Diamond market in India

(→The market share of cities) |

|||

| Line 10: | Line 10: | ||

=The market share of cities= | =The market share of cities= | ||

| + | ==Mumbai vis-à-vis Surat: 2023== | ||

[https://epaper.timesgroup.com/article-share?article=30_06_2023_009_009_cap_TOI Hemali Chhapia, June 30, 2023: ''The Times of India''] | [https://epaper.timesgroup.com/article-share?article=30_06_2023_009_009_cap_TOI Hemali Chhapia, June 30, 2023: ''The Times of India''] | ||

| Line 21: | Line 22: | ||

When TOIcontacted members of the managing committee of SDB, they said their scheme was merely intended to persuade their own members “to return”. “This scheme is for the members of the SDB. Not for anyone else. We have decided to offer them some relaxation in maintenance, there is nothing wrong in our committee decision as we want business houses to take advantage of this offer and move,” said Dinesh Navadia, member of the SDB managing committee. |

When TOIcontacted members of the managing committee of SDB, they said their scheme was merely intended to persuade their own members “to return”. “This scheme is for the members of the SDB. Not for anyone else. We have decided to offer them some relaxation in maintenance, there is nothing wrong in our committee decision as we want business houses to take advantage of this offer and move,” said Dinesh Navadia, member of the SDB managing committee. | ||

| + | |||

| + | [[Category:Economy-Industry-Resources|D DIAMOND MARKET IN INDIA | ||

| + | DIAMOND MARKET IN INDIA]] | ||

| + | [[Category:India|D DIAMOND MARKET IN INDIA | ||

| + | DIAMOND MARKET IN INDIA]] | ||

=2014: India world's No. 3 mkt for diamonds= | =2014: India world's No. 3 mkt for diamonds= | ||

Revision as of 06:57, 29 July 2023

This is a collection of articles archived for the excellence of their content. |

Contents |

Mumbai vis-à-vis Surat: 2023

Hemali Chhapia, June 30, 2023: The Times of India

Mumbai : A tussle has broken out between Surat and Mumbai over market share in the gems trade. Surat Diamond Bourse (SDB), whose construction is complete and is slated to be opened by PM Narendra Modi later this year, is now inviting diamantaires to set up units. But its aggressive marketing has not gone down well with Bharat Diamond Bourse in Mumbai. The younger bourse has offered a year of free maintenance to those who will completely shut shop in Mumbai and move their businesses to Surat.

The sops are meant to “accelerate diamond trading and related businesses in SDB” and there could be more in store for the initial entrants as the scheme has a Phase 2. Those who “completely close their Mumbai office and discontinue sale of polished diamond from their Mumbai office and start the sale from Surat Diamond Bourse only” will have their names emblazoned permanently on a list titled ‘Leading members to start diamond trading activity in Surat Diamond Bourse’. The plaque or board will be placed in the reception area of the SDB. Mehul Shah, vice president of the Bharat Diamond Bourse, said members in Mumbai were appalled. “One wonders why they have come out with such offers. People from Surat are not moving in. Why are you sending such offers to business houses in Mumbai? We don’t tell them to close their factory and come here,” said Shah.

Considering that “Indians control 70-80% of the world’s diamond trade”, the industry has enough space for two diamond bourses, said Shah.

Traditionally, diamantaires have had historical links with both cities. Most large trading houses have a part of their family operating from Surat; some branches moved to Mumbai decades ago realising that an international clientele could be better serviced from here. “Avenues for this industry are huge. So, we can grow in both bourses. There is really no need for anyone to close any business anywhere,” said Ash ok Gajera, owner of Laxmi Diamond who operates out of Mumbai, while his brothers run a unit in Surat.

When TOIcontacted members of the managing committee of SDB, they said their scheme was merely intended to persuade their own members “to return”. “This scheme is for the members of the SDB. Not for anyone else. We have decided to offer them some relaxation in maintenance, there is nothing wrong in our committee decision as we want business houses to take advantage of this offer and move,” said Dinesh Navadia, member of the SDB managing committee.

2014: India world's No. 3 mkt for diamonds

The Times of India, Sep 22 2015

Partha Sinha

India world's No. 3 mkt for diamonds

India is not only the the second largest goldconsuming country , it has also become one of the largest markets for diamonds.With an 8% share for polished diamonds, India is now the world's third largest diamond consumer behind US (42%) and China (16%), the latest Diamond Insight report by global major De Beers showed. The Indian appetite for diamonds has grown at a tremendous pace: In 10 years, the Indian market nearly trebled in size to about Rs 22,000 crore by end-2014, and around 25 lakh pieces of diamond jewellery were acquired by Indian women in 2013, roughly six times the number acquired in 2002, the report pointed out.

“India's domestic diamond consumer market has achieved almost uninterrupted growth over the last two decades, with demand for dia mond jewellery expanding in 19 of the last 20 years in rupee terms,“ De Beers said. “The brief contraction in 2013, caused by the depreciating purchasing power of the rupee and a weakening of the broader Indian economy , reversed in 2014,“ it said.

The report also pointed out that as income is growing, Indian consumers are increasingly buying diamonds, which is reflected in the increasing volumes of diamond jewellery sales.

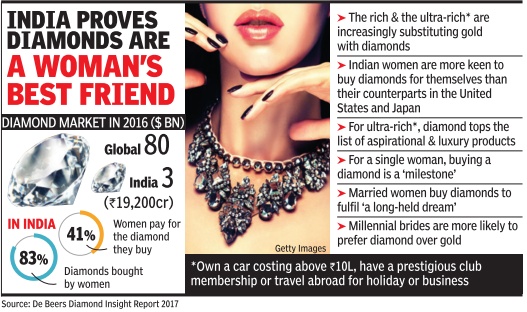

2016 (data): De Beers Diamond Insight Report, 2017

See graphic:

Diamond market in India, 2016

See also

Diamond market in India