Taxes: India

(→Tax collection) |

(→1991-21) |

||

| Line 32: | Line 32: | ||

'' 1991-21 <br/> The Share of direct, corporate, income taxes; <br/> Tariff rates. '' | '' 1991-21 <br/> The Share of direct, corporate, income taxes; <br/> Tariff rates. '' | ||

| − | [[Category:Economy-Industry-Resources|T TAXES: INDIA | + | |

| + | ==2014-22== | ||

| + | [https://epaper.timesgroup.com/article-share?article=13_10_2022_030_012_cap_TOI Atul Thakur, Oct 13, 2022: ''The Times of India''] | ||

| + | |||

| + | Since the financial year 2020-21 – the first to be completely impacted by the pandemic – the share of indirect taxes in the Centre’s total tax collections has risen above 50%. Unlike direct taxes – like income tax and corporation tax, which are based on income – indirect taxes like customs, excise and so on are paid by both rich and poor. | ||

| + | |||

| + |

Further analysis of the data shows the increase in the share of indirect taxes in the government’s overall tax collection seems to be linked to the increased tax collection from petroleum products. In 2014-15, the year since when data on tax collection from petroleum is available, the Centre had Rs 12. 5 lakh crore of gross tax collections. Of this, Rs 6. 9 lakh crore came from corporation and income taxes, constituting 55. 2% of the total. Another Rs 5. 5 lakh crore was collected through major indirect taxes, which was 44. 4% of the total tax collection. | ||

| + | |||

| + |

Since 2014-15 there has been a steady decline in the share of corporation taxes in the Centre’s overall tax collection. From 34. 5% in 2014-15, it fell to 22. 6% in 2020-21. There has been an increase since 2020-21, but at 25. 2% the share of corporation tax in gross taxes is still signifi cantly lower than in 2014-15. | ||

| + | |||

| + |

During the same period, the share of income tax in gross tax collections increased from 20. 8% in 2014-15 to over 24% in 2019-20 and has remained around that level. This increase of about 3 percentage points, however, has been too small to offset the over 9 percentage-point fall in the share of corporation taxes. Despite this, except for 2016-17, the share of direct taxes (corporation tax plus income tax) remained more than 50% of the central government’s total tax collections, till the trend was reversed in 2020-21.

The period since 2014-15 has seen a relatively steady increase in the share of indirect taxes. From 44. 4% in 2014-15 the share increased to 53. 1% in 2020-21. Although there was a slight drop in 2021-22, indirect taxes’ share

of 50% in total collections was still about 5. 6 percentage points higher than its 2014-15 value.

Apart from the fall in corporatetax’s share, the other factor that has pushed up the share of indirect taxes is the increase in taxes on various In 2014-15 the central exchequer collected Rs 1. 3 lakh crore as taxes on various petroleumproducts. This was 22. 8% of the government’s total indirect tax collection. Since then every successive year saw a rather steady increase inpetroleum’s contribution in indirect taxes. From 22. 8% in 2014-15, the share increased to 39% in 2020-21. There has been a decline since then to 34. 3% in 2021-22, but that’s still much higher than the 2014-15 level. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|T TAXES: INDIATAXES: INDIA | ||

TAXES: INDIA]] | TAXES: INDIA]] | ||

| − | [[Category:India|T TAXES: INDIA | + | [[Category:India|T TAXES: INDIATAXES: INDIA |

TAXES: INDIA]] | TAXES: INDIA]] | ||

| − | [[Category:Pages with broken file links|TAXES: INDIA | + | [[Category:Pages with broken file links|TAXES: INDIATAXES: INDIA |

TAXES: INDIA]] | TAXES: INDIA]] | ||

Revision as of 20:06, 25 October 2022

This is a collection of articles archived for the excellence of their content. |

Contents |

1995-2017

From: The Times of India, Feb 2, 2017

See graphic:

The share of direct taxes, service tax, excise duty and customs duty in the total tax collections of India, 1995-2017

1950-2021

From: February 2, 2022: The Times of India

See graphic:

The share of direct and direct, corporate and income taxes in the total tax collections of India, 1950-2021

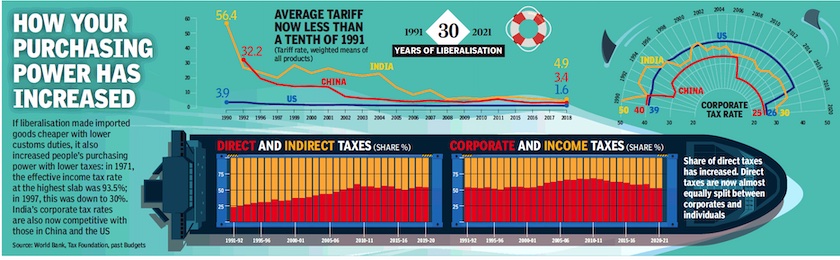

1991-21

The Share of direct, corporate, income taxes;

Tariff rates.

From: February 1, 2021: The Times of India

See graphic:

1991-21

The Share of direct, corporate, income taxes;

Tariff rates.

2014-22

Atul Thakur, Oct 13, 2022: The Times of India

Since the financial year 2020-21 – the first to be completely impacted by the pandemic – the share of indirect taxes in the Centre’s total tax collections has risen above 50%. Unlike direct taxes – like income tax and corporation tax, which are based on income – indirect taxes like customs, excise and so on are paid by both rich and poor.

Further analysis of the data shows the increase in the share of indirect taxes in the government’s overall tax collection seems to be linked to the increased tax collection from petroleum products. In 2014-15, the year since when data on tax collection from petroleum is available, the Centre had Rs 12. 5 lakh crore of gross tax collections. Of this, Rs 6. 9 lakh crore came from corporation and income taxes, constituting 55. 2% of the total. Another Rs 5. 5 lakh crore was collected through major indirect taxes, which was 44. 4% of the total tax collection.

Since 2014-15 there has been a steady decline in the share of corporation taxes in the Centre’s overall tax collection. From 34. 5% in 2014-15, it fell to 22. 6% in 2020-21. There has been an increase since 2020-21, but at 25. 2% the share of corporation tax in gross taxes is still signifi cantly lower than in 2014-15.

During the same period, the share of income tax in gross tax collections increased from 20. 8% in 2014-15 to over 24% in 2019-20 and has remained around that level. This increase of about 3 percentage points, however, has been too small to offset the over 9 percentage-point fall in the share of corporation taxes. Despite this, except for 2016-17, the share of direct taxes (corporation tax plus income tax) remained more than 50% of the central government’s total tax collections, till the trend was reversed in 2020-21. The period since 2014-15 has seen a relatively steady increase in the share of indirect taxes. From 44. 4% in 2014-15 the share increased to 53. 1% in 2020-21. Although there was a slight drop in 2021-22, indirect taxes’ share of 50% in total collections was still about 5. 6 percentage points higher than its 2014-15 value. Apart from the fall in corporatetax’s share, the other factor that has pushed up the share of indirect taxes is the increase in taxes on various In 2014-15 the central exchequer collected Rs 1. 3 lakh crore as taxes on various petroleumproducts. This was 22. 8% of the government’s total indirect tax collection. Since then every successive year saw a rather steady increase inpetroleum’s contribution in indirect taxes. From 22. 8% in 2014-15, the share increased to 39% in 2020-21. There has been a decline since then to 34. 3% in 2021-22, but that’s still much higher than the 2014-15 level.

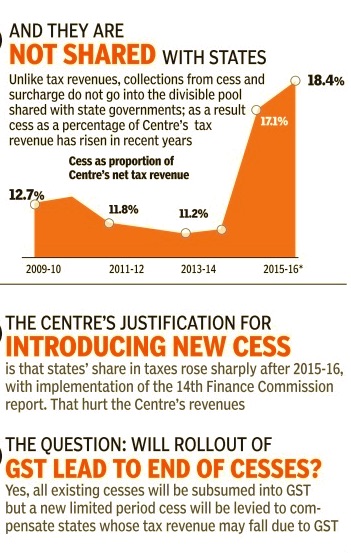

2009-16

From: The Times of India, Feb 2, 2017

See graphic:

Cess as proportion of centre's net tax revenue, 2009-16 and impact of GST on imposition of cesses

2009-19

From: The Times of India, Feb 2, 2017

See graphic:

Cess in Indian economy and revenue collection from cesses, 2009-17 and cesses and surcharges that fetch over Rs. 1000 crore annually

Tax collection

2015-16

From: The Times of India, Feb 11, 2017

See graphic:

%change in industrial production and tax collection ,2015-16

2011-21

From: April 19, 2022: The Times of India

See graphic:

Tax receipts, direct and indirect, India: 2011-21