a savings account, overdraft facilities, and insurance benefits by the unbanked targeted by the programme.Second, we exploit the regional variation in pre-JDY financial access to explore how expanding access to financial services is related to broader outcomes such as lending, GDP growth, and consumer prices.

Several economic theories predict that financial inclusion programmes can directly benefit lower income households at the micro level through savings, spending, and reduction in transaction costs.What does the evidence say? We begin by documenting substantial outreach of the programme that led to 255 million formerly unbanked individuals getting access to formal banking services by November 2016. About 77% of the new accounts maintain a positive balance with the average monthly balance of Rs 482, which is about 60% of the rural poverty line in India.

Overall, our micro-evidence suggests that there was substantial uptake by households under JDY. Moreover, both savings and transactions go up over time for individuals banked under the programme. This evidence is consistent with learning by individuals that results in an increase in usage over time as they gain familiarity with banking services.The initial usage is also more frequent among married account holders.

We also note that financial inclusion programmes such as JDY can also have broader regional implications through at least two channels. First, such a programme could allow new capital to come into the formal banking system by means of new deposits, relaxing the capital constraints. This would allow banks to increase lending to their clients.

Second, information asymmetry between new customers and lenders or other costs in acquiring new customers may imply that a programme like JDY may allow banks to meet the unmet demand for credit for some households. To the extent that this increase in credit is large, one would see such programmes stimulating local economic growth through increased con sumption, investments, and employment.

To investigate such broader effects, we exploit spatial (regional) variation in implementation of this programme to explore how access to consumer savings accounts is related to broader economic outcomes such as lending and local GDP growth. To do this, we construct four pre-programme measures of JDY exposure that reflect the number of adults per branch in a region, the fraction of branches owned by the state-owned banks in a region, the percentage of unbanked households in a region, and a comprehen sive index capturing the degree of financial inclusion in a region.

In districts with high ex-ante exposure to JDY, using aggregate data provided by the central bank of India, we observe an increase in aggregate lending in areas with greater ex-ante JDY exposure. We verify these effects are present in our micro data and find an increase in both the number of new loans granted and the amount of loans granted in regions with greater JDY exposure relative to those with lower exposure. Our findings suggest that JDY may have allowed banks to meet the unmet demand for credit for some households that did not have prior access to formal banking products.

We also examine the impact of JDY on a number of other macroeconomic outcomes at the regional level. Here we do not observe an economically significant change in the GDP growth rate in more affected areas. However, given our nearterm focus due to the short time series of data, it is possible that the overall impact of the programme on GDP growth rate will manifest itself over the longer term.

We do find some evidence suggesting that the programme was associated with an increase in investments, though the data underlying this test is very limited.Importantly , we do not observe any significant relative change in the inflation rate in more exposed areas.This suggests that one of the common concerns that the programme may have led to substantially higher price level due to a higher circulation of money and creation of additional demand may be unwarranted, at least in the near term.

Overall, our research has shown that a financial inclusion programme like the JDY can have a very meaningful impact on the number of households using formal banking services. Our results also suggest that JDY has led banks to cater to the new demand for formal banking credit by previously unbanked borrowers, which could have a positive impact on the broader economy in the long run.

2018: 33.5cr a/cs; ₹85k cr deposits

Jan Dhan a/cs soar to 33.5cr; deposits ₹85k cr, December 30, 2018: The Times of India

From: Jan Dhan a/cs soar to 33.5cr; deposits ₹85k cr, December 30, 2018: The Times of India

Of Total Accounts, 25.6Cr Are Operative: Govt

After an initial target of six crore rural and 1.5 crore urban households, the Jan Dhan scheme for the unbanked has touched 33.5 crore accounts of which 25.6 crore are “operative” while the deposits in the accounts add up to a substantial Rs 85,494 crore.

With the government’s focus shifting from “every household” to “every unbanked adult”, the PM Jan Dhan Yojana is offering an enhanced overdraft facility to 65 lakh account holders of which 30 lakh availed of the benefits to draw Rs 340 crore, the government has told Parliament.

The statistics show impressive progress in financial inclusion of “unbanked” less well off households as apart from a steady increase in account holders, some 26 crore RuPay cards have also been issued. Regular credit ensures an overdraft facility and eligibility for credit guarantee fund for micro units.

Going by the norm that accounts must show at least one “customer-induced” transaction in two years to be counted as “active”, around 76% of Jan Dhan accounts are in use. Many of these are used for direct benefis transfers for welfare schemes and overdraft facility is provided to accounts that show regular credit. The limit has been increased from Rs 5,000 to Rs 10,000 and the age limit to claim OD hiked from 60 to 65 years.

There are, as on December 12, 2018, some 19.6 crore rural and semi-urban beneficiaries and 13.6 crore urban-metro account holders, the ministry of finance told nominated Anglo-Indian MP George Baker and BJP MP Varun Gandhi.

The details provided by the ministry show that UP, with its large population, expectedly has the highest number of 5.2 crore accounts and deposits of Rs 14,882 crore, West Bengal has deposits of Rs 11,470 crore. Bihar is next with deposits of Rs 8,417 crore, Rajasthan with Rs 6,360 crore and Maharashtra and Madhya Pradesh with Rs 5,035 crore and Rs 4,325 crore.

Among larger states that seem to be lagging, Jammu and Kashmir has only 20,40,248 beneficiaries and Tamil Nadu has 93,17,460 account holders. Andhra Pradesh has 92 lakh accounts but only Rs 1,628 crore in deposits.

Odisha has deposits of Rs 3,759 crore and Gujarat of Rs 3,676 crore, while Assam has Rs 2,969 crore. Chhattisgarh has deposits of Rs Rs 2,619 crore, Haryana of Rs 2,695 crore, Jharkhand Rs 2,668 crore, Karnataka Rs 2,862 crore and Punjab Rs 2,361 crore.

2014- 2019, March

From: April 23, 2019: The Times of India

See graphic:

Jan Dhan deposits, 2014- 2019, Apr 10

State-wise performance

Bihar: 2015-20

Praveen Kumar, Madnesh Kumar Mishra, Sandeep Kandikuppa, April 29, 2022: The Times of India

From: Praveen Kumar, Madnesh Kumar Mishra, Sandeep Kandikuppa, April 29, 2022: The Times of India

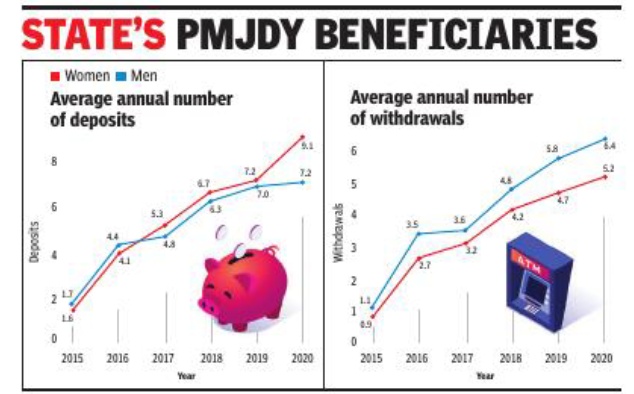

The Pradhan Mantri Jan Dhan Yojana, launched in 2014, is a national mission on financial inclusion that aims to ensure that all Indians, particularly low-income groups and weaker sections, have access to financial services, including a basic savings bank account, needbased credit, remittances, low-cost life and general insurance and pension. The scheme also envisages a robust financial literacy programme, with a key objective being to enable the beneficiaries to leverage digital technology and internet-based banking.

In Bihar, PMJDY has covered more than 5 crore beneficiaries, of whom more than 3. 67 crore are in rural areas. Since 2015, more than 3. 8 crore RuPay debit cards have been issued in the state. The reach of this scheme is indeed impressive.

However, two key questions need to be asked: 1) Has increased and relatively easy access to banking channels resulted in a corresponding increase in the utilisation of banking services, including among the women?; 2) Has financial literacy under PMJDY contributed to increased utilisation of digital banking?

We examined the account level data provided by 12 public sector banks for over 73 lakh out of 82 lakh beneficiaries, whose accounts were opened in 2015. We analysed the financial behaviour of these 73 lakh account holders from 2015 to early 2020 (till March). Almost 53% of these beneficiaries were women, and 45% were men. Approximately 47% hailed from rural areas. While providing this data, the banks deidentified the accounts.

In answering our first question we examined trends in the average number of deposits and withdrawals undertaken per account per year between 2015-20. To address the second question we examined 1) the average number of debit card transactions per account per year; and 2) the number of digital transactions as a percentage of total number of transactions undertaken by PMJDY beneficiaries.

Banking the unbanked

The basic banking services – deposits and withdrawals – have witnessed a significant increase among women. The number of deposits per account per year among women was less than two in 2015 across all 38 districts of Bihar. By 2020, it increased to more than eight deposits per account per year in 26 districts. From 2017 through 2020, women have outnumbered men in the average number of deposits per year (see figure). These trends are across both rural and urban areas, and could be partly attributed to central and state government initiatives to make women the primary recipients of various development schemes. There has also been an increase in the per capita number of withdrawals by women beneficiaries of PMJDY. While this figure stood at less than one in 29 districts of Bihar in 2015, it rose to between four and six in 24 districts by 2020. Begusarai, East and West Champaran, and Samastipur witnessed a relatively higher (>6) per capita number of withdrawals among women compared to other districts. There has been an average annual increase of approximately 59% over the preceding year in the average number of withdrawals among women in rural areas. The increase in withdrawals is particularly significant as it indicates a deeper engagement with banking services. Women are not just passive recipients of benefits from the government but are actively utilising their bank accounts in their day-to-day lives. It is worth noting that the percentage of women-held accounts with one or more withdrawals witnessed a jump of 30 percentage points from 24% in 2015 to 54% in 2020.

Leveraging digital technology

Perhaps the most interesting finding from this studyis the increase in the uptake of digital banking services by all genders. This outcome points to the efficacy of the financial literacy efforts as part of the PMJDY. In 29 out of 38 districts, digital transactions represented only 10% of all transactions in 2015. By 2020, 40% of the transactions undertaken by women across all districts in Bihar were digital.

Interestingly, it is not the urbanised districts like Patna and Gaya which witnessed the highest increase in the uptake of digital banking but predominantly rural districts like Sitamarhi, Buxar, Madhubani and Samastipur. The proportion of accounts undertaking one or more digital transactions has also shown an upward trend. Whereas only about 5% of the accounts held by women in Bihar saw some digital transactions in 2015, this figure nearly tripled to more than 15% by 2020. Precise reasons for this encouraging trend in the uptake of digital banking services among women, including those in rural areas, merit further granular studies. However, there is a strong likelihood that the systematic mapping of each district into sub-service areas and the large-scale deployment of bank mitras have contributed to the increase in the utilisation of banking services across demographic segments. These combined strategies ensured that households could find banking services within a short distance or even at their doorsteps, even as financial literacy was enhanced among previously unbanked or under-banked communities. Kumar is Assistant Professor at Boston College, US.

Mishra is former Joint Secretary, Department of Financial Services, GoI. Kandikuppa is Research Fellow at the East-West Centre, Hawaii, US

Suggestions

Abuse of its liberal terms leads to calls for strictness

The Jan Dhan [‘the common man’s wealth’] scheme is part of the NDA government's plan to provide banking facilities to the poor and encourage savings, and allows customers to open accounts with zero balance. Normal savings accounts involve conditions like an opening sum and minimum balance.

With more people using Jan Dhan accounts in the wake of the demonetisation drive, bankers are weighing the need to convert the accounts into normal savings bank accounts.

After concerns were raised about the reported misuse of Jan Dhan accounts amid the ongoing crackdown on black money, economic affairs secretary Shaktikanta Das announced on Tuesday a Rs 50,000 limit on annual cash deposits in the accounts, after which the source of funds would be verified.

Following the announcement, bankers are re-examining the threshold they set for converting Jan Dhan accounts into normal savings accounts. The earlier limit was Rs 1 lakh a year, which banks will now have to bring down to Rs 50,000.

“Jan Dhan accounts require minimum know-your-customer (KYC) documentation. If someone tries to deposit over Rs 50,000, or the earlier limit of Rs 1 lakh, we cannot send them back. We only ask for more KYC details and convert it into a full-fledged savings account with all the charges applicable,“ said Rakesh Sharma, chairman, Canara Bank. “We cannot deny any customer the right to deposit their own money,“ Sharma added.

Officials at SBI branches in Tirunelveli and Nellore said that they had spotted about a dozen cases of deposits beyond Rs 1lakh in Jan Dhan accounts. “We asked the customers to fulfil KYC requirements and then accepted the deposits. We believed these unorganised workers, retail vendors and petty shop owners were genuine customers. Then again, even if they were to deposit Rs 2 lakh, and that was their income, it is well within their taxable limit,“ said an SBI official.

“...It is important to remember that Jan Dhan accounts are primarily for financial inclusion. And if there are customers who want to deposit more money , they can when they fulfil our conditions,“ said K Venkataraman, CEO, Karur Vysya Bank.