Anil Ambani

(→Manipal Technologies ) |

|||

| Line 132: | Line 132: | ||

However, the legal trouble for RCom does not end with Manipal Technologies’ plea. The insolvency plea filed by Ericsson against RCom for unpaid dues of nearly Rs 1, 150 crore also stands. | However, the legal trouble for RCom does not end with Manipal Technologies’ plea. The insolvency plea filed by Ericsson against RCom for unpaid dues of nearly Rs 1, 150 crore also stands. | ||

| + | |||

| + | =Reliance Capital= | ||

| + | ==The Rise & Fall/ 2008- 2024== | ||

| + | [https://epaper.indiatimes.com/article-share?article=24_08_2024_021_018_cap_TOI August 24, 2024: ''The Times of India''] | ||

| + | |||

| + | [[File: The Rise and Fall of Reliance Capital and Anil Ambani, 2008- 2024.jpg| The Rise and Fall of Reliance Capital and Anil Ambani, 2008- 2024 <br/> From: [https://epaper.indiatimes.com/article-share?article=24_08_2024_021_018_cap_TOI August 24, 2024: ''The Times of India'']|frame|500px]] | ||

| + | |||

| + | Mumbai : In 2008, Reliance Capital’s market capitalisation of over Rs 70,000 crore was larger than HDFC. Its chairman Anil Ambani had declared that it was among the top three financial institutions in the country. Just over a decade later, rating agency firm Care downgraded Reliance Capital to default. | ||

| + | |||

| + |

From heading a conglomerate that had a market cap larger than the Tata Group in 2007 and being the sixth richest man globally, to having to declare himself bankrupt before a UK court in 2019, Anil Ambani’s fortunes have reflected that of his flagship financial services firm.

| ||

| + | |||

| + | The troubles began with the global financial crisis in 2008, which strained liquidity for financial services companies. Instead of consolidating, ADAG Group continued its expansion, making big ticket investments in a joint venture with Steven Spielberg’s Dreamworks. There was also a string of acquisitions including Global Cloud Xchange, a global video game maker which was renamed Zapak, UTV Television, Pipavav Shipyard and MTS telecom. | ||

| + | |||

| + |

The group’s diversification into infrastructure, particularly Reliance Power, defence and media took its toll on finances as the entry was at the wrong end of the business cycle and made matters worse. | ||

| + |

Reliance Communications (Rcom), which was expected to be a cash cow, also took a hit because of excess leverage. Also, the fact that Rcom was running on code division multiple access (CDMA) technology, which was shut down as industry shifted to GSM, also impacted business. | ||

| + | |||

| + |

While other group companies faced their own challenges, at the core of Reliance Capital’s downfall were governance issues, particularly related-party transactions. Reliance Capital’s two main lending subsidiaries, Reliance Home Finance and Reliance Commercial Finance, went into default. The primary reason for the default was that these two companies had extended loans to related parties, which subsequ- ently defaulted. Sebi’s latest actions against Ambani and other senior officials of the ADAG group pertain to these transactions conducted by Reliance Home Finance. | ||

| + | |||

| + |

The final nail on the coffin for the financial services firm was the tightening of liquidity after the twin failures of IL&FS and DHFL. Because of governance issues, Reliance Capital’s auditor PWC refused to sign the FY19 balance sheet leading to the Reserve Bank of India finally superseding the firm’s board initiating bankruptcy proceedings in November 2021.

Ambani inherited the financial services, power and telecom businesses after his father and founder of Reliance Industries Dhirubhai Ambani’s death in 2002. | ||

| + | |||

| + | [[Category:Biography|AANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANI | ||

| + | ANIL AMBANI]] | ||

| + | [[Category:Economy-Industry-Resources|AANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANI | ||

| + | ANIL AMBANI]] | ||

| + | [[Category:India|AANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANI | ||

| + | ANIL AMBANI]] | ||

| + | [[Category:Pages with broken file links|ANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANIANIL AMBANI | ||

| + | ANIL AMBANI]] | ||

= RCom= | = RCom= | ||

Revision as of 20:16, 19 September 2024

This is a collection of articles archived for the excellence of their content.

|

Contents |

As an industrialist

The marathon-runner CEO is considered to be close to PM Narendra Modi, and was the only industrialist to figure in the list of nine personalities Modi nominated for the Clean India campaign in October.

Some of his businesses crossed important milestones in 2014. Reliance Infrastructure's Mumbai Metro became operational, creating a world record with 30 million passengers in just over 100 days. His communications firm raised a billion dollars via qualified institutional placement QIP), India's largest-ever QIP in the private sector.

Reliance Media Works partnered with Prime Focus to create the world's largest media services company that handled blockbusters Gravity in 2013 and Transformers 4 in 2014.

Early bird

He starts giving to-do instructions to executives as early as 5.30 a.m. when he wakes up. Works till 7.30 p.m, has an early dinner and is in bed by 10 p.m. Conducts review meetings on Sundays.

Inverted Diet

He has fruits for breakfast, a frugal soup and vegetable sandwich for lunch, but has a heavy dinner.

Marriage with Tina Munim

When Tina Munim turned down Anil Ambani

One of the most popular couples of the country, Anil and Tina Ambani are a perfect example of 'love conquers all'. Though in an interview with Simi Garewal, Anil Ambani revealed that it was never love at first sight for him, his friends and Tina love to disagree over this. Anil spotted Tina for the first time unofficially at a wedding. As per Anil the thing that caught his attention was Tina's black saree as she was the only person in the entire wedding ceremony who wore something black. The second time they met was when Anil Ambani was in Philadelphia. Anil was introduced to Tina and he instantly asked her out. But Tina coming from the place where everyone runs after beautiful actresses turned him down.

In 1986, Tina was again introduced to Anil Ambani by her nephew. In the interview Tina said that she was not too keen on meeting guys at that stage in her life. This was the reason she kept postponing or cancelling their dates. But when they finally met Tina was struck by his simplicity and genuinity. Tina thought he was very different from the lot. And she instantly felt the connection as they were also born and brought up the same way.

On the other hand, Anil who was already struck by her beauty found her very down to earth and beautiful from within. Anil had known many people from the industry and he had certain notions about how Tina would be. But he said she was not like any of them. Anil stressed on the fact that he was really attracted to her only after they'd met a couple of times.

Tina and Anil dated for a couple of months after this. During this period Tina was also in the process of giving up Bollywood and was mostly busy with completing shoots. When Anil's family got to know of Tina, they weren't really excited about the match. They had certain notions about people from the film industry thus the thought of bringing someone from the fraternity into their lives and home did not go down too well with them.

It was family pressure that influenced Anil and Tina to stop seeing each other. Anil tried explaining things to Tina agreed to his decision without questioning him. But at the end she was just a girl who was heart broken. After this incident Anil and Tina did not speak to each other for 3-4 years.

During this period of 3-4 years, Tina left Bollywood and went to America. She continued studying interior designing and putting everything else behind her. And time just flew by. In the meanwhile Anil was showered with marriage prospects from good families but he kept turning them down. Anil said in the interview, "It was a lot of pain, a feeling of great loss." But during this period, neither Tina nor Anil went out with anyone else.

In that period of 3-4 years where they never interacted, there was only one time when Anil called her up. In 1989 when Anil heard that there was a major earthquake in Los Angeles, he got Tina's number and called her up. Anil asked Tina if she was alright and she being surprised and overwhelmed said 'yes'. But before she could continue the interaction or ask him something else Anil disconnected the call.

During this period, Anil kept refusing all the marriage proposals and kept trying to persuade his parents that Tina was the girl he should be with. After much persuasion when his family finally agreed, he called up Tina again and asked 'when are you coming back'. Tina replied that she would be back in a couple of weeks but later she just brushed it off. Though Tina still had strong feelings for him, she knew there was no future and thus just brushed off this conversation.

Tina who after leaving Bollywood had absolutely no friends in the industry kept postponing her plans of coming back to India. Weeks passed by and one day Anil called up Tina Munim again. He said, "you ahve been telling me you'll come back I want to know when will you come back?" Tina says, "This was the moment I realised I had to go back now. I could not have missed this."

After she came back, he told her his plans and Tina met his family. Anil also went to Khar to meet Tina's family and informed them about his plans. After everything materialised, Tina and Anil tied the knot in a spectacular ceremony six weeks later.

Anmol Ambani

2016: Additional director of Reliance Capital

The Times of India, Aug 24 2016

Anil Ambani's son Anmol inducted into RCap board

Anmol Ambani, the 24-year-old eldest son of Reliance Group chairman Anil Dhirubhai Ambani, is joining Reli ance Capital as additional director following a board meet. The appointment marks continua tion of the third generation of the Ambani family in the divided Reliance business empire.

Earlier, Mukesh Ambani's children Akash and Isha took up positions in the telecom and retail businesses. Anmol, who joined Reliance Capital in 2014, is expected to join the management as an executive director after shareholders' approval.In the last two years, he has been actively involved in internal business reviews across subsidiaries of Reliance Capital. He has also been part of the negotiations with Nippon Life for increasing stake in Reliance Life Insurance and Reliance Capital Asset Management.

The induction follows the recommendation by the nomination and compensation committee of the board of Reliance Capital, comprising mostly independent directors. “The last two years have given me great learnings about the financial services business. I look forward to using this experience for scaling up our businesses and contributing towards their growth and progress,“ said Anmol.

Ericsson

2018, May: ‘Settlement outside of bankruptcy court with Ericsson unlikely’

Investments in the Indian capital market through participatory notes climbed to Rs 84,647 crore till August-end, making it the first rise in such fund infusion in 10 months.

Participatory notes (P-notes) are issued by registered foreign portfolio investors (FPIs) to overseas players who wish to be part of the Indian stock market without registering themselves directly. They, however, need to go through due diligence.

According to the Securities Exchange Board of India (SEBI) data, total value of P-note investments in the Indian market - equity, debt, and derivatives - rose to Rs 84,647 crore till August-end from Rs 80,341 crore clocked by the end of July.

Prior to this, an increase in investment was seen in October 2017, when the cumulative value of such fund infusion rose to Rs 1,31,006 crore from Rs 1,22,684 crore in September-end.

Of the total investments made last month, P-note holdings in equities were at Rs 66,233 crore and the remaining in debt and derivatives markets.

Besides, the quantum of FPI investments via P-notes rose to 2.5 percent during the period under review from 2.4 percent in the preceding month.

Before the rise, P-note investments were on a decline since, June last year and hit an over eight-year low in September. However, these investments rose slightly in October but fell again in November and the trend continued till July this year.

In July this year, the investment had touched the lowest level since April 2009 when the cumulative value of such investments stood at Rs 72,314 crore.

The decline in investment could be attributed to several measures taken by the market watchdog to stop the misuse of the controversy-ridden participatory notes.

In July 2017, SEBI had notified stricter norms stipulating a fee of $1,000 on each instrument to check any misuse for channelising black money. It had also prohibited FPIs from issuing such notes where the underlying asset is a derivative, except those which are used for hedging purposes.

Last month, market regulator SEBI issued revised KYC norms for FPIs, wherein resident, as well as, non-resident Indians have been permitted to hold non-controlling stake in such entities.

These norms have been put in place weeks after a panel suggested various changes to the guidelines proposed earlier, amid concerns in certain quarters that overseas funds might face difficulties in ensuring compliance.

Non-resident Indians (NRIs), overseas citizens of India (OCIs) and resident Indians (RIs) have been permitted to hold non-controlling stake in FPIs. There would also be no restriction on them to manage the non-investing FPIs SEBI-registered offshore funds as well as registered investment managers.

2018, Oct: Ericsson files contempt of court petition against Anil

Kiran Rathee, October 2, 2018: Business Standard

SC will hear the plea of RCom on October 4 whereas a date is not finalised for Ericsson

Swedish telecom gear maker Ericsson has filed a petition in the Supreme Court for contempt of court against Anil Ambani, chairman of Reliance Communications after the firm failed to pay about Rs 5.50 billion to Ericsson to settle the dispute over dues.

RCom had to pay the amount to Ericsson by September 30 but the company approached SC seeking a 60-day extension. As Ericsson did not agree to the extension, it has now filed a contempt of court petition.

SC will hear the plea of RCom on October 4 whereas a date is not finalised for Ericsson. However, sources say Ericsson's petition can also be taken up on October 4.

Meanwhile, the National Company Law Appellate Tribunal will hear the matter on October 3. The tribunal has asked the two parties to settle the disputes.

Queries sent to the companies remained unanswered.

In order to pare debt, RCom has already sold its tower and fibre business to Reliance Jio. However, selling of spectrum to Jio has not received a clearance from Department of Telecommunications yet. RCom has contested the department's Rs 20 bn (approx) demand for spectrum charges for clearing the deal.

Manipal Technologies

Rs 2.74 crore case in NCLAT/ 2018

On December 28, on the date of the deadline for conversion of debt to equity, Anil Ambani's Reliance Communications (RCom) signed a definitive agreement with big brother Mukesh Ambani's Reliance Jio and bought itself some time from lenders.

On December 28, just on the deadline of conversion from debt to equity by the Banks under the Reserve Bank of India Strategic Debt Restructuring (SDR) regulations Anil Ambani’s Reliance Communications (RCom) signed a definitive agreement with big brother Mukesh Ambani’s Reliance Jio and bought itself some time from lenders. Nearly 10 days later, its Chinese lender, which had moved the insolvency court for a debt of Rs 9,000 crore, withdrew the case. However, RCom’s legal trouble is far from over.

A petition was filed by a Karnataka-based company, Manipal Technologies for a due of about Rs 2.74 crore from the troubled RCom. Agencies on Thursday reported that the dispute between the two companies is not over and the National Company Law Appellate Tribunal (NCLAT) will hear the case on January 25.

Manipal Technologies supplied fingerprint scanners to RCom in 2016. However, the money was not paid as RCom claimed that the invoices were raised in the name of HP financial services and not RCom. Earlier, it had approached the National Company Law Tribunal, which had rejected Manipal’s plea, accepting RCom’s argument that dues were not against the firm. Following this, Manipal Technologies moved the NCLAT.

RCom has a total debt of Rs 45,000 crore, including Rs 20,000 crore in the form of foreign loans and bonds. After failing to seal two deals with Aircel and Brookfield, Anil Ambani finally turned to his big brother for the deal. “The transaction has happened after a transparent and due process of bidding for RCom’s assets” and “was duly monitored by an oversight committee in which Reliance Jio emerged as the highest bidder for some of the assets…” RCom clarified. According to a Times of India report, Anil Ambani took the decision after Kokilaben Ambani, his mother, caught him in a pensive mood and told him “to ensure no lender loses a single rupee.” Anil Ambani then took the decision to exit the bleeding wireless telecom business.

RCom signed a deal with elder brother Mukesh Ambani’s Reliance Jio to sell four wireless infrastructure assets for Rs 23,000 crore on December 28, the birth anniversary of the late Dhirubhai Ambani. In his latest meeting with lenders, Anil Ambani said, “I owe this money to you morally, rather than legally.” RCom, in the process, has also shut its 2G and DTH services.

However, the legal trouble for RCom does not end with Manipal Technologies’ plea. The insolvency plea filed by Ericsson against RCom for unpaid dues of nearly Rs 1, 150 crore also stands.

Reliance Capital

The Rise & Fall/ 2008- 2024

August 24, 2024: The Times of India

From: August 24, 2024: The Times of India

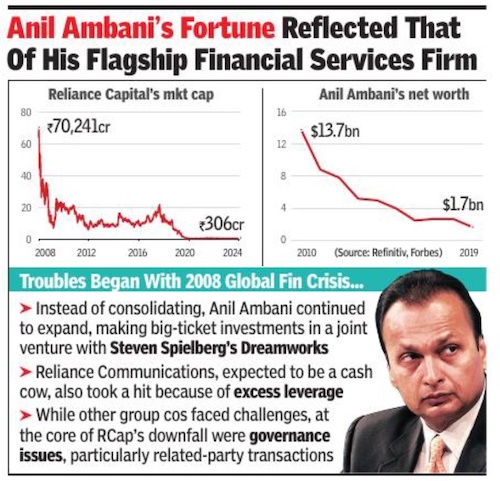

Mumbai : In 2008, Reliance Capital’s market capitalisation of over Rs 70,000 crore was larger than HDFC. Its chairman Anil Ambani had declared that it was among the top three financial institutions in the country. Just over a decade later, rating agency firm Care downgraded Reliance Capital to default.

From heading a conglomerate that had a market cap larger than the Tata Group in 2007 and being the sixth richest man globally, to having to declare himself bankrupt before a UK court in 2019, Anil Ambani’s fortunes have reflected that of his flagship financial services firm.

The troubles began with the global financial crisis in 2008, which strained liquidity for financial services companies. Instead of consolidating, ADAG Group continued its expansion, making big ticket investments in a joint venture with Steven Spielberg’s Dreamworks. There was also a string of acquisitions including Global Cloud Xchange, a global video game maker which was renamed Zapak, UTV Television, Pipavav Shipyard and MTS telecom.

The group’s diversification into infrastructure, particularly Reliance Power, defence and media took its toll on finances as the entry was at the wrong end of the business cycle and made matters worse. Reliance Communications (Rcom), which was expected to be a cash cow, also took a hit because of excess leverage. Also, the fact that Rcom was running on code division multiple access (CDMA) technology, which was shut down as industry shifted to GSM, also impacted business.

While other group companies faced their own challenges, at the core of Reliance Capital’s downfall were governance issues, particularly related-party transactions. Reliance Capital’s two main lending subsidiaries, Reliance Home Finance and Reliance Commercial Finance, went into default. The primary reason for the default was that these two companies had extended loans to related parties, which subsequ- ently defaulted. Sebi’s latest actions against Ambani and other senior officials of the ADAG group pertain to these transactions conducted by Reliance Home Finance.

The final nail on the coffin for the financial services firm was the tightening of liquidity after the twin failures of IL&FS and DHFL. Because of governance issues, Reliance Capital’s auditor PWC refused to sign the FY19 balance sheet leading to the Reserve Bank of India finally superseding the firm’s board initiating bankruptcy proceedings in November 2021. Ambani inherited the financial services, power and telecom businesses after his father and founder of Reliance Industries Dhirubhai Ambani’s death in 2002.

RCom

2019: The fall

The collapse of Reliance Communications (RCom) marks a complete fall in flamboyant Anil Ambani’s fortune as the ‘prized family jewel’ — that he inherited as part of a family settlement with elder brother Mukesh — comes to haunt him nearly 15 years after the Ambanis’ mega expansion into the telecom business.

While Anil always viewed the telecom business as the next frontier for growth, after losing the lucrative oil and gas operations in the family settlement, heavy investments and stiff competition made it an uphill task for him to realise his dreams. And with debts mounting by the day — it is estimated at nearly Rs 47,000 crore now — the final death knell was sounded when Mukesh made a re-entry into the telecom arena (in September 2016) with free services under the Reliance Jio banner.

The debt proved too daunting even for the ambitious Anil, once touted as the financial wizard of the combined Reliance Group. In between the family handover and the collapse, there were many failed deals that led to the unprecedented fall in Anil’s fortune. As he began aggressive expansion of the business after getting RCom in 2005 and listing it on the bourses in 2006, the challenging nature of the telecom sector and its need for heavy investments started hitting home.

The market was shifting from 2G voice, and then to data and internet-heavy 3G and 4G, requiring heavy investments in telecom equipment and also in spectrum purchases. In between all this, Anil also had to fight off the so-called GSM lobby that comprised the combined might of Airtel, Vodafone and Idea Cellular. The pressures of a high-pitched battle and aggressive investments started showing on the company, which eventually spun off into a debt pile-up from which he could never manage to recover.

Failed deals were surely a part of the saga, which included the collapsed Rs 50,000-crore telecom infra deal with GTL Infra in 2010. Undeterred at that time, Anil continued to make investments in 3G, under-sea cable and network expansion.

But with his services never really making a cut with the high-paying mobile users, Anil was never really seen as a strong challenger by his competitors. The saga of failed deals continued and the most notable was the collapse of the merger deal with Aircel in 2017, just when RCom (like other telecom operators) was coming to terms with the highly-aggressive re-entry of Mukesh into the business.

The collapse of the Aircel deal, that RCom blamed on “inordinate delays” caused by “legal and regulatory uncertainties and various interventions by vested interests”, also led to the failure of a nearcompleted tower sale deal with Canadian infra company Brookfield. With no Aircel deal, Brookfield found it wiser to back off, giving a death blow to RCom. Soon after, RCom announced closure of 2G and 3G mobile business, shaving off over 75% of an estimated 80 million customers.

As it shifted focus on the enterprise business, the debt resolution process became harder as lenders started approaching court for recovery. The most notable of these included Sweden’s Ericsson, which accused Anil and RCom of deliberate and wilful default in payment of Rs 550 crore, which it had scaled down from the original Rs 1,600 crore.

The courtroom battle and the failure to realise a deal with Mukesh saw the company’s stocks being hammered. It closed the day at Rs 5.62, a far cry from the high of Rs 821 reached on January 9, 2008.

The fall

2008-19

ADAG chairman Anil Ambani barely managed to stay a free bird after his flagship company RCom on Monday paid Rs 462 crore to telecom equipment maker Ericsson + , which had filed a bankruptcy case against the telecom company.

The Supreme Court had held Ambani guilty of contempt and gave him till March 19 to either pay up or face imprisonment of three months. Once worth more than his elder brother Mukesh Ambani’s current net worth, Anil Ambani’s saga could well qualify for the "riches-to-rags" tale.

The Ambani brothers used to serve as executives at their father Dhirubhai Ambani’s company. In 2005, three years after their father’s death, the pair agreed to split the empire into two. Anil got newer businesses such as telecommunications, power generation and financial services.

In 2008, Anil Ambani was worth $55 billion, according to Bloomberg Billionaires Index — that's more than what RIL chairman Mukesh Ambani is currently valued at, $52.9 billion. Anil, on the other hand, is now worth just $300 million — a decline of more than 99% in his wealth.

Anil's stunning fall stands in contrast to the success of Mukesh, whose net worth is $54.3 billion and has increased $10 billion this year alone, according to the Bloomberg Billionaires Index.

Mukesh has re-entered India’s now lucrative telecommunications sector with the creation of Reliance Jio Infocomm. His nationwide 4G network, which debuted with free services in 2016, has disrupted the industry, forcing rivals including RCom to bleed, merge or exit the business.

Meanwhile, RCom is struggling to repay its debt of Rs 46,000 crore.

Its proposed sale of assets to Anil's elder brother Mukesh's Reliance Jio and Canadian AMC Brookefield came a cropper. Once quoting at Rs 821.55 a share, RCom's stock closed at Rs 4.40 on Tuesday after a 10 per cent jump following the payment to Ericsson, but still a massive plunge from its peak market value in January 2008.

Meanwhile, Reliance Power, which had come out with India's largest IPO to raise Rs 11,700 crore, is now valued at almost a fourth of the money it raised, at Rs 3,094 crore.

Several of Anil Ambani's businesses — such as the entertainment channels and the power distribution in Mumbai — were sold to help pay off debts.

His foray into politics as a Rajya Sabha member — which he eventually quit — also made him easy fodder for opposition parties as well as creditors, who linked his name with the controversy over Rafale jets deal.

Ericsson in fact rejected his plea of fund crunch by saying that if he had money to invest in the Rafale deal, he could afford to pay it the outstanding dues.

The threat of a prison term if Anil didn’t make the payment also came as a rare warning to some of India’s richest borrowers whose firms have turned defaulters over the past few years. The government and courts have been cracking down on delinquency to help banks saddled with the world’s worst bad-loan ratio.

(With inputs from agencies)

2019/ RCom first Anil company to file for bankruptcy

Gadgets Now Bureau, June 12, 2019: The Times of India

To say that Anil Ambani has had a tough time over the last few months would be an understatement. However, yesterday in a media conference call Anil Ambani revealed that more than Rs 35,000 crore of loans have been paid back in the last 14 months. He further said that all future payments will be done in a “timely manner”. However, on May 31, the bankruptcy proceedings of Reliance Communications (RCom) were officially started and it became the first Anil Ambani company to file for bankruptcy. Here is everything you need to know about it:

Claims of Rs 85,000 crore have been filed by banks and financial institutions against RCom and its subsidiary companies

Rs 24,000 crore: Claims filed against Reliance Telecom that handled GSM business

Rs 49,000 crore: Claims filed against RCom that had the spectrum and mobile telephony business.

Rs 12,00 crore: Claims filed against Reliance Infratel, which was associated with the telecom tower business.

RCom made several public promises to pay back lenders but was unable to do so

Anil Ambani’s RCom made a lot attempts to restructure the company’s debt by selling assets like telecom towers and spectrum but to no avail.

On February 4, 2019, RCom officially announced through a stock market notification that it would subject itself to insolvency proceedings.

RCom had discontinued its telecom services for customers back in 2017.

Anil Ambani wanted to sell RCom’s spectrum business to Reliance Jio to avoid bankruptcy.

Government approvals got delayed and legal hurdles prevented RCom from selling to Reliance Jio.

It was Swedish telecom giant Ericsson that first took RCom to National Company Law Tribunal over debt of Rs 550 crore

Mukesh Ambani, elder brother of Anil, saved him from a possible jail-term after a last-minute bailout in April

Rs 480 crore were paid to Ericsson by Mukesh Ambani which led to Anil Ambani thanking his brother and sister-in-law Neeta Ambani

Since the bailout, Ambani has been on an asset-selling drive to pay off his remaining debts.

It has been reported that Anil Ambani has sold his radio station and mutual fund business.

Nov: Resigns as director of RCom

Nov 16, 2019: The Times of India

Key Highlights

The development comes a day after RCom posted a consolidated loss of Rs 30,142 crore for July-September 2019 due to provisioning for liabilities after the Supreme Court ruling on statutory dues

RCom's total liability includes Rs 23,327 crore licence fee and Rs 4,987 crore spectrum usage charges

NEW DELHI: Reliance Communications (RCom) chairman Anil Ambani along with four directors have resigned from the company, which is going through insolvency process, according to a regulatory filing.

The chief financial officer of the debt-ridden company Manikantan V has also resigned, the filing said.

"Shri Anil D Ambani, Smt Chhaya Virani, Smt Manjari Kacker have tendered their resignation as Director of Company on November 15, 2019," the filing said.

Ryna Karani and Suresh Rangachar tendered their resignations on November 14 and November 13, 2019 respectively. The development comes a day after RCom posted a consolidated loss of Rs 30,142 crore for July-September 2019 due to provisioning for liabilities after the Supreme Court ruling on statutory dues.

This was the second highest loss posted by any Indian corporate till date.

Ambani was once in the world's top 10 rich persons list but now the company is struggling to even sell assets for the recovery of dues. The company, which is going through insolvency process, had made a profit of Rs 1,141 crore in the corresponding three months a year ago. During July-September 2019, the company set aside Rs 28,314 crore on account of provisioning following the Supreme Court order on calculation of annual adjusted gross revenue (AGR) of telecom companies.

The apex court last month upheld the government's position on including revenue from non-telecommunication businesses in calculating the annual AGR, a share of which has to be paid as licence and spectrum fee to the exchequer.

RCom's total liability includes Rs 23,327 crore licence fee and Rs 4,987 crore spectrum usage charges.

"The resignation of Shri Manikantan V and appointment of Shri D Vishwanath as executive director and chief financial officer has been put up to the COC for their approval. Upon approval by the Committee of Creditors, further disclosures will be made to stock exchanges," the filing said.

Ambani got the charge of RCom after property division between him and his elder brother Mukesh Ambani in 2005.

The company is undergoing through insolvency proceedings following an application filed by Swedish telecom gear maker Ericsson.

The National Company Law Tribunal has handed over control of the company to an insolvency resolution professional.

Sources estimate that RCom Group's total secured debt is around Rs 33,000 crore. Lenders have submitted claim of around Rs 49,000 crore in August.

RCom has put its all assets for sale which include spectrum holding of 122 MHz that the company before insolvency proceedings estimated to be around Rs 14,000 crore, towers business for Rs 7,000 crore, optical fibre network Rs 3,000 crore and data centres worth Rs 4,000 crore.

The Committee of Creditors looking after asset sale of RCom will open bids received for the assets on November 24.

Four RComm directors step down

Nov 17, 2019: The Times of India

A day after Reliance Communications announced its biggest loss ever, chairman Anil Ambani and some of the directors have resigned from their positions, the telecom company said in a regulatory filing.

Ambani, Chhaya Virani and Manjari Kacker quit their directorships on Friday, while Suresh Rangachar and Ryna Karani put in their papers. CFO and director Manikantan V had resigned on October 4, 2019. “Since the company is under the bankruptcy process, all the resignations have been put before the committee of creditors for their consideration,” Reliance Communications said.

It added that the appointment of D Vishwanath as the new CFO and director has also been put before the creditors’ committee for approval.

Reliance Communications, once the flagship of the Anil Ambani group, posted a loss of Rs 30,142 crore in the second quarter of fiscal 2020. The loss is the second highest by an Indian company so far. Rival Vodafone-Idea posted a loss of Rs 50,922 crore in the July to September period of fiscal 2020. The losses were mainly because of provisioning of liabilities due to the government. Last month, the Supreme Court had ruled that non-telecom items should be included in the calculation of annual adjusted gross revenue of telecom companies. This dealt a big blow to the players, increasing their liability payments to the government.

RCom lenders reject Anil’s resignation

Nov 25, 2019: The Times of India

Reliance Communications (RCom) said its lenders have rejected the resignation of chairman Anil Ambani and four other directors, and asked them to cooperate in the ongoing corporate insolvency resolution process.

Ambani, along with four directors — Ryna Karani, Chhaya Virani, Manjari Kacker and Suresh Rangachar — had resigned from the company earlier this month. The company is going through insolvency proceedings following an application filed by Swedish telecom gear maker Ericsson. The National Company Law Tribunal has handed over control of the company to an insolvency resolution professional. Sources estimate that RCom Group’s total secured debt is around Rs 33,000 crore. Lenders had submitted claims of around Rs 49,000 crore in August.

RCom had posted a consolidated loss of Rs 30,142 crore for the September 2019 quarter due to provisioning for liabilities after the Supreme Court’s ruling on statutory dues. This had marked the second-highest loss posted by any Indian corporate till date, after Vodafone Idea’s Rs 50,921 crore loss. During July-September 2019, RCom set aside Rs 28,314 crore on account of provisioning following the Supreme Court order on calculation of annual adjusted gross revenue of telecom companies.

Meanwhile, Bharti Airtel, RIL, UV Asset Reconstruction Company, Varde Partners and I Squared Capital are likely to bid for RCom’s assets, the last date for submission, according to sources. RCom’s committee of creditors will also meet on the same day to open bids.

RCom has put all its assets for sale, including spectrum holding of 122 MHz, towers business, optical fibre network and data centres. AGENCIES

2019: ceases to be a billionaire

June 19, 2019: The Times of India

From: June 19, 2019: The Times of India

Anil Ambani may be out of billionaire club

Total M-Cap Of Group Cos At $773M Sees $41Bn Personal Wealth Wiped Out In 11 Yrs

Mumbai:

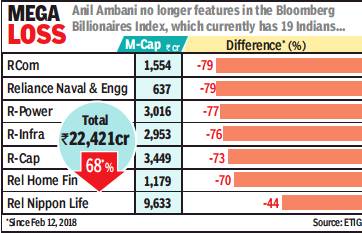

Businessman Anil Ambani, who a little over a decade ago was one of the richest persons in the world with a net worth of about $42 billion, may not be a billionaire any more. At Tuesday’s close of trading on Dalal Street, the combined market capitalisation of all of Anil Ambani-controlled Reliance Group companies was nearly Rs 5,400 crore, or about $773 million.

Ambani holds less than 75% stake in each of the six companies in his group — Reliance Infrastructure, Reliance Naval & Engineering, Reliance Power, Reliance Capital, Reliance Home Finance and the now-defunct Reliance Communications. Going by the market value of listed companies in his group, the younger of the two famous Ambani brothers would be worth much less than the billion-dollar mark.

Till recently, the group had a large stake in a profitable mutual fund business — Reliance Nippon Life Assets Management — a joint venture with Japanese life insurance major Nippon Life, which has been sold to its partner recently. Valued at nearly Rs 13,500 crore, or a little over $2 billion, the fund house is in the process of being transferred to the Japanese insurance major.

Anil, the younger brother of Mukesh who is listed as the 13th richest man in the world with a net worth of $50 billion by Forbes, has been going through several challenges in almost all his businesses.

At one point of time, Anil held over 60% in Reliance Communications, the telecom venture which is currently going through the bankruptcy process under the Insolvency and Bankruptcy Code, with its total debt at nearly Rs 58,000 crore. Auditors have resigned from three of his companies — Reliance Capital, Reliance Home Finance and Reliance Infrastructure — after alleging non-cooperation and wrongdoings on the part of their management. The group is fighting these allegations by the auditors.

The holding company for all of the group’s defence businesses, Reliance Naval & Engineering, has been in the red for several quarters. And so is the power-generation business, Reliance Power, which in 2008 had one of the most hyped IPOs in Indian stock market history.

A look at Anil’s depleting wealth shows that after peaking at $42 billion in 2008, he has been steadily losing net worth, with the global financial crisis months during late 2008 and early 2009 being the most savage when he saw over 75% vanish. By mid-2009, his net worth was down to about $10 billion. From then on, it’s been a steady slide for him.

Interestingly, in 2008 when Anil was ranked sixth among the world’s richest, Mukesh, with a net worth of $43 billion, was at the fifth position. Currently, Mukesh’s net worth is about $51 billion. Forbes’ realtime net worth indicator, however, shows Anil’s net worth at $1.5 billion. This indicator considers a person’s total wealth that includes all the stakes he/she holds in listed companies as well as in unlisted companies and other assets.

YEAR-WISE DEVELOPMENTS

2019

From: Partha Sinha, Anil Ambani cos allege illegal pledged share sale, February 9, 2019: The Times of India

Accuse Edelweiss, L&T Arms Of Wrongly Offloading Stocks, Fin Cos Deny Charges

A war of words has broken out in India Inc involving three leading business groups with allegations of “breach of trust” and veiled legal threats.

Anil Ambani’s Reliance conglomerate on Friday accused financial arms of Edelweiss and L&T of illegally selling promoters’ shares in four of its group companies in the open market, causing a steep fall in their value.

Edelweiss and L&T Finance denied any illegality and said all rules were followed while selling these shares. The four Anil group companies whose shares plunged by over 50% this week, causing a market capitalisation loss of about Rs 13,000 crore, are Reliance Communications, R-Power, R-Infrastructure and RCapital.

Reliance Group, meanwhile, removed Edelweiss as one of the lead merchant bankers to manage the IPO of Reliance General Insurance following selling of pledged shares. Sources said Edelweiss had walked out of the IPO deal since it did not “find any value in it”. Reliance General Insurance has filed an offer document with Sebi.

Reliance Power said L&T Finance and certain entities of Edelweiss Group, among others, sold pledged shares of group companies in the open market for about Rs 400 crore. “The illegal, motivated and wholly unjustified action by the two groups has precipitated a fall of Rs 13,000 crore, an unprecedented nearly 55%, in market capitalisation of Reliance Group over four days, causing substantial losses to 72 lakh institutional and retail shareholders, and harming the interests of all stakeholders,” R-Power said in a statement. The company alleged that the way these shares were sold could be termed as “price manipulation, insider trading, front-running and market abuse”, and were in violation of various regulatory provisions.

The shares sold were once pledged by Ambani and his associates to borrow money from arms of Edelweiss and L&T, among others. According to Edelweiss, since the stock prices of these shares had fallen sharply in the last few months, the total value of promoters’ shares — which were pledged with these entities to avail of the loan — was less than the loan amount.

In its statement, Edelweiss refuted Reliance Group’s allegations, calling it “entirely unfounded, baseless and false”. It said that despite their best efforts and opportunities given to the Ambani-controlled group for a remedy, “not only did Reliance Group fail to address any of the concerns raised by Edelweiss Group, but also continued to breach contractual obligations”. Throughout the process, Edelweiss had acted in a lawful and responsible manner, it said.

L&T Finance too refuted the allegations made by Reliance Group, relating to sale of pledged shares of that group. The financier had given loans against pledge of shares to Reliance Group companies and under loan and pledge agreements, “the borrower did not cure various events of defaults, including providing margin for shortfall in the stipulated security cover”.

“Despite various notices in the past few months, events of defaults continued. Consequently, L&T Finance enforced its rights of invocation and sold pledged shares to the extent of its outstanding dues by following the due process of contract and law,” the company said.

Anil group loses 68% value in a year

February 13, 2019: The Times of India

From: February 13, 2019: The Times of India

The market value of Anil Ambani group companies have fallen by nearly 68% in the last 12 months. In absolute terms, the group has lost Rs 47,300 crore in valuation. In 2018, Anil ranked 28 on the Forbes Indian billionaire list with a net worth of $2.4 billion — a gap of nearly $45 billion with his elder brother and country’s richest man, Mukesh Ambani.

A 65% erosion in value of holdings would mean that the junior Ambani has dropped off the billionaire list. His net worth would have also come down because his shares pledged with the finance arms of L&T and Edelweiss were sold by them following a default, which led to a sharp drop in the value of group companies.

The decline in fortunes accelerated in February when RCom said that it failed to come up with a resolution plan and had no choice but file for bankruptcy.

2020

UK court orders Anil Ambani to pay $100 mn

LONDON: A UK court directed Reliance Group chairman Anil Ambani to pay $100 million towards a conditional order granted to three Chinese banks pursuing the recovery of over $680 million owed to them as part of a loan agreement.

In what is in effect a deposit to be paid into court pending a full trial in the case, Judge David Waksman has set a six-week timeline for such a payment to be made as he concluded that he did not accept Ambani's defence that his net worth was nearly zero or that his family would not step in to assist him when "push came to shove".

"In my overall conclusion, Mr Ambani has not satisfied me that he can't make any payment at all," Judge Waksman said as he expressed particular criticism of a "lack of candour" and "transparency" on the part of Ambani's defence in reference to his financial means.

The Reliance Group indicated that it plans to appeal against the ruling, which will involve a process of seeking permission to appeal.

My net worth is zero: Anil Ambani in UK court

London:

Former billionaire Anil Ambani, once the sixth richest man in the world, declared to a UK court his “net worth was zero” and that he was bankrupt.

Three Chinese banks are suing Ambani in the high court here for more than $700 million (over Rs 5,000 crore), including interest, for defaulting on a loan they gave RCom — now in insolvency proceedings — in February 2012, which it defaulted on. The banks claim Ambani provided a personal guarantee for the loan, but he disputes this.

At Friday’s hearing, which his son, Anmol, attended, the banks asked the court to make a conditional order requiring him to pay into court $656 million (Rs 4,690 crore) ahead of the trial. However, the judge said he must pay $100 million (Rs 715 crore).

Statements packed with falsehoods, says judge

Justice Waksman heavily criticised Ambani’s statements, saying they were packed with “falsehoods” and that Ambani had “clearly lied”. He said Ambani had put a misleading spin on the role of his brother (Mukesh Ambani) in bailing him out last year and also spoke of “irregular corporate activities” within the Reliance group.

“He clearly has more assets or income than he is letting on. The family members can and will in my view assist and bearing in mind what they can afford, $100 million must be paid into court,” Waksman said. “It would be absurd if Mukesh said he could not afford to lend the money given the size of his fortune. This is an extremely wealthy family who have helped each other in the past. I don’t accept his own available assets are as limited as he says.”

Ambani told the commercial court he would be “unable to raise any finance from external sources” to comply with any conditional order, despite being the brother of Mukesh Ambani, the richest man in Asia, who the court heard had wealth estimated at $55 billion to $57 billion (Rs 3,93,000 crore to Rs 4,07,000 crore). He claimed that because of the loss of his telecom empire, he was completely broke and insolvent.

Justice Waksman said: “On your case he is bankrupt. Has he filed for bankruptcy in India? Has anyone done a search? I would expect someone to have done so. I want to find out what is going on.”

To which Robert Howe QC, representing Ambani, alongside Harish Salve QC, replied: “No, he has not. They have just recently introduced bankruptcy laws in India. It is unhelpful to give expert evidence at this point as there is Union law and provincial law in India.” The court heard that a change in government policy in 2012 “led to the exit of all major players in the market and a new entry to industry which others found difficult to compete with”. This led to RCom closing down in 2017. Ambani claimed he had a personal deficit of $305 million and that his net worth had collapsed from more than $7 billion in March 2012 to zero in December 2019.

2022

Anil Ambani banned from mkt for 3 months

February 12, 2022: The Times of India

Mumbai: Market regulator Sebi late on Friday banned Anil Ambani, three of his associates and Reliance Home Finance, one of his former group companies, from the market for three months for misusing funds of the company and diverting it to other group entities to pay off debt. Ambani and the others — Amit Bapna, Ravindra Sudhalkar, Pinkesh R Shah — were also restrained from associating with any listed entities.

See also

The Ambanis <> Anil Ambani <> Mukesh Ambani